Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 16 2024 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-39436

KE Holdings Inc.

(Registrant’s Name)

Oriental Electronic Technology Building,

No. 2 Chuangye Road, Haidian District,

Beijing 100086

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KE Holdings Inc. |

| |

|

| |

|

|

|

| |

By |

: |

/s/ XU Tao |

| |

Name |

: |

XU Tao |

| |

Title |

: |

Chief Financial Officer |

Date: December 16, 2024

Exhibit 99.1

| FF305

Page 1 of 6 v 1.3.0

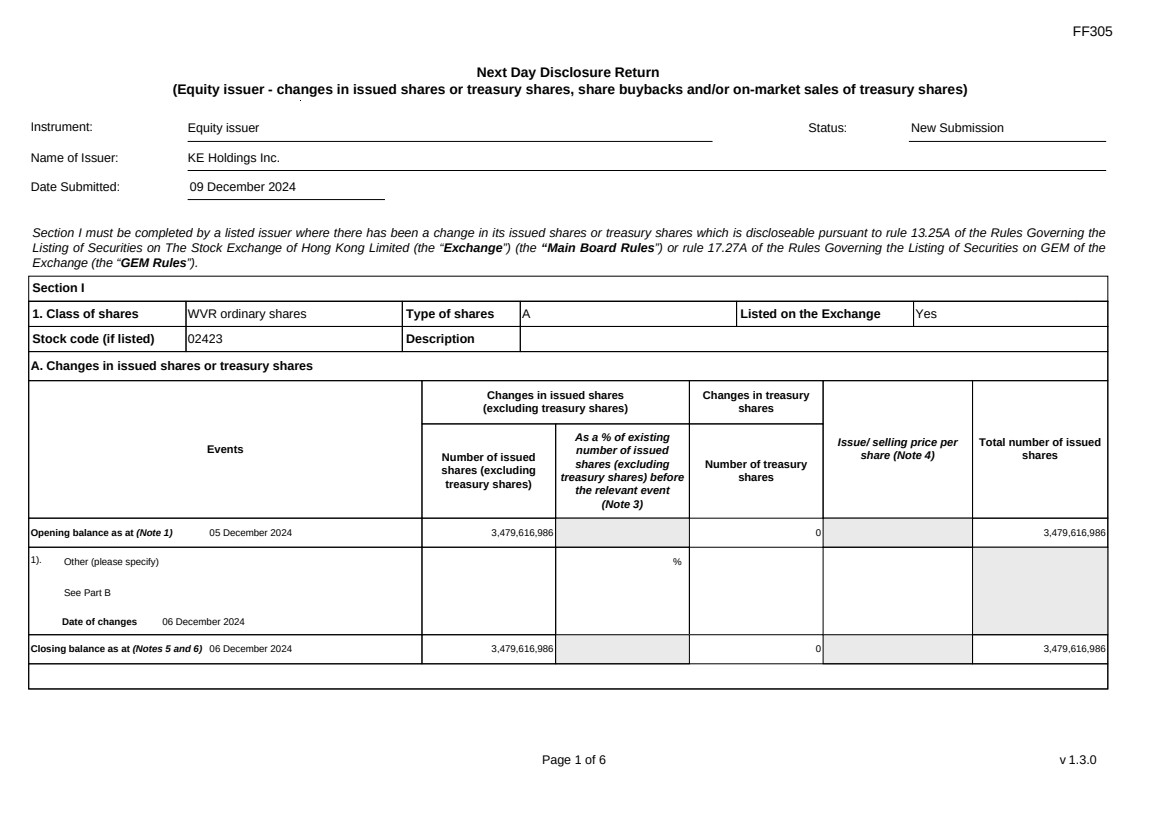

Next Day Disclosure Return

(Equity issuer - changes in issued shares or treasury shares, share buybacks and/or on-market sales of treasury shares)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holdings Inc.

Date Submitted: 09 December 2024

Section I must be completed by a listed issuer where there has been a change in its issued shares or treasury shares which is discloseable pursuant to rule 13.25A of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”) (the “Main Board Rules”) or rule 17.27A of the Rules Governing the Listing of Securities on GEM of the

Exchange (the “GEM Rules”).

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Changes in issued shares or treasury shares

Events

Changes in issued shares

(excluding treasury shares)

Number of issued

shares (excluding

treasury shares)

As a % of existing

number of issued

shares (excluding

treasury shares) before

the relevant event

(Note 3)

Changes in treasury

shares

Number of treasury

shares

Issue/ selling price per

share (Note 4)

Total number of issued

shares

Opening balance as at (Note 1) 05 December 2024 3,479,616,986 0 3,479,616,986

1). Other (please specify)

See Part B

Date of changes 06 December 2024

%

Closing balance as at (Notes 5 and 6) 06 December 2024 3,479,616,986 0 3,479,616,986

|

| FF305

Page 2 of 6 v 1.3.0

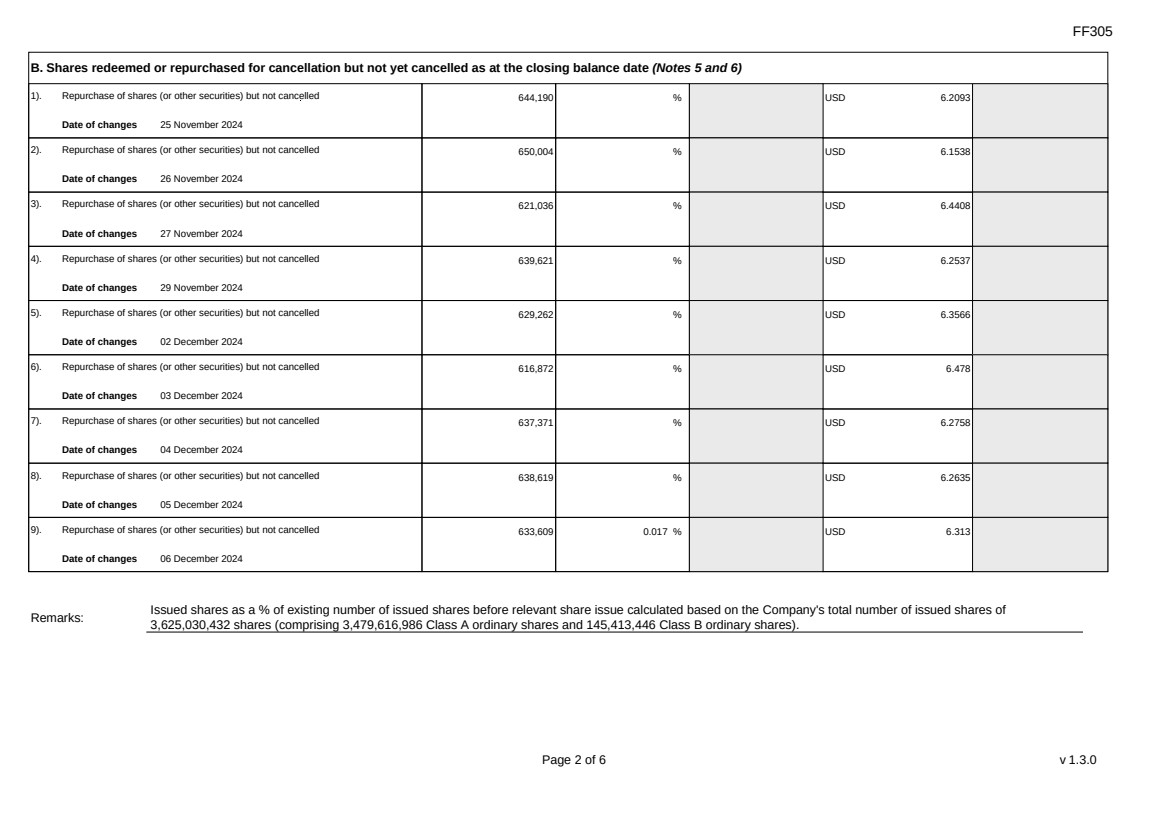

B. Shares redeemed or repurchased for cancellation but not yet cancelled as at the closing balance date (Notes 5 and 6)

1). Repurchase of shares (or other securities) but not cancelled

Date of changes 25 November 2024

644,190 % USD 6.2093

2). Repurchase of shares (or other securities) but not cancelled

Date of changes 26 November 2024

650,004 % USD 6.1538

3). Repurchase of shares (or other securities) but not cancelled

Date of changes 27 November 2024

621,036 % USD 6.4408

4). Repurchase of shares (or other securities) but not cancelled

Date of changes 29 November 2024

639,621 % USD 6.2537

5). Repurchase of shares (or other securities) but not cancelled

Date of changes 02 December 2024

629,262 % USD 6.3566

6). Repurchase of shares (or other securities) but not cancelled

Date of changes 03 December 2024

616,872 % USD 6.478

7). Repurchase of shares (or other securities) but not cancelled

Date of changes 04 December 2024

637,371 % USD 6.2758

8). Repurchase of shares (or other securities) but not cancelled

Date of changes 05 December 2024

638,619 % USD 6.2635

9). Repurchase of shares (or other securities) but not cancelled

Date of changes 06 December 2024

633,609 0.017 % USD 6.313

Remarks: Issued shares as a % of existing number of issued shares before relevant share issue calculated based on the Company's total number of issued shares of

3,625,030,432 shares (comprising 3,479,616,986 Class A ordinary shares and 145,413,446 Class B ordinary shares). |

| FF305

Page 3 of 6 v 1.3.0

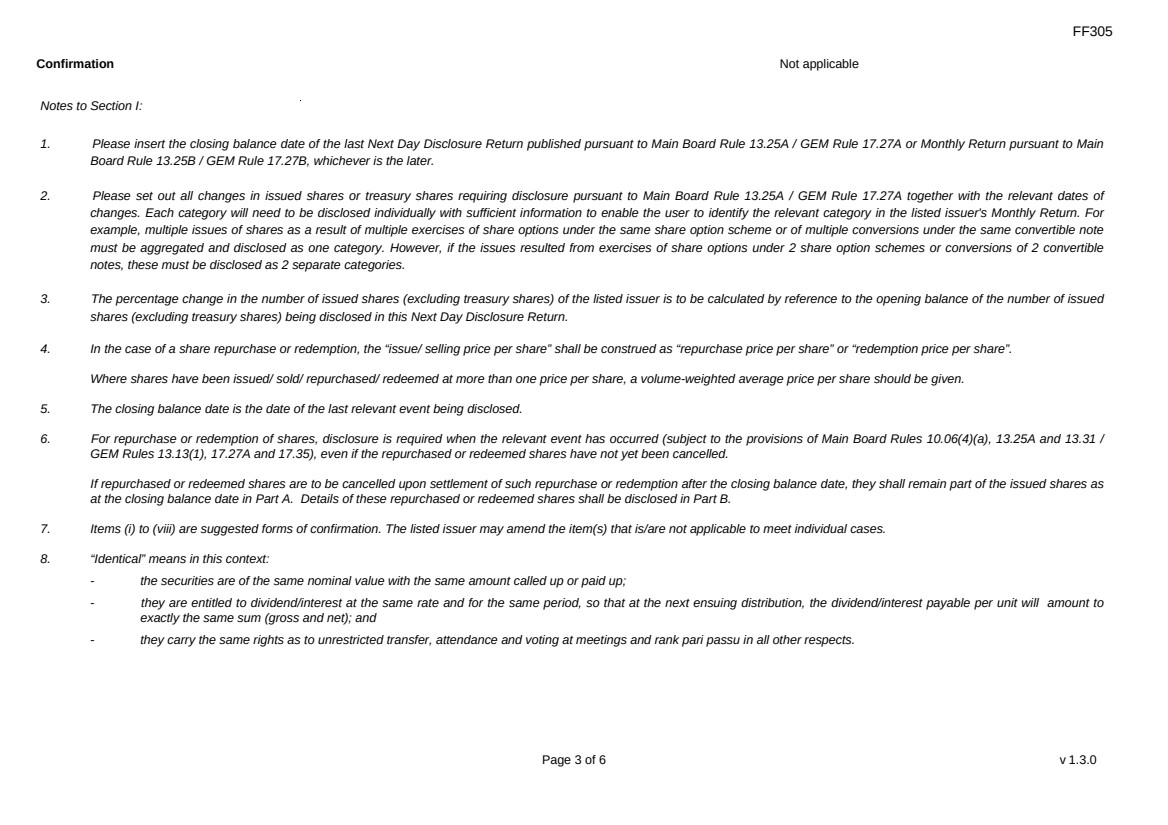

Confirmation Not applicable

Notes to Section I:

1. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

2. Please set out all changes in issued shares or treasury shares requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of

changes. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For

example, multiple issues of shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note

must be aggregated and disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible

notes, these must be disclosed as 2 separate categories.

3. The percentage change in the number of issued shares (excluding treasury shares) of the listed issuer is to be calculated by reference to the opening balance of the number of issued

shares (excluding treasury shares) being disclosed in this Next Day Disclosure Return.

4. In the case of a share repurchase or redemption, the “issue/ selling price per share” shall be construed as “repurchase price per share” or “redemption price per share”.

Where shares have been issued/ sold/ repurchased/ redeemed at more than one price per share, a volume-weighted average price per share should be given.

5. The closing balance date is the date of the last relevant event being disclosed.

6. For repurchase or redemption of shares, disclosure is required when the relevant event has occurred (subject to the provisions of Main Board Rules 10.06(4)(a), 13.25A and 13.31 /

GEM Rules 13.13(1), 17.27A and 17.35), even if the repurchased or redeemed shares have not yet been cancelled.

If repurchased or redeemed shares are to be cancelled upon settlement of such repurchase or redemption after the closing balance date, they shall remain part of the issued shares as

at the closing balance date in Part A. Details of these repurchased or redeemed shares shall be disclosed in Part B.

7. Items (i) to (viii) are suggested forms of confirmation. The listed issuer may amend the item(s) that is/are not applicable to meet individual cases.

8. “Identical” means in this context:

- the securities are of the same nominal value with the same amount called up or paid up;

- they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

- they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF305

Page 4 of 6 v 1.3.0

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

Repurchase report

Section II

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Repurchase report

Trading date Number of shares

repurchased

Method of repurchase

(Note 1)

Repurchase price per share or

highest repurchase price per

share $

Lowest repurchase

price per share $ Aggregate price paid $

1). 06 December 2024 633,609 On another stock exchange

New York Stock Exchange

USD 6.4 USD 6.25 USD 3,999,995

Total number of shares

repurchased 633,609 Aggregate price paid $ USD 3,999,995

Number of shares

repurchased for

cancellation

633,609

Number of shares

repurchased for holding

as treasury shares

0

B. Additional information for issuer who has a primary listing on the Exchange

1). Date of the resolution granting the repurchase mandate 14 June 2024

2). Total number of shares which the issuer is authorised to repurchase under the repurchase mandate 367,706,331

3). Number of shares repurchased on the Exchange or another stock exchange under the repurchase mandate (a) 53,357,787

4). As a % of number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

(a) x 100 / number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

1.451 %

5). Moratorium period for any issue of new shares, or sale or transfer of treasury shares after the share repurchase(s) set out in Part A

(Note 2)

Up to 05 January 2025 |

| FF305

Page 5 of 6 v 1.3.0

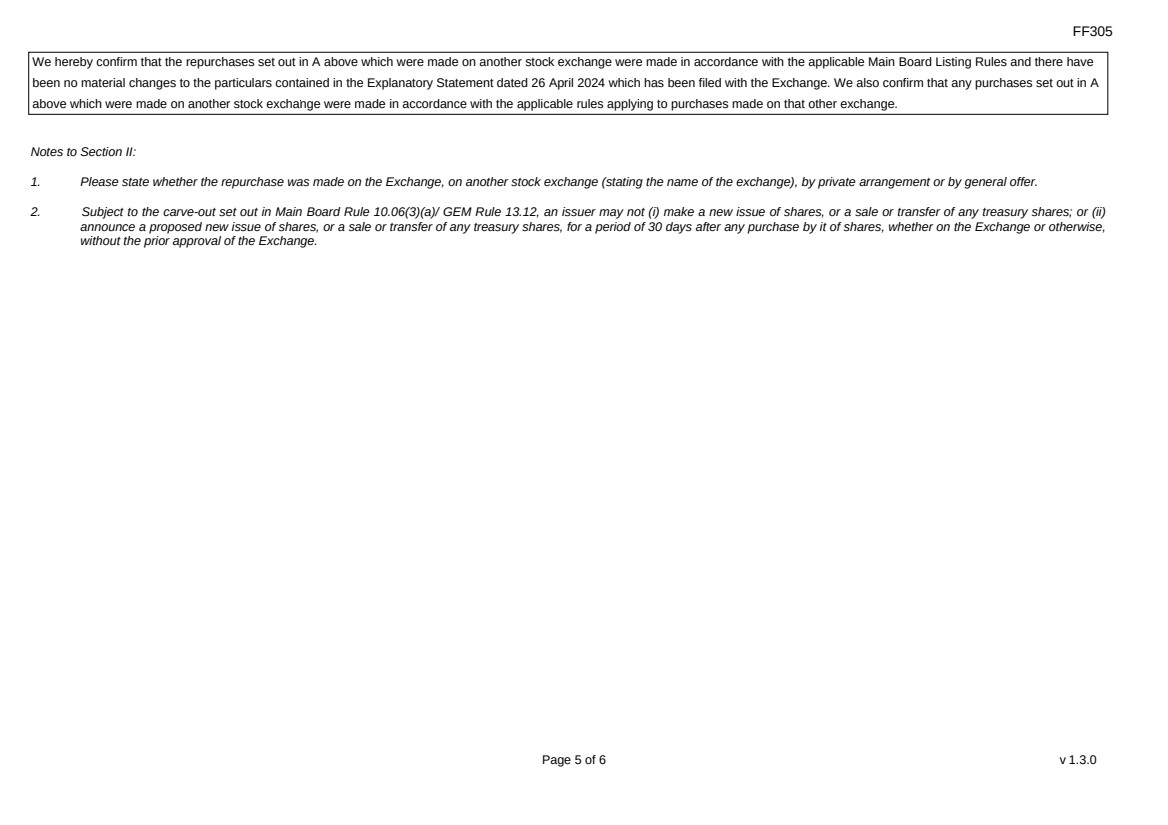

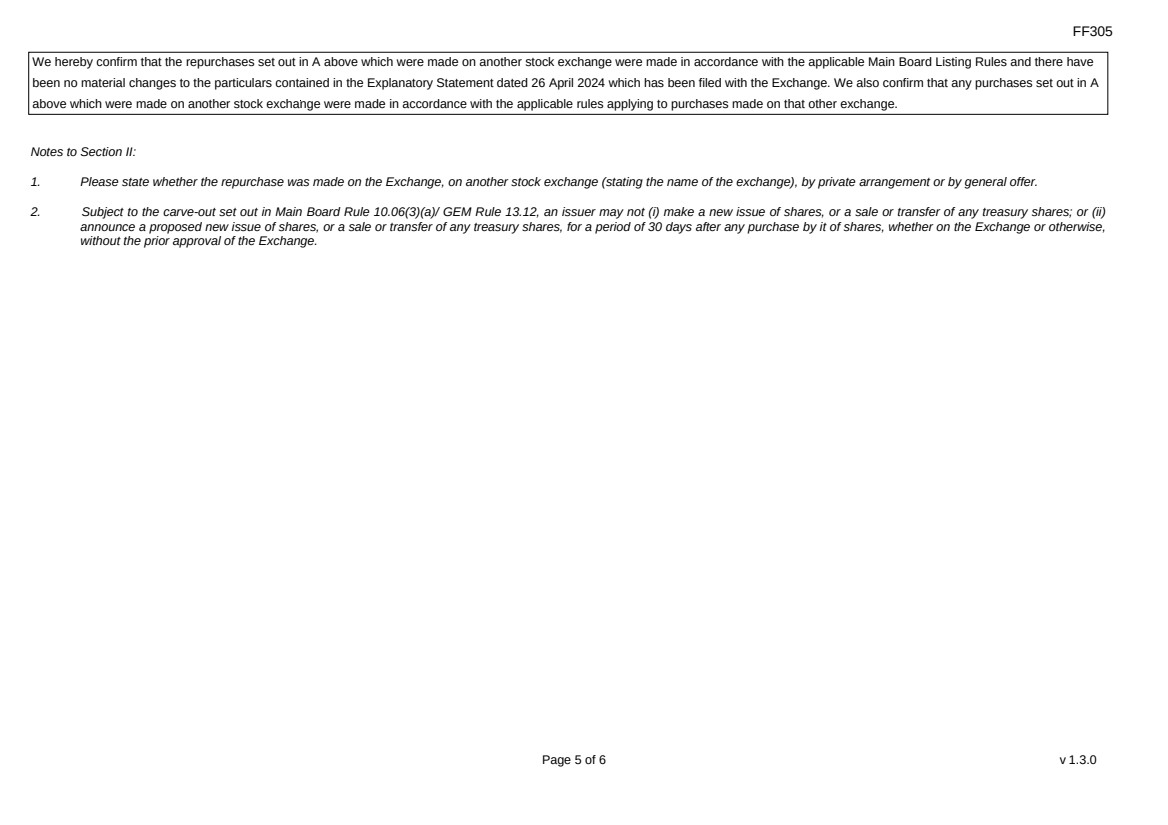

We hereby confirm that the repurchases set out in A above which were made on another stock exchange were made in accordance with the applicable Main Board Listing Rules and there have

been no material changes to the particulars contained in the Explanatory Statement dated 26 April 2024 which has been filed with the Exchange. We also confirm that any purchases set out in A

above which were made on another stock exchange were made in accordance with the applicable rules applying to purchases made on that other exchange.

Notes to Section II:

1. Please state whether the repurchase was made on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

2. Subject to the carve-out set out in Main Board Rule 10.06(3)(a)/ GEM Rule 13.12, an issuer may not (i) make a new issue of shares, or a sale or transfer of any treasury shares; or (ii)

announce a proposed new issue of shares, or a sale or transfer of any treasury shares, for a period of 30 days after any purchase by it of shares, whether on the Exchange or otherwise,

without the prior approval of the Exchange. |

| FF305

Page 6 of 6 v 1.3.0

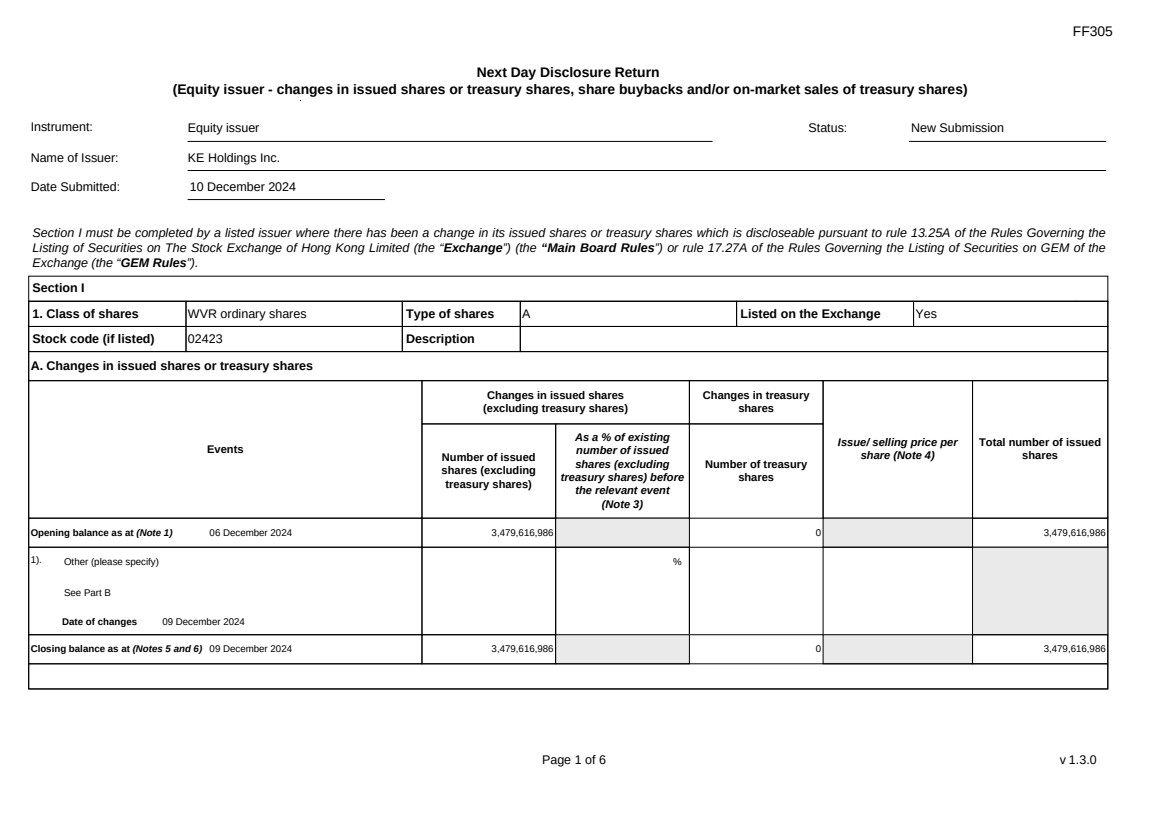

Section III must also be completed by a listed issuer where it has made a sale of treasury shares on the Exchange or any other stock exchange on which the issuer is listed which is discloseable

under Main Board Rule 10.06B / GEM Rule 13.14B.

Report of on-market sale of treasury shares Not applicable

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

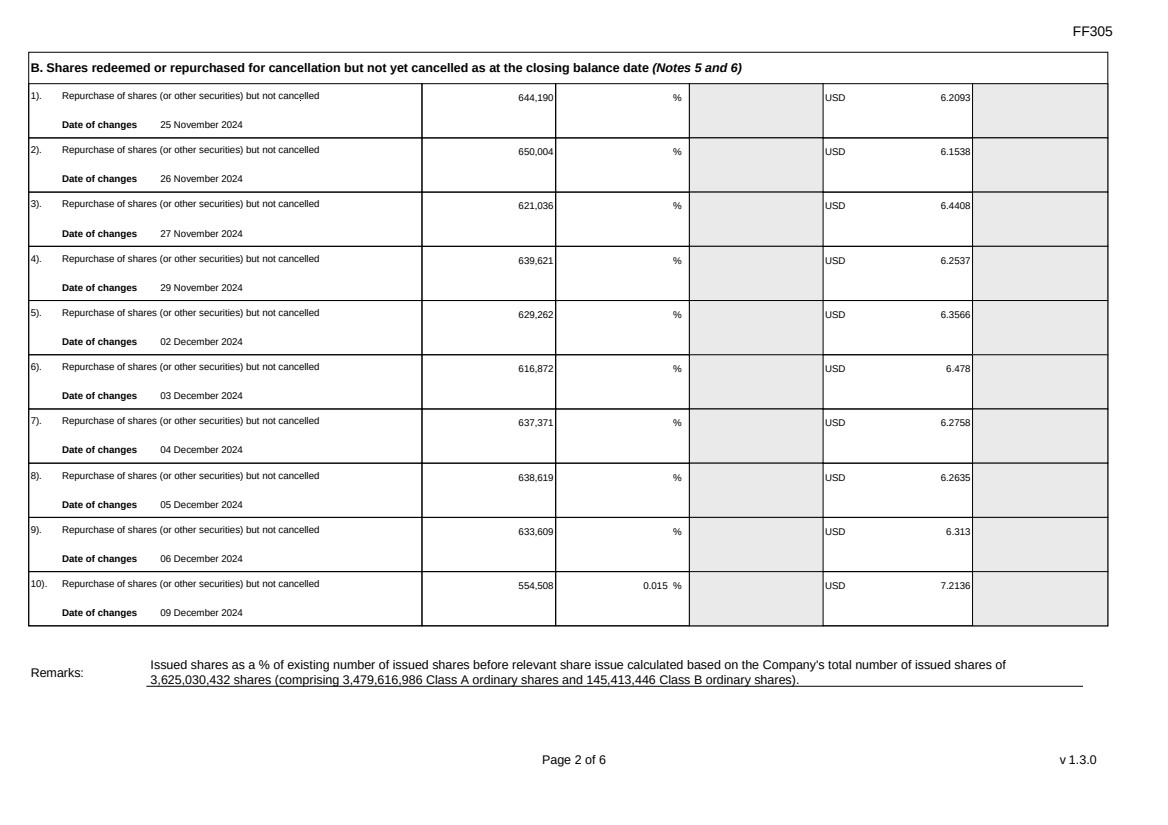

Exhibit 99.2

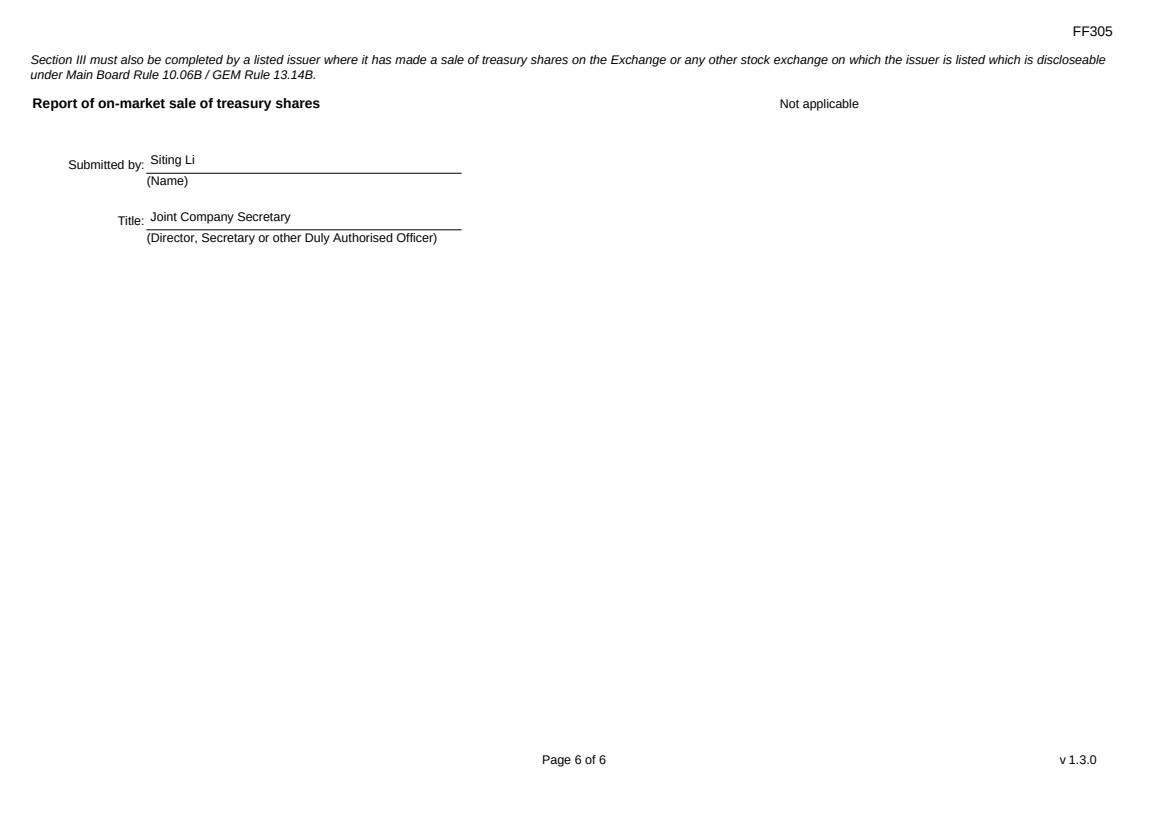

| FF305

Page 1 of 6 v 1.3.0

Next Day Disclosure Return

(Equity issuer - changes in issued shares or treasury shares, share buybacks and/or on-market sales of treasury shares)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holdings Inc.

Date Submitted: 10 December 2024

Section I must be completed by a listed issuer where there has been a change in its issued shares or treasury shares which is discloseable pursuant to rule 13.25A of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”) (the “Main Board Rules”) or rule 17.27A of the Rules Governing the Listing of Securities on GEM of the

Exchange (the “GEM Rules”).

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Changes in issued shares or treasury shares

Events

Changes in issued shares

(excluding treasury shares)

Number of issued

shares (excluding

treasury shares)

As a % of existing

number of issued

shares (excluding

treasury shares) before

the relevant event

(Note 3)

Changes in treasury

shares

Number of treasury

shares

Issue/ selling price per

share (Note 4)

Total number of issued

shares

Opening balance as at (Note 1) 06 December 2024 3,479,616,986 0 3,479,616,986

1). Other (please specify)

See Part B

Date of changes 09 December 2024

%

Closing balance as at (Notes 5 and 6) 09 December 2024 3,479,616,986 0 3,479,616,986

|

| FF305

Page 2 of 6 v 1.3.0

B. Shares redeemed or repurchased for cancellation but not yet cancelled as at the closing balance date (Notes 5 and 6)

1). Repurchase of shares (or other securities) but not cancelled

Date of changes 25 November 2024

644,190 % USD 6.2093

2). Repurchase of shares (or other securities) but not cancelled

Date of changes 26 November 2024

650,004 % USD 6.1538

3). Repurchase of shares (or other securities) but not cancelled

Date of changes 27 November 2024

621,036 % USD 6.4408

4). Repurchase of shares (or other securities) but not cancelled

Date of changes 29 November 2024

639,621 % USD 6.2537

5). Repurchase of shares (or other securities) but not cancelled

Date of changes 02 December 2024

629,262 % USD 6.3566

6). Repurchase of shares (or other securities) but not cancelled

Date of changes 03 December 2024

616,872 % USD 6.478

7). Repurchase of shares (or other securities) but not cancelled

Date of changes 04 December 2024

637,371 % USD 6.2758

8). Repurchase of shares (or other securities) but not cancelled

Date of changes 05 December 2024

638,619 % USD 6.2635

9). Repurchase of shares (or other securities) but not cancelled

Date of changes 06 December 2024

633,609 % USD 6.313

10). Repurchase of shares (or other securities) but not cancelled

Date of changes 09 December 2024

554,508 0.015 % USD 7.2136

Remarks: Issued shares as a % of existing number of issued shares before relevant share issue calculated based on the Company's total number of issued shares of

3,625,030,432 shares (comprising 3,479,616,986 Class A ordinary shares and 145,413,446 Class B ordinary shares). |

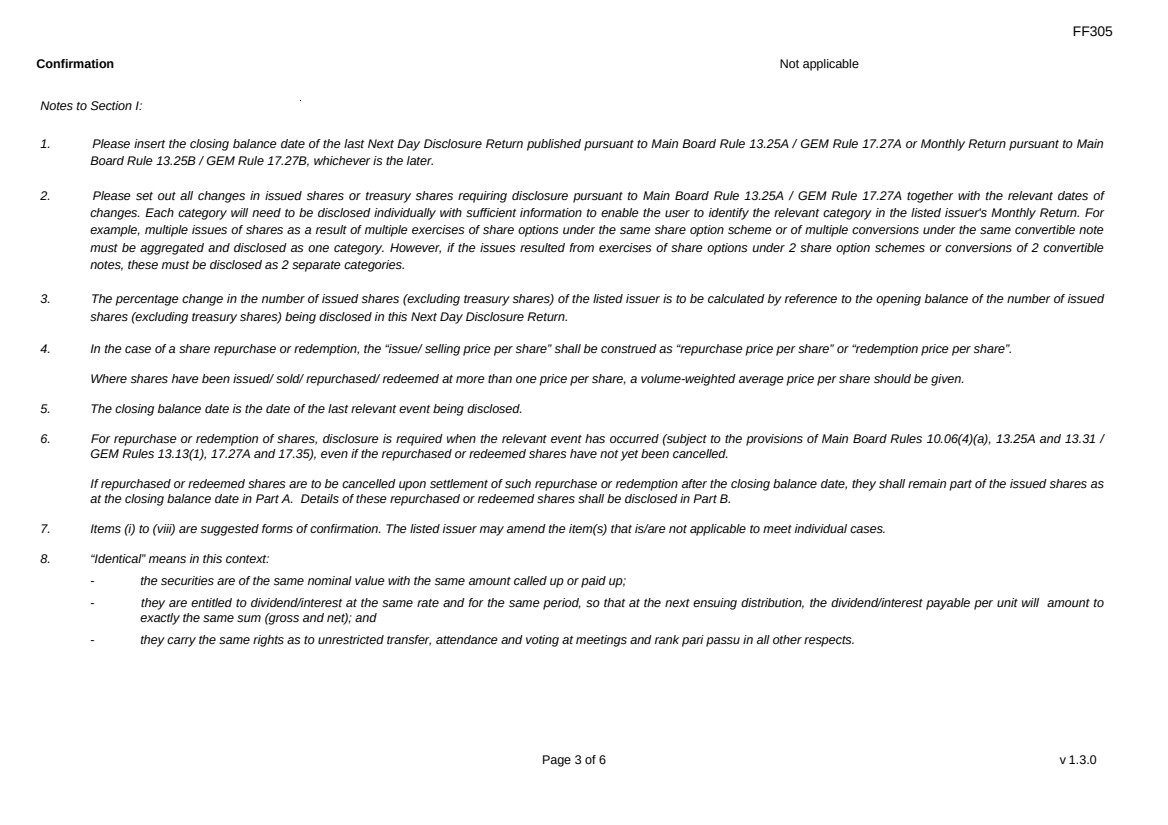

| FF305

Page 3 of 6 v 1.3.0

Confirmation Not applicable

Notes to Section I:

1. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

2. Please set out all changes in issued shares or treasury shares requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of

changes. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For

example, multiple issues of shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note

must be aggregated and disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible

notes, these must be disclosed as 2 separate categories.

3. The percentage change in the number of issued shares (excluding treasury shares) of the listed issuer is to be calculated by reference to the opening balance of the number of issued

shares (excluding treasury shares) being disclosed in this Next Day Disclosure Return.

4. In the case of a share repurchase or redemption, the “issue/ selling price per share” shall be construed as “repurchase price per share” or “redemption price per share”.

Where shares have been issued/ sold/ repurchased/ redeemed at more than one price per share, a volume-weighted average price per share should be given.

5. The closing balance date is the date of the last relevant event being disclosed.

6. For repurchase or redemption of shares, disclosure is required when the relevant event has occurred (subject to the provisions of Main Board Rules 10.06(4)(a), 13.25A and 13.31 /

GEM Rules 13.13(1), 17.27A and 17.35), even if the repurchased or redeemed shares have not yet been cancelled.

If repurchased or redeemed shares are to be cancelled upon settlement of such repurchase or redemption after the closing balance date, they shall remain part of the issued shares as

at the closing balance date in Part A. Details of these repurchased or redeemed shares shall be disclosed in Part B.

7. Items (i) to (viii) are suggested forms of confirmation. The listed issuer may amend the item(s) that is/are not applicable to meet individual cases.

8. “Identical” means in this context:

- the securities are of the same nominal value with the same amount called up or paid up;

- they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

- they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF305

Page 4 of 6 v 1.3.0

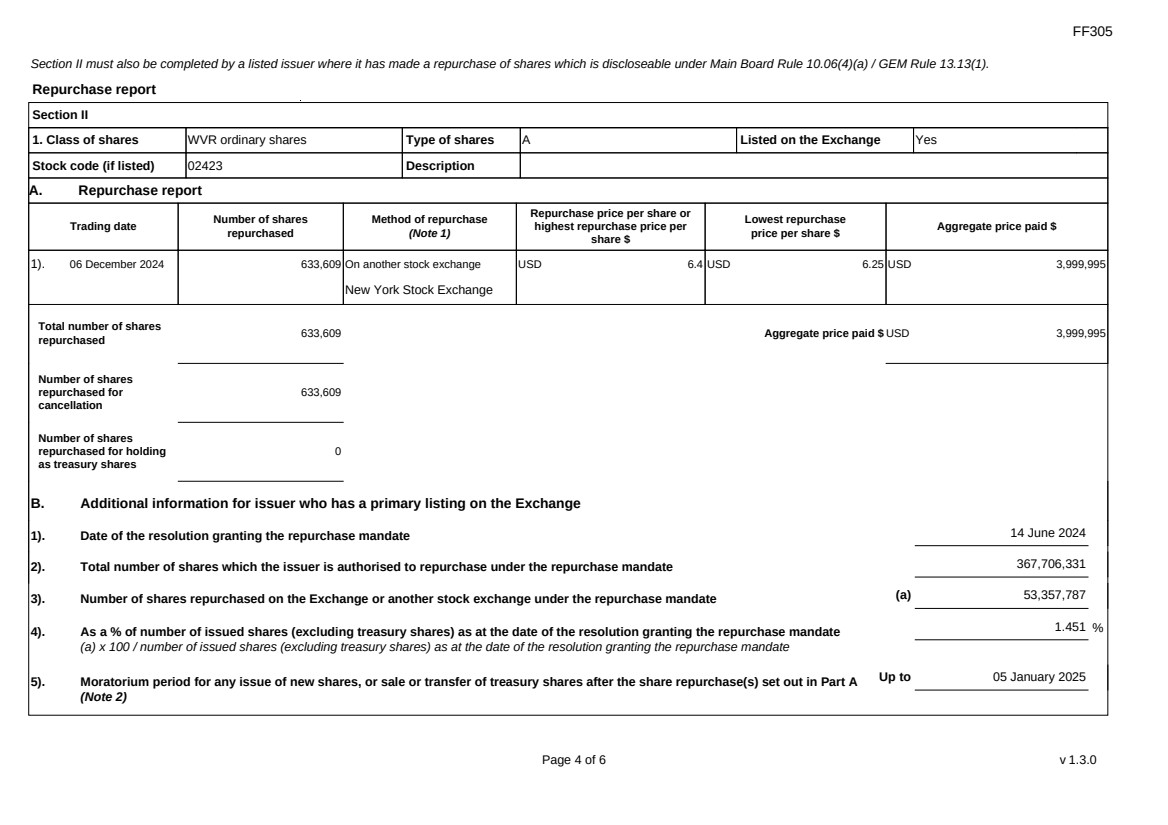

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

Repurchase report

Section II

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Repurchase report

Trading date Number of shares

repurchased

Method of repurchase

(Note 1)

Repurchase price per share or

highest repurchase price per

share $

Lowest repurchase

price per share $ Aggregate price paid $

1). 09 December 2024 554,508 On another stock exchange

New York Stock Exchange

USD 7.5 USD 7 USD 3,999,999

Total number of shares

repurchased 554,508 Aggregate price paid $ USD 3,999,999

Number of shares

repurchased for

cancellation

554,508

Number of shares

repurchased for holding

as treasury shares

0

B. Additional information for issuer who has a primary listing on the Exchange

1). Date of the resolution granting the repurchase mandate 14 June 2024

2). Total number of shares which the issuer is authorised to repurchase under the repurchase mandate 367,706,331

3). Number of shares repurchased on the Exchange or another stock exchange under the repurchase mandate (a) 53,912,295

4). As a % of number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

(a) x 100 / number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

1.466 %

5). Moratorium period for any issue of new shares, or sale or transfer of treasury shares after the share repurchase(s) set out in Part A

(Note 2)

Up to 08 January 2025 |

| FF305

Page 5 of 6 v 1.3.0

We hereby confirm that the repurchases set out in A above which were made on another stock exchange were made in accordance with the applicable Main Board Listing Rules and there have

been no material changes to the particulars contained in the Explanatory Statement dated 26 April 2024 which has been filed with the Exchange. We also confirm that any purchases set out in A

above which were made on another stock exchange were made in accordance with the applicable rules applying to purchases made on that other exchange.

Notes to Section II:

1. Please state whether the repurchase was made on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

2. Subject to the carve-out set out in Main Board Rule 10.06(3)(a)/ GEM Rule 13.12, an issuer may not (i) make a new issue of shares, or a sale or transfer of any treasury shares; or (ii)

announce a proposed new issue of shares, or a sale or transfer of any treasury shares, for a period of 30 days after any purchase by it of shares, whether on the Exchange or otherwise,

without the prior approval of the Exchange. |

| FF305

Page 6 of 6 v 1.3.0

Section III must also be completed by a listed issuer where it has made a sale of treasury shares on the Exchange or any other stock exchange on which the issuer is listed which is discloseable

under Main Board Rule 10.06B / GEM Rule 13.14B.

Report of on-market sale of treasury shares Not applicable

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

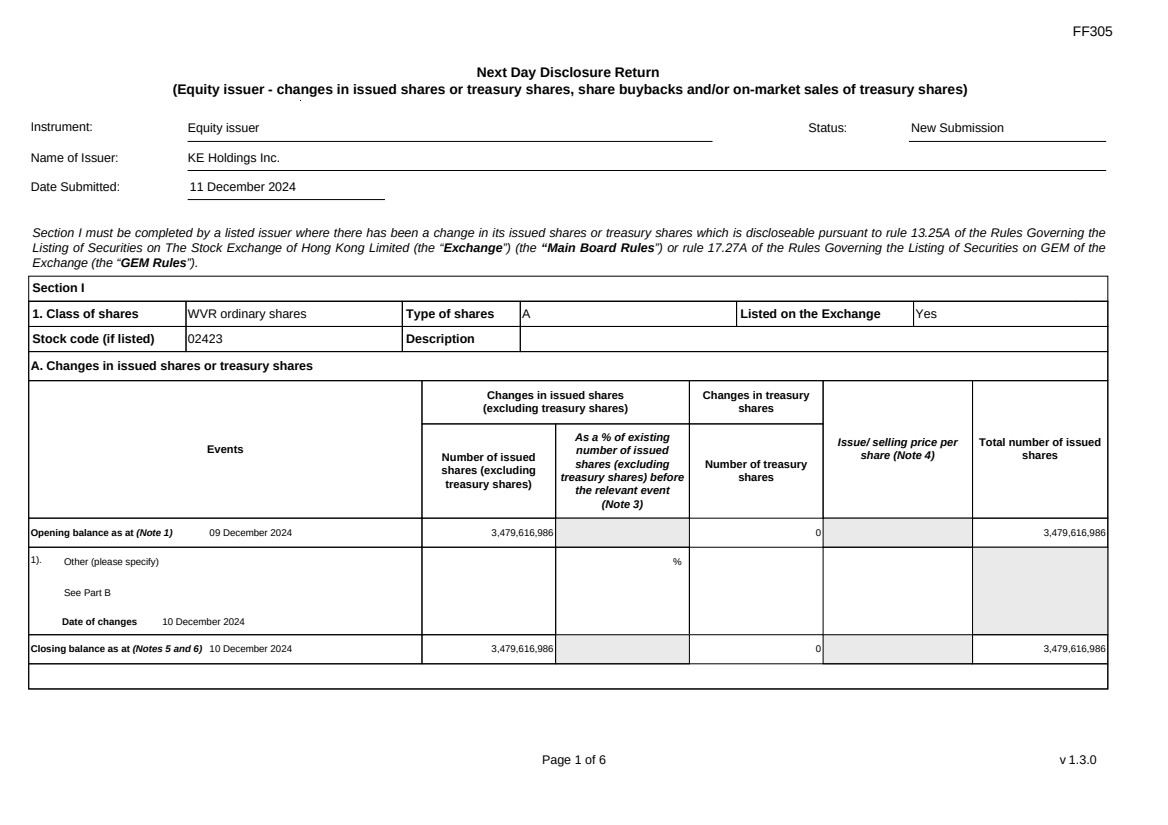

Exhibit 99.3

| FF305

Page 1 of 6 v 1.3.0

Next Day Disclosure Return

(Equity issuer - changes in issued shares or treasury shares, share buybacks and/or on-market sales of treasury shares)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holdings Inc.

Date Submitted: 11 December 2024

Section I must be completed by a listed issuer where there has been a change in its issued shares or treasury shares which is discloseable pursuant to rule 13.25A of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”) (the “Main Board Rules”) or rule 17.27A of the Rules Governing the Listing of Securities on GEM of the

Exchange (the “GEM Rules”).

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Changes in issued shares or treasury shares

Events

Changes in issued shares

(excluding treasury shares)

Number of issued

shares (excluding

treasury shares)

As a % of existing

number of issued

shares (excluding

treasury shares) before

the relevant event

(Note 3)

Changes in treasury

shares

Number of treasury

shares

Issue/ selling price per

share (Note 4)

Total number of issued

shares

Opening balance as at (Note 1) 09 December 2024 3,479,616,986 0 3,479,616,986

1). Other (please specify)

See Part B

Date of changes 10 December 2024

%

Closing balance as at (Notes 5 and 6) 10 December 2024 3,479,616,986 0 3,479,616,986

|

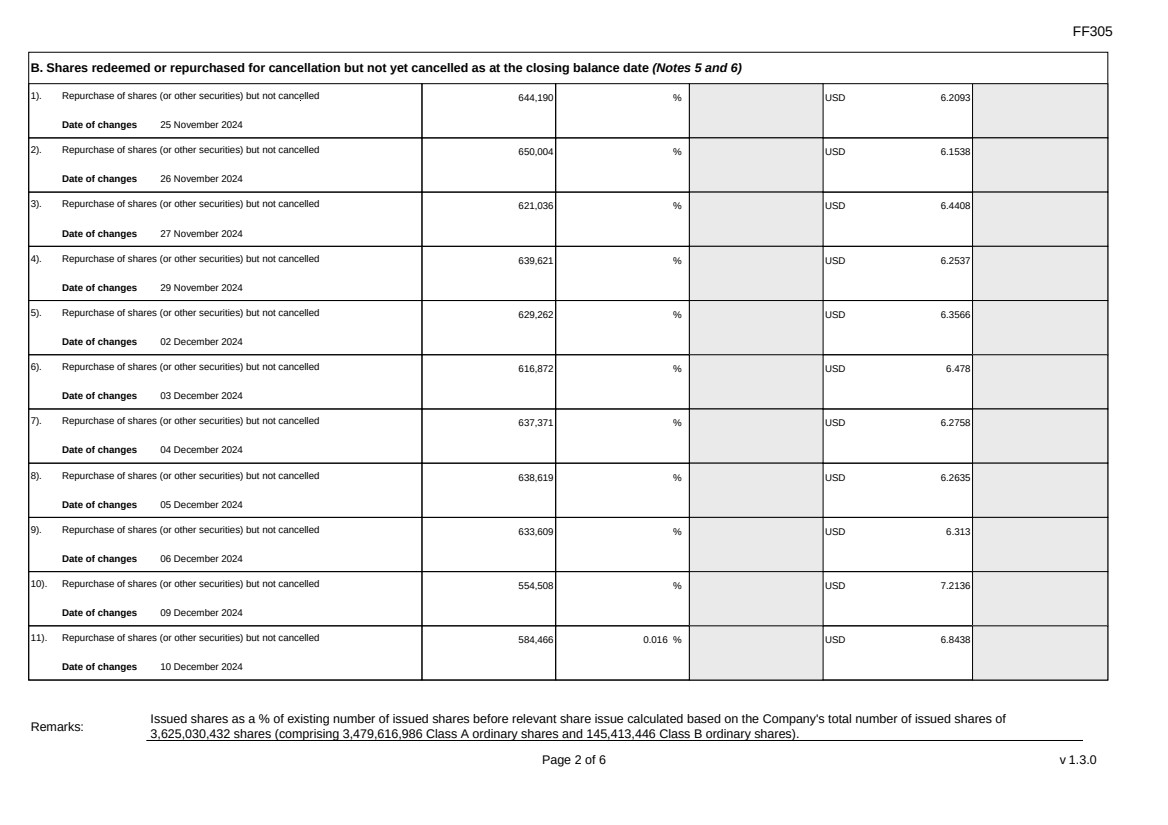

| FF305

Page 2 of 6 v 1.3.0

B. Shares redeemed or repurchased for cancellation but not yet cancelled as at the closing balance date (Notes 5 and 6)

1). Repurchase of shares (or other securities) but not cancelled

Date of changes 25 November 2024

644,190 % USD 6.2093

2). Repurchase of shares (or other securities) but not cancelled

Date of changes 26 November 2024

650,004 % USD 6.1538

3). Repurchase of shares (or other securities) but not cancelled

Date of changes 27 November 2024

621,036 % USD 6.4408

4). Repurchase of shares (or other securities) but not cancelled

Date of changes 29 November 2024

639,621 % USD 6.2537

5). Repurchase of shares (or other securities) but not cancelled

Date of changes 02 December 2024

629,262 % USD 6.3566

6). Repurchase of shares (or other securities) but not cancelled

Date of changes 03 December 2024

616,872 % USD 6.478

7). Repurchase of shares (or other securities) but not cancelled

Date of changes 04 December 2024

637,371 % USD 6.2758

8). Repurchase of shares (or other securities) but not cancelled

Date of changes 05 December 2024

638,619 % USD 6.2635

9). Repurchase of shares (or other securities) but not cancelled

Date of changes 06 December 2024

633,609 % USD 6.313

10). Repurchase of shares (or other securities) but not cancelled

Date of changes 09 December 2024

554,508 % USD 7.2136

11). Repurchase of shares (or other securities) but not cancelled

Date of changes 10 December 2024

584,466 0.016 % USD 6.8438

Remarks: Issued shares as a % of existing number of issued shares before relevant share issue calculated based on the Company's total number of issued shares of

3,625,030,432 shares (comprising 3,479,616,986 Class A ordinary shares and 145,413,446 Class B ordinary shares). |

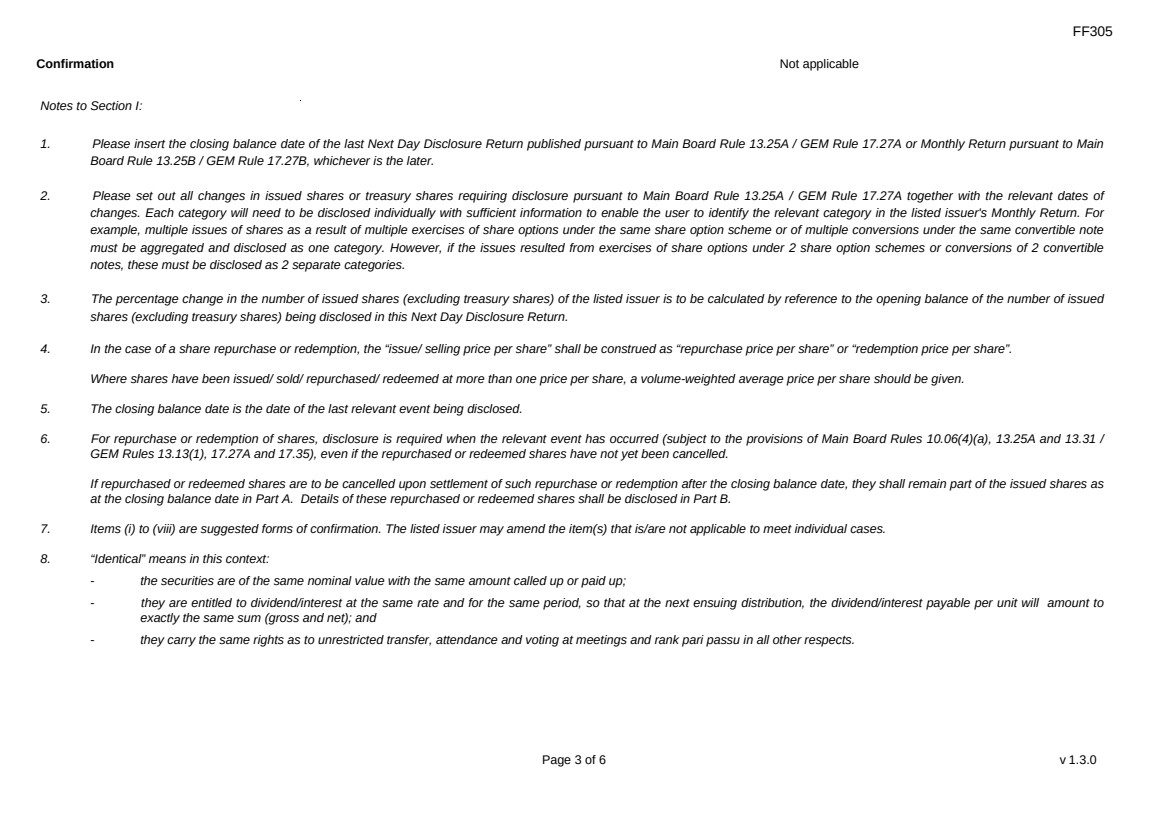

| FF305

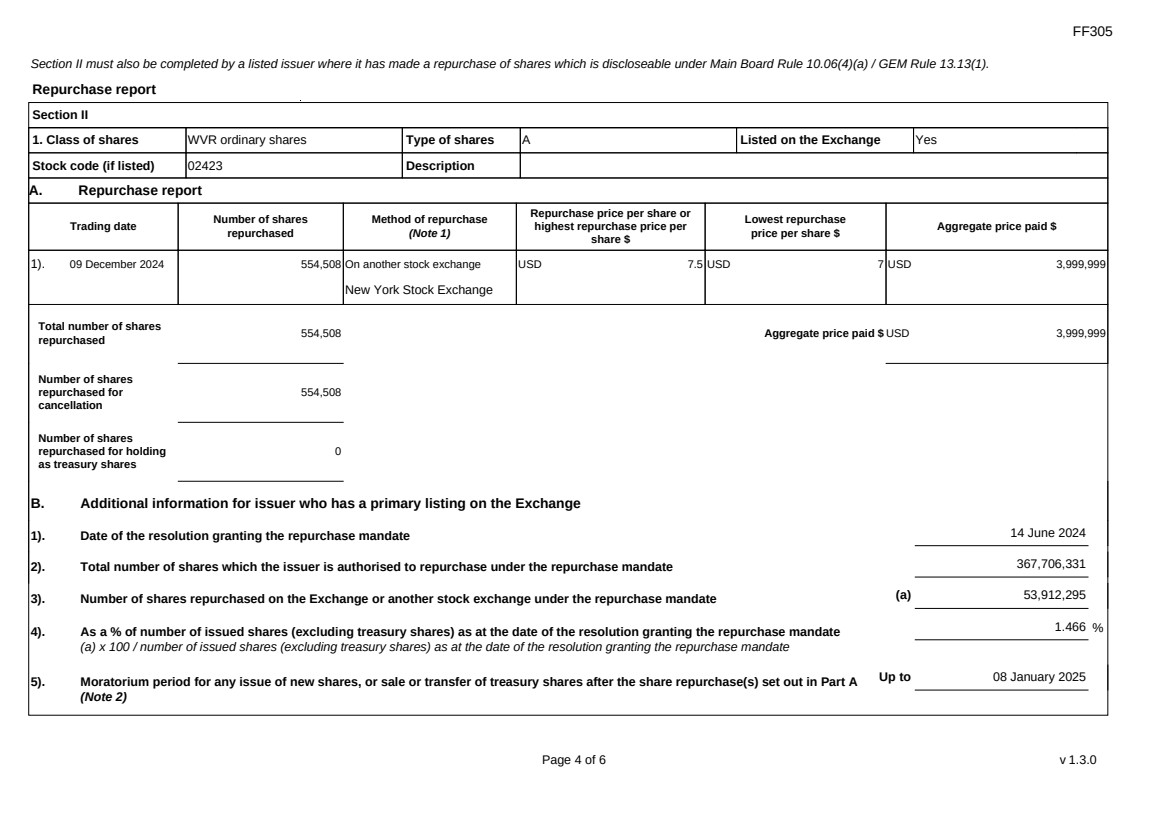

Page 3 of 6 v 1.3.0

Confirmation Not applicable

Notes to Section I:

1. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

2. Please set out all changes in issued shares or treasury shares requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of

changes. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For

example, multiple issues of shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note

must be aggregated and disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible

notes, these must be disclosed as 2 separate categories.

3. The percentage change in the number of issued shares (excluding treasury shares) of the listed issuer is to be calculated by reference to the opening balance of the number of issued

shares (excluding treasury shares) being disclosed in this Next Day Disclosure Return.

4. In the case of a share repurchase or redemption, the “issue/ selling price per share” shall be construed as “repurchase price per share” or “redemption price per share”.

Where shares have been issued/ sold/ repurchased/ redeemed at more than one price per share, a volume-weighted average price per share should be given.

5. The closing balance date is the date of the last relevant event being disclosed.

6. For repurchase or redemption of shares, disclosure is required when the relevant event has occurred (subject to the provisions of Main Board Rules 10.06(4)(a), 13.25A and 13.31 /

GEM Rules 13.13(1), 17.27A and 17.35), even if the repurchased or redeemed shares have not yet been cancelled.

If repurchased or redeemed shares are to be cancelled upon settlement of such repurchase or redemption after the closing balance date, they shall remain part of the issued shares as

at the closing balance date in Part A. Details of these repurchased or redeemed shares shall be disclosed in Part B.

7. Items (i) to (viii) are suggested forms of confirmation. The listed issuer may amend the item(s) that is/are not applicable to meet individual cases.

8. “Identical” means in this context:

- the securities are of the same nominal value with the same amount called up or paid up;

- they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

- they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

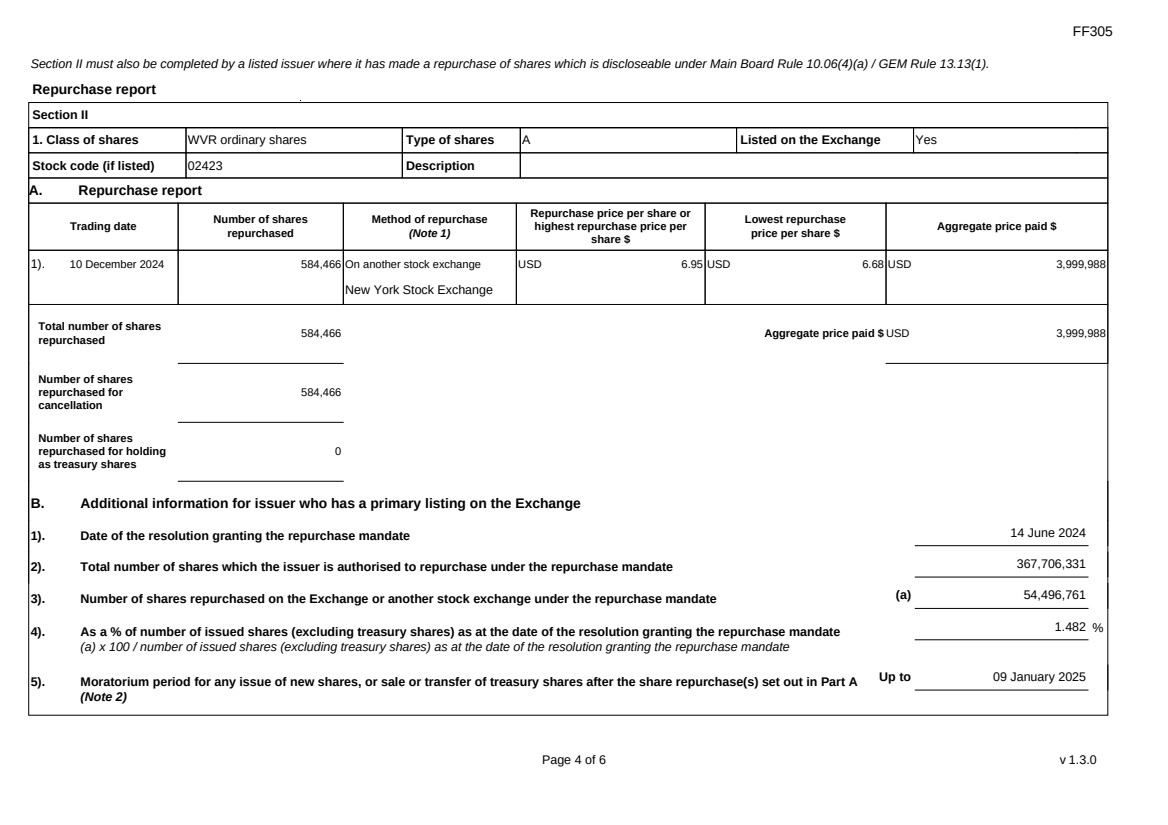

| FF305

Page 4 of 6 v 1.3.0

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

Repurchase report

Section II

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Repurchase report

Trading date Number of shares

repurchased

Method of repurchase

(Note 1)

Repurchase price per share or

highest repurchase price per

share $

Lowest repurchase

price per share $ Aggregate price paid $

1). 10 December 2024 584,466 On another stock exchange

New York Stock Exchange

USD 6.95 USD 6.68 USD 3,999,988

Total number of shares

repurchased 584,466 Aggregate price paid $ USD 3,999,988

Number of shares

repurchased for

cancellation

584,466

Number of shares

repurchased for holding

as treasury shares

0

B. Additional information for issuer who has a primary listing on the Exchange

1). Date of the resolution granting the repurchase mandate 14 June 2024

2). Total number of shares which the issuer is authorised to repurchase under the repurchase mandate 367,706,331

3). Number of shares repurchased on the Exchange or another stock exchange under the repurchase mandate (a) 54,496,761

4). As a % of number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

(a) x 100 / number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

1.482 %

5). Moratorium period for any issue of new shares, or sale or transfer of treasury shares after the share repurchase(s) set out in Part A

(Note 2)

Up to 09 January 2025 |

| FF305

Page 5 of 6 v 1.3.0

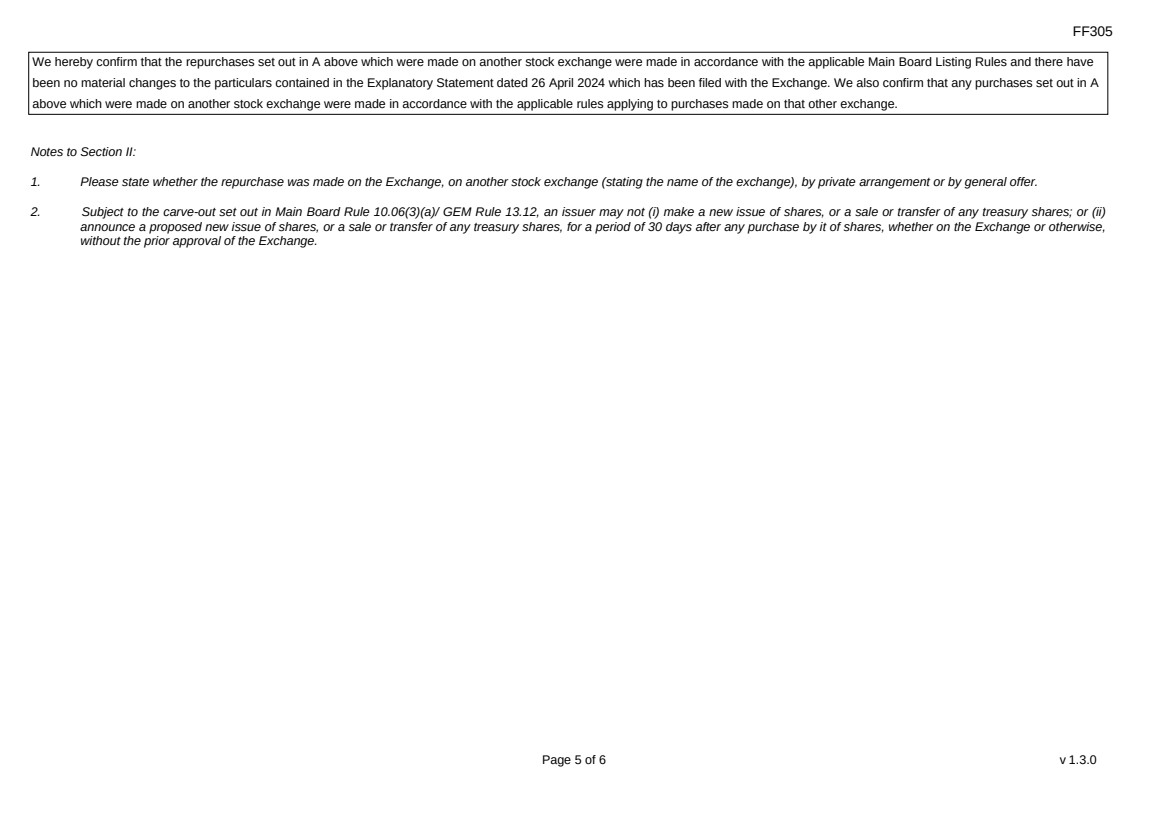

We hereby confirm that the repurchases set out in A above which were made on another stock exchange were made in accordance with the applicable Main Board Listing Rules and there have

been no material changes to the particulars contained in the Explanatory Statement dated 26 April 2024 which has been filed with the Exchange. We also confirm that any purchases set out in A

above which were made on another stock exchange were made in accordance with the applicable rules applying to purchases made on that other exchange.

Notes to Section II:

1. Please state whether the repurchase was made on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

2. Subject to the carve-out set out in Main Board Rule 10.06(3)(a)/ GEM Rule 13.12, an issuer may not (i) make a new issue of shares, or a sale or transfer of any treasury shares; or (ii)

announce a proposed new issue of shares, or a sale or transfer of any treasury shares, for a period of 30 days after any purchase by it of shares, whether on the Exchange or otherwise,

without the prior approval of the Exchange. |

| FF305

Page 6 of 6 v 1.3.0

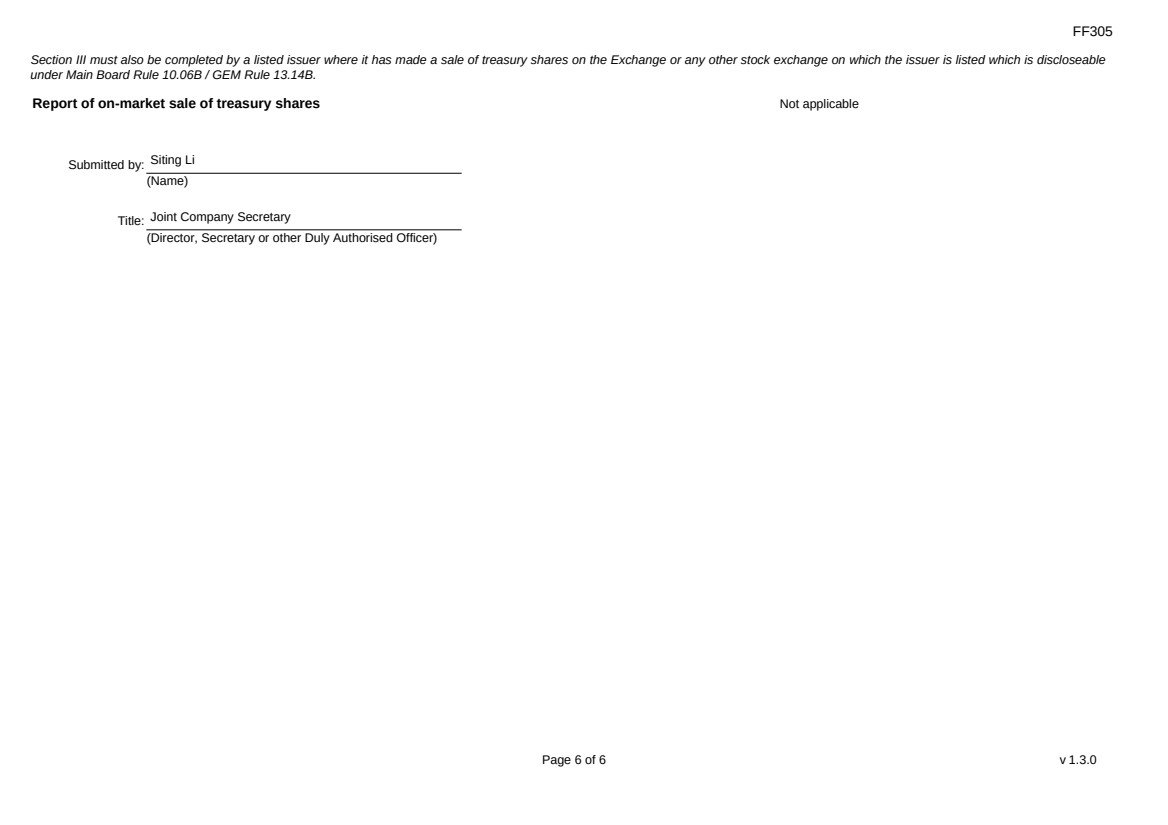

Section III must also be completed by a listed issuer where it has made a sale of treasury shares on the Exchange or any other stock exchange on which the issuer is listed which is discloseable

under Main Board Rule 10.06B / GEM Rule 13.14B.

Report of on-market sale of treasury shares Not applicable

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

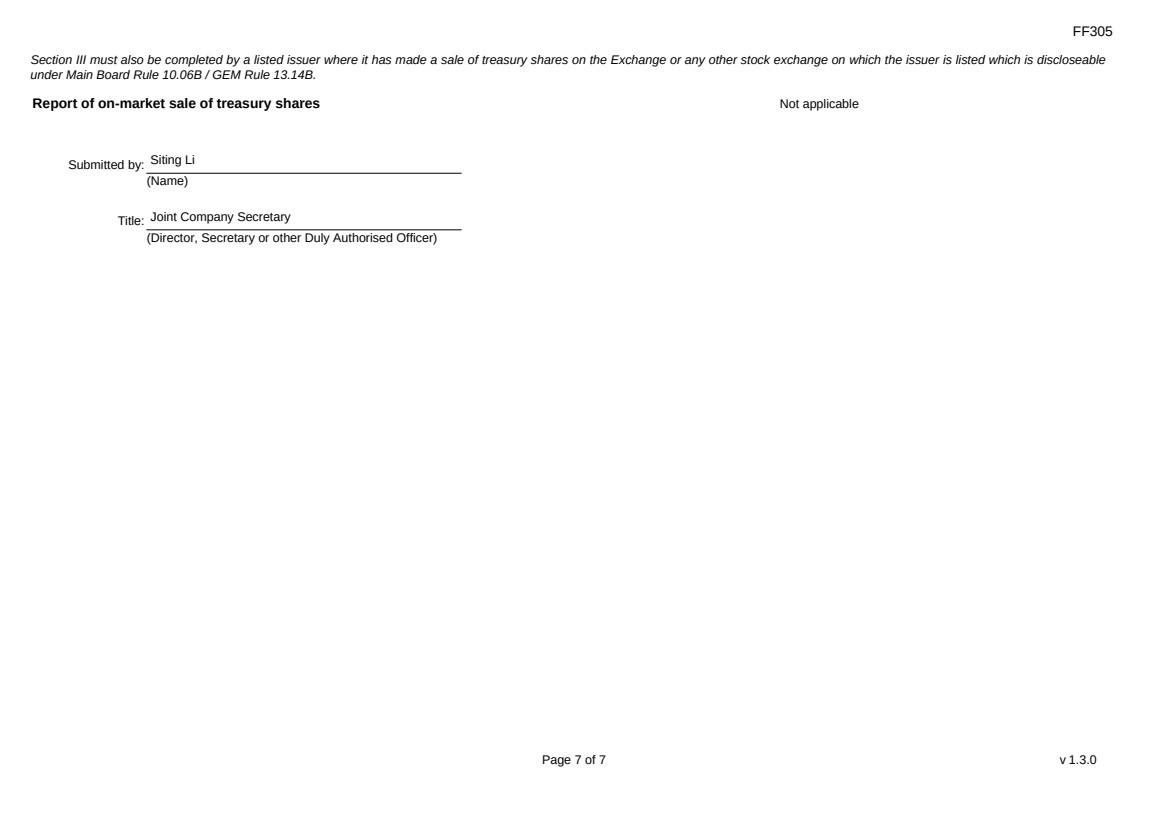

Exhibit 99.4

| FF305

Page 1 of 7 v 1.3.0

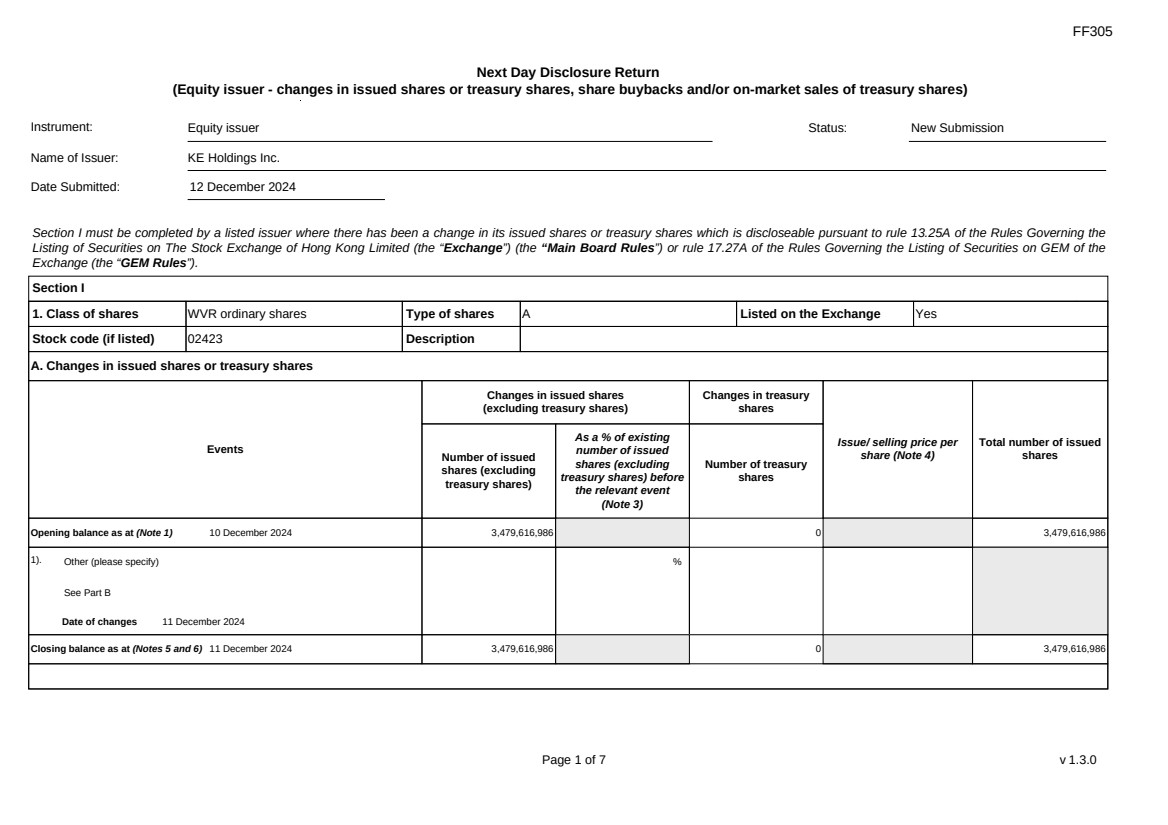

Next Day Disclosure Return

(Equity issuer - changes in issued shares or treasury shares, share buybacks and/or on-market sales of treasury shares)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holdings Inc.

Date Submitted: 12 December 2024

Section I must be completed by a listed issuer where there has been a change in its issued shares or treasury shares which is discloseable pursuant to rule 13.25A of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”) (the “Main Board Rules”) or rule 17.27A of the Rules Governing the Listing of Securities on GEM of the

Exchange (the “GEM Rules”).

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Changes in issued shares or treasury shares

Events

Changes in issued shares

(excluding treasury shares)

Number of issued

shares (excluding

treasury shares)

As a % of existing

number of issued

shares (excluding

treasury shares) before

the relevant event

(Note 3)

Changes in treasury

shares

Number of treasury

shares

Issue/ selling price per

share (Note 4)

Total number of issued

shares

Opening balance as at (Note 1) 10 December 2024 3,479,616,986 0 3,479,616,986

1). Other (please specify)

See Part B

Date of changes 11 December 2024

%

Closing balance as at (Notes 5 and 6) 11 December 2024 3,479,616,986 0 3,479,616,986

|

| FF305

Page 2 of 7 v 1.3.0

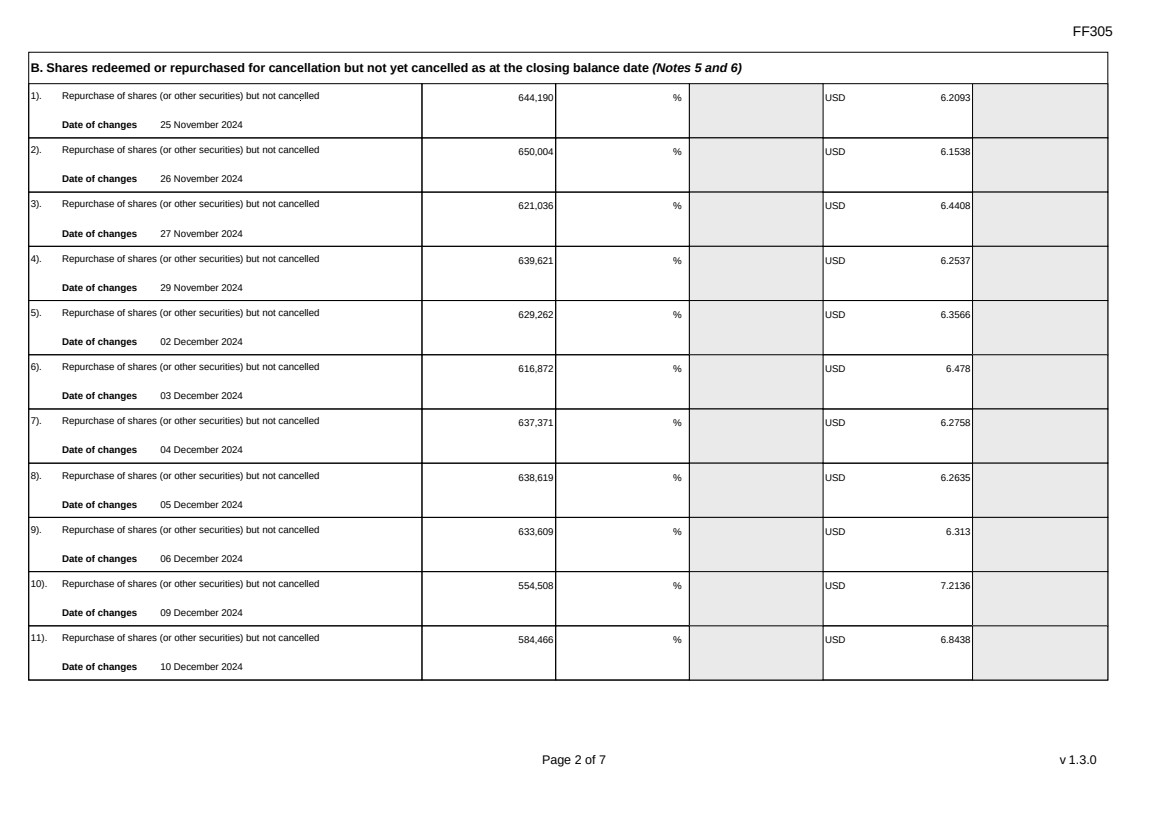

B. Shares redeemed or repurchased for cancellation but not yet cancelled as at the closing balance date (Notes 5 and 6)

1). Repurchase of shares (or other securities) but not cancelled

Date of changes 25 November 2024

644,190 % USD 6.2093

2). Repurchase of shares (or other securities) but not cancelled

Date of changes 26 November 2024

650,004 % USD 6.1538

3). Repurchase of shares (or other securities) but not cancelled

Date of changes 27 November 2024

621,036 % USD 6.4408

4). Repurchase of shares (or other securities) but not cancelled

Date of changes 29 November 2024

639,621 % USD 6.2537

5). Repurchase of shares (or other securities) but not cancelled

Date of changes 02 December 2024

629,262 % USD 6.3566

6). Repurchase of shares (or other securities) but not cancelled

Date of changes 03 December 2024

616,872 % USD 6.478

7). Repurchase of shares (or other securities) but not cancelled

Date of changes 04 December 2024

637,371 % USD 6.2758

8). Repurchase of shares (or other securities) but not cancelled

Date of changes 05 December 2024

638,619 % USD 6.2635

9). Repurchase of shares (or other securities) but not cancelled

Date of changes 06 December 2024

633,609 % USD 6.313

10). Repurchase of shares (or other securities) but not cancelled

Date of changes 09 December 2024

554,508 % USD 7.2136

11). Repurchase of shares (or other securities) but not cancelled

Date of changes 10 December 2024

584,466 % USD 6.8438 |

| FF305

Page 3 of 7 v 1.3.0

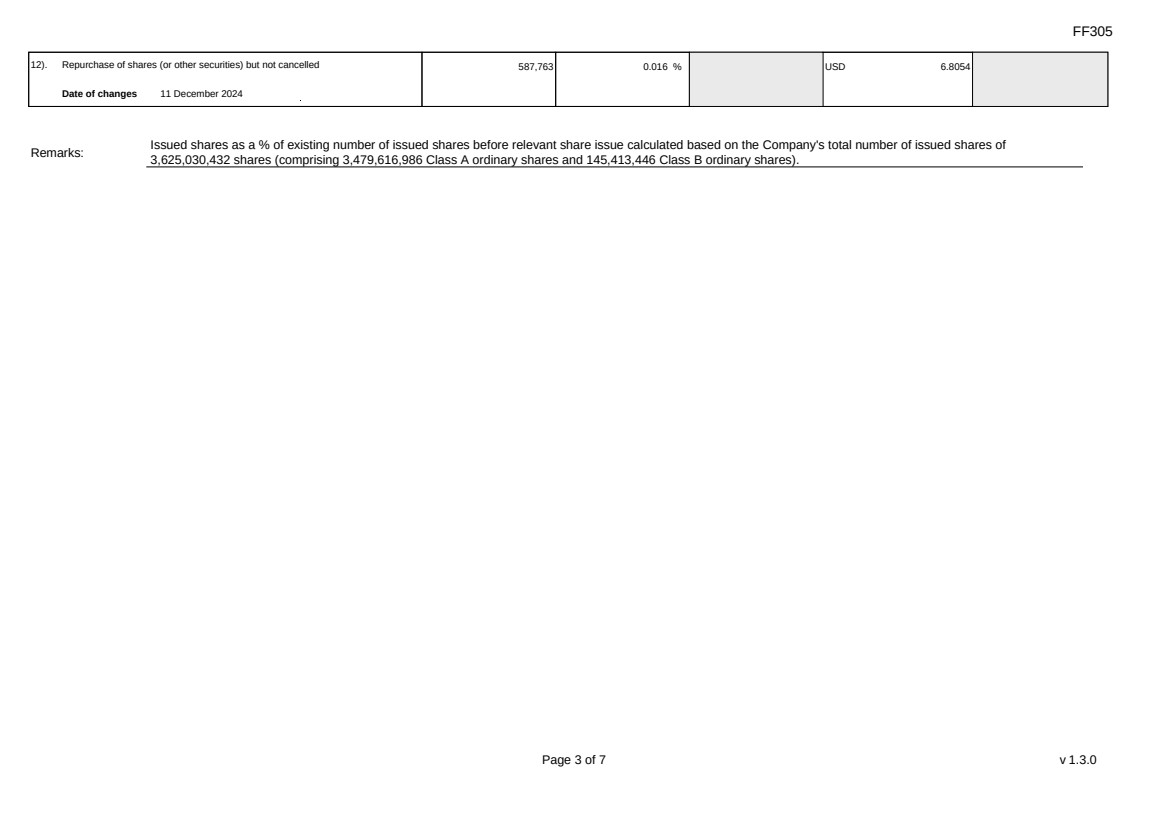

12). Repurchase of shares (or other securities) but not cancelled

Date of changes 11 December 2024

587,763 0.016 % USD 6.8054

Remarks: Issued shares as a % of existing number of issued shares before relevant share issue calculated based on the Company's total number of issued shares of

3,625,030,432 shares (comprising 3,479,616,986 Class A ordinary shares and 145,413,446 Class B ordinary shares). |

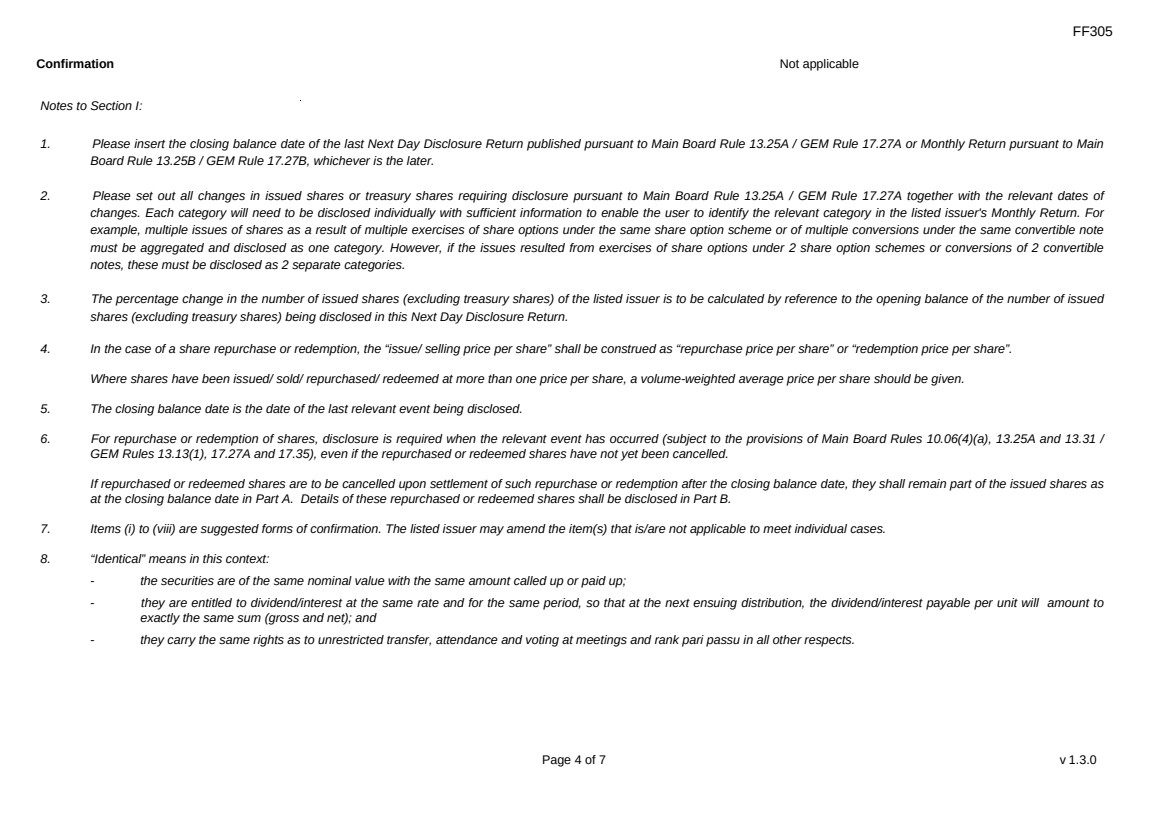

| FF305

Page 4 of 7 v 1.3.0

Confirmation Not applicable

Notes to Section I:

1. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

2. Please set out all changes in issued shares or treasury shares requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of

changes. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For

example, multiple issues of shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note

must be aggregated and disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible

notes, these must be disclosed as 2 separate categories.

3. The percentage change in the number of issued shares (excluding treasury shares) of the listed issuer is to be calculated by reference to the opening balance of the number of issued

shares (excluding treasury shares) being disclosed in this Next Day Disclosure Return.

4. In the case of a share repurchase or redemption, the “issue/ selling price per share” shall be construed as “repurchase price per share” or “redemption price per share”.

Where shares have been issued/ sold/ repurchased/ redeemed at more than one price per share, a volume-weighted average price per share should be given.

5. The closing balance date is the date of the last relevant event being disclosed.

6. For repurchase or redemption of shares, disclosure is required when the relevant event has occurred (subject to the provisions of Main Board Rules 10.06(4)(a), 13.25A and 13.31 /

GEM Rules 13.13(1), 17.27A and 17.35), even if the repurchased or redeemed shares have not yet been cancelled.

If repurchased or redeemed shares are to be cancelled upon settlement of such repurchase or redemption after the closing balance date, they shall remain part of the issued shares as

at the closing balance date in Part A. Details of these repurchased or redeemed shares shall be disclosed in Part B.

7. Items (i) to (viii) are suggested forms of confirmation. The listed issuer may amend the item(s) that is/are not applicable to meet individual cases.

8. “Identical” means in this context:

- the securities are of the same nominal value with the same amount called up or paid up;

- they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

- they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

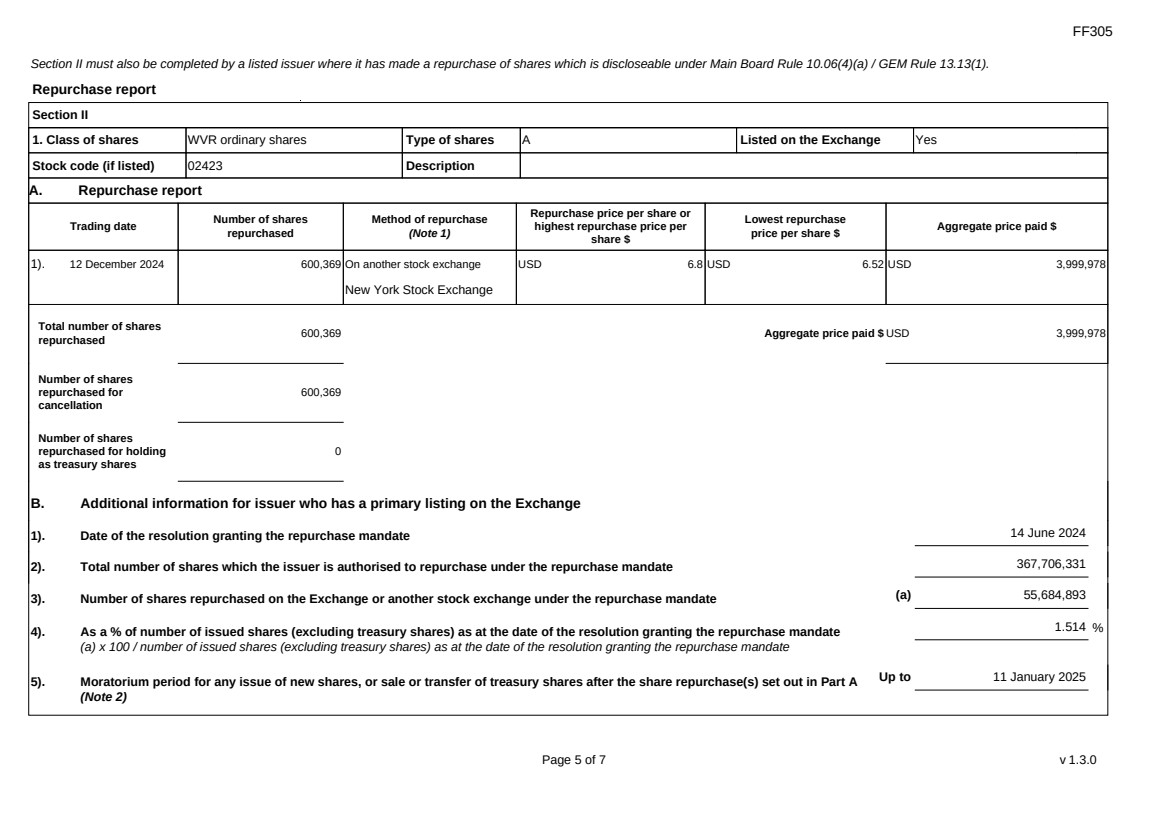

| FF305

Page 5 of 7 v 1.3.0

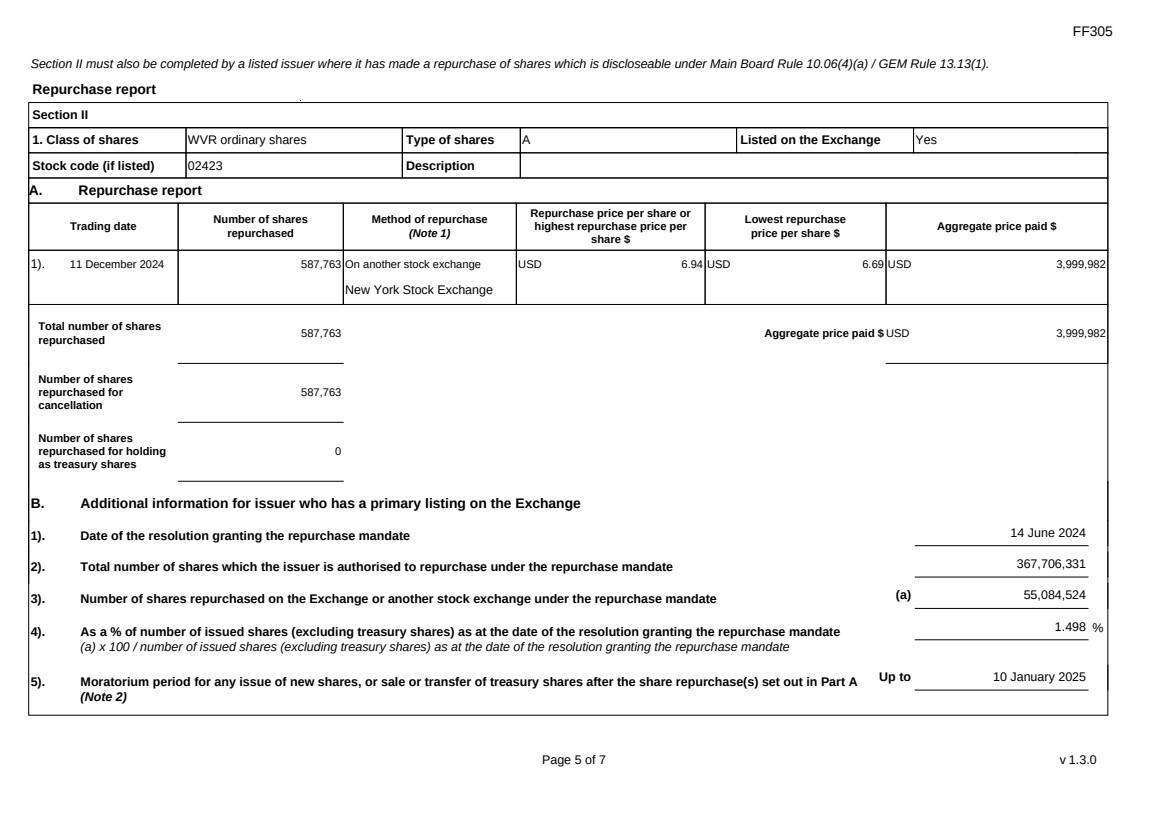

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

Repurchase report

Section II

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Repurchase report

Trading date Number of shares

repurchased

Method of repurchase

(Note 1)

Repurchase price per share or

highest repurchase price per

share $

Lowest repurchase

price per share $ Aggregate price paid $

1). 11 December 2024 587,763 On another stock exchange

New York Stock Exchange

USD 6.94 USD 6.69 USD 3,999,982

Total number of shares

repurchased 587,763 Aggregate price paid $ USD 3,999,982

Number of shares

repurchased for

cancellation

587,763

Number of shares

repurchased for holding

as treasury shares

0

B. Additional information for issuer who has a primary listing on the Exchange

1). Date of the resolution granting the repurchase mandate 14 June 2024

2). Total number of shares which the issuer is authorised to repurchase under the repurchase mandate 367,706,331

3). Number of shares repurchased on the Exchange or another stock exchange under the repurchase mandate (a) 55,084,524

4). As a % of number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

(a) x 100 / number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

1.498 %

5). Moratorium period for any issue of new shares, or sale or transfer of treasury shares after the share repurchase(s) set out in Part A

(Note 2)

Up to 10 January 2025 |

| FF305

Page 6 of 7 v 1.3.0

We hereby confirm that the repurchases set out in A above which were made on another stock exchange were made in accordance with the applicable Main Board Listing Rules and there have

been no material changes to the particulars contained in the Explanatory Statement dated 26 April 2024 which has been filed with the Exchange. We also confirm that any purchases set out in A

above which were made on another stock exchange were made in accordance with the applicable rules applying to purchases made on that other exchange.

Notes to Section II:

1. Please state whether the repurchase was made on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

2. Subject to the carve-out set out in Main Board Rule 10.06(3)(a)/ GEM Rule 13.12, an issuer may not (i) make a new issue of shares, or a sale or transfer of any treasury shares; or (ii)

announce a proposed new issue of shares, or a sale or transfer of any treasury shares, for a period of 30 days after any purchase by it of shares, whether on the Exchange or otherwise,

without the prior approval of the Exchange. |

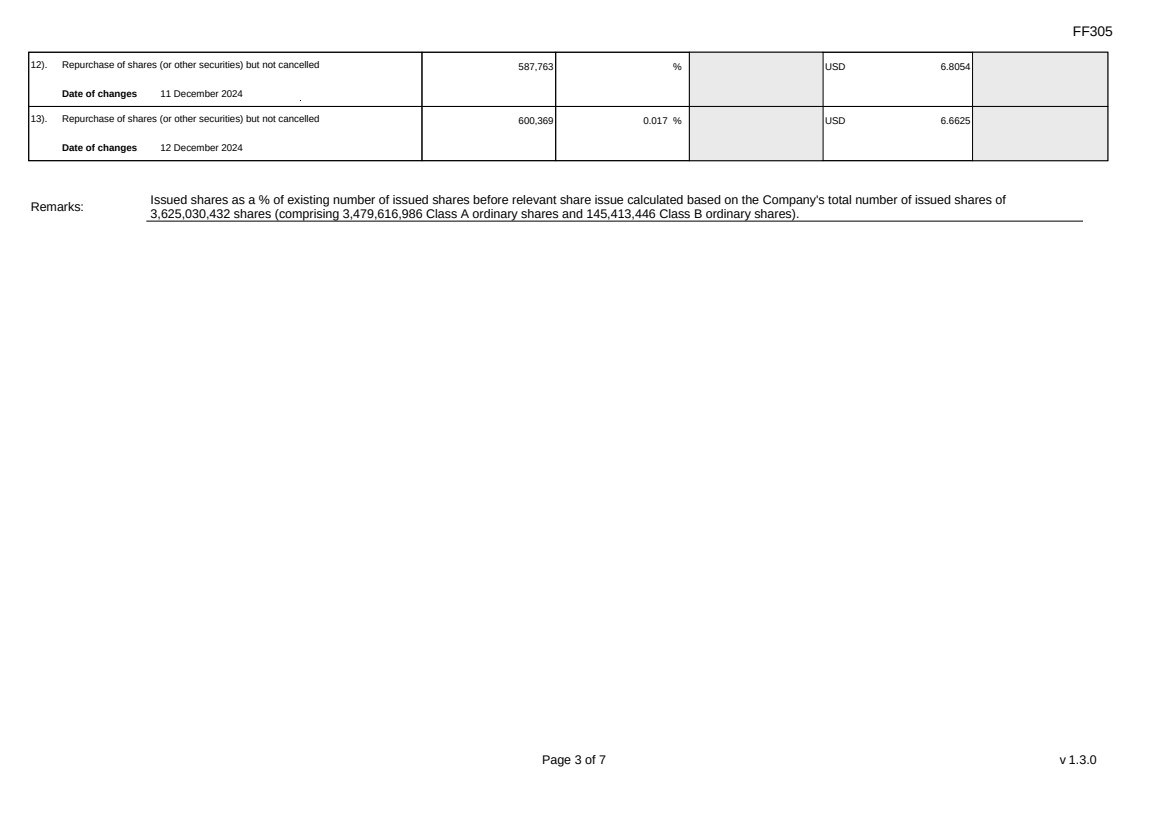

| FF305

Page 7 of 7 v 1.3.0

Section III must also be completed by a listed issuer where it has made a sale of treasury shares on the Exchange or any other stock exchange on which the issuer is listed which is discloseable

under Main Board Rule 10.06B / GEM Rule 13.14B.

Report of on-market sale of treasury shares Not applicable

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

Exhibit 99.5

| FF305

Page 1 of 7 v 1.3.0

Next Day Disclosure Return

(Equity issuer - changes in issued shares or treasury shares, share buybacks and/or on-market sales of treasury shares)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holdings Inc.

Date Submitted: 13 December 2024

Section I must be completed by a listed issuer where there has been a change in its issued shares or treasury shares which is discloseable pursuant to rule 13.25A of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”) (the “Main Board Rules”) or rule 17.27A of the Rules Governing the Listing of Securities on GEM of the

Exchange (the “GEM Rules”).

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Changes in issued shares or treasury shares

Events

Changes in issued shares

(excluding treasury shares)

Number of issued

shares (excluding

treasury shares)

As a % of existing

number of issued

shares (excluding

treasury shares) before

the relevant event

(Note 3)

Changes in treasury

shares

Number of treasury

shares

Issue/ selling price per

share (Note 4)

Total number of issued

shares

Opening balance as at (Note 1) 11 December 2024 3,479,616,986 0 3,479,616,986

1). Other (please specify)

See Part B

Date of changes 12 December 2024

%

Closing balance as at (Notes 5 and 6) 12 December 2024 3,479,616,986 0 3,479,616,986

|

| FF305

Page 2 of 7 v 1.3.0

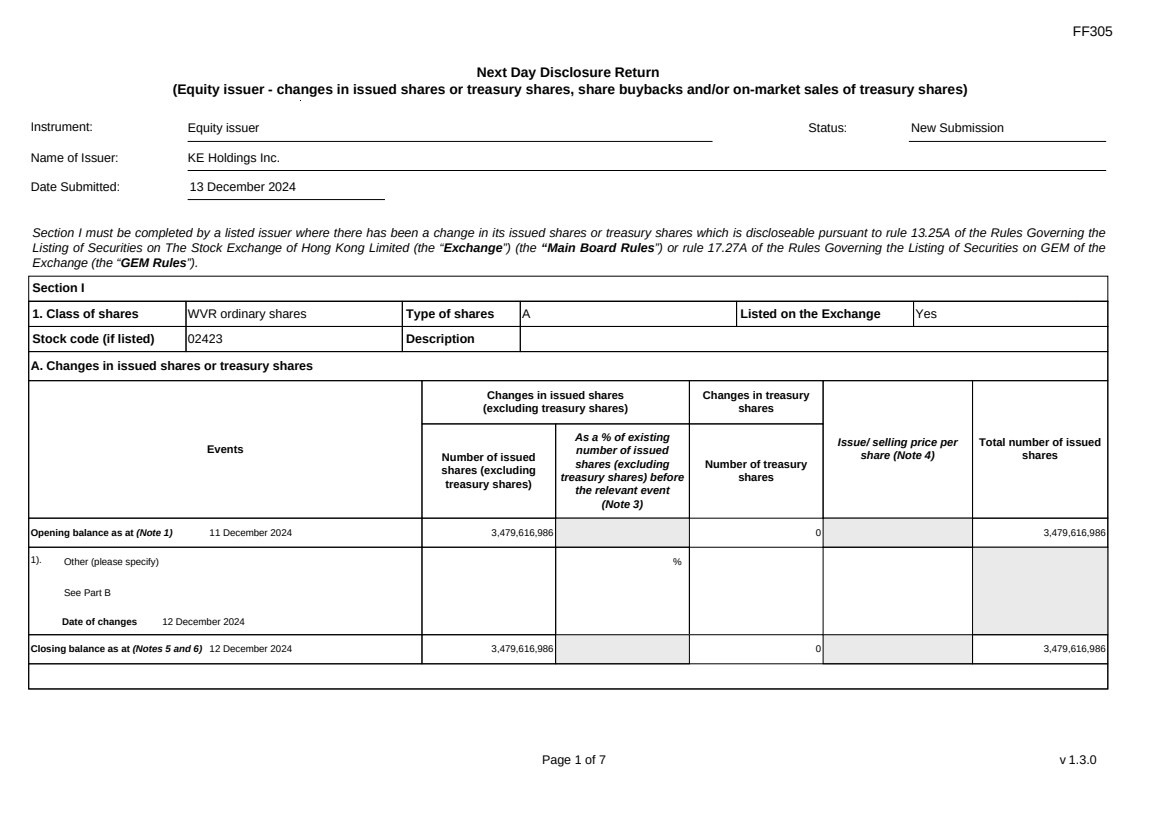

B. Shares redeemed or repurchased for cancellation but not yet cancelled as at the closing balance date (Notes 5 and 6)

1). Repurchase of shares (or other securities) but not cancelled

Date of changes 25 November 2024

644,190 % USD 6.2093

2). Repurchase of shares (or other securities) but not cancelled

Date of changes 26 November 2024

650,004 % USD 6.1538

3). Repurchase of shares (or other securities) but not cancelled

Date of changes 27 November 2024

621,036 % USD 6.4408

4). Repurchase of shares (or other securities) but not cancelled

Date of changes 29 November 2024

639,621 % USD 6.2537

5). Repurchase of shares (or other securities) but not cancelled

Date of changes 02 December 2024

629,262 % USD 6.3566

6). Repurchase of shares (or other securities) but not cancelled

Date of changes 03 December 2024

616,872 % USD 6.478

7). Repurchase of shares (or other securities) but not cancelled

Date of changes 04 December 2024

637,371 % USD 6.2758

8). Repurchase of shares (or other securities) but not cancelled

Date of changes 05 December 2024

638,619 % USD 6.2635

9). Repurchase of shares (or other securities) but not cancelled

Date of changes 06 December 2024

633,609 % USD 6.313

10). Repurchase of shares (or other securities) but not cancelled

Date of changes 09 December 2024

554,508 % USD 7.2136

11). Repurchase of shares (or other securities) but not cancelled

Date of changes 10 December 2024

584,466 % USD 6.8438 |

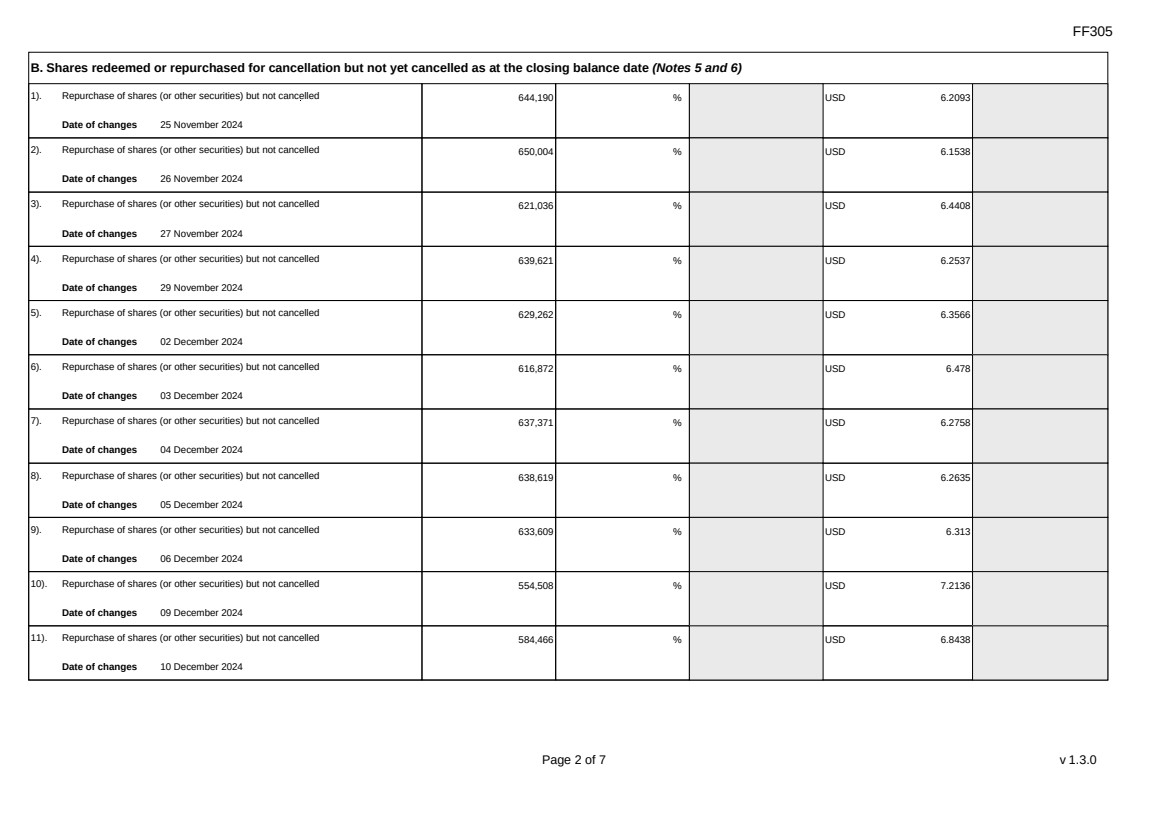

| FF305

Page 3 of 7 v 1.3.0

12). Repurchase of shares (or other securities) but not cancelled

Date of changes 11 December 2024

587,763 % USD 6.8054

13). Repurchase of shares (or other securities) but not cancelled

Date of changes 12 December 2024

600,369 0.017 % USD 6.6625

Remarks: Issued shares as a % of existing number of issued shares before relevant share issue calculated based on the Company's total number of issued shares of

3,625,030,432 shares (comprising 3,479,616,986 Class A ordinary shares and 145,413,446 Class B ordinary shares). |

| FF305

Page 4 of 7 v 1.3.0

Confirmation Not applicable

Notes to Section I:

1. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

2. Please set out all changes in issued shares or treasury shares requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of

changes. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For

example, multiple issues of shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note

must be aggregated and disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible

notes, these must be disclosed as 2 separate categories.

3. The percentage change in the number of issued shares (excluding treasury shares) of the listed issuer is to be calculated by reference to the opening balance of the number of issued

shares (excluding treasury shares) being disclosed in this Next Day Disclosure Return.

4. In the case of a share repurchase or redemption, the “issue/ selling price per share” shall be construed as “repurchase price per share” or “redemption price per share”.

Where shares have been issued/ sold/ repurchased/ redeemed at more than one price per share, a volume-weighted average price per share should be given.

5. The closing balance date is the date of the last relevant event being disclosed.

6. For repurchase or redemption of shares, disclosure is required when the relevant event has occurred (subject to the provisions of Main Board Rules 10.06(4)(a), 13.25A and 13.31 /

GEM Rules 13.13(1), 17.27A and 17.35), even if the repurchased or redeemed shares have not yet been cancelled.

If repurchased or redeemed shares are to be cancelled upon settlement of such repurchase or redemption after the closing balance date, they shall remain part of the issued shares as

at the closing balance date in Part A. Details of these repurchased or redeemed shares shall be disclosed in Part B.

7. Items (i) to (viii) are suggested forms of confirmation. The listed issuer may amend the item(s) that is/are not applicable to meet individual cases.

8. “Identical” means in this context:

- the securities are of the same nominal value with the same amount called up or paid up;

- they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

- they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF305

Page 5 of 7 v 1.3.0

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

Repurchase report

Section II

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Repurchase report

Trading date Number of shares

repurchased

Method of repurchase

(Note 1)

Repurchase price per share or

highest repurchase price per

share $

Lowest repurchase

price per share $ Aggregate price paid $

1). 12 December 2024 600,369 On another stock exchange

New York Stock Exchange

USD 6.8 USD 6.52 USD 3,999,978

Total number of shares

repurchased 600,369 Aggregate price paid $ USD 3,999,978

Number of shares

repurchased for

cancellation

600,369

Number of shares

repurchased for holding

as treasury shares

0

B. Additional information for issuer who has a primary listing on the Exchange

1). Date of the resolution granting the repurchase mandate 14 June 2024

2). Total number of shares which the issuer is authorised to repurchase under the repurchase mandate 367,706,331

3). Number of shares repurchased on the Exchange or another stock exchange under the repurchase mandate (a) 55,684,893

4). As a % of number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

(a) x 100 / number of issued shares (excluding treasury shares) as at the date of the resolution granting the repurchase mandate

1.514 %

5). Moratorium period for any issue of new shares, or sale or transfer of treasury shares after the share repurchase(s) set out in Part A

(Note 2)

Up to 11 January 2025 |

| FF305

Page 6 of 7 v 1.3.0

We hereby confirm that the repurchases set out in A above which were made on another stock exchange were made in accordance with the applicable Main Board Listing Rules and there have

been no material changes to the particulars contained in the Explanatory Statement dated 26 April 2024 which has been filed with the Exchange. We also confirm that any purchases set out in A

above which were made on another stock exchange were made in accordance with the applicable rules applying to purchases made on that other exchange.

Notes to Section II:

1. Please state whether the repurchase was made on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

2. Subject to the carve-out set out in Main Board Rule 10.06(3)(a)/ GEM Rule 13.12, an issuer may not (i) make a new issue of shares, or a sale or transfer of any treasury shares; or (ii)

announce a proposed new issue of shares, or a sale or transfer of any treasury shares, for a period of 30 days after any purchase by it of shares, whether on the Exchange or otherwise,

without the prior approval of the Exchange. |

| FF305

Page 7 of 7 v 1.3.0

Section III must also be completed by a listed issuer where it has made a sale of treasury shares on the Exchange or any other stock exchange on which the issuer is listed which is discloseable

under Main Board Rule 10.06B / GEM Rule 13.14B.

Report of on-market sale of treasury shares Not applicable

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

KE (NYSE:BEKE)

Historical Stock Chart

From Nov 2024 to Dec 2024

KE (NYSE:BEKE)

Historical Stock Chart

From Dec 2023 to Dec 2024