UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2023

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-41616

Lucy Scientific Discovery Inc.

(Exact Name of Registrant as Specified in Its Charter)

| British Columbia, Canada | | Not Applicable |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

301-1321 Blanshard Street

Victoria, British Columbia, Canada V8W

0B6

(Address of Principal Executive Offices)

(778) 410-5195

(Registrant’s telephone number, including

area code)

Not applicable

(Former name, former address, and former fiscal

year, if changed since last report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, no par value | | LSDI | | The Nasdaq Stock Market LLC |

Securities registered under Section 12(g) of the

Exchange Act: None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

No ☒

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether

any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the

registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the

registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the

registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to

submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging growth company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the

registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the registrant’s

common stock outstanding as of October 13, 2023 was 17,646,296 shares.

The Registrant was not a public company as of the last business day

of its most recently completed second fiscal quarter (December 31, 2022) and therefore cannot calculate the aggregate market value of

the voting and non-voting common equity held by non-affiliates as of such date.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form

10-K (“Annual Report”) contains forward-looking statements within the meaning of the federal securities laws. All statements

contained in this Annual Report, other than statements of historical fact, including statements regarding our future operating results

and financial position, our business strategy and plans, potential growth or growth prospects, future research and development, sales

and marketing and general and administrative expenses, and our objectives for future operations, are forward-looking statements. Words

such as “believes,” “may,” “will,” “estimates,” “potential,” “continues,”

“anticipates,” “intends,” “expects,” “could,” “would,” “projects,”

“plans,” “targets,” and variations of such words and similar expressions are intended to identify forward-looking

statements. We have based these forward-looking statements largely on our current expectations and projections about future events and

trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business

operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions,

including those described in the “Risk Factors” in this Annual Report. Readers are urged to carefully review and consider

the various disclosures made in this Annual Report and in other documents we file from time to time with the Securities and Exchange Commission

(the “SEC”) that disclose risks and uncertainties that may affect our business. Moreover, we operate in a very competitive

and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess

the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions,

the future events and circumstances discussed in this Annual Report may not occur and actual results could differ materially and adversely

from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking

statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved

or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future

results, performance, or achievements. In addition, the forward-looking statements in this Annual Report are made as of the date of this

filing, and we do not undertake, and expressly disclaim any duty, to update such statements for any reason after the date of this Annual

Report or to conform statements to actual results or revised expectations, except as required by law.

You should read this Annual

Report and the documents that we reference herein and have filed with the SEC as exhibits to this Annual Report with the understanding

that our actual future results, performance, and events and circumstances may be materially different from what we expect.

This Annual Report also contains

or may contain estimates, projections and other information concerning our industry, our business and the markets for our products, including

data regarding the estimated size of those markets and their projected growth rates. Information that is based on estimates, forecasts,

projections or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from

events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained these industry, business, market

and other data from reports, research surveys, studies and similar data prepared by third parties, industry and general publications,

government data and similar sources. In some cases, we do not expressly refer to the sources from which these data are derived.

PART I

ITEM 1. BUSINESS

Business Overview

Overview

We are an early-stage psychotropics

contract manufacturing company focused on becoming the premier contract research, development, and manufacturing organization for the

emerging psychotropics-based medicines industry. In August 2021, Health Canada’s Office of Controlled Substances granted us

a Controlled Drugs and Substances Dealer’s Licence under Part J of the Food and Drug Regulations promulgated under the Food

and Drugs Act (Canada), or a Dealer’s Licence. A Dealer’s Licence authorizes us to develop, sell, deliver, and manufacture

(through extraction or synthesis) certain pharmaceutical-grade active pharmaceutical ingredients, or APIs, used in controlled substances

and their raw material precursors. Since current Canadian regulations prohibit the commercial sales of APIs and other products we intend

to produce, APIs and such other products would only be authorized for sale in Canada for clinical testing purposes in an “institution,”

for the purpose of determining the hazards and efficacy of the drug, and for laboratory research in an institution by qualified investigators.

Our mission is to make our products and research services available to our clients for the development of medicines and experimental therapies

to address certain psychiatric health disorders and other medical needs. We cannot guarantee that we will receive further approvals from

Health Canada, and a failure to receive such approvals could have a material adverse effect on our business and result in an inability

to generate revenue from said products and services. Further, as of the date of this prospectus, we have not manufactured all of the psychedelics-based

products allowable under the Dealer’s Licence or generated any revenues from the sale of such psychedelics-based products.

The success of our business

plan is dependent on our activities being permissible under applicable laws and upon the occurrence of regulatory changes for psychotropics-based

medicines. In Canada, the psychedelic compounds that we are approved to produce under our Dealer’s Licence, psilocybin, psilocin,

lysergic acid diethylamide, or LSD, N,N-Dimethyltryptamine, or N,N-DMT, and 3,4-Methylenedioxymethamphetamine, or MDMA, and 4-Bromo-2,5-Dimethoxybenzeneethanamine,

or 2C-B, are regulated under the Controlled Drugs and Substances Act, or CDSA. Certain psychedelic substances, including psilocybin, psilocin,

mescaline and DMT, are classified as Schedule III drugs and the CDSA prohibits the possession of a Schedule III drug absent authorization

under the CDSA or a related regulation, and it is illegal to possess Schedule III substances without a prescription. In the United States,

these substances are classified under the Controlled Substances Act (21 U.S.C. § 811), or the CSA, and the Controlled Substances

Import and Export Act, or the CSIEA, and as such, medical and recreational use is illegal under the U.S. federal laws. Under the CSA,

the Drug Enforcement Agency, or DEA, regulates chemical compounds with a potential for abuse as Schedule I, II, III, IV or V substances.

Schedule I substances may not be prescribed, marketed or sold in the United States. Most, if not all, state laws in the United States

classify psilocybin, LSD, MDMA, DMT and 2C-B as Schedule I controlled substances. For any product containing any of these substances to

be available for commercial marketing in the United States, the applicable substance must be rescheduled, or the product itself must be

scheduled, by the DEA to Schedule II, III, IV or V. If the DEA does not reschedule psilocybin, LSD, MDMA, DMT and 2C-B as Schedule II,

III, IV or V, such substances will be subject to individually-allotted manufacturing and procurement quotas, which may have a material

adverse effect on our business and result in an inability to generate sufficient revenue from said substances to be profitable. Additionally,

regardless of the scheduling of a finished, approved therapeutic product, if the API used in the final dosage form is a Schedule I or

II controlled substance, it would be subject to such quotas as the API could remain listed on Schedule I or II. Moreover, even if the

finished dosage form of a psychedelics-based medicine developed by one of our clients is approved by the FDA, and if such product is listed

by the DEA as a Schedule II, III, or IV controlled substance, its manufacture, importation, exportation, domestic distribution, storage,

sale and legitimate use will continue to be subject to a significant degree of regulation by the DEA.

An increasing number of the

leading universities, hospitals and other public, private, and government institutions throughout the world have launched research programs

and are conducting clinical studies aimed at understanding the therapeutic potential of a range of psychedelic substances, including the

John Hopkins Center for Psychedelic and Conscious Research at Johns Hopkins University, the Imperial College London Centre for Psychedelic

Research, the Center for the Science of Psychedelics at the University of California, Berkeley, the Depression Evaluation Service at Columbia

University, the Center for Psychedelic Psychotherapy and Trauma Research at the Icahn School of Medicine at Mount Sinai Health System,

New York City’s largest academic medical system, and the Center for the Neuroscience of Psychedelics at Massachusetts General

Hospital, among many others.

To address mounting demands

for alternative therapies incorporating the use of psychedelics, we intend to leverage our 25,000 square foot facility located near Victoria,

British Columbia, for research, development, and large-scale production of high-quality biological raw materials, APIs, and finished biopharmaceutical

products. Supported by an executive leadership and advisory team consisting of highly experienced biotechnology and pharmaceutical industry

experts, we will seek to position our company to be at the forefront of new discovery in this rapidly emerging market.

Recent Developments

On January 16, 2023,

we entered into a strategic investment agreement, or the Strategic Investment Agreement, with Hightimes Holding Corp., or Hightimes, 1252240

BC LTD, a wholly owned subsidiary of Hightimes, and Trans-High Corporation, a wholly owned subsidiary of Hightimes, pursuant to which

Hightimes granted to us $833,333 of annual advertising and marketing credits, or Advertising Credits, for five consecutive years, in exchange

for 625,000 of our common shares. The Advertising Credits enable us to advertise (i) on all Hightimes publications, including the Hightimes

print and website publications, and (ii) at all festivals and events conducted by Hightimes. Unless earlier terminated pursuant to the

terms of the Strategic Investment Agreement, the Strategic Investment Agreement will terminate on December 31, 2025, which term may

be extended by the parties to the Strategic Investment Agreement upon such terms and conditions as the parties may mutually agree. Paul

Abramowitz, one of our directors, is the stepfather of the Executive Chairman of Hightimes. Mr. Abramowitz’s biological son

is a beneficial owner of Roma Ventures, LLC, or Roma Ventures, an entity that owns approximately 8.53% of our issued and outstanding common

shares. Benjamin Windle is the investment manager of Roma Ventures and has sole voting and investment control with respect to our common

shares held by the Roma Ventures. Each of the Executive Chairman of Hightimes, Mr. Abramowitz and Roma Ventures are shareholders

of Hightimes. The sale of the above common shares were deemed to be exempt from registration under the Securities Act in reliance upon

Section 4(a)(2) of the Securities Act as a transaction by an issuer not involving any public offering.

On February 13, 2023, we

completed our initial public offering (the “IPO”). Our registration statement on Form S-1 (File No. 333-262296) relating to

the IPO was declared effective by the SEC on February 8, 2023. We issued 1,875,000 common shares at a price of $4.00 per share for aggregate

net cash proceeds of $5.8 million, after deducting underwriting discounts and commissions and other offering related costs. None of the

expenses associated with the IPO were paid to directors, officers, persons owning 10% or more of any class of equity securities, or to

their associates, or to our affiliates. WestPark Capital, Inc. acted as sole book running manager of the offering and as representative

of the underwriters.

On February 16, 2023, we

filed an amendment with our current Dealer’s License to add coca leaves, ketamine, methamphetamine, methadone, buprenorphine, diacetylmorphine

(heroin), opium, thenaine (paramorphine), benzoylmethylecgonine (cocaine), fentanyl, hydromorphone, oxycodone, hydrocodone, morphine and

codine to the list of approved substances that it is authorized to manufacture. The shift toward a public health response to the drug

crisis should provide greater opportunities for people who use substances to connect with a growing range of harm reduction and treatment

options. Currently, we focus on the development and sale of psychedelic drugs for research purposes.

On February 27, 2023, we

agreed to our first commercial sale to the prestigious Hadassah BrainLabs - Center for Psychedelics Research, Hadassah Medical Center,

Hebrew University, Jerusalem, Israel. This first commercial sale of psilocybin, while modest in size, marks a key operational milestone

for the company as we shift from pre revenue to revenue producing. This transaction establishes our ability to supply the global psychedelic

community with compounds and services.

On March 20, 2023, we entered

into a definitive asset purchase agreement (the “APA”) with Wesana Health Holdings Inc. (“Wesana”) for the purchase

of Wesana’s SANA-013 intellectual property and related assets (the “Transaction”). The Transaction provides an opportunity

for the continued development of SANA-013 through the next phases of the US FDA regulatory process and for the Company to have economic

exposure to any positive advancements in any such future research and development efforts by Lucy. On June 30, 2023, the Company entered

into the First Amendment to the APA (the “First Amendment”). Pursuant to the First Amendment, the consideration to be paid

for these assets is: (a) $300,000 in cash to be paid within 24 hours of the signing of the First Amendment; (b) upon the closing of the

acquisition (the “Closing”), the Company will issue Wesana an aggregate of 1,000,000 shares of the Company’s common

stock (the “Shares”); (c) $177,973.99 in cash payable in the following 4 installments: (i) $100,000.00 due on or before July

1, 2023; (ii) $25,991.33 due on or before October 1, 2023; (iii) $25,991.33 due on or before January 1, 2024; and (iv) $25,991.33 due

on or before April 1, 2024, and (d) at the Closing, the Company will assume certain liabilities of Wesana which principally consists of

$92,026.01 of trade payables owed by Wesana to a law firm.

On March 23, 2023, we launched

a new line of unscheduled psychoactive compounds that are available for sale throughout the United States, and where permitted. This product

line is named Mindful by Lucy and is the first line in the new family of brands contains Amanita Muscaria mushrooms, a psychoactive adaptogen.

The product leverages the compounds of these mushrooms, and a proprietary blend of other natural functional ingredients, to create a transformative

experience for consumers. We aim to distribute and market Mindful by Lucy through Hightimes’ websites and social channels. Lucy

and High Times entered into a Strategic Investment Agreement in January 2023 whereby Lucy received $2.5 million in advertising credits

in exchange for 625,000 of our common shares that will help launch the new brand into market through High Times channels and experiential

events without cash outlays for marketing by Lucy. This new line is well-positioned to capitalize on the growing market for psychoactive

alternatives, which Forbes predicts will double to over $5 billion in gross sales by 2025.

On June 30, 2023, the Closing

of Wesana occurred. A total of $100,000 was paid by the Company to Wesana on July 5, 2023 and the Shares were issued on June 30, 2023.

On July 11, 2023, we announced

the launch of Twilight by Lucy, a blend of Amanita and Reishi mushrooms that include a variety of other nootropics promoting improved

cognitive function and enhanced sleep quality. This release comes on the heels of the recent launch of Mindful by Lucy. Both of these

products are now available for purchase on the company’s official online store, www.buytrippy.com, as well as through Hightimes.com

and other channels. Twilight by Lucy is a product designed to enhance and optimize consumer’s nightly sleep. The introduction of

Twilight alongside Mindful underscores Lucy’s dedication to providing solutions in the psychotropic marketplace.

On July 24, 2023, Christopher

McElvany resigned from his positions as the Company’s President and Chief Executive Officer and resigned as a member of the

Company’s Board of Directors (the “Board”). The Company and Mr. McElvany agreed that his last day of employment was

July 14, 2023. Mr. McElvany did not resign as a result of any disagreement with the Company on any matter relating to the Company’s

operations, policies or practices.

On July 24, 2023, the Board

ratified the appointment of Richard Nanula (a member of the Board since February 2022) as CEO.

On September 6, 2023, we entered

into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Hightimes to acquire the intellectual property of High

Times. Hightimes owns all of the issued and outstanding shares of common stock of HT-Lucy Acquisition Corp., a Delaware corporation. Pursuant

to the Stock Purchase Agreement, Hightimes agreed to sell to us all of the common stock of HT-Lucy Acquisition Corp. upon the terms and

subject to the conditions of the Stock Purchase Agreement. In exchange for the common stock of HT-Lucy Acquisition Corp., we shall pay

Hightimes as consideration (i) the number of shares of common stock of the Company that represents 19.9% of the total issued and outstanding

shares of the Company at the closing; and (ii) semi-annual earn-out payments (the “Hightimes Earn-Out Payments”) payable for

the five (5) consecutive fiscal years ending on June 30, 2029, in amounts equal to three (3) times the adjusted EBITDA of HT-Lucy Acquisition

Corp., calculated pursuant to the terms of the Stock Purchase Agreement. We have the discretion to pay the Hightimes Earn-Out Payments

with either Lucy common shares or cash. At the closing, we will also cause HT-Lucy Acquisition Corp. to enter into an intellectual property

license agreement pursuant to which HT-Lucy Acquisition Corp. will grant to an affiliate of Hightimes the exclusive right and license

to utilize certain intellectual property rights to operate retail stores and to manufacture and sell THC products in the United States

in return for a license fee of $1.0 million per year, increasing to $2.0 million per year upon Federal legalization.

On September 12, 2023, we entered

into an amalgamation agreement (the “Amalgamation Agreement”) with Bluesky Biologicals Inc. (“Bluesky”) to acquire

the Bluesky. Bluesky, through Bluesky Wellness Inc., owns a portfolio of plant-based wellness brands including Keoni, Keoni Sport, Blush

Wellness and AMMA Healing. Pursuant to the Amalgamation Agreement, Bluesky will amalgamate with a wholly-owned subsidiary of the Company

upon the terms and subject to the conditions of the Amalgamation Agreement. We shall pay Bluesky as consideration (i) the number of shares

of common stock of the Company that represents 19.9% of the total issued and outstanding shares of the Company at the closing; and (ii)

earn-out payments (the “Bluesky Earn-Out Payments”) payable for the four (4) consecutive fiscal years ending on June 30, 2028,

the six (6) month period ended June 30, 2024, and the six (6) month period ending December 31, 2028, in amounts equal to two and one half

(2.5) times the adjusted EBITDA of Bluesky., calculated pursuant to the terms of the Amalgamation Agreement. We have the discretion to

pay the Bluesky Earn-Out Payments with either Lucy common shares or cash.

Psychotropics: An Emerging Market Opportunity

Psychotropics are a broad classification

of chemical substances that can cause alterations in perception, mood, consciousness, cognition, or behavior through various interactions

with the nervous system. Psychedelics are a subclassification of psychotropics that interact primarily with serotonergic receptors in

the brain. Psychedelic compounds such as psilocybin, psilocin, LSD N,N-DMT, and MDMA, have become areas of interest for many new companies.

The psychedelic compounds we are approved to produce under our Dealer’s Licence — psilocybin, psilocin, N,N-DMT,

mescaline, MDMA, LSD, and 4-Bromo-2,5-Dimethoxybenzeneethanamine, or 2C-B — will represent our initial areas of focus

for our research, development and manufacturing efforts on behalf of our clients. In addition, subject to further approvals by Health

Canada with respect to the expansion of the scope of our Dealer’s Licence, we expect to extend our research and production efforts

to various non-serotonergic psychotropics, such as ketamine, as such compounds may provide significant future market opportunities for

us. Since current Canadian regulations prohibit the commercial sales of APIs and other products we intend to produce, APIs and such other

products would only be authorized for sale in Canada for clinical testing purposes in an “institution,” for the purpose of

determining the hazards and efficacy of the drug, and for laboratory research in an institution by qualified investigators. We cannot

guarantee we will receive such approvals, and a failure to receive further approvals would have a material adverse effect on our business

and result in an inability to generate revenue from said substances.

Clinical Trials and Studies Involving Psychotropics

To date, only a limited number

of psychotropic- and psychedelic-based medicines have been approved by Health Canada and the FDA. However, a number of studies have been

conducted in recent years to determine the efficacy of psychedelic therapies in patients suffering from various mental health and

addiction disorders, including the following:

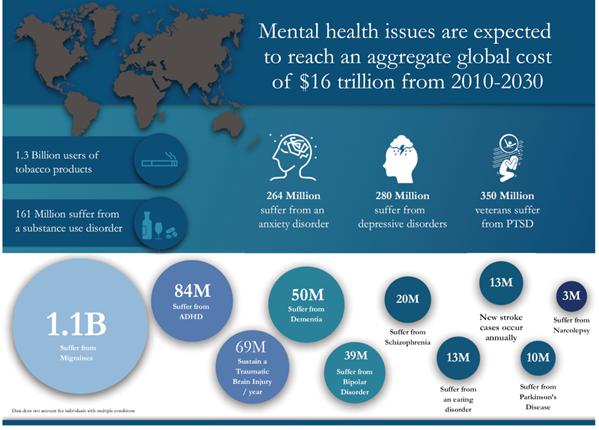

| ● | Depressive Disorders: An estimated

3.8% of the global population, or approximately 280 million people, suffer from depressive episodes. The bulk of these episodes

are part of major depressive disorder, or MDD, a mood disorder that causes a persistent feeling of sadness and loss of interest in normal

activities. MDD affects approximately 17.3 million adults or about 7.1% of the United States population age 18 and older in

a given year and an estimated 10% of the adult population of Canada will experience MDD at some point in their life. A small study of

adults with major depression conducted in November 2020, Johns Hopkins Medicine researchers report that two doses of the psychedelic

substance psilocybin, given with supportive psychotherapy, produced rapid and significant reductions in depressive symptoms, with most

participants showing improvement and half of study participants achieving remission through the four-week follow-up period. |

| ● | Anxiety Disorders: Anxiety

disorders are defined as frequent, intense, excessive, and/or persistent worry and fear about everyday situations, affecting an estimated

264 million individuals globally. Over 40 million U.S. adults and an estimated 3 million Canadians suffer from an anxiety

disorder. Anxiety disorders include generalized anxiety disorder, social anxiety disorder, specific phobias, separation anxiety disorder,

and many others. An individual may suffer from more than one anxiety disorder. A systematic literature review of 20 studies published

from 1940 to 2000 concluded that a combination of psychedelic drug administration and psychological therapy was most beneficial in treating

individuals suffering from anxiety disorders. |

| ● | Post-Traumatic Stress Disorder: Post-traumatic

stress disorder, or PTSD, is a disorder characterized by a person’s re-experiencing a past traumatic incident through flashbacks,

bad dreams, frightening thoughts and other manifestations. PTSD affects approximately 354 million war survivors worldwide, in addition

to others affected by traumatic events such as physical, sexual or psychological abuse. PTSD can result in avoidance of normal activities,

sleep disturbances, angry outbursts, and distorted feelings of guilt or blame, and it is often accompanied by depression and/or substance

abuse. According to the National Institute of Mental Health, or NIMH, about 6.8% of U.S. persons will experience PTSD in their lifetimes.

CNS Neuroscience & Therapeutics estimated the prevalence rate of lifetime PTSD in Canada to be 9.2% in spite of comparably low rates

of violent crime, a small military, and few natural disasters. A longitudinal pooled analysis of six Phase 2 clinical trials, published

in 2020 by the Medical University of South Carolina’s Dr. Michael Mithoefer and colleagues, considered the impact on PTSD

symptoms (measured using a clinician-administered assessment of known as CAPS-IV, a well-established means of assessing PTSD severity)

of administering two to three active doses of MDMA during psychotherapy sessions. The analysis showed a reduction in CAPS-IV total severity

scores from baseline to treatment exit (i.e., one to two months after the last active MDMA psychotherapy session) and when assessed

at least 12 months thereafter. From treatment exit to the 12 month follow-up, CAPS-IV scores continued to decrease (i.e., PTSD

symptoms became less severe) and the percentage of trial participants who no longer met PTSD criteria increased. |

| ● | Addiction: Substance addiction

and abuse represents a significant global problem, with approximately 1.3 billion people who are users of tobacco products, 107 million

people suffering from alcohol use disorder, and 36 million people impacted by drug use disorder. In Canada, it is estimated that

approximately 21% of the population, or about six million people, will meet the criteria for addiction in their lifetime. Approximately

21.2 million individuals in the U.S. have a substance abuse disorder, and in 2018, 11% of those patients received the treatment

for such substance abuse disorder. In a small study measured over the course of six months in 2014, researchers at Johns Hopkins

University reported an 80% smoking abstinence rate in patients participating in a treatment program involving psilocybin. In 2015, researchers

at the University of New Mexico treated a small population suffering from alcohol dependence with 1-2 supervised psilocybin treatment

sessions, resulting in immediate and sustained outcomes lasting 36 weeks. |

| ● | Other Potentially Applicable Conditions: According

to a study published in 2020 by Frontiers in Synaptic Neuroscience in the United Kingdom and reviewed by universities in the United States,

Brazil, and Switzerland, the renaissance in psychedelic research in recent years, in particular studies involving psilocybin and

LSD, coupled with anecdotal reports of cognitive benefits from micro-dosing, suggests that they may have a therapeutic role in a range

of psychiatric and neurological conditions due to their potential to enhance functional neuronal connectivity, stimulate neurogenesis,

restore brain plasticity, reduce inflammation, and enhance cognition. In 2021, scientists at the University of California at Los Angeles

made significant discoveries about the interaction of LSD with dopamine that they believe may lead to a better understanding and eventual

treatment of schizophrenia and that shows promise in the pursuit of treating physically crippling disorders such as Parkinson’s

disease. |

Many researchers actively conducting

studies today believe that a there is a significant opportunity for the continued discovery and refinement of alternative treatments using

psychotropics-based medicines for a variety of mental health and addiction disorders. A number of major academic institutions, including

those noted above, have established dedicated psychedelic research centers in the past two years. As of September 2021, clinicaltrials.gov

reports 146 registered clinical studies (including those not yet recruiting, enrolling by invitation, and active) involving psychedelic

compounds.

Mental Health and Addiction Disorders: Prevalence

and Costs

Public Support and Regulatory Change

Notable academic and clinical

research efforts, as well as broad support from both the psychiatric health community and the general public (according to an independent

study conducted by Prohibition Partners in 2020), have prompted U.S. and Canadian regulatory bodies to re-evaluate various psychedelic

compound classifications. In Canada, drug decriminalization is being strongly considered throughout the nation, government initiatives

such as Safe Supply and the Special Access Program for Drugs may provide opportunities for market growth. Similarly, in 2017, the U.S. Food

and Drug Administration, or the FDA, granted the Multidisciplinary Association for Psychedelic Studies, or MAPS, Breakthrough Therapy

Designation to MDMA-assisted psychotherapy for the treatment of PTSD on the basis of pooled analyses showing a large effect size for this

treatment. In 2018 and 2019, the FDA granted the Usona Institute Breakthrough Therapy Designation for psilocybin-assisted psychotherapy

for the treatment of MDD. In 2019, the FDA approved the use of S-ketamine nasal spray, in conjunction with an oral antidepressant, for

the treatment of TRD, which marked the first approval by the FDA of a psychedelics-based therapy. In February 2021, Oregon commenced

the first state-regulated psilocybin program, and concurrently, Washington, D.C. joined other cities including Oakland and Santa Cruz,

California, and Ann Arbor, Michigan in decriminalizing the cultivation and possession of all entheogenic plants and fungi. Decriminalize

Nature, an entheogenic educational campaign, currently has active lobbying campaigns ongoing in 42 cities in the United States to

decriminalize psychedelics. In January 2022, the Canada Gazette published a notice of amended regulations related to restricted drugs

that allow practitioners the ability to request access to restricted drugs through the Special Access Program for the emergency treatment

of patients with serious or life-threatening injuries.

Our Dealer’s Licence

Our Health Canada Dealer’s Licence, which we hold through our wholly

owned subsidiary, LSDI Manufacturing Inc., authorizes us to produce, sell, deliver, and conduct research using psilocybin, psilocin, N,N-DMT,

mescaline, MDMA, and LSD. Per current Canadian regulations, these APIs and other products we intend to produce would only be authorized

for sale in Canada for clinical testing purposes in an “institution,” for the purpose of determining the hazards and efficacy

of the drug, and for laboratory research in an institution by qualified investigators; sales of APIs in Canada for commercial purposes

are currently prohibited. We also anticipate submitting applications to Health Canada for additional approvals under our Dealer’s

Licence allowing us to produce and distribute ketamine. There is no guarantee that we will receive further approvals from the Office of

Controlled Substances in a timely manner or at all. A failure to receive such further approvals would have a material adverse effect on

our business and result in an inability to generate revenue from said substances.

Our Management Team

Mr. Nanula is our Chief Executive

Officer and has served as our Chair and a director since February 2022. Mr. Nanula is a highly experienced business advisor and senior

executive with more than 35 years of experience in corporate finance and strategy including tenure with the Walt Disney Company (Disney),

Starwood Hotels and Resorts, Amgen, and Colony Capital. Additionally, Mr. Nanula also served as a board member for Boeing Corporation

and Starwood Capital. Our management team also features Assad J. Kazeminy, Ph.D., our Chief Scientific Officer, who previously served

as Chief Executive Officer of Irvine Pharmaceutical Services Inc. and Avrio Biopharmaceutical LLC and has over 30 years of research

and development experience in the biopharmaceutical industry.

What Sets Us Apart

As a contract research and

manufacturing organization serving the emerging psychedelics-based medicines market, we believe that we can be distinguished from other

companies in the psychedelics market and we have a number of competitive advantages, as described below:

| ● | Strategic Approach Centered on Adaptability. We

believe that most other companies in the psychedelics market are centered around very specific drug targets with rigid production and

scaling plans that are heavily dependent on major regulatory changes. Our strategy has been designed to enable us to have agility and

scalability necessary to pursue groundbreaking research, advance with the changing regulatory landscape, and expand to meet future market

opportunities at scale. |

| ● | Executive Team and Board of Directors with Industry

Experience. Our management team consists of accomplished business entrepreneurs with deep knowledge of

agriculture, production, extraction, chemistry, research, medicine, and drug discovery. We intend to leverage our team’s experience

in an effort to target licensed organizations for contract manufacturing and research and development opportunities. |

| ● | Technologies, Processes, and Intellectual Property. Our

management team brings to market several key advantages, including the utilization of our TerraCube horticulture/fungiculture growth

chambers, which feature our patented downdraft technology, located on-site to our application of biosynthesis techniques. By leveraging

our processes and technologies, we will continually pursue new opportunities to obtain critical patents and other intellectual property

rights, and to develop advanced production methods and new enabling technologies in an effort to distinguish and position our company

in a rapidly evolving competitive landscape. Our management team intends to remain dedicated to ensuring the quality of our products

and forging a cooperative culture of perpetual discovery and advancement. |

Our History

We were initially founded in

2017 as Hollyweed North Cannabis, Inc., or HNCI. In May 2018, our newly-constructed facility was inspected by Health Canada, and we received

our Controlled Substances Dealer’s Licence in June of that year. Shortly thereafter, our wholly-owned subsidiary TerraCube was founded,

and the first TerraCube prototype was constructed. Later that same year, HNCI obtained a Health Canada Cannabis Standard Processing Licence.

In May of 2020, we submitted an application to Health Canada for a Controlled Substances Dealer’s Licence for the ability to produce

and conduct research using psilocybin, psilocin, N,N-DMT, and mescaline. In parallel, we began the process of rebranding to our current

name, Lucy Scientific Discovery, Inc. In February 2021, the Health Canada Office of Controlled Substances completed the inspection, and

the licence was obtained by Lucy in August 2021. In October 2021, we filed an amendment with Health Canada to add the ability to sell,

send, transport, and deliver the substances currently included on our licence and add MDMA, LSD, and 2C-B to our license, which was approved

on December 17, 2021.

Our Business Strategy

Our mission is to become the

premier research, development, and contract manufacturing organization in the emerging psychotropics-based medicines industry, while aggressively

working to pursue expanding global market frontiers. Leveraging our highly skilled and experienced management team, we have designed a

competitive business strategy centered around agility, speed, and innovation. We aim to first establish and secure base revenues by quickly

commencing production capabilities and partnerships, and to continually pursue new opportunities for growth in our market.

Secure Base Revenue

| ● | Leverage Assets to Facilitate Market Entry: Our

research, development, and manufacturing operations will be conducted at our 25,000 square foot facility near Victoria, British Columbia,

Canada. This facility was designed to optimize workflow and support industry-leading current good manufacturing practices, or cGMP, good

laboratory practices, or GLP, cultivation, processing, sanitation, and physical security standards. Featuring energy-efficient design

and equipment, compartmentalized production bays, testing and analytics laboratories, and dedicated office space, this complex will provide

our team of experts and research partners a premier venue for productivity and innovation. Our facility features multiple TerraCubes

for cultivating plant and fungi biomass, thereby minimizing reliance on external suppliers for naturally derived materials. |

| ● | Establish Ability to Rapidly Commence Contract Manufacturing: By

establishing the capability to produce APIs through various methods of cultivation, purification, advanced cell expression, and direct

synthesis, we believe that we will be able to quickly execute highly scalable, flexible, and efficient production operations while keeping

batch-manufacturing costs low. We plan to enter into supply agreements with institutions, clinicians, and licensed researchers throughout

the United States and Canada. To that end, we have already entered into a preliminary agreement for a project involving psychedelics

cultivation and supply, and we are currently engaged in discussions with counterparties for two additional projects. Our goal is to rapidly

commence scaled cGMP manufacturing capabilities for psilocybin, psilocin, N,N-DMT, MDMA, 2-CB and mescaline. We expect to be able to

commence additional production following minimal buildout and infrastructure acquisition. See “Use of Proceeds” for more

information. |

| ● | Facilitate and Conduct Contract Psychotropics Research: We

seek to serve as an incubator and facilitator for the advancement of the psychotropics-based medicines industry. We will pursue this

objective by building a comprehensive support suite with the means to provide research collaboration and contract research, production,

funding, data capture, intellectual property and IP-capture opportunities, quality assurance, and compliance capabilities. Our team brings

vast relevant experience to bear regarding the development and commercialization of APIs and finished products, and we intend to partner

with researchers in an effort to advance the market. We believe that acting as a contract research organization will provide diversified

revenue sources under a number of different partnerships in accordance with our project assessment and advancement pipeline, and that

these activities will lead to further opportunities as our clients develop and commercialize various psychotropics-based therapies. |

| ● | Achieve and Maintain Compliance Excellence: In

addition to maintaining necessary licensing for the production of APIs, we will uphold rigorous internal operating standards, employing

cGMPs for production and GLPs for testing and analysis. Our management team brings a wealth of relevant knowledge about, and extensive

experience with, regulatory compliance and quality controls, which we believe will enable us to comply with evolving legal frameworks. |

Pursue New Frontiers

| ● | Expand Market Access: We

plan to pave the way for growth into new and emerging market landscapes by designing and executing strategic market access initiatives.

These initiatives involve collaborating with regulators and participating in legislative study campaigns while strategically aligning

and optimizing our partnerships and capabilities to thrive in the regulated markets we intend to incubate. We believe this will be a

highly effective method of expanding the viability, access, and control of government regulated business and will provide us with substantial

advantages in both placement and speed-to-market. |

| ● | Meet Emerging Demands with Innovative Products: We

intend to develop raw materials, cGMP-grade APIs, and finished biopharmaceutical products in an ongoing effort to meet the needs of new

and evolving markets. Our management team aims to develop or acquire technology that could, for example, be applied to optimize the delivery

of drug compounds for use in conjunctive treatment therapy, ensuring a safer and more consistent dose. We may seek to add new compounds

to our Health Canada Dealer’s Licence through a 45-day application process, potentially facilitating the means to perpetually innovate

and adapt to the developing needs of the psychedelics industry and market. |

| ● | Develop and Acquire Intellectual Property Assets: Members

of our management and research and development teams have significant experience with establishing and protecting critical process, product,

and technological differentiators. We intend to actively pursue the direct development and acquisition of relevant intellectual property

related to the psychotropics-based medicines industry, with an initial focus on intellectual property that will support and enhance our

contract research and manufacturing capabilities. We expect that our extensive market and research knowledge will allow us to recognize

and define a number of opportunities to acquire and create intellectual property, and enable iterative process improvements, to maintain

a competitive advantage. |

| ● | Achieve Business and Technological Diversification: To

further capitalize on direct, indirect, and ancillary opportunities created by the market, we may further diversify by investing in and

acquiring additional biotechnology companies and/or specific technologies that are complementary to our products and business strategy

when suitable opportunities arise, subject to the availability of sufficient financial and other resources to enable us to make such

investments and acquisitions. These efforts are designed to support our goal of creating deeper levels of resilience and integration,

and to differentiate our company from our competitors. |

In an effort to actualize each

facet of our overall business strategy as outlined above, we have established the following three-phase plan:

| ● | Phase 1 — Commence operations (Complete): We

incurred costs of approximately $35,000 associated with Phase 1 of our business plan to procure general equipment to enable process development

for the production of key APIs from natural product extraction. Achieving this manufacturing capability allow us to fulfil supply agreements

with academic and research facilities or other companies as permitted by our licence, resulting in first revenue generation. |

| ● | Phase 2 — Complete construction of R&D labs

and initiate cGMP certification: In order to broaden our research capabilities and expand into lab-scale synthetic and biosynthetic

production, we will need to complete construction of R&D labs by acquiring equipment utilized in standard synthetic and biosynthetic

laboratories. We anticipate the costs associated with Phase 2 of our business plan to be approximately $700,000. We believe these expanded

capabilities will allow us to potentially generate more revenue contingent upon future supply agreements. In parallel, we intend to initiate

the process of obtaining cGMP certification of key processes involved in the production of APIs. At this time, we cannot estimate when

this phase will be completed. |

| ● | Phase 3 — Achieve production-scale manufacturing

capabilities and cGMP certification: Contingent upon market demands, we intend to expand to production-scale manufacturing capabilities

by procuring larger production-scale equipment. We also aim to obtain cGMP certification pursuant to our goal of becoming a preferred

supplier of cGMP-grade APIs and other compounds. We anticipate the costs associated with Phase 3 of our business plan to be approximately

$1,500,000. At this time, we cannot estimate when this phase will be completed. |

The timing of the target milestones

may be subject to change due to a variety of factors including the need to obtain additional financing through the issuance of debt or

equity securities. There can be no assurance that we will be able to obtain any such financing, if needed, upon commercially reasonable

terms or at all. The failure to obtain such financing, if needed, would have a material adverse effect on our business.

Production Program

Our goal is to position our

company as a premier contract manufacturer of high-quality biological raw materials, cGMP-grade APIs, and finished biopharmaceutical products,

utilizing various methods of scalable production capabilities, to meet the needs of the rapidly growing psychotropics-based medicines

market. Leveraging advanced and efficient systems and processes, we will seek to minimize production costs while maintaining the highest

standards in quality and safety. We believe that our purpose-built campus and use of state-of-the-art technology will facilitate a variety

of scaled production methods that adhere to cGMP pharmaceutical standards.

To meet immediate and anticipated

rising demands from researchers and clinicians, our initial focus of production will be centered around the classic serotonergic psychedelics:

psilocybin, psilocin, and N,N-DMT. These APIs are in increasingly high demand, and we believe that there are very few cGMP-compliant

sources that are currently available in the market.

Our Strategic Approach to Production

Recognizing the broad range

of product requirements needed to best support ongoing research, trials, and treatments, our production program will take a highly scalable

and tiered approach to manufacturing that we believe has the potential to secure a strong foundation for revenue and growth. This approach

will leverage three key methods of production, with the goal of achieving best-in-class quality and facilitating market penetration through

competitive pricing. Regardless of method, all production and formulation efforts will involve proper analytical procedures and quality

controls that are designed to ensure the highest standards of purity, quality, and safety.

| ● | Cultivation and Extraction: We

intend to utilize a full suite of cGMP-grade cultivation, extraction, and purification systems to fulfill biological raw material and

small volume API orders for a rapid market entry. Our state-of-the-art medicinal fungiculture and horticulture program, featuring our

TerraCube growth chambers, will be capable of facilitating the production of consistent and high-quality raw materials, from which we

may derive medicinally valuable key-compounds and minor constituent molecules. Utilizing this production suite, our team has the ability

to observe broad-spectrum compositions, advance superior trait lines, and support various research organizations with best-in-class raw

materials and APIs as well as crude extracts, single-molecule fractions, and targeted formulations as required. |

| ● | Biosynthesis: Through

the development or acquisition of transgenic yeast, bacteria, and/or other cell lines, we will employ lab and pilot-scale bioreactors

to produce a master repository of API expression systems which can be rapidly scaled to meet emerging market demands. Our biopharmaceutical-based

core manufacturing approach involves the use of designer expression cassettes genetically encoded to produce APIs of interest from host

cells such as yeast or bacteria. The APIs expressed in these cultures can be subsequently purified and characterized. This production

methodology will provide us with a far greater ability to control post-translational modifications and allows for rapid scalability and

precise manufacturing of cGMP grade APIs. |

| ● | Synthesis: To accommodate

the need for consistent and scalable production capabilities, we intend to employ direct chemical synthesis methods coupled with subsequent

chromatographic and crystallization techniques for the isolation and purification of APIs. In addition, we expect that our team’s

wealth of experience in industrial scale organic and pharmaceutical chemistry will allow us to apply process optimizing retrosynthetic

methodologies, a technique that involves the transformation and examination of target molecules into precursor molecules. These methods

will maximize safety, quality, and consistency while providing critical flexibility in production. |

Finished Product Development and Commercialization

Support

Moving beyond raw material

and single-molecule API manufacturing, our team intends to develop the capacity to support the development and production of finished

pharmaceutical products. In addition to contract-based projects for our customers, our team will independently pursue scientific breakthroughs

in optimized drug delivery and molecular enhancement for licensed application in finished drug products. The overall aim of these strategic

ventures is to expand our market reach and involvement while creating additional revenue streams. We have and will continue to build strong

relationships with pharmaceutical research and development groups and clinicians studying the efficacy of psychedelic and emerging psychotropic

compounds in an effort to ensure all product designs and applications will best achieve the desired outcome for patients.

Research and Development Program

Our mission is to become a

best-in-class producer of pharmaceutical-grade psychotropic APIs and finished products. Our research and development program will be established

with the goal of supporting this mission by providing better APIs, target formulations, and finished drug products faster and more affordably

to a broadening marketplace. Our employment of critical performance assessments, analyses, and improvement practices function with the

objective of optimizing production, maintaining high quality standards, and lowering costs. We expect that our projected revenue increases

will drive aggressive advancements in our production and formulation projects, as well as in intellectual property and critical patent

capture programs.

We expect that continuously

improving our product offerings and iterating our production processes will best enable us to support advancements in clinical research

and applied therapies. To that end, our team is committed to conducting research and development activities aimed at optimizing our production

program — from initial project selection through post-clinical commercialization — by strategically employing

enabling technologies and innovative processes to meet the rigors of the emerging psychotropics-based medicines industry.

Market Assessment and Project Prioritization

Leveraging strategies from

the most successful growth companies in the biotechnology and pharmaceutical development industries, our Market Assessment and Project

Prioritization, or MAPP, process is designed to identify emerging market opportunities and direct our research and development pipeline.

The MAPP process quantifies and ranks opportunities in the following categories:

| ● | Potential for Treatment Efficacy |

| ● | Current & Forecasted Market Demand |

| ● | Market Regulation and Accessibility |

This data-driven approach is

designed to enable our team to determine key success and sustainability factors within each opportunity to inform selection, prioritization,

and resource allocation decisions. The intended outcome of the MAPP process is to support and pursue projects with the highest probabilities

of success and implement a consistent method to understand the value and risks associated with each R&D project candidate.

Project Selection and Advancement Pipeline

We seek to actively drive a

diversified research and development pipeline designed to accelerate potentially market-disrupting products from discovery through commercialization.

By combining powerful market opportunity analytics with well-established project selection and advancement processes, we believe that

our approach will maximize value-capture opportunities, success probabilities, and competitive advantages in new and emerging market spaces.

To best support these dynamic

project advancement efforts, our research and development teams will be well-equipped for success through the allocation of cutting-edge

technological systems and a centralized operational support network. These critical assets will facilitate project selection and advancement

decisions through:

| ● | Establishment of Success Metrics: A

key component of our pipeline process is a reliance on data to drive decisions. We will establish a set of measurable metrics and key

performance indicators, or KPIs, for all projects. We will track these KPIs and supporting metrics on a project dashboard to create transparency

and enable data-driven selection and advancement decisions. |

| ● | Prioritization of Functional Needs: To

facilitate effective functional support of all pipeline projects and the efficient use of assets, resources will be allocated to projects

determined to have the greatest impact and probability of success. Proper resource allocation and prioritization will enable our team

to support a broader range of projects appropriately and efficiently. |

| ● | Pipeline Advancement Decisions: Using

a structured process and well-defined advancement criteria our team will conduct periodic project reviews to assess KPIs, and success

probabilities. These reviews will consist of reports provided by project leadership and key personnel to a review panel of cross-functional

representatives from within the R&D organization. These process standards will be applied to all projects within the company’s

R&D pipeline, ensuring company assets are employed and redirected in accordance with company strategies. |

Furthermore, we intend to fully

leverage the broad network of collaborative relationships between the senior members of our management team and clinical research institutions,

contract research organizations, and licensed therapeutic clinicians to accurately assess emerging market needs and identify opportunities.

We believe that the value of our research and development program is enhanced by our commitment to explore and access enabling technologies

that can benefit and support our programs in a rapidly evolving emerging industry. We will seek to achieve sustainable revenue growth

by establishing and fostering a culture of continuous improvement and leveraging proven process and systems improvement philosophies.

Facilities

Our corporate headquarters

and operations are located near Victoria, British Columbia, Canada, where we currently lease approximately 25,000 square feet of laboratory

and office space. The property lease expires on July 31, 2027, at which point we may, at our option, either extend this lease for

an additional five-year term or purchase the facility. We have the option to purchase the property for CAD $14.5 million during the

lease term. Our facility has been designed to support key enabling technologies and production workflow, and feature two floors of compartmentalized

production bays, analytics laboratories, office space, and loading docks. With critical input from our highly experienced leadership team,

operators, and advisors, our facility was designed to maximize production while minimizing waste through the use of high-efficiency climate

and lighting systems. Furthermore, our security-by-design approach maintains high standards of safety and security, including expert implementation

of overlapping surveillance and monitoring systems, controlled access and alarms, and multiple Health Canada security level 8 vaults.

We believe that our current facilities are adequate to meet our ongoing needs, and that, if we require additional space, we will be able

to obtain additional facilities on commercially reasonable terms.

TerraCube Advanced Cultivation Module

Our TerraCube system, which

consists of climate-controlled agriculture/fungiculture growth chambers that employ our patented downdraft HEPA filtration technology,

is designed to provide our medicinal horticulture and fungiculture program leaders environmental control and manipulation capabilities.

These stackable and highly efficient systems are expected to facilitate multiple revenue-producing cultivation-based operations, adding

production scalability and sustainability to our program by allowing for modular and iterative expansion and project prioritization. From

cultivation of raw source materials and superior-trait psilocybe to contract ethnobotany research of rare medicinally valuable plants

from around the world, our TerraCube system will allow our team to rapidly begin researching and producing naturally derived products

and raw materials.

Each TerraCube module features

a patent-pending environmental control system drawing information from more than 100 data sensors. Each unit’s air-handling system

provides a positive pressure environment designed to ensure cultivars remain unadulterated by impurities or cross-contaminants. These

growth modules are expected to enable our team to conduct highly advanced genomic assessment and superior trait selection, intellectual

property capture, and Genetic Use Restriction Technology, or GURT, programs.

Bioprocess Development

Laboratory

Our bioprocess development

laboratory, or BDL, which supports API biosynthesis, is expected to enable the development of plasmids containing API expression cassettes

for insertion into host cell lines. The BDL will leverage both lab- and pilot-scale bioreactors in addition to necessary analytical and

supporting equipment. Stable API-expressing host cell lines will be banked in cryogenic freezers for subsequent transfer to quality control

and manufacturing processes.

Testing and Analysis Laboratory

Our testing and analysis

laboratory, or TAL, will utilize high-performance liquid chromatography with mass spectrophotometric detectors, or HPLC-MS, a proven

method for high purity quantification and low sensitivity detection of biopharmaceutical APIs. The HPLC-MS and supporting systems

are designed to ensure all APIs meet or exceed the standards for compliance and expectations of our customers. The TAL is capable of

facilitating various analytic functions in support of contract and partner research projects and serves as a final quality check for

production APIs prior to submission for third-party testing. The use of third-party laboratory testing is a requirement of good

clinical practices and GLP protocols.

Competition

The psychotropics-based product

manufacturing and contract research business is an emerging industry with increasing levels of competition and is subject to significant

technological change. We face substantial competition from other psychotropics-based product manufacturing companies and suppliers of

medical-grade psychedelic raw materials, APIs and finished drug products and/or contract research services. Our competitors are already

in the process of development and contract manufacturing of psychotropics-based products and providing contract research services in the

industry. Many of our competitors have substantially greater financial, technical and human resources, higher capitalization, a more experienced

management team, and a more mature business than us. These factors could prevent us from achieving our revenue, market share and growth

targets. Further, we may not be able to effectively manage our growth, if any, and operations, which could materially and adversely affect

our business. If we are not able to compete effectively against our current and future competitors, our business will not grow, and our

financial condition and operations will be materially and adversely affected.

Our potential competitors include

large and specialty pharmaceutical companies and biotechnology companies, academic research institutions and governmental agencies, and

public and private research institutions. Our plan to cultivate, extract and purify medical-grade psilocybin and other psychotropics-based

products and to offer them to appropriately licensed research institutions, biopharmaceutical companies and other parties who are engaged

in discovery and development with respect to psychotropics-based medicines, will compete with other entities that are developing or supplying

psychoactive compounds for use in medical research. Due to the depth and diversity of our intended product offerings, we may face competition

from a variety of companies, including:

| ● | Developers of psychotropics-based products: Companies

such as Mind Medicine (MindMed) Inc., a neuro-pharmaceutical drug development platform, Psygen Industries, Ltd., a manufacturer of pharmaceutical

grade psychedelic drug products for clinical research and therapeutic applications and Numinus Wellness Inc., a health care company focused

on creating wellness solutions centered on psychedelic therapies, and HAVN Life Sciences Inc., a biotechnology company pursuing standardized

extraction of psychoactive compounds, the development of natural health care products and mental health treatments. To the extent we

are unable to sell our products to these companies, our clients will face competition from them in the market for psychotropics-based

medicines. |

| ● | Contract research providers: Companies known

to provide contract research services to facilitate improved pharmaceutical and biotechnology product development, such as KGK Science

Inc. |

We expect to face increasing

competition as new APIs and other products enter the market and further advancements in technologies are made. We expect market adoption

of any products that we develop to be dependent on, among other things, purity, efficacy, and price.

Many of our current or potential

competitors, either alone or with their collaboration partners, have significantly greater financial resources and expertise in the development

and marketing of contract manufacturing and research services than we do. Mergers and acquisitions in the psychedelic and biotechnology

industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller or early-stage companies

may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. As

attention on the emerging psychotropics-based medicines industry intensifies, we expect that additional competitors will enter the marketplace.

Government Regulation

We are focused on

developing and commercializing APIs comprising biologically sourced derivatives and synthetic compounds, primarily psychedelics,

with potential medicinal and therapeutic value as regulated medicines. In order for our APIs and other products to be developed into

regulated medicines, our process and our clients’ operations must be conducted in strict compliance with the regulations of

the regulatory agencies in the jurisdictions in which we and our clients operate or intend to operate, including the

United States and Canada, at the federal, state and (in the case of Canada) provincial level. These regulatory authorities

extensively regulate, among other things, the cultivation, manufacture, import, export, research, testing, quality control,

labelling, packaging, storage, record-keeping, promotion advertising, distribution, post-approval monitoring and reporting,

marketing, and export and import and commercialization of drugs and their APIs, such as those we are developing, in specific

jurisdictions under applicable laws and regulations.

We, along with our vendors

and research and commercial clients, will be required to navigate the various manufacturing, importation, exportation, preclinical, clinical,

and commercial approval requirements of the governing regulatory agencies of the countries in which we and our clients wish to manufacture,

test, store, seek approval and distribute our or our clients’ products and product candidates. The process of obtaining regulatory

approvals of drugs and their APIs and of ensuring subsequent compliance with appropriate federal, state, local and foreign statutes and

regulations requires the expenditure of substantial time and financial resources and may not be successful.

International Conventions Governing Controlled

Substances

Our business involves the use

of psychoactive compounds or materials that contain psychoactive compounds, including the manufacture, transportation, testing, storage

and sale of such compounds and products, and as such, will be subject to extensive regulation under international and national laws.

The current international drug

control system was established by three main international drug conventions: the 1961 United Nations, or UN, Single Convention on Narcotic

Drugs, or the Single Convention; the 1971 UN Convention on Psychotropic Substances, or the 1971 Convention; and the 1988 UN Convention

Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, or the 1988 Convention. The Single Convention established the drug

scheduling system, which is also used in the 1971 Convention, to establish various degrees of control applicable to controlled substances,

or substances with a potential for abuse. The 1988 Convention focuses on criminal enforcement against illicit drug trafficking and money

laundering. All three conventions seek to restrict the use of controlled substances to legitimate purposes and avoid their diversion into

illicit markets through strict regulatory controls.

The 1971 Convention establishes

a regulatory framework and four schedules for psychotropic substances, which are substances that affect one’s mental state, including

hallucinogenic, or psychedelic, drugs. In addition to requiring controls on the manufacture, trade, distribution, and possession of psychotropic

substances, the 1971 Convention requires that signatories provide the International Narcotics Control Board, or INCB, with annual statistical

reports of quantities of psychotropic substances manufactured, exported from, or imported to their country. If, based on the information

provided, the INCB has reason to believe that the aims of the 1971 Convention are endangered, it can ask an endangering country to provide

explanations for its deviation from the 1971 Convention; call on the government to adopt remedial measures; or, bring the matter to the

attention of the greater UN and recommend that the country stop the export and/or import of a particular psychotropic substance. Regarding

substances in Schedule I of the convention, such as MDMA, DMT, and psilocybin, signatories are required to “prohibit all use

except for scientific and very limited medical purposes.”

The Single Convention requires

signatories to provide the INCB an annual estimate of the quantities of narcotic drugs to be used for medical and scientific purposes,

to be used in the manufacture of other drugs, and the stocks of narcotic drugs to be held by the signatory country. Signatories may not

exceed their submitted estimates without furnishing a supplementary estimate to the INCB explaining the need for the adjustment. The 1971

Convention does not establish the same type of ceiling on the manufacture and use of psychotropic substances.

The 1988 Convention outlines

a criminal enforcement framework for the manufacture, distribution, and sale of narcotic drugs or psychotropic substances in contravention

of the Single Convention and the 1971 Convention. It includes provision for the confiscation of proceeds from the illicit traffic of drugs

and creates a system for requesting extradition of guilty parties between signatory countries. In order to stem the international illicit

trade of narcotic drugs and psychotropic substances, all imports and exports of signatory countries — including the lawful

import and export of narcotics and psychotropics — must be properly documented and controlled.

As signatories to the Single

Convention, the 1971 Convention, and the 1988 Convention, Canada, our country of domicile, and the United States, one of our primary

markets, have based their domestic regulation of narcotics and psychotropic substances on the frameworks established in these conventions,

and they must comply with the conventions’ ongoing recordkeeping and reporting requirements.

Canada

Certain psychoactive compounds,

such as psilocybin, are considered controlled substances under Canada’s Controlled Drugs and Substances Act, or the CDSA. Specifically,

psilocin (3 — [2 — (dimethylamino)ethyl] — 4 — hydroxyindole) and any salt thereof

and psilocybin (3 — [2 — (dimethylamino)ethyl] — 4 — phosphoryloxyindole) and any

salt thereof, are listed under Schedule III of the CDSA. Psilocin and psilocybin are also restricted drugs under Part J

of the Food and Drug Regulations. In Canada, MDMA and ketamine are Schedule I controlled substances, while LSD is a Schedule III

controlled substance. The production, possession, obtaining, trafficking (including, among other things, sale, distribution, and administration),

importing or exporting of controlled substances and precursors is prohibited in Canada unless specifically permitted by applicable law.

Penalties for contravention of the CDSA related to Schedule I substances are the most punitive, with Schedule II being less

punitive than Schedule I, and Schedule III being less punitive than Schedule I and II. A party may seek government

approval for an exemption under Section 56(1) of the CDSA to allow for the possession, transport or production of a controlled

substance for medical or scientific purposes or if such usage is otherwise in the public interest.

A licence may be obtained

to produce, assemble, sell, provide, transport, send, deliver, import and export controlled substances and products that contain a controlled

substance. A party can apply for a Dealer’s Licence under the Canadian Food and Drug Regulations (Part J), which would permit

a party to perform authorized activities in relation to a restricted drug, such as psilocybin and psilocin. By law, a Dealer’s Licence

for a restricted drug may only be issued to eligible persons, which include: (i) an individual who ordinarily resides in Canada;

(ii) a corporation that has its head office in Canada or operates a branch office in Canada; or (iii) the holder of a position

that includes responsibility for restricted drugs on behalf of the Government of Canada or of a government of a province, a police force,

a hospital or a university in Canada.

To qualify for a Dealer’s

Licence, a party must meet all regulatory requirements, including having compliant facilities and security measures, compliant materials

and staff that meet the qualifications under the regulations. An applicant must designate a senior person in charge, who is responsible