true

0001602409

0001602409

2024-05-17

2024-05-17

0001602409

dei:BusinessContactMember

2024-05-17

2024-05-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

As filed

with the Securities and Exchange Commission on May 17, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3/A

(Amendment No. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

| FINGERMOTION, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

| (State or other jurisdiction of incorporation or organization) |

| 46-4600326 |

| (I.R.S. Employer Identification Number) |

111 Somerset Road, Level 3

Singapore 238164

(347) 349-5339 |

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

|

United Corporate Services, Inc.

800 North State Street, Suite 304

Dover, DE 19901

Telephone: (877) 734-8300 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies of communications to:

Michael Shannon, Esq.

McMillan LLP

1055 West Georgia Street, Suite 1500

Vancouver, British Columbia, Canada V6E 4N7

Telephone: (604) 689-9111

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement as determined by the Registrant.

If the only securities being registered on this

form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 of the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. o

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated Filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in this Prospectus is not complete

and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission

is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any

state where the offer or sale is not permitted.

Subject

to Completion: Dated May 17, 2024

PROSPECTUS

FINGERMOTION, INC.

5,271,285 Warrants to Purchase Shares of

Common Stock

5,271,285 Shares of Common Stock

We are distributing at no cost to you, as

a holder of shares of our common stock, par value $0.0001 per share (“Common Shares”), transferrable warrants to purchase

Common Shares (“Warrants”). If you own Common Shares on [●], 2024,

the record date, you will be entitled to receive one (1) Warrant for each ten (10) Common Shares you own. When exercisable, one (1) Warrant

will entitle the holder thereof to purchase one (1) Common Share at an exercise price of $7.00 per Common Share. The Warrants will be

exercisable in accordance with the terms of the warrant agreement until 5:00 p.m., Eastern Time, on the expiration date, [●],

2026.

Our board of directors is not making a recommendation

regarding your exercise of the Warrants. You should carefully consider whether to exercise them.

We have applied for listing the warrants on

the NASDAQ Capital Market (“Nasdaq”) and expect trading to commence on or around [●],

2024 under the symbol “FNGRW”. Our Common Shares are traded on Nasdaq under the symbol “FNGR”. The last reported

sales price of our Common Shares on Nasdaq on May 16, 2024, the last practicable date before the filing of this prospectus, was $3.30. We

urge you to obtain a current market price for the Common Shares before making any investment decision with respect to the Warrants.

Investing in our

securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk

Factors” beginning on page 13 of this Prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these Securities or passed upon the adequacy

or accuracy of this Prospectus. Any representation to the contrary is a criminal offense.

INTRODUCTORY

COMMENTS

We are a holding company

incorporated in Delaware and not a Chinese operating company. As a holding company, we conduct a significant part of our operations through

our subsidiaries and through contractual arrangements with a variable interest entity (“VIE”) based in the People’s

Republic of China (“PRC” or “China”). To address challenges resulting from laws, policies and practices

that may disfavor foreign-owned entities that operate within industries deemed sensitive by the Chinese government, we use the VIE structure

to provide contractual exposure to foreign investment in Chinese-based companies. We own 100% of the equity of a wholly foreign owned

enterprise (“WFOE”), which has entered into contractual arrangements with the VIE (the “VIE Agreements”),

which is owned by Ms. Li Li, the legal representative and general manager and also the shareholder of the VIE. The VIE Agreements have

not been tested in court. For a description of the VIE structure and our contractual arrangements with the VIE, see “Corporate

Information”. As a result of our use of the VIE structure, you may never directly hold equity interests in the VIE.

Because we do not directly

hold an equity interest in the VIE, which has never been challenged or recognized in court for the time being, we are subject to risks

and uncertainties of the interpretations and applications of Chinese laws and regulations, including but not limited to, the validity

and enforcement of the contractual arrangements among the WFOE, the VIE and the shareholder of the VIE. We are also subject to the risks

and uncertainties about any future actions of the Chinese government in this regard that could disallow the VIE structure, which would

likely result in a material change in our operations, and the value of our common stock may depreciate significantly or become worthless.

See “Risk Factors—Risks Related to the VIE Agreements” and “Risk Factors—Risks Related to Doing

Business in China”.

We are subject to certain

legal and operational risks associated with having a significant portion of our operations in China. Chinese laws and regulations governing

our current business operations are sometimes vague and uncertain, and as a result, these risks could result in a material change in our

operations, significant depreciation of the value of our common stock, or a complete hindrance of our ability to offer our securities

to investors. Recently, the Chinese government adopted a series of regulatory actions and issued statements to regulate business operations

in China, including those related to the use of VIEs, data security and anti-monopoly concerns. As of the date of this Prospectus, our

Company and subsidiaries and the VIE have not been involved in any investigations on cybersecurity review initiated by any Chinese regulatory

authority, nor has any of them received any inquiry, notice or sanction.

On February 17, 2023,

the China Securities Regulatory Commission (the “CSRC”) promulgated Trial Administrative Measures of Overseas Securities

Offering and Listing by Domestic Companies (the “Overseas Listing Trial Measures”) and five relevant guidelines, which

became effective on March 31, 2023. The Overseas Listing Trial Measures regulate both direct and indirect overseas offering and listing

of PRC domestic companies’ securities by adopting a filing-based regulatory regime. According to the Overseas Listing Trial Measures,

if the issuer meets both the following conditions, the overseas securities offering and listing conducted by such issuer will be determined

as indirect overseas offering, which shall be subject to the filing procedure set forth under the Overseas Listing Trial Measures: (i)

50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated

financial statements for the most recent accounting year is accounted for by domestic companies; and (ii) the main parts of the issuer’s

business activities are conducted in mainland China, or its main places of business are located in mainland China, or the senior managers

in charge of its business operations and management are mostly Chinese citizens or domiciled in mainland China. Where an abovementioned

issuer submits an application for an initial public offering to competent overseas regulators, such issuer shall file with the CSRC within

three business days after such application is submitted. Where a domestic company fails to fulfill filing procedure or in violation of

the provisions as stipulated above, in respect of its overseas offering and listing, the CSRC shall order rectification, issue warnings

to such domestic company, and impose a fine ranging from RMB1,000,000 to RMB10,000,000. Also the directly liable persons and actual controllers

of the domestic company that organize or instruct the aforementioned violations shall be warned and/or imposed fines.

Also on February 17,

2023, the CSRC also held a press conference for the release of the Overseas Listing Trial Measures and issued the Notice on Administration

for the Filing of Overseas Offering and Listing by Domestic Companies, which, among others, clarifies that the domestic companies that

have already been listed overseas on or before the effective date of the Overseas Listing Trial Measures (March 31, 2023) shall be deemed

as “stock enterprises”. Stock enterprises are not required to complete the filling procedures immediately, and they shall

be required to file with the CSRC when subsequent matters such as refinancing are involved.

As of the date of this

Prospectus, our Company and subsidiaries and the VIE have not received any inquiry, notice, warning or sanctions from the CSRC or any

other Chinese governmental authorities relating to securities listings, although we may have to file with the CSRC with respect to a

new offering of our securities. However, since these statements and regulatory actions, including the Overseas Listing Trial Measures,

are newly published it is uncertain what potential impact such modified or new laws and regulations will have on our ability to conduct

our business, accept investments or list or maintain a listing on a U.S. or foreign exchange. See “Risk Factors— Risks

Related to Doing Business in China”.

As of the date of this Prospectus, none of our

subsidiaries or any of the consolidated VIE have made any dividends or distributions to our Company. Under Delaware law, a Delaware corporation’s

ability to pay cash dividends on its capital stock requires the corporation to have either net profits or positive net assets (total assets

less total liabilities) over its capital. If we determine to pay dividends on any of our common stock in the future, as a holding company,

we will rely, in part, on payments made from the VIE to our WFOE in accordance with the VIE Agreements and dividends and other distributions

on equity from our WFOE to the Company. Our ability to settle amounts owed under the VIE Agreements is subject to certain restrictions

and limitations. Under the VIE Agreements, the VIE is obligated to make payments to our WFOE, in cash or in kind, at the WFOE’s

request. However, such payments are subject to Chinese taxes, including a 6% VAT and 25% enterprise income tax. In addition, current Chinese

regulations permit our WFOE to pay dividends to its shareholders only out of registered capital amount, if any, as determined in accordance

with Chinese accounting standards and regulations. If our WFOE incurs debt in the future, the instruments governing the debt may restrict

its ability to pay dividends or make other payments to us. Any limitation on the ability of our WFOE to distribute dividends or other

payments to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to

our businesses, pay dividends or otherwise fund and conduct our business. In addition, any cash dividends or distributions of assets by

our WFOE to its stockholder are subject to a Chinese withholding tax of as much as 10%. The Chinese government also imposes controls on

the conversion of Renminbi (“RMB”) into foreign currencies and the remittance of currencies out of China. Therefore,

we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment

of dividends from our profits, if any. If we are unable to receive all of the revenues from our operations through the current VIE Agreements,

we may be unable to pay dividends on our common stock.

Transfer of Cash or Assets

Dividend Distributions

We have never

declared or paid dividends or distributions on our common stock. We currently intend to grant a dividend in kind of warrants to purchase

shares of our common stock to holders of our common stock as previously disclosed, however, we intend to retain all available funds and

any future consolidated earnings to fund our operations and continue the development and growth of our business; therefore, we do not

anticipate paying any cash dividends.

Under Delaware law, a Delaware corporation’s

ability to pay cash dividends on its capital stock requires the corporation to have either net profits or positive net assets (total assets

less total liabilities) over its capital. If we determine to pay dividends on any of our common stock in the future, as a holding company,

we may rely on dividends and other distributions on equity from our WFOE for cash requirements, including the funds necessary to pay dividends

and other cash contributions to our shareholders.

Our WFOE’s ability to distribute dividends

is based upon its distributable earnings. PRC legal restrictions permit payments of dividends by our WFOE only out of its accumulated

after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. A PRC company is not permitted to

distribute any profits until any losses from prior fiscal years have been offset. Profits retained from prior fiscal years may be distributed

together with distributable profits from the current fiscal year. Our WFOE is also required under PRC laws and regulations to allocate

at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts

in said fund reach 50% of our register capital. Current Chinese regulations permit our WFOE to pay dividends to its shareholder only

out of its registered capital amount, if any, as determined in accordance with PRC accounting standards and regulations. If our WFOE

incurs debt in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to us.

Any limitation on the ability of our WFOE to distribute dividends or other payments to us could materially and adversely limit our ability

to grow, make investments or acquisitions that could be beneficial to our businesses, pay dividends or otherwise fund and conduct our

business. In addition, any cash dividends or distributions of assets by our WFOE to its shareholder are subject to a Chinese withholding

tax of as much as 10%. Remittance of dividends by our WFOE out of China is also subject to examination by the banks designated by the

State Administration of Foreign Exchange, or the SAFE. For risks relating to the fund flows of our operations in China, see “Risk

Factors— Risks Related to Doing Business in China”.

The Chinese government also imposes controls on

the conversion of RMB into foreign currencies and the remittance of currencies out of China. Therefore, we may experience difficulties

in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits,

if any. If we are unable to receive all of the revenues from our operations through the current VIE Agreements, we may be unable to pay

dividends on our common stock.

For us to pay dividends to our shareholders, we

will rely on payments made from the VIE to our WFOE in accordance with the VIE Agreements, and the distribution of payments from the WFOE

to the Delaware holding company as dividends. Certain payments from the VIE to the WFOE pursuant to the VIE Agreements are subject to

Chinese taxes, including a 6% VAT and 25% enterprise income tax.

Our Company’s Ability to Settle Amounts

Owed under the VIE Agreements

We transfer cash to our wholly-owned Hong Kong

subsidiary, by making capital contributions or providing loans, and our Hong Kong Subsidiary transfers cash to the WFOE in China by making

capital contributions. Because we control the VIE through contractual arrangements, we are unable to make direct capital contributions

to the VIE and its subsidiaries.

Under the VIE Agreements, the VIE is obligated

to make payments to our WFOE, in cash or in kind, at the WFOE’s request. We will be able to settle amounts owed under the VIE Agreements

through dividends paid by our WFOE to our Company. Such ability may be restricted or limited as follows:

| · | First, any payments from the VIE to our WFOE is subject to Chinese taxes, including a 6% VAT and 25% enterprise

income tax. |

| · | Second, current Chinese regulations permit our WFOE to pay dividends to their shareholders only out of

its registered capital amount, if any, as determined in accordance with Chinese accounting standards and regulations. In addition, if

our WFOE incurs debt in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments

to the Delaware holding company. |

| · | Third, the Chinese government also imposes controls on the conversion of RMB into foreign currencies and

the remittance of currencies out of China. Therefore, we may experience difficulties in completing the administrative procedures necessary

to obtain and remit foreign currency for the payment of dividends from profits, if any. |

The VIE may transfer cash to our WFOE by paying

service fees according to the consulting services agreement.

Effect of Holding Foreign Companies Accountable

Act and Related SEC Rules.

On December

16, 2021, Public Company Accounting Oversight Board (“PCAOB”) issued a report on its determinations that PCAOB is

unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong,

a Special Administrative Region of the PRC, because of positions taken by PRC authorities in those jurisdictions. The PCAOB made these

determinations pursuant to PCAOB Rule 6100, which provides a framework for how the PCAOB fulfills its responsibilities under the Holding

Foreign Companies Accountable Act (“HFCAA”). The report further listed in its Appendix A and Appendix B, Registered

Public Accounting Firms Subject to the Mainland China Determination and Registered Public Accounting Firms Subject to the Hong Kong Determination,

respectively. The audit report included in our Annual Report on Form 10-K for the years ended February 28, 2023 and 2022 was issued by

Centurion ZD CPA & Co. (“CZD CPA”), an audit firm headquartered in Hong Kong, a jurisdiction that the PCAOB previously

determined that the PCAOB is unable to conduct inspections or investigate auditors. However, on December 15, 2022, the PCAOB determined

that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland

China and Hong Kong and voted to vacate its previous determinations. Should the PRC authorities obstruct or otherwise fail to facilitate

the PCAOB’s access in the future, the PCAOB will consider the need to issue a new determination.

In June 2022, we were

identified on the SEC’s “Conclusive list of issuers identified under the HFCAA” (available at https://www.sec.gov.hfcaa)

and, as a result we are required to comply with the submission or disclosure requirements in this Prospectus for our fiscal year ended

February 28, 2023. If we are so identified for two consecutive years, the SEC would prohibit our securities from trading on a securities

exchange or in the over-the-counter trading market in the United States. As noted above, on December 15, 2022, the PCAOB vacated its

previous determinations that it is unable to inspect and investigate completely PCAOB-registered public accounting firms headquartered

in mainland China and Hong Kong. Accordingly, until such time as the PCAOB issues any new determination, we do not expect to be at risk

of having our securities subject to a trading prohibition under the HFCAA.

Under the HFCAA (as amended by the Consolidated

Appropriations Act, 2023), our securities may be prohibited from trading on the U.S. stock exchanges or in the over the counter trading

market in the U.S. if our auditor is not inspected by the PCAOB for two consecutive years, and this ultimately could result in our common

stock being delisted. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”),

which was enacted under the Consolidated Appropriations Act, 2023, as further described below.

On August 26, 2022, the PCAOB signed a Statement

of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the PRC, taking the first step toward opening

access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. The

Statement of Protocol gives the PCAOB sole discretion to select the firms, audit engagements and potential violations it inspects and

investigates and put in place procedures for PCAOB inspectors and investigators to view complete audit work papers with all information

included and for the PCAOB to retain information as needed. In addition, the Statement of Protocol grants the PCAOB direct access to interview

and take testimony from all personnel associated with the audits the PCAOB inspects or investigates. While significant, the Statement

of Protocol is only a first step. Uncertainties still exists as to whether and how this new Statement of Protocol will be implemented.

Notwithstanding the signing of the Statement of Protocol, if the PCAOB cannot make a determination that it is able to inspect and investigate

completely registered public accounting firms headquartered in mainland China and Hong Kong, trading of our securities will still be prohibited

under the HFCAA and Nasdaq will determine to delist our securities. Therefore, there is no assurance that the Statement of Protocol will

relieve us from the delisting risks under the HFCAA.

On December 29, 2022, the Consolidated Appropriations

Act, 2023, was signed into law, which amended the HFCAA (i) to reduce the number of consecutive years that would trigger delisting from

three years to two years, and (ii) so that any foreign jurisdiction could be the reason why the PCAOB does not to have complete access

to inspect or investigate a company’s auditors. As it was originally enacted, the HFCAA applied only if the PCAOB’s inability

to inspect or investigate because of a position taken by an authority in the foreign jurisdiction where the relevant public accounting

firm is located. As a result of the Consolidated Appropriations Act, 2023, the HFCAA now also applies if the PCAOB’s inability to

inspect or investigate the relevant accounting firm is due to a position taken by an authority in any foreign jurisdiction. The denying

jurisdiction does not need to be where the accounting firm is located.

In the future, if we do not engage an auditor

that is subject to regular inspection by the PCAOB, our common stock may be delisted. The delisting of our Common Shares, or the threat

of the Common Shares being delisted, may materially and adversely affect the value of your investment.

The date of this Prospectus

is ____________ __, 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This Prospectus is a part of a registration statement on Form S-3 that

we filed with the Securities and Exchange Commission (the “SEC”). Please carefully read this Prospectus together with

the documents incorporated herein by reference under “Documents Incorporated by Reference”. This Prospectus and the

information incorporated herein by reference contain summaries of certain provisions contained in some of the documents described herein,

but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual

documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits

to the registration statement of which this Prospectus is a part, and you may obtain copies of those documents as described below under

the heading “Where to Find Additional Information”.

You should rely only on the information contained

in this Prospectus, including the information incorporated by reference. We have not authorized anyone to provide you with information

different from that contained in this Prospectus. The information contained in this Prospectus is accurate only as of the date of this

Prospectus, regardless of the time of delivery of this Prospectus or of any sale of the securities. Our business, financial condition,

results of operations and prospects may have changed since that date.

This Prospectus does not constitute an offer

to sell or a solicitation of an offer to buy securities in any jurisdiction where, or to any person to whom, it is unlawful to make such

offer or solicitation.

REFERENCES

Unless the context otherwise requires, in this

Prospectus: (i) the terms “we”, “us”, “our”, “Company”, “FingerMotion” and

“our business” refer to FingerMotion, Inc. or as the context requires, collectively with its consolidated subsidiaries; (ii)

“SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the United States Securities

Act of 1933, as amended; (iv) “Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended; and

(v) all dollar amounts refer to United States dollars unless otherwise indicated.

PROSPECTUS SUMMARY

The following summary highlights selected

information contained elsewhere or incorporated by reference in this Prospectus and does not contain all of the information that you

should consider in making your investment decision. Before investing in our securities, you should carefully read this entire Prospectus,

including our financial statements and the related notes and other documents incorporated by reference in this Prospectus, as well as

the information under the heading “Risk Factors” contained herein and under similar headings in the other documents that

are incorporated by reference into this Prospectus and the exhibits to the registration statement of which this Prospectus is a part.

Our Company

Overview

We operate the following lines of business: (i)

Telecommunications Products and Services; (ii) Value Added Product and Services; (iii) Short Message Services (“SMS”)

and Multimedia Messaging Services (“MMS”); (iv) a Rich Communication Services (“RCS”) platform;

(v) Big Data Insights; and (vi) a Video Game Division (inactive).

Our common stock is registered under section 12(b)

of the Exchange Act. Our common stock is listed on the Nasdaq Capital Market under the symbol “FNGR”.

Our website address is www.FingerMotion.com.

Information contained on, or accessible through, our website does not constitute a part of and is not incorporated into this Prospectus,

and the only information that you should rely on in making your decision whether to invest in our common stock is the information contained

in this Prospectus.

Corporate Information

The Company was initially incorporated as “Property

Management Corporation of America” on January 23, 2014 in the State of Delaware.

On June 21, 2017, the Company amended its certificate

of incorporation to effect a 1-for-4 reverse stock split of the Company’s outstanding Common Shares, to increase the authorized

number of Common Shares to 200,000,000 and to change the name of the Company from “Property Management Corporation of America”

to “FingerMotion, Inc.” (collectively, the “Corporate Actions”). The Corporate Actions and the amended

certificate of incorporation became effective on June 21, 2017.

The principal executive office of the Company

is located at 111 Somerset Road, Level 3, Singapore 238164, and our telephone number is (347) 349-5339.

We are a holding company incorporated in Delaware

and not an operating company incorporated in the PRC. As a holding company, we conduct a significant part of our operations through our

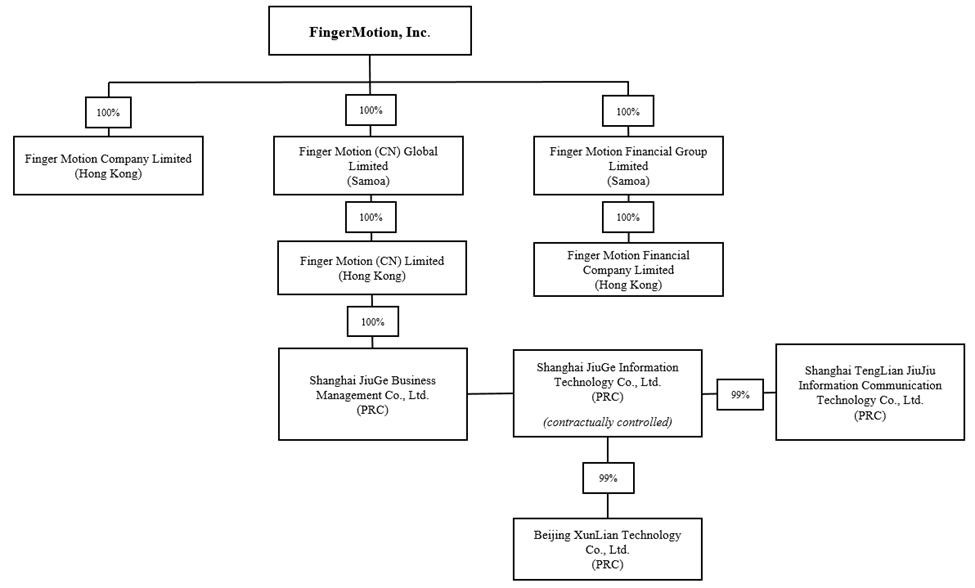

subsidiaries and through the VIE Agreements with the VIE based in China. The following diagram depicts our corporate structure:

Our holding company structure presents unique

risks as our investors may never directly hold equity interests in our subsidiaries or the VIE, and will be dependent upon contributions

from our subsidiaries and the VIE to finance our cash flow needs. Our subsidiaries and the VIE are currently not required to obtain permission

from the Chinese authorities including the CSRC or Cybersecurity Administration Committee (the “CAC”), to operate or

to issue securities to foreign investors. However, as of March 31, 2023, pursuant to the Overseas Listing Trial Measures promulgated by

the CSRC, we may have to file with the CSRC with respect to a new offering of our securities. The business of our subsidiaries and the

VIE until now are not subject to cybersecurity review with the CAC, given that: (i) data processed in our business does not have a bearing

on national security and thus may not be classified as core or important data by the authorities; (ii) we do not possess a large amount

of personal information in our business operations. In addition, we are not subject to merger control review by China’s anti-monopoly

enforcement agency due to the level of our revenues which provided from us and audited by our auditor and the fact that we currently do

not expect to propose or implement any acquisition of control of, or decisive influence over, any company with revenues within China of

more than RMB400 million. Currently, these statements and regulatory actions have had no impact on our daily business operations, the

ability to accept foreign investments and list our securities on an U.S. or other foreign exchange. However, since these statements and

regulatory actions, including the Overseas Listing Trial Measures, are new, it is uncertain what potential impact such modified or new

laws and regulations will have on our daily business operation, the ability to accept foreign investments and list our securities on an

U.S. or other foreign exchange.

To operate, the VIE and Beijing XunLian TianXia

Technology Co., Ltd. are required to obtain, and have obtained, a value-added telecommunications business license from PRC authorities.

In connection with our previous issuance of securities to foreign investors, under current PRC laws, regulations and regulatory rules,

as of the date of this Annual Report on Form 10-K, we, our PRC subsidiaries and the VIE, (i) are not required to obtain permissions from

the CSRC except that as of March 31, 2023 we may have to file with the CSRC with respect to a new offering of our securities, (ii) are

not required to go through cybersecurity review by the CAC, and (iii) have received or were not denied such requisite permissions by any

PRC authority. If we, our subsidiaries or the VIE (i) do not receive or maintain such permissions or approvals, (ii) inadvertently conclude

that such permissions or approvals are not required or (iii) applicable laws, regulations, or interpretations change and we are required

to obtain such permissions or approvals in the future, we may be subject to government enforcement actions, investigations, penalties,

sanctions and fines imposed by the CSRC, the CAC and relevant departments of the State Council. In severe circumstances, the business

of our PRC subsidiary may be ordered to suspend and its business qualifications and licenses may be revoked.

To address challenges resulting from laws, policies

and practices that may disfavor foreign-owned entities that operate within industries deemed sensitive by the Chinese government, we use

the VIE structure to provide contractual exposure to foreign investment in the PRC-based companies. We own 100% of the equity of a WFOE,

Shanghai JiuGe Business Management Co., Ltd. (“JiuGe Management”), which has entered into the VIE Agreements with the

VIE, which is owned by Ms. Li Li, the legal representative and general manager and also the shareholder of the VIE. The VIE Agreements

have not been tested in court. As a result of our use of the VIE structure, you may never directly hold equity interests the VIE. Any

securities that we offer will be securities of the Company, the Delaware holding company, not of the VIE.

We fund

the registered capital and operating expenses of the VIE by extending loans to the shareholders of the VIE. The VIE Agreements governing

the relationship between the VIE and our WFOE enable us to (i) direct the activities of the VIE that most significantly impact the VIE’s

economic performance, (ii) receive substantially all of the economic benefits of the VIE, and (iii) have an exclusive call option to purchase,

at any time, all or part of the equity interests in and/or assets of the VIE to the extent permitted by Chinese laws. As a result of the

VIE Agreements, the Company is considered the primary beneficiary of the VIE for accounting purposes and is able to consolidate the financial

results of the VIE in its consolidated financial statements in accordance with U.S. GAAP. As a result, investors in our Common

Shares are not purchasing an equity interest in the VIE but instead are purchasing equity interest in FingerMotion, Inc., a Delaware holding

company.

VIE Agreements

On October 16, 2018, the Company, through its

indirect wholly owned subsidiary, Shanghai JiuGe Business Management Co., Ltd. (“JiuGe Management”), entered into a

series of agreements known as the VIE Agreements pursuant to which Shanghai JiuGe Information Technology Co., Ltd. (“JiuGe Technology”)

became our contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly

in certain industries in which foreign investment is restricted or forbidden by the PRC government. The VIE Agreements include a Consulting

Services Agreement, a Loan Agreement, a Power of Attorney Agreement, a Call Option Agreement, and a Share Pledge Agreement in order to

secure the connection and commitments of the JiuGe Technology. We operate our mobile payment platform business through JiuGe Technology.

The VIE Agreements include:

| · | a consulting services agreement (the “JiuGe Technology Consulting Services Agreement”)

through which JiuGe Management is mainly engaged in data marketing, technical services, technical consulting and business consultancy

to Shanghai JiuGe Information Technology Co., Ltd. (“JiuGe Technology”); |

| · | a loan agreement through which JiuGe Management grants a loan to the Legal Representative of JiuGe Technology

for the purpose of capital contribution (the “JiuGe Technology Loan Agreement”); |

| · | a power of attorney agreement under which the owner of JiuGe Technology has vested their collective voting

control over JiuGe Technology to JiuGe Management and will only transfer their equity interests in JiuGe Technology to JiuGe Management

or its designee(s) (the “JiuGe Technology Power of Attorney Agreement”); |

| · | a call option agreement under which the owner of JiuGe Technology has granted to JiuGe Management the

irrevocable and unconditional right and option to acquire all of their equity interests in JiuGe Technology or transfer these rights to

a third party (the “JiuGe Technology Call Option Agreement”); and |

| · | a share pledge agreement under which the owner of JiuGe Technology has pledged all of their rights, titles

and interests in JiuGe Technology to JiuGe Management to guarantee JiuGe Technology’s performance of its obligations under the JiuGe

Technology Consulting Services Agreement (the “JiuGe Technology Share Pledge Agreement”). |

Our PRC counsel has reviewed these agreements

and believes that all the VIE Agreements were duly signed and are not in violation of applicable laws of PRC. We are of the opinion that

the VIE Agreements are valid and giving the WFOE a full control over the VIE in respect of the current and effective PRC laws and regulations.

However, the VIE Agreements have never been challenged or recognized in court for the time being, and the PRC government may determine

that the VIE Agreements are not in compliance with applicable PRC laws, rules and regulations compared with direct ownership, there may

be less effective in controlling through the VIE structure.

In the first half of 2018, JiuGe Technology secured

contracts with China Unicom and China Mobile to distribute mobile data for businesses and corporations in 9 provinces/municipalities,

namely Chengdu, Jiangxi, Jiangsu, Chongqing, Shanghai, Zhuhai, Zhejiang, Shaanxi and Inner Mongolia.

In September 2018, JiuGe Technology launched and

commercialized mobile payment and recharge services to businesses for China Unicom. The JiuGe Technology mobile payment and recharge platform

enables the seamless delivery of real-time payment and recharge services to third-party channels and businesses. We earn a negotiated

rebate amount from each of China Unicom and China Mobile for all monies paid by consumers to China Unicom and China Mobile that we process.

To encourage consumers to utilize our portal instead of using our competitors’ platforms or paying China Unicom or China Mobile

directly, we offer mobile data and talk time at a rate discounted from these companies’ stated rates, which are also the rates we

must pay to them to purchase the mobile data and talk time provided to consumers through the use of our platform. Accordingly, we earn

income on the rebates we receive from the telecommunications companies, reduced by the amounts by which we discount the mobile data and

talk time sold through our platform.

In October 2018, China Unicom and China Mobile

awarded JiuGe Technology with contracts that established partnerships for data analysis, that could unlock potential value-added services.

This description of the VIE Agreements discussed

above do not purport to be complete and are qualified in their entirety by reference to the terms of the VIE Agreements, which were filed

as exhibits to our Current Report on Form 8-K filed with the SEC on December 27, 2018 and are incorporated by reference herein. The English

translation version of the JiuGe Technology Share Pledge Agreement was filed as Exhibit 10.6 to our Form S-1/A (Amendment No. 1) filed

with the SEC on January 5, 2023, and is incorporated by reference herein.

Acquisition of Beijing Technology

On March 7, 2019, the Company through JiuGe Technology

acquired Beijing Technology, a company in the business of providing mass SMS text services to businesses looking to communicate with large

numbers of their customers and prospective customers. Through Beijing Technology, the Company entered into the business of mass SMS text

message service as a compliment to its mobile payment and recharge business. The mass SMS text message service offers bulk SMS services

to end consumers with competitive pricing. Currently, the Company’s SMS integrated platform is processing more than 150 million

SMS text messages per month. Beijing Technology retains a license from the Ministry of Industry and Information Technology to operate

SMS and MMS business in the PRC. Similar to the mobile recharge business, Beijing Technology is required to make a deposit or bulk purchase

in advance and has secured business customers that will utilize Beijing Technology’s SMS integrated platform to send bulk SMS text

messages monthly. Beijing Technology has the capability to manage and track the entire process, including to assist the Company’s

clients to fulfill the government guidelines, until the SMS messages have been delivered successfully.

China Unicom Cooperation Agreement

On July 7, 2019, JiuGe Technology entered into

that certain Yunnan Unicom Electronic Sales Platform Construction and Operation Cooperation Agreement (the “Cooperation Agreement”)

with China United Network Communications Limited Yunnan Branch (“China Unicom Yunnan”). Under the Cooperation Agreement,

JiuGe Technology is responsible for constructing and operating China Unicom Yunnan’s electronic sales platform through which consumers

can purchase various goods and services from China Unicom Yunnan, including mobile telephones, mobile telephone service, broadband data

services, terminals, “smart” devices and related financial insurance. The Cooperation Agreement provides that JiuGe Technology

is required to construct and operate the platform’s webpage in accordance with China Unicom Yunnan’s specifications and policies,

and applicable law, and bear all expenses in connection therewith. As consideration for the services it provides under the Cooperation

Agreement, JiuGe Technology receives a percentage of the revenue received from all sales it processes for China Unicom Yunnan on the platform.

The Cooperation Agreement expires three years

from the date of its signature with a yearly auto-renewal clause, but it may be terminated by (i) JiuGe Technology upon three months’

written notice or (ii) by China Unicom Yunnan unilaterally. The Cooperation Agreement contains customary representations from each party

regarding such party’s authority to enter into and perform under the Cooperation Agreement, and provides customary events of default,

including for various types of failure to perform. Any disputes arising between the parties under the Cooperation Agreement will be adjudicated

in Chinese courts.

This description of the Cooperation Agreement

does not purport to be complete and is qualified in its entirety by reference to the terms of the Cooperation Agreement, which was filed

as an exhibit to our Current Report on Form 8-K filed with the SEC on November 9, 2019 and is incorporated by reference herein.

In January 2022, Shanghai TengLian JiuJiu Information

Communication Technology Co., Ltd. (“TengLian”) (a 99% owned subsidiary of Shanghai JiuGe Information Technology Co.,

Ltd.) signed a co-operation agreement with China Unicom to launch the Device Protection program for mobile phones and the new 5G phones.

The Offering

| Securities Distributed |

We

are distributing to the holders of our Common Shares on the record date, at no charge, one (1) Warrant for each ten (10) Common Shares

owned. When exercisable, one (1) Warrant will entitle the holder thereof to purchase one (1) Common Share at the exercise

price. |

| Record Date |

[●], 2024 |

| Exercise Price |

$7.00 |

| Exercise Period |

The Warrants will be exercisable in accordance with the terms of the warrant agreement until 5:00 p.m., Eastern Time, on the expiration date. |

| Expiration Date |

[●], 2026 |

| Transferability of Warrants; Listing |

The Warrants may be sold, transferred or assigned, in whole or in part. We have applied for listing the Warrants on the Nasdaq and expect trading to commence on or around [●], 2024 under the symbol “FNGRW”. Our Common Shares are listed on the Nasdaq under the symbol “FNGR”. |

| Common

Shares Outstanding After Exercise of Warrants |

52,712,850

Common Shares were outstanding as of May 16, 2024. If all of the Warrants are exercised in full, 57,984,135 Common Shares will be outstanding. |

| Use of Proceeds |

The purpose of this distribution of Warrants is

to return a portion of the Company’s future value to our stockholders in a cost-effective manner that gives all of our stockholders

the opportunity to participate in the Company’s growth.

Assuming that all Warrants are exercised, the

net proceeds from the exercise of the Warrants will be approximately $36.809 million, after deducting our estimated expenses related to

this offering. We intend to use the net proceeds of Warrant exercises for general corporate purposes. |

| Warrant Agent |

VStock Transfer, LLC |

RISK

FACTORS

Prospective investors should carefully consider

the following risks, as well as the other information contained in this Prospectus and in the documents incorporated by reference herein,

including the risks described in our annual report on Form 10-K and our quarterly reports on Form 10-Q, before investing in our securities.

Any one of these material risks and uncertainties has the potential to cause actual results, performance, achievements or events to be

materially different from any future results, performance, achievements or events implied, suggested or expressed by any forward-looking

statements made by us or by persons acting on our behalf. Refer to "Cautionary Note Regarding Forward-Looking Statements".

There is no assurance that we will be successful

in preventing the material adverse effects that any one or more of the following material risks and uncertainties may cause on our business,

prospects, financial condition and operating results, which may result in a significant decrease in the market price of our common stock.

Furthermore, there is no assurance that these material risks and uncertainties represent a complete list of the material risks and uncertainties

facing us. There may be additional risks and uncertainties of a material nature that, as of the date of this prospectus, we are unaware

of or that we consider immaterial that may become material in the future, any one or more of which may result in a material adverse effect

on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks Related to Our Company and Business

We have a limited operating history and,

as a result, our past results may not be indicative of future operating performance.

We have a limited operating history, which makes

it difficult to forecast our future results. You should not rely on our past results of operations as indicators of future performance.

You should consider and evaluate our prospects in light of the risks and uncertainty frequently encountered by companies like ours.

If we fail to address the risks and difficulties

that we face, including those described elsewhere in this “Risk Factors” section, our business, financial condition

and results of operations could be adversely affected. Further, because we have limited historical financial data and operate in an evolving

market, any predictions about our future revenue and expenses may not be as accurate as they would be if we had a longer operating history

or operated in a more predictable market. We have encountered in the past, and will encounter in the future, risks and uncertainties

frequently experienced by growing companies with limited operating histories in rapidly changing industries. If our assumptions regarding

these risks and uncertainties are incorrect or change, or if we do not address these risks successfully, our results of operations could

differ materially from our expectations and our business, financial condition and results of operations could be adversely affected.

We have a history of net losses and we may

not be able to achieve or maintain profitability in the future.

For all annual periods of our operating history

we have experienced net losses. We generated a net loss of approximately $3.3 million during the nine-month period ended November 30,

2023 and net losses of approximately $7.5 million, $4.9 million and $4.3 million for the years ended February 28, 2023, 2022 and 2021,

respectively. At November 30, 2023 and February 28, 2023, we had an accumulated deficit of approximately $28.0 million and $24.7 million,

respectively. We have not achieved profitability, and we may not realize sufficient revenue to achieve profitability in future periods.

Our expenses will likely increase in the future as we develop and launch new offerings and platform features, expand in existing and new

markets, increase our sales and marketing efforts and continue to invest in our platform. These efforts may be more costly than we expect

and may not result in increased revenue or growth in our business. If we are unable to generate adequate revenue growth and manage our

expenses, we may continue to incur significant losses in the future and may not be able to achieve or maintain profitability.

If we fail to effectively manage our growth,

our business, financial condition and results of operations could be adversely affected.

We are currently experiencing growth in our business.

This expansion increases the complexity of our business and has placed, and will continue to place, strain on our management, personnel,

operations, systems, technical performance, financial resources and internal financial control and reporting functions. Our ability to

manage our growth effectively and to integrate new employees, technologies and acquisitions into our existing business will require us

to continue to expand our operational and financial infrastructure and to continue to retain, attract, train, motivate and manage employees.

Continued growth could strain our ability to develop and improve our operational, financial and management controls, enhance our reporting

systems and procedures, recruit, train and retain highly skilled personnel and maintain user satisfaction. Additionally, if we do not

effectively manage the growth of our business and operations, the quality of our offerings could suffer, which could negatively affect

our reputation and brand, business, financial condition and results of operations.

The impact of the COVID-19 pandemic on the

global economy, our operations and consumer demand for consumer goods and services remains uncertain, which could have a material adverse

impact on our business, results of operations and financial condition and on the market price of our Common Shares.

In December

2019, a strain of novel coronavirus (now commonly known as COVID-19) was reported to have surfaced in Wuhan, China. COVID-19 had since

spread rapidly throughout many countries, and, on March 12, 2020, the World Health Organization declared COVID-19 to be a pandemic. In

an effort to contain and mitigate the spread of COVID-19, many countries, including the United States, Canada and China, have imposed

unprecedented restrictions on travel, and there have been business closures and a substantial reduction in economic activity in countries

that have had significant outbreaks of COVID-19. Although our operating subsidiaries and contractually controlled entity report that

is operation have not been materially affected at this point, significant uncertainty remains as to the potential impact of the COVID-19

pandemic on our operations and on the global economy as a whole. It is currently not possible to predict how long the pandemic will last

or the time that it will take for economic activity to return to prior levels. The COVID-19 pandemic has resulted in significant financial

market volatility and uncertainty in recent years. A continuation or worsening of the levels of market disruption and volatility seen

in the recent past could have an adverse effect on our ability to access capital, on our business, results of operations and financial

condition, on the market price of our Common Shares, and on consumer demand for consumer services, including those offered by our Company.

We depend on our key personnel and other

highly skilled personnel, and if we fail to attract, retain, motivate or integrate our personnel, our business, financial condition and

results of operations could be adversely affected.

Our success depends in part on the continued service

of our founders, senior management team, key technical employees and other highly skilled personnel and on our ability to identify, hire,

develop, motivate, retain and integrate highly qualified personnel for all areas of our organization. We may not be successful in attracting

and retaining qualified personnel to fulfill our current or future needs. Our competitors may be successful in recruiting and hiring members

of our management team or other key employees, and it may be difficult for us to find suitable replacements on a timely basis, on competitive

terms or at all. If we are unable to attract and retain the necessary personnel, particularly in critical areas of our business, we may

not achieve our strategic goals.

Our concentration of earnings from two telecommunications

companies may have a material adverse effect on our financial condition and results of operations.

We currently derive a substantial amount of our

total revenue through contracts secured with China Unicom and China Mobile. If we were to lose the business of one or both of these mobile

telecommunications companies, if either were to fail to fulfill its obligations to us, if either were to experience difficulty in paying

rebates to us on a timely basis, if either negotiated lower pricing terms, or if either increased the number of licensed payment portals

it permits to process its payments, it could have a material adverse effect on our competitive position, business, financial condition,

results of operations and cash flows. Additionally, we cannot guarantee that the volume of revenue we earn from China Unicom and China

Mobile will remain consistent going forward. Any substantial change in our relationships with either China Unicom or China Mobile, or

both, whether due to actions by our competitors, regulatory authorities, industry factors or otherwise, could have a material adverse

effect on our business, financial condition and results of operations.

Any actual or perceived security or privacy

breach could interrupt our operations, harm our brand and adversely affect our reputation, brand, business, financial condition and results

of operations.

Our business involves the processing and transmission

of our users’ personal and other sensitive data. Because techniques used to obtain unauthorized access to or to sabotage information

systems change frequently and may not be known until launched against us, we may be unable to anticipate or prevent these attacks. Unauthorized

parties may in the future gain access to our systems or facilities through various means, including gaining unauthorized access into our

systems or facilities or those of our service providers, partners or users on our platform, or attempting to fraudulently induce our employees,

service providers, partners, users or others into disclosing names, passwords, payment information or other sensitive information, which

may in turn be used to access our information technology systems, or attempting to fraudulently induce our employees, partners or others

into manipulating payment information, resulting in the fraudulent transfer of funds to criminal actors. In addition, users on our platform

could have vulnerabilities on their own mobile devices that are entirely unrelated to our systems and platform but could mistakenly attribute

their own vulnerabilities to us. Further, breaches experienced by other companies may also be leveraged against us. For example, credential

stuffing attacks are becoming increasingly common and sophisticated actors can mask their attacks, making them increasingly difficult

to identify and prevent. Certain efforts may be state-sponsored or supported by significant financial and technological resources, making

them even more difficult to detect.

Although we have developed systems and processes

that are designed to protect our users’ data, prevent data loss and prevent other security breaches, these security measures cannot

guarantee security. Our information technology and infrastructure may be vulnerable to cyberattacks or security breaches; also, employee

error, malfeasance or other errors in the storage, use or transmission of personal information could result in an actual or perceived

privacy or security breach or other security incident.

Any actual or perceived breach of privacy or security

could interrupt our operations, result in our platform being unavailable, result in loss or improper disclosure of data, result in fraudulent

transfer of funds, harm our reputation and brand, damage our relationships with third-party partners, result in significant legal, regulatory

and financial exposure and lead to loss of confidence in, or decreased use of, our platform, any of which could adversely affect our business,

financial condition and results of operations. Any breach of privacy or security impacting any entities with which we share or disclose

data (including, for example, our third-party providers) could have similar effects.

Additionally, defending against claims or litigation

based on any security breach or incident, regardless of their merit, could be costly and divert management’s attention. We cannot

be certain that our insurance coverage will be adequate for data handling or data security liabilities actually incurred, that insurance

will continue to be available to us on commercially reasonable terms, or at all, or that any insurer will not deny coverage as to any

future claim. The successful assertion of one or more large claims against us that exceed available insurance coverage, or the occurrence

of changes in our insurance policies, including premium increases or the imposition of large deductible or co-insurance requirements,

could have an adverse effect on our reputation, brand, business, financial condition and results of operations.

Systems failures and resulting interruptions

in the availability of our platform or offerings could adversely affect our business, financial condition and results of operations.

Our systems, or those of third parties upon which

we rely, may experience service interruptions or degradation because of hardware and software defects or malfunctions, distributed denial-of-service

and other cyberattacks, human error, earthquakes, hurricanes, floods, fires, natural disasters, power losses, disruptions in telecommunications

services, fraud, military or political conflicts, terrorist attacks, computer viruses, ransomware, malware or other events. Our systems

also may be subject to break-ins, sabotage, theft and intentional acts of vandalism, including by our own employees. Some of our systems

are not fully redundant and our disaster recovery planning may not be sufficient for all eventualities. Our business interruption insurance

may not be sufficient to cover all of our losses that may result from interruptions in our service as a result of systems failures and

similar events.

We have not experienced any system failures or

other events or conditions that have interrupted the availability or reduced or effected the speed or functionality of our offerings.

These events, were they to occur in the future, could adversely affect our business, reputation, results of operations and financial condition.

The successful operation of our business

depends upon the performance and reliability of Internet, mobile, and other infrastructures that are not under our control.

Our business depends on the performance and reliability

of Internet, mobile and other infrastructures that are not under our control. Disruptions in Internet infrastructure or the failure of

telecommunications network operators to provide us with the bandwidth we need to provide our services and offerings could interfere with

the speed and availability of our platform. If our platform is unavailable when platform users attempt to access it, or if our platform

does not load as quickly as platform users expect, platform users may not return to our platform as often in the future, or at all, and

may use our competitors’ products or offerings more often. In addition, we have no control over the costs of the services provided

by national telecommunications operators. If mobile Internet access fees or other charges to Internet users increase, consumer traffic

may decrease, which may in turn cause our revenue to significantly decrease.

Our business depends on the efficient and uninterrupted

operation of mobile communications systems. The occurrence of an unanticipated problem, such as a power outage, telecommunications delay

or failure, security breach or computer virus could result in delays or interruptions to our services, offerings and platform, as well

as business interruptions for us and platform users. Furthermore, foreign governments may leverage their ability to shut down directed

services, and local governments may shut down our platform at the routing level. Any of these events could damage our reputation, significantly

disrupt our operations, and subject us to liability, which could adversely affect our business, financial condition and operating results.

We have invested significant resources to develop new products to mitigate the impact of potential interruptions to mobile communications

systems, which can be used by consumers in territories where mobile communications systems are less efficient. However, these products

may ultimately be unsuccessful.

We may be subject to claims, lawsuits, government

investigations and other proceedings that may adversely affect our business, financial condition and results of operations.

We may be subject to claims, lawsuits, arbitration

proceedings, government investigations and other legal and regulatory proceedings as our business grows and as we deploy new offerings,

including proceedings related to our products or our acquisitions, securities issuances or business practices. The results of any such

claims, lawsuits, arbitration proceedings, government investigations or other legal or regulatory proceedings cannot be predicted with

certainty. Any claims against us, whether meritorious or not, could be time-consuming, result in costly litigation, be harmful to our

reputation, require significant management attention and divert significant resources. Determining reserves for litigation is a complex

and fact-intensive process that requires significant subjective judgment and speculation. It is possible that such proceedings could result

in substantial damages, settlement costs, fines and penalties that could adversely affect our business, financial condition and results

of operations. These proceedings could also result in harm to our reputation and brand, sanctions, consent decrees, injunctions or other

orders requiring a change in our business practices. Any of these consequences could adversely affect our business, financial condition

and results of operations. Furthermore, under certain circumstances, we have contractual and other legal obligations to indemnify and

to incur legal expenses on behalf of our business and commercial partners and current and former directors and officers.

We may require additional funding to support

our business.

To grow our business, FingerMotion currently looks

to take advantage of the immense growth in the total variety of mobile services provided in China. On February 1, 2022, the Xinhua News

Agency reported that the combined business revenue in the telecom sector rose 8% year on year to about USD232.43 billion in 2021, with

the growth rate up 4.1 percentage points from 2020, according to the PRC Ministry of Industry and Information Technology. For the Company

to continue to grow, the deposit with the Telecoms needs to increase, as most of the revenue we process is dependent on the size of the

deposit we have with each Telecom. We will likely need to raise additional capital to materially increase the amounts of these deposits.

If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences

or privileges senior to those of our common stock, and our existing stockholders may experience dilution. Any debt financing secured by

us in the future could involve restrictive covenants relating to our capital-raising activities and other financial and operational matters,

which may make it more difficult for us to obtain additional capital and to pursue business opportunities. We cannot be certain that additional

funding will be available to us on favorable terms, or at all. If we are unable to obtain adequate funding or funding on terms satisfactory

to us, when we require it, our ability to continue to support our business growth and to respond to business challenges could be significantly

limited, and our business, financial condition and results of operations could be adversely affected.

Claims by others that we infringed their

proprietary technology or other intellectual property rights could harm our business.

Companies in the Internet and technology industries

are frequently subject to litigation based on allegations of infringement or other violations of intellectual property rights. In addition,

certain companies and rights holders seek to enforce and monetize patents or other intellectual property rights they own, have purchased

or otherwise obtained. As we gain a public profile and the number of competitors in our market increases, the possibility of intellectual

property rights claims against us grows. From time to time, third parties may assert claims of infringement of intellectual property rights

against us. Many potential litigants, including some of our competitors and patent-holding companies, have the ability to dedicate substantial

resources to assert their intellectual property rights. Any claim of infringement by a third party, even those without merit, could cause

us to incur substantial costs defending against the claim, could distract our management from our business and could require us to cease

use of such intellectual property. Furthermore, because of the substantial amount of discovery required in connection with intellectual

property litigation, we risk compromising our confidential information during this type of litigation. We may be required to pay substantial

damages, royalties or other fees in connection with a claimant securing a judgment against us, we may be subject to an injunction or other

restrictions that prevent us from using or distributing our intellectual property, or we may agree to a settlement that prevents us from

distributing our offerings or a portion thereof, which could adversely affect our business, financial condition and results of operations.

With respect to any intellectual property rights

claim, we may have to seek out a license to continue operations found to be in violation of such rights, which may not be available on

favorable or commercially reasonable terms and may significantly increase our operating expenses. Some licenses may be non-exclusive,

and therefore our competitors may have access to the same technology licensed to us. If a third party does not offer us a license to its

intellectual property on reasonable terms, or at all, we may be required to develop alternative, non-infringing technology, which could

require significant time (during which we would be unable to continue to offer our affected offerings), effort and expense and may ultimately

not be successful. Any of these events could adversely affect our business, financial condition and results of operations.

Risks Related to Our Securities

The Warrants may not have any value.

The Warrants will be exercisable in accordance

with the terms of the warrant agreement until 5:00 p.m., Eastern Time, on the expiration date, [●],

2026.

The Warrants have an exercise price of $7.00 per

Common Share. This exercise price does not necessarily bear any relationship to established criteria for valuation of our Common Shares,

such as book value per Common Share, cash flows, or earnings, and you should not consider this exercise price as an indication of the

current or future market price of our Common Shares. There can be no assurance that the market price of our Common Shares will exceed

$7.00 per Common Share at any time on the expiration date of the Warrants or at any other time the Warrants may be exercised. If the market

price of our Common Shares does not exceed $7.00 per Common Share during the term of the Warrants, your Warrants will be of no value.

No Warrants will be exercisable unless at the

time of exercise a Prospectus relating to our Common Shares issuable upon exercise of the Warrants is current and the Common Shares have

been registered or qualified or deemed to be exempt under the securities laws of the state of residence of the holder of the Warrants.

Under the terms of the warrant agreement, we have agreed to meet these conditions and use our best efforts to maintain a current Prospectus

relating to the Common Shares issuable upon exercise of the Warrants until the expiration of the Warrants. However, we cannot assure you

that we will be able to do so, and if we do not maintain a current prospectus related to the Common Shares issuable upon exercise of the

Warrants, holders of the Warrants will be unable to exercise their Warrants and we will not be required to settle any such Warrant exercise.

If the Prospectus relating to the Common Shares issuable upon the exercise of the Warrants is not current or if the Common Shares is not

qualified or exempt from qualification in the jurisdictions in which the holders of the Warrants reside, we will not be required to net

cash settle or cash settle the Warrant exercise, the Warrants may have no value, the market for the Warrants may be limited and the Warrants

may expire worthless.

An active trading market for our Warrants may

not develop.

Prior to this offering, there has been no public

market for our Warrants. We have applied for listing the Warrants on the Nasdaq and expect trading to commence on or around [●],

2024, under the symbol “FNGRW”. Even if the Warrants are approved for listing on the Nasdaq, an active trading market for

the Warrants may not develop or be sustained. If an active market for the Warrants does not develop, it may be difficult for you to sell

your Warrants without depressing the market price for such securities.

The receipt of Warrants may be treated as

a taxable distribution to you.

The distribution of Warrants to a holder of our

Common Shares could be treated, for U.S. federal income tax purposes, as a taxable distribution under Section 305(b) of the Code and the

Treasury Regulations promulgated thereunder, although we are not expressing an opinion as to such matter. Since there appears to be a

significant uncertainty in regard to the tax treatment of the receipt and exercise of Warrants your receipt of Warrants may be treated

as the receipt of a taxable distribution to you. Each holder of our Common Shares is urged to consult with his, her or its own tax advisor

in order to assess possible adverse tax consequences. Please see the section in this prospectus under the caption: “Material U.S.

Federal Income Tax Consequences.”

Holders of our Warrants will have no rights

as a common stockholder until such holders exercise their Warrants and acquire Common Shares.

Until Warrant holders acquire Common Shares upon

exercise of the Warrants, Warrant holders will have no rights with respect to the Common Shares underlying such Warrants. Upon the acquisition

of Common Shares upon exercise of the Warrants, the holders thereof will be entitled to exercise the rights of a common stockholder only

as to matters for which the record date for the matter occurs after the exercise date of the Warrants.

Adjustments to the exercise price of the

Warrants, or the number of Common Shares for which the Warrants are exercisable, following certain corporate events may not fully compensate

Warrant holders for the value they would have received if they held the Common Shares underlying the Warrants at the time of such events.

The Warrants provide for adjustments to the exercise

price of the Warrants following a number of corporate events, including (i) our issuance of a stock dividend or the subdivision or combination

of our Common Shares, (ii) a distribution of capital stock of the Company or any subsidiary other than our Common Shares, rights to acquire

such capital stock, evidences of indebtedness or assets, (iii) our issuance of a cash dividend on our Common Shares, and (iv) certain

tender offers for our Common Shares by the Company or one or more of our wholly-owned subsidiaries. The Warrants also provide for adjustments

to the number of Common Shares for which the Warrants are exercisable following our issuance of a stock dividend or the subdivision or

combination of our Common Shares. Any adjustment made to the exercise price of the Warrants or the number of Common Shares for which the

Warrants are exercisable following a corporate event in accordance with these provisions may not fully compensate Warrant holders for