false000163156900016315692023-10-312023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 31, 2023

COMMUNITY HEALTHCARE TRUST INCORPORATED

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-37401 | | 46-5212033 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

3326 Aspen Grove Drive, Suite 150, Franklin, Tennessee 37067

| | |

| (Address of principal executive offices) (Zip Code) |

(615) 771-3052

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each Class | Trading Symbol | Name of each exchange on which registered | |

| Common stock, $0.01 par value per share | CHCT | New York Stock Exchange | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 31, 2023, Community Healthcare Trust Incorporated (the "Company") issued a press release announcing its earnings for the third quarter ended September 30, 2023. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference in its entirety.

This information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act.

Item 7.01 Regulation FD Disclosure

The Company is furnishing its Supplemental Information for the third quarter ended September 30, 2023, which is also contained on its website (www.chct.reit). See Exhibit 99.2 to this Current Report on Form 8-K.

The Company has prepared an investor presentation for the third quarter ended September 30, 2023 that is expected to be used in meetings with current and potential investors. A copy of this presentation is available on the Company's website (www.chct.reit).

This information furnished pursuant to this Item 7.01, including Exhibit 99.2, shall not be deemed "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act.

Item 9.01 Financial Statements and Exhibits

The exhibits required by Item 601 of Regulation S-K which are filed with this report are listed in the Exhibit Index and are hereby incorporated in by reference.

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

|

| | |

| | COMMUNITY HEALTHCARE TRUST INCORPORATED |

| | |

| By: | /s/ William G. Monroe IV |

| | William G. Monroe IV |

| | Executive Vice President and Chief Financial Officer |

| October 31, 2023 | | |

Exhibit 99.1

News Release

Community Healthcare Trust Announces Results for the Three Months Ended September 30, 2023

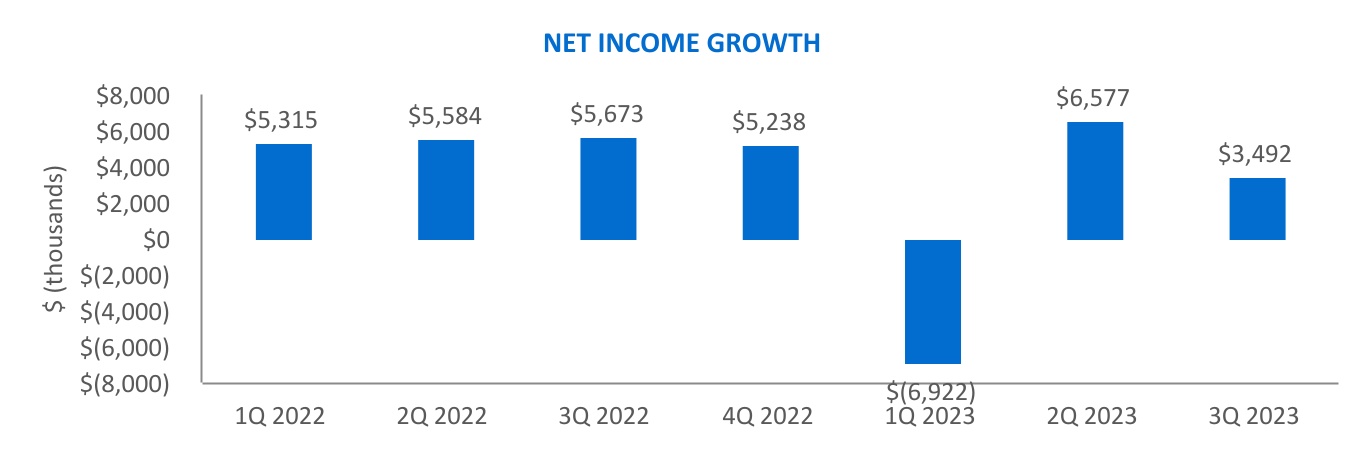

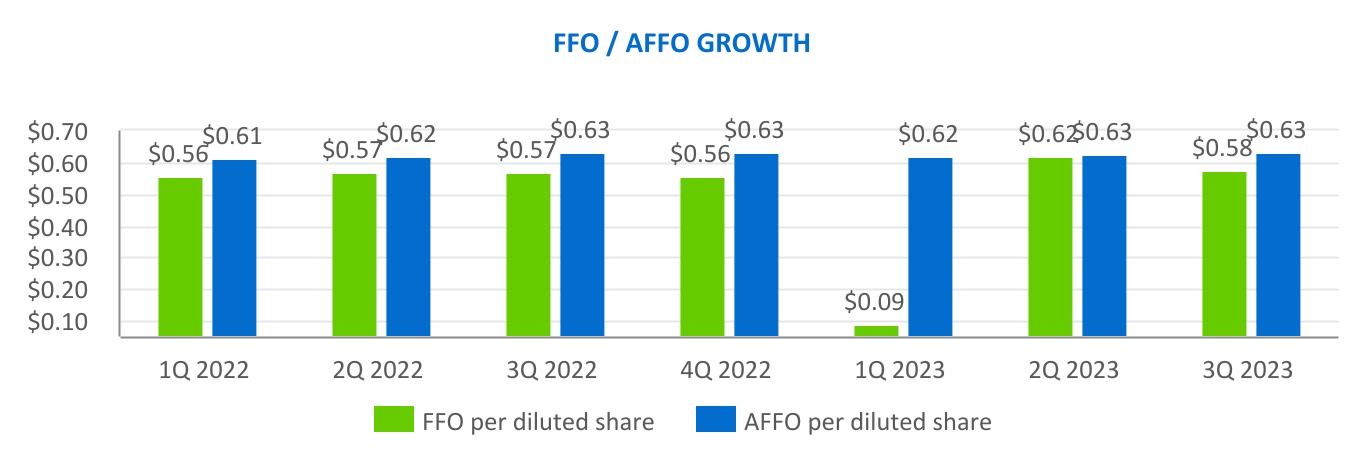

FRANKLIN, Tenn., October 31, 2023 / PRNewswire / -- Community Healthcare Trust Incorporated (NYSE: CHCT) (the "Company") today announced results for the three months ended September 30, 2023. The Company reported net income for the three months ended September 30, 2023 of approximately $3.5 million, or $0.11 per diluted common share. Funds from operations ("FFO") and adjusted funds from operations ("AFFO") for the three months ended September 30, 2023 totaled $0.58 and $0.63, respectively, per diluted common share.

Items Impacting Our Results include:

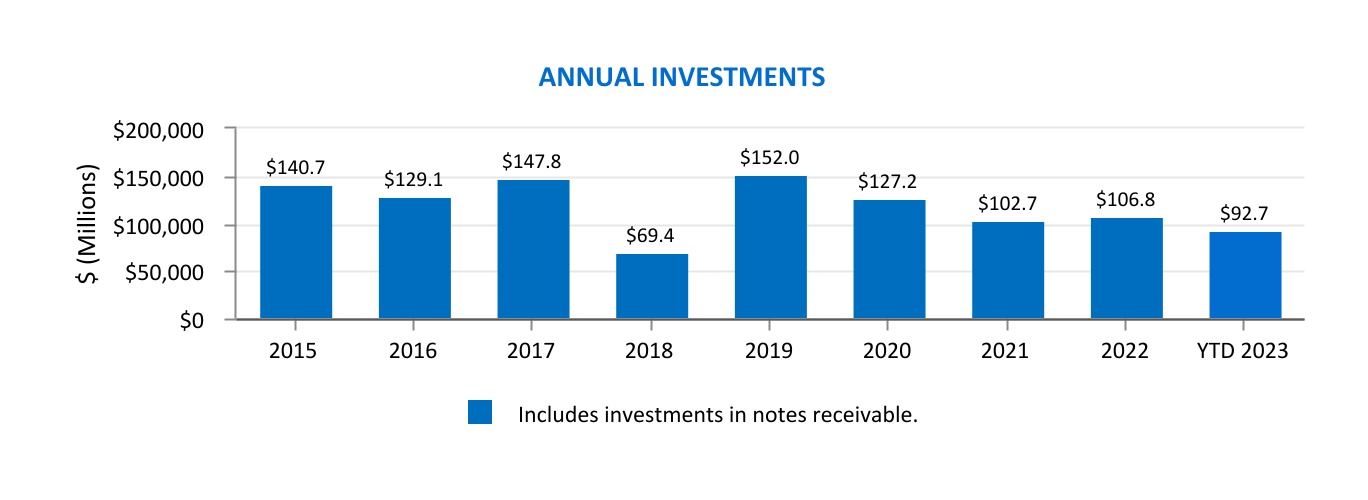

•During the three months ended September 30, 2023, the Company acquired seven real estate properties for an aggregate purchase price of approximately $51.7 million. Upon acquisition, the properties totaling approximately 177,000 square feet, were 99.8% leased in the aggregate with lease expirations through 2038.

•Subsequent to September 30, 2023, the Company acquired two medical office buildings in a single transaction for an aggregate purchase price and cash consideration of approximately $7.1 million. Upon acquisition, the properties were 96.8% leased in the aggregate with lease expirations through 2031. The acquisitions were funded with proceeds from the Company's Revolving Credit Facility.

•The Company has seven properties under definitive purchase agreements, to be acquired after completion and occupancy, for an aggregate expected purchase price of approximately $166.5 million. The Company's expected returns on these investments are approximately 9.1% to 9.75%. The Company anticipates closing on these properties throughout 2024 and 2025; however, the Company cannot provide assurance as to the timing of when, or whether, these transactions will actually close.

•During the third quarter of 2023, the Company issued, through its at-the-market offering program, 552,000 shares of common stock at an average gross sales price of $32.93 per share for net proceeds of approximately $17.8 million at an approximate 5.61% current equity yield.

•On October 26, 2023, the Company’s Board of Directors declared a quarterly common stock dividend in the amount of $0.455 per share. The dividend is payable on November 24, 2023 to stockholders of record on November 9, 2023.

About Community Healthcare Trust Incorporated

Community Healthcare Trust Incorporated is a real estate investment trust that focuses on owning income-producing real estate properties associated primarily with the delivery of outpatient healthcare services in our target sub-markets throughout the United States. As of September 30, 2023, the Company had investments of approximately $1.05 billion in 191 real estate properties (including a portion of one property accounted for as a sales-type lease and one property classified as held for sale). The properties are located in 34 states, totaling approximately 4.2 million square feet in the aggregate.

Additional information regarding the Company, including this quarter's operations, can be found at www.chct.reit. Please contact the Company at 615-771-3052 to request a printed copy of this information.

Cautionary Note Regarding Forward-Looking Statements

In addition to the historical information contained within, the matters discussed in this press release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “believes”, “expects”, “may”, “will,” “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, “anticipates” or other similar words or expressions, including the negative thereof. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections or other forward-looking information. Such forward-looking statements reflect management’s current beliefs and are based on information currently available to management. Because forward-looking statements relate to future events, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the control of Community Healthcare Trust Incorporated (the "Company"). Thus, the Company’s actual results and financial condition may differ materially from those indicated in such forward-looking statements. Some factors that might cause such a difference include the following: general volatility of the capital markets and the market price of the Company’s common stock, changes in the Company’s business strategy, availability, terms and deployment of capital, the Company’s ability to refinance existing indebtedness at or prior to maturity on favorable terms, or at all, changes in the real estate industry in general, interest rates or the general economy, adverse developments related to the healthcare industry, changes in governmental regulations, the degree and nature of the Company’s competition, the ability to consummate acquisitions under contract, catastrophic or extreme weather and other natural events and the physical effects of climate change, the occurrence of cyber incidents, effects on global and national markets as well as businesses resulting from increased inflation, rising interest rates, supply chain disruptions, labor conditions, the conflict between Russia and Ukraine, and/or new and ongoing hostilities between Israel and Hamas, and the other factors described in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and the Company’s other filings with the Securities and Exchange Commission from time to time. Readers are therefore cautioned not to place undue reliance on the forward-looking statements contained herein which speak only as of the date hereof. The Company intends these forward-looking statements to speak only as of the time of this press release and undertakes no obligation to update forward-looking statements, whether as a result of new information, future developments, or otherwise, except as may be required by law.

COMMUNITY HEALTHCARE TRUST INCORPORATED

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars and shares in thousands, except per share amounts)

| | | | | | | | | | | | | |

| (Unaudited) | | | | |

| September 30, 2023 | | December 31, 2022 | | |

| | | | | |

ASSETS | | | | | |

Real estate properties: | | | | | |

Land and land improvements | $ | 135,809 | | | $ | 117,657 | | | |

Buildings, improvements, and lease intangibles | 908,788 | | | 825,257 | | | |

Personal property | 296 | | | 253 | | | |

Total real estate properties | 1,044,893 | | | 943,167 | | | |

Less accumulated depreciation | (192,962) | | | (165,341) | | | |

Total real estate properties, net | 851,931 | | | 777,826 | | | |

Cash and cash equivalents | 3,885 | | | 11,233 | | | |

Restricted cash | 1,048 | | | 835 | | | |

| | | | | |

| | | | | |

Other assets, net | 98,262 | | | 86,531 | | | |

Total assets | $ | 955,126 | | | $ | 876,425 | | | |

| | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

Liabilities | | | | | |

Debt, net | $ | 401,192 | | | $ | 352,997 | | | |

Accounts payable and accrued liabilities | 15,446 | | | 11,377 | | | |

| | | | | |

Other liabilities, net | 16,194 | | | 15,237 | | | |

Total liabilities | 432,832 | | | 379,611 | | | |

| | | | | |

Commitments and contingencies | | | | | |

| | | | | |

Stockholders' Equity | | | | | |

Preferred stock, $0.01 par value; 50,000 shares authorized; none issued and outstanding | — | | | — | | | |

Common stock, $0.01 par value; 450,000 shares authorized; 27,265 and 25,897 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 273 | | | 259 | | | |

Additional paid-in capital | 676,716 | | | 625,136 | | | |

Cumulative net income | 84,289 | | | 81,142 | | | |

Accumulated other comprehensive gain | 29,038 | | | 22,667 | | | |

Cumulative dividends | (268,022) | | | (232,390) | | | |

Total stockholders’ equity | 522,294 | | | 496,814 | | | |

Total liabilities and stockholders' equity | $ | 955,126 | | | $ | 876,425 | | | |

| | |

| The Consolidated Balance Sheets do not include all of the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements. |

COMMUNITY HEALTHCARE TRUST INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

(Unaudited; Dollars and shares in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | |

REVENUES | | | | | | | |

Rental income | $ | 27,690 | | | $ | 23,919 | | | $ | 80,582 | | | $ | 69,720 | |

| | | | | | | |

| | | | | | | |

Other operating interest | 1,045 | | | 888 | | | 3,139 | | | 2,617 | |

| 28,735 | | | 24,807 | | | 83,721 | | | 72,337 | |

| | | | | | | |

EXPENSES | | | | | | | |

Property operating | 5,456 | | | 4,327 | | | 15,115 | | | 12,480 | |

General and administrative (1) | 3,618 | | | 3,762 | | | 23,610 | | | 10,688 | |

Depreciation and amortization | 11,208 | | | 8,003 | | | 29,445 | | | 24,022 | |

| | | | | | | |

| 20,282 | | | 16,092 | | | 68,170 | | | 47,190 | |

| | | | | | | |

INCOME BEFORE INCOME TAXES AND OTHER ITEMS | 8,453 | | | 8,715 | | | 15,551 | | | 25,147 | |

Impairment of real estate asset | (102) | | | — | | | (102) | | | — | |

Interest expense | (4,641) | | | (3,028) | | | (12,773) | | | (8,409) | |

| | | | | | | |

Deferred income tax expense | (221) | | | (21) | | | (306) | | | (20) | |

Interest and other income | 3 | | | 7 | | | 777 | | | 63 | |

| | | | | | | |

NET INCOME | $ | 3,492 | | | $ | 5,673 | | | $ | 3,147 | | | $ | 16,781 | |

| | | | | | | |

NET INCOME PER COMMON SHARE (1): | | | | | | | |

Net income per common share – Basic | $ | 0.11 | | | $ | 0.21 | | | $ | 0.05 | | | $ | 0.62 | |

Net income per common share – Diluted | $ | 0.11 | | | $ | 0.21 | | | $ | 0.05 | | | $ | 0.62 | |

WEIGHTED AVERAGE COMMON SHARE OUTSTANDING-BASIC | 25,514 | | | 23,587 | | | 24,940 | | | 23,578 | |

WEIGHTED AVERAGE COMMON SHARE OUTSTANDING-DILUTED | 25,514 | | | 23,587 | | | 24,940 | | | 23,578 | |

| ___________ | | | | | | |

(1) General and administrative expenses for the nine months ended September 30, 2023 included stock-based compensation expense totaling approximately $17.9 million, including the accelerated amortization of stock-based compensation totaling approximately $11.8 million, or $0.47 per diluted common share, recognized upon the passing of our former CEO and President during the first quarter of 2023. General and administrative expenses for the nine months ended September 30, 2022 included stock-based compensation expense totaling approximately $6.8 million. |

| | |

| The Condensed Consolidated Statements of Income do not include all of the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements. |

COMMUNITY HEALTHCARE TRUST INCORPORATED

RECONCILIATION OF FFO and AFFO (1)

(Unaudited; Dollars and shares in thousands, except per share amounts)

| | | | | | | | | | | |

| Three Months Ended September 30, |

| 2023 | | 2022 |

| Net income | $ | 3,492 | | | $ | 5,673 | |

| Real estate depreciation and amortization | 11,375 | | | 8,078 | |

| | | |

| | | |

| Impairment of real estate asset | 102 | | | — | |

| Total adjustments | 11,477 | | | 8,078 | |

| FFO | $ | 14,969 | | | $ | 13,751 | |

| | | |

| Straight-line rent | (444) | | | (853) | |

| Stock-based compensation | 1,898 | | | 2,464 | |

| | | |

| | | |

| AFFO | $ | 16,423 | | | $ | 15,362 | |

FFO per Common Share-Diluted | $ | 0.58 | | | $ | 0.57 | |

| AFFO per Common Share-Diluted | $ | 0.63 | | | $ | 0.63 | |

Weighted Average Common Shares Outstanding-Diluted (2) | 26,025 | | | 24,312 | |

| | | | | |

| (1) | | Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. However, since real estate values have historically risen or fallen with market conditions, many industry investors deem presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. For that reason, the Company considers funds from operations ("FFO") and adjusted funds from operations ("AFFO") to be appropriate measures of operating performance of an equity real estate investment trust ("REIT"). In particular, the Company believes that AFFO is useful because it allows investors, analysts and Company management to compare the Company's operating performance to the operating performance of other real estate companies and between periods on a consistent basis without having to account for differences caused by unanticipated items and other events.

The Company uses the National Association of Real Estate Investment Trusts, Inc. ("NAREIT") definition of FFO. FFO is an operating performance measure adopted by NAREIT. NAREIT defines FFO as the most commonly accepted and reported measure of a REIT’s operating performance equal to net income (calculated in accordance with GAAP), excluding gains or losses from the sale of certain real estate assets, gains and losses from change in control, impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity, plus depreciation and amortization related to real estate properties, and after adjustments for unconsolidated partnerships and joint ventures. NAREIT also provides REITs with an option to exclude gains, losses and impairments of assets that are incidental to the main business of the REIT from the calculation of FFO.

In addition to FFO, the Company presents AFFO and AFFO per share. The Company defines AFFO as FFO, excluding certain expenses related to closing costs of properties acquired accounted for as business combinations and mortgages funded, excluding straight-line rent and the amortization of stock-based compensation, and including or excluding other non-cash items from time to time. AFFO presented herein may not be comparable to similar measures presented by other real estate companies due to the fact that not all real estate companies use the same definition.

FFO and AFFO should not be considered as alternatives to net income (determined in accordance with GAAP) as indicators of the Company's financial performance or as alternatives to cash flow from operating activities (determined in accordance with GAAP) as measures of the Company’s liquidity, nor are they necessarily indicative of sufficient cash flow to fund all of the Company’s needs. The Company believes that in order to facilitate a clear understanding of the consolidated historical operating results of the Company, FFO and AFFO should be examined in conjunction with net income as presented elsewhere herein. |

| (2) | | Diluted weighted average common shares outstanding for FFO and AFFO are calculated based on the treasury method, rather than the 2-class method used to calculate earnings per share. |

CONTACT: Bill Monroe, 615-771-3052

SOURCE: Community Healthcare Trust Incorporated

| | |

SUPPLEMENTAL INFORMATION Q3 2023 |

| | | | | | | | |

| Community Healthcare Trust | | 3Q 2023 | Supplemental Information |

ABOUT US

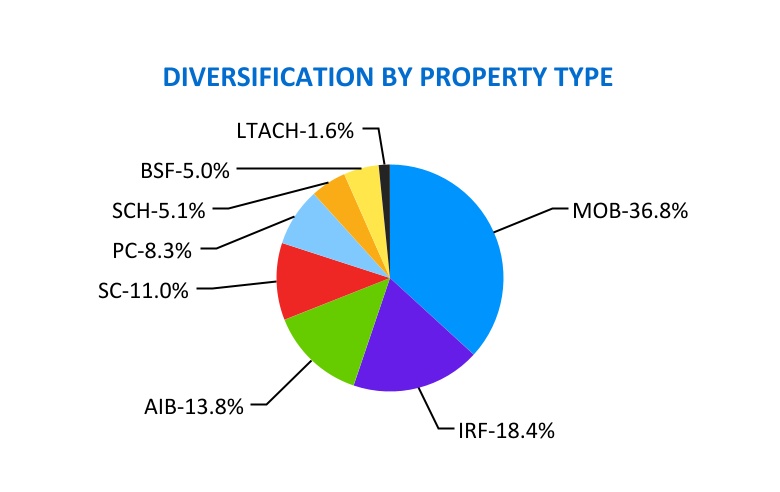

CHCT is a self-managed healthcare real estate investment trust (“REIT”) that owns a diverse portfolio of properties including medical office buildings, acute inpatient behavioral facilities, inpatient rehabilitation facilities, physician clinics, specialty centers, behavioral specialty facilities, and surgical centers and hospitals across the United States, primarily outside of urban centers. As a result of favorable demographic trends, increases in healthcare spending, and the shift in the delivery of healthcare services to community-based facilities, we believe our properties are essential for healthcare providers to serve their local markets.

TABLE OF CONTENTS

| | | | | | | | |

| Community Healthcare Trust | | 3Q 2023 | Supplemental Information |

COMPANY SNAPSHOT

| | | | | |

| September 30, 2023 |

Gross real estate investments (in thousands) (1) | $1,049,025 | |

| Total properties | 191 | |

| % Leased | 91.0 | % |

| Total square feet owned | 4,202,547 | |

| Weighted Average remaining lease term (years) | 7.1 |

| Cash and cash equivalents and restricted cash (in thousands) | $4,933 | |

| Debt to Total Capitalization | 35.9 | % |

| Weighted average interest rate per annum on Revolving Line of Credit | 7.1 | % |

| Weighted average interest rate per annum on Term Loans | 4.3 | % |

| Equity market cap (in millions) | $809.8 | |

| Quarterly dividend paid in the period (per share) | $0.4525 | |

| Quarter end stock price (per share) | $29.70 | |

| Dividend yield | 6.09 | % |

| Common shares outstanding | 27,264,661 | |

| ___________ | |

(1) Includes a portion of one property accounted for as a sales-type lease and one property classified as held for sale. |

| | | | | | | | |

| Community Healthcare Trust | Page | 3 | 3Q 2023 | Supplemental Information |

CORPORATE INFORMATION

| | | | | | | | | | | | | | | | | |

| | | | | |

| Community Healthcare Trust Incorporated |

| 3326 Aspen Grove Drive, Suite 150 |

| Franklin, TN 37067 |

| Phone: 615-771-3052 |

| E-mail: Investorrelations@chct.reit |

Website: www.chct.reit |

| |

| |

| BOARD OF DIRECTORS | |

| | | | | |

| | | | | |

| Alan Gardner | Robert Hensley | Claire Gulmi | R. Lawrence Van Horn | Cathrine Cotman | David Dupuy |

Chairman of the

Board | Audit Committee

Chair | Compensation Committee

Chair | ESG Committee

Chair | Board

member | Board

member |

| | | | | |

| | | | | |

| | | | | | | | | | | | |

| EXECUTIVE MANAGEMENT TEAM |

| | | | |

| | | | |

| David H. Dupuy | William G. Monroe IV | Leigh Ann Stach | Timothy L. Meyer |

| Chief Executive Officer

and President | Executive Vice President

Chief Financial Officer | Executive Vice President

Chief Accounting Officer | Executive Vice President

Asset Management |

| | | | |

| | | | |

| | | | | |

| COVERING ANALYSTS |

| |

| |

| A. Goldfarb - Piper Sandler | M. Lewis - Truist Securities |

| S. Sakwa - Evercore ISI | R. Stevenson - Janney Capital Markets |

| W. Golladay - Baird | D. Toti - Colliers International Securities |

| |

| |

| PROFESSIONAL SERVICES |

| |

| |

| Independent Registered Public Accounting Firm | Transfer Agent |

| BDO USA, P.C. | Equiniti Trust Company, LLC |

| 501 Commerce Street, Suite 1400 | Operations Center |

| Nashville, TN 37203 | 6201 15th Avenue |

| Brooklyn, NY 11219 |

| 1-800-937-5449 |

| | | | | | | | |

| Community Healthcare Trust | Page | 4 | 3Q 2023 | Supplemental Information |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | 3Q 2023 | 2Q 2023 | 1Q 2023 | 4Q 2022 | 3Q 2022 |

| | (Unaudited and in thousands, except per share data) |

| STATEMENTS OF OPERATIONS ITEMS | | | | | |

| Revenues | $ | 28,735 | | $ | 27,810 | | $ | 27,176 | | $ | 25,342 | | $ | 24,807 | |

| Net income (loss) (1)(2)(3) | $ | 3,492 | | $ | 6,577 | | $ | (6,922) | | $ | 5,238 | | $ | 5,673 | |

| NOI | $ | 23,279 | | $ | 23,024 | | $ | 22,303 | | $ | 21,186 | | $ | 20,480 | |

| EBITDAre | $ | 19,664 | | $ | 19,986 | | $ | 6,123 | | $ | 17,040 | | $ | 16,725 | |

| Adjusted EBITDAre | $ | 21,562 | | $ | 20,972 | | $ | 20,469 | | $ | 19,685 | | $ | 19,189 | |

| FFO (2) | $ | 14,969 | | $ | 15,870 | | $ | 2,166 | | $ | 13,620 | | $ | 13,751 | |

| AFFO | $ | 16,423 | | $ | 16,037 | | $ | 15,595 | | $ | 15,411 | | $ | 15,362 | |

| | | | | | |

| Per Diluted Share: | | | | | |

| Net income (loss) attributable to common shareholders | $ | 0.11 | | $ | 0.24 | | $ | (0.32) | | $ | 0.19 | | $ | 0.21 | |

| FFO | $ | 0.58 | | $ | 0.62 | | $ | 0.09 | | $ | 0.56 | | $ | 0.57 | |

| AFFO | $ | 0.63 | | $ | 0.63 | | $ | 0.62 | | $ | 0.63 | | $ | 0.63 | |

| ___________ | | | | | |

| (1) Net loss for the first quarter of 2023 included accelerated amortization of deferred compensation of approximately $11.8 million, or $0.47 per diluted common share and $0.46 FFO per diluted share, recognized upon passing of our former CEO and President. |

| (2) Net income for the second quarter of 2023 includes a $0.7 million net casualty gain recognized from insurance proceeds received related to one property that was vandalized, increasing FFO by $0.03 per diluted share. |

| (3) Net income for the third quarter of 2023 included accelerated amortization of lease intangibles on the two GenesisCare properties where the leases have been rejected of approximately $1.5 million, or $0.06 per diluted common share. |

| | | | | | | | |

| Community Healthcare Trust | Page | 5 | 3Q 2023 | Supplemental Information |

FINANCIAL HIGHLIGHTS (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | As of |

| | 3Q 2023 | 2Q 2023 | 1Q 2023 | 4Q 2022 | 3Q 2022 |

| | (Unaudited and dollars in thousands) |

| BALANCE SHEET ITEMS | | | | | |

| ASSETS | | | | | |

| Total real estate properties | $ | 1,044,893 | | $ | 986,948 | | $ | 971,026 | | $ | 943,167 | | $ | 886,958 | |

| Total assets | $ | 955,126 | | $ | 900,466 | | $ | 886,294 | | $ | 876,425 | | $ | 811,929 | |

| | | | | | |

| CAPITALIZATION | | | | | |

| Net debt | $ | 401,192 | | $ | 368,127 | | $ | 365,061 | | $ | 352,997 | | $ | 310,781 | |

| Total capitalization | $ | 1,116,448 | | $ | 1,055,221 | | $ | 1,033,922 | | $ | 1,015,152 | | $ | 946,307 | |

| Net debt/total capitalization | 35.9 | % | 34.9 | % | 35.3 | % | 34.8 | % | 32.8 | % |

| Market valuation | $ | 809,760 | | $ | 876,392 | | $ | 961,617 | | $ | 927,129 | | $ | 828,547 | |

| Enterprise value | $ | 1,206,019 | | $ | 1,240,843 | | $ | 1,322,053 | | $ | 1,268,058 | | $ | 1,135,990 | |

| | | | | | | | |

| Community Healthcare Trust | Page | 6 | 3Q 2023 | Supplemental Information |

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | | | | |

| As of |

| 3Q 2023 | 2Q 2023 | 1Q 2023 | 4Q 2022 | 3Q 2022 |

ASSETS | (Unaudited; Dollars and shares in thousands, except per share data) |

Real estate properties | | | | | |

Land and land improvements | $ | 135,809 | | $ | 127,433 | | $ | 122,702 | | $ | 117,657 | | $ | 103,413 | |

Buildings, improvements, and lease intangibles | 908,788 | | 859,231 | | 848,060 | | 825,257 | | 783,308 | |

Personal property | 296 | | 284 | | 264 | | 253 | | 237 | |

Total real estate properties | 1,044,893 | | 986,948 | | 971,026 | | 943,167 | | 886,958 | |

Less accumulated depreciation | (192,962) | | (181,769) | | (174,346) | | (165,341) | | (157,040) | |

Total real estate properties, net | 851,931 | | 805,179 | | 796,680 | | 777,826 | | 729,918 | |

Cash and cash equivalents | 3,885 | | 2,627 | | 3,666 | | 11,233 | | 2,656 | |

Restricted cash | 1,048 | | 1,049 | | 959 | | 835 | | 682 | |

| | | | | |

| | | | | |

Other assets, net | 98,262 | | 91,611 | | 84,989 | | 86,531 | | 78,673 | |

Total assets | $ | 955,126 | | $ | 900,466 | | $ | 886,294 | | $ | 876,425 | | $ | 811,929 | |

| | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

Liabilities | | | | | |

Debt, net | $ | 401,192 | | $ | 368,127 | | $ | 365,061 | | $ | 352,997 | | $ | 310,781 | |

Accounts payable and accrued liabilities | 15,446 | | 10,605 | | 10,478 | | 11,377 | | 8,143 | |

| | | | | |

Other liabilities, net | 16,194 | | 16,409 | | 16,240 | | 15,237 | | 14,519 | |

Total liabilities | 432,832 | | 395,141 | | 391,779 | | 379,611 | | 333,443 | |

| | | | | |

Commitments and contingencies | | | | | |

| | | | | |

Stockholders' Equity | | | | | |

Preferred stock, $0.01 par value; 50,000 shares authorized | — | | — | | — | | — | | — | |

Common stock, $0.01 par value; 450,000 shares authorized | 273 | | 265 | | 263 | | 259 | | 253 | |

Additional paid-in capital | 676,716 | | 657,057 | | 648,384 | | 625,136 | | 601,968 | |

Cumulative net income | 84,289 | | 80,797 | | 74,220 | | 81,142 | | 75,904 | |

Accumulated other comprehensive gain | 29,038 | | 23,085 | | 15,684 | | 22,667 | | 21,468 | |

Cumulative dividends | (268,022) | | (255,879) | | (244,036) | | (232,390) | | (221,107) | |

Total stockholders’ equity | 522,294 | | 505,325 | | 494,515 | | 496,814 | | 478,486 | |

Total liabilities and stockholders' equity | $ | 955,126 | | $ | 900,466 | | $ | 886,294 | | $ | 876,425 | | $ | 811,929 | |

| | | | | | | | |

| Community Healthcare Trust | Page | 7 | 3Q 2023 | Supplemental Information |

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| 3Q 2023 | 2Q 2023 | 1Q 2023 | 4Q 2022 | 3Q 2022 |

| (Unaudited; Dollars and shares in thousands, except per share data) |

REVENUES | | | | | |

Rental income | $ | 27,690 | | $ | 26,764 | | $ | 26,128 | | $ | 24,383 | | $ | 23,919 | |

| | | | | |

| | | | | |

Other operating interest | 1,045 | | 1,046 | | 1,048 | | 959 | | 888 | |

| 28,735 | | 27,810 | | 27,176 | | 25,342 | | 24,807 | |

| | | | | |

EXPENSES | | | | | |

Property operating | 5,456 | | 4,786 | | 4,873 | | 4,156 | | 4,327 | |

General and administrative (1) (2) | 3,618 | | 3,787 | | 16,205 | | 4,149 | | 3,762 | |

Depreciation and amortization | 11,208 | | 9,219 | | 9,018 | | 8,317 | | 8,003 | |

| | | | | |

| 20,282 | | 17,792 | | 30,096 | | 16,622 | | 16,092 | |

| | | | | |

INCOME BEFORE INCOME TAXES AND OTHER ITEMS | 8,453 | | 10,018 | | (2,920) | | 8,720 | | 8,715 | |

Impairment of real estate asset | (102) | | — | | — | | — | | — | |

Interest expense | (4,641) | | (4,140) | | (3,992) | | (3,464) | | (3,028) | |

| | | | | |

Deferred income tax expense | (221) | | (50) | | (35) | | (21) | | (21) | |

Interest and other income | 3 | | 749 | | 25 | | 3 | | 7 | |

NET INCOME (LOSS) | $ | 3,492 | | $ | 6,577 | | $ | (6,922) | | $ | 5,238 | | $ | 5,673 | |

| | | | | |

NET INCOME (LOSS) PER COMMON SHARE | | | | | |

| | | | | |

NET INCOME (LOSS) PER DILUTED COMMON SHARE | $ | 0.11 | | $ | 0.24 | | $ | (0.32) | | $ | 0.19 | | $ | 0.21 | |

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | 25,514 | | 25,065 | | 24,227 | | 23,787 | | 23,587 | |

DIVIDENDS DECLARED, PER COMMON SHARE, IN THE PERIOD | $ | 0.4525 | | $ | 0.4500 | | $ | 0.4475 | | $ | 0.4450 | | $ | 0.4425 | |

| | | | | | |

|

(1) GENERAL AND ADMINISTRATIVE EXPENSES: | | | | |

| Non-cash vs. Cash: | | | | | |

Non-cash (stock-based compensation) | 52.5 | % | 44.7 | % | 57.8 | % | 63.8 | % | 65.5 | % |

Cash | 47.5 | % | 55.3 | % | 42.2 | % | 36.2 | % | 34.5 | % |

| As a % of Revenue: | | | | | |

Non-cash (stock-based compensation) | 6.6 | % | 5.9 | % | 9.3 | % | 10.4 | % | 9.9 | % |

Cash | 6.0 | % | 7.3 | % | 6.8 | % | 5.9 | % | 5.2 | % |

| | | | | |

(2) General and administrative expenses for the three months ended March 31, 2023 includes the accelerated amortization of stock-based compensation totaling $11.8 million recognized upon the passing of our former CEO and President but the accelerated amortization is not included in the calculations above in footnote (1). |

| | | | | | | | |

| Community Healthcare Trust | Page | 8 | 3Q 2023 | Supplemental Information |

RECONCILIATION OF NON-GAAP MEASURES

FUNDS FROM OPERATIONS (FFO) ADJUSTED FUNDS FROM OPERATIONS (AFFO)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | 3Q 2023 | 2Q 2023 | 1Q 2023 | 4Q 2022 | 3Q 2022 |

| | (Unaudited; Dollars and shares in thousands, except per share data) |

| NET INCOME (LOSS) | $ | 3,492 | | $ | 6,577 | | $ | (6,922) | | $ | 5,238 | | $ | 5,673 | |

| Real estate depreciation and amortization | 11,375 | | 9,293 | | 9,088 | | 8,382 | | 8,078 | |

| | | | | | |

| | | | | | |

| Impairment of real estate asset | 102 | | — | | — | | — | | — | |

| Total adjustments | 11,477 | | 9,293 | | 9,088 | | 8,382 | | 8,078 | |

| FFO (1) | 14,969 | | 15,870 | | 2,166 | | 13,620 | | 13,751 | |

| Straight-line rent | (444) | | (819) | | (917) | | (854) | | (853) | |

| Stock-based compensation | 1,898 | | 1,692 | | 2,547 | | 2,645 | | 2,464 | |

| Accelerated amortization of stock-based compensation | — | | — | | 11,799 | | — | | — | |

| Net gain from insurance recovery on casualty loss | — | | (706) | | — | | — | | — | |

| AFFO | $ | 16,423 | | $ | 16,037 | | $ | 15,595 | | $ | 15,411 | | $ | 15,362 | |

| FFO PER COMMON SHARE (1) | $ | 0.58 | | $ | 0.62 | | $ | 0.09 | | $ | 0.56 | | $ | 0.57 | |

| AFFO PER COMMON SHARE | $ | 0.63 | | $ | 0.63 | | $ | 0.62 | | $ | 0.63 | | $ | 0.63 | |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | 26,025 | | 25,650 | | 25,298 | | 24,471 | | 24,312 | |

| ________________ | | | | | |

| (1) FFO for the second quarter of 2023 includes a $0.7 million net casualty gain from insurance proceeds received related to one property that was vandalized. The net gain increased FFO by $0.03 per diluted share for the three months ended June 30, 2023. |

| | | | | | |

| AFFO, ADJUSTED FOR ACQUISITIONS (1) | | | | | |

| | | | | |

| AFFO | $ | 16,423 | | $ | 16,037 | | $ | 15,595 | | $ | 15,411 | | $ | 15,362 | |

| Revenue on Properties Acquired in the period (2) | 757 | | 308 | | 383 | | 1,116 | | 308 | |

| Property operating expense adjustment (2) | (149) | | (71) | | (104) | | (308) | | (4) | |

| Interest expense adjustment (3) | (165) | | (68) | | (65) | | (232) | | (58) | |

| AFFO, ADJUSTED FOR ACQUISITIONS | $ | 16,866 | | $ | 16,206 | | $ | 15,809 | | $ | 15,987 | | $ | 15,608 | |

| | | | | | |

| (1) AFFO is adjusted to reflect acquisitions as if they had occurred on the first day of the applicable period. |

| (2) Revenue and expense adjustments are calculated based on expected returns and leases in place at acquisition. |

| (3) Assumes that acquisitions were 40% funded with debt and the remainder funded with equity. The interest expense adjustment was calculated using the weighted average interest rate on the Company's revolving credit facility for the period. |

|

| AMORTIZATION OF STOCK-BASED COMPENSATION (1) | | | | | |

| Amortization Required by GAAP (2) | $ | 1,898 | | $ | 1,692 | | $ | 2,547 | | $ | 2,675 | | $ | 2,464 | |

| Amortization Based on Legal Vesting Periods | 1,540 | | 1,430 | | 1,830 | | 1,845 | | 1,822 | |

| Acceleration of Amortization | $ | 358 | | $ | 262 | | $ | 717 | | $ | 830 | | $ | 642 | |

| | | | | | |

| (1) Excludes the accelerated amortization totaling $11.8 million recognized in the first quarter of 2023 upon the passing of our former CEO and President. |

| (2) GAAP requires that deferred compensation be amortized over the earlier of the vesting or retirement eligibility date. |

| | | | | | | | |

| Community Healthcare Trust | Page | 9 | 3Q 2023 | Supplemental Information |

RECONCILIATION OF NON-GAAP MEASURES (CONTINUED)

NET OPERATING INCOME (NOI)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | 3Q 2023 | 2Q 2023 | 1Q 2023 | 4Q 2022 | 3Q 2022 |

| | (Unaudited; Dollars and shares in thousands, except per share data) |

| NET OPERATING INCOME | | | | | |

| Net income (loss) | $ | 3,492 | | $ | 6,577 | | $ | (6,922) | | $ | 5,238 | | $ | 5,673 | |

| General and administrative | 3,618 | | 3,787 | | 4,406 | | 4,149 | | 3,762 | |

| Accelerated amortization of stock-based compensation | — | | — | | 11,799 | | — | | — | |

| Depreciation and amortization | 11,208 | | 9,219 | | 9,018 | | 8,317 | | 8,003 | |

| Impairment of real estate asset | 102 | | — | | — | | — | | — | |

| Interest expense | 4,641 | | 4,140 | | 3,992 | | 3,464 | | 3,028 | |

| Deferred Income tax expense (benefit) | 221 | | 50 | | 35 | | 21 | | 21 | |

| Interest and other income, net | (3) | | (749) | | (25) | | (3) | | (7) | |

| NOI | $ | 23,279 | | $ | 23,024 | | $ | 22,303 | | $ | 21,186 | | $ | 20,480 | |

| | | | | | |

| | | | | | |

|

| | | | | | |

EBITDAre and ADJUSTED EBITDAre | | | | | |

| | | | | | |

EBITDAre | | | | | |

| Net income (loss) | $ | 3,492 | | $ | 6,577 | | $ | (6,922) | | $ | 5,238 | | $ | 5,673 | |

| Interest expense | 4,641 | | 4,140 | | 3,992 | | 3,464 | | 3,028 | |

| Depreciation and amortization | 11,208 | | 9,219 | | 9,018 | | 8,317 | | 8,003 | |

| Deferred Income tax expense | 221 | | 50 | | 35 | | 21 | | 21 | |

| Gain on sale of depreciable real estate | 102 | | — | | — | | — | | — | |

EBITDAre | $ | 19,664 | | $ | 19,986 | | $ | 6,123 | | $ | 17,040 | | $ | 16,725 | |

| Non-cash stock-based compensation expense | 1,898 | | 1,692 | | 2,547 | | 2,645 | | 2,464 | |

| Accelerated amortization of stock-based compensation | — | | — | | 11,799 | | — | | — | |

| Net gain from insurance recovery on casualty loss | — | | (706) | | — | | — | | — | |

ADJUSTED EBITDAre | $ | 21,562 | | $ | 20,972 | | $ | 20,469 | | $ | 19,685 | | $ | 19,189 | |

| | | | | | |

ADJUSTED EBITDAre ANNUALIZED (1) | $ | 86,248 | | | | | |

| | | | | |

| (1) | | Adjusted EBITDAre multiplied by 4. This annualized amount may differ significantly from the actual full year results. |

| | | | | | | | |

| Community Healthcare Trust | Page | 10 | 3Q 2023 | Supplemental Information |

WEIGHTED AVERAGE SHARES

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | 3Q 2023 | 2Q 2023 | 1Q 2023 | 4Q 2022 | 3Q 2022 |

| | (Unaudited; Dollars and shares in thousands, except per share data) |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | | | | | |

| Weighted average common shares outstanding | 26,823 | | 26,358 | | 26,043 | | 25,498 | | 25,221 | |

| Unvested restricted shares | (1,309) | | (1,293) | | (1,816) | | (1,711) | | (1,634) | |

| Weighted average common shares outstanding - EPS | 25,514 | | 25,065 | | 24,227 | | 23,787 | | 23,587 | |

| | | | | | |

| Weighted average common shares outstanding - FFO Basic | 25,514 | | 25,065 | | 24,227 | | 23,787 | | 23,587 | |

| Dilutive potential common shares (from below) | 511 | | 585 | | 1,071 | | 684 | | 725 | |

| Weighted average common shares outstanding - FFO Diluted | 26,025 | | 25,650 | | 25,298 | | 24,471 | | 24,312 | |

| | | | | | |

| TREASURY SHARE CALCULATION | | | | | |

| Unrecognized deferred compensation-end of period | $ | 28,814 | | $ | 24,780 | | $ | 24,465 | | $ | 33,652 | | $ | 36,364 | |

| Unrecognized deferred compensation-beginning of period | $ | 24,780 | | $ | 24,465 | | $ | 33,652 | | $ | 36,364 | | $ | 30,886 | |

| Average unrecognized deferred compensation | $ | 26,797 | | $ | 24,623 | | $ | 29,059 | | $ | 35,008 | | $ | 33,625 | |

| Average share price per share | $ | 33.56 | | $ | 34.78 | | $ | 39.01 | | $ | 34.06 | | $ | 36.97 | |

| Treasury shares | 798 | | 708 | | 745 | | 1,027 | | 909 | |

| | | | | | |

| Unvested restricted shares | (1,309) | | (1,293) | | (1,816) | | (1,711) | | (1,634) | |

| Treasury shares | 798 | | 708 | | 745 | | 1,027 | | 909 | |

| Dilutive potential common shares | 511 | | 585 | | 1,071 | | 684 | | 725 | |

| | | | | | | | |

| Community Healthcare Trust | Page | 11 | 3Q 2023 | Supplemental Information |

EXECUTIVE COMPENSATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Performance Based Incentive Compensation |

| Name and Position | Year | Total

Compensation | Salary

Taken In

Stock (1) | Other (2) | Bonus

Stock (1) | Alignment

of Interest

Stock (3) | 1-Year Total

Shareholder

Return

Stock | 3-Year Total

Shareholder

Return

Stock | 5-Year Total Shareholder Return

Stock | Total

Performance

Based

Incentive

Compensation | Percent

of Total |

| | | | | | | | | | | |

| Timothy G. Wallace (4) | 2022 | $ | 4,540,328 | | $ | 794,200 | | $ | 12,425 | | $ | 913,330 | | $ | 1,710,257 | | $ | — | | $ | 222,023 | | $ | 888,093 | | $ | 3,733,703 | | 82.2 | % |

| Former Chief Executive Officer and President | 2021 | $ | 4,788,861 | | $ | 750,000 | | $ | 11,650 | | $ | 862,500 | | $ | 1,621,703 | | $ | — | | $ | 771,504 | | $ | 771,504 | | $ | 4,027,211 | | 84.1 | % |

| 2020 | $ | 3,737,563 | | $ | 645,000 | | $ | 13,382 | | $ | 548,250 | | $ | 1,402,181 | | $ | 483,750 | | $ | 645,000 | | $ | — | | $ | 3,079,181 | | 82.4 | % |

| | | | | | | | | | | | |

| David H. Dupuy (5) | 2022 | $ | 2,785,183 | | $ | 487,200 | | $ | 7,487 | | $ | 560,280 | | $ | 1,049,216 | | $ | — | | $ | 136,192 | | $ | 544,808 | | $ | 2,290,496 | | 82.2 | % |

| Chief Executive Officer, President and

Former Chief Financial Officer | 2021 | $ | 3,183,341 | | $ | 460,000 | | $ | 253,262 | | $ | 529,000 | | $ | 994,675 | | $ | — | | $ | 473,202 | | $ | 473,202 | | $ | 2,470,079 | | 77.6 | % |

| 2020 | $ | 2,451,981 | | $ | 392,000 | | $ | 188,572 | | $ | 333,200 | | $ | 852,209 | | $ | 294,000 | | $ | 392,000 | | $ | — | | $ | 1,871,409 | | 76.3 | % |

| | | | | | | | | | | | |

| Leigh Ann Stach | 2022 | $ | 2,342,141 | | $ | 410,500 | | $ | 1,750 | | $ | 472,075 | | $ | 883,998 | | $ | — | | $ | 114,764 | | $ | 459,054 | | $ | 1,929,891 | | 82.4 | % |

| Executive Vice President and

Chief Accounting Officer | 2021 | $ | 2,472,513 | | $ | 387,600 | | $ | 3,648 | | $ | 445,740 | | $ | 838,123 | | $ | — | | $ | 398,701 | | $ | 398,701 | | $ | 2,081,265 | | 84.2 | % |

| 2020 | $ | 1,895,617 | | $ | 326,800 | | $ | 8,734 | | $ | 277,780 | | $ | 710,403 | | $ | 245,100 | | $ | 326,800 | | $ | — | | $ | 1,560,083 | | 82.3 | % |

| | | | | | | | | | | | |

| Timothy L. Meyer (6) | 2022 | $ | 1,785,445 | | $ | 312,400 | | $ | 4,311 | | $ | 359,260 | | $ | 672,777 | | $ | — | | $ | 87,339 | | $ | 349,358 | | $ | 1,468,734 | | 82.3 | % |

| Executive Vice President -

Asset Management | 2021 | $ | 917,202 | | $ | 280,000 | | $ | 14,789 | | $ | 165,000 | | $ | 457,413 | | $ | — | | $ | — | | $ | — | | $ | 622,413 | | 67.9 | % |

| | | | | | | | | | | |

| (1) Each Executive Officer has elected to take 100% of their salary and cash bonus in deferred stock with an 8-year cliff vesting. |

| (2) Other includes employer contributions to the executive officer's health savings account (HSA) and 401(k); the value of the grant of 5,000 shares of restricted stock to Mr. Dupuy in each of the years 2020 and 2021, and the value of the grant of 260 shares of restricted stock to Mr. Meyer in 2021. |

| (3) Alignment of interest stock grants per the Alignment Interest Program which is part of the Company's Incentive Plan. |

| (4) Mr. Wallace, our former CEO and President, passed away on March 3, 2023. |

| (5) Mr. Dupuy was appointed as CEO effective March 6, 2023 and continued on as CFO until his successor was named on June 1, 2023. |

| (6) Mr. Meyer joined the Company on July 1, 2019 and was promoted to Executive Vice President on October 1, 2021. |

| | | | | | | | | | | | | | | | | |

| CEO Pay Ratios | |

| Former CEO and

President | Median

Employee | Average

Employee (1) | Lowest Paid

Employee (1) | |

| Cash | $ | — | | $ | 123,900 | | $ | 114,349 | | $ | 63,500 | | |

| Compensation Taken in Stock | 4,527,903 | | 68,500 | | 295,291 | | — | | |

| Other Compensation | 12,425 | | 3,047 | | 4,638 | | 1,348 | | |

| Total Compensation | $ | 4,540,328 | | $ | 195,447 | | $ | 414,278 | | $ | 64,848 | | |

| CEO to Employee Ratio | | 23:1 | 11:1 | 70:1 | |

| ___________ | | | | | |

| (1) Excludes part-time employees who worked less than 20 hours per week. | | | |

| | | | | | | | |

| Community Healthcare Trust | Page | 12 | 3Q 2023 | Supplemental Information |

DEBT SUMMARY

| | | | | | | | | | | |

| As of September 30, 2023 |

| Principal

Balance | Stated

Rate | Hedged

Rate |

| (in thousands) | | |

| | | |

| Revolving credit facility | $ | 48,000 | | 7.05 | % | — | |

| Term loan A-3 | 75,000 | | | 4.29 | % |

| Term loan A-4 | 125,000 | | | 3.35 | % |

| Term loan A-5 | 150,000 | | | 5.11 | % |

| Total Credit Facility | 398,000 | | | |

| | | |

| Secured mortgage loan | 4,853 | | 4.98 | % | — | |

| | | |

| Debt | 402,853 | | | |

| Deferred Financing Costs, net | (1,661) | | | |

| Debt, net | $ | 401,192 | | | |

| | | |

| | | | | | | | |

| Select Covenants | Required | 3Q 2023 |

| Leverage ratio | ≤ 60.0% | 37.1 | % |

| Fixed charge coverage ratio | ≥ 1.50x | 4.7 |

| Tangible net worth (in thousands) | ≥ $491,756 | $681,718 |

| Secured indebtedness | ≤ 30.0% | 0.4 | % |

| Minimum debt service coverage ratio | ≥ 2.0 | 5.3 |

| | | | | | | | |

| Community Healthcare Trust | Page | 13 | 3Q 2023 | Supplemental Information |

2023 PROPERTY ACQUISITIONS

| | | | | | | | | | | | | | | | | | | | |

| Property | Market | Property

Type | Date

Acquired | % Leased at Acquisition | Purchase Price (in thousands) | Square Feet |

| Emory Healthcare | LaGrange, GA | MOB | 01/18/23 | 100.0 | % | $ | 8,007 | | 55,310 | |

| Emory Healthcare | West Point, GA | MOB | 01/18/23 | 100.0 | % | 811 | | 5,600 | |

| Hills & Dales Professional Center | Canton, OH | MOB | 01/30/23 | 100.0 | % | 3,669 | | 27,920 | |

| Northeastern Eye Institute | Scranton, PA | MOB | 02/23/23 | 100.0 | % | 1,957 | | 22,743 | |

| Northeastern Eye Institute | Scranton, PA | MOB | 02/23/23 | 100.0 | % | 2,207 | | 15,768 | |

| Emory Southern Orthopedics | LaGrange, GA | MOB | 03/06/23 | 100.0 | % | 6,469 | | 31,473 | |

| Emory Southern Orthopedics | LaGrange, GA | MOB | 03/06/23 | 100.0 | % | 249 | | 2,972 | |

| Land | Lakeland, FL | n/a | 04/03/23 | n/a | 838 | | — | |

| UPMC Hermitage Road | Hermitage, PA | MOB | 05/04/23 | 100.0 | % | 4,218 | | 25,982 | |

| JDH Professional Building | San Antonio, TX | MOB | 05/22/23 | 100.0 | % | 2,772 | | 12,376 | |

| Clinton Towers MOB | Clinton, MD | MOB | 06/21/23 | 94.9 | % | 7,850 | | 37,344 | |

| Eye Health of America | Ft. Myers, FL | MOB | 7/28/2023 | 100.0 | % | 10,646 | | 43,322 | |

| Eye Health of America | Ft. Myers, FL | MOB | 7/28/2023 | 100.0 | % | 582 | | 3,200 | |

| Eye Health of America | Immokalee, FL | MOB | 7/28/2023 | 100.0 | % | 847 | | 6,757 | |

| Everest Rehabilitation Hospital | El Paso, TX | IRF | 7/31/2023 | 100.0 | % | 23,500 | | 37,992 | |

| The Heart & Vascular Center | Beaver, PA | MOB | 8/24/2023 | 100.0 | % | 3,330 | | 15,878 | |

| Westlake Medical Office | Westlake, OH | MOB | 8/25/2023 | 100.0 | % | 2,425 | | 14,100 | |

| Nesbitt Place | Newcastle, PA | MOB | 9/15/2023 | 98.3 | % | 10,375 | | 56,003 | |

| | | | | | |

| | | | 99.6 | % | $ | 90,752 | | 414,740 | |

| | | | | | | | |

| Community Healthcare Trust | Page | 14 | 3Q 2023 | Supplemental Information |

PORTFOLIO DIVERSIFICATION

| | | | | |

| Property Type | Annualized Rent (%) |

| Medical Office Building (MOB) | 36.8 | % |

| Inpatient Rehabilitation Facilities (IRF) | 18.4 | % |

| Acute Inpatient Behavioral (AIB) | 13.8 | % |

| Specialty Centers (SC) | 11.0 | % |

| Physician Clinics (PC) | 8.3 | % |

| Surgical Centers and Hospitals (SCH) | 5.1 | % |

| Behavioral Specialty Facilities (BSF) | 5.0 | % |

| Long-term Acute Care Hospitals (LTACH) | 1.6 | % |

| Total | 100.0 | % |

| | | | | |

| State | Annualized

Rent (%) |

| Texas (TX) | 16.2 | % |

| Ohio (OH) | 11.3 | % |

| Illinois (IL) | 10.9 | % |

| Florida (FL) | 8.2 | % |

| Pennsylvania (PA) | 6.1 | % |

| All Others | 47.3 | % |

| Total | 100.0 | % |

| | | | | |

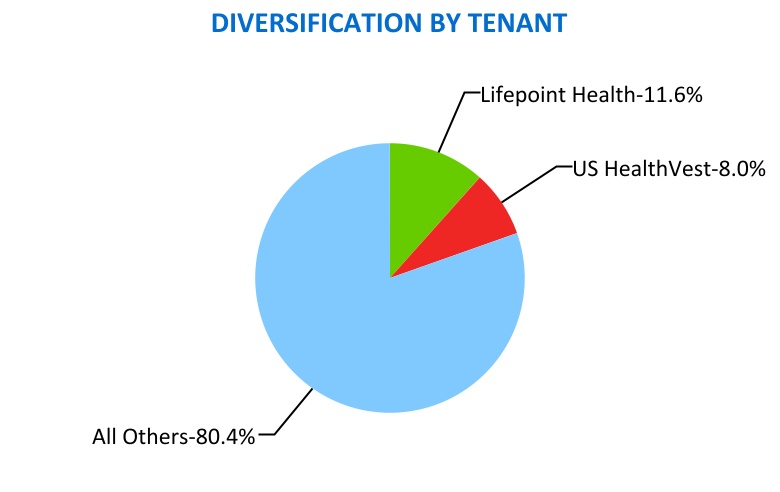

| Tenant | Annualized

Rent (%) |

| Lifepoint Health | 11.6 | % |

| US HealthVest | 8.0 | % |

| All Others | 80.4 | % |

| Total | 100.0 | % |

| | | | | | | | |

| Community Healthcare Trust | Page | 15 | 3Q 2023 | Supplemental Information |

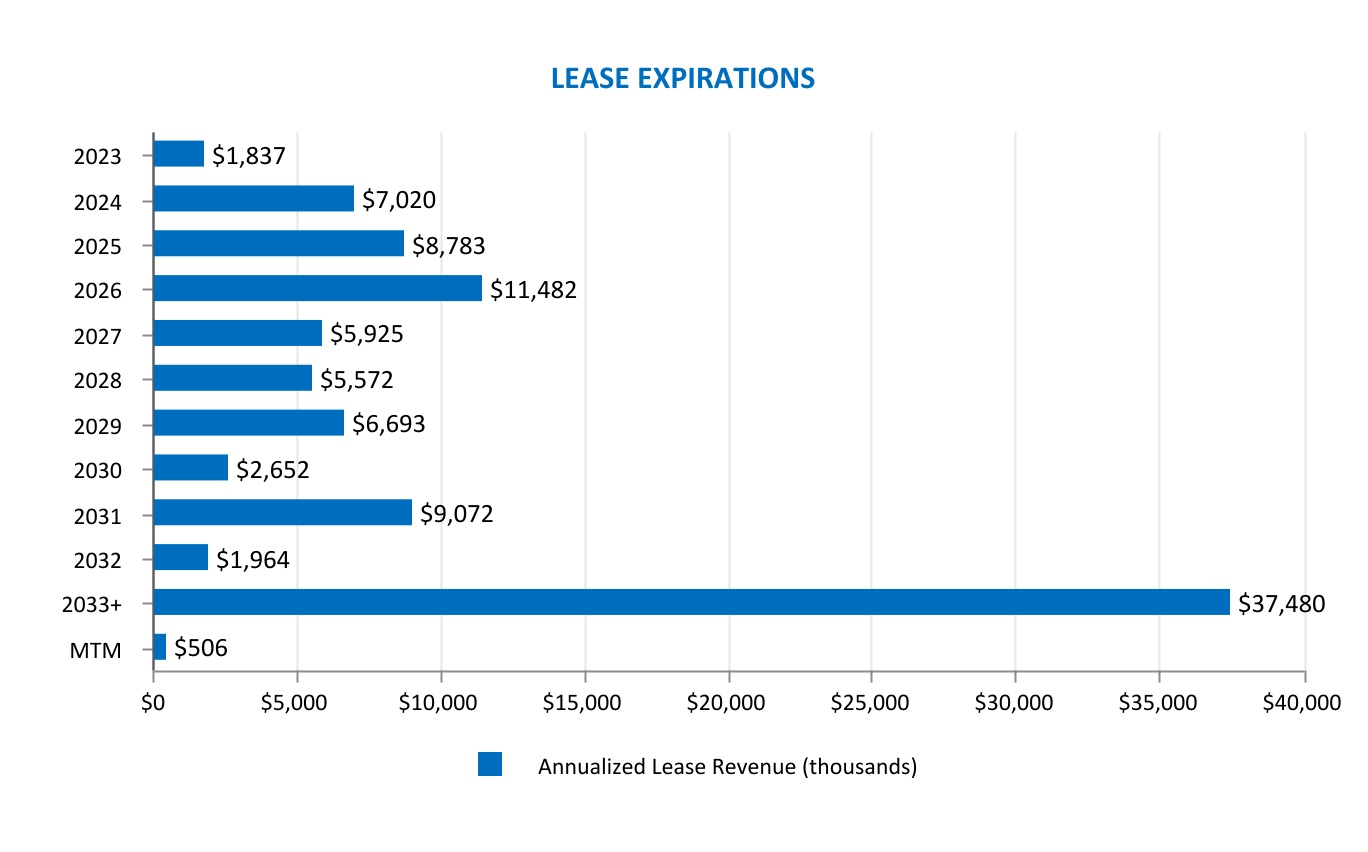

LEASE EXPIRATIONS

| | | | | | | | | | | | | | | | | | | | |

| | Total Leased Sq. Ft. | | Annualized Rent |

| Year | Number of

Leases Expiring | Amount (thousands) | Percent (%) | | Amount ($) (thousands) | Percent (%) |

| 2023 | 16 | | 99 | | 2.6 | % | | $ | 1,837 | | 1.9 | % |

| 2024 | 70 | | 331 | | 8.7 | % | | 7,020 | | 7.1 | % |

| 2025 | 49 | | 325 | | 8.5 | % | | 8,783 | | 8.9 | % |

| 2026 | 62 | | 536 | | 14.0 | % | | 11,482 | | 11.6 | % |

| 2027 | 48 | | 282 | | 7.4 | % | | 5,925 | | 6.0 | % |

| 2028 | 54 | | 304 | | 8.0 | % | | 5,572 | | 5.6 | % |

| 2029 | 23 | | 259 | | 6.8 | % | | 6,693 | | 6.8 | % |

| 2030 | 13 | | 83 | | 2.2 | % | | 2,652 | | 2.7 | % |

| 2031 | 20 | | 336 | | 8.8 | % | | 9,072 | | 9.2 | % |

| 2032 | 12 | | 142 | | 3.7 | % | | 1,964 | | 2.0 | % |

| Thereafter | 49 | | 1,100 | | 28.6 | % | | 37,480 | | 37.7 | % |

| Month-to-Month | 13 | | 26 | | 0.7 | % | | 506 | | 0.5 | % |

| Totals | 429 | | 3,823 | | 100.0 | % | | $ | 98,986 | | 100.0 | % |

Total portfolio was approximately 91.0% leased in the aggregate at September 30, 2023 with lease expirations ranging from 2023 through 2039.

| | | | | | | | |

| Community Healthcare Trust | Page | 16 | 3Q 2023 | Supplemental Information |

PROPERTY LOCATIONS

Approximately 48% of our property revenues are in MSAs with populations over 1,000,000 and approximately 91% are in MSAs with populations over 100,000.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Area | % of Square Feet | Annualized

Rent ($000's) | % of Annualized

Rent | Population | MSA/MISA | Rank |

| Lancaster MOB | MOB | 10,646 | | 0.25 | % | $ | 210.8 | | 0.21 | % | 13,200,998 | | Los Angeles-Long Beach-Anaheim, CA | 2 |

| Future Diagnostics Group | SC | 8,876 | | 0.21 | % | $ | 390.9 | | 0.39 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Gurnee Medical Office Building | MOB | 22,943 | | 0.55 | % | $ | 237.7 | | 0.24 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Joliet Oncology-Hematology Associates | PC | 7,905 | | 0.19 | % | $ | 375.6 | | 0.38 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Morris Cancer Center | MOB | 18,470 | | 0.44 | % | $ | 623.4 | | 0.63 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Center for Reconstructive Surgery - Oak Lawn | MOB | 33,356 | | 0.79 | % | $ | 409.3 | | 0.41 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Presence | PC | 14,863 | | 0.35 | % | $ | 310.8 | | 0.31 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Presence Regional Cancer Center | SC | 44,888 | | 1.07 | % | $ | 1,453.1 | | 1.47 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Skin MD | PC | 13,565 | | 0.32 | % | $ | 512.2 | | 0.52 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Chicago Behavioral Hospital | AIB | 85,000 | | 2.02 | % | $ | 2,182.5 | | 2.21 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| US HealthVest - Lake | AIB | 83,658 | | 1.99 | % | $ | 2,920.7 | | 2.95 | % | 9,618,502 | | Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Texas Rehabilitation Hospital of Fort Worth, LLC | IRF | 39,761 | | 0.95 | % | $ | 1,988.2 | | 2.01 | % | 7,637,387 | | Dallas-Fort Worth-Arlington, TX | 4 |

| Bayside Medical Center | MOB | 50,593 | | 1.20 | % | $ | 1,064.9 | | 1.08 | % | 7,122,240 | | Houston-The Woodlands-Sugar Land, TX | 5 |

| Gessner Road MOB | MOB | 14,360 | | 0.34 | % | $ | 301.8 | | 0.30 | % | 7,122,240 | | Houston-The Woodlands-Sugar Land, TX | 5 |

| Clear Lake Institute for Rehabilitation | IRF | 55,646 | | 1.32 | % | $ | 2,913.2 | | 2.94 | % | 7,122,240 | | Houston-The Woodlands-Sugar Land, TX | 5 |

| Northwest Surgery Center | SCH | 11,200 | | 0.27 | % | $ | — | | — | % | 7,122,240 | | Houston-The Woodlands-Sugar Land, TX | 5 |

| Clinton Towers MOB | MOB | 37,344 | | 0.89 | % | $ | 947.2 | | 0.96 | % | 6,385,162 | | Washington-Arlington-Alexandria, DC-VA-MD-WV | 6 |

| 2301 Research Boulevard | MOB | 93,079 | | 2.21 | % | $ | 2,171.9 | | 2.19 | % | 6,385,162 | | Washington-Arlington-Alexandria, DC-VA-MD-WV | 6 |

| Haddon Hill Professional Center | MOB | 25,118 | | 0.60 | % | $ | 276.1 | | 0.28 | % | 6,245,051 | | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 7 |

| Hopebridge - Westlake | BSF | 15,057 | | 0.36 | % | $ | 229.6 | | 0.23 | % | 6,245,051 | | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 7 |

| Continuum Wellness Center | MOB | 8,227 | | 0.20 | % | $ | 159.9 | | 0.16 | % | 4,845,832 | | Phoenix-Mesa-Chandler, AZ | 11 |

| Desert Endoscopy Center | SCH | 11,722 | | 0.28 | % | $ | 304.8 | | 0.31 | % | 4,845,832 | | Phoenix-Mesa-Chandler, AZ | 11 |

| Mountain View Surgery Center | SCH | 14,046 | | 0.33 | % | $ | 547.8 | | 0.55 | % | 4,845,832 | | Phoenix-Mesa-Chandler, AZ | 11 |

| Associated Surgical Center of Dearborn | SCH | 12,400 | | 0.30 | % | $ | 353.4 | | 0.36 | % | 4,392,041 | | Detroit-Warren-Dearborn, MI | 14 |

| | | | | | | | |

| Community Healthcare Trust | Page | 17 | 3Q 2023 | Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Area | % of Square Feet | Annualized

Rent ($000's) | % of Annualized

Rent | Population | MSA/MISA | Rank |

| Berry Surgical Center | SCH | 27,217 | | 0.65 | % | $ | 615.4 | | 0.62 | % | 4,392,041 | | Detroit-Warren-Dearborn, MI | 14 |

| Smokey Point Behavioral Hospital | AIB | 70,100 | | 1.67 | % | $ | 2,772.8 | | 2.80 | % | 4,018,762 | | Seattle-Tacoma-Bellevue, WA | 15 |

| Sanderling Dialysis | SC | 11,300 | | 0.27 | % | $ | 414.6 | | 0.42 | % | 3,298,634 | | San Diego-Chula Vista-Carlsbad, CA | 17 |

| Bay Area Physicians Surgery Center | MOB | 17,943 | | 0.43 | % | $ | 290.1 | | 0.29 | % | 3,175,275 | | Tampa-St. Petersburg-Clearwater, FL | 18 |

| Liberty Dialysis | SC | 8,450 | | 0.20 | % | $ | 275.9 | | 0.28 | % | 2,963,821 | | Denver-Aurora-Lakewood, CO | 19 |

| Waters Edge Medical | MOB | 23,388 | | 0.56 | % | $ | 419 | | 0.42 | % | 2,844,510 | | Baltimore-Columbia-Towson, MD | 20 |

| Righttime Medical Care | SC | 6,236 | | 0.15 | % | $ | 330.9 | | 0.33 | % | 2,844,510 | | Baltimore-Columbia-Towson, MD | 20 |

| Eyecare Partners | PC | 6,487 | | 0.15 | % | $ | 139 | | 0.14 | % | 2,820,253 | | St. Louis, MO-IL | 21 |

| Eyecare Partners | PC | 5,560 | | 0.13 | % | $ | 45.3 | | 0.05 | % | 2,820,253 | | St. Louis, MO-IL | 21 |

| Eyecare Partners | SCH | 16,608 | | 0.40 | % | $ | 310.6 | | 0.31 | % | 2,820,253 | | St. Louis, MO-IL | 21 |

| Eyecare Partners | PC | 6,311 | | 0.15 | % | $ | 49.5 | | 0.05 | % | 2,820,253 | | St. Louis, MO-IL | 21 |

| Bassin Center For Plastic-Surgery-Villages | PC | 2,894 | | 0.07 | % | $ | 170.2 | | 0.17 | % | 2,673,376 | | Orlando-Kissimmee-Sanford, FL | 22 |

| Bassin Center For Plastic Surgery-Orlando | PC | 2,420 | | 0.06 | % | $ | 142.3 | | 0.14 | % | 2,673,376 | | Orlando-Kissimmee-Sanford, FL | 22 |

| Kissimmee Physicians Clinic | PC | 4,902 | | 0.12 | % | $ | 110.3 | | 0.11 | % | 2,673,376 | | Orlando-Kissimmee-Sanford, FL | 22 |

| Orthopaedic Associates of Osceola | PC | 15,167 | | 0.36 | % | $ | 347.2 | | 0.35 | % | 2,673,376 | | Orlando-Kissimmee-Sanford, FL | 22 |

| Medical Village at Wintergarden | MOB | 21,532 | | 0.51 | % | $ | 591.5 | | 0.60 | % | 2,673,376 | | Orlando-Kissimmee-Sanford, FL | 22 |

| Baptist Health | PC | 13,500 | | 0.32 | % | $ | 403.1 | | 0.41 | % | 2,558,143 | | San Antonio-New Braunfels, TX | 24 |

| San Antonio Head & Neck Surgical Associates | PC | 6,500 | | 0.15 | % | $ | 187.9 | | 0.19 | % | 2,558,143 | | San Antonio-New Braunfels, TX | 24 |

| JDH Professional Building | MOB | 12,376 | | 0.29 | % | $ | 261.9 | | 0.26 | % | 2,558,143 | | San Antonio-New Braunfels, TX | 24 |

| The Heart & Vascular Center | MOB | 15,878 | | 0.38 | % | $ | 307.8 | | 0.31 | % | 2,370,930 | | Pittsburgh, PA | 27 |

| Butler Medical Center | MOB | 10,116 | | 0.24 | % | $ | 273.3 | | 0.28 | % | 2,370,930 | | Pittsburgh, PA | 27 |

| Forefront Dermatology Building | MOB | 15,650 | | 0.37 | % | $ | 342 | | 0.35 | % | 2,370,930 | | Pittsburgh, PA | 27 |

| Nesbitt Place | MOB | 56,003 | | 1.33 | % | $ | 1,097.2 | | 1.11 | % | 2,370,930 | | Pittsburgh, PA | 27 |

| Greentree Primary Care | MOB | 34,077 | | 0.81 | % | $ | 888 | | 0.90 | % | 2,370,930 | | Pittsburgh, PA | 27 |

| Vascular Access Centers of Southern Nevada | SC | 4,800 | | 0.11 | % | $ | 97.9 | | 0.10 | % | 2,265,461 | | Las Vegas-Henderson-Paradise, NV | 29 |

| Assurance Health System | BSF | 14,381 | | 0.34 | % | $ | 555.4 | | 0.56 | % | 2,256,884 | | Cincinnati, OH-KY-IN | 30 |

| Cavalier Medical & Dialysis Center | MOB | 17,614 | | 0.42 | % | $ | 218.2 | | 0.22 | % | 2,256,884 | | Cincinnati, OH-KY-IN | 30 |

| 51 Cavalier Blvd | MOB | 18,016 | | 0.43 | % | $ | 179.6 | | 0.18 | % | 2,256,884 | | Cincinnati, OH-KY-IN | 30 |

| Anderson Ferry Plaza | MOB | 43,599 | | 1.04 | % | $ | 549.1 | | 0.55 | % | 2,256,884 | | Cincinnati, OH-KY-IN | 30 |

| Everest Rehabilitation Hospital | IRF | 37,720 | | 0.90 | % | $ | 2,444.9 | | 2.47 | % | 2,256,884 | | Cincinnati, OH-KY-IN | 30 |

| Davita Commercial Way | SC | 4,980 | | 0.12 | % | $ | — | | — | % | 2,256,884 | | Cincinnati, OH-KY-IN | 30 |

| | | | | | | | |

| Community Healthcare Trust | Page | 18 | 3Q 2023 | Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Area | % of Square Feet | Annualized

Rent ($000's) | % of Annualized

Rent | Population | MSA/MISA | Rank |

| Fresenius Florence Dialysis Center | MOB | 17,845 | | 0.42 | % | $ | 305.4 | | 0.31 | % | 2,256,884 | | Cincinnati, OH-KY-IN | 30 |

| Prairie Star Medical Facility I | MOB | 24,724 | | 0.59 | % | $ | 921 | | 0.93 | % | 2,192,035 | | Kansas City, MO-KS | 31 |

| Prairie Star Medical Facility II | MOB | 24,840 | | 0.59 | % | $ | 154.1 | | 0.16 | % | 2,192,035 | | Kansas City, MO-KS | 31 |

| Ravines Edge | MOB | 16,751 | | 0.40 | % | $ | 263.9 | | 0.27 | % | 2,138,926 | | Columbus, OH | 32 |

| Court Street Surgery Center | SCH | 7,787 | | 0.19 | % | $ | 80.2 | | 0.08 | % | 2,138,926 | | Columbus, OH | 32 |

| Hopebridge - Columbus | BSF | 13,969 | | 0.33 | % | $ | 173 | | 0.17 | % | 2,138,926 | | Columbus, OH | 32 |

| Sedalia Medical Center | MOB | 20,043 | | 0.48 | % | $ | 304.4 | | 0.31 | % | 2,138,926 | | Columbus, OH | 32 |

| Assurance Health, LLC | BSF | 10,200 | | 0.24 | % | $ | 372.9 | | 0.38 | % | 2,111,040 | | Indianapolis-Carmel-Anderson, IN | 33 |

| Assurance Health System | BSF | 13,722 | | 0.33 | % | $ | 495.8 | | 0.50 | % | 2,111,040 | | Indianapolis-Carmel-Anderson, IN | 33 |

| Kindred Hospital Indianapolis North | LTACH | 37,270 | | 0.89 | % | $ | 1,566.9 | | 1.58 | % | 2,111,040 | | Indianapolis-Carmel-Anderson, IN | 33 |

| Brook Park Medical Building | MOB | 18,444 | | 0.44 | % | $ | 399.9 | | 0.40 | % | 2,088,251 | | Cleveland-Elyria, OH | 34 |

| Smith Road | MOB | 16,802 | | 0.40 | % | $ | 310.3 | | 0.31 | % | 2,088,251 | | Cleveland-Elyria, OH | 34 |

| Assurance - Hudson | BSF | 13,290 | | 0.32 | % | $ | 554.2 | | 0.56 | % | 2,088,251 | | Cleveland-Elyria, OH | 34 |

| Rockside Medical Center | MOB | 55,316 | | 1.32 | % | $ | 1,015.4 | | 1.03 | % | 2,088,251 | | Cleveland-Elyria, OH | 34 |

| Westlake Medical Office | MOB | 14,100 | | 0.34 | % | $ | 248.2 | | 0.25 | % | 2,088,251 | | Cleveland-Elyria, OH | 34 |

| Virginia Orthopaedic & Spine Specialists | PC | 8,445 | | 0.20 | % | $ | 153.1 | | 0.15 | % | 1,799,674 | | Virginia Beach-Norfolk-Newport News, VA-NC | 37 |

| Genesis Care - Warwick | SC | 10,236 | | 0.24 | % | $ | 380.8 | | 0.38 | % | 1,676,579 | | Providence-Warwick, RI-MA | 38 |

| South County Hospital | PC | 13,268 | | 0.32 | % | $ | 311.3 | | 0.31 | % | 1,676,579 | | Providence-Warwick, RI-MA | 38 |

| Ortho Rhode Island - Warwick | PC | 7,340 | | 0.17 | % | $ | 217 | | 0.22 | % | 1,676,579 | | Providence-Warwick, RI-MA | 38 |

| Mercy Rehabilitation Hospital | IRF | 39,637 | | 0.94 | % | $ | 1,988.2 | | 2.01 | % | 1,425,695 | | Oklahoma City, OK | 41 |

| Memphis Center | MOB | 11,669 | | 0.28 | % | $ | 232.3 | | 0.23 | % | 1,337,779 | | Memphis, TN-MS-AR | 43 |

| Sanderling Dialysis | SC | 10,133 | | 0.24 | % | $ | 552.4 | | 0.56 | % | 1,337,779 | | Memphis, TN-MS-AR | 43 |

| Glastonbury | MOB | 49,593 | | 1.18 | % | $ | 581.1 | | 0.59 | % | 1,213,531 | | Hartford-East Hartford-Middletown, CT | 48 |

| Sterling Medical Center | MOB | 28,685 | | 0.68 | % | $ | 366.5 | | 0.37 | % | 1,166,902 | | Buffalo-Cheektowaga, NY | 49 |

| Gardendale MOB | MOB | 12,956 | | 0.31 | % | $ | 317.4 | | 0.32 | % | 1,115,289 | | Birmingham-Hoover, AL | 50 |

| Genesis Care - Southbridge | SC | 20,046 | | 0.48 | % | $ | 861.4 | | 0.87 | % | 978,529 | | Worcester, MA-CT | 57 |

| Worcester Behavioral | AIB | 81,972 | | 1.95 | % | $ | 2,690.9 | | 2.72 | % | 978,529 | | Worcester, MA-CT | 57 |

| Los Alamos Professional Plaza | MOB | 43,395 | | 1.03 | % | $ | 648.7 | | 0.66 | % | 870,781 | | McAllen-Edinburg-Mission, TX | 65 |

| Everest Rehabilitation Hospital | IRF | 38,000 | | 0.90 | % | $ | 2,138.5 | | 2.16 | % | 868,859 | | El Paso, TX | 67 |

| Cardiology Associates of Greater Waterbury | PC | 16,793 | | 0.40 | % | $ | 323.3 | | 0.33 | % | 864,835 | | New Haven-Milford, CT | 68 |

| Columbia Gastroenterology Surgery Center | MOB | 17,016 | | 0.40 | % | $ | 344.1 | | 0.35 | % | 829,470 | | Columbia, SC | 72 |

| | | | | | | | |

| Community Healthcare Trust | Page | 19 | 3Q 2023 | Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Area | % of Square Feet | Annualized

Rent ($000's) | % of Annualized

Rent | Population | MSA/MISA | Rank |

| Davita Turner Road | SC | 18,125 | | 0.43 | % | $ | 351.8 | | 0.36 | % | 814,049 | | Dayton-Kettering, OH | 73 |

| Davita Springboro Pike | SC | 10,510 | | 0.25 | % | $ | 182.6 | | 0.18 | % | 814,049 | | Dayton-Kettering, OH | 73 |

| Davita Business Center Court | SC | 12,988 | | 0.31 | % | $ | 228.4 | | 0.23 | % | 814,049 | | Dayton-Kettering, OH | 73 |

| Genesis Care - Bonita Springs | SC | 4,445 | | 0.11 | % | $ | 279.7 | | 0.28 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Cape Coral Suite 3 | SC | 12,130 | | 0.29 | % | $ | 437.3 | | 0.44 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Cape Coral Suite 3A | MOB | 2,023 | | 0.05 | % | $ | 37.9 | | 0.04 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Cape Coral Suite 5 & 6 | MOB | 6,379 | | 0.15 | % | $ | 98.1 | | 0.10 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Colonial Blvd Office | SC | 46,356 | | 1.10 | % | $ | — | | — | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Corporate Office 3660 | MOB | 22,104 | | 0.53 | % | $ | 602.3 | | 0.61 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Corporate Annex Building | MOB | 16,000 | | 0.38 | % | $ | 301.1 | | 0.30 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Wildwood Hammock RPET Facility | SC | 10,832 | | 0.26 | % | $ | 416.6 | | 0.42 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Wildwood Hammock - Diagnostic Imaging | SC | 9,376 | | 0.22 | % | $ | 393.8 | | 0.40 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Wildwood Hammock - Northland | MOB | 1,201 | | 0.03 | % | $ | 13.2 | | 0.01 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Eye Health of America 4101 | MOB | 43,322 | | 1.03 | % | $ | 1,004.4 | | 1.01 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Eye Health of America 2665 | MOB | 3,200 | | 0.08 | % | $ | 54.7 | | 0.06 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Eye Health of America 1320 | MOB | 6,757 | | 0.16 | % | $ | 79.7 | | 0.08 | % | 760,822 | | Cape Coral-Fort Myers, FL | 78 |

| Parkway Professional Plaza | MOB | 40,918 | | 0.97 | % | $ | 815.3 | | 0.82 | % | 725,046 | | Lakeland-Winter Haven, FL | 81 |

| Mercy One Physicians Clinic | PC | 17,318 | | 0.41 | % | $ | 390.4 | | 0.39 | % | 709,466 | | Des Moines-West Des Moines, IA | 82 |

| Novus Clinic | SCH | 14,315 | | 0.34 | % | $ | 300.7 | | 0.30 | % | 702,219 | | Akron, Oh | 83 |

| UH Walden Health Center | PC | 11,000 | | 0.26 | % | $ | 320.5 | | 0.32 | % | 702,219 | | Akron, Oh | 83 |

| UW Health Clinic- Portage | PC | 14,000 | | 0.33 | % | $ | 325.1 | | 0.33 | % | 680,796 | | Madison, WI | 87 |

| Daytona Medical Office | MOB | 20,193 | | 0.48 | % | $ | 369.9 | | 0.37 | % | 668,921 | | Deltona-Daytona Beach-Ormond Beach, FL | 90 |

| Debary Professional Plaza | MOB | 21,874 | | 0.52 | % | $ | 188.5 | | 0.19 | % | 668,921 | | Deltona-Daytona Beach-Ormond Beach, FL | 90 |

| Cypress Medical Center | MOB | 39,746 | | 0.95 | % | $ | 374.6 | | 0.38 | % | 647,610 | | Wichita, KS | 93 |

| Family Medicine East | PC | 16,581 | | 0.39 | % | $ | 331.6 | | 0.34 | % | 647,610 | | Wichita, KS | 93 |

| Grene Vision Center | PC | 18,681 | | 0.44 | % | $ | 314.8 | | 0.32 | % | 647,610 | | Wichita, KS | 93 |

| Perrysburg Medical Arts Building | MOB | 25,930 | | 0.62 | % | $ | 443.4 | | 0.45 | % | 646,604 | | Toledo, OH | 94 |

| St. Vincent Mercy Medical Center, Inc. | PC | 23,368 | | 0.56 | % | $ | 319.9 | | 0.32 | % | 646,604 | | Toledo, OH | 94 |

| Assurance - Toledo | BSF | 13,290 | | 0.32 | % | $ | 520.8 | | 0.53 | % | 646,604 | | Toledo, OH | 94 |

| Granite Circle | MOB | 17,164 | | 0.41 | % | $ | 236 | | 0.24 | % | 646,604 | | Toledo, OH | 94 |

| | | | | | | | |

| Community Healthcare Trust | Page | 20 | 3Q 2023 | Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Area | % of Square Feet | Annualized

Rent ($000's) | % of Annualized

Rent | Population | MSA/MISA | Rank |

| Bassin Center For Plastic Surgery-Melbourne | PC | 5,228 | | 0.12 | % | $ | 307.4 | | 0.31 | % | 606,612 | | Palm Bay-Melbourne-Titusville, FL | 96 |

| Penn State Health - Camp Hill | SC | 8,400 | | 0.20 | % | $ | 178.2 | | 0.18 | % | 591,712 | | Harrisburg-Carlisle, PA | 98 |

| Penn State Health - Harrisburg | SC | 10,000 | | 0.24 | % | $ | 195 | | 0.20 | % | 591,712 | | Harrisburg-Carlisle, PA | 98 |

| Eynon Surgery Center | SCH | 6,500 | | 0.15 | % | $ | 195.8 | | 0.20 | % | 567,559 | | Scranton--Wilkes-Barre, PA | 100 |

| Riverview Medical Center | MOB | 26,199 | | 0.62 | % | $ | 444.2 | | 0.45 | % | 567,559 | | Scranton--Wilkes-Barre, PA | 100 |

| NEI | MOB | 22,743 | | 0.54 | % | $ | 409.4 | | 0.41 | % | 567,559 | | Scranton--Wilkes-Barre, PA | 100 |

| NEI | MOB | 15,768 | | 0.38 | % | $ | 304.9 | | 0.31 | % | 567,559 | | Scranton--Wilkes-Barre, PA | 100 |

| Grandview Plaza | MOB | 20,000 | | 0.48 | % | $ | 306.3 | | 0.31 | % | 552,984 | | Lancaster, PA | 102 |

| Pinnacle Health | PC | 10,753 | | 0.26 | % | $ | 246 | | 0.25 | % | 552,984 | | Lancaster, PA | 102 |

| Manteca Medical Group Building | PC | 10,564 | | 0.25 | % | $ | 304.3 | | 0.31 | % | 552,878 | | Modesto, CA | 103 |

| Everest Rehabilitation Hospital | IRF | 38,817 | | 0.92 | % | $ | 2,228.7 | | 2.25 | % | 546,725 | | Fayetteville-Springdale-Rogers, AR | 105 |

| UPMC Specialty Care | MOB | 25,982 | | 0.62 | % | $ | 453.4 | | 0.46 | % | 541,243 | | Youngstown-Warren-Boardman, OH-PA | 107 |

| Treasure Coast Medical Pavilion | MOB | 55,844 | | 1.33 | % | $ | 864.6 | | 0.87 | % | 487,657 | | Port St. Lucie, FL | 115 |

| AMG Specialty Hospital - Lafayette | MOB | 29,062 | | 0.69 | % | $ | — | | — | % | 478,384 | | Lafayette, LA | 116 |

| Everest Rehabilitation Hospital | IRF | 38,817 | | 0.92 | % | $ | 2,246.6 | | 2.27 | % | 475,367 | | Killeen-Temple, TX | 118 |

| Biltmore Medical Office | SC | 10,850 | | 0.26 | % | $ | — | | — | % | 469,015 | | Asheville, NC | 120 |

| Genesis Care - Weaverville | SC | 10,696 | | 0.25 | % | $ | 443.2 | | 0.45 | % | 469,015 | | Asheville, NC | 120 |

| Martin Foot & Ankle Clinic | PC | 27,100 | | 0.64 | % | $ | 414.9 | | 0.42 | % | 456,438 | | York-Hanover, PA | 121 |

| Affinity Health Center | MOB | 47,366 | | 1.13 | % | $ | 506.7 | | 0.51 | % | 401,574 | | Canton-Massillon, OH | 137 |

| Hills & Dales Professional Center | MOB | 27,920 | | 0.66 | % | $ | 352.8 | | 0.36 | % | 401,574 | | Canton-Massillon, OH | 137 |

| Prattville Town Center Medical Office Bldg | MOB | 13,319 | | 0.32 | % | $ | 379.7 | | 0.38 | % | 386,047 | | Montgomery, AL | 142 |

| Wellmont Bristol Urgent Care | SC | 4,548 | | 0.11 | % | $ | 76.2 | | 0.08 | % | 307,614 | | Kingsport-Bristol, TN-VA | 165 |

| Bristol Pediatric Associates | MOB | 10,804 | | 0.26 | % | $ | 183.5 | | 0.19 | % | 307,614 | | Kingsport-Bristol, TN-VA | 165 |

| Bluewater Orthopedics Center | MOB | 10,255 | | 0.24 | % | $ | 218.2 | | 0.22 | % | 286,973 | | Crestview-Fort Walton Beach-Destin, FL | 171 |

| Everest Rehabilitation Hospital | IRF | 38,817 | | 0.92 | % | $ | 2,280.3 | | 2.30 | % | 286,184 | | Longview, TX | 172 |

| Londonderry Centre | MOB | 21,115 | | 0.50 | % | $ | 339.8 | | 0.34 | % | 277,547 | | Waco, TX | 176 |

| Meridian Behavioral Health Systems | AIB | 132,430 | | 3.15 | % | $ | 3,136.8 | | 3.17 | % | 258,859 | | Charleston, WV | 190 |

| Gulf Coast Cancer Centers-Foley | SC | 6,146 | | 0.15 | % | $ | 169.6 | | 0.17 | % | 231,767 | | Daphne-Fairhope-Foley, AL | 200 |

| Gulf Coast Cancer Centers- Gulf Shores | SC | 6,398 | | 0.15 | % | $ | 131.8 | | 0.13 | % | 231,767 | | Daphne-Fairhope-Foley, AL | 200 |

| Monroe Surgical Hospital | SCH | 58,121 | | 1.38 | % | $ | 2,354.5 | | 2.38 | % | 207,104 | | Monroe, LA | 219 |

| Fresenius Ft. Valley | SC | 4,920 | | 0.12 | % | $ | 83.6 | | 0.08 | % | 191,614 | | Warner Robins, GA | 228 |

| | | | | | | | |

| Community Healthcare Trust | Page | 21 | 3Q 2023 | Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Area | % of Square Feet | Annualized

Rent ($000's) | % of Annualized

Rent | Population | MSA/MISA | Rank |

| Tuscola Professional Building | MOB | 25,500 | | 0.61 | % | $ | 610.2 | | 0.62 | % | 190,124 | | Saginaw, MI | 229 |

| Genesis Care - Redding | SC | 12,206 | | 0.29 | % | $ | 587.5 | | 0.59 | % | 182,155 | | Redding, CA | 233 |

| Kedplasma | SC | 12,870 | | 0.31 | % | $ | 272.1 | | 0.27 | % | 171,415 | | Burlington, NC | 251 |

| Decatur Morgan Hospital Medical Office Building | MOB | 35,933 | | 0.86 | % | $ | 580.1 | | 0.59 | % | 156,494 | | Decatur, AL | 268 |

| Provena Medical Center | MOB | 54,894 | | 1.31 | % | $ | 700.9 | | 0.71 | % | 107,502 | | Kankakee, IL | 346 |

| Parkside Family & Davita Clinics | MOB | 15,637 | | 0.37 | % | $ | 215.5 | | 0.22 | % | 98,331 | | Victoria, TX | 361 |

| Cub Lake Square | MOB | 49,059 | | 1.17 | % | $ | 1,114.4 | | 1.13 | % | 108,650 | | Show Low, AZ | N/A |

| Cub Lake Square - Building B | MOB | — | | — | % | $ | — | | — | % | 108,650 | | Show Low, AZ | N/A |

| Cub Lake Square - Building C | MOB | — | | — | % | $ | — | | — | % | 108,650 | | Show Low, AZ | N/A |

| Emory Healthcare | MOB | 61,301 | | 1.46 | % | $ | 871.7 | | 0.88 | % | 104,279 | | LaGrange, GA-AL | N/A |

| Emory Southern Orthopedics | MOB | 31,473 | | 0.75 | % | $ | 699.7 | | 0.71 | % | 104,279 | | LaGrange, GA-AL | N/A |

| Emory Southern Orthopedics | MOB | 2,972 | | 0.07 | % | $ | 60.3 | | 0.06 | % | 104,279 | | LaGrange, GA-AL | N/A |

| Emory Healthcare | MOB | 5,600 | | 0.13 | % | $ | 79.6 | | 0.08 | % | 104,279 | | LaGrange, GA-AL | N/A |

| Marion Medical Plaza | MOB | 27,246 | | 0.65 | % | $ | 346.5 | | 0.35 | % | 64,642 | | Marion, OH | N/A |

| Davita Dialysis | MOB | 12,545 | | 0.30 | % | $ | 457.8 | | 0.46 | % | 54,738 | | Pahrump, NV | N/A |

| Davita Etowah Dialysis Center | SC | 4,720 | | 0.11 | % | $ | 67.4 | | 0.07 | % | 54,719 | | Athens, TN | N/A |

| Fresenius Dialysis Center | MOB | 17,746 | | 0.42 | % | $ | 351.9 | | 0.36 | % | 54,636 | | Corsicana, TX | N/A |

| Fresenius Gallipolis Dialysis Center | SC | 15,110 | | 0.36 | % | $ | 157.9 | | 0.16 | % | 54,068 | | Point Pleasant, WV-OH | N/A |

| Arkansas Valley Surgery Center | MOB | 10,853 | | 0.26 | % | $ | 270.4 | | 0.27 | % | 49,621 | | Cañon City, CO | N/A |

| Sanford West Behavioral Facility | BSF | 96,886 | | 2.31 | % | $ | 1,338.5 | | 1.35 | % | 45,205 | | Grand Rapids, MN | N/A |

| Wellmont Norton Urgent Care | SC | 4,843 | | 0.12 | % | $ | 56.8 | | 0.06 | % | 39,030 | | Big Stone Gap, VA | N/A |

| Wellmont Associates Complex | MOB | 32,757 | | 0.78 | % | $ | 359.1 | | 0.36 | % | 39,030 | | Big Stone Gap, VA | N/A |

| Fremont Medical Office Building & Surgery Ctr | MOB | 13,050 | | 0.31 | % | $ | 325.5 | | 0.33 | % | 36,997 | | Fremont, NE | N/A |

| Eyecare Partners | PC | 8,421 | | 0.20 | % | $ | 134.3 | | 0.14 | % | 36,914 | | Centralia, IL | N/A |

| Gulf Coast Cancer Centers-Brewton | SC | 3,971 | | 0.09 | % | $ | 109.6 | | 0.11 | % | 36,666 | | Atmore, AL | N/A |

| Baylor Scott & White Clinic | PC | 37,354 | | 0.89 | % | $ | 485.8 | | 0.49 | % | 36,159 | | Brenham, TX | N/A |

| Ottumwa Medical Clinic | MOB | 68,895 | | 1.64 | % | $ | 728.8 | | 0.74 | % | 35,043 | | Ottumwa, IA | N/A |

| Ottumwa Medical Clinic | MOB | 6,850 | | 0.16 | % | $ | 92.5 | | 0.09 | % | 35,043 | | Ottumwa, IA | N/A |

| Sanderling Dialysis Center | SC | 4,186 | | 0.10 | % | $ | 295.1 | | 0.30 | % | 27,082 | | Crescent City, CA | N/A |

| Russellville Medical Plaza | MOB | 29,129 | | 0.69 | % | $ | 158.9 | | 0.16 | % | County: 31,362 | Rural - No CBSA | N/A |

| Genesis Care - Andalusia | SC | 10,373 | | 0.25 | % | $ | 394.2 | | 0.40 | % | County: 37,049 | Rural - No CBSA | N/A |

| | | | | | | | |

| Community Healthcare Trust | Page | 22 | 3Q 2023 | Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Area | % of Square Feet | Annualized

Rent ($000's) | % of Annualized

Rent | Population | MSA/MISA | Rank |

| Lexington Carilion Clinic | PC | 15,820 | | 0.38 | % | $ | 376.7 | | 0.38 | % | County: 22,573 | Rural - No CBSA | N/A |

| Dahlonega Medical Mall | MOB | 22,804 | | 0.54 | % | $ | 281.2 | | 0.28 | % | County: 33,610 | Rural - No CBSA | N/A |

| Batesville Regional Medical Center | MOB | 9,263 | | 0.22 | % | $ | 49.5 | | 0.05 | % | County: 34,192 | Rural - No CBSA | N/A |

| Tri Lakes Behavioral | BSF | 58,400 | | 1.39 | % | $ | 696 | | 0.70 | % | County: 34,192 | Rural - No CBSA | N/A |

| North Mississippi Health Services | MOB | 17,629 | | 0.42 | % | $ | 94.3 | | 0.10 | % | County: 35,252 | Rural - No CBSA | N/A |

| North Mississippi Health Services | MOB | 27,743 | | 0.66 | % | $ | 148.4 | | 0.15 | % | County: 35,252 | Rural - No CBSA | N/A |

| North Mississippi Health Services | MOB | 18,074 | | 0.43 | % | $ | 96.7 | | 0.10 | % | County: 35,252 | Rural - No CBSA | N/A |