UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-41737

Lifezone Metals Limited

2nd Floor, St George’s Court,

Upper Church Street, Douglas,

Isle of Man, IM1 1EE

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Lifezone Metals Limited (the “Company”)

is furnishing this current report on Form 6-K to report a December 2024 Mineral Resource Update and related Technical Report Summary.

The Company intends to incorporate this Form 6-K and the

accompanying exhibits by reference into its registration statements on Form F-3 (File Nos. 333-272865

and 333-281189) and Form S-8 (File No. 333-274449)

and the related prospectuses, respectively as such registration statements and prospectuses may be amended from time to time, and to

be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently

filed or furnished.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Lifezone Metals Limited |

| |

|

|

| Date: December 5, 2024 |

By: |

/s/ Chris Showalter |

| |

Name: |

Chris Showalter |

| |

Title: |

Chief Executive Officer |

Exhibit 23.1

CONSENT OF EXPERT

I hereby consent to the use of and reference to

my name, Sharron Sylvester, B.Sc. (Geol), RPGeo AIG, and the information listed below that I reviewed and approved, as described

or incorporated by reference in Lifezone Metals Limited’s Form F-3 (File Nos. 333-272865 and 333-281189)

and Form S-8 (File No. 333-274449) and the related prospectuses, filed with the United States Securities and Exchange Commission

and any amendments and/or exhibits thereto (collectively, the “Registration Statements”). I am a “Qualified Person”

as defined in Regulation S-K 1300.

I have reviewed and approved the following:

| ● | the

Technical Report Summary titled “Kabanga 2024 Mineral Resource Update Technical Report

Summary” effective December 4, 2024 (the “Technical Report Summary”); and |

| ● | the

information derived, summarized, quoted or referenced from the Technical Report Summary,

or portions thereof, that was prepared by me, that I supervised the preparation of and/or

that was reviewed and approved by me, that is included or incorporated by reference in the

Registration Statements. |

I consent to the public filing and use of the Technical Report Summary

as exhibits to the Registration Statements and the Form 6-K of Lifezone Metals Limited to which this consent is an exhibit.

| Dated this 4th day of December, 2024. |

|

| |

|

| Yours sincerely, |

|

| |

|

| /s/ S T Sylvester |

|

| Sharron Sylvester, B.Sc. (Geol), RPGeo AIG |

|

| Technical Director – Geology |

|

| OreWin Pty Ltd |

|

Exhibit 23.2

CONSENT OF EXPERT

I hereby consent to the use of and reference to

my name, Bernard Peters, BEng (Mining), FAusIMM, and the information listed below that I reviewed and approved, as described or incorporated

by reference in Lifezone Metals Limited’s Form F-3 (File Nos. 333-272865 and 333-281189) and Form S-8 (File

No. 333-274449) and the related prospectuses, filed with the United States Securities and Exchange Commission and any amendments

and/or exhibits thereto (collectively, the “Registration Statements”). I am a “Qualified Person” as defined in

Regulation S-K 1300.

I have reviewed and approved the following:

| ● | the

Technical Report Summary titled “Kabanga 2024 Mineral Resource Update Technical Report

Summary” effective December 4, 2024 (the “Technical Report Summary”); and |

| ● | the

information derived, summarized, quoted or referenced from the Technical Report Summary,

or portions thereof, that was prepared by me, that I supervised the preparation of and/or

that was reviewed and approved by me, that is included or incorporated by reference in the

Registration Statements. |

I consent to the public filing and use of the

Technical Report Summary as exhibits to the Registration Statements and the Form 6-K of Lifezone Metals Limited to which this consent

is an exhibit.

| Dated this 4th day of December, 2024. |

|

| |

|

| Yours sincerely, |

|

| |

|

| /s/ B F Peters |

|

| Bernard Peters, BEng (Mining), FAusIMM |

|

| Technical Director – Mining |

|

| OreWin Pty Ltd |

|

Exhibit 96.1

Title Page

| Project Name: |

Kabanga |

| |

|

| Title: |

Kabanga 2024 Mineral Resource Update Technical Report Summary |

| |

|

| Location: |

Ngara District, Tanzania |

| |

|

| Effective Date of Technical Report: |

4 December 2024 |

| |

|

| Effective Date of Mineral Resources: |

4 December 2024 |

| |

|

| Effective Date of Drilling Database: |

4 June 2024 |

| |

|

Qualified Persons:

| ● | Sharron Sylvester, BSc (Geol), RPGeo AIG (10125), employed

by OreWin Pty Ltd as Technical Director – Geology, was responsible for the preparation of the Mineral Resources, Sections 1 to

5; Sections 6 to 9; Section 11; and Sections 22 to 25. |

| ● | Bernard Peters, BEng (Mining), FAusIMM (201743), employed

by OreWin Pty Ltd as Technical Director – Mining, was responsible for the preparation of Sections 1 to 5; Section 10; Section 11.4,

and Sections 12 to 25. |

OreWin Pty Ltd ACN 165 722 574 140 South Terrace Adelaide 5000 P +61 8 8210 5600 E orewin@orewin.com W orewin.com | i |

Signature Page

| Project Name: |

Kabanga |

| |

|

| Title: |

Kabanga 2024 Mineral Resource Update Technical Report Summary |

| |

|

| Location: |

Ngara District, Tanzania |

| |

|

| Effective Date of Technical Report: |

4 December 2024 |

/s/ Sharron Sylvester

Date of Signing: 4 December 2024

Sharron Sylvester, Technical Director – Geology, OreWin Pty Ltd,

BSc (Geol), RPGeo AIG (10125)

/s/ Bernard Peters

Date of Signing: 4 December 2024

Bernard Peters, Technical Director – Mining, OreWin Pty Ltd,

BEng (Mining), FAusIMM (201743)

TABLE OF CONTENTS

| 1 |

|

EXECUTIVE SUMMARY |

1 |

| |

|

|

|

| 1.1 |

|

Introduction |

1 |

| |

|

|

|

| 1.2 |

|

Accessibility, Climate, Local Resources, Infrastructure, and Physiography |

1 |

| |

|

|

|

| 1.3 |

|

Land Tenure and Ownership |

3 |

| |

|

|

|

| 1.3.1 |

|

Ownership |

3 |

| |

|

|

|

| 1.3.2 |

|

Tanzanian Legislation |

5 |

| |

|

|

|

| 1.3.3 |

|

Kabanga Framework Agreement Summary |

5 |

| |

|

|

|

| 1.3.4 |

|

Special Mining Licence |

7 |

| |

|

|

|

| 1.3.5 |

|

BHPB Investment in Kabanga Nickel Limited |

9 |

| |

|

|

|

| 1.4 |

|

Geology and Mineralisation |

11 |

| |

|

|

|

| 1.4.1 |

|

Regional Geology |

11 |

| |

|

|

|

| 1.4.2 |

|

Property Geology |

12 |

| |

|

|

|

| 1.4.3 |

|

Lithologies and Stratigraphy |

12 |

| |

|

|

|

| 1.4.4 |

|

Structural Setting |

12 |

| |

|

|

|

| 1.4.5 |

|

Deposit Description |

13 |

| |

|

|

|

| 1.4.6 |

|

Mineralisation Style |

14 |

| |

|

|

|

| 1.4.7 |

|

Alteration and Weathering |

14 |

| |

|

|

|

| 1.5 |

|

Exploration |

14 |

| |

|

|

|

| 1.6 |

|

Mineral Processing and Metallurgical Testing |

17 |

| |

|

|

|

| 1.7 |

|

Mineral Resources |

17 |

| |

|

|

|

| 1.7.1 |

|

Mineral Resource Modelling |

18 |

| |

|

|

|

| 1.7.2 |

|

Classification |

19 |

| |

|

|

|

| 1.7.3 |

|

Cut-off Grade |

19 |

| |

|

|

|

| 1.7.4 |

|

Reasonable Prospects for Eventual Economic Extraction (Initial Assessment) |

19 |

| |

|

|

|

| 1.7.5 |

|

December 2024 Mineral Resources Estimates |

20 |

| |

|

|

|

| 1.7.6 |

|

Comparison to Previous Mineral Resource Estimates – All Mineralisation Types |

25 |

| |

|

|

|

| 1.8 |

|

Mineral Reserves |

28 |

| |

|

|

|

| 1.9 |

|

Market Studies |

28 |

| |

|

|

|

| 1.10 |

|

Environmental, Social, and Governance |

28 |

| |

|

|

|

| 1.10.1 |

|

Environmental and Social Impact Assessments, Baseline and Management Plans |

29 |

| |

|

|

|

| 1.10.2 |

|

Stakeholder Engagement |

30 |

| |

|

|

|

| 1.10.3 |

|

Land Access and Resettlement |

30 |

| 1.10.4 |

|

Mine and Facility Closure |

30 |

| |

|

|

|

| 1.11 |

|

Interpretation and Conclusions |

31 |

| |

|

|

|

| 1.12 |

|

Recommendations |

31 |

| |

|

|

|

| 2 |

|

INTRODUCTION |

32 |

| |

|

|

|

| 2.1 |

|

Ownership History |

32 |

| |

|

|

|

| 2.2 |

|

Terms of Reference |

33 |

| |

|

|

|

| 2.3 |

|

Qualified Persons |

34 |

| |

|

|

|

| 2.4 |

|

Qualified Persons Property Inspection |

34 |

| |

|

|

|

| 2.5 |

|

Units and Currency |

34 |

| |

|

|

|

| 2.6 |

|

Effective Dates |

34 |

| |

|

|

|

| 3 |

|

PROPERTY DESCRIPTION |

35 |

| |

|

|

|

| 3.1 |

|

Location |

35 |

| |

|

|

|

| 3.2 |

|

Ownership |

37 |

| |

|

|

|

| 3.2.1 |

|

Introduction |

40 |

| |

|

|

|

| 3.2.2 |

|

Primary Mining Sector Legislation |

40 |

| |

|

|

|

| 3.2.3 |

|

Environmental and Social Legislation and Land Legislation |

41 |

| |

|

|

|

| 3.3 |

|

Framework Agreement Summary |

44 |

| |

|

|

|

| 3.4 |

|

Economic Benefits Sharing Principle |

46 |

| |

|

|

|

| 3.5 |

|

Special Mining Licence |

47 |

| |

|

|

|

| 3.6 |

|

The Refinery and the Refining Licence |

51 |

| |

|

|

|

| 3.7 |

|

Special Economic Zone |

55 |

| |

|

|

|

| 3.7.1 |

|

Special Economic Zone Licences for RefineCo |

55 |

| |

|

|

|

| 3.7.2 |

|

Developer’s Licence |

55 |

| |

|

|

|

| 3.7.3 |

|

Operator’s Licence |

55 |

| |

|

|

|

| 3.7.4 |

|

EPZA Inquiry on Special Economic Zone Licences for RefineCo |

56 |

| |

|

|

|

| 3.7.5 |

|

Relevant Special Economic Zone Licence Application Processes and Requirements |

56 |

| |

|

|

|

| 3.7.6 |

|

General Incentives to Special Economic Zone Investors |

57 |

| |

|

|

|

| 3.7.7 |

|

Category A: Developers of Infrastructure in a Special Economic Zone |

57 |

| |

|

|

|

| 3.7.8 |

|

Category C: Investors who Produce for Export Markets |

58 |

| |

|

|

|

| 3.7.9 |

|

Transit Cargo under both Category A and Category C |

59 |

| |

|

|

|

| 3.7.10 |

|

Practicality of Shifting between Special Economic Zone Licences |

59 |

| |

|

|

|

| 3.8 |

|

BHPB Investment in Kabanga Nickel Limited |

60 |

| |

|

|

|

| 3.8.1 |

|

T1A Agreement |

61 |

| |

|

|

|

| 3.8.2 |

|

T1B Agreement |

61 |

| |

|

|

|

| 3.8.3 |

|

T2 Agreement |

61 |

| 3.9 |

|

Lifezone-KNL Development, Licensing and Services Agreement |

62 |

| |

|

|

|

| 3.10 |

|

Mineral Rights, Surface Rights, and Environmental Rights |

63 |

| |

|

|

|

| 3.11 |

|

Other Significant Factors and Risks |

65 |

| |

|

|

|

| 4 |

|

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY |

66 |

| |

|

|

|

| 4.1 |

|

Overview |

66 |

| |

|

|

|

| 4.2 |

|

Kabanga Site |

68 |

| |

|

|

|

| 4.2.1 |

|

Accessibility |

69 |

| |

|

|

|

| 4.2.2 |

|

Local Resources |

71 |

| |

|

|

|

| 4.2.3 |

|

Existing Infrastructure |

71 |

| |

|

|

|

| 4.2.4 |

|

Physiography |

72 |

| |

|

|

|

| 4.2.5 |

|

Climate |

74 |

| |

|

|

|

| 4.2.6 |

|

Seismicity – Kabanga |

75 |

| |

|

|

|

| 4.3 |

|

Kahama Site |

76 |

| |

|

|

|

| 4.3.1 |

|

Location |

76 |

| |

|

|

|

| 4.3.2 |

|

Accessibility |

76 |

| |

|

|

|

| 4.3.3 |

|

Local Resources |

77 |

| |

|

|

|

| 4.3.4 |

|

Climate |

77 |

| |

|

|

|

| 4.3.5 |

|

Existing Infrastructure |

78 |

| |

|

|

|

| 4.3.6 |

|

Kahama Physiography |

80 |

| |

|

|

|

| 4.4 |

|

National Infrastructure |

80 |

| |

|

|

|

| 4.4.1 |

|

National Port Infrastructure |

80 |

| |

|

|

|

| 4.4.2 |

|

International Airports |

81 |

| |

|

|

|

| 4.4.3 |

|

Tanzania Bulk Water Infrastructure |

82 |

| |

|

|

|

| 4.4.4 |

|

Tanzanian Road Infrastructure |

83 |

| |

|

|

|

| 4.4.5 |

|

National Rail Infrastructure |

84 |

| |

|

|

|

| 4.4.6 |

|

National Power Generation and Distribution |

85 |

| |

|

|

|

| 4.5 |

|

Country and Regional Setting |

86 |

| |

|

|

|

| 4.5.1 |

|

Population and Demographics |

86 |

| |

|

|

|

| 4.5.2 |

|

National Government |

86 |

| |

|

|

|

| 4.5.3 |

|

Regional Sub-Divisions |

87 |

| |

|

|

|

| 4.5.4 |

|

Burundi |

88 |

| |

|

|

|

| 5 |

|

HISTORY |

89 |

| |

|

|

|

| 5.1 |

|

UNDP Era (1976–79) |

89 |

| |

|

|

|

| 5.2 |

|

Sutton Era (1990–99) |

89 |

| |

|

|

|

| 5.2.1 |

|

Sutton – BHP JV Era (1990–95) |

89 |

| 5.2.2 |

|

Sutton (1995–97) |

89 |

| |

|

|

|

| 5.2.3 |

|

Sutton – Anglo JV Era (1997–99) |

90 |

| |

|

|

|

| 5.3 |

|

Barrick Era (1999–2004) |

90 |

| |

|

|

|

| 5.4 |

|

Barrick – Glencore JV Era (2005–18) |

91 |

| |

|

|

|

| 5.5 |

|

Tanzanian Mining Law Reform (2018–21) |

92 |

| |

|

|

|

| 5.6 |

|

Previous Technical Report Summaries |

92 |

| |

|

|

|

| 5.6.1 |

|

March 2023 Technical Report Summary |

92 |

| |

|

|

|

| 5.6.2 |

|

November 2023 Technical Report Summary |

92 |

| |

|

|

|

| 6 |

|

GEOLOGICAL SETTING, MINERALISATION, AND DEPOSIT |

93 |

| |

|

|

|

| 6.1 |

|

Regional Geological Setting |

93 |

| |

|

|

|

| 6.2 |

|

Property Geology |

94 |

| |

|

|

|

| 6.3 |

|

Lithologies and Stratigraphy |

96 |

| |

|

|

|

| 6.4 |

|

Structural Setting |

97 |

| |

|

|

|

| 6.5 |

|

Deposit Description |

98 |

| |

|

|

|

| 6.6 |

|

Mineralisation Style |

99 |

| |

|

|

|

| 6.7 |

|

Alteration and Weathering |

99 |

| |

|

|

|

| 7 |

|

EXPLORATION |

105 |

| |

|

|

|

| 7.1 |

|

Exploration Timeline |

105 |

| |

|

|

|

| 7.1.1 |

|

Early Regional Exploration : 1976–79 |

105 |

| |

|

|

|

| 7.1.2 |

|

Sutton Era Exploration |

106 |

| |

|

|

|

| 7.1.3 |

|

Barrick Era Exploration |

107 |

| |

|

|

|

| 7.1.4 |

|

TNCL Exploration : 2021–Present |

111 |

| |

|

|

|

| 7.2 |

|

Exploration and Drillhole Database |

111 |

| |

|

|

|

| 7.3 |

|

Drilling, Core Logging, Downhole Survey, and Sampling |

111 |

| |

|

|

|

| 7.3.1 |

|

Drilling |

111 |

| |

|

|

|

| 7.3.2 |

|

Core Recovery |

112 |

| |

|

|

|

| 7.3.3 |

|

Core Logging |

112 |

| |

|

|

|

| 7.3.4 |

|

Core Sampling |

113 |

| |

|

|

|

| 7.3.5 |

|

Collar Survey |

113 |

| |

|

|

|

| 7.3.6 |

|

Down-hole Survey |

113 |

| |

|

|

|

| 7.3.7 |

|

Borehole Electromagnetic (BHEM) Data |

115 |

| |

|

|

|

| 7.3.8 |

|

Drillhole Database |

115 |

| |

|

|

|

| 7.4 |

|

Density Measurements |

116 |

| |

|

|

|

| 7.5 |

|

Planned Drilling Campaigns |

117 |

| |

|

|

|

| 7.6 |

|

Safari Link Exploration Results |

119 |

| 8 |

|

SAMPLE PREPARATION, ANALYSES, AND SECURITY |

121 |

| |

|

|

|

| 8.1 |

|

Introduction |

121 |

| |

|

|

|

| 8.2 |

|

Sample Preparation |

121 |

| |

|

|

|

| 8.3 |

|

Assaying |

122 |

| |

|

|

|

| 8.4 |

|

QA/QC |

123 |

| |

|

|

|

| 8.4.1 |

|

QA/QC Sample Frequency |

123 |

| |

|

|

|

| 8.4.2 |

|

Sample Preparation QA/QC – Screen Test |

124 |

| |

|

|

|

| 8.4.3 |

|

Duplicates and Check Assays – ALS-Chemex Coarse Reject Duplicates |

125 |

| |

|

|

|

| 8.4.4 |

|

Genalysis Pulp Check Assays |

128 |

| |

|

|

|

| 8.4.5 |

|

SGS Lakefield Pulp Check Assays |

133 |

| |

|

|

|

| 8.4.6 |

|

Quarter Core Replicates |

134 |

| |

|

|

|

| 8.4.7 |

|

Certified Reference Material Standards |

136 |

| |

|

|

|

| 8.4.8 |

|

Blanks |

144 |

| |

|

|

|

| 9 |

|

DATA VERIFICATION |

146 |

| |

|

|

|

| 9.1 |

|

Independent Verifications |

146 |

| |

|

|

|

| 9.1.1 |

|

Site Visit |

146 |

| |

|

|

|

| 9.1.2 |

|

Discussion |

146 |

| |

|

|

|

| 10 |

|

MINERAL PROCESSING AND METALLURGICAL TESTWORK |

147 |

| |

|

|

|

| 10.1 |

|

Testwork Facilities |

147 |

| |

|

|

|

| 10.2 |

|

Concentrator Testwork |

148 |

| |

|

|

|

| 10.2.1 |

|

Summary of Historical Metallurgical Testwork |

148 |

| |

|

|

|

| 10.2.2 |

|

Current Study Concentrator Testwork Samples and Scope |

152 |

| |

|

|

|

| 10.3 |

|

Concentrator Metallurgical Performance Projection |

164 |

| |

|

|

|

| 10.3.1 |

|

Concentrator Recoveries and Mass Pull Assumptions |

166 |

| |

|

|

|

| 10.4 |

|

Refinery Testwork |

166 |

| |

|

|

|

| 10.4.1 |

|

Historical Flowsheet Assessments and Testwork |

166 |

| |

|

|

|

| 10.4.2 |

|

Study Testwork Concentrate Samples |

168 |

| |

|

|

|

| 10.4.3 |

|

Phase 1 Refinery Testwork |

168 |

| |

|

|

|

| 10.4.4 |

|

Phase 2 Refinery Testwork |

169 |

| |

|

|

|

| 10.4.5 |

|

Refinery Pilot Testwork |

172 |

| |

|

|

|

| 10.4.6 |

|

Refinery Testwork Analytical Methods |

174 |

| |

|

|

|

| 10.4.7 |

|

Testwork QA/QC |

174 |

| |

|

|

|

| 10.5 |

|

QP Comments |

174 |

| |

|

|

|

| 11 |

|

MINERAL RESOURCE ESTIMATE |

175 |

| |

|

|

|

| 11.1 |

|

Mineral Resource Modelling |

175 |

| 11.2 |

|

2024 Mineral Resource Drillhole Database |

175 |

| |

|

|

|

| 11.3 |

|

Mineral Resource Domain Interpretations |

175 |

| |

|

|

|

| 11.3.1 |

|

Grade and Lithology |

178 |

| |

|

|

|

| 11.3.2 |

|

Drillhole Compositing |

184 |

| |

|

|

|

| 11.3.3 |

|

Top Cutting |

186 |

| |

|

|

|

| 11.3.4 |

|

Boundary Treatment |

186 |

| |

|

|

|

| 11.3.5 |

|

Variography |

188 |

| |

|

|

|

| 11.3.6 |

|

Search Parameters |

188 |

| |

|

|

|

| 11.3.7 |

|

Grade Estimation |

191 |

| |

|

|

|

| 11.3.8 |

|

Model Validation |

191 |

| |

|

|

|

| 11.3.9 |

|

Classification |

196 |

| |

|

|

|

| 11.4 |

|

Mineral Resource Cut-off Grade |

198 |

| |

|

|

|

| 11.4.1 |

|

2024 Cut-off Grade |

199 |

| |

|

|

|

| 11.5 |

|

Reasonable Prospects for Economic Extraction |

204 |

| |

|

|

|

| 11.6 |

|

Kabanga 2024 Mineral Resource Statement |

205 |

| |

|

|

|

| 11.6.1 |

|

Comparison to Previous Mineral Resource Estimates – All Mineralisation Types |

210 |

|

|

|

|

| 11.7 |

|

Risks and Opportunities |

213 |

| |

|

|

|

| 11.7.1 |

|

Risks |

213 |

| |

|

|

|

| 11.7.2 |

|

Opportunities |

213 |

| |

|

|

|

| 12 |

|

MINERAL RESERVE ESTIMATES |

214 |

| |

|

|

|

| 13 |

|

MINING METHODS |

215 |

| |

|

|

|

| 14 |

|

PROCESSING AND RECOVERY METHODS |

216 |

| |

|

|

|

| 15 |

|

INFRASTRUCTURE |

217 |

| |

|

|

|

| 16 |

|

MARKET STUDIES |

218 |

| |

|

|

|

| 16.1 |

|

Marketing and Metal Prices |

218 |

| |

|

|

|

| 16.2 |

|

QP Opinion |

218 |

| |

|

|

|

| 17 |

|

ENVIRONMENTAL STUDIES, PERMITTING, AND PLANS, NEGOTIATIONS, OR AGREEMENTS WITH LOCAL INDIVIDUALS OR GROUPS |

219 |

| |

|

|

|

| 17.1 |

|

Summary |

219 |

| |

|

|

|

| 17.1.1 |

|

Environmental Studies |

219 |

| |

|

|

|

| 17.1.2 |

|

Environmental and Social Licencing Conditions |

220 |

| |

|

|

|

| 17.1.3 |

|

Permitting Status and Bonds |

221 |

| |

|

|

|

| 17.1.4 |

|

Environmental and Social Management Plans |

221 |

| |

|

|

|

| 17.1.5 |

|

Land Access and Resettlement |

222 |

| |

|

|

|

| 17.1.6 |

|

Mine and Facility Closure |

223 |

| 17.1.7 |

|

Local Procurement and Hiring |

223 |

| |

|

|

|

| 17.2 |

|

Environmental and Social Impact Assessments and Baselines |

223 |

| |

|

|

|

| 17.2.1 |

|

Environmental and Social Baseline Assessment |

225 |

| |

|

|

|

| 17.2.2 |

|

Kabanga and Resettlement Project Baseline Assessments |

226 |

| |

|

|

|

| 17.2.3 |

|

Kahama Refinery Project Baseline Assessment |

235 |

| |

|

|

|

| 17.2.4 |

|

Kahama Refinery Project Baseline Assessment |

235 |

| |

|

|

|

| 17.3 |

|

Project Environmental and Social Impacts |

243 |

| |

|

|

|

| 17.3.1 |

|

Kabanga Project Impacts |

243 |

| |

|

|

|

| 17.3.2 |

|

Kahama Refinery Project |

244 |

| |

|

|

|

| 17.3.3 |

|

Kabanga Resettlement Project Impacts |

244 |

| |

|

|

|

| 17.3.4 |

|

Monitoring and Impact Mitigation |

245 |

| |

|

|

|

| 17.4 |

|

Licensing Conditions and Waste and Tailings Disposal |

246 |

| |

|

|

|

| 17.4.1 |

|

Specific Kabanga Licence Conditions |

246 |

| |

|

|

|

| 17.4.2 |

|

Specific Kabanga Resettlement Sites EIA Conditions |

247 |

| |

|

|

|

| 17.4.3 |

|

Kahama Refinery Licence Conditions |

249 |

| |

|

|

|

| 17.4.4 |

|

Kabanga Tailings Management |

250 |

| |

|

|

|

| 17.4.5 |

|

Kahama Refinery Residue Management |

250 |

| |

|

|

|

| 17.5 |

|

Stakeholder Engagement |

251 |

| |

|

|

|

| 17.6 |

|

Management Plans |

251 |

| |

|

|

|

| 17.7 |

|

Permitting Requirements, Status of Applications, Required Bonds |

252 |

| |

|

|

|

| 17.7.1 |

|

Required Bonds |

252 |

| |

|

|

|

| 17.8 |

|

Land Acquisition and Resettlement |

253 |

| |

|

|

|

| 17.8.1 |

|

Resettlement Action Plan |

253 |

| |

|

|

|

| 17.8.2 |

|

Stakeholder Engagement |

253 |

| |

|

|

|

| 17.8.3 |

|

Compensation Agreements and Process |

253 |

| |

|

|

|

| 17.8.4 |

|

Livelihood Restoration |

255 |

| |

|

|

|

| 17.9 |

|

Mine and Facility Closure, Remediation and Reclamation |

255 |

| |

|

|

|

| 17.9.1 |

|

Mine and Facility Closure |

256 |

| |

|

|

|

| 17.9.2 |

|

Tailings Management and Closure |

256 |

| |

|

|

|

| 17.10 |

|

Local Procurement and Employment |

256 |

| |

|

|

|

| 17.10.1 |

|

Procurement |

257 |

| |

|

|

|

| 17.10.2 |

|

Local Employment |

257 |

| |

|

|

|

| 17.11 |

|

QP Opinion |

258 |

| |

|

|

|

| 18 |

|

CAPITAL AND OPERATING COSTS |

259 |

| |

|

|

|

| 19 |

|

ECONOMIC ANALYSIS |

260 |

| 20 |

|

ADJACENT PROPERTIES |

261 |

| |

|

|

|

| 21 |

|

OTHER RELEVANT DATA AND INFORMATION |

262 |

| |

|

|

|

| 22 |

|

INTERPRETATION AND CONCLUSIONS |

263 |

| |

|

|

|

| 23 |

|

RECOMMENDATIONS |

264 |

| |

|

|

|

| 23.1 |

|

KNL Work Plan |

264 |

| |

|

|

|

| 23.2 |

|

QP Comments |

265 |

| |

|

|

|

| 24 |

|

REFERENCES |

266 |

| |

|

|

|

| 25 |

|

RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT |

268 |

TABLES

|

Table 1.1 |

|

Exploration Drilling Summary (to 4 December 2024) |

15 |

| |

|

|

|

| Table 1.2 |

|

Kabanga Mineral Resource Estimates1 as at 4 December 2024 – Based on $9.50/lb Nickel Price, $4.50/lb Copper Price, and $23.00/lb Cobalt Price |

21 |

| |

|

|

|

| Table 1.3 |

|

Kabanga Mineral Resource Estimates – Massive Sulfide1 (subset of Table 1.2) as at 4 December 2024 – Based on $9.50/lb Nickel Price, $4.50/lb Copper Price, and $23.00/lb Cobalt Price |

22 |

| |

|

|

|

| Table 1.4 |

|

Kabanga Mineral Resource Estimates – Ultramafic1 (subset of Table 1.2) as at 4 December 2024 – Based on $9.50/lb Nickel Price, $4.50/lb Copper Price, and $23.00/lb Cobalt Price |

23 |

| |

|

|

|

| Table 1.5 |

|

Kabanga Mineral Resource Estimates1 – Showing Contained Metals as at 4 December 2024 – Based on $9.50/lb Nickel Price, $4.50/lb Copper Price, and $23.00/lb Cobalt Price |

24 |

| |

|

|

|

| Table 1.6 |

|

Kabanga Mineral Resource Estimates1 Comparison – Tonnes and Grades |

26 |

| |

|

|

|

| Table 1.7 |

|

Kabanga Mineral Resource Estimates1 Comparison – Contained Metals |

27 |

| |

|

|

|

| Table 3.1 |

|

Special Mining Licence SML 651 / 2021 Corner

Coordinates (ARC1960 UTM36S) |

50 |

| |

|

|

|

| Table 3.2 |

|

Refining Licence Boundary Coordinates (ARC1960 UTM36S) |

52 |

| |

|

|

|

| Table 7.1 |

|

Exploration Drilling Summary |

105 |

| |

|

|

|

| Table 7.2 |

|

Down-hole Survey Statistics for North and Tembo |

114 |

| |

|

|

|

| Table 7.3 |

|

Down-hole Survey Statistics for North and Tembo |

114 |

| |

|

|

|

| Table 7.4 |

|

Safari and Safari Link Drilling Result Composites |

120 |

| |

|

|

|

| Table 8.1 |

|

Summary of Analytical Techniques for Mineral Resource Drilling |

123 |

| |

|

|

|

| Table 8.2 |

|

Frequency of QA/QC Samples 2005–09 |

124 |

| |

|

|

|

| Table 8.3 |

|

Kabanga CRMs – Accepted Grades |

136 |

| |

|

|

|

| Table 8.4 |

|

Kabanga CRMs – Tracking of Ni% Results 2005–09 |

138 |

| |

|

|

|

| Table 8.5 |

|

Kabanga Massive Sulfide CRM – Tracking of Ni% Results by Era |

138 |

| |

|

|

|

| Table 8.6 |

|

Kabanga CRMs – Summary Statistics 2005–09 |

140 |

| Table 8.7 |

|

ALS-Chemex Internal Reference Material Standards – Tracking of Ni% Results 2005–09 |

140 |

| |

|

|

|

| Table 8.8 |

|

ALS-Chemex Internal Forrest B Standard – Summary Statistics 2005–09 |

141 |

| |

|

|

|

| Table 10.1 |

|

Summary of Historical MPP Mass Balance Results |

150 |

| |

|

|

|

| Table 10.2 |

|

Concentrator Testwork Samples – Tembo |

155 |

| |

|

|

|

| Table 10.3 |

|

Concentrator Testwork Samples – North |

157 |

| |

|

|

|

| Table 10.4 |

|

Comminution Testwork Samples and Scope |

161 |

| |

|

|

|

| Table 10.5 |

|

Flotation Testwork Samples and Scope |

162 |

| |

|

|

|

| Table 10.6 |

|

Flotation Concentrate and Tailings Product Testwork Samples and Scope |

163 |

| |

|

|

|

| Table 10.7 |

|

Summary of Test Data Used for Concentrator Recovery Modelling |

165 |

| |

|

|

|

| Table 10.8 |

|

Concentrator Recoveries and Mass Pull Assumptions |

166 |

| |

|

|

|

| Table 10.9 |

|

POX Leach Extractions at 220 °C |

171 |

| |

|

|

|

| Table 10.10 |

|

Summary of POX Extractions – Pilot Plant versus Bench-Scale Testwork |

173 |

| |

|

|

|

| Table 11.1 |

|

Grade Estimation Search Parameters |

189 |

| |

|

|

|

| Table 11.2 |

|

NiEq24 MSSX Input Parameters |

198 |

| |

|

|

|

| Table 11.3 |

|

NiEq24 UMAF Input Parameters |

198 |

| |

|

|

|

| Table 11.4 |

|

Concentrator Recoveries and Mass Pull Assumptions |

200 |

| |

|

|

|

| Table 11.5 |

|

2024 Cut-off Grade Assumptions |

204 |

| |

|

|

|

| Table 11.6 |

|

Kabanga Mineral Resource Estimates1 as at 4 December 2024 – Based on $9.50/lb Nickel Price, $4.50/lb Copper Price, and $23.00/lb Cobalt Price |

206 |

| |

|

|

|

| Table 11.7 |

|

Kabanga Mineral Resource Estimates – Massive Sulfide1 (subset of Table 11.6) as at 4 December 2024 – Based on $9.50/lb Nickel Price, $4.50/lb Copper Price, and $23.00/lb Cobalt Price |

207 |

| |

|

|

|

| Table 11.8 |

|

Kabanga Mineral Resource Estimates – Ultramafic1 (subset of Table 11.6) as at 4 December 2024 – Based on $9.50/lb Nickel Price, $4.50/lb Copper Price, and $23.00/lb Cobalt Price |

208 |

| |

|

|

|

| Table 11.9 |

|

Kabanga Mineral Resource Estimates1 – Showing Contained Metals as at 4 December 2024 – Based on $9.50/lb Nickel Price, $4.50/lb Copper Price, and $23.00/lb Cobalt Price |

209 |

| |

|

|

|

| Table 11.10 |

|

Kabanga Mineral Resource Estimates1 Comparison – Tonnes and Grades |

211 |

| |

|

|

|

| Table 11.11 |

|

Kabanga Mineral Resource Estimates1 Comparison – Contained Metals |

212 |

| |

|

|

|

| Table 16.1 |

|

Metal Prices |

218 |

| |

|

|

|

| Table 17.1 |

|

Kabanga Project EIA, ESIA and ESMP Summary |

224 |

FIGURES

|

Figure 1.1 |

|

Kabanga and Kahama Site Locations |

2 |

| |

|

|

|

| Figure 1.2 |

|

Local Area Plan |

3 |

| |

|

|

|

| Figure 1.3 |

|

Lifezone and Kabanga Nickel Group Structure |

4 |

| |

|

|

|

| Figure 1.4 |

|

Location of the Project showing Detail of SML 651 / 2021 |

9 |

| |

|

|

|

| Figure 1.5 |

|

Plan View Schematic of Geology of the Kabanga Area (UTM) |

13 |

| |

|

|

|

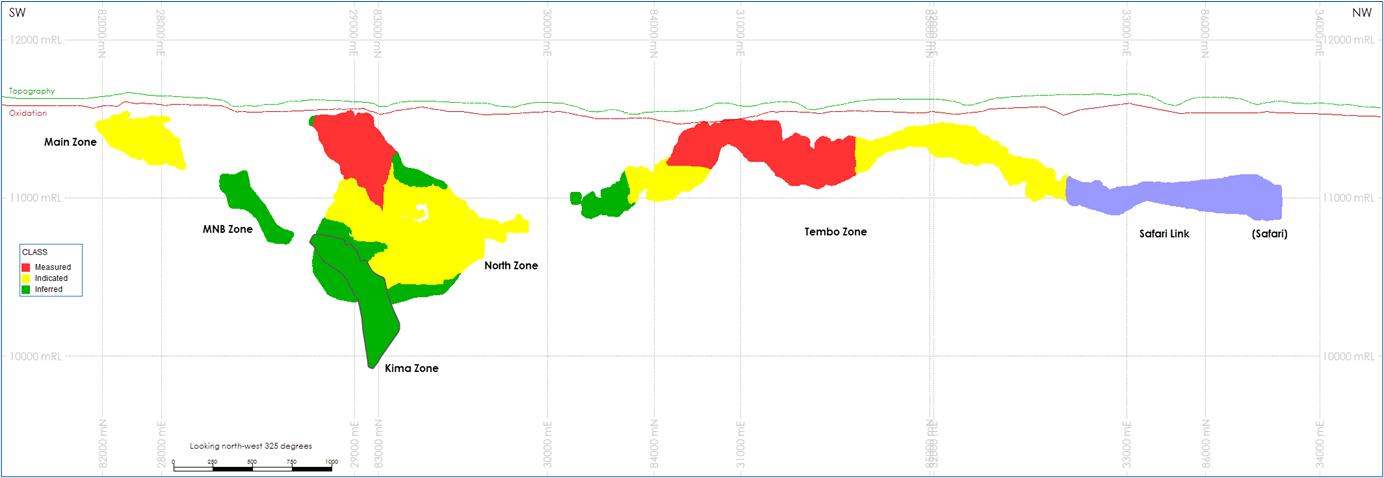

| Figure 1.6 |

|

Schematic Projected Long-section of the Kabanga Mineralised Zones (truncated UTM, looking north-west) |

14 |

| |

|

|

|

| Figure 3.1 |

|

Kabanga and Kahama Site Locations |

36 |

| |

|

|

|

| Figure 3.2 |

|

Mine Site Local Area Plan |

37 |

| |

|

|

|

| Figure 3.3 |

|

Current Lifezone and Kabanga Nickel Group Structure |

39 |

| |

|

|

|

| Figure 3.4 |

|

Location of the Proposed Mine Site showing SML 651 / 2021 |

49 |

| |

|

|

|

| Figure 3.5 |

|

Kahama Refinery Property |

53 |

| |

|

|

|

| Figure 4.1 |

|

Kabanga Project Location |

67 |

| |

|

|

|

| Figure 4.2 |

|

Local Area Plan |

68 |

| |

|

|

|

| Figure 4.3 |

|

Kabanga Special Mining Licence (No. SML 651 / 2021) Area |

69 |

| |

|

|

|

| Figure 4.4 |

|

Existing Access Routes to the Kabanga Site |

70 |

| |

|

|

|

| Figure 4.5 |

|

Kahama Refinery Property |

79 |

| |

|

|

|

| Figure 4.6 |

|

Tanzanian Road Network |

83 |

| |

|

|

|

| Figure 4.7 |

|

Standard Gauge Railway Key Routes |

85 |

| |

|

|

|

| Figure 6.1 |

|

Stratigraphic Column for the Kagera Supergroup |

94 |

| |

|

|

|

| Figure 6.2 |

|

Plan View Schematic of Geology of the Kabanga Area (UTM) |

95 |

| |

|

|

|

| Figure 6.3 |

|

Typical Stratigraphy Cross-Section Schematics for North and Tembo (local grid) |

96 |

| |

|

|

|

| Figure 6.4 |

|

Plan View of Major Structures (Kabanga mineralisation zones shown in red) |

97 |

| |

|

|

|

| Figure 6.5 |

|

Comparative Interpretation of 3D and 2D VTEM Data |

98 |

| |

|

|

|

| Figure 6.6 |

|

Schematic Projected Long-section of the Kabanga Mineralised Zones (truncated UTM, looking north-west) |

100 |

| |

|

|

|

| Figure 6.7 |

|

Example Schematic Cross-section* of Mineralisation Geometry at Main Zone (truncated UTM) |

101 |

| |

|

|

|

| Figure 6.8 |

|

Example Schematic Cross-section* of Mineralisation Geometry at MNB Zone (truncated UTM) |

102 |

| |

|

|

|

| Figure 6.9 |

|

Example Schematic Cross-section* of Mineralisation Geometry at North Zone (with Kima) (truncated UTM) |

103 |

| |

|

|

|

| Figure 6.10 |

|

Example Schematic Cross-section* of Mineralisation Geometry at Tembo Zone (truncated UTM) |

104 |

| |

|

|

|

| Figure 7.1 |

|

Kabanga Drillhole Locations Proximal to Mineral Resources (truncated UTM) |

115 |

| |

|

|

|

| Figure 7.2 |

|

Comparison of Water Immersion Density vs. Pycnometry Specific Gravity for Massive Sulfide |

117 |

| |

|

|

|

| Figure 7.3 |

|

Pycnometer Specific Gravity Measurements for Massive Sulfide in North and Tembo |

118 |

| Figure 7.4 |

|

Pycnometer Specific Gravity Measurements for UMAF_1a in North and Tembo |

118 |

| |

|

|

|

| Figure 8.1 |

|

Percent Reject Passing – 2 mm Screen – 2005–09 |

125 |

| |

|

|

|

| Figure 8.2 |

|

ALS-Chemex – Percent Relative Difference for Ni Duplicates – 2005–09 |

126 |

| |

|

|

|

| Figure 8.3 |

|

ALS-Chemex – Percent Relative Difference for Cu Duplicates – 2005–09 |

127 |

| |

|

|

|

| Figure 8.4 |

|

ALS-Chemex – Percent Relative Difference for Co Duplicates – 2005–09 |

128 |

| |

|

|

|

| Figure 8.5 |

|

Genalysis vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Ni Grades 2005–09 – Sequential Analysis for Massive Sulfide Ni > 2% |

130 |

| |

|

|

|

| Figure 8.6 |

|

Genalysis vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Ni Grades 2005–09 |

131 |

| |

|

|

|

| Figure 8.7 |

|

Genalysis vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Cu Grades 2005–09 |

132 |

| |

|

|

|

| Figure 8.8 |

|

Genalysis vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Co Grades 2005–09 |

133 |

| |

|

|

|

| Figure 8.9 |

|

SGS Lakefield vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Ni Grades |

134 |

| |

|

|

|

| Figure 8.10 |

|

ALS-Chemex – Percent Relative Difference for Ni Grades for Quarter Core Replicates – 2005–07 |

135 |

| |

|

|

|

| Figure 8.11 |

|

ALS-Chemex – Percent Relative Difference for Cu Grades for Quarter Core Replicates – 2005–07 |

135 |

| |

|

|

|

| Figure 8.12 |

|

ALS-Chemex – Percent Relative Difference for Co Grades for Quarter Core Replicates – 2005–07 |

136 |

| |

|

|

|

| Figure 8.13 |

|

Kabanga Massive Sulfide CRM Ni Values 2005–09 |

137 |

| |

|

|

|

| Figure 8.14 |

|

Kabanga Ultramafic CRM Ni Values 2005–09 |

138 |

| |

|

|

|

| Figure 8.15 |

|

Kabanga Massive Sulfide CRM Ni% Values by Genalysis 2005–09 |

139 |

| |

|

|

|

| Figure 8.16 |

|

ALS-Chemex Internal Forrest B Standard – Results from 2005–09 |

141 |

| |

|

|

|

| Figure 8.17 |

|

Kabanga MSSX CRM Cu Values 2005–09 |

142 |

| |

|

|

|

| Figure 8.18 |

|

Kabanga UMAF CRM Cu Values 2005–09 |

143 |

| |

|

|

|

| Figure 8.19 |

|

Kabanga MSSX CRM Co Values 2005–09 |

143 |

| |

|

|

|

| Figure 8.20 |

|

Kabanga UMAF CRM Co Values 2005–09 |

144 |

| |

|

|

|

| Figure 8.21 |

|

Blanks – Ni Results 2005–09 |

145 |

| |

|

|

|

| Figure 10.1 |

|

Summary of Historical MPP Testwork Grade Recovery Curves |

149 |

| |

|

|

|

| Figure 10.2 |

|

MSSX Metallurgical Testwork Sample Locations (truncated UTM) |

159 |

| |

|

|

|

| Figure 10.3 |

|

UMAF_1a Metallurgical Testwork Sample Locations (truncated UTM) |

159 |

| |

|

|

|

| Figure 10.4 |

|

DiEW Base Case Flowsheet showing Unit Operations Tested in Phase 2 Programme |

170 |

| |

|

|

|

| Figure 10.5 |

|

POX Kinetics Test (KABA-0145) |

172 |

| |

|

|

|

| Figure 11.1 |

|

Schematic Projected Long-section of the Kabanga Mineralised Zones (looking north-west) |

177 |

|

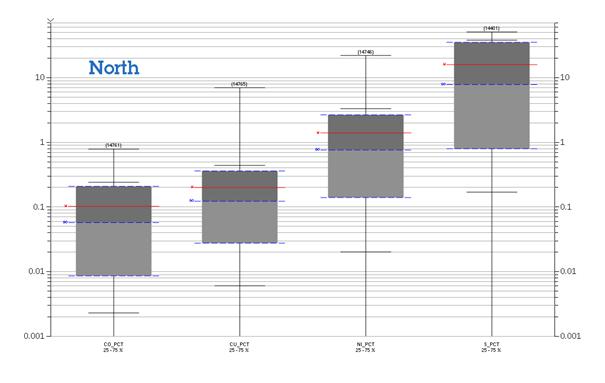

Figure 11.2 |

|

Ni Box Plot for all Assayed Lithologies – All Zones |

178 |

| |

|

|

|

| Figure 11.3 |

|

Pie Chart of Assayed Lithologies – North Zone |

179 |

| |

|

|

|

| Figure 11.4 |

|

Box Plots for a Suite of Elements for the Three Predominant Mineralisation Types – North Zone |

180 |

| |

|

|

|

| Figure 11.5 |

|

Pie Chart of Assayed Lithologies – Tembo Zone |

181 |

| |

|

|

|

| Figure 11.6 |

|

Box Plots for a Suite of Elements for the Three Predominant Mineralisation Types – Tembo Zone |

182 |

| |

|

|

|

| Figure 11.7 |

|

Box Plot of Grades (Co, Cu, Ni, and S) for North Zone and Tembo Zone |

183 |

| |

|

|

|

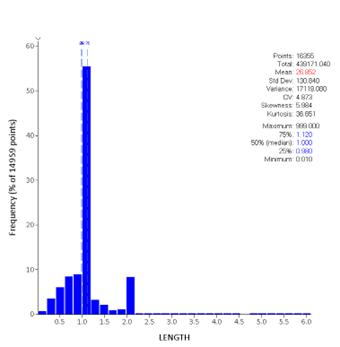

| Figure 11.8 |

|

Histograms of Sample Lengths – North Zone (where assayed) |

185 |

| |

|

|

|

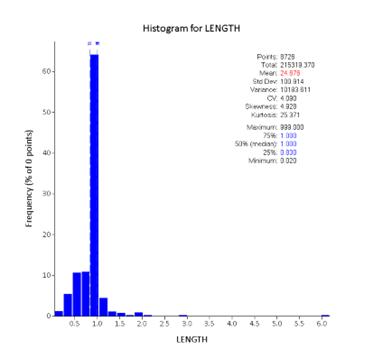

| Figure 11.9 |

|

Histograms of Sample Lengths – Tembo Zone (where assayed) |

185 |

| |

|

|

|

| Figure 11.10 |

|

Contact Plots for Ni% Across INTRUSIV:UMAF Boundary |

187 |

| |

|

|

|

| Figure 11.11 |

|

Contact Plots for Ni% Across UMAF:MSSX Boundary |

187 |

| |

|

|

|

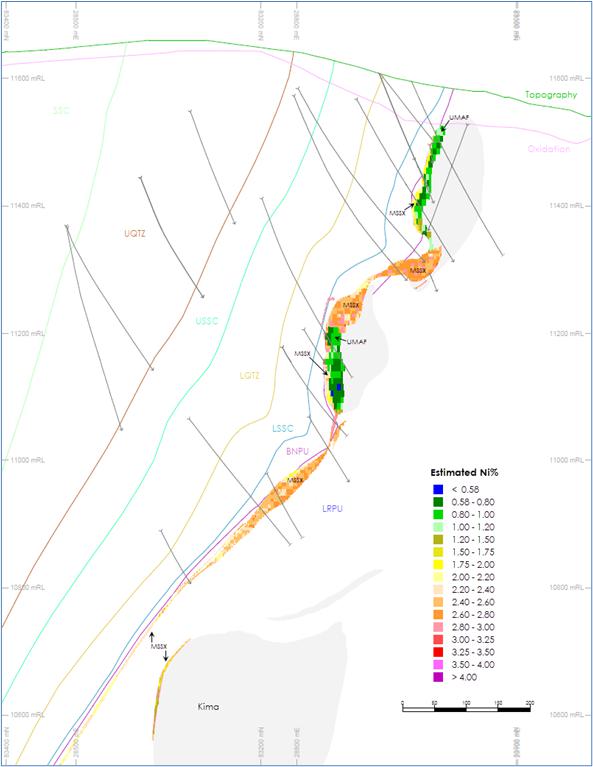

| Figure 11.12 |

|

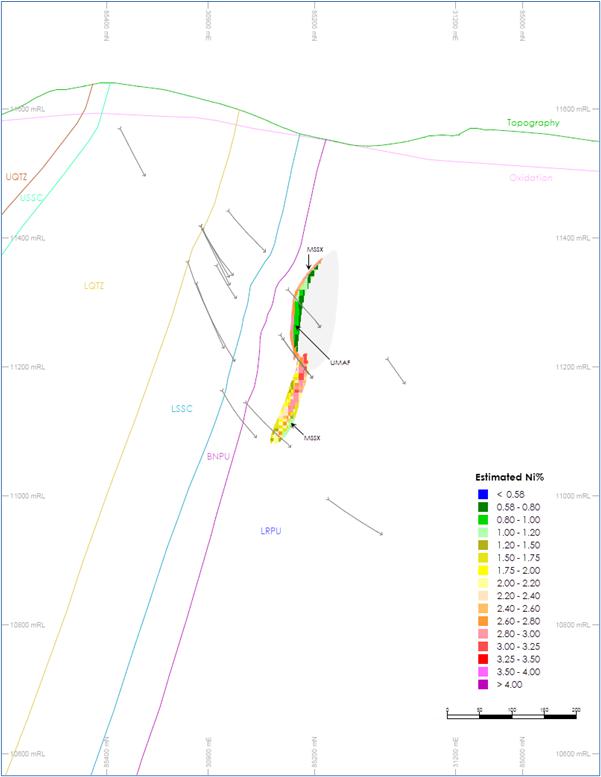

Example Cross-section* of Ni% Grade Estimates at North Zone (shows Kima) |

192 |

| |

|

|

|

| Figure 11.13 |

|

Example Cross-section* of Ni% Grade Estimates at Tembo Zone |

193 |

| |

|

|

|

| Figure 11.14 |

|

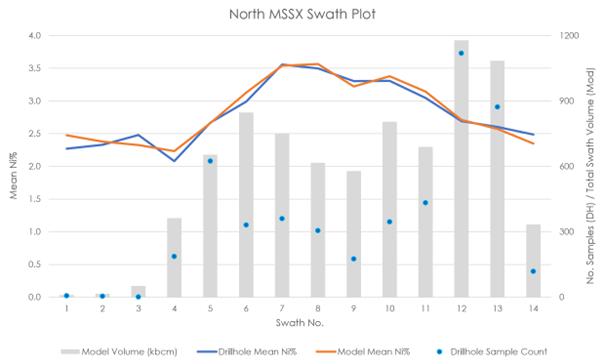

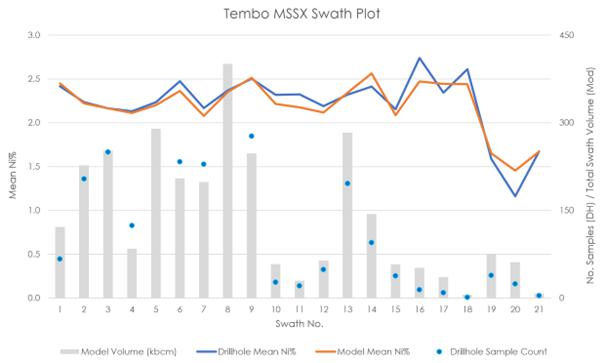

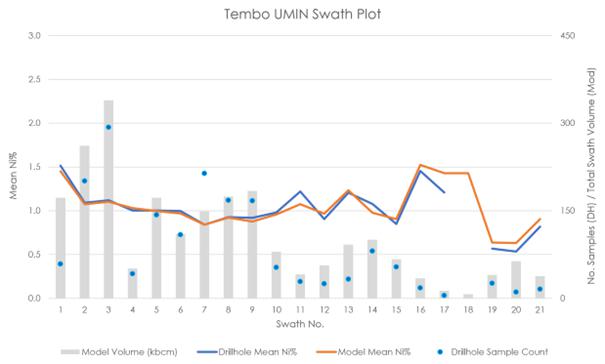

Example Swath Plots – Ni% Along Strike for North Zone MSSX and UMAF |

194 |

| |

|

|

|

| Figure 11.15 |

|

Example Swath Plots – Ni% Along Strike for Tembo Zone MSSX and UMAF |

195 |

| |

|

|

|

| Figure 11.16 |

|

Schematic Projected Long-section of the Kabanga Classification (truncated UTM, looking north-west) |

197 |

| |

|

|

|

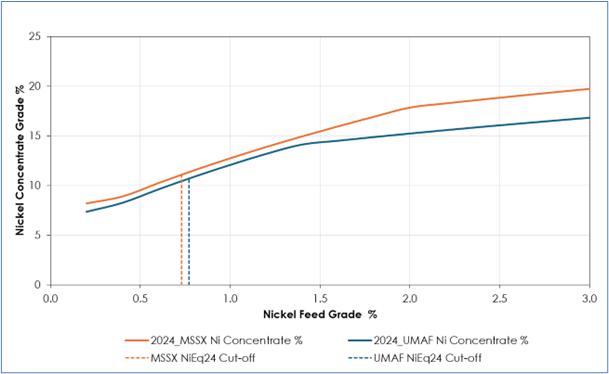

| Figure 11.17 |

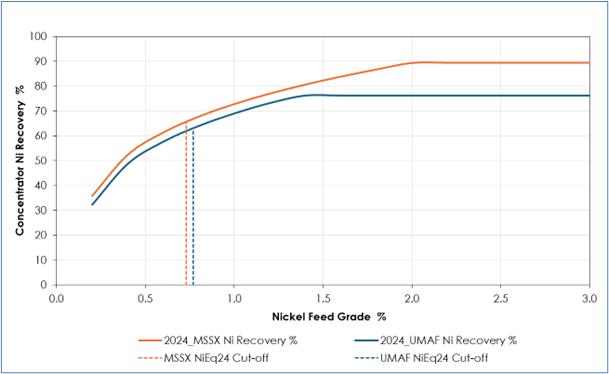

|

MSSX and UMAF Concentrator Nickel Recoveries |

201 |

| |

|

|

|

| Figure 11.18 |

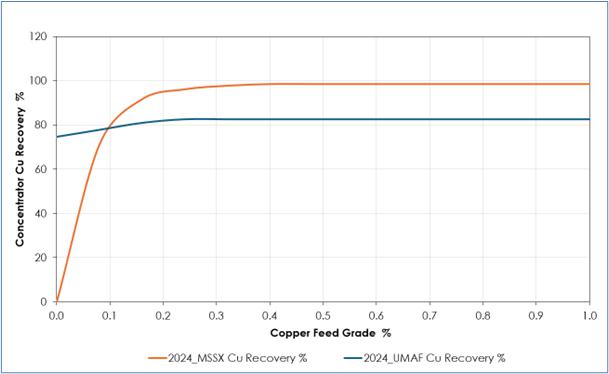

|

MSSX and UMAF Concentrator Copper Recoveries |

201 |

| |

|

|

|

| Figure 11.19 |

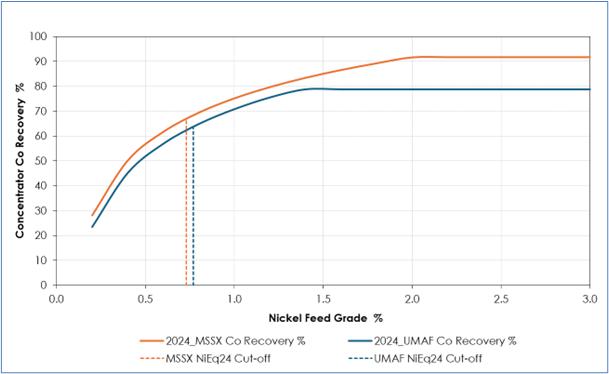

|

MSSX and UMAF Concentrator Cobalt Recoveries |

202 |

| |

|

|

|

| Figure 11.20 |

|

MSSX and UMAF Concentrate Nickel Grade |

202 |

| |

|

|

|

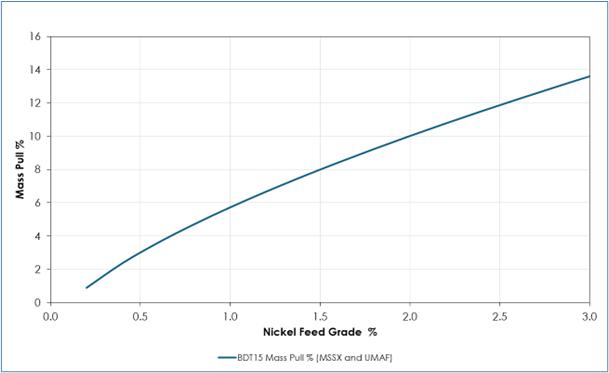

| Figure 11.21 |

|

MSSX and UMAF Mass Pull |

203 |

| |

|

|

|

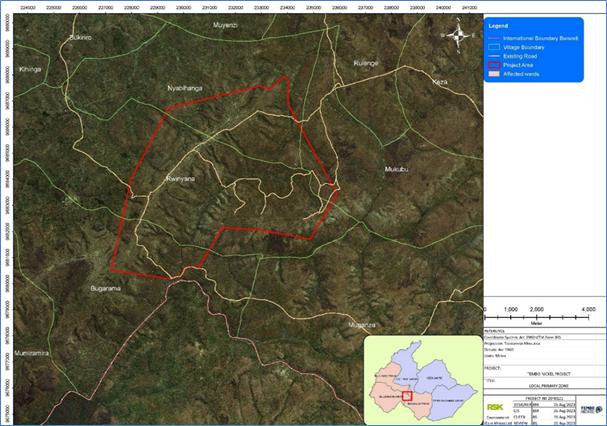

| Figure 17.1 |

|

Project Area and Affected Communities |

226 |

1 EXECUTIVE SUMMARY

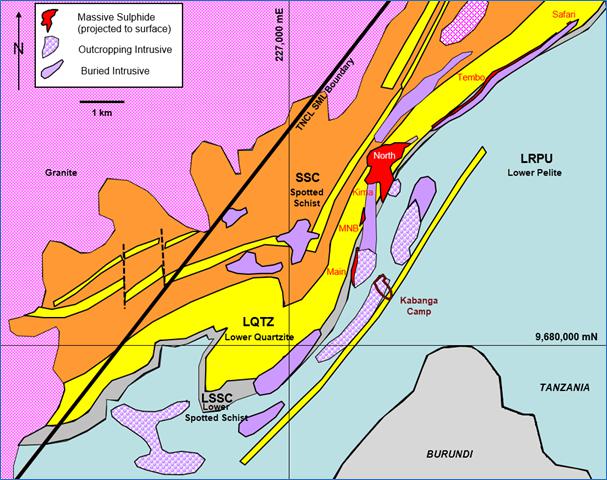

1.1 Introduction

The Kabanga 2024 Mineral Resource Update Technical Report Summary (2024MRU)

has been prepared in accordance with the U.S. Securities and Exchange Commission (US SEC) Regulation S-K subpart 1300 rules for Property

Disclosures for Mining Registrants (S-K 1300) for Lifezone Metals Ltd (LZM) on the Kabanga nickel project (the Project). The

2024MRU is a preliminary technical and economic study of the economic potential of the Project mineralisation to support the disclosure

of Mineral Resources. The Mineral Resource estimates are current as at 4 December 2024.

The majority owner of the Project, Kabanga Nickel Ltd (KNL), is the

primary source of technical data and information discussed within this Technical Report Summary (TRS).

The Mineral Resource estimates in the 2024MRU were prepared by the

Qualified Persons (QPs) and the QPs have reviewed the supplied data and information, the QPs accept this information for use in the 2024MRU

on the basis that it is accurate. Information and data supplied by LZM that were relied upon when forming the findings and conclusions

of this report but were outside the areas of expertise of the QP are detailed in Section 25. Any individual or entity referenced within

the 2024MRU as having completed work, but not identified therein as being a QP, does not constitute a QP.

The 2024MRU should be construed in light of the methods, procedures,

and techniques used in its preparation. Sections or parts of the 2024MRU should not be read in isolation from or removed from their original

context.

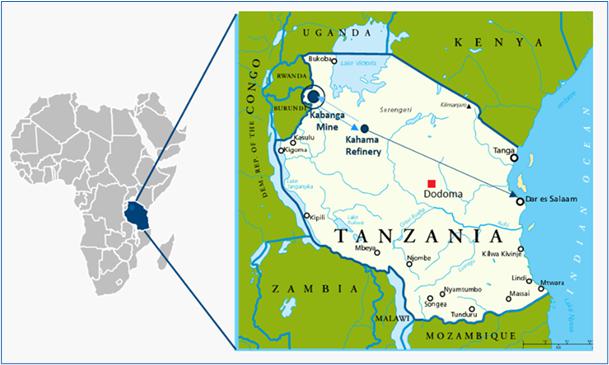

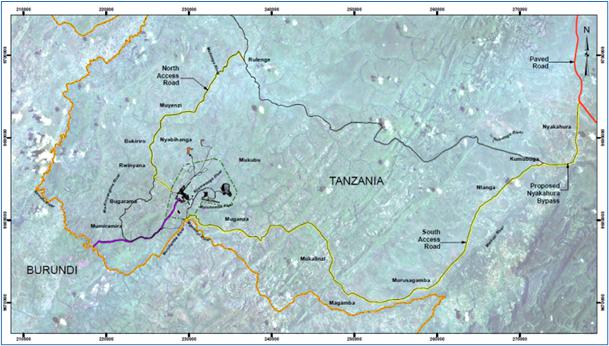

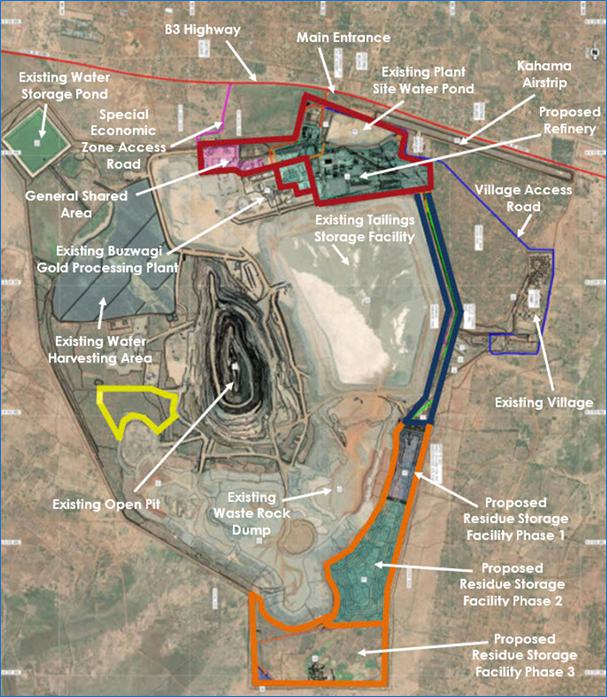

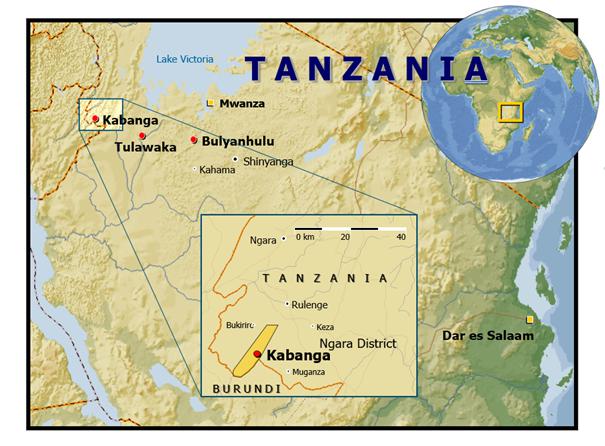

1.2 Accessibility, Climate, Local Resources, Infrastructure, and Physiography

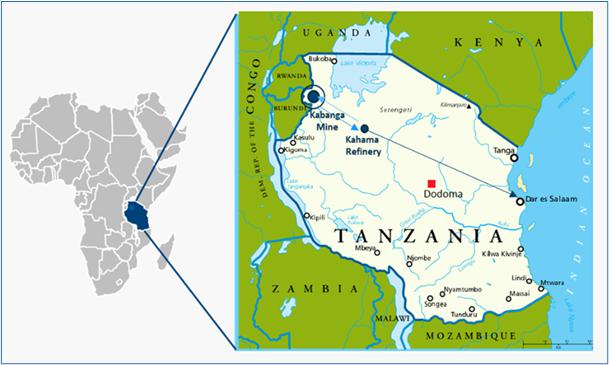

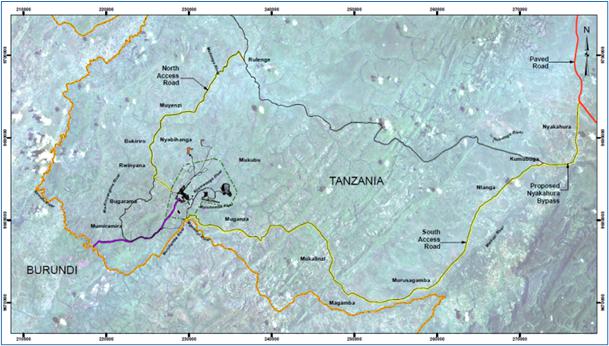

The Project is located in the Ngara district in north-west Tanzania,

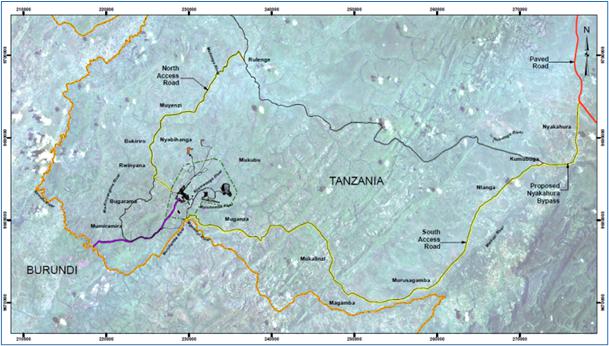

44 km south of the town of Ngara, south-east of the nearest town of Bugarama, and close to the border with Burundi. Figure 1.1

shows the Project location in Tanzania. Figure 1.2 shows the Project site, nearby villages, and the Burundi border. The exploration

camp is located at 02°53.161’S and 30°33.626’E.

The Ngara district is one of the eight districts of the Kagera region

of Tanzania. It is bordered to the north by Karagwe district, to the east by Biharamulo district, to the south by the Kigoma region, to

the north-east by Muleba district, and to the west by the countries of Rwanda and Burundi. Lake Victoria is approximately 130 km

north-east of the Project area.

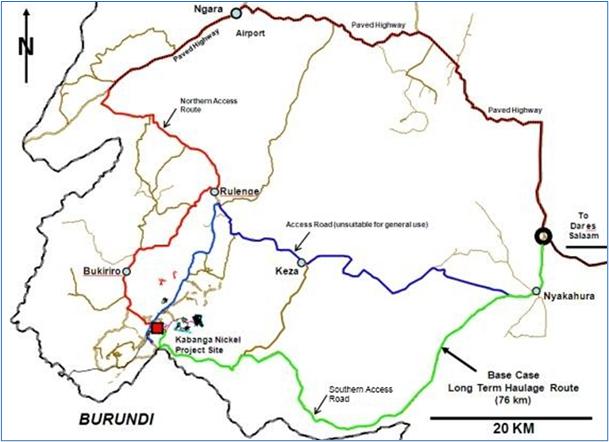

The site is accessible by road connecting to the National Route B3

at Muzani. Three potential access routes have been identified: northern, central, and southern, with the southern route currently preferred

due to its shorter distance (approximately 80 km to Muzani) and being considered to have the lowest environmental and social impact.

The southern route is presently a dirt road, prone, in at least two places, to rutting in the rainy season and occasional flooding.

There is a railway from Dar es Salaam to Isaka that is currently being

upgraded. Isaka is approximately 350 km south-east of the Project (approximately 90 km south–south-east

of Bulyanhulu).

Figure 1.1 Kabanga and

Kahama Site Locations

Within the Project area, domestic water supplies are typically obtained

from the small tributary streams, from springs on the Project ridge, and from shallow dug wells in the valley bottom lands. The rivers

are not used for domestic water supply. The Project area is located in the moist sub-humid climate zone of east central Africa, which

is dominated by monsoonal weather patterns. The long-term average annual rainfall in the Project area is 1,013 mm.

Infrastructure in the Ngara district is limited in terms of national

grid power and reticulated potable water supplies. A transmission line and substation from a new hydroelectric project to the north-west

of Tanzania is within 70 km of the Project site and an extension of the 200 kV line to the project is planned within the development

time of the Project.

Despite resource shortfalls, the local government system is functional,

and all of the 15 villages adjacent to the Project have at least one primary school. All wards have secondary schools, and most villages

and wards have health facilities.

Figure 1.2 Local Area

Plan

1.3 Land Tenure and Ownership

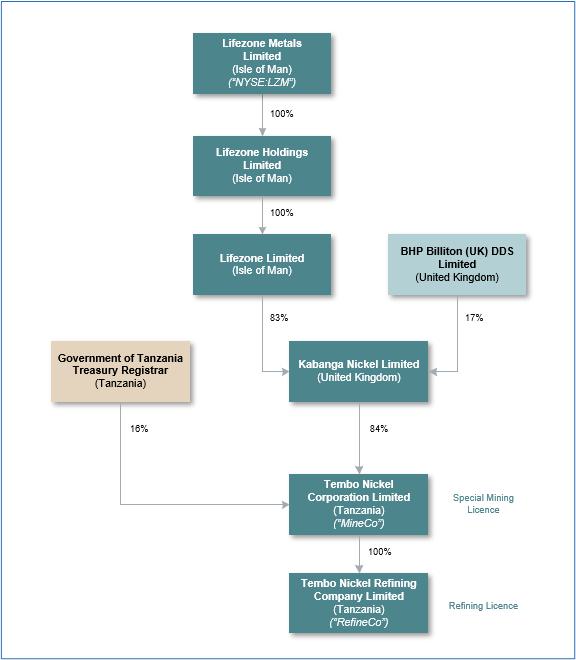

1.3.1 Ownership

LZM was incorporated on 8 December 2022 for the purpose of effectuating

a Business Combination. On 6 July 2023, LZM consummated a Business Combination pursuant to the Business Combination Agreement dated

13 December 2022 between (amongst others) GoGreen Investments Corporation and LZM. On 6 July 2023, in accordance with the terms

of the Business Combination Agreement, the Lifezone Holdings Ltd (LHL) shareholders transferred all of the outstanding ordinary shares

of LHL to LZM in exchange for the issuance of new Lifezone Metals Ordinary Shares issued by LZM. LZM ordinary shares trade on the New

York Stock Exchange (NYSE) under the ticker symbols LZM. LZM raised approximately $86.6 million from the listing on the NYSE, including

approximately $70.2 million from Private Investment in Public Equity (PIPE) investors.

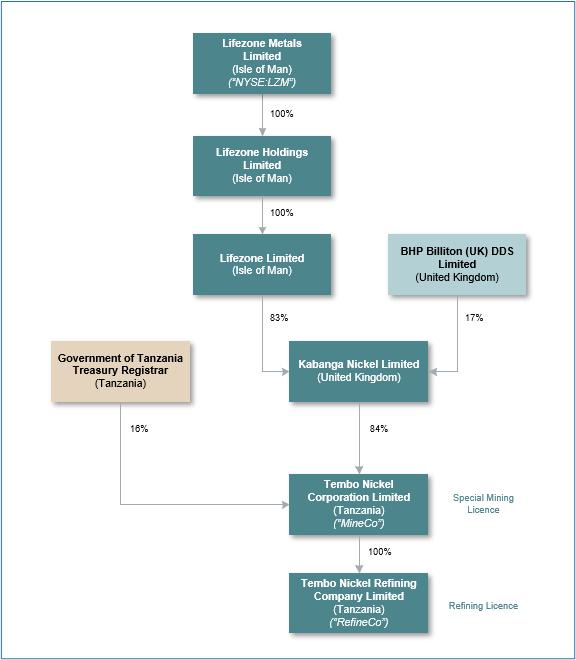

The relationship between LHL and the operating entities that will manage

the Project are shown in Figure 1.3. The Project is 84% owned and operated by Kabanga Nickel Limited (KNL), with the remaining 16%

held by the Government of Tanzania under the terms of a framework agreement. KNL is jointly owned by LZM (83%) through its 100% owned

subsidiary, Lifezone Limited, with the remaining 17% directly owned by BHP Billiton (UK) DDS Limited (BHPB). For Mineral Resource reporting,

the LZM direct ownership share is 69.713% of the in situ mineralisation after excluding the shares of the Government and the direct BHPB

ownership.

Figure 1.3 Lifezone and

Kabanga Nickel Group Structure

1.3.2 Tanzanian Legislation

In Tanzania, mineral rights are held in the form of prospecting licences,

special mining licences, mining licences and primary mining licences. There are several types of prospecting licences and mining licences,

depending on the nature of the minerals being mined and the size of the mine. A Special Mining Licence (SML) is the type of licence required

for large scale mining operations (‘large-scale’ being defined as those projects requiring a capital investment not less

than $100 million), therefore this is the type of licence required for the Kabanga project.

Associated with each SML is an Investor-State Framework Agreement

(Framework Agreement) between the holder of the SML and the Government. This Framework Agreement includes clauses on the conduct of mining

operations, the grant of the Government free carried interest and State participation in mining, and the financing of any mining operations.

Mining legislation requires observance of environmental legislation.

Mining licences cannot be granted without an environmental approval certificate being in place. After mining licences are approved, several

secondary permits are required for activities that could impact on people and the environment.

Under modern Tanzanian legislation, mineral rights do not confer surface

rights. Surface rights were strengthened with the passing of the Land Act 1999, and the Village Act 1999, and application of these Acts

to the mining sector was enhanced by The Mining Act [Cap 123 R.E. 2019].

1.3.3 Kabanga Framework Agreement Summary

The following summary and description of the Kabanga Framework Agreement,

signed on 19 January 2021 between the holder of the SML and the Government of Tanzania, has been prepared by LZM.

The Kabanga Framework Agreement is focussed on equitable economic benefit

sharing according to the principles included in Article 3 of that agreement. It recognises the formation of a Joint Venture Company

(JVC) that is called Tembo Nickel Corporation Limited (TNCL), which has two subsidiaries – Tembo Nickel Mining Company Limited,

and Tembo Nickel Refining Company Limited. TNCL is referred to as both ‘JVC’ and ‘Tembo Nickel Corporation Limited’

in the Framework Agreement and in the SML. The Key Principles of the Framework Agreement are intended to underline and guide the development

of the Project for the mutual benefit of the Parties. The Key Principles include:

| ● | the application of the Economic Benefits Sharing Principle

(EBSP) on the life of mine plans of the Project and the Multipurpose Mineral Processing Facility (MMPF); |

| ● | having a Joint Financial Model (JFM) to guide the management

and operations of the JVC and the JVC subsidiaries; |

| ● | jointly managing the JVC pursuant to the Shareholders’ Agreement; |

| ● | agreeing on the fiscal assumptions underlying the EBSP; |

| ● | establishing minerals beneficiation facilities at Kahama

township in Shinyanga Region in Tanzania. |

The Parties agree equitably to share the economic benefits derived

from the Project in accordance with the JFM. The Agreement provides that KNL shall receive its 84% share of the economic benefits through

payment of dividends and proportionate returns of capital to shareholders of the JVC and the JVC subsidiaries. The Agreement provides

that the Government of Tanzania will receive its share of the economic benefits through the payment by the JVC and the JVC subsidiaries

of taxes, royalties, fees and other fiscal levies through the Government’s 16% Free Carried Interest in the JVC. The Kabanga Framework

Agreement is governed by the laws of Tanzania and any dispute may be referred to conciliation in accordance with the United Nations Commission

on International Trade Law (UNCITRAL) Conciliation Rules and, failing which, arbitration in accordance with the UNCITRAL Arbitration Rules.

As is required under the Miscellaneous Amendments Act 2017, which amends

The Mining Act [Cap 123 R.E. 2019], the Framework Agreement:

| ● | Provides for the Government to have a 16% non-dilutable, free-carried share interest in the capital of TNCL (with the remaining

interest being held by KNL), |

| ● | Includes royalties on the gross value of minerals to be paid at a rate of 6%, where ‘gross value’ means the market value

of minerals determined through valuation as defined in the Miscellaneous Amendments Act 2017. The Government can reject the valuation

if it is low due to market volatility, and can buy the minerals at the low value ascertained, |

| ● | Requires beneficiation of mineral products of operations in country, and |

| ● | Includes requirements to procure goods and services locally. |

In addition to royalties, the Framework Agreement elaborates on other

taxes, fiscal levies, and funding mechanisms that will apply, notably:

| ● | A service levy of 0.3% of gross revenue, |

| ● | Non-deductibility of royalty for the calculation of corporate income tax, |

| ● | Corporate income tax of 30%, |

| ● | Indefinite carry-forward of losses but with the ability to offset against taxable income in any given tax year subject to a cap of

70% of the taxable income in a given tax year, |

| ● | Application of straight-line pooled asset depreciation at a rate of 20% per annum, and |

| ● | The ability for KNL to lend funding to TNCL through shareholder loans. |

The beneficiation facility in the Framework Agreement is referred to

in that agreement as a ‘Multi-purpose Mineral Processing Facility’ (MMPF, or multi-metal mineral processing facility),

and its purpose is stated as ‘processing, smelting and refining of nickel and other mineral concentrates’, albeit that it

should be noted that no smelting is envisaged in this project as all metal extraction will utilise a hydrometallurgical process. TNCL

will manage the operations of the mine and the MMPF through subsidiaries, while the Government will assist TNCL in acquiring suitable

land for the construction of the MMPF within the vicinity of Kahama township. KNL is required to oversee the construction of the MMPF

at Kahama, and to prepare the requisite reports on Kabanga, including feasibility studies for the mine and the MMPF, and the corresponding

Environmental Impact Assessments (EIAs) required by law.

The Framework Agreement states that upon granting of the SML, TNCL

(or any relevant subsidiary) will begin the process of identifying a physical location for the MMPF with the Kahama region being the initial

priority location to assess given the beneficial infrastructure advantages. Upon confirmation of site identification, JVC (or any relevant

subsidiary) may submit an application for a Refining Licence for the MMPF.

The Framework Agreement requires that the management of JVC’s

operations is carried out in Tanzania, with a focus on engaging local talent to maximise employment of Tanzanians, including: preference

for Tanzanian nationals to be appointed to management positions within the JVC, and implementing a local procurement plan that emphasises

spending in Tanzania, except where goods or supplies are not available in Tanzania (or on commercially viable or competitive terms in

Tanzania) or supplies are permitted to be procured from sources outside Tanzania as provided for under relevant laws.

The Framework Agreement contains a number of schedules. These schedules

provide a process for the establishment of the various legal entities, shareholder agreements, and importantly a series of timebound undertakings

to facilitate the development of the Project.

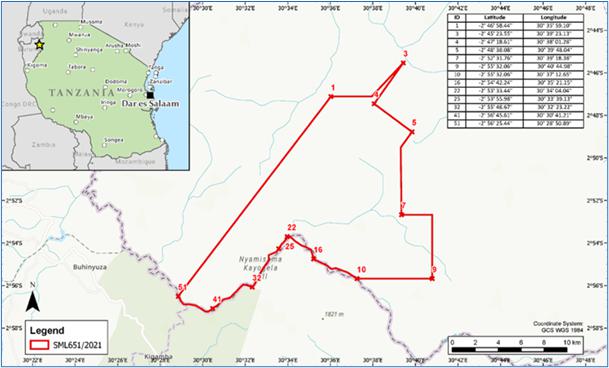

1.3.4 Special Mining Licence

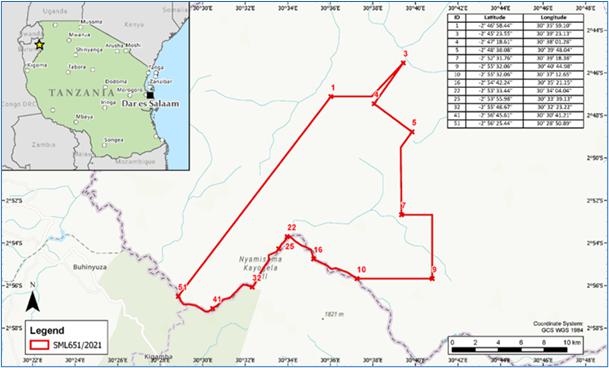

Following the signing of the Framework Agreement, the Government, on

25 October 2021, granted a Special Mining Licence (SML) No. SML 651 / 2021 to Tembo Nickel Corporation Limited (JVC)

for the Project. The SML is currently in force as of the date of this report.

The SML confers to JVC the exclusive right to search for, mine, dig,

mill, process, refine, transport, use, and/or market nickel or other minerals found to occur in association with that mineral, in and

vertically under the SML area, and execute such other works as are necessary for that purpose.

The SML shall remain valid for a period of the esteemed life of the

ore body indicated in the feasibility study report or such period as the applicant may request unless it is cancelled, suspended, or surrendered

in accordance with the law.

The SML requires JVC to strictly observe the mining laws, in particular

but not limited to, the recognition that all mineral data and exploration information over the licence area is the property of the United

Republic of Tanzania and must be submitted to the Geological Survey of Tanzania in accordance with the Mining Act.

Conditions of the SML include:

| ● | Submission of a Feasibility Study to the Mining Commission. |

| ● | An update of the proposed plan for compensation, relocation and resettlement and submission to the Mining Commission. |

| ● | Take all the measures necessary to avert occurrence of accidents whether accidental or premeditated and to observe and satisfy safety

conditions stipulated under the Occupational safety and Health Act. |

| ● | Ensure that management of production, transportation, storage, treatment and disposal of waste arising out of mining operations is

carried out in accordance with safeguards prescribed by the Environmental Management Act. |

| ● | Ensure regular environmental audit, monitoring and evaluation are carried out to avert environmental spoil, degradation and hazardous

substances which may be harmful to human being and or environment. |

| ● | Develop and adopt Mine Closure and Rehabilitation plans of the area where mining operations are carried out. |

| ● | An update of the environmental management plan and submission to the Mining Commission. |

| ● | Preparation of an annual social responsibility plan agreed by the relevant government authorities. |

| ● | The commencement of mining activities within 18 months from 25 October 2021, or such further period as determined by the Mining

Commission on the basis of plans, general designs for the mine, and related facilities as well as other ancillary operations consistent

with the approved mining plan. |

| ● | An undertaking by the JVC to beneficiate in-country. |

| ● | The JVC complying with Tanzanian regulations relating to mining operations, financing arrangements and local content. |

| ● | The JVC complying with the Statement of Integrity Pledge in accordance with Part VIII of the Mining Act and the Mining (Integrity

Pledge) Regulations, 2018. |

With the grant of the SML, JVC agreed to become a strategic partner

to the Government, which shall have not less than 16% of the capital of the entity established, to carry out mining activities over the

licence area in the form of non-dilutable free-carried interest in accordance with the Mining Act, and subject to the provisions

of the Mining Act and of the regulations made thereunder now in force, or which may come into force during the continuance of this licence,

or any renewal thereof. A map of the property showing SML 651 / 2021 is provided in Figure 1.4.

Figure 1.4 Location of

the Project showing Detail of SML 651 / 2021

1.3.5 BHPB Investment in Kabanga Nickel Limited

The following summary of the commercial arrangement between LZM and

BHP Billiton DDS Limited (BHPB) has been prepared by LZM.

LZM and BHPB have three agreements: T1A, T1B, and T2.

1.3.5.1 T1A Agreement

KNL entered into a loan agreement with BHPB dated 24 December

2021, pursuant to which KNL received investment of $40 million from BHPB by way of a convertible loan. Following receipt of approval

from the Tanzanian Fair Competition Commission, and the fulfilment of the other conditions, such convertible loan was converted into an

8.9% equity interest in KNL on 1 July 2022.

1.3.5.2 T1B Agreement

KNL entered into an equity subscription agreement with BHPB dated 14 October

2022 (the T1B Agreement). All the conditions precedent of the T1B Agreement were satisfied or waived on, or before, 8 February 2023,

and in accordance with the T1B Agreement, BHPB subscribed $50 million for an additional 8.9% equity interest in KNL on 15 February

2023, giving BHPB a total equity interest in KNL of 17% (the T1B Investment).

The T1B Investment proceeds will be used for the ongoing funding requirements

of the Project in accordance with a budget agreed between KNL and BHPB.

1.3.5.3 T2 Agreement

KNL and Lifezone Limited entered into an option agreement with BHPB

dated 14 October 2022 pursuant to which KNL will (at BHPB’s option) receive investment from BHPB by way of an equity subscription.

The option grants BHPB the right, subject to certain conditions, to subscribe for the required number of new KNL shares that, in aggregate

with its existing KNL shareholding, would result in BHPB indirectly owning 51% of the total voting and economic equity rights in TNCL

on a fully diluted basis as at closing at a price to be determined through an independent expert valuation. If exercised as at the date

of the agreement, the option would result in BHPB owning 60.71% of the total voting and economic equity rights in KNL on a fully diluted

basis.

BHPB may (at its sole option) deliver a maximum of one valuation notice

to KNL and Lifezone Limited requiring the commencement of a valuation process in respect of KNL during the period which shall:

| ● | Commence on the later of the date on which: |

| (i) | the feasibility study relating to the Kabanga project is agreed

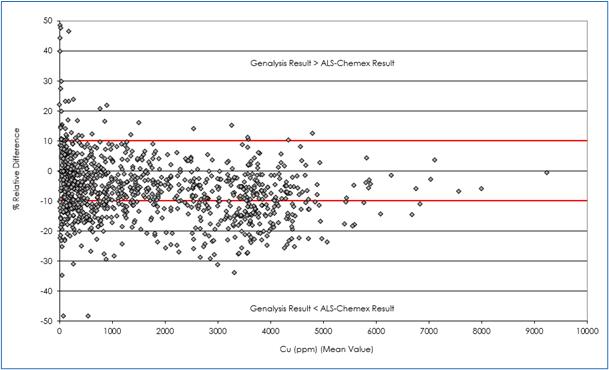

(or finally determined) between BHPB and KNL (the Feasibility Study Agreement Date); and |

| (ii) | the Joint Financial Model in respect of the Kabanga project

is agreed between BHPB and KNL, or such earlier date as the parties may agree in writing, and |

| ● | End on the date falling 30 calendar days after the later

of: |

| (i) | the Feasibility Study Agreement Date; and |

| (ii) | the date on which the Joint Financial Model is agreed between

BHPB, KNL, and the Government of Tanzania. |

The investment is subject to certain conditions, including the receipt

of approval from the Tanzanian Fair Competition Commission (FCC).

The proceeds of the investment shall be used for the ongoing funding

requirements of the Kabanga project.

1.4 Geology and Mineralisation

The Kabanga deposit is located within the East African Nickel Belt

(EANB), which extends approximately 1,500 km along a north-east trend that extends from Zambia in the south-west, though

the Democratic Republic of Congo (DRC), Burundi, Rwanda, Tanzania, and Uganda in the north-east, and straddles the western boundary

of the Tanzania Craton to the east, and the eastern boundary of the Congo Kasai Craton to the west.

1.4.1 Regional Geology

In the northern and central sections of the EANB, a thick package of

Paleoproterozoic to Mesoproterozoic metasedimentary rocks, known as the Karagwe-Ankole Belt (KAB), overlies this boundary, within

which occurs a suite of broadly coeval, bimodal intrusions, (Evans et al, 2016). These igneous rocks correspond to the Mesoproterozoic

Kibaran tectonothermal event between 1,350 to 1,400 Ma, (Kokonyangi et al, 2006; Tack et al, 2010).

The KAB has been divided into several broad domains, (Tack et al, 1994),

as follows:

| ● | An Eastern Domain (ED) that is characterised by lower degrees of metamorphism and tectonism, and the absence of Kibaran-aged granite

magmatism, |

| ● | A Western Domain (WD) characterised by higher degrees of metamorphism and polyphase deformation, and the voluminous Kibaran granite

intrusion, and |

| ● | A Transitional Domain (TD) between the other two domains, which is marked by a north-east trending line of mafic–ultramafic

intrusions known as the Kabanga-Musongati Alignment (Tack et al, 1994). |

The sedimentary rocks of the ED and WD form uncorrelated and distinct

sub-basins, both comprising alternating arenaceous and pelitic rocks including quartzites, schists, greywackes, and conglomerates,

developed in long-lived, shallow-water intracratonic and pericontinental basins, (Fernandez Alonso et al, 2012).

The Kibaran igneous rocks comprise mafic–ultramafic

intrusions, including well-differentiated lopolithic layered intrusions, and small, narrow, tube-like sills, often concentrically

zoned, called chonoliths. The nickel mineralisation zones discovered to date at the Project have exclusively been found associated with

the mafic–ultramafic intrusions, in particular, along the Kabanga-Musongati Alignment, (Deblond and Tack, 1999;

Evans et al, 2000). Felsic intrusions occur coeval with the mafic–ultramafic intrusions. Recent ages (U-Pb zircon

SHRIMP) from Kabanga date the marginal mafic rocks of the North intrusion at 1,403 ± 14 Ma, (Maier et al, 2007).

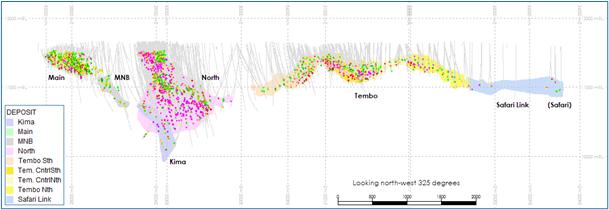

1.4.2 Property Geology

The intrusions that host the known potentially economic nickel-bearing

massive sulfide zones in the Project area (Figure 1.5), namely Main, MNB, Kima, North, and Tembo, are found within steeply-dipping

overturned metasediments (dipping to the west (70° to 80°) with a north–north-east strike orientation

(025°) from Main to North zone, changing to a north-east strike orientation (055°) from North to Tembo.

The mineralised zones are located within, and at the bottom margin

of, the mafic–ultramafic chonoliths. The chonoliths are concentrically zoned with a gabbronorite margin and an ultramafic

cumulate core zone that ranges in composition from sulfidic dunite, plagioclase-peridotite, orthopyroxenite, to olivine melanorite,

(Evans et al, 2000).

The metasediments comprise approximately 90% metapelites and metasandstones,

with the remainder comprising clean arenitic metasandstones or quartzites, (Evans et al, 2016). Lenses and bands of iron sulfides (up

to 5% modal of pyrrhotite) and graphite are common in the more-pelitic rocks, and it has been demonstrated that the sulfur within

the different mineralised zones has similar isotopic signatures, indicating significant assimilation of external sulfur from the KAB sediments,

(Maier et al, 2010).

1.4.3 Lithologies and Stratigraphy

Three lithological groups are present at Kabanga:

| ● | Remobilised massive sulfide (>80% sulfide) (MSSX), which carries 90% of the sulfide occurrence, and massive sulfide with xenoliths

of metasedimentary, or gabbro / ultramafic rock (≥50% to 80% sulfides) (MSXI). |

| ● | Ultramafic–mafic intrusive complex rocks, which display a wide range of metamorphism / metasomatism. These lithologies

can also carry significant sulfide mineralisation, such as in the ultramafic unit named UMAF_1a (≥30% sulfides, located adjacent

to the MSSX, present at Tembo and North). |

| ● | Metasediments comprising a series of pelitic units, schists, and quartzites, forming the hanging wall and footwall of the massive

sulfide lenses. |

The massive sulfide comprises principally pyrrhotite, with up to 15%

pentlandite. The pentlandite shows distinct globular recrystallisation textures and crystals may reach up to 5 cm in size. Accessory sulfides

include chalcopyrite, and traces of pyrite, galena, arsenopyrite, cubanite, niccolite, cobaltite, and mackinawite.

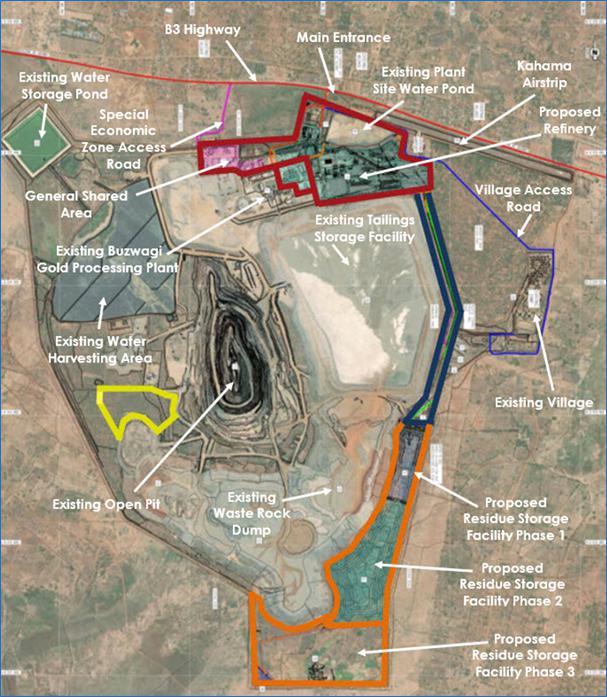

1.4.4 Structural Setting