The weekly COT report:

As of Tuesday 28th May:

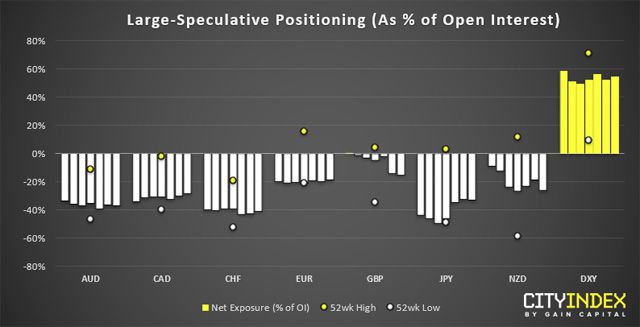

- Large speculators increased net-long exposure to USD by just $0.48 billion to $31.3 billion ($35.7 billion against G10 currencies)

- Traders were net-short NZD futures at their most bearish level since December 2018

- Net-short exposure on GBP was its most bearish since March, although we’ve seen a rise in both long and short bets

- Overall, volume changes across FX majors were relatively minor and all below 6k contracts

USD: Over the past four weeks, traders have reduced net-log exposure by -$3.6 billion after being their most bullish since Q4 2015. Over this time we’ve also seen the US dollar index fail to hold above 98, suggesting a temporary top could be in place.

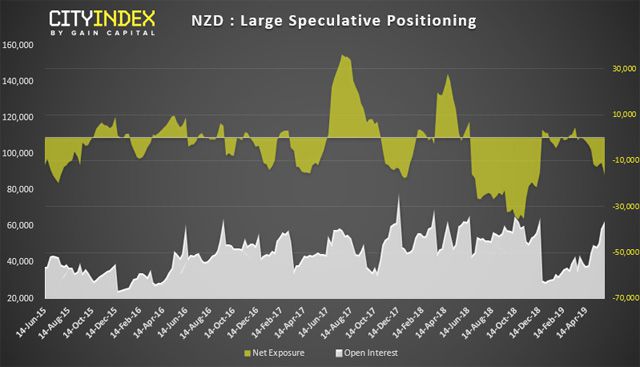

NZD: Large speculators increased gross short exposure to +41,1k contracts, their most bearish level since November 2018. -5.3k long contracts were closed. Total open interest is also rising to show underlying strength in the bearish positioning.

As of Tuesday 28th May:

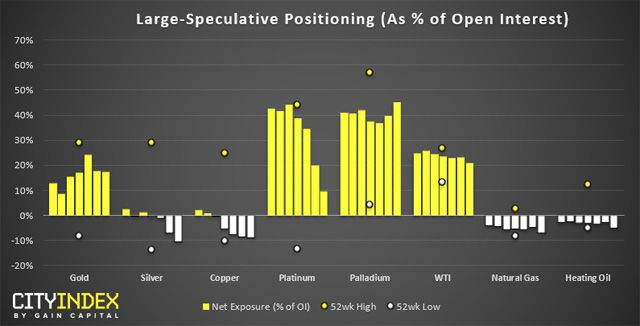

- Large speculators were their most bearish on silver since September 2018

- Traders were their most bearish on Copper since late January

- Whilst Platinum remain net-long, a rise of short interest saw traders their least bullish since February

- Net-long exposure on WTI fell to its least bullish level since March

Gold: Last week -9.2k long contracts and -7k short contracts closed and the past two reports show a reduction of -25.9k contracts have been closed. Yet gold continues to rally. We noted on Friday that gold bears may have been squeezed near the lows, as the shiny yellow metal has now rallied 2.8% after traders since volumes were reduced. Given the strength of gold’s rally we expect longs have been added again in next week’s report.

Silver: We could be approaching a sentiment extreme on Silver, as traders are not too far from record level of short bets. With data going back to March 1995, there has only been a handful of times that Silver has been net-short, and September 2018 set the record at -29k contracts short. As of last week, traders were net-short by -22.4k contracts.

WTI: Whilst WTI remains under selling pressure, we note that short interest has not risen despite the closure of longs. This continues to point to a correction as opposed to a change in trend. With momentum on WTI pointing glower, we prefer to sell into rallies over the near-term and monitor price action for a potential base to form.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.

Hot Features

Hot Features