0000843006false--12-31FY2023false0.001100000000000.00120000000379102038152126.80 – 27.7100008430062023-01-012023-12-310000843006isdr:ChangeMember2023-12-310000843006isdr:ComplianceMember2022-01-012022-12-310000843006isdr:ComplianceMember2023-01-012023-12-310000843006isdr:CommunicationMember2022-01-012022-12-310000843006isdr:CommunicationMember2023-01-012023-12-310000843006isdr:MarchTwentyNineteenMember2023-01-012023-12-310000843006isdr:MarchTwentyNineteenMember2023-12-310000843006isdr:LeaseLiabilitiyMember2023-12-310000843006isdr:UnvestedRestrictedStockMember2023-12-310000843006us-gaap:NonqualifiedPlanMember2023-12-310000843006isdr:TwentyFourteenPlanMember2020-06-012020-06-170000843006isdr:TwentyFourteenPlanMember2016-06-012016-06-100000843006isdr:TwentyTwentyThreePlanMember2023-01-012023-12-310000843006isdr:TwentyFourteenPlanMember2023-01-012023-12-310000843006isdr:TwentyTwentyThreePlanMember2023-12-310000843006isdr:TwentyFourteenPlanMember2023-12-310000843006isdr:StockOption6Member2023-01-012023-12-310000843006isdr:StockOption5Member2023-01-012023-12-310000843006isdr:StockOption4Member2023-01-012023-12-310000843006isdr:StockOption3Member2023-01-012023-12-310000843006isdr:StockOption2Member2023-01-012023-12-310000843006isdr:StockOption1Member2023-01-012023-12-310000843006isdr:StockOption6Member2023-12-310000843006isdr:StockOption5Member2023-12-310000843006isdr:StockOption4Member2023-12-310000843006isdr:StockOption3Member2023-12-310000843006isdr:StockOption2Member2023-12-310000843006isdr:StockOption1Member2023-12-310000843006us-gaap:OptionMember2023-12-310000843006us-gaap:OptionMember2022-01-012022-12-310000843006us-gaap:OptionMember2023-01-012023-12-310000843006us-gaap:OptionMember2022-12-310000843006us-gaap:OptionMember2021-12-310000843006isdr:OneMarchTwoThousandTwentyTwoMember2022-08-310000843006isdr:OneMarchTwoThousandTwentyTwoMember2022-03-010000843006isdr:CommonSharesMember2023-12-310000843006isdr:ThirtyFirstAugustTwoThousandTwentyTwoMember2023-12-310000843006isdr:ThirtyFirstJulyTwoThousandTwentyTwoMember2023-12-310000843006isdr:ThirtyJuneTwoThousandTwentyTwoMember2023-12-310000843006isdr:ThityOneMayTwoThousandTwentyTwoMember2023-12-310000843006isdr:ThityAprilTwoThousandTwentyTwoMember2023-12-310000843006isdr:ThirtyMarchTwoThousandTwentyTwoMember2023-12-310000843006isdr:CommonSharesMember2023-01-012023-12-310000843006isdr:ThirtyFirstAugustTwoThousandTwentyTwoMember2023-01-012023-12-310000843006isdr:ThirtyFirstJulyTwoThousandTwentyTwoMember2023-01-012023-12-310000843006isdr:ThirtyJuneTwoThousandTwentyTwoMember2023-01-012023-12-310000843006isdr:ThityOneMayTwoThousandTwentyTwoMember2023-01-012023-12-310000843006isdr:ThityAprilTwoThousandTwentyTwoMember2023-01-012023-12-310000843006isdr:ThirtyMarchTwoThousandTwentyTwoMember2023-01-012023-12-3100008430062023-03-012023-03-200000843006isdr:TotalIntangibleAssetsMember2023-12-310000843006us-gaap:TrademarksMember2023-12-310000843006isdr:TrademarksDefiniteMember2023-12-310000843006us-gaap:NoncompeteAgreementsMember2023-12-310000843006isdr:DistributionPartnerRelationshipsMember2023-12-310000843006us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310000843006us-gaap:CustomerRelationshipsMember2023-12-310000843006us-gaap:CustomerListsMember2023-12-310000843006isdr:TotalIntangibleAssetsMember2022-12-310000843006us-gaap:TrademarksMember2022-12-310000843006isdr:TrademarksDefiniteMember2022-12-310000843006us-gaap:NoncompeteAgreementsMember2022-12-310000843006isdr:DistributionPartnerRelationshipsMember2022-12-310000843006us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310000843006us-gaap:CustomerRelationshipsMember2022-12-310000843006us-gaap:CustomerListsMember2022-12-310000843006isdr:RangeTheteenMemberus-gaap:OtherExpenseMember2023-01-012023-12-310000843006isdr:RangeTheteenMember2023-03-310000843006isdr:RangeTheteenMember2023-12-310000843006isdr:RangeTheteenMember2023-01-012023-12-310000843006isdr:SupplementalProFormaInformationMember2023-01-012023-12-310000843006isdr:SupplementalProFormaInformationMember2022-01-012022-12-310000843006isdr:NetLiabilitiesAssumedMemberisdr:AsAdjustmentMember2023-12-310000843006isdr:NetLiabilitiesAssumedMemberisdr:MeasurementPeriodAdjustmentMember2023-12-310000843006isdr:NetLiabilitiesAssumedMemberisdr:AsOriginallyReportedMember2023-12-310000843006isdr:AsAdjustmentMember2023-12-310000843006isdr:MeasurementPeriodAdjustmentMember2023-12-310000843006isdr:AsOriginallyReportedMember2023-12-310000843006us-gaap:LeaseholdImprovementsMember2022-12-310000843006us-gaap:LeaseholdImprovementsMember2023-12-310000843006isdr:FurnitureEquipmentMember2022-12-310000843006isdr:FurnitureEquipmentMember2023-12-310000843006us-gaap:ComputerEquipmentMember2023-12-310000843006us-gaap:ComputerEquipmentMember2022-12-310000843006us-gaap:CanadaRevenueAgencyMember2023-12-310000843006srt:EuropeMember2023-12-310000843006srt:MaximumMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-01-012023-12-310000843006srt:MinimumMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-01-012023-12-310000843006us-gaap:NoncompeteAgreementsMember2023-01-012023-12-310000843006isdr:DistributionPartnerRelationshipsMember2023-01-012023-12-310000843006us-gaap:CustomerListsMember2023-01-012023-12-310000843006srt:MaximumMemberus-gaap:CustomerRelationshipsMember2023-01-012023-12-310000843006srt:MinimumMemberus-gaap:CustomerRelationshipsMember2023-01-012023-12-310000843006us-gaap:LeaseholdImprovementsMember2023-01-012023-12-310000843006srt:MaximumMemberisdr:FurnitureAndEquipmentMember2023-01-012023-12-310000843006srt:MinimumMemberisdr:FurnitureAndEquipmentMember2023-01-012023-12-310000843006us-gaap:ComputerEquipmentMember2023-01-012023-12-310000843006us-gaap:RetainedEarningsMember2023-12-310000843006us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000843006us-gaap:AdditionalPaidInCapitalMember2023-12-310000843006us-gaap:CommonStockMember2023-12-310000843006us-gaap:RetainedEarningsMember2023-01-012023-12-310000843006us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000843006us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000843006us-gaap:CommonStockMember2023-01-012023-12-310000843006us-gaap:RetainedEarningsMember2022-12-310000843006us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000843006us-gaap:AdditionalPaidInCapitalMember2022-12-310000843006us-gaap:CommonStockMember2022-12-310000843006us-gaap:RetainedEarningsMember2022-01-012022-12-310000843006us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000843006us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000843006us-gaap:CommonStockMember2022-01-012022-12-3100008430062021-12-310000843006us-gaap:RetainedEarningsMember2021-12-310000843006us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000843006us-gaap:AdditionalPaidInCapitalMember2021-12-310000843006us-gaap:CommonStockMember2021-12-3100008430062022-01-012022-12-3100008430062022-12-3100008430062023-12-3100008430062024-03-0700008430062023-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 10-K

_____________________

☒ | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Year Ended: December 31, 2023

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ___________to ___________

_____________________

ISSUER DIRECT CORPORATION |

(Name of small business issuer in its charter) |

_____________________

Delaware | | 1-10185 | | 26-1331503 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Glenwood Avenue, Suite 1001, Raleigh, NC 27603

(Address of Principal Executive Office) (Zip Code)

(919) 481-4000

(Registrant’s telephone number, including area code)

_____________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | | ISDR | | NYSE American. |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

_____________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2023, the last business day of the registrant's second fiscal quarter, was approximately $71,573,914 based on the closing price reported on the NYSE American as of such date.

As of March 7, 2024, the number of outstanding shares of the registrant's common stock was 3,815,212.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2024 annual meeting of stockholders (the “2024 Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The 2024 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the year to which this report relates.

TABLE OF CONTENTS

CAUTIONARY STATEMENT

All statements, other than statements of historical fact, included in this Form 10-K, including without limitation the statements under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business,” are, or may be deemed to be, forward-looking statements. Such forward-looking statements involve assumptions, known and unknown risks, uncertainties, and other factors, which may cause the actual results, performance or achievements of Issuer Direct Corporation, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements contained in this Form 10-K.

In our capacity as Company management, we may from time to time make written or oral forward-looking statements with respect to our long-term objectives or expectations which may be included in our filings with the Securities and Exchange Commission (the “SEC”), reports to stockholders and information provided on our web site.

The words or phrases “will likely,” “are expected to,” “is anticipated,” “is predicted,” “forecast,” “estimate,” “project,” “plans to continue,” “believes,” or similar expressions identify “forward-looking statements.” Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical earnings and those presently anticipated or projected. We wish to caution you not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We are calling to your attention important factors that could affect our financial performance and could cause actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements.

The following list of important risk factors is not all-inclusive, and we specifically decline to undertake an obligation to publicly revise any forward-looking statements that have been made to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Among the factors that could have an impact on our ability to achieve expected operating results and growth plan goals and/or affect the market price of our stock are (please see full list of risk factors in Item 1A):

| ● | Dependence on key personnel. |

| ● | Fluctuation in quarterly operating results related to transaction-based revenue. |

| ● | Our ability to successfully integrate and operate acquired assets, businesses, ventures and/or subsidiaries. |

| ● | Our ability to successfully develop new products and introduce them to the markets in which we operate. |

| ● | Changes in laws and regulations that affect our operations and demand for our products and services. |

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Financial Data in iXBRL, Current Reports on Form 8-K, proxy statements and amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, are available, free of charge, in the investor relations section of our website at www.issuerdirect.com.

The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

PART I

ITEM 1. DESCRIPTION OF BUSINESS.

Company Overview

Overview

Issuer Direct Corporation and its subsidiaries are hereinafter collectively referred to as “Issuer Direct”, the “Company”, “We” or “Our” unless otherwise noted. Our corporate headquarters are located at One Glenwood Ave., Suite 1001, Raleigh, North Carolina, 27603.

We announce material financial information to our investors using our investor relations website, SEC filings, investor events, news and earnings releases, public conference calls, webcasts, and social media. We use these channels to communicate with our investors and the public about our company, our products and services and other related matters. It is possible that information we post on some of these channels could be deemed to be material information. Therefore, we encourage investors, the media and others interested in Issuer Direct to review the information we post to all our channels, including our social media accounts.

We are a leading communications and compliance company, providing solutions for both public relations and investor relations professionals. Our comprehensive solutions are used by thousands of customers from emerging startups to multi-billion-dollar global brands, ensuring their most important moments are reaching the right audiences, via our industry leading newswire, IR website solutions, events technology and compliance solutions. Our platform efficiently and effectively helps our customers manage their events when seeking to distribute their messaging to key constituents, investors, markets and regulatory systems around the globe.

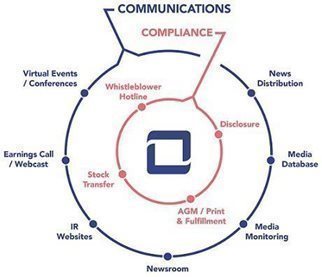

Our platform consists of several related but distinct Communications and Compliance modules that companies and customers utilize every quarter. As such, we disclose our revenue in the following two main categories: (i) Communications and (ii) Compliance. Set forth below is an infographic depicting the products included in each of these two main categories we provide today:

In the future, we expect the Communications portion of our business to continue to increase, both in terms of overall revenue and as compared to the Compliance portion of our business. Therefore, we plan to continue to invest in offerings we intend to incorporate into and complement our Communications product lineup. Within most of our target markets, customers require several individual services and/or software providers to meet their communications and investor relations needs. We believe our platform can address all these needs in a single, secure, cloud-based platform - one that offers a customer control, increases efficiencies, demonstrates clear value and, most importantly, delivers consistent and compliant messaging from one centralized platform.

We work with a diverse customer base, which includes not only corporate issuers and private companies, but also investment banks, professional firms, such as investor relations and public relations firms, as well as the accounting and legal communities. Our customers and their service providers utilize our platform and related solutions from document creation all the way to dissemination to regulatory bodies, news outlets, financial platforms, and our customers’ shareholders. Private companies primarily use our news distribution, newsroom and webcasting products and services to disseminate their message globally.

We also work with several select stock exchanges by making available certain parts of our platform under agreements to integrate our offerings within their products. We believe such partnerships will continue to yield increased exposure to a targeted customer base that could impact our revenue and overall brand in the market.

Communications

Our Communications platform consists of our press release distribution businesses branded as ACCESSWIRE and Newswire, our webcasting and events business, professional conference and events software, as well as our investor relations website technology. Our ACCESSWIRE and Newswire news distribution platforms have been integrated into one dissemination platform that will give our customers all the distribution benefits of our global distribution footprint. These products are sold as the leading part of our Communications subscription, as well as individually to customers around the globe and are further described below.

Acquisition of iNewswire.com LLC

On November 1, 2022, we acquired iNewswire.com LLC (“Newswire”). Newswire is a media technology company that provides customers press release distribution, media databases, media monitoring, and newsrooms for greater brand awareness through earned media, increased online visibility through greater search engine optimization recognition, and more sales inquiries through targeted digital marketing campaigns. Through its PR Optimizer (”PRO”) offering, formally Media Advantage Platform, Newswire automates media and marketing communications for large and small businesses seeking to deliver the right message to the right audience at the right time for the right purpose.

We believe Newswire strengthens our entire communications portfolio and combined with our ACCESSWIRE business, grows our press release distribution business to now be one of North America’s largest press release distribution platforms. Newswire customers also benefit from the global footprint ACCESSWIRE has built over the last nine years, whereas Issuer Direct’s customers will have access to Newswire’s media database platform, pitching and monitoring capabilities, as well as its PRO offering.

Through the PRO offering, we provide content and media communications services that provide customers the opportunity to optimize their content and increase their media visibility, therefore building their brand awareness and engaging a larger audience. With the flexibility of these offerings, customers have the ability to choose between support with content optimization, increased media visibility, or both for optimal results. We believe the PRO product offering provides the most effective and efficient integrated media and content communication program available in the market today.

ACCESSWIRE

Our existing press release offering, which is marketed under the brand ACCESSWIRE, is a news dissemination and media outreach service. The ACCESSWIRE product offering focuses on press release distribution for both private and public companies globally. We believe ACCESSWIRE is becoming a competitive alternative in the newswire industry because we have been able to use our technological advancements to allow customers to self-edit releases or use our editorial staff as desired to edit releases. We continue to expand our distribution points, improve our targeting and enhance our analytics reporting. We also offer an e-commerce element to our ACCESSWIRE product, whereby customers can self-select their distribution, register, and then upload their press release for editorial review in minutes. We believe these enhancements have helped increase ACCESSWIRE revenues each year compared to the prior year, a trend we expect to continue over the next several years. We have also been able to maintain high gross margins while providing our customer flexible pricing, with options to pay per release or enter longer-term agreements for a designated package of releases.

Like other newswires globally, ACCESSWIRE and Newswire are dependent upon several key partners for its news distribution. Disruption in any of our partnerships could have a materially adverse impact on our overall business.

Media Suite

As part of the iNewswire acquisition, we acquired certain assets that with further development resulted in our ability to release a subscription add-on to our Newswire and ACCESSWIRE brands, which we call Media Suite. Media Suite includes three new products: Media Database, Media Pitching, and Media Monitoring, all of which are further described below.

The Media Suite offering provides communication professionals with the opportunity to build their story, incorporate artificial intelligence (AI) if desired, effectively pitch the media, and monitor their internal brand as well as their competitors. This is all accomplished with a blend of human curation and an advanced AI engine that ultimately serves as the foundation of an easy-to-use workflow we branded as our Media Suite. Media Suite is a recurring subscription product, with three subscription options available: Media Suite Starter, Media Suite Plus, and Media Suite Enterprise, each providing different combinations of our solutions to help our customers reach their goals.

Media Database – Our media database is based on the idea that pitching the media should be a targeted endeavor. Our dataset includes only the journalists that are actively writing and publishing articles. We built this component in reverse, looking at the tens of millions of articles published annually and sorted articles by industry, publication and journalist, then human curated the most accurate data of each contact and made them available within our media database. Additionally, within the interface we made it easy to see each article published by every journalist a user may want to connect with, making Media Suite a compelling combination of the right features and intelligence between database, pitching, and monitoring.

Media Pitching – Pitching is a critical part of the Media Suite because it allows the user to contact and connect the most active journalists in their industry. Media Suite not only gives you the professionals to pitch, it also offers AIMee, our AI writing and recommendation engine, to enhance your message, write a new message and highlight engageable content to help bring your pitch to the forefront.

Media Monitoring – a brand Monitoring solution is extremely important, and every company should consider monitoring not only their brands, but their products, executives and competitors mentioned in all mediums – print, broadcast media and television, web, radio, video, blogs and social media. Our monitoring solution offers many of these mediums and we will continue to undergo expansion in each of these mediums with a goal of being a comprehensive media monitoring solution by the end of 2024. Our media monitoring solution ties together our journalist contacts and mention analytics into and with a customer’s dashboard of daily activity.

Media Room

A natural addition to our ACCESSWIRE and investor relations website business is our corporate Media Room. This product offering can be an add-on to any customer’s ACCESSWIRE or Communications subscription account. The Media Room suite includes a custom newsroom page builder, a brand asset manager and contact manager.

Our Media Room suite addresses the needs of our customers looking to build connections with media, journalists, customers and if applicable the investment community. According to a survey from TekGroup, a majority of journalists and media professionals indicated the importance of newsrooms that include digital media, press kits and video. We believe our Media Room suite accomplishes this by making it a part of our new Media Suite, giving us a further competitive advantage in the market. This also allows our customers to have one media platform to manage all their assets, brands and outreach.

Webcasting & Events

Our webcasting and events business is comprised of our earnings call webcasting solutions and our virtual meeting and events software (such as annual meetings, deal/non-deal road shows, analyst days and shareholder days). The demand for these products with a virtual component was at an all-time high for us in 2020, largely due to the COVID-19 pandemic. Since the end of the pandemic, the industry overall has seen a reduction in the number of virtual events, specifically annual meetings and deal/non-deal roadshows, as customers are relying on internal enterprise solutions or are returning to pre-pandemic travel and in-person meetings, reducing the need for a virtual component. This has contributed to a decline in demand for our virtual components since 2020 and 2021.

Traditional earnings calls and webcasts are a highly competitive market with the majority of the business being driven from practitioners in investor relations and communications firms. We estimate there are approximately 5,000 companies in North America conducting earnings events each quarter that include a teleconference, webcast or both as part of their events. Our platform incorporates other elements of the earnings event, including earnings date/call announcement, earnings press release and SEC Form 8-K filings. There are a handful of our competitors that can offer this integrated full-service solution today, however, we believe our real-time event setup and integrated approach offers a more effective way to manage the process.

Additionally, as a commitment to broadening the reach of our webcast platform, we broadcast live additional companies’ earnings events, whether they are conducted on our platform or not, within our shareholder outreach module, which helps drive new audiences and give companies the ability to view their analytics and engagement of each event.

Our Webcasting Platform is a cloud-based webcast, webinar and virtual meeting platform that delivers live and on-demand streaming of events to audiences of all sizes. Our solution allows customers to create, produce and deliver events, which we feel has significantly strengthened our webcasting product and Communications offering. The platform architecture gives us the ability to host thousands of webcasts each year, expanding and diversifying our webcast business from our historical earnings-based events to include any type of virtual event. As we expand our platform, it is vital for us to have solutions that service both our core public companies but also a growing segment of private customers.

Professional Conference and Events Software

Our professional conference and events software is a subscription offering we currently license to investor conference organizers. This software, which is also available as a native mobile app, offers organizers, issuers and investors the ability to register, request and approve one-on-one meetings, manage schedules, perform event promotion and sponsorship, print attendee badges and manage lodging. This cloud-based product can be used in a virtual or in person conference setting and is integrated within our Communications subscription offerings of newswire, newsrooms, webcasting and shareholder targeting. We believe this integration gives us a unique offering for professional conference organizers that is not available elsewhere in the market.

Investor Relations Websites

Our investor relations content network is another component of our Communications offering, which is used to create the investor relations’ tab of a company’s website. This investor relations content network is a robust series of data feeds including news feeds, stock feeds, fundamentals, regulatory filings, corporate governance and many other components which are aggregated from most of the major exchanges and news distribution outlets around the world. Customers can subscribe to one or more of these data feeds or as a component of a fully designed and hosted website for pre-IPO companies, SEC reporting companies and partners seeking to display our content on their corporate sites. The clear benefit to our investor relations content network is its integration with our other Communications offerings. As such, companies can produce content for public distribution and it is automatically linked to their corporate website, distributed to targeted groups and placed into our data feed partners.

During 2023 we released significant upgrades to our investor relations website, that included ADA Compliance (Americans with Disabilities Act) which ensures that people with disabilities have the same access to all areas of a business's premises. Specifically, this module addresses electronic information and technology, such as our customers’ websites. This add-on requires a recurring annual subscription and is delivered fully integrated into and with our investor relations website offering.

Compliance

Our Compliance offerings consist of our disclosure software for financial reporting, stock transfer services, whistleblower hotline and related annual meeting, print and shareholder distribution services. Some of these products are sold as part of a Compliance subscription as well as individually to customers around the globe.

Disclosure Software and Services

Our disclosure reporting module is a document conversion, editing and filing offering which is designed for reporting companies and professionals seeking to insource the document drafting, editing and filing processes to the SEC’s EDGAR system. Our disclosure business also offers companies the ability to use our in-house staff to assist in the conversion, tagging and filing of their documents. We generate revenues in disclosure both from software and services and, in most cases, customers have both components within their annual agreements, while others pay for services as they are completed.

Whistleblower Hotline

Our whistleblower hotline is an add-on product within our platform. This system delivers secure notifications and basic incident workflow management processes that align with a company’s corporate governance whistleblower policy. As a supported and subsidized bundle product of the New York Stock Exchange (“NYSE”) offerings, we are introduced to new IPO customers and other larger cap customers listed on the NYSE. Since 2014, we have been a named NYSE subsidy provider of this Whistleblower solution. In 2020, NYSE renewed and extended the initial subsidy term to four years from two years, whereby the first two years are provided under subsidy and the added two years are at our standard subscription rates. Recently, we have been working on upgrading the incident response and management component of the workflow, which is expected to be deployed this year.

Stock Transfer Module

A valued subscription module in our Compliance offering is the ability for our customers to gain access to real-time information about their shareholders, stock ledgers and reports and to issue new shares from our cloud-based stock transfer module. Managing the capitalization table of a public company or pre-IPO company is a cornerstone of corporate governance and transparency, and as such companies and community banks have chosen us to assist with their stock transfer needs, including bond offerings and dividend management. This is an industry which has experienced declining overall revenues as it was affected by the replacement of paper certificates with digital certificates. However, we have been focused on selling subscriptions of the stock transfer component of our platform, allowing customers to gain access to our cloud-based system in order to move shares or query shareholders, which we believe has resulted in a more efficient process for both our customers and us.

Annual Meeting / Proxy Voting Platform

Our proxy module is marketed as a fully integrated, real-time voting platform for our customers and their shareholders of record. This module is utilized for every annual meeting or special meeting we manage for our customers and offers both full-set mailing and notice of internet availability options.

This module has been incorporated within our webcasting offering to enable our customers the ability to conduct their annual meetings in-person or fully virtual. Our solution incorporates shareholder and guest registration, voting integration, real-time statistics on attendance, audio video and presentation features as well as fully managed meeting managers and inspector of elections. Although we believe a virtual component to an annual meeting is both a benefit to all shareholders and a corporate governance advantage, there can be no assurances this product has longevity in the market.

Shareholder Distribution

Over the past few years, we have worked on refining the model of digital distribution of our customers’ message to the investment community and beyond. This was accomplished by integrating our shareholder outreach module, Investor Network, into and with our Compliance offerings. Most of the customers subscribing to this module today are historical PrecisionIR (“PIR”) – Annual Report Service (“ARS”) users, as well as new customers purchasing the entire platform subscription. We migrated some of the customers from the traditional ARS business into this new digital subscription business, however, we continue to operate a portion of this legacy physical hard copy delivery of annual reports and prospectuses for customers who opt to take advantage of it. We continue to see customer attrition for customers who subscribe to both the electronic and physical distribution of reports as a stand-alone product.

Our overall strategy includes:

Expansion of Customer Base

We expect to continue to see demand for our products within our customer base and in the industries we serve. We continue to focus on migrating customer contracts to subscription-based contracts that are typically with terms of one year or greater. We believe this will help us move from a transaction-based revenue model to a recurring subscription-based revenue model, which may give us more consistent, predictable revenue patterns and hopefully create longer lasting customer relationships.

Additionally, as part of our customer expansion efforts, we are committed to working beyond the single point of contact and into the entire C suite (CEO, CFO, IRO, CMO, Corporate Communications Director, Corporate Secretary, etc.) of an organization which we believe will help drive subscription revenues per customer.

Our primary growth strategy continues to be selling our communications solutions to new customers under a subscription arrangement, whereas in the past we were inclined to sell a single point solution. Selling a subscription to our Communications platform allows us to provide our customers with a competitively priced, complete solution for their communications needs. Our strategy of selling our cloud-based offerings via our platform to all customers under a subscription agreement should benefit us by moving away from selling individual solutions within highly commoditized markets that are experiencing pricing pressures.

New Offerings

During 2024 and going forward, we plan to continue to innovate, improve and build new applications into and with our platform, with the objective of developing integrated application solutions that are typically not offered by our competitors. As a company focused on technology offerings, we understand the importance of advancements and fully appreciate the risks and consequences of losing our market position if our product offerings become obsolete.

Each year we bring to market certain platform upgrades, add-ons, and new offerings that we believe will complement our overall platform solutions. We believe our innovation and platform technology efficiencies continue to be a competitive advantage and focus for us.

We have a slate of product platform enhancements coming this fiscal year as we have had in the past, that will help our customers stay connected with their customers, shareholders and constituent base. Specifically, these advancements will be centered around our communications business, whereby we will be adding analytical components and databases to aid in the discovery of a company’s brand. Additionally, we have other strategic upgrades to our platform that we believe will both increase customer retention and annual revenue per customer.

Our acquisition of Newswire provides us the opportunity to offer PRO and our media database platform to existing ACCESSWIRE customers. PRO is a media and marketing communications utility that converts customers’ owned media into earned media opportunities to accelerate business growth. PRO provides integrated media and marketing communications programs aimed to increase site traffic, qualified leads and lowering cost of acquisition for new accounts. The media database platform offers customers access to over a million journalists, broadcasters, and other publishers to target and compose their customized campaign to disseminate to a specific audience. The database also allows customers access to recently published articles by the media contacts to find relevant points to include their messages.

Acquisition Strategy

We will continue to evaluate complimentary verticals and businesses that we can integrate into our communications platform. While we typically focus on accretive acquisition opportunities, we will also evaluate technology acquisitions that we believe would be strategic to our overall long-term business. Specifically, we will look for communications products and businesses that have recurring revenues, customers and technologies that will further enhance our overall market position.

Sales and Marketing

During 2023, we continued to strengthen our brands in the market by working aggressively to expand our customer footprint and continue to cross sell to increase average revenue per customer. Since our platform, systems and operations are built to handle growth, we can leverage them to produce consistently high margins and increased cash flows without a proportional increase in our capital or operating expenses.

Our sales organization is responsible for generating new customer opportunities and expanding our current customers. We ended 2023 with a multi-tier organization of sales personnel, consisting of Business Development Managers, Customer Service Managers and strategic agency and reseller executives. We believe this approach is the most efficient and effective way to reach new customers and grow our current install base. The total compensation packages for these teams are heavily weighted with commission compensation to incent sales and retention. All members of the sales team have quotas. As of December 31, 2023, we employed 35 full-time equivalent sales and marketing personnel compared to 40 as of December 31, 2022.

Our marketing organization has been focused on both new customer acquisition as well as campaigns to educate current customers on the advantages of using our platform. Additionally, our marketing team has expanded their focus on investor conferences, strategic partnerships and private company marketing activities in order to continue to scale our business long term.

Industry Overview

According to a 2022 Burton-Taylor Media Intelligence report, the global communications technology market is more than $5.5 billion in annual revenue. This total includes spending on social media solutions, media monitoring, press release targeting and distribution, and investor relations platforms globally. A key driver of growth in our industry is the introduction of new innovative technologies and solutions. We believe that in early 2024 we will have released fully our new Media Suite subscriber offering, which adds new products in our offering, media monitoring, media database, and pitching. We believe our expanded technology and solutions will help us gain market share within the industry as well as further expand our news distributions brands.

The communications industry also benefits from increased regulatory requirements and the need for platforms and systems to manage these new regulations. Additionally, the industry, along with cloud-based technologies, have matured considerably over the past several years, whereby corporate issuers and communication professionals are seeking platforms and systems to do some, if not all the work themselves. We believe we are well positioned in this new environment to benefit from subscriptions and further advancements of our platform.

The compliance industry is highly fragmented, with hundreds of independent service companies that provide a range of financial reporting and document management services. There is also a wide range of printing and technology software providers. The demands for many of our services historically have been cyclical and reliant on capital market activity. Over the past few years, we have been offering subscriptions which combine both compliance software and service in one annual contract. We believe this offering affords us the ability to reduce our revenue seasonality and provide a new baseline of recurring annualized revenue.

Competition

Despite some significant consolidation in recent years, the communications and compliance industries remain both highly fragmented and extremely competitive. The success of our products and services are generally based on price, quality, and the ability to service customer demands. Management has been focused on offsetting the risks relating to competition as well as the seasonality by introducing our cloud-based subscription platform, with higher margins, clear competitive advantages, higher customer stickiness and scalability to withstand market and pricing pressures.

We also review our operations on a regular basis to balance growth with opportunities to maximize efficiencies and support our long-term strategic goals. We believe by blending our workflow technologies with our legacy service offerings we can offer a comprehensive set of products and solutions to each of our customers within one platform that most competitors cannot offer today.

We believe we are positioned to be one of the communications platforms of choice as a cost-effective alternative to both small regional providers and global providers. We also believe we benefit from our location in Raleigh, North Carolina, as we can hire and retain customer service or production personnel in the area at a reasonable cost. However, there are positions where we have strong competition in hiring, such as research and development and qualified sales individuals with communications industry experience.

Customers

Our customers include a wide variety of public and private companies, mutual funds, law firms, brokerage firms, investment banks, individuals, and other institutions. For the year ended December 31, 2023, we worked with 11,924 customers, compared to 8,218 for the year ended December 31, 2022. The increase in customers is primarily related to an increase in Newswire customers as the 2022 amount only included November and December compared to a full year for 2023. We did not have any customers during the year ended December 31, 2023 that accounted for more than 10% of our revenue or more than 10% of our year end accounts receivable balance as of December 31, 2023.

Human Capital and Culture

As of December 31, 2023, we employed 136 employees and independent contractors, none of which are represented by a union. Our employees work in our corporate offices in North Carolina or their home offices throughout the world.

We recognize and value our people as our most important asset in achieving our strategic goals and growing an industry leading communications and compliance company. We are continually working on a human resources strategy that helps drive the right culture, leadership, talent management, performance, reward and recognition, personal development, and ways of working to ensure we achieve our strategic goals while our people benefit from an exceptional experience. Our efforts in creating a working environment that draws out the best in our employees and allows them to fulfil their potential and support our goals focus on the following::

| ● | Attract, identify, develop and retain high-performing employees across all areas. |

| ● | Develop and support the growth of management and leadership. |

| ● | Enable the development of a high-performance culture in which staff performance can be supported, rewarded, enhanced and managed effectively. |

| ● | Foster a values-based culture focused on diversity, equity, inclusion, well-being, and positive staff engagement. |

| ● | Develop a total reward approach which is valued by staff and facilitates company objectives. |

| ● | Provide excellent core human resources, professional development and health and safety services across all departments to enable the effective operation of the Company. |

Our recruitment strategy is based on identifying top talent, predominantly via existing networks and referrals, and offering competitive compensation packages that combine salary, benefits, equity, and a bonus plan. We apply a wide range of retention initiatives that include rewarding high-performance and opening opportunities for progression and career development. Identification of high-performing talent is linked to succession planning and development of the future-workforce is embedded in employee professional development plans.

We attempt to set clear standards with respect to generating an open and transparent working environment in which everyone has a voice. We believe this invokes effective personal development discussions and provides the opportunity to conduct performance reviews supported by transparent data and open conversation.

We are dedicated to embedding Diversity, Equity and Inclusion (“DEI”) as an important part of developing our culture through delivery of innovative initiatives and internal workshops, ensuring that DEI policies touch on all aspects of the Company from recruitment practices to company behavior/operating frameworks. These policies will also be reviewed periodically as required and updated accordingly.

We strive to deliver a total reward strategy which appropriately supports achievement of our goals and will help position us as an employer of choice which employees value and understand. This will undergo periodic review to ensure we are able to attract and retain top talent in a financially sustainable way.

All of our human resource initiatives are supported by key performance indicators to monitor their effectiveness and gain insight into gaps that can be addressed quickly and ensure our overall human resource strategy is adapted as required and maintained to a high degree.

Facilities

Our headquarters are located in Raleigh, North Carolina. In October 2019, we began a new lease for 9,766 square feet of office space, which expires December 31, 2027.

As part of our acquisition of VWP in 2019, we assumed a three-year lease in Ft. Lauderdale, Florida, which expired on January 3, 2022 and we did not renew. Additionally, we had an office in Salt Lake City, Utah, which we vacated in 2022. We did not assume any leases associated with the Newswire acquisition. We continue to monitor the needs of our employees both in a remote and on-site basis and make necessary adjustments to our locations as needed.

Insurance

We maintain a general business liability, cyber-security and an errors and omissions policies specific to our industry and operations. We believe that our insurance policies provide adequate coverage for all reasonable risks associated with operating our business. Additionally, we maintain a Directors and Officers insurance policy, which is standard for our industry and size. We also maintain key person life insurance on our C level executives, and one other key individual.

We obtained a representation and warranty insurance policy in connection with our acquisition of Newswire relating to potential indemnification claims under the purchase agreement up to an aggregate amount of $12.9 million subject to a retention of $0.4 million.

Regulations

The securities and financial services industries generally are subject to regulation in the United States and elsewhere. Regulatory policies in the United States and the rest of the world are tasked with safeguarding the integrity of the securities and financial markets and with protecting the interests of both issuers and shareholders.

In the United States, corporate issuers are subject to regulation under both federal and state laws, which often require public disclosure and regulatory filings. At the federal level, the SEC regulates the securities industry, along with the Financial Industry Regulatory Authority, or FINRA, formally known as NASD, and NYSE market regulations, various stock exchanges, and other self-regulatory organizations (“SRO”).

We operate our filing agent business and transfer agent business under the supervision and regulations of the SEC. Our transfer agency business, Direct Transfer, LLC, is registered with the SEC and is subject to SEC regulations relating to, among other things, annual reporting, examination, internal controls, tax reporting and escheatment services. Our transfer agency is currently approved to handle the securities of NYSE, NASDAQ and OTC Markets.

Our objective is to assist corporate issuers with these regulations, communication and compliance of rules imposed by regulatory bodies. The majority of our business involves the distribution of content, either electronically or on paper, to governing bodies and shareholders alike. We are recognized under these regulations to disseminate, communicate and or solicit on behalf of our customers, the issuers.

ITEM 1A. RISK FACTORS.

Forward-Looking and Cautionary Statements

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the following risks and uncertainties and all other information contained or referred to in this Annual Report on Form 10-K before investing in our common stock. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties that we are unaware of, or that we currently deem immaterial, also may become important factors that affect us. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the trading price of our common stock could decline, and you could lose some or all your investment.

Risks related to our business

Legislative and regulatory changes can influence demand for our solutions and could adversely affect our business.

The market for our solutions depends in part on the requirements of the SEC and other regulatory bodies. Any legislation or rulemaking substantially affecting the content or method of delivery of documents to be filed with these regulatory bodies could have an adverse effect on our business. In addition, evolving market practices in light of regulatory developments could adversely affect the demand for our solutions. New legislation, or a significant change in rules, regulations, directives or standards could reduce demand for our products and services. Regulatory changes could also increase expenses as we modify our products and services to comply with new requirements and retain relevancy, impose limitations on our operations, and increase compliance or litigation expense, each of which could have a material adverse effect on our business, financial condition and results of operations.

The environment in which we compete is highly competitive, which creates adverse pricing pressures and may harm our business and operating results if we cannot compete effectively.

Competition across all of our businesses is intense. The speed and accuracy with which we can meet customers’ needs, the price of our services and the quality of our products and supporting services are factors in this competition.

Some of our competitors have longer operating histories, greater name recognition, more established customer bases and significantly greater financial, technical, marketing and other resources than we do. As a result, they may be able to respond more quickly and effectively than we can to new or changing market demands and requirements. We could also be negatively impacted if our competitors reduce prices, add new features, form strategic alliances with other companies, or are acquired by other companies with greater available resources.

These competitive pressures to any aspect of our business could reduce our revenue and earnings.

Our business could be harmed if we do not successfully manage the integration of any business that we have acquired or may acquire in the future, particularly in light of our recent acquisition of Newswire. These risks include, among other things:

| ● | the difficulty of integrating the operations and personnel of the acquired businesses into our ongoing operations; |

| ● | the potential disruption of our ongoing business and distraction of management; |

| ● | the potential for new cyber-security risks to existing operations that weren’t previously mitigated: |

| ● | the difficulty in incorporating acquired technology and rights into our products and technology; |

| ● | unanticipated expenses and delays relating to completing acquired development projects and technology integration; |

| ● | a potential increase in our indebtedness and contingent liabilities, which could restrict our ability to access additional capital when needed or to pursue other important elements of our business strategy; |

| ● | the management of geographically remote units; |

| ● | the establishment and maintenance of uniform standards, controls, procedures and policies; |

| ● | the impairment of relationships with employees and customers as a result of any integration of new management personnel; |

| ● | risks of entering markets or types of businesses in which we have either limited or no direct experience; |

| ● | the potential loss of key employees and/or customers of the acquired businesses; and |

| ● | potential unknown liabilities, such as liability for hazardous substances, or other difficulties associated with acquired businesses. |

Our revenue growth rate in past periods relating to our Communications revenue stream may not be indicative of its future performance.

With respect to our Communications revenue stream, we have experienced an annual revenue growth rate ranging from 13% to 55% between 2016 and 2023. Throughout these years, most of the growth has been due to the success of our ACCESSWIRE newswire brand. In 2023 and 2022, we also had additional growth from our acquisition of Newswire. In 2020, much of the growth came from demand for our events products that were upgraded to handle virtual needs in the industry as a result of the COVID-19 pandemic. Additionally, acquisitions of VWP in January 2019 and FSCwire in July 2018 have contributed to the growth. Our historical revenue growth rate of the Communications revenue stream is not indicative of future growth, and we may not achieve similar revenue growth rates in future periods. You should not rely on our revenue or revenue growth for any prior quarterly or annual periods as an indication of our future revenue or revenue growth. If we are unable to maintain consistent revenue or revenue growth, it may be difficult to achieve and maintain profitability and our stock price may be negatively impacted.

The success of our cloud-based software largely depends on our ability to provide reliable solutions to our customers. If a customer were to experience a product defect, a disruption in its ability to use our solutions or a security flaw, demand for our solutions could be diminished, we could be subject to substantial liability and our business could suffer.

Our product solutions are complex, and we often release new features. As such, our solutions could have errors, defects, viruses or security flaws that could result in unanticipated downtime for our customers and harm our reputation and our business. Internet-based software may contain undetected errors or security flaws when first introduced or when new versions or enhancements are released. We might from time to time find such defects in our solutions, the detection and correction of which could be time consuming and costly. Since our customers use our solutions for important aspects of their business, any errors, defects, disruptions in access, security flaws, viruses, data corruption or other performance problems with our solutions could hurt our reputation and may damage our customers’ businesses. If that occurs, customers could elect not to renew, could delay or withhold payment to us or may make claims against us, which could result in an increase in our provision for doubtful accounts, an increase in collection cycles for accounts receivable or the expense and risk of litigation. We could also lose future sales. In addition, a security breach of our solutions could result in our future business prospects being materially adversely impacted.

A substantial portion of our business is derived from our press release distribution business, which is dependent on technology and key partners.

As noted, our ACCESSWIRE brand has been vital to the increase in revenue associated with our Communications business. It is expected that our recent acquisition of Newswire will also add significant revenue to our Communications business in the future. ACCESSWIRE and Newswire are dependent upon several key partners for news distribution, some of which are also partners that we rely on for other shareholder communications services. During the second quarter of 2019, one of our key partners made an industry-wide decision to no longer accept investor commentary content. A significant portion of our historical ACCESSWIRE revenue was generated from this type of content, which significantly affected revenue going forward. Further disruption in any of these partnerships could have a material adverse impact on our business and financial results and the inability to procure new key partners could impact the growth of the ACCESSWIRE brand, particularly with respect to public company news distribution. Additionally, ACCESSWIRE and Newswire are highly dependent on technology and any performance issues with this technology could have a material impact on our ability to serve our customers and thus our ability to generate revenue.

Failure to manage our growth may adversely affect our business or operations.

Since 2013, we have experienced overall growth in our business, customer base, employee headcount and operations, and we expect to continue to grow our business over the next several years. This growth places a significant strain on our executive management team and employees and on our operating and financial systems. To manage our future growth, we must continue to scale our business functions, improve our financial and management controls and our reporting systems and procedures and expand and train our work force. In particular, we grew from 24 employees and contractors as of December 31, 2012 to 136 (including 32 independent contractors) as of December 31, 2023. We anticipate that additional investments in sales personnel, infrastructure and research and development spending will be required to:

| ● | scale our operations and increase productivity; |

| ● | address the needs of our customers; |

| ● | further develop and enhance our existing solutions and offerings; and |

We cannot assure you that our controls, systems and procedures will be adequate to support our future operations or that we will be able to manage our growth effectively. We also cannot assure you that we will be able to continue to expand our market presence in the United States and other current markets or successfully establish our presence in other markets. Failure to effectively manage growth could result in difficulty or delays in deploying customers, declines in quality or customer satisfaction, increases in costs, difficulties in introducing new features or other operational difficulties, and any of these difficulties could adversely impact our business performance and results of operations.

If we are unable to retain our key employees and attract and retain other qualified personnel, our business could suffer.

Our ability to grow and our future success will depend to a significant extent on the continued contributions of our key executives, managers and employees. In addition, many of our individual technical and sales personnel have extensive experience in our business operations and/or have valuable customer relationships that would be difficult to replace. Their departure, if unexpected and unplanned, could cause a disruption to our business. Our competition for these individuals is intense in certain areas of our business. We may not succeed in identifying and retaining the appropriate personnel in key positions. Further, competitors and other entities have in the past recruited and may in the future attempt to recruit our employees, particularly our sales personnel. The loss of the services of our key personnel, the inability to identify, attract and retain qualified personnel in the future or delays in hiring qualified personnel, particularly technical and sales personnel, could make it difficult for us to manage our business and meet key objectives, such as the timely introduction of new technology-based products and services, which could harm our business, financial condition and operating results.

If we fail to keep our customers’ information confidential or if we handle their information improperly, our business and reputation could be significantly and adversely affected.

If we fail to keep customers’ proprietary information and documentation confidential, we may lose existing customers and potential new customers and may expose them to significant loss of revenue based on the premature release of confidential information. While we have security measures in place to protect customer information and prevent data loss and other security breaches, these measures may be breached as a result of third-party action, employee error, malfeasance or otherwise. Because the techniques used to obtain unauthorized access or sabotage systems change frequently and generally are not identified until they are launched against a target, we may be unable to anticipate these techniques or implement adequate preventative measures.

In addition, our service providers (including, without limitation, hosting facilities, disaster recovery providers and software providers) may have access to our customers’ data and could suffer security breaches or data losses that affect our customers’ information.

If an actual or perceived security breach or premature release occurs, our reputation could be damaged, and we may lose future sales and customers. We may also become subject to civil claims, including indemnity or damage claims in certain customer contracts, or criminal investigations by appropriate authorities, any of which could harm our business and operating results. Furthermore, while our errors and omissions insurance policies include liability coverage for these matters, if we experienced a widespread security breach that impacted a significant number of our customers for whom we have these indemnity obligations, we could be subject to indemnity claims that exceed such coverage.

We must adapt to rapid changes in technology and customer requirements to remain competitive.

The market and demand for our products and services, to a varying extent, have been characterized by:

| ● | frequent product and service introductions; and |

| ● | evolving customer requirements. |

We believe that these trends will continue into the foreseeable future. Our success will depend, in part, upon our ability to:

| ● | enhance our existing products and services; |

| ● | gain market acceptance; and |

| ● | successfully develop new products and services that meet increasing customer requirements. |

To achieve these goals, we will need to continue to make substantial investments in sales and marketing. We may not:

| ● | be successful in developing product and service enhancements or new products and services on a timely basis, if at all; or |

| ● | be able to successfully market these enhancements and new products once developed. |

Further, our products and services may be rendered obsolete or uncompetitive by new industry standards or changing technology.

Revenue from subscriptions and many of our service contracts is recognized ratably over the term of the contract or subscription period. As a result, downturns or upturns in sales may not be immediately reflected in our operating results.

We generally recognize subscription and support revenue from customers ratably over the terms of their subscription agreements, which are typically on a quarterly or annual cycle and automatically renew for additional periods. As a result, a substantial portion of the revenue we report in each quarter will be derived from the recognition of deferred revenue relating to subscription agreements entered into during previous quarters. Consequently, a decline in new or renewed subscriptions in any one quarter may not be immediately reflected in our revenue results for that quarter. This decline, however, will negatively affect our revenue in future quarters. Accordingly, the effect of significant downturns in sales and market acceptance of our solutions and potential changes in our rate of renewals may not be fully reflected in our results of operations until future periods. Our subscription model also makes it difficult for us to rapidly increase our subscription revenue through additional sales in any period, as revenue from new customers must be recognized over the applicable subscription term. In addition, we may be unable to adjust our cost structure to reflect the changes in revenue, which could adversely affect our operating results.

Our subscription renewal or upgrade rates may decline due to various factors which may impact our future revenue and operating results.

Our business depends substantially on customers renewing their subscriptions with us and expanding their use of our products. Our customers have no obligation to renew their subscriptions for our products after the expiration of their initial subscription period. We may not accurately predict new subscription or expansion rates and the impact these rates may have on our future revenue and operating results. Our renewal rates may decline or fluctuate as a result of a number of factors, including customer dissatisfaction with our service, customers’ ability to continue their operations and spending levels and deteriorating general economic conditions. If our customers do not renew their subscriptions for our products, purchase fewer solutions at the time of renewal, or negotiate a lower price upon renewal, our revenue will decline, and our business will suffer. Our future success also depends in part on our ability to sell additional solutions and products, more subscriptions, or enhanced editions of our products to our current customers. If our efforts to sell additional solutions and products to our customers are not successful, our growth and operations may be impeded. In addition, any decline in our customer renewals or failure to convince our customers to broaden their use of our products would harm our future operating results.

We are subject to general litigation and regulatory requirements that may materially adversely affect us.

From time to time, we may be involved in disputes or regulatory inquiries that arise in the ordinary course of business. We expect that the number and significance of these potential disputes may increase as our business expands and we grow larger. While most of our agreements with customers limit our liability for damages arising from our solutions, we cannot assure you that these contractual provisions will protect us from liability for damages in the event we are sued. Although we carry general liability insurance coverage, our insurance may not cover all potential claims to which we are exposed or may not be adequate to indemnify us for all liability that may be imposed. Any claims against us, whether meritorious or not, could be time consuming, result in costly litigation, require significant amounts of management time, and result in the diversion of significant operational resources. Because litigation is inherently unpredictable, we cannot assure you that the results of any of these actions will not have a material adverse effect on our business, financial condition, results of operations and prospects.

New and existing laws make determining our sales and use taxes and income tax rate complex and subject to uncertainty.

The computation of sales and use taxes and our provision for income tax is complex, as it is based on the laws of multiple taxing jurisdictions and requires significant judgment on the application of complicated rules governing accounting for such tax provisions under U.S. generally accepted accounting principles. Since sales and use tax varies by state, it may be difficult to determine taxability of our products and services in each state and remain current on frequently changing laws. Additionally, provisions for income tax for interim quarters are based on forecasts of our U.S. and non-U.S. effective tax rates for the year and contain numerous assumptions. Various items cannot be accurately forecasted, and future events may be treated as discrete to the period in which they occur. Our provision for income tax can be materially impacted by things such as changes in our business, internal restructuring and acquisitions, changes in tax laws and accounting guidance and other regulatory, legislative developments, tax audit determinations, changes in uncertain tax positions, tax deductions attributed to equity compensation and changes in our determination for a valuation allowance for deferred tax assets. For all of these reasons, our actual income taxes may be materially different than our provision for income tax.

We are subject to U.S. and foreign data privacy and protection laws and regulations as well as contractual privacy obligations, and our failure to comply could subject us to fines and damages and would harm our reputation and business.

We manage private and confidential information and documentation related to our customers’ finances and transactions, often prior to public dissemination. The use of insider information is highly regulated in the United States and abroad, and violations of securities laws and regulations may result in civil and criminal penalties. In addition, we are subject to the data privacy and protection laws and regulations adopted by federal, state and foreign legislatures and governmental agencies. Data privacy and protection is highly regulated and may become the subject of additional regulation in the future. Privacy laws restrict our storage, use, processing, disclosure, transfer and protection of non-public personal information by our customers or collected from visitors of our website. We strive to comply with all applicable laws, regulations, policies and legal obligations relating to privacy and data protection. However, it is possible that these requirements may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. Any failure, or perceived failure, by us to comply with federal, state or international laws, including laws and regulations regulating privacy, payment card information, personal health information, data or consumer protection, could result in proceedings or actions against us by governmental entities or others.

The regulatory framework for privacy and data protection issues worldwide is evolving, and various government and consumer agencies and public advocacy groups have called for new regulation and changes in industry practices, including some directed at providers of mobile and online resources in particular. Our obligations with respect to privacy and data protection may become broader or more stringent. If we are required to change our business activities or revise or eliminate services, or to implement costly compliance measures, our business and results of operations could be harmed.

If potential customers take a long time to evaluate the use of our products, we could incur additional selling expenses and decrease our profitability.

The acceptance of our services depends on a number of factors, including the nature and size of the potential customer base, the effectiveness of our system, and the extent of the commitment being made by the potential customer, and is difficult to predict. Currently, our sales and marketing expenses per customer are fairly low. If potential customers take longer than we expect to decide whether to use our services and require that we travel to their sites, present more marketing material, or spend more time in completing the sales process, our selling expenses could increase, and decrease our profitability.

The seasonality of business makes it difficult to predict future results based on specific quarters.

A greater portion of our printing, distribution and solicitation of proxy materials business will be processed during the second quarter of our fiscal year. Therefore, the seasonality of our revenue makes it difficult to estimate future operating results based on the results of any specific quarter and could affect an investor’s ability to compare our financial condition and results of operations on a quarter-by-quarter basis. To balance the seasonal activity of print, distribution and solicitation of proxy materials, we will attempt to continue to grow other revenues linked to predictable periodic activity that is not cyclical in nature.

If we are unable to successfully develop and timely introduce new technology-based products or enhance existing technology-based products, our business may be adversely affected.

In the past few years, we have expended significant resources to develop and introduce new technology-based products and improve and enhance our existing technology-based products in an attempt to maintain or increase our sales. The long-term success of new or enhanced technology-based products may depend on a number of factors including, but not limited to, the following: anticipating and effectively addressing customer preferences and demand, the success of our sales and marketing efforts, timely and successful development, changes in governmental regulations and the quality of or defects in our products.