0000763744FALSE00007637442024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

| | | | | | | | | | | | | | |

| LCI INDUSTRIES |

| | | | |

| | | | |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 001-13646 | 13-3250533 |

| | | | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | |

| 3501 County Road 6 East, | Elkhart, | Indiana | 46514 |

| | | | |

| (Address of principal executive offices) | (Zip Code) |

| | | | |

| Registrant's telephone number, including area code: | (574) | 535-1125 |

| | | | |

| | | | |

| N/A |

| | | | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value | LCII | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 6, 2024, LCI Industries issued a press release setting forth LCI Industries' second quarter 2024 results. A copy of the press release is attached hereto as Exhibit 99.1.

An investor presentation that LCI Industries will refer to during its conference call to discuss the results is attached hereto as Exhibit 99.2 and will be posted on LCI Industries' investor relations website in advance of the call.

The foregoing information is furnished pursuant to Item 2.02, "Results of Operations and Financial Condition." Such information, including the Exhibits attached hereto, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

Exhibit Index:

| | | | | | | | |

| | |

| | Press Release dated August 6, 2024 |

| | |

| | Investor Presentation dated August 6, 2024 |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

LCI INDUSTRIES |

(Registrant) |

|

|

By: /s/ Lillian D. Etzkorn Lillian D. Etzkorn Chief Financial Officer |

|

|

| Dated: | August 6, 2024 |

Exhibit 99.1 | | | | | | | | |

FOR IMMEDIATE RELEASE | | |

Contact: Lillian D. Etzkorn, CFO |

Phone: (574) 535-1125 |

E Mail: LCII@lci1.com |

| |

LCI INDUSTRIES REPORTS SECOND QUARTER FINANCIAL RESULTS

Delivered revenue growth and strong margin expansion

Second Quarter 2024 Highlights

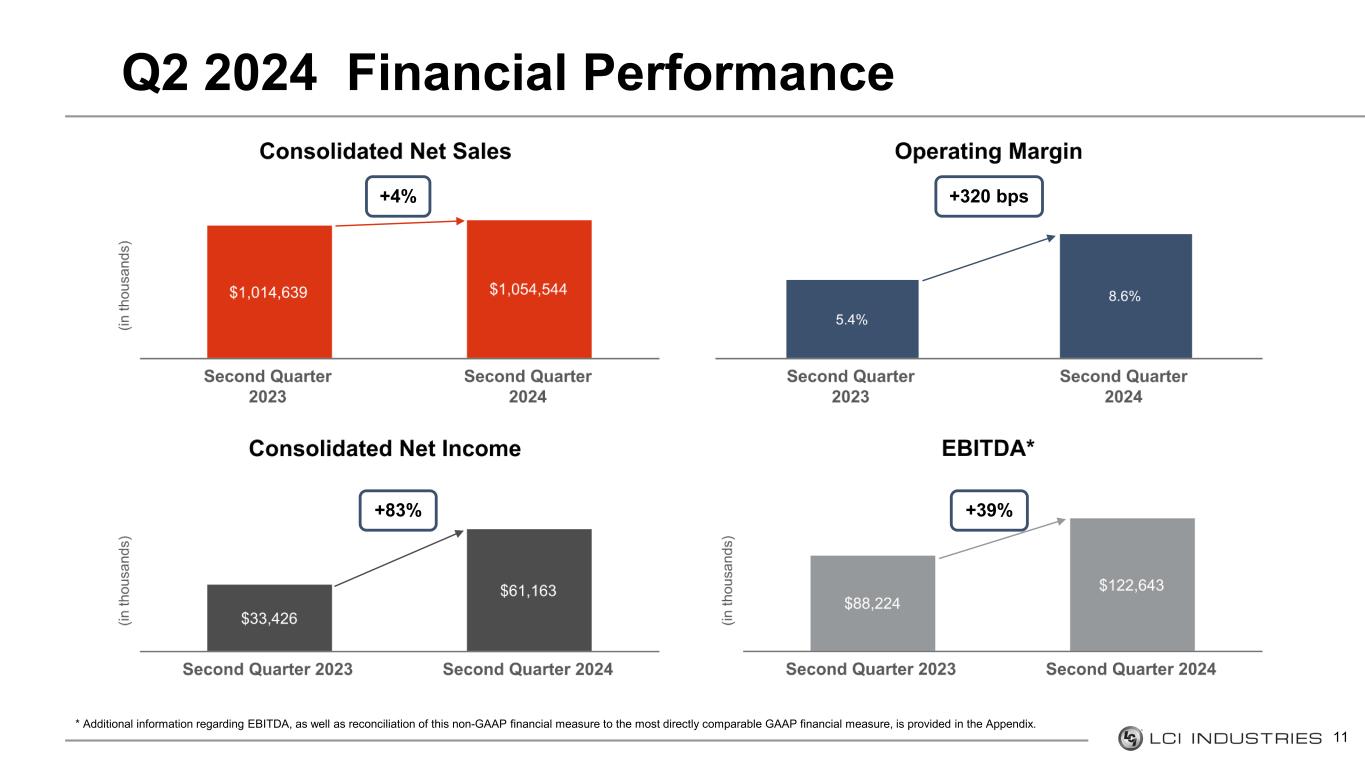

•Net sales of $1.1 billion in the second quarter, up 4% year-over-year

•Net income of $61 million, or $2.40 per diluted share, in the second quarter, up from $33 million, or $1.31 per diluted share, in the second quarter of 2023

•EBITDA of $123 million in the second quarter, up 39% year-over-year

•Operating profit margin of 8.6% in the second quarter, up from 5.4% in the second quarter of 2023

•Inventory reduction of $142 million from the second quarter of 2023

•Quarterly dividend of $1.05 per share paid, totaling $27 million in the second quarter

•Cash flows provided by operations of $439 million for the LTM period ended June 30, 2024

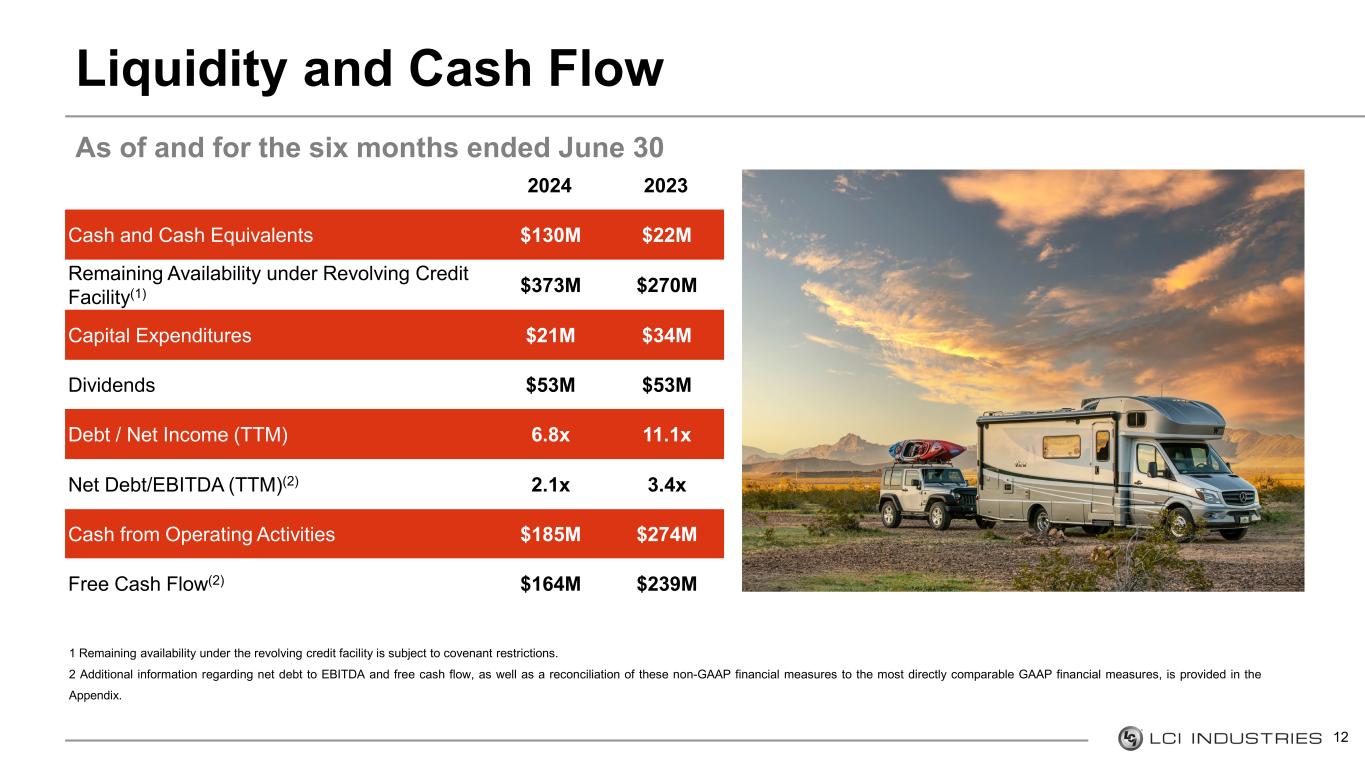

•Improved liquidity position with $130 million of cash and cash equivalents and $373 million of availability on revolving credit facility at June 30, 2024, up sequentially from $23 million of cash and cash equivalents and $154 million of availability at March 31, 2024

Elkhart, Indiana - August 6, 2024 - LCI Industries (NYSE: LCII) which, through its wholly-owned subsidiary, Lippert Components, Inc. ("Lippert"), supplies, domestically and internationally, a broad array of highly engineered components for the leading original equipment manufacturers ("OEMs") in the recreation and transportation markets, and the related aftermarkets of those industries, today reported second quarter 2024 results.

“We delivered strong second quarter results, with revenue growth in towable RV OEM, Aftermarket, and certain Adjacent OEM businesses while achieving over 300 basis points of operating profit margin expansion compared to the second quarter of 2023,” commented Jason Lippert, LCI Industries’ President and Chief Executive Officer. “Our strategy has been working. Diversification continues to help mitigate market cyclicality and support margins, while innovation is fueling content growth. Continued expansion into new product markets is also broadening our reach, which has opened up over $12 billion in combined addressable opportunities across our business. As a result, we continue to deliver strong results in a challenging backdrop and are well-placed to benefit meaningfully when the RV market rebounds and retail demand improves.”

“We are generating substantial cash flows through disciplined working capital management, having notably reduced inventories by $142 million in the past year, as well as by taking action to optimize and enhance our manufacturing footprint. Efforts to increase efficiencies, driving operational effectiveness through continuous improvements, are also helping to lift profitability. As our results reinforce our financial foundation, we plan to continue paying down debt and investing in growth opportunities for our business,” continued Mr. Lippert. “Heading further into the year, we will keep executing our strategy and drive sustained value creation for our stakeholders.”

“Thanks to the hard work and dedication of our team members, we showed solid performance in the second quarter while navigating a challenging environment. Through a consistent focus on our key strategic pillars, including customer service, safety, quality, culture and leadership, and innovation, we are delivering profitable growth while solidifying our leading position across the recreation space,” commented Ryan Smith, LCI Industries' Group President - North America.

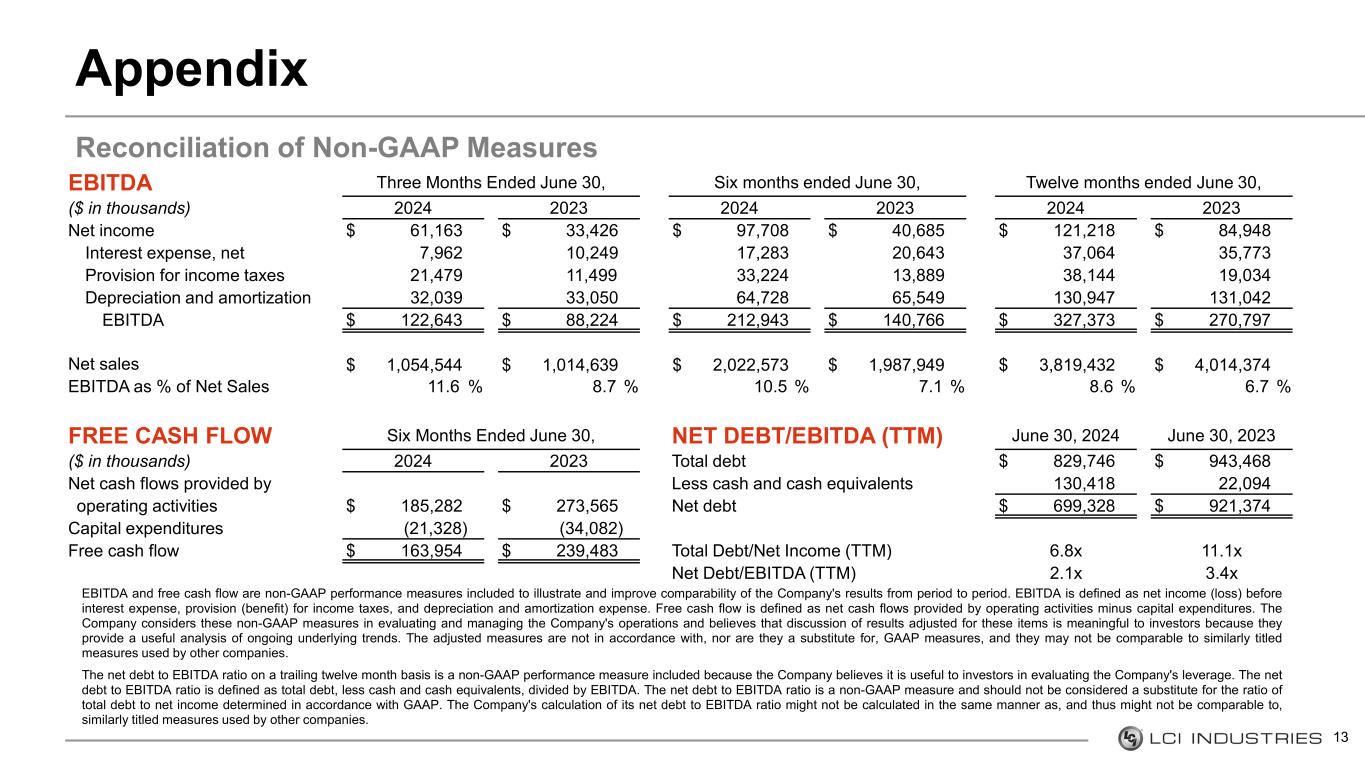

Second Quarter 2024 Results

Consolidated net sales for the second quarter of 2024 were $1.1 billion, an increase of 4% from 2023 second quarter net sales of $1.0 billion. Net income in the second quarter of 2024 was $61.2 million, or $2.40 per diluted share, compared to $33.4 million, or $1.31 per diluted share, in the second quarter of 2023. EBITDA in the second quarter of 2024 was $122.6 million, compared to EBITDA of $88.2 million in the second quarter of 2023. Additional information regarding EBITDA, as well as reconciliations of this non-GAAP financial measure to the most directly comparable GAAP financial measure of net income, is provided in the "Supplementary Information - Reconciliation of Non-GAAP Measures" section below.

The increase in year-over-year net sales for the second quarter of 2024 was primarily driven by increased North American RV wholesale shipments of travel trailers and fifth-wheels and market share gains in the automotive aftermarket, partially offset by lower North American marine sales volume.

July 2024 Results

July 2024 consolidated net sales were approximately $311 million, up 6% from July 2023, primarily due to an approximate 15% increase in North American RV production, partially offset by an approximate 16% decline in marine sales compared to July 2023.

OEM Segment - Second Quarter Performance

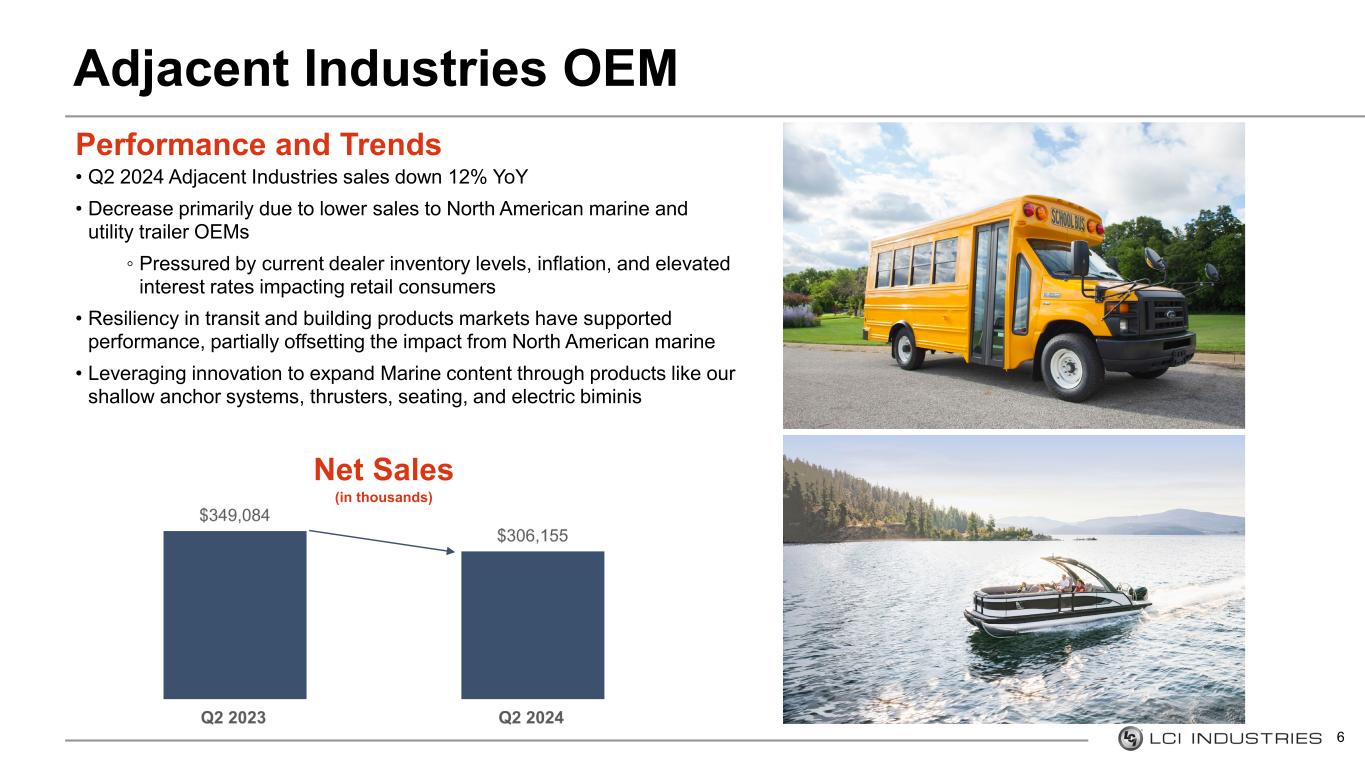

OEM net sales for the second quarter of 2024 were $796.1 million, an increase of $37.1 million compared to the same period of 2023. RV OEM net sales for the second quarter of 2024 were $490.0 million, up 20% compared to the same prior year period, driven by a 15% increase in North American travel trailer and fifth-wheel wholesale shipments, increased selling prices which are indexed to select commodities, and market share gains. Adjacent Industries OEM net sales for the second quarter of 2024 were $306.2 million, down 12% year-over-year, primarily due to lower sales to North American marine and utility trailers OEMs, driven by current dealer inventory levels, inflation, and rising interest rates impacting retail consumers. North American marine OEM net sales in the second quarter of 2024 were $64.2 million, down 33% year-over-year.

Operating profit of the OEM Segment was $50.6 million in the second quarter of 2024, or 6.4% of net sales, compared to $18.6 million, or 2.5% of net sales, in the same period in 2023. The operating profit expansion of the OEM Segment for the quarter was primarily driven by decreased material and freight costs.

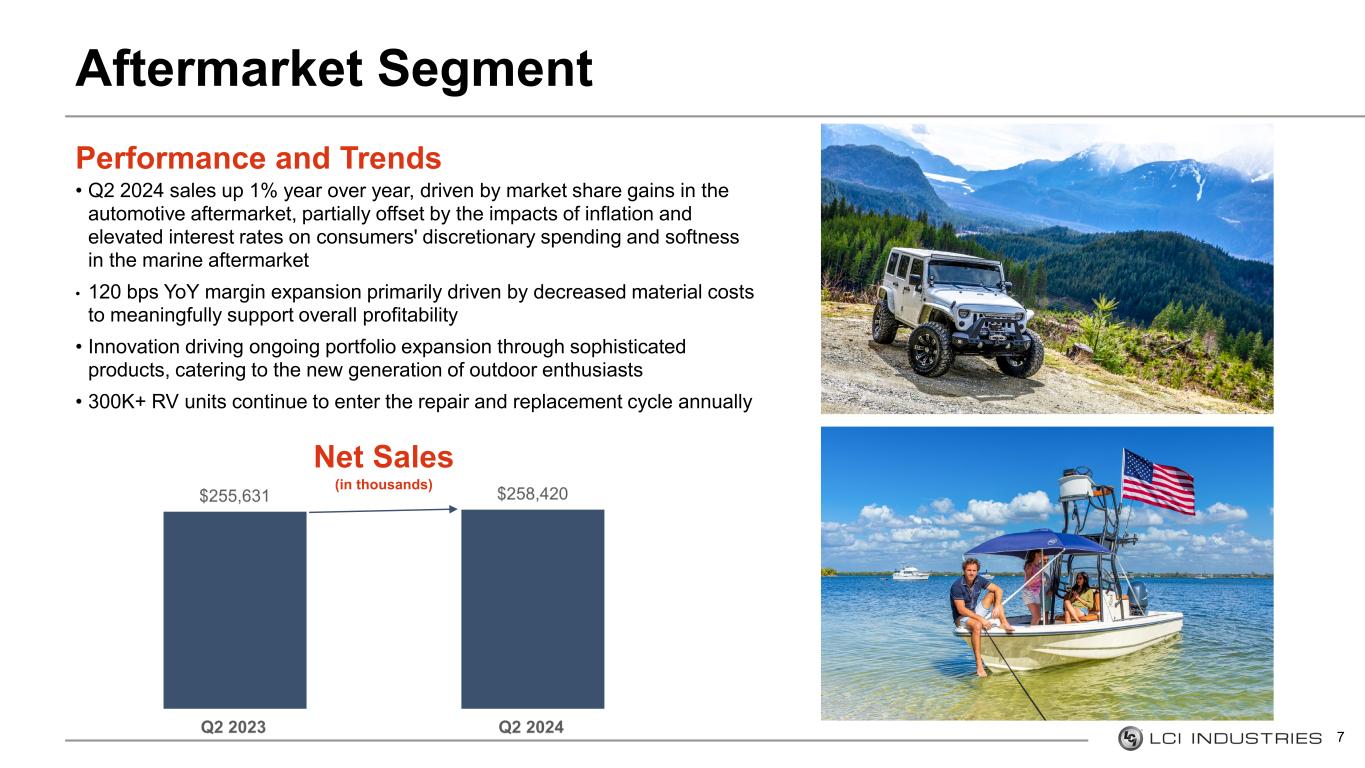

Aftermarket Segment - Second Quarter Performance

Aftermarket net sales for the second quarter of 2024 were $258.4 million, up 1% year-over-year, primarily driven by market share gains in the automotive aftermarket, partially offset by lower volumes within marine and RV aftermarkets, which have been negatively impacted by lower consumers' discretionary spending. Operating profit of the Aftermarket Segment was $40.0 million in the second quarter of 2024, or 15.5% of net sales, compared to $36.5 million, or 14.3% of net sales, in the same period in 2023. The operating profit expansion of the Aftermarket Segment for the quarter was primarily driven by decreased material and freight costs, partially offset by increased labor costs and investments to expand capacity within the automotive aftermarket.

“Our Aftermarket business remains healthy, as we delivered another quarter of solid margin expansion, continuing to support overall profitability for Lippert. Strength in the automotive aftermarket was a primary driver during the quarter, along with the structural tailwind from the record number of RVs entering the repair, replacement, and upgrade cycle,” commented Jamie Schnur, LCI Industries’ Group President – Aftermarket commented. “We look

forward to continue delivering long-term, profitable growth as we leverage our core competencies and seek to gain share in premium markets like appliances, transportation, and building products.”

Income Taxes

The Company's effective tax rate was 26.0% for the quarter ended June 30, 2024, compared to 25.6% for the quarter ended June 30, 2023. The increase in the effective tax rate was primarily due to a discrete tax expense related to the surrender of certain company-owned life insurance policies.

Balance Sheet and Other Items

At June 30, 2024, the Company's cash and cash equivalents balance was $130.4 million, compared to $66.2 million at December 31, 2023. The Company used $53.5 million for dividend payments to shareholders, $21.3 million for capital expenditures, and $20.0 million for an acquisition in the six months ended June 30, 2024.

The Company remained focused on inventory reductions to improve cash generation and optimize working capital in the second quarter. As of June 30, 2024, the Company's net inventory balance was $687.9 million, down from $768.4 million at December 31, 2023 and $830.0 million at June 30, 2023.

The Company's outstanding long-term indebtedness, including current maturities, was $829.7 million at June 30, 2024, and the Company was in compliance with its debt covenants. As of June 30, 2024, the Company had $130.4 million of cash and cash equivalents, and the Company had $373.1 million of borrowing availability under the revolving credit facility.

Conference Call & Webcast

LCI Industries will host a conference call to discuss its second quarter results on Tuesday, August 6, 2024, at 8:30 a.m. Eastern time, which may be accessed by dialing (833) 470-1428 for participants in the U.S. and (929) 526-1599 for participants outside the U.S. using the required conference ID 439054. Due to the high volume of companies reporting earnings at this time, please be prepared for hold times of up to 15 minutes when dialing in to the call. In addition, an online, real-time webcast, as well as a supplemental earnings presentation, can be accessed on the Company's website, www.investors.lci1.com.

A replay of the conference call will be available for two weeks by dialing (866) 813-9403 for participants in the U.S. and (44) 204-525-0658 for participants outside the U.S. and referencing access code 716397. A replay of the webcast will be available on the Company’s website immediately following the conclusion of the call.

About LCI Industries

LCI Industries, through its wholly-owned subsidiary, Lippert, supplies, domestically and internationally, a broad array of highly engineered components for the leading OEMs in the recreation and transportation markets, consisting primarily of recreational vehicles and adjacent industries, including boats; buses; trailers used to haul boats, livestock, equipment, and other cargo; trucks; trains; manufactured homes; and modular housing. The Company also supplies engineered components to the related aftermarkets of these industries, primarily by selling to retail dealers, wholesale distributors, and service centers, as well as direct to retail customers via the Internet. Lippert's products include steel chassis and related components; axles and suspension solutions; slide-out mechanisms and solutions; thermoformed bath, kitchen, and other products; vinyl, aluminum, and frameless windows; manual, electric, and hydraulic stabilizer and leveling systems; entry, luggage, patio, and ramp doors; furniture and mattresses; electric and manual entry steps; awnings and awning accessories; towing products; truck accessories; electronic components; appliances; air conditioners; televisions and sound systems; tankless water heaters; and other accessories. Additional information about Lippert and its products can be found at www.lippert.com.

Forward-Looking Statements

This press release contains certain "forward-looking statements" with respect to our financial condition, results of operations, profitability, margin growth, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company's common stock, the impact of legal proceedings, and other matters. Statements in this press release that are not historical facts are "forward-looking statements" for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties.

Forward-looking statements, including, without limitation, those relating to production levels, future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, commodity prices, addressable markets, and industry trends, whenever they occur in this press release are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this press release, the impacts of future pandemics, geopolitical tensions, armed conflicts, or natural disasters on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace of and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices, and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company's subsequent filings with the Securities and Exchange Commission. Readers of this press release are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

###

LCI INDUSTRIES

OPERATING RESULTS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, | | Last Twelve |

| | 2024 | | 2023 | | 2024 | | 2023 | | Months |

| (In thousands, except per share amounts) | | | | | | | | | |

| | | | | | | | | |

| Net sales | $ | 1,054,544 | | | $ | 1,014,639 | | | $ | 2,022,573 | | | $ | 1,987,949 | | | $ | 3,819,432 | |

| Cost of sales | 788,099 | | | 796,519 | | | 1,532,222 | | | 1,583,758 | | | 2,957,082 | |

| Gross profit | 266,445 | | | 218,120 | | | 490,351 | | | 404,191 | | | 862,350 | |

| Selling, general and administrative expenses | 175,841 | | | 162,946 | | | 342,136 | | | 328,974 | | | 665,924 | |

| | | | | | | | | |

| Operating profit | 90,604 | | | 55,174 | | | 148,215 | | | 75,217 | | | 196,426 | |

| Interest expense, net | 7,962 | | | 10,249 | | | 17,283 | | | 20,643 | | | 37,064 | |

| Income before income taxes | 82,642 | | | 44,925 | | | 130,932 | | | 54,574 | | | 159,362 | |

| Provision for income taxes | 21,479 | | | 11,499 | | | 33,224 | | | 13,889 | | | 38,144 | |

| Net income | $ | 61,163 | | | $ | 33,426 | | | $ | 97,708 | | | $ | 40,685 | | | $ | 121,218 | |

| | | | | | | | | |

| Net income per common share: | | | | | | | | | |

| Basic | $ | 2.40 | | | $ | 1.32 | | | $ | 3.86 | | | $ | 1.61 | | | $ | 4.78 | |

| Diluted | $ | 2.40 | | | $ | 1.31 | | | $ | 3.85 | | | $ | 1.60 | | | $ | 4.76 | |

| | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | |

| Basic | 25,473 | | | 25,329 | | | 25,344 | | | 25,273 | | | 25,386 | |

| Diluted | 25,504 | | | 25,437 | | | 25,367 | | | 25,359 | | | 25,485 | |

| | | | | | | | | |

| Depreciation | $ | 17,936 | | | $ | 18,867 | | | $ | 36,521 | | | $ | 37,117 | | | $ | 74,096 | |

| Amortization | $ | 14,103 | | | $ | 14,183 | | | $ | 28,207 | | | $ | 28,432 | | | $ | 56,851 | |

| Capital expenditures | $ | 12,720 | | | $ | 16,923 | | | $ | 21,328 | | | $ | 34,082 | | | $ | 49,455 | |

LCI INDUSTRIES

SEGMENT RESULTS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, | | Last Twelve |

| 2024 | | 2023 | | 2024 | | 2023 | | Months |

| (In thousands) | | | | | | | | | |

| Net sales: | | | | | | | | | |

| OEM Segment: | | | | | | | | | |

| RV OEMs: | | | | | | | | | |

| Travel trailers and fifth-wheels | $ | 426,349 | | | $ | 338,739 | | | $ | 817,112 | | | $ | 669,292 | | | $ | 1,506,673 | |

| Motorhomes | 63,620 | | | 71,185 | | | 132,458 | | | 140,736 | | | 261,079 | |

| Adjacent Industries OEMs | 306,155 | | | 349,084 | | | 604,866 | | | 707,152 | | | 1,173,245 | |

| Total OEM Segment net sales | 796,124 | | | 759,008 | | | 1,554,436 | | | 1,517,180 | | | 2,940,997 | |

| Aftermarket Segment: | | | | | | | | | |

| Total Aftermarket Segment net sales | 258,420 | | | 255,631 | | | 468,137 | | | 470,769 | | | 878,435 | |

| Total net sales | $ | 1,054,544 | | | $ | 1,014,639 | | | $ | 2,022,573 | | | $ | 1,987,949 | | | $ | 3,819,432 | |

| | | | | | | | | |

| Operating profit: | | | | | | | | | |

| OEM Segment | $ | 50,562 | | | $ | 18,642 | | | $ | 83,398 | | | $ | 17,921 | | | $ | 82,838 | |

| Aftermarket Segment | 40,042 | | | 36,532 | | | 64,817 | | | 57,296 | | | 113,588 | |

| | | | | | | | | |

| | | | | | | | | |

| Total operating profit | $ | 90,604 | | | $ | 55,174 | | | $ | 148,215 | | | $ | 75,217 | | | $ | 196,426 | |

| | | | | | | | | |

| Depreciation and amortization: | | | | | | | | | |

| OEM Segment depreciation | $ | 13,733 | | | $ | 14,655 | | | $ | 27,768 | | | $ | 29,004 | | | $ | 57,160 | |

| Aftermarket Segment depreciation | 4,203 | | | 4,212 | | | 8,753 | | | 8,113 | | | 16,936 | |

| Total depreciation | $ | 17,936 | | | $ | 18,867 | | | $ | 36,521 | | | $ | 37,117 | | | $ | 74,096 | |

| | | | | | | | | |

| OEM Segment amortization | $ | 10,150 | | | $ | 10,204 | | | $ | 20,430 | | | $ | 20,654 | | | $ | 41,356 | |

| Aftermarket Segment amortization | 3,953 | | | 3,979 | | | 7,777 | | | 7,778 | | | 15,495 | |

| Total amortization | $ | 14,103 | | | $ | 14,183 | | | $ | 28,207 | | | $ | 28,432 | | | $ | 56,851 | |

LCI INDUSTRIES

BALANCE SHEET INFORMATION

(unaudited)

| | | | | | | | | | | | | |

| | June 30, | | | | December 31, |

| | 2024 | | | | 2023 |

| (In thousands) | | | | | |

| | | | | |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | $ | 130,418 | | | | | $ | 66,157 | |

| | | | | |

| Accounts receivable, net | 333,059 | | | | | 214,707 | |

| Inventories, net | 687,870 | | | | | 768,407 | |

| Prepaid expenses and other current assets | 67,637 | | | | | 67,599 | |

| Total current assets | 1,218,984 | | | | | 1,116,870 | |

| Fixed assets, net | 448,025 | | | | | 465,781 | |

| Goodwill | 588,523 | | | | | 589,550 | |

| Other intangible assets, net | 421,713 | | | | | 448,759 | |

| Operating lease right-of-use assets | 239,810 | | | | | 245,388 | |

| | | | | |

| Other long-term assets | 94,924 | | | | | 92,971 | |

| Total assets | $ | 3,011,979 | | | | | $ | 2,959,319 | |

| | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

| Current liabilities | | | | | |

| Current maturities of long-term indebtedness | $ | 558 | | | | | $ | 589 | |

| Accounts payable, trade | 202,622 | | | | | 183,697 | |

| | | | | |

| Current portion of operating lease obligations | 38,656 | | | | | 36,269 | |

| Accrued expenses and other current liabilities | 190,657 | | | | | 174,437 | |

| Total current liabilities | 432,493 | | | | | 394,992 | |

| Long-term indebtedness | 829,188 | | | | | 846,834 | |

| Operating lease obligations | 214,434 | | | | | 222,680 | |

| Deferred taxes | 29,350 | | | | | 32,345 | |

| Other long-term liabilities | 112,101 | | | | | 107,432 | |

| Total liabilities | 1,617,566 | | | | | 1,604,283 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total stockholders' equity | 1,394,413 | | | | | 1,355,036 | |

| Total liabilities and stockholders' equity | $ | 3,011,979 | | | | | $ | 2,959,319 | |

LCI INDUSTRIES

SUMMARY OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| | Six Months Ended

June 30, |

| | 2024 | | 2023 |

| (In thousands) | | | |

| Cash flows from operating activities: | | | |

| Net income | $ | 97,708 | | | $ | 40,685 | |

| Adjustments to reconcile net income to cash flows provided by operating activities: | | | |

| Depreciation and amortization | 64,728 | | | 65,549 | |

| Stock-based compensation expense | 9,301 | | | 9,080 | |

| | | |

| Other non-cash items | 2,238 | | | 2,192 | |

| Changes in assets and liabilities, net of acquisitions of businesses: | | | |

| Accounts receivable, net | (118,962) | | | (80,952) | |

| Inventories, net | 96,351 | | | 209,346 | |

| Prepaid expenses and other assets | (2,746) | | | 11,607 | |

| Accounts payable, trade | 18,977 | | | 37,949 | |

| Accrued expenses and other liabilities | 17,687 | | | (21,891) | |

| Net cash flows provided by operating activities | 185,282 | | | 273,565 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (21,328) | | | (34,082) | |

| Acquisitions of businesses | (19,957) | | | (25,851) | |

| | | |

| | | |

| Other investing activities | 552 | | | 4,344 | |

| Net cash flows used in investing activities | (40,733) | | | (55,589) | |

| Cash flows from financing activities: | | | |

| Vesting of stock-based awards, net of shares tendered for payment of taxes | (9,111) | | | (9,585) | |

| Proceeds from revolving credit facility | 86,248 | | | 234,200 | |

| Repayments under revolving credit facility | (87,766) | | | (402,726) | |

| | | |

| Repayments under term loan and other borrowings | (15,007) | | | (10,703) | |

| | | |

| | | |

| | | |

| | | |

| Payment of dividends | (53,455) | | | (53,154) | |

| Payment of contingent consideration and holdbacks related to acquisitions | — | | | (517) | |

| | | |

| Other financing activities | (2) | | | (834) | |

| Net cash flows used in financing activities | (79,093) | | | (243,319) | |

| Effect of exchange rate changes on cash and cash equivalents | (1,195) | | | (62) | |

| Net increase (decrease) in cash and cash equivalents | 64,261 | | | (25,405) | |

| Cash and cash equivalents at beginning of period | 66,157 | | | 47,499 | |

| Cash and cash equivalents at end of period | $ | 130,418 | | | $ | 22,094 | |

LCI INDUSTRIES

SUPPLEMENTARY INFORMATION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended | | | |

| June 30, | | June 30, | | Last Twelve | |

| 2024 | | 2023 | | 2024 | | 2023 | | Months | |

Industry Data(1) (in thousands of units): | | | | | | | | | | |

| Industry Wholesale Production: | | | | | | | | | | |

| Travel trailer and fifth-wheel RVs | 82.0 | | | 71.6 | | | 155.5 | | | 134.3 | | | 280.4 | | |

| Motorhome RVs | 8.8 | | | 12.1 | | | 19.2 | | | 25.5 | | | 39.8 | | |

| Industry Retail Sales: | | | | | | | | | | |

| Travel trailer and fifth-wheel RVs | 96.4 | | (2) | 109.1 | | | 161.8 | | (2) | 180.9 | | | 307.5 | | (2) |

| Impact on dealer inventories | (14.4) | | (2) | (37.5) | | | (6.3) | | (2) | (46.6) | | | (27.7) | | (2) |

| Motorhome RVs | 11.5 | | (2) | 14.6 | | | 21.3 | | (2) | 25.6 | | | 40.9 | | (2) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | Twelve Months Ended | | | |

| | | | | June 30, | | | |

| | | | | 2024 | | 2023 | | | |

| Lippert Content Per Industry Unit Produced: | | | | | | | |

| Travel trailer and fifth-wheel RV | | | | | $ | 5,237 | | | $ | 5,459 | | | | |

| Motorhome RV | | | | | $ | 3,766 | | | $ | 3,760 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | June 30, | | December 31, | |

| | | | | 2024 | | 2023 | | 2023 | |

Balance Sheet Data (debt availability in millions): | | | | | | | |

Remaining availability under the revolving credit facility (3) | | $ | 373.1 | | | $ | 270.0 | | | $ | 245.3 | | |

| Days sales in accounts receivable, based on last twelve months | | 30.5 | | | 28.4 | | | 30.1 | | |

| Inventory turns, based on last twelve months | | 3.9 | | | 3.2 | | | 3.5 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | 2024 | | | |

| Estimated Full Year Data: | | | | | | | | | | |

| Capital expenditures | | | | | $40 - $60 million | | | |

| Depreciation and amortization | | | | | $125 - $135 million | | | |

| Stock-based compensation expense | | | | | $17 - $22 million | | | |

Annual tax rate | | | | | 24% - 26% | | | |

| | | | | | | | | | |

(1) Industry wholesale production data for travel trailer and fifth-wheel RVs and motorhome RVs provided by the Recreation Vehicle Industry Association. Industry retail sales data provided by Statistical Surveys, Inc.

(2) June 2024 retail sales data for RVs has not been published yet, therefore 2024 retail data for RVs includes an estimate for June 2024 retail units. Retail sales data have historically been revised upwards in future months as various states report.

(3) Remaining availability under the revolving credit facility is subject to covenant restrictions.

LCI INDUSTRIES

SUPPLEMENTARY INFORMATION

RECONCILIATION OF NON-GAAP MEASURES

(unaudited)

The following table reconciles net income to EBITDA.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| (In thousands) | | | | | | | |

| Net income | $ | 61,163 | | | $ | 33,426 | | | $ | 97,708 | | | $ | 40,685 | |

| Interest expense, net | 7,962 | | | 10,249 | | | 17,283 | | | 20,643 | |

| Provision for income taxes | 21,479 | | | 11,499 | | | 33,224 | | | 13,889 | |

| Depreciation expense | 17,936 | | | 18,867 | | | 36,521 | | | 37,117 | |

| Amortization expense | 14,103 | | | 14,183 | | | 28,207 | | | 28,432 | |

| EBITDA | $ | 122,643 | | | $ | 88,224 | | | $ | 212,943 | | | $ | 140,766 | |

| | | | | | | |

| | | | | | | |

In addition to reporting financial results in accordance with U.S. GAAP, the Company has provided the non-GAAP performance measure of EBITDA to illustrate and improve comparability of its results from period to period. EBITDA is defined as net income before interest expense, net, provision for income taxes, depreciation expense, and amortization expense during the three and six month periods ended June 30, 2024 and 2023. The Company considers this non-GAAP measure in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends. The measure is not in accordance with, nor is it a substitute for, GAAP measures, and it may not be comparable to similarly titled measures used by other companies.

LCI Industries Q2 2024 Earnings Conference Call August 6, 2024 1

Forward-Looking Statements This presentation contains certain “forward-looking statements” with respect to our financial condition, results of operations, profitability, margin growth, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company’s common stock, the impact of legal proceedings, and other matters. Statements in this presentation that are not historical facts are “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties. Forward-looking statements, including, without limitation, those relating to the Company's future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, commodity prices and industry trends, whenever they occur in this presentation are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this presentation, the impacts of future pandemics, geopolitical tensions, armed conflicts, or natural disaster on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company’s subsequent filings with the Securities and Exchange Commission, including the Company's Quarterly Reports on the Form 10-Q. Readers of this presentation are cautioned not to place undue reliance on these forward- looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law. This presentation includes certain non-GAAP financial measures, such as EBITDA, EBITDA as a percentage of net sales, net debt to EBITDA leverage, and free cash flow. These non-GAAP financial measures should not be considered a substitute for the comparable GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure are included in the presentation. 2

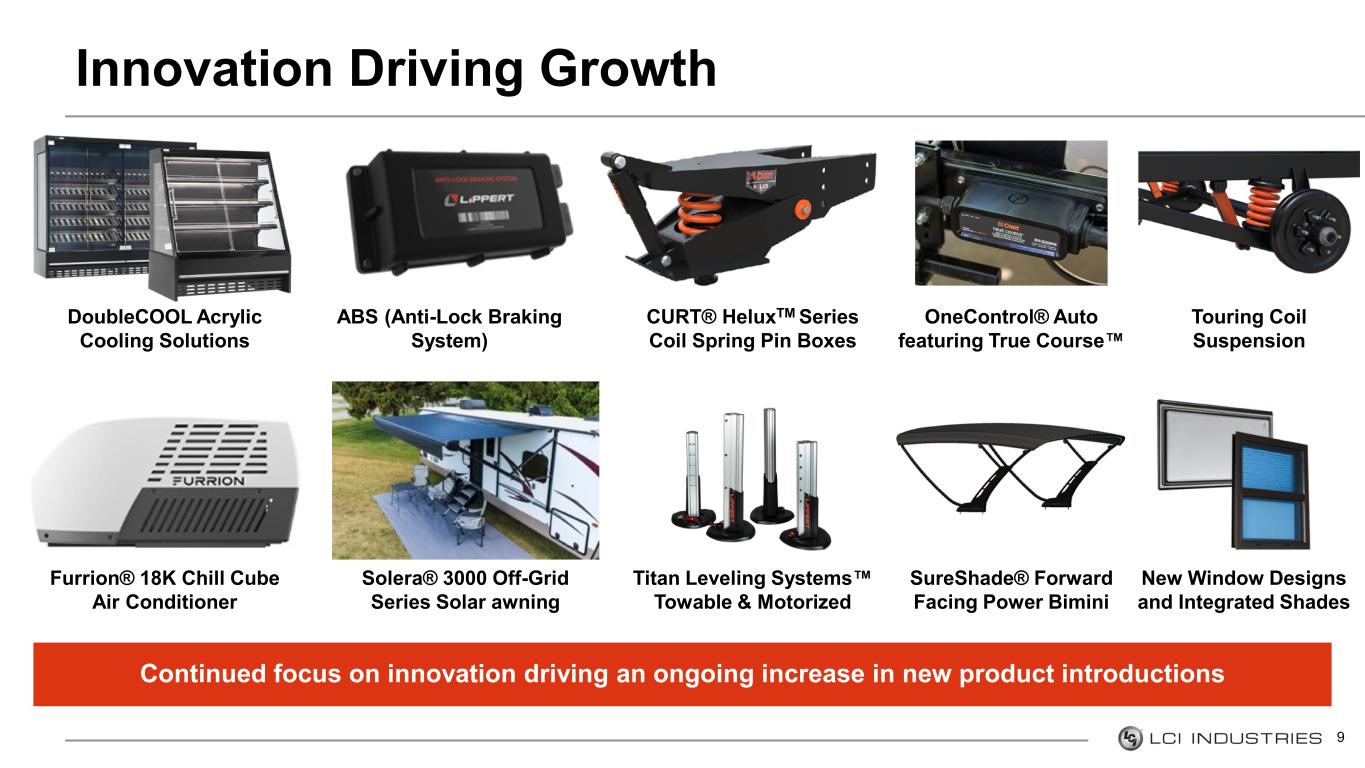

Delivered revenue growth and strong margin expansion Second Quarter 2024 Highlights Financial Performance ■ Net sales of $1.1 in the second quarter, up 4% year- over-year ■ Net income of $61 million in the second quarter, up 83% year-over-year ■ EBITDA1 of $123 million, or 11.6% of net sales, in the second quarter, up 39% year-over-year ■ Inventory reduction of $142 million from the second quarter of 2023 ■ Cash flows provided by operations of $439 million for the LTM period ended June 30, 2024 Executing on Diversification ■ Delivered meaningful operating margin expansion year-over-year in Q2 2024 ■ OEM Segment operating margin up 390 bps ■ Aftermarket Segment operating margin up 120 bps ■ Aftermarket and adjacent industries make up 54% of total Company sales for Q2 2024 Ongoing Innovation Fuels Content ■ Delivered organic towable content growth both sequentially and year-over-year2 ■ Key product innovations: ▪ CURT® HeluxTM Series Coil Spring Pin Boxes ▪ Furrion® 18K Chill Cube Air Conditioner ▪ Touring Coil Suspension ▪ ABS (Anti-lock Braking Systems) ▪ New Window Designs and Integrated Shades 3 1 Additional information regarding EBITDA and reconciliations of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in the Appendix 2 For twelve months ended June 30, 2024 Balanced Capital Allocation ■ Improved liquidity position with $130 million of cash and cash equivalents and $373 million of availability on revolving credit facility at June 30, 2024, up sequentially from $23 million of cash and cash equivalents and $154 million of availability at March 31, 2024 ■ Returned $53 million of capital to shareholders with quarterly dividends YTD through June 30, 2024

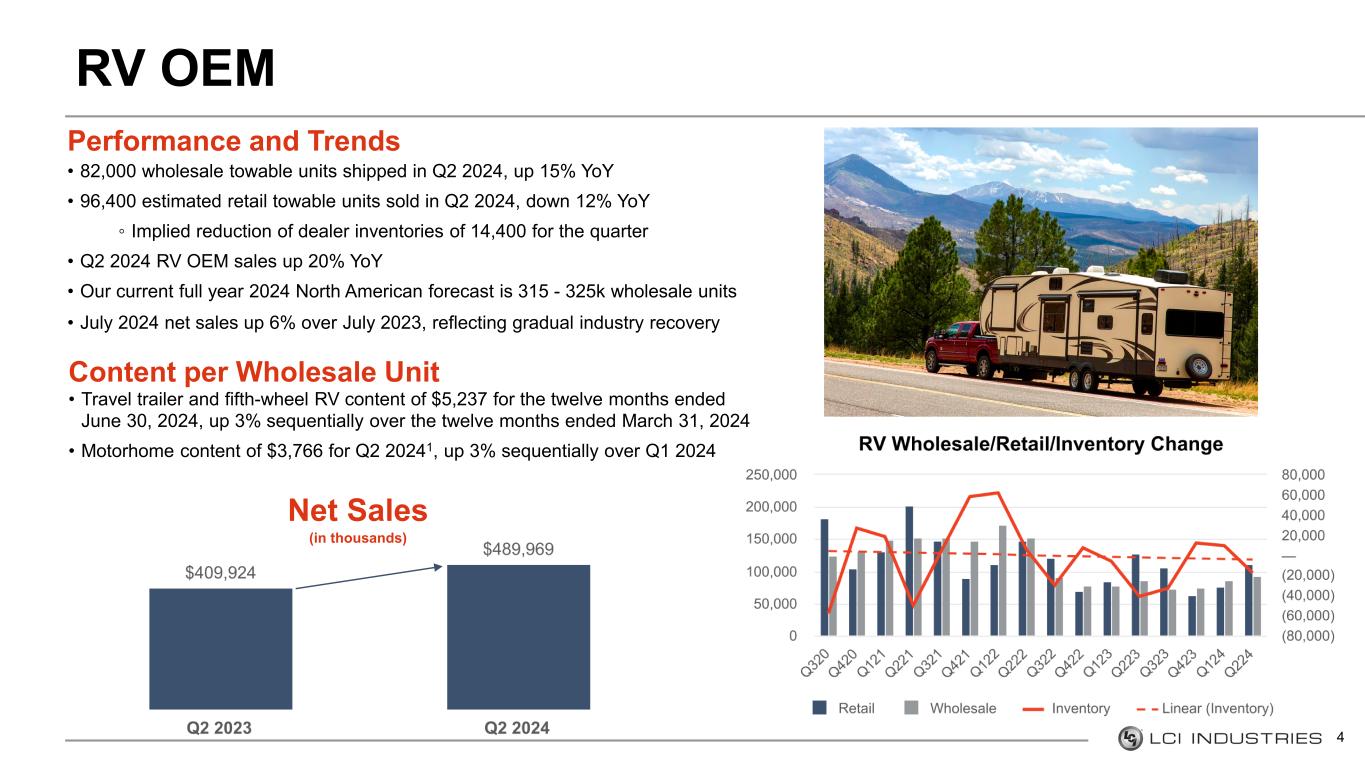

Performance and Trends • 82,000 wholesale towable units shipped in Q2 2024, up 15% YoY • 96,400 estimated retail towable units sold in Q2 2024, down 12% YoY ◦ Implied reduction of dealer inventories of 14,400 for the quarter • Q2 2024 RV OEM sales up 20% YoY • Our current full year 2024 North American forecast is 315 - 325k wholesale units • July 2024 net sales up 6% over July 2023, reflecting gradual industry recovery RV OEM Content per Wholesale Unit • Travel trailer and fifth-wheel RV content of $5,237 for the twelve months ended June 30, 2024, up 3% sequentially over the twelve months ended March 31, 2024 • Motorhome content of $3,766 for Q2 20241, up 3% sequentially over Q1 2024 4 Net Sales (in thousands)

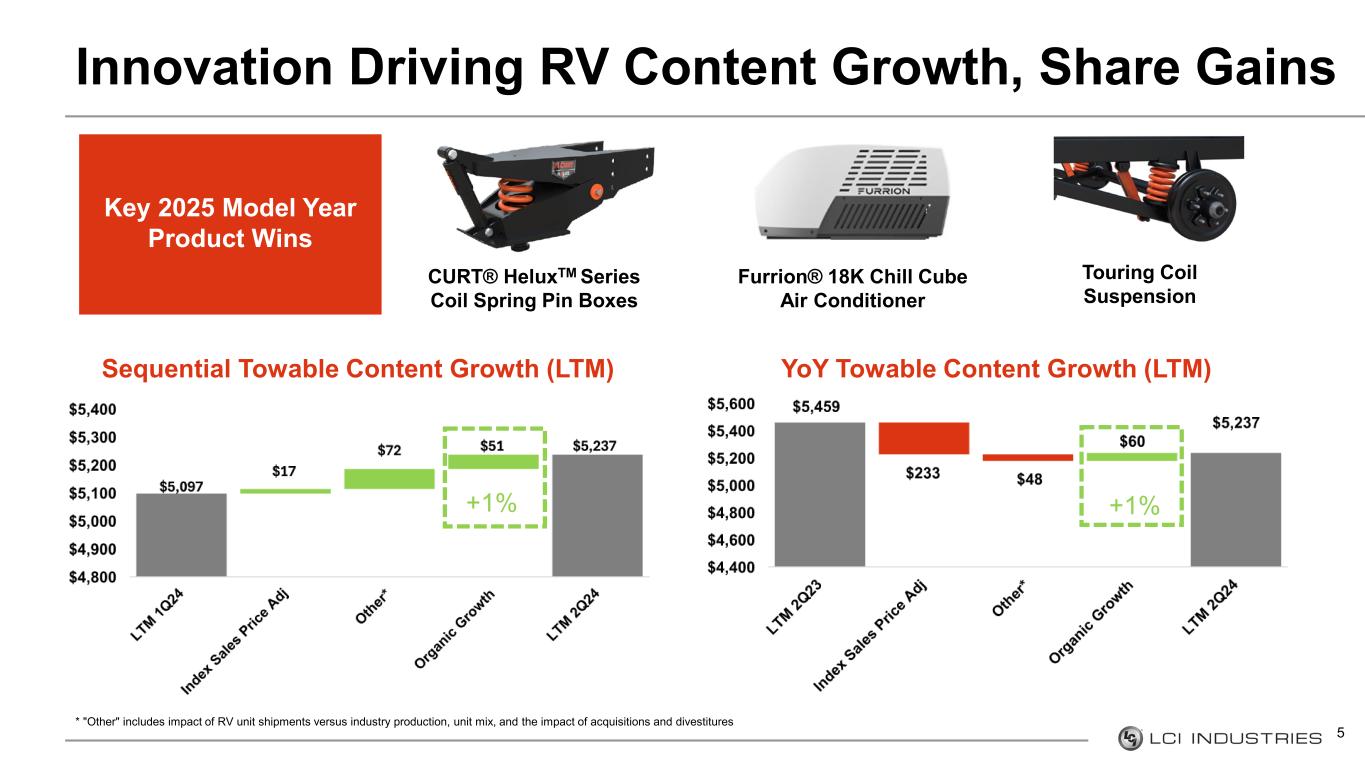

Innovation Driving RV Content Growth, Share Gains 5 YoY Towable Content Growth (LTM) Key 2025 Model Year Product Wins Sequential Towable Content Growth (LTM) CURT® HeluxTM Series Coil Spring Pin Boxes Touring Coil Suspension Furrion® 18K Chill Cube Air Conditioner * "Other" includes impact of RV unit shipments versus industry production, unit mix, and the impact of acquisitions and divestitures +1% +1%

Performance and Trends • Q2 2024 Adjacent Industries sales down 12% YoY • Decrease primarily due to lower sales to North American marine and utility trailer OEMs ◦ Pressured by current dealer inventory levels, inflation, and elevated interest rates impacting retail consumers • Resiliency in transit and building products markets have supported performance, partially offsetting the impact from North American marine • Leveraging innovation to expand Marine content through products like our shallow anchor systems, thrusters, seating, and electric biminis Adjacent Industries OEM 6 Net Sales (in thousands)

Performance and Trends • Q2 2024 sales up 1% year over year, driven by market share gains in the automotive aftermarket, partially offset by the impacts of inflation and elevated interest rates on consumers' discretionary spending and softness in the marine aftermarket • 120 bps YoY margin expansion primarily driven by decreased material costs to meaningfully support overall profitability • Innovation driving ongoing portfolio expansion through sophisticated products, catering to the new generation of outdoor enthusiasts • 300K+ RV units continue to enter the repair and replacement cycle annually Aftermarket Segment 7 Net Sales (in thousands)

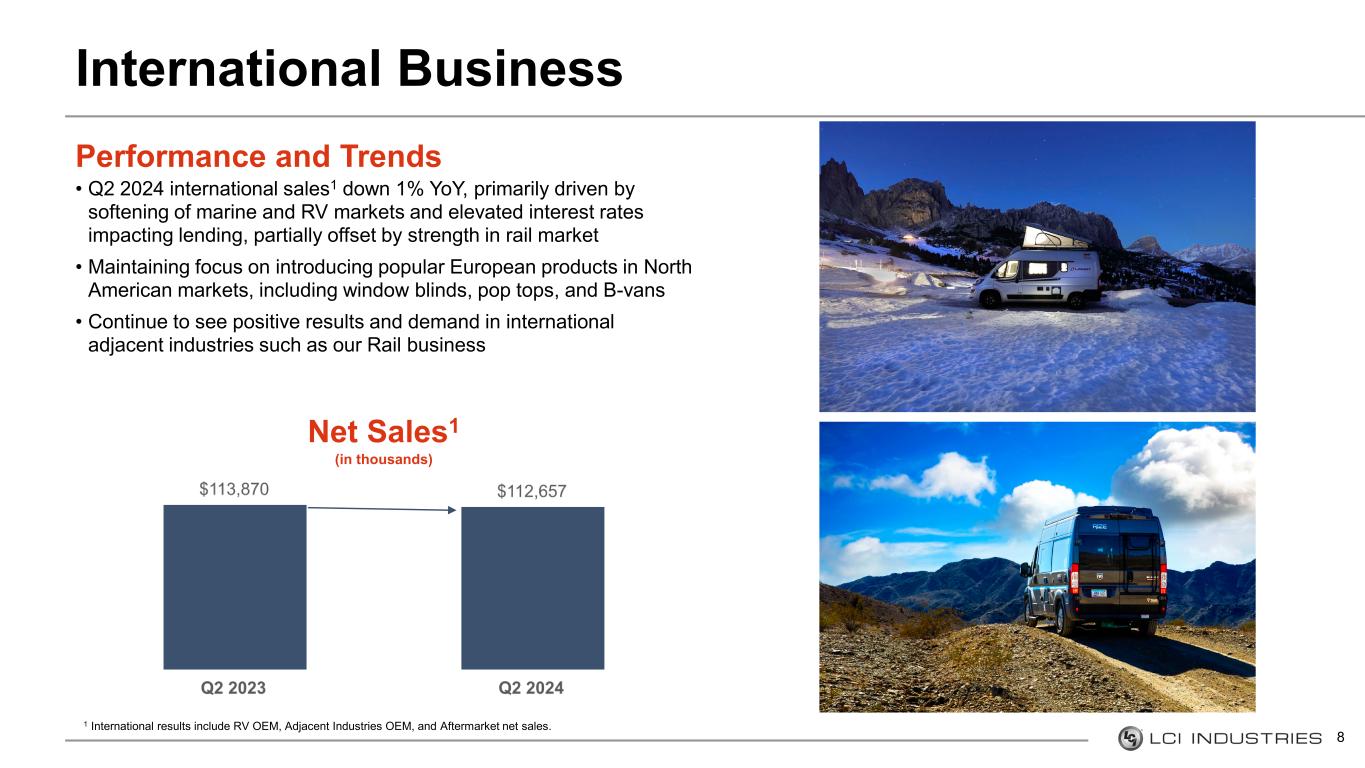

Performance and Trends • Q2 2024 international sales1 down 1% YoY, primarily driven by softening of marine and RV markets and elevated interest rates impacting lending, partially offset by strength in rail market • Maintaining focus on introducing popular European products in North American markets, including window blinds, pop tops, and B-vans • Continue to see positive results and demand in international adjacent industries such as our Rail business International Business 8 Net Sales1 (in thousands) 1 International results include RV OEM, Adjacent Industries OEM, and Aftermarket net sales.

Innovation Driving Growth Continued focus on innovation driving an ongoing increase in new product introductions 9 Touring Coil Suspension Furrion® 18K Chill Cube Air Conditioner Solera® 3000 Off-Grid Series Solar awning Titan Leveling Systems Towable & Motorized CURT® HeluxTM Series Coil Spring Pin Boxes OneControl® Auto featuring True Course ABS (Anti-Lock Braking System) SureShade® Forward Facing Power Bimini New Window Designs and Integrated Shades DoubleCOOL Acrylic Cooling Solutions

Leveraging Strengths to Win Market Share • Delivering innovative products through leading, nimble manufacturing capabilities • Building upon long-term customer relationships to expand product offering and bundle multiple product categories • Focusing on long-term content per unit growth in all markets Growth Strategy Maintaining strong balance sheet while also investing in innovation and growth Balanced Capital Allocation Strategy • Reducing leverage • Investing in R&D and automation to drive profitable growth • Executing strategic acquisitions to expand presence in new and existing markets • Returning capital to shareholders Continue Execution of our Diversification Strategy • Expanding market share beyond our RV OEM channel to increase stability and deliver shareholder value • Enhancing our offerings in our various markets through innovations and acquisitions, building upon rich history of growth through acquisitions • Working to capture $12 billion in combined addressable opportunities across our business 10

Q2 2024 Financial Performance * Additional information regarding EBITDA, as well as reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in the Appendix. 11 +4% +83% +320 bps +39%

As of and for the six months ended June 30 Liquidity and Cash Flow 2024 2023 Cash and Cash Equivalents $130M $22M Remaining Availability under Revolving Credit Facility(1) $373M $270M Capital Expenditures $21M $34M Dividends $53M $53M Debt / Net Income (TTM) 6.8x 11.1x Net Debt/EBITDA (TTM)(2) 2.1x 3.4x Cash from Operating Activities $185M $274M Free Cash Flow(2) $164M $239M 1 Remaining availability under the revolving credit facility is subject to covenant restrictions. 2 Additional information regarding net debt to EBITDA and free cash flow, as well as a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, is provided in the Appendix. 12

Reconciliation of Non-GAAP Measures Appendix EBITDA Three Months Ended June 30, Six months ended June 30, Twelve months ended June 30, ($ in thousands) 2024 2023 2024 2023 2024 2023 Net income $ 61,163 $ 33,426 $ 97,708 $ 40,685 $ 121,218 $ 84,948 Interest expense, net 7,962 10,249 17,283 20,643 37,064 35,773 Provision for income taxes 21,479 11,499 33,224 13,889 38,144 19,034 Depreciation and amortization 32,039 33,050 64,728 65,549 130,947 131,042 EBITDA $ 122,643 $ 88,224 $ 212,943 $ 140,766 $ 327,373 $ 270,797 Net sales $ 1,054,544 $ 1,014,639 $ 2,022,573 $ 1,987,949 $ 3,819,432 $ 4,014,374 EBITDA as % of Net Sales 11.6 % 8.7 % 10.5 % 7.1 % 8.6 % 6.7 % FREE CASH FLOW Six Months Ended June 30, NET DEBT/EBITDA (TTM) June 30, 2024 June 30, 2023 ($ in thousands) 2024 2023 Total debt $ 829,746 $ 943,468 Net cash flows provided by Less cash and cash equivalents 130,418 22,094 operating activities $ 185,282 $ 273,565 Net debt $ 699,328 $ 921,374 Capital expenditures (21,328) (34,082) Free cash flow $ 163,954 $ 239,483 Total Debt/Net Income (TTM) 6.8x 11.1x Net Debt/EBITDA (TTM) 2.1x 3.4x 13 EBITDA and free cash flow are non-GAAP performance measures included to illustrate and improve comparability of the Company's results from period to period. EBITDA is defined as net income (loss) before interest expense, provision (benefit) for income taxes, and depreciation and amortization expense. Free cash flow is defined as net cash flows provided by operating activities minus capital expenditures. The Company considers these non-GAAP measures in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because they provide a useful analysis of ongoing underlying trends. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies. The net debt to EBITDA ratio on a trailing twelve month basis is a non-GAAP performance measure included because the Company believes it is useful to investors in evaluating the Company's leverage. The net debt to EBITDA ratio is defined as total debt, less cash and cash equivalents, divided by EBITDA. The net debt to EBITDA ratio is a non-GAAP measure and should not be considered a substitute for the ratio of total debt to net income determined in accordance with GAAP. The Company's calculation of its net debt to EBITDA ratio might not be calculated in the same manner as, and thus might not be comparable to, similarly titled measures used by other companies.

14

v3.24.2.u1

Cover

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

LCI INDUSTRIES

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13646

|

| Entity Tax Identification Number |

13-3250533

|

| Entity Address, Address Line One |

3501 County Road 6 East,

|

| Entity Address, City or Town |

Elkhart,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46514

|

| City Area Code |

(574)

|

| Local Phone Number |

535-1125

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

LCII

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0000763744

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Oct 2024 to Nov 2024

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Nov 2023 to Nov 2024