false00017803120001780312asts:WarrantsExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50Member2022-11-142022-11-1400017803122022-11-142022-11-140001780312asts:ClassCommonStockParValue00001PerShareMember2022-11-142022-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 14, 2022 |

AST SpaceMobile, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39040 |

84-2027232 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Midland Intl. Air & Space Port 2901 Enterprise Lane |

|

Midland, Texas |

|

79706 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (432) 276-3966 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, par value $0.0001 per share |

|

ASTS |

|

The NASDAQ Stock Market LLC |

Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

ASTSW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 14, 2022, AST SpaceMobile, Inc. (“AST SpaceMobile” or the “Company”) issued a press release announcing financial results for the three and nine months ended September 30, 2022. A copy of the press release is attached hereto as Exhibit 99.1.

The information included in this Item 2.02 and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (“Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

AST SpaceMobile is also furnishing a Third Quarter Business Update, dated November 14, 2022 (the “Presentation”), attached as Exhibit 99.2 to this Current Report on Form 8-K, which may be referred to on the Company’s third quarter 2022 conference call to be held on November 14, 2022. The Presentation will also be available on the Company’s website at www.ast-science.com.

The information included in this Item 7.01 and in Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

AST SPACEMOBILE, INC. |

|

|

|

|

Date: |

November 14, 2022 |

By: |

/s/ Sean R. Wallace |

|

|

|

Name: Sean R. Wallace

Title: Chief Financial Officer |

PRESS RELEASE EXHIBIT 99.1

AST SpaceMobile Provides Third Quarter 2022 Business Update

MIDLAND, TX, November 14, 2022 – AST SpaceMobile, Inc. (“AST SpaceMobile”) (NASDAQ: ASTS), the company building the first and only space-based cellular broadband network accessible directly by standard mobile phones, today is providing its business update for the third quarter ended September 30, 2022.

"The successful unfolding of BlueWalker 3 is a major step forward for our patented space-based cellular broadband technology and paves the way for the ongoing production of our BlueBird satellites,” said Abel Avellan, Chairman and Chief Executive Officer of AST SpaceMobile. “In completing this deployment, as well as the other learnings from stowing, launching, operating, testing and flying the satellite over the last 2 months, we feel confident in our architecture and do not foresee any major changes to the architecture of our Block 1 satellites.”

Business Update

Progress with our BlueWalker 3 test satellite

•Completed the successful launch of the BlueWalker 3 ("BW3") test satellite from Cape Canaveral, FL

•Acquired control of the BlueWalker 3 test satellite shortly after deployment and implemented Telemetry, Tracking and Control protocols for operations control of the satellite

•Successfully unfolded the largest communications array ever deployed on a commercial Low Earth Orbit satellite

•Completed validation of key aspects of our satellite architecture after two months of in-orbit operation

Industrialization of our SpaceMobile constellation

•Plan to launch five Block 1 BlueBird satellites in late 2023

•Continued to ramp up the assembly, testing and implementation processes at our Site 2 facility in Midland to build five Block 1 BlueBird satellites

•Grew portfolio of patent and patent pending claims to more than 2,600 worldwide as of November 14, 2022 compared to the more than 2,400 as of August 14, 2022

Third Quarter 2022 Financial Highlights

•Ended the third quarter with cash, cash equivalents, and restricted cash of $199.5 million

•Total operating expenses increased by $6.7 million to $42.1 million for the third quarter of 2022, as compared to $35.4 million in the second quarter of 2022, due to a $4.4 million increase in research and development costs and $2.5 million increase in engineering services offset by a $0.2 million decrease in general and administrative costs

•As of September 30, 2022, the Company incurred $92.1 million of capitalized costs (including launch cost and non-recurring engineering costs) related to the assembly, testing and deployment of the BlueWalker 3 test satellite

•As of September 30, 2022, the Company incurred approximately $43.5 million of capitalized property and equipment costs primarily related to the Texas facilities, satellite antennas, satellite parts assembly and test equipment, and leasehold improvements

•Completed the sale of 51% interest in NanoAvionika UAB for net proceeds of $26.7 million

•Issued shares of Class A common stock under the Common Stock Purchase Agreement and Equity Distribution Agreement for net proceeds of approximately $17.0 million

Conference Call Information

AST SpaceMobile will hold a quarterly business update conference call at 5:00 p.m. (Eastern Time) today, November 14, 2022. The call will be accessible via a live webcast on the Events page of AST SpaceMobile’s Investor Relations website at https://investors.ast-science.com/. An archive of the webcast will be available shortly after the call.

About AST SpaceMobile

AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on our extensive IP and patent portfolio. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today's five billion mobile subscribers and finally bring broadband to the billions who remain unconnected. For more information, follow AST SpaceMobile on YouTube, Twitter, LinkedIn and Facebook. Watch this video for an overview of the SpaceMobile mission.

Forward-Looking Statements

This communication contains “forward-looking statements” that are not historical facts, and involve risks and uncertainties that could cause actual results of AST SpaceMobile to differ materially from those expected and projected. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “would,” “potential,” “projects,” “predicts,” “continue,” or “should,” or, in each case, their negative or other variations or comparable terminology.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside AST SpaceMobile’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (i) expectations regarding AST SpaceMobile’s strategies and future financial performance, including AST’s future business plans or objectives, expected functionality of the SpaceMobile Service, anticipated timing and level of deployment of satellites, anticipated demand and acceptance of mobile satellite services, prospective performance and commercial opportunities and competitors, the timing of obtaining regulatory approvals, ability to finance its research and development activities, commercial partnership acquisition and retention, products and services, pricing, marketing plans, operating expenses, market trends, revenues, liquidity, cash flows and uses of cash, capital expenditures, and AST’s ability to invest in growth initiatives; (ii) the negotiation of definitive agreements with mobile network operators relating to the SpaceMobile service that would supersede preliminary agreements and memoranda of understanding; (iii) the ability of AST SpaceMobile to grow and manage growth profitably and retain its key employees and AST SpaceMobile’s responses to actions of its competitors and its ability to effectively compete; (iv) changes in applicable laws or regulations; (v) the possibility that AST SpaceMobile may be adversely affected by other economic, business, and/or competitive factors; (vi) the outcome of any legal proceedings that may be instituted against AST SpaceMobile; and (vii) other risks and uncertainties indicated in the Company’s filings with the SEC, including those in the Risk Factors section of AST SpaceMobile’s Form 10-K filed with the SEC on March 31, 2022.

The planned testing of the BW3 test satellite may not be completed due to a variety of factors, which could include loss of satellite connectivity, destruction of the satellite, or other communication failures, and even if completed as planned, the BW3 testing may indicate adjustments that are needed or modifications that must be made, any of which could result in additional costs, which could be material, and delays in commercializing our service. If there are delays or issues with our testing, it may become more costly to raise capital, if we are able to do so at all.

AST SpaceMobile cautions that the foregoing list of factors is not exclusive. AST SpaceMobile cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors incorporated by reference into AST SpaceMobile’s Form 10-K filed with the SEC on March 31, 2022. AST SpaceMobile’s securities filings can be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law, AST SpaceMobile disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Investor Contact:

Scott Wisniewski

investors@ast-science.com

Media Contact:

Brandyn Bissinger

press@ast-science.com

+1 866 845 6521

|

|

|

|

|

|

|

|

|

AST SPACEMOBILE, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

|

(dollars in thousands, except share data) |

|

|

|

|

|

|

|

|

|

|

September 30,

2022 |

|

|

December 31,

2021 |

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

198,869 |

|

|

$ |

321,787 |

|

Restricted cash (1) |

|

|

660 |

|

|

|

2,750 |

|

Accounts receivable |

|

|

- |

|

|

|

2,173 |

|

Inventories |

|

|

- |

|

|

|

1,412 |

|

Prepaid expenses |

|

|

5,650 |

|

|

|

2,831 |

|

Other current assets |

|

|

20,127 |

|

|

|

4,850 |

|

Total current assets |

|

|

225,306 |

|

|

|

335,803 |

|

|

|

|

|

|

|

|

Property and equipment: |

|

|

|

|

|

|

BlueWalker 3 satellite - construction in progress |

|

|

92,094 |

|

|

|

67,615 |

|

Property and equipment, net |

|

|

43,543 |

|

|

|

28,327 |

|

Total property and equipment, net |

|

|

135,637 |

|

|

|

95,942 |

|

|

|

|

|

|

|

|

Other non-current assets: |

|

|

|

|

|

|

Operating lease right-of-use assets, net |

|

|

7,901 |

|

|

|

7,991 |

|

Goodwill |

|

|

- |

|

|

|

3,641 |

|

Other non-current assets |

|

|

17,424 |

|

|

|

559 |

|

Total other non-current assets |

|

|

25,325 |

|

|

|

12,191 |

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

386,268 |

|

|

$ |

443,936 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

9,546 |

|

|

$ |

6,638 |

|

Accrued expenses and other current liabilities |

|

|

10,837 |

|

|

|

7,469 |

|

Deferred revenue |

|

|

- |

|

|

|

6,636 |

|

Current operating lease liabilities |

|

|

803 |

|

|

|

634 |

|

Total current liabilities |

|

|

21,186 |

|

|

|

21,377 |

|

|

|

|

|

|

|

|

Warrant liabilities |

|

|

56,390 |

|

|

|

58,062 |

|

Non-current operating lease liabilities |

|

|

7,195 |

|

|

|

7,525 |

|

Long-term debt |

|

|

4,820 |

|

|

|

5,000 |

|

Total liabilities |

|

|

89,591 |

|

|

|

91,964 |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

|

|

Class A Common Stock, $.0001 par value; 800,000,000 shares authorized; 54,369,296 and 51,730,904 shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively. |

|

|

5 |

|

|

|

5 |

|

Class B Common Stock, $.0001 par value; 200,000,000 shares authorized; 51,636,922 shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively. |

|

|

5 |

|

|

|

5 |

|

Class C Common Stock, $.0001 par value; 125,000,000 shares authorized; 78,163,078 shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively. |

|

|

8 |

|

|

|

8 |

|

Additional paid-in capital |

|

|

185,435 |

|

|

|

171,155 |

|

Accumulated other comprehensive loss |

|

|

(271 |

) |

|

|

(433 |

) |

Accumulated deficit |

|

|

(93,872 |

) |

|

|

(70,461 |

) |

Noncontrolling interest |

|

|

205,367 |

|

|

|

251,693 |

|

Total stockholders' equity |

|

|

296,677 |

|

|

|

351,972 |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

386,268 |

|

|

$ |

443,936 |

|

(1)As of September 30, 2022, restricted cash of $0.7 million represents deposits against the bank guaranty issued to the landlord for lease of a property. As of December 31, 2021, restricted cash of $2.8 million represented deposits with a bank to exclusively use for capital improvements at the Company’s facility in Texas, United States.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AST SPACEMOBILE, INC. |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) |

|

|

(dollars in thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

4,168 |

|

|

$ |

2,450 |

|

|

|

$ |

13,825 |

|

|

$ |

6,185 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of items shown separately below) |

|

|

2,525 |

|

|

|

2,103 |

|

|

|

|

6,714 |

|

|

|

4,122 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

1,643 |

|

|

|

347 |

|

|

|

|

7,111 |

|

|

|

2,063 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engineering services |

|

|

14,492 |

|

|

|

8,026 |

|

|

|

|

38,208 |

|

|

|

18,757 |

|

|

General and administrative costs |

|

|

12,916 |

|

|

|

9,331 |

|

|

|

|

37,634 |

|

|

|

24,031 |

|

|

Research and development costs |

|

|

13,543 |

|

|

|

4,888 |

|

|

|

|

30,969 |

|

|

|

15,491 |

|

|

Depreciation and amortization |

|

|

1,172 |

|

|

|

867 |

|

|

|

|

3,457 |

|

|

|

2,049 |

|

|

Total operating expenses |

|

|

42,123 |

|

|

|

23,112 |

|

|

|

|

110,268 |

|

|

|

60,328 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) gain on remeasurement of warrant liabilities |

|

|

(15,897 |

) |

|

|

39,401 |

|

|

|

|

1,669 |

|

|

|

(2,276 |

) |

|

Other income, net |

|

|

24,875 |

|

|

|

184 |

|

|

|

|

24,211 |

|

|

|

156 |

|

|

Total other income (expense), net |

|

|

8,978 |

|

|

|

39,585 |

|

|

|

|

25,880 |

|

|

|

(2,120 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income before income tax expense |

|

|

(31,502 |

) |

|

|

16,820 |

|

|

|

|

(77,277 |

) |

|

|

(60,385 |

) |

|

Income tax expense |

|

|

550 |

|

|

|

16 |

|

|

|

|

747 |

|

|

|

73 |

|

|

Net (loss) income before allocation to noncontrolling interest |

|

|

(32,052 |

) |

|

|

16,804 |

|

|

|

|

(78,024 |

) |

|

|

(60,458 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to noncontrolling interest |

|

|

(22,286 |

) |

|

|

12,689 |

|

|

|

|

(54,613 |

) |

|

|

(33,015 |

) |

|

Net (loss) income attributable to common stockholders |

|

$ |

(9,766 |

) |

|

$ |

4,115 |

|

|

|

$ |

(23,411 |

) |

|

$ |

(27,443 |

) |

|

Net (loss) income per share of common stock attributable to common stockholders (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.18 |

) |

|

$ |

0.08 |

|

|

|

$ |

(0.45 |

) |

|

$ |

(0.31 |

) |

|

Diluted |

|

$ |

(0.18 |

) |

|

$ |

0.07 |

|

|

|

$ |

(0.45 |

) |

|

$ |

(0.31 |

) |

|

Weighted average shares used in computing net (loss) income per share of common stock (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

53,233,552 |

|

|

|

51,729,704 |

|

|

|

|

52,292,972 |

|

|

|

51,729,704 |

|

|

Diluted |

|

|

53,233,552 |

|

|

|

51,839,841 |

|

|

|

|

52,292,972 |

|

|

|

51,729,704 |

|

|

(1)Earnings per share information excludes earnings for the periods prior to the Business Combination, as it resulted in values that would not be meaningful to the users of these condensed consolidated financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AST SPACEMOBILE, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED) |

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income before allocation to noncontrolling interest |

|

$ |

(32,052 |

) |

|

$ |

16,804 |

|

|

$ |

(78,024 |

) |

|

$ |

(60,458 |

) |

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(1,267 |

) |

|

|

(220 |

) |

|

|

(1,865 |

) |

|

|

(494 |

) |

Total other comprehensive loss |

|

|

(1,267 |

) |

|

|

(220 |

) |

|

|

(1,865 |

) |

|

|

(494 |

) |

Total comprehensive (loss) income before allocation to noncontrolling interest |

|

|

(33,319 |

) |

|

|

16,584 |

|

|

|

(79,889 |

) |

|

|

(60,952 |

) |

Comprehensive (loss) income attributable to noncontrolling interest |

|

|

(23,083 |

) |

|

|

12,490 |

|

|

|

(55,915 |

) |

|

|

(33,283 |

) |

Comprehensive (loss) income attributable to common stockholders |

|

$ |

(10,236 |

) |

|

$ |

4,094 |

|

|

$ |

(23,974 |

) |

|

$ |

(27,669 |

) |

AST SPACEMOBILE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

Net loss before allocation to noncontrolling interest |

|

|

$ |

(78,024 |

) |

|

$ |

(60,458 |

) |

Adjustments to reconcile net loss before noncontrolling interest to cash

used in operating activities: |

|

|

|

|

|

|

|

Gain on sale of Nano |

|

|

|

(24,646 |

) |

|

|

- |

|

Depreciation and amortization |

|

|

|

3,457 |

|

|

|

2,049 |

|

(Gain) loss on remeasurement of warrant liabilities |

|

|

|

(1,669 |

) |

|

|

2,276 |

|

Non-cash lease expense |

|

|

|

364 |

|

|

|

505 |

|

Stock-based compensation |

|

|

|

7,093 |

|

|

|

1,899 |

|

Issuance of common stock for commitment shares |

|

|

|

332 |

|

|

|

- |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

|

(2,241 |

) |

|

|

710 |

|

Prepaid expenses and other current assets |

|

|

|

(20,444 |

) |

|

|

(2,700 |

) |

Inventory |

|

|

|

(2,461 |

) |

|

|

(282 |

) |

Accounts payable and accrued expenses |

|

|

|

12,259 |

|

|

|

(1,069 |

) |

Operating lease liabilities |

|

|

|

(323 |

) |

|

|

(354 |

) |

Deferred revenue |

|

|

|

2,395 |

|

|

|

1,662 |

|

Other assets and liabilities |

|

|

|

(17,516 |

) |

|

|

(2,850 |

) |

Net cash used in operating activities |

|

|

|

(121,424 |

) |

|

|

(58,612 |

) |

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

|

(20,685 |

) |

|

|

(11,293 |

) |

BlueWalker 3 satellite - construction in process |

|

|

|

(25,165 |

) |

|

|

(29,201 |

) |

Proceeds from sale of Nano, net of cash deconsolidated and transaction costs |

|

|

|

26,036 |

|

|

|

- |

|

Net cash used in investing activities |

|

|

|

(19,814 |

) |

|

|

(40,494 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

|

|

16,994 |

|

|

|

- |

|

Proceeds from business combination |

|

|

|

- |

|

|

|

456,420 |

|

Direct and incremental costs incurred for the Business Combination |

|

|

|

- |

|

|

|

(39,542 |

) |

Issuance of incentive units under employee stock plan |

|

|

|

60 |

|

|

|

|

Warrant exercises |

|

|

|

14 |

|

|

|

- |

|

Proceeds from debt |

|

|

|

230 |

|

|

|

- |

|

Net cash provided by financing activities |

|

|

|

17,298 |

|

|

|

416,878 |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

|

(1,068 |

) |

|

|

(159 |

) |

|

|

|

|

|

|

|

|

Net (decrease) increase in cash, cash equivalents and restricted cash |

|

|

|

(125,008 |

) |

|

|

317,613 |

|

Cash, cash equivalents and restricted cash, beginning of period |

|

|

|

324,537 |

|

|

|

42,777 |

|

Cash, cash equivalents and restricted cash, end of period |

|

|

$ |

199,529 |

|

|

$ |

360,390 |

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

Non-cash transactions: |

|

|

|

|

|

|

|

Purchases of construction in process in accounts payable |

|

|

$ |

3,966 |

|

|

$ |

2,266 |

|

Purchases of property and equipment in accounts payable |

|

|

|

755 |

|

|

|

1,306 |

|

Right-of-use assets obtained in exchange for operating lease liabilities |

|

|

|

1,129 |

|

|

|

- |

|

Transforming how�the world connects Business Update – Third Quarter 2022 November 14, 2022 NASDAQ: ASTS

ast-science.com Forward Looking Statements The information in this presentation and the oral statements made in connection therewith includes “forward-looking statements” for the purposes of federal securities laws that are not historical facts and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical fact in this presentation and the oral statements made in connection therewith regarding AST SpaceMobile, Inc.’s, collectively with its subsidiaries (“SpaceMobile” or the “Company”), financial position, business strategy and the plans and objectives of management for future operations, are forward-looking statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,” “seek” and variations and similar words and expressions are intended to identify such forward-looking statements. Such forward-looking statements relate to future events or future performance, but reflect management’s current beliefs, based on information currently available. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors contained in AST SpaceMobile’s Annual Report on Form 10-K, filed with the SEC on March 31, 2022. The Company’s securities filings can be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. Use of Non-GAAP Financial Measures Adjusted operating expense is an alternative financial measure used by management to evaluate our operating performance as a supplement to our most directly comparable U.S. GAAP financial measure. We define Adjusted operating expense as Total operating expenses adjusted to exclude amounts of stock-based compensation expense and depreciation and amortization expense. We believe Adjusted operating expenses is a useful measure across time in evaluating the Company's operating performance as we use Adjusted operating expenses to manage the business, including in preparing our annual operating budget and financial projections. Adjusted operating expense is a non-GAAP financial measure that has no standardized meaning prescribed by U.S. GAAP, and therefore has limits in its usefulness to investors. Because of the non-standardized definition, it may not be comparable to the calculation of similar measures of other companies and are presented solely to provide investors with useful information to more fully understand how management assesses performance. This measure is not, and should not be viewed as, a substitute for its most directly comparable GAAP measure of Total operating expenses. Industry and Market Data This presentation includes market data and other statistical information from sources believed to be reliable, including independent industry publications, governmental publications or other published independent sources. Although AST SpaceMobile believes these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. Trademarks and Trade Names AST SpaceMobile owns or has rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with AST SpaceMobile, or an endorsement or sponsorship by or of AST SpaceMobile. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that AST SpaceMobile will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

Q3 2022 �update AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on our extensive IP and patent portfolio. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today's five billion mobile subscribers and finally bring broadband to the billions who remain unconnected.

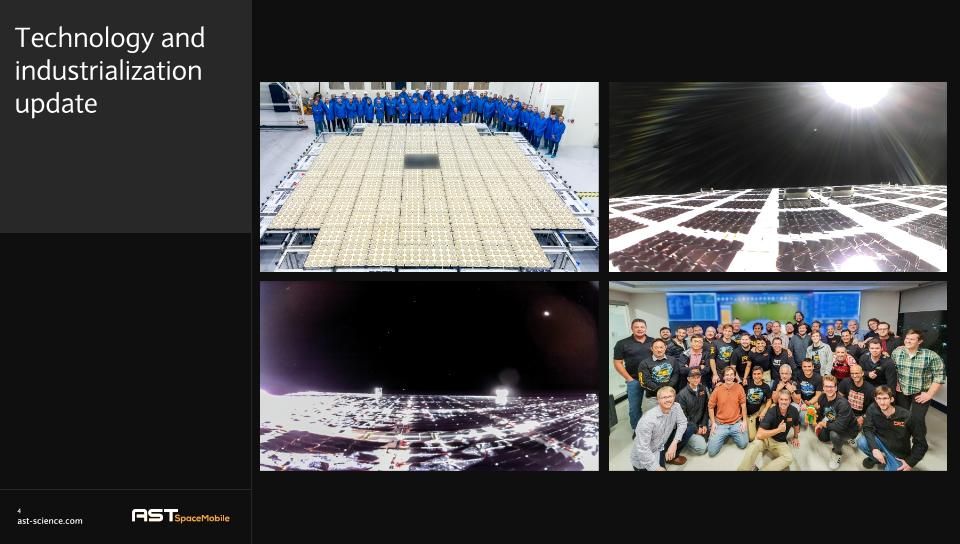

Technology and industrialization update

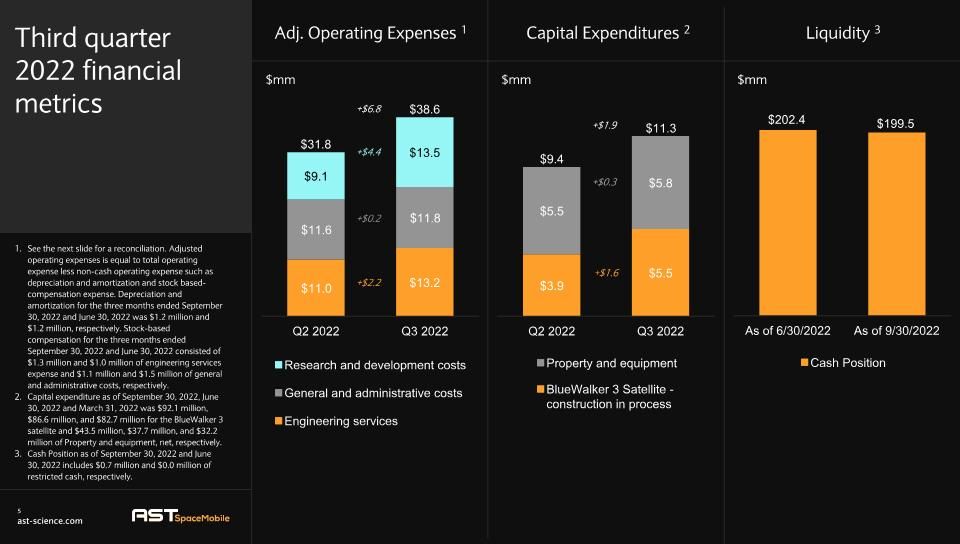

Third quarter �2022 financial�metrics Adj. Operating Expenses 1 Liquidity 3 $mm $mm See the next slide for a reconciliation. Adjusted operating expenses is equal to total operating expense less non-cash operating expense such as depreciation and amortization and stock based-compensation expense. Depreciation and amortization for the three months ended September 30, 2022 and June 30, 2022 was $1.2 million and $1.2 million, respectively. Stock-based compensation for the three months ended September 30, 2022 and June 30, 2022 consisted of $1.3 million and $1.0 million of engineering services expense and $1.1 million and $1.5 million of general and administrative costs, respectively. Capital expenditure as of September 30, 2022, June 30, 2022 and March 31, 2022 was $92.1 million, $86.6 million, and $82.7 million for the BlueWalker 3 satellite and $43.5 million, $37.7 million, and $32.2 million of Property and equipment, net, respectively. Cash Position as of September 30, 2022 and June 30, 2022 includes $0.7 million and $0.0 million of restricted cash, respectively. Capital Expenditures 2 $mm +$4.4 +$0.2 +$2.2 +$6.8 +$1.6 +$0.3 +$1.9

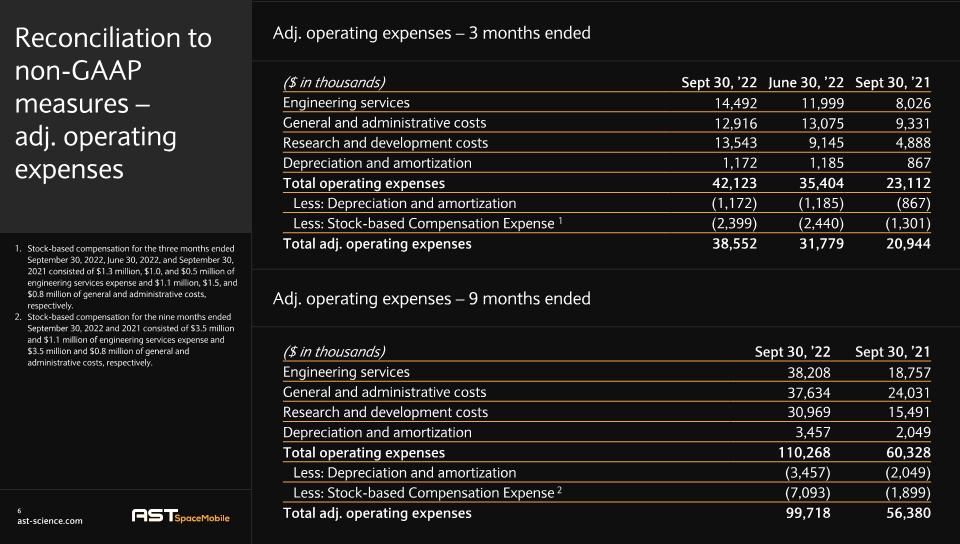

Reconciliation to �non-GAAP �measures –�adj. operating expenses Adj. operating expenses – 3 months ended Stock-based compensation for the three months ended September 30, 2022, June 30, 2022, and September 30, 2021 consisted of $1.3 million, $1.0, and $0.5 million of engineering services expense and $1.1 million, $1.5, and $0.8 million of general and administrative costs, respectively. Stock-based compensation for the nine months ended September 30, 2022 and 2021 consisted of $3.5 million and $1.1 million of engineering services expense and $3.5 million and $0.8 million of general and administrative costs, respectively. ($ in thousands) Sept 30, ’22 June 30, ’22 Sept 30, ’21 Engineering services 14,492 11,999 8,026 General and administrative costs 12,916 13,075 9,331 Research and development costs 13,543 9,145 4,888 Depreciation and amortization 1,172 1,185 867 Total operating expenses 42,123 35,404 23,112 Less: Depreciation and amortization (1,172) (1,185) (867) Less: Stock-based Compensation Expense 1 (2,399) (2,440) (1,301) Total adj. operating expenses 38,552 31,779 20,944 Adj. operating expenses – 9 months ended ($ in thousands) Sept 30, ’22 Sept 30, ’21 Engineering services 38,208 18,757 General and administrative costs 37,634 24,031 Research and development costs 30,969 15,491 Depreciation and amortization 3,457 2,049 Total operating expenses 110,268 60,328 Less: Depreciation and amortization (3,457) (2,049) Less: Stock-based Compensation Expense 2 (7,093) (1,899) Total adj. operating expenses 99,718 56,380

NASDAQ: ASTS

v3.22.2.2

Document And Entity Information

|

Nov. 14, 2022 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 14, 2022

|

| Entity Registrant Name |

AST SpaceMobile, Inc.

|

| Entity Central Index Key |

0001780312

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39040

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

84-2027232

|

| Entity Address, Address Line One |

Midland Intl. Air & Space Port

|

| Entity Address, Address Line Two |

2901 Enterprise Lane

|

| Entity Address, City or Town |

Midland

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

79706

|

| City Area Code |

(432)

|

| Local Phone Number |

276-3966

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants exercisable for one share of Class A common stock at an exercise price of $11.50

|

| Trading Symbol |

ASTSW

|

| Security Exchange Name |

NASDAQ

|

| Class Common Stock Par Value 0.0001 Per Share [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

ASTS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=asts_WarrantsExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=asts_ClassCommonStockParValue00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

This regulatory filing also includes additional resources:

asts-q3_2022_press_release_8.pdf

asts-ex99_1.pdf

asts-ex99_2.pdf

New Providence Acquisition (NASDAQ:NPAUU)

Historical Stock Chart

From Oct 2024 to Nov 2024

New Providence Acquisition (NASDAQ:NPAUU)

Historical Stock Chart

From Nov 2023 to Nov 2024