A summary of the weekly Commitment of Traders Report (COT) from CFTC to show market positioning among large speculators.

- EUR traders extended their net-short exposure to their most bearish level since December 2016

- Traders continue to bet on low volatility, with the VIX net-short exposure at its most bearish level since

- WTI net-long exposure its most bullish since October

- JPY traders are their most bearish on the yen this year

EUR: Whilst net-short exposure is its most bearish since December 2016, it’s worth noting bearish exposure was pushed marginally lower on reduced volumes last week. And, as EUR/USD has rebounded from long-term support, we have to consider the potential for bearish exposure to be reduced whilst prices remain elevated relative to positioning.

VIX: Several reads points towards the potential for a sentiment extreme (ie an inflection point). The 3-year Z-score is -2.8, so nearly 3 standard deviations from its mean. Net-short exposure is its most bearish since October 2017 and, adjusted for open interest, its most bearish since 2009. Nailing an actual turning point can prove tricky, but if we cast our minds back to Feb 2018, when ‘short vol’ wants to reverse, it comes hard and fast. With so many traders net-short volatility whilst S&P500 approaches new highs, it could serve well to trade long with caution.

WTI: Traders are their most bullish on WTI in 6-months, and this is the 6th week in a row longs have increased exposure and shorts have reduced. Having suffered heavy losses between October and December (around 45%) it’s hard to label current positioning as a sentiment extreme. Whilst price action may appear a little stretched on a technical basis, the underlying flow appears supportive of the trend.

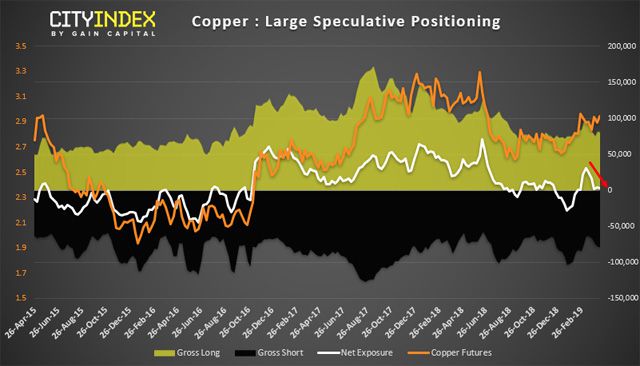

Copper: The net-long exposure, which confirmed the original breakout for copper in February has all but collapsed. An increase of gross-short positioning has dragged positioning back towards neutral and traders are close to switching to net-short. This now begs the question as to whether copper can remains within its elevated range, and brings potential for prices to move lower.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.

Hot Features

Hot Features