false

--12-31

Q1

0001771995

P3Y

0001771995

2024-01-01

2024-03-31

0001771995

2024-05-02

0001771995

2024-03-31

0001771995

2023-12-31

0001771995

us-gaap:RelatedPartyMember

2024-03-31

0001771995

us-gaap:RelatedPartyMember

2023-12-31

0001771995

us-gaap:NonrelatedPartyMember

2024-03-31

0001771995

us-gaap:NonrelatedPartyMember

2023-12-31

0001771995

2023-01-01

2023-03-31

0001771995

us-gaap:CommonStockMember

2022-12-31

0001771995

us-gaap:PreferredStockMember

2022-12-31

0001771995

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001771995

us-gaap:RetainedEarningsMember

2022-12-31

0001771995

2022-12-31

0001771995

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001771995

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0001771995

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001771995

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001771995

us-gaap:CommonStockMember

2023-03-31

0001771995

us-gaap:PreferredStockMember

2023-03-31

0001771995

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001771995

us-gaap:RetainedEarningsMember

2023-03-31

0001771995

2023-03-31

0001771995

us-gaap:CommonStockMember

2023-12-31

0001771995

us-gaap:PreferredStockMember

2023-12-31

0001771995

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001771995

us-gaap:RetainedEarningsMember

2023-12-31

0001771995

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001771995

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001771995

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001771995

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001771995

us-gaap:CommonStockMember

2024-03-31

0001771995

us-gaap:PreferredStockMember

2024-03-31

0001771995

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001771995

us-gaap:RetainedEarningsMember

2024-03-31

0001771995

us-gaap:RelatedPartyMember

2024-01-01

2024-03-31

0001771995

us-gaap:RelatedPartyMember

2023-01-01

2023-03-31

0001771995

APHP:EIDLLoanMember

2024-01-01

2024-03-31

0001771995

APHP:EIDLLoanMember

2023-01-01

2023-03-31

0001771995

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

APHP:CustomerMember

2024-03-31

0001771995

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

APHP:CustomerMember

2024-01-01

2024-03-31

0001771995

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

APHP:BUFFALOEDCAMAMember

2023-01-01

2023-12-31

0001771995

APHP:CashAssetManagementAgreementMember

2022-11-30

0001771995

APHP:CashAssetManagementAgreementMember

2024-01-01

2024-03-31

0001771995

APHP:CashAssetManagementAgreementMember

2023-01-01

2023-03-31

0001771995

APHP:BoldCrayonsMember

2024-01-01

2024-03-31

0001771995

APHP:BoldCrayonsMember

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001771995

APHP:BoldCrayonsMember

us-gaap:PreferredStockMember

srt:MaximumMember

2024-01-01

2024-03-31

0001771995

APHP:ConsultingServicesMember

2023-01-01

2023-03-31

0001771995

APHP:RiboMusicLLCMember

2023-01-01

2023-03-31

0001771995

us-gaap:ProductAndServiceOtherMember

2023-01-01

2023-03-31

0001771995

us-gaap:TradeAccountsReceivableMember

2024-03-31

0001771995

us-gaap:TradeAccountsReceivableMember

2023-12-31

0001771995

APHP:CashAssetManagementAgreementMember

2024-03-31

0001771995

APHP:CashAssetManagementAgreementMember

2023-12-31

0001771995

us-gaap:ConvertibleDebtSecuritiesMember

2024-01-01

2024-03-31

0001771995

us-gaap:ConvertibleDebtSecuritiesMember

2023-01-01

2023-12-31

0001771995

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001771995

2023-01-01

2023-12-31

0001771995

us-gaap:ServiceMember

2023-01-01

2023-12-31

0001771995

us-gaap:ServiceMember

2022-01-01

2022-12-31

0001771995

us-gaap:ServiceMember

2021-01-01

2021-12-31

0001771995

us-gaap:ServiceMember

2020-01-01

2020-12-31

0001771995

APHP:MasterLoanAgreementMember

2023-12-31

0001771995

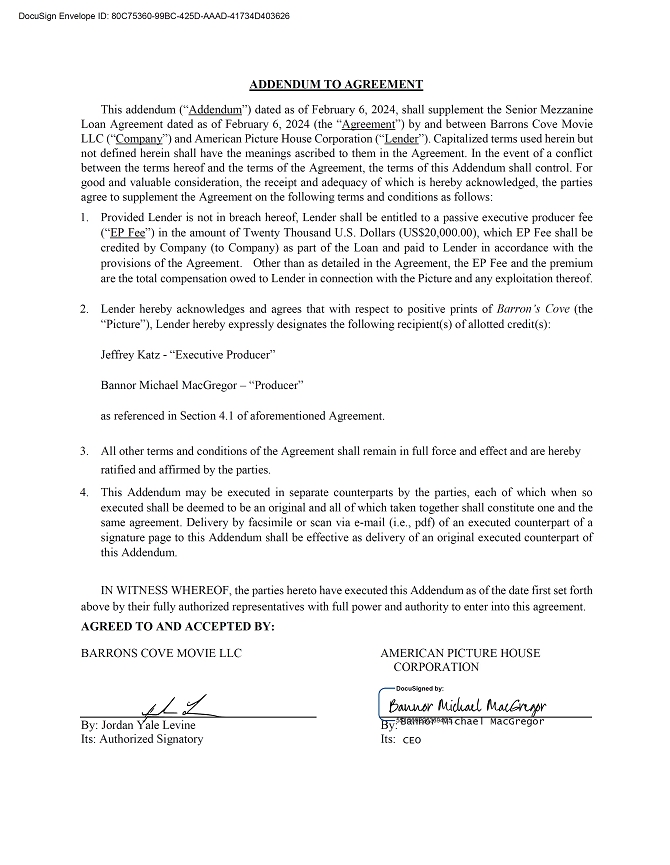

APHP:SeniorMezzannineLoanAgreementWithBarronsCoveMovieLLCMember

APHP:BarronsCoveMovieLLCMember

2024-02-29

0001771995

APHP:SeniorMezzannineLoanAgreementWithBarronsCoveMovieLLCMember

2024-02-01

2024-02-29

0001771995

APHP:SeniorMezzannineLoanAgreementWithBarronsCoveMovieLLCMember

APHP:MrMacgregorMember

2024-02-01

2024-02-29

0001771995

APHP:SeniorLoanAgreementWithPNPMovieLLCMember

2024-02-29

0001771995

APHP:SeniorLoanAgreementWithPNPMovieLLCMember

2024-01-01

2024-03-31

0001771995

APHP:SeniorLoanAgreementWithPNPMovieLLCMember

us-gaap:SubsequentEventMember

2024-04-30

0001771995

APHP:SeniorLoanAgreementWithPNPMovieLLCMember

us-gaap:SubsequentEventMember

2024-05-15

2024-05-15

0001771995

APHP:SeniorLoanAgreementWithPNPMovieLLCMember

2024-02-01

2024-02-29

0001771995

APHP:WebsitePlacedInServiceMember

2024-03-31

0001771995

APHP:WebsitePlacedInServiceMember

2023-12-31

0001771995

APHP:WebsiteUnderDevelopmentMember

2024-03-31

0001771995

APHP:WebsiteUnderDevelopmentMember

2023-12-31

0001771995

APHP:SoftwarePredeploymentMember

2024-03-31

0001771995

APHP:SoftwarePredeploymentMember

2023-12-31

0001771995

APHP:MrMacgregorMember

2023-01-01

2023-03-31

0001771995

APHP:MrMacgregorMember

2023-03-31

0001771995

APHP:MrMacgregorMember

2024-01-01

2024-03-31

0001771995

APHP:MrMacgregorMember

2024-03-31

0001771995

APHP:NoahMorganPrivateFamilyTrustLoanAgreementMember

2024-02-06

0001771995

APHP:NoahMorganPrivateFamilyTrustLoanAgreementMember

2024-02-06

2024-02-06

0001771995

2021-03-31

0001771995

2021-03-01

2021-03-31

0001771995

us-gaap:SubsequentEventMember

2024-05-02

0001771995

us-gaap:SubsequentEventMember

2024-05-02

2024-05-02

0001771995

us-gaap:SeriesAPreferredStockMember

2024-03-31

0001771995

us-gaap:SeriesAPreferredStockMember

2024-01-01

2024-03-31

0001771995

srt:BoardOfDirectorsChairmanMember

2024-02-08

2024-02-08

0001771995

APHP:AdvisorsMember

2024-02-08

2024-02-08

0001771995

APHP:MrMacgregorMember

2024-02-08

2024-02-08

0001771995

APHP:MrBlanchardMember

2024-02-08

2024-02-08

0001771995

2024-02-08

2024-02-08

0001771995

srt:DirectorMember

2024-01-01

2024-03-31

0001771995

srt:DirectorMember

2023-01-01

2023-03-31

0001771995

APHP:ConsultingServicesMember

2024-01-01

2024-03-31

0001771995

2023-01-01

2023-01-01

0001771995

2023-01-01

0001771995

APHP:RiboMusicLLCMember

2024-01-01

2024-03-31

0001771995

APHP:RiboMusicLLCMember

2023-01-01

2023-03-31

0001771995

APHP:RiboMusicLLCMember

2024-03-31

0001771995

APHP:RiboMusicLLCMember

2023-12-31

0001771995

APHP:DevilsHalfAcreProductionsLLCMember

2023-07-31

0001771995

APHP:DashiellLuessenhopMember

2023-09-01

2023-09-30

0001771995

APHP:CashAssetManagementAgreementMember

2022-12-31

0001771995

APHP:BoldCrayonsMember

2022-01-01

2022-12-31

0001771995

APHP:BoldCrayonsMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001771995

APHP:MrLuessenhopMember

2022-11-10

0001771995

APHP:MrLuessenhopMember

2022-11-10

2022-11-10

0001771995

APHP:NewInvestorsMember

us-gaap:SubsequentEventMember

2024-04-01

2024-04-01

0001771995

APHP:NewInvestorsMember

us-gaap:SubsequentEventMember

2024-04-01

0001771995

us-gaap:SubsequentEventMember

APHP:AmericanExpressBusinessMember

2024-04-01

0001771995

us-gaap:SubsequentEventMember

APHP:AmericanExpressBusinessMember

2024-04-10

0001771995

us-gaap:SubsequentEventMember

APHP:MrMacgregorMember

2024-04-01

0001771995

us-gaap:SubsequentEventMember

APHP:MrMacgregorMember

2024-04-01

2024-04-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

APHP:Shareholders

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

COMMISSION

FILE NO. 000-56586

American

Picture House Corporation

(Exact

name of registrant as specified in its charter)

Wyoming

(State

or other jurisdiction of incorporation)

7812

(Primary

Standard Industrial Classification Code Number)

85-4154740

(IRS

Employer Identification No.)

477

Madison Avenue, 6th Floor

New

York, NY 10022

1-800-689-6885

(Address

and telephone number of registrant’s executive office)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Securities

registered pursuant to Section 12(g) of the Act: Common Stock

Indicate

by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for shorter period that the registrant as required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained,

to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

Filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of May 2, 2024 the Registrant had 111,399,325 shares of common stock issued and outstanding.

AMERICAN

PICTURE HOUSE CORP

FORM

10-Q

FOR

THE QUARTER ENDED MARCH 31, 2024

TABLE

OF CONTENTS

General

and Where You Can Find Other Information

Unless

otherwise indicated, all references to the “Company,” “we,” “our,” “APH” and “APHP”

refer to American Picture House Corporation a Wyoming corporation. References to “revenues” refer to net revenues. References

to “U.S. dollars,” “dollars,” “U.S. $” and “$” are to the lawful currency of the United

States of America.

PART

I—FINANCIAL INFORMATION

Item

1. Financial Statements.

AMERICAN

PICTURE HOUSE CORPORATION

CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

AS

OF MARCH 31, 2024

INDEX

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AMERICAN

PICTURE HOUSE CORPORATION

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

March

31, 2024 | | |

December

31, 2023 | |

| | |

(Unaudited) | | |

* | |

| ASSETS | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash

equivalents | |

$ | 25,126 | | |

$ | 203,971 | |

| Accounts receivable | |

| 51,775 | | |

| 31,948 | |

| Prepaid expenses | |

| 13,367 | | |

| 29,185 | |

| Receivable - related party | |

| 621 | | |

| 1,349 | |

| Total Current Assets | |

| 90,889 | | |

| 266,453 | |

| | |

| | | |

| | |

| Produced and licensed content costs | |

| 200,403 | | |

| 210,633 | |

| Loans receivable, film financing arrangements | |

| 220,000 | | |

| - | |

| Intangible assets, net of accumulated amortization

of $1,750 and $1,000 as of March 31, 2024 and December 31, 2023, respectively. | |

| 74,114 | | |

| 71,864 | |

| IMM loans receivable,

net of allowance of $366,387 | |

| - | | |

| - | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

| 585,406 | | |

| 548,950 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued

expenses | |

| 48,710 | | |

| 90,377 | |

| Deferred revenue, current

portion | |

| 50,000 | | |

| - | |

| Interest payable - related

party | |

| 1,641 | | |

| - | |

| Interest payable - EIDL

loan | |

| 10,889 | | |

| 11,580 | |

| Note

payable - related party | |

| 250,000 | | |

| - | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 361,240 | | |

| 101,957 | |

| | |

| | | |

| | |

| Economic injury disaster loan, non-current | |

| 149,900 | | |

| 149,900 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 511,140 | | |

| 251,857 | |

| | |

| | | |

| | |

| Stockholders’ Equity (Deficit): | |

| | | |

| | |

| Common Stock $0.0001 par

value. 1,000,000,000 authorized. 109,865,991 and 109,790,991 issued and outstanding as of March 31, 2024 and December 31, 2023, respectively. | |

| 471,577 | | |

| 471,569 | |

| Preferred Stock $0.0001 par value. 1,000,000

authorized. 3,829 issued and outstanding as of March 31, 2024 and December 31, 2023. | |

| - | | |

| - | |

| Additional paid in capital | |

| 6,120,372 | | |

| 4,847,220 | |

| Accumulated deficit | |

| (6,517,683 | ) | |

| (5,021,696 | ) |

| Total Stockholders’ Equity (Deficit) | |

| 74,266 | | |

| 297,093 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY (DEFICIT) | |

$ | 585,406 | | |

$ | 548,950 | |

The

accompanying notes are an integral part of these unaudited interim consolidated financial statements.

AMERICAN

PICTURE HOUSE CORPORATION

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

Three

Months ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 23,003 | | |

$ | 169,111 | |

| | |

| | | |

| | |

| Cost of revenues | |

| - | | |

| 36,701 | |

| Gross profit | |

| 23,003 | | |

| 132,410 | |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| General and administrative | |

| 1,501,932 | | |

| 183,603 | |

| Sales

and marketing | |

| 13,975 | | |

| - | |

| Total

Operating Expenses | |

| 1,515,907 | | |

| 183,603 | |

| Net Operating Loss | |

| (1,492,904 | ) | |

| (51,193 | ) |

| | |

| | | |

| | |

| Other Income (Expenses): | |

| | | |

| | |

| Interest income | |

| 102 | | |

| 741 | |

| Interest

expense | |

| (3,185 | ) | |

| (1,888 | ) |

| Net

Other Income (Expenses) | |

| (3,083 | ) | |

| (1,147 | ) |

| Income taxes | |

| - | | |

| - | |

| Net loss | |

$ | (1,495,987 | ) | |

$ | (52,340 | ) |

| | |

| | | |

| | |

| Net loss per common share - Basic and Diluted | |

$ | (0.01 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | |

| Weighted average shares used in per share computation - Basic and Diluted | |

| 109,865,001 | | |

| 100,735,159 | |

The

accompanying notes are an integral part of these unaudited interim consolidated financial statements.

AMERICAN

PICTURE HOUSE CORPORATION

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIT

For

the three months ended March 31, 2024 and 2023

(Unaudited)

| | |

Shares | | |

Par

Value | | |

Shares | | |

Amount | | |

Paid In Capital | | |

Deficit | | |

(Deficit) | |

| | |

Common

Stock | | |

Preferred

Stock | | |

Additional | | |

Accumulated | | |

Total

Stockholders’

Equity | |

| | |

Shares | | |

Par

Value | | |

Shares | | |

Amount | | |

Paid In Capital | | |

Deficit | | |

(Deficit) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance, December 31, 2022 | |

| 100,735,159 | | |

$ | 10,074 | | |

| 3,829 | | |

$ | - | | |

$ | 3,577,548 | | |

$ | (3,655,378 | ) | |

$ | (67,756 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of Common Stock | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of Common Stock, shares | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock option compensation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of accrued liabilities totaling

$105,000 into options to purchase 1,160,221 shares of Common Stock | |

| - | | |

| - | | |

| - | | |

| - | | |

| 105,000 | | |

| - | | |

| 105,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (52,340 | ) | |

| (52,340 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31,

2023 | |

| 100,735,159 | | |

$ | 10,074 | | |

| 3,829 | | |

$ | - | | |

$ | 3,682,548 | | |

$ | (3,707,718 | ) | |

$ | (15,096 | ) |

| | |

Common

Stock | | |

Preferred

Stock | | |

Additional | | |

Accumulated | | |

Total

Stockholders’

Equity | |

| | |

Shares | | |

Par

Value | | |

Shares | | |

Amount | | |

Paid In Capital | | |

Deficit | | |

(Deficit) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance, December 31, 2023 | |

| 109,790,991 | | |

$ | 10,979 | | |

| 3,829 | | |

$ | - | | |

$ | 5,307,810 | | |

$ | (5,021,696 | ) | |

$ | 297,093 | |

| Balance | |

| 109,790,991 | | |

$ | 10,979 | | |

| 3,829 | | |

$ | - | | |

$ | 5,307,810 | | |

$ | (5,021,696 | ) | |

$ | 297,093 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of Common Stock for cash | |

| 75,000 | | |

| 8 | | |

| - | | |

| - | | |

| 14,992 | | |

| - | | |

| 15,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock option compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,258,160 | | |

| - | | |

| 1,258,160 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,495,987 | ) | |

| (1,495,987 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31,

2024 | |

| 109,865,991 | | |

$ | 10,987 | | |

| 3,829 | | |

$ | - | | |

$ | 6,580,962 | | |

$ | (6,517,683 | ) | |

$ | 74,266 | |

| Balance | |

| 109,865,991 | | |

$ | 10,987 | | |

| 3,829 | | |

$ | - | | |

$ | 6,580,962 | | |

$ | (6,517,683 | ) | |

$ | 74,266 | |

The

accompanying notes are an integral part of these unaudited interim consolidated financial statements.

AMERICAN

PICTURE HOUSE CORPORATION

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

Three

Months ended March 31, | |

| | |

2024 | | |

2023 | |

| Cash Flows from Operating Activities: | |

| | | |

| | |

| Net Income (Loss) | |

$ | (1,495,987 | ) | |

$ | (52,340 | ) |

| Adjustments to Reconcile

Net Income (Loss) to Net Cash Flows from Operating Activities: | |

| | | |

| | |

| Expiration of produced

and licensed costs | |

| 15,000 | | |

| - | |

| Stock option expense | |

| 1,258,160 | | |

| - | |

| Amortization expense | |

| 750 | | |

| - | |

| Change in operating assets

and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (19,827 | ) | |

| 109,702 | |

| Prepaid expenses | |

| 15,818 | | |

| 17,838 | |

| Other receivables | |

| - | | |

| 168 | |

| Receivables - related party | |

| 728 | | |

| - | |

| Loans receivable, film

financing arrangements | |

| (220,000 | ) | |

| - | |

| Accounts payable and accrued

expenses | |

| (41,667 | ) | |

| (41,783 | ) |

| Payable to related party | |

| - | | |

| (130,000 | ) |

| Interest payable - related

parties | |

| 1,641 | | |

| 111 | |

| Interest payable - EIDL

loan | |

| (691 | ) | |

| 1,386 | |

| Deferred

revenue | |

| 50,000 | | |

| (35,000 | ) |

| Net Cash Flows from Operating

Activities | |

| (436,075 | ) | |

| (129,918 | ) |

| | |

| | | |

| | |

| Cash Flows from Investing Activities: | |

| | | |

| | |

| Produced and licensed costs | |

| (4,770 | ) | |

| (10,016 | ) |

| Intangible

assets | |

| (3,000 | ) | |

| - | |

| Net Cash Flows from Investing

Activities | |

| (7,770 | ) | |

| (10,016 | ) |

| | |

| | | |

| | |

| Cash Flows from Financing Activities: | |

| | | |

| | |

| Proceeds from debt borrowings

- related parties | |

| 250,000 | | |

| 125,000 | |

| Proceeds

from sale of Common Stock | |

| 15,000 | | |

| - | |

| Net Cash Flows from Financing

Activities | |

| 265,000 | | |

| 125,000 | |

| | |

| | | |

| | |

| Net Increase in Cash and Cash Equivalents | |

| (178,845 | ) | |

| (14,934 | ) |

| Cash and Cash Equivalents,

Beginning of Period | |

| 203,971 | | |

| 31,573 | |

| Cash and Cash Equivalents,

End of Period | |

$ | 25,126 | | |

$ | 16,639 | |

| | |

| | | |

| | |

| Non-cash Financing and Investing Activities: | |

| | | |

| | |

| Conversion of accrued expenses

into options to purchase Common Stock | |

$ | - | | |

$ | 105,000 | |

The

accompanying notes are an integral part of these unaudited interim consolidated financial statements.

AMERICAN

PICTURE HOUSE CORPORATION

NOTES

TO (UNAUDITED) FINANCIAL STATEMENTS

NOTE

1 – Organization And Description Of Business

American

Picture House Corporation. (“the Company,” “we” “us”) was incorporated in the State of Nevada on

September 21, 2005, originally under the corporate name of Servinational, Inc. The Company subsequently changed its name to Shikisai

International, Inc. in November 2005 and then to Life Design Station, Intl., Inc. in August 2007. The Company changed its state of domicile

from Nevada to Wyoming on October 13, 2020. On December 4, 2020, the Company changed its name to American Picture House Corporation.

The

Company’s year-end is December 31.

NOTE

2 – Summary Of Significant Accounting Policies

Basis

of Presentation

The

accompanying financial statements have been prepared in accordance with the Financial Accounting Standards Board (“FASB”)

“FASB Accounting Standard Codification™” (the “Codification”) which is the source of authoritative

accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in

conformity with accepted accounting principles (“GAAP”) in the United States.

Principles

of Consolidation

The

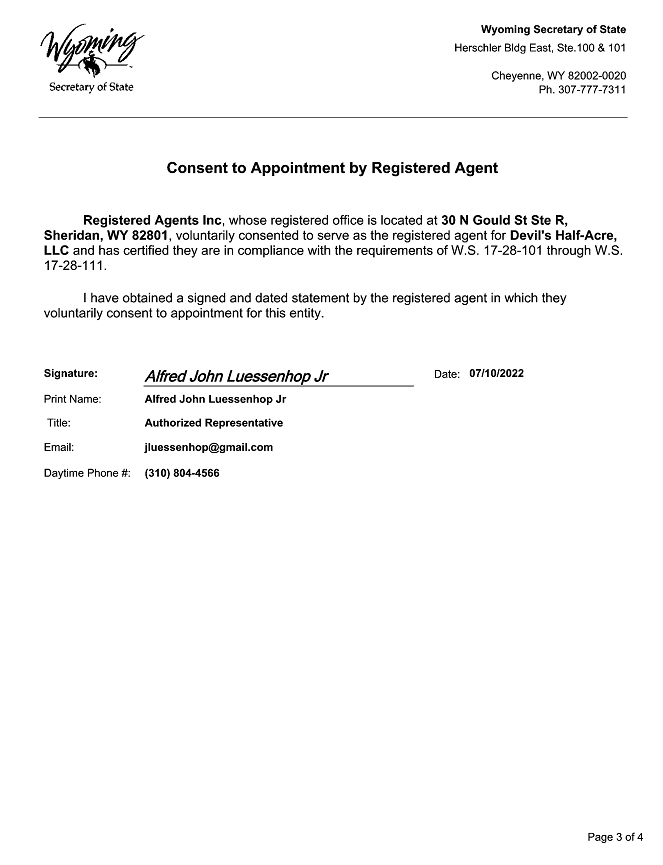

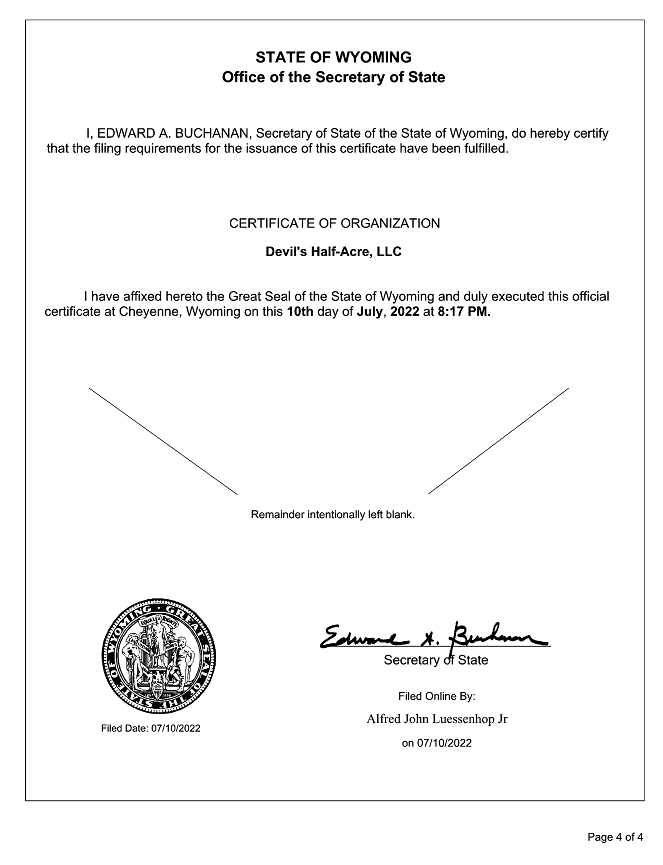

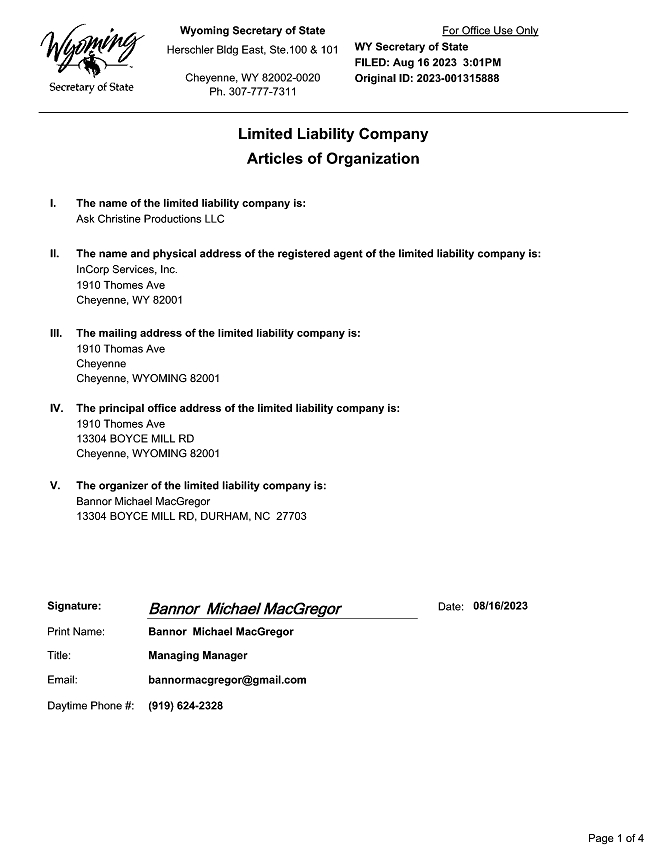

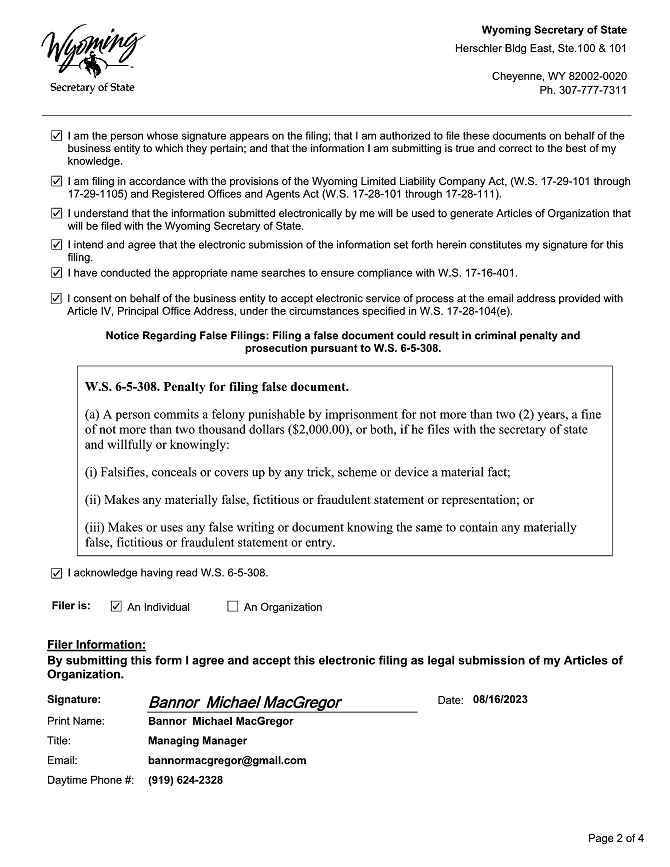

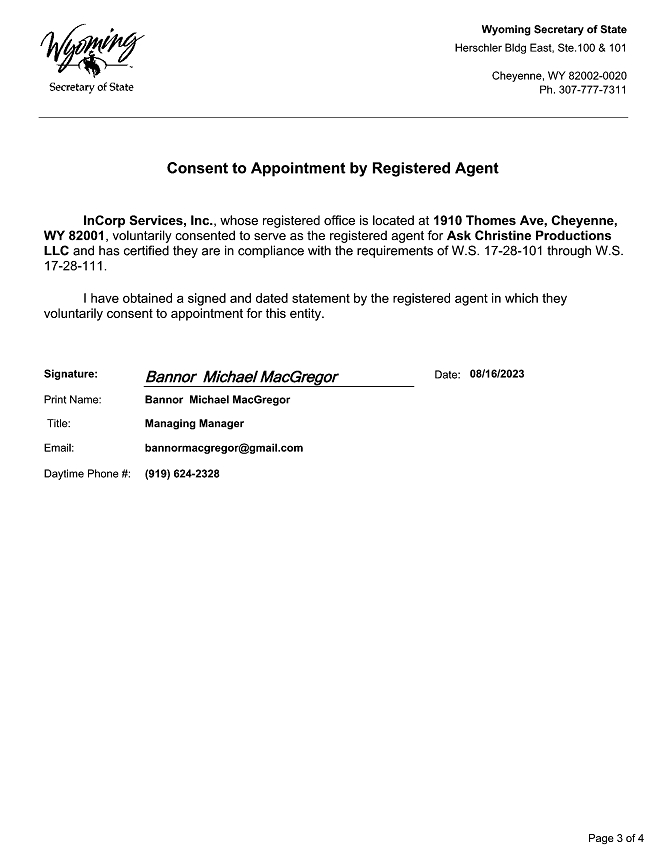

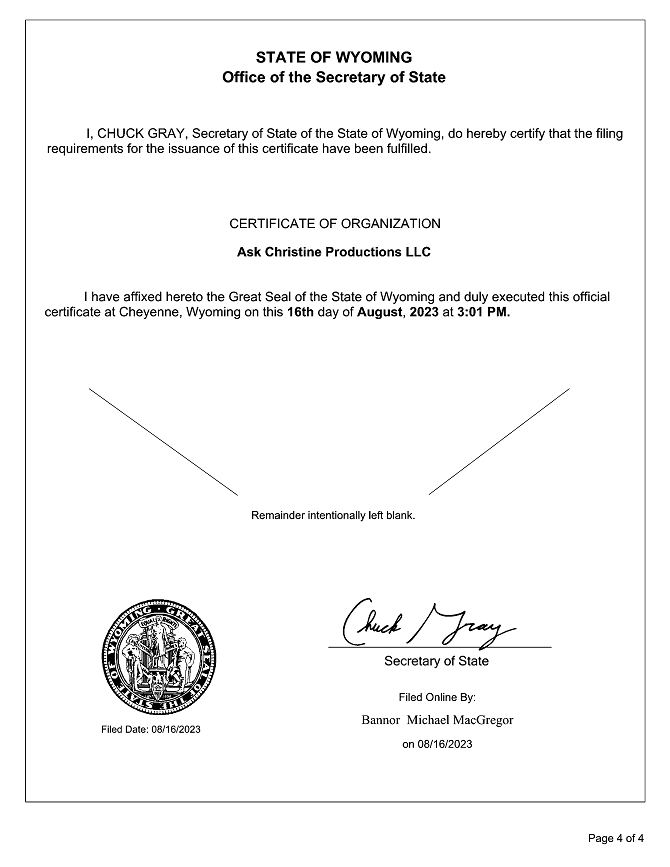

condensed consolidated financial statements of the Company include the accounts of American Picture House Corporation and its wholly

owned subsidiaries, Devil’s Half-Acre, LLC and Ask Christine Productions, LLC.

Going

Concern

The

accompanying financial statements have been prepared assuming the Company will continue as a going concern, which contemplates the realization

of assets and the satisfaction of liabilities in the normal course of business for the twelve months following the date of these financial

statements. As of March 31, 2024, the Company had a working capital deficit of ($270,351) and an accumulated deficit of $6,517,683.

Because

the Company does not expect that the existing operational cash flow will be sufficient to fund presently anticipated operations, this

raises substantial doubt about the Company’s ability to continue as a going concern. Therefore, the Company will need to raise

additional funds and is currently exploring alternative sources of financing. Recently the Company has been funded by related party shareholders

and officers. Historically, the Company raised capital through private placements, to finance working capital needs and may attempt to

raise capital through the sale of common stock or other securities and obtaining some short-term loans. The Company will be required

to continue to do so until its operations become profitable. Also, the Company has, in the past, paid for consulting services with its

common stock to maximize working capital, and intends to continue this practice where feasible.

Use

of Estimates

The

preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the

reported amounts of liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported

amounts of revenues and expenses during the reporting period. The most significant estimates relate to income taxes and contingencies.

The Company bases its estimates on historical experience, known or expected trends, and various other assumptions that are believed to

be reasonable given the quality of information available as of the date of these financial statements. The results of these assumptions

provide the basis for making estimates about the carrying amount of assets and liabilities that are not readily apparent from other sources.

Actual results could differ from these estimates.

Cash

and cash equivalents

Cash

equivalents are short-term highly liquid investments which include short term bank deposits (up to three months from date of deposit),

that are not restricted as to withdrawals or use that are readily convertible to cash with maturities of three months or less as of the

date acquired. The Company’s policy is to maintain its cash balances with financial institutions with high credit ratings and in

accounts insured by the Federal Deposit Insurance Corporation (the “FDIC”) and/or by the Securities Investor Protection Corporation

(the “SIPC”). The Company may periodically have cash balances in financial institutions in excess of the FDIC and SIPC insurance

limits of $250,000 and $500,000, respectively. The Company has not experienced any losses to date resulting from this policy.

Accounts

receivable

Accounts

receivable primarily consist of trade receivables due from customers for consulting services and from fees derived from licensing of

IP to content providers worldwide. As of March 31, 2024, $50,000 (97%) of accounts receivable were related to the grant of a producer

credit in a proposed future film. As of December 31, 2023, 100% of accounts receivable were due from the BUFFALOED CAMA (see Assigned

Rights to feature film, BUFFALOED below).

SCHEDULE OF ACCOUNTS RECEIVABLE

| | |

March

31, 2024 | | |

December

31, 2023 | |

| Accounts receivable, trade | |

$ | 50,000 | | |

$ | - | |

| Accounts receivable, related party | |

| 1,775 | | |

| - | |

| Accounts receivable,

CAMA | |

| - | | |

| 31,948 | |

| Accounts receivable | |

$ | 51,775 | | |

$ | 31,948 | |

Allowance

for doubtful accounts

The

allowance for doubtful accounts is determined with respect to amounts the Company has determined to be doubtful of collection. In determining

the allowance for doubtful accounts, the Company considers, among other things, its past experience with customers, the length of time

that the balance is past due, the customer’s current ability to pay and available information about the credit risk on such customers.

In 2023, the Company wrote off $193,932 of receivables as bad debt based on a review of the customer’s ability to pay, the customer’s

Managing Director resigning, and the customer ceasing operations. There was no bad debt expense during the quarter ended March 31, 2024

and no allowance for doubtful accounts at March 31, 2024 or December 31, 2023.

Prepaid

expenses

At

March 31, 2024, prepaid expenses consisted of prepaid insurance, prepaid licenses, and prepaid services. Prepaid expenses are amounts

paid to secure the use of assets or the receipt of services at a future date or continuously over one or more future periods. When the

prepaid expenses are eventually consumed, they are charged to expense. The Company had $13,367 and $29,185 in prepaid expenses as of

March 31, 2024 and December 31, 2023, respectively.

Produced

and Licensed Content Costs

Capitalized

production costs, whether produced or acquired/ licensed rights, include development costs, direct costs and production overhead. These

amounts and licensed content are included in “Produced and Licensed Content Costs” on the balance sheet as follows:

SCHEDULE OF PRODUCED AND LICENSED CONTENT COSTS

| | |

March

31, 2024 | | |

December

31, 2023 | |

| Films in

development and pre-production stage | |

$ | 200,403 | | |

$ | 210,633 | |

| | |

$ | 200,403 | | |

$ | 210,633 | |

Impairment

Assessment for Investment in Films and Licensed Program Rights

A

film group or individual film is evaluated for impairment when an event or change in circumstances indicates that the fair value of an

individual film or film group is less than its unamortized cost.

During

the quarter ended March 31, 2024, the Company allowed options to two screenplays to expire and wrote-off $15,000 of previously capitalized

option costs.

Assigned

rights to the feature film, BUFFALOED.

In

November 2022, the Company obtained certain limited rights to the feature film BUFFALOED from Bold Crayon, Inc. (“BC”),

including a secured position of a one million three hundred eighty-thousand-dollar ($1,380,000.00 USD) receivable against the film’s

revenues as per the film’s Cash Asset Management Agreement (“CAMA”) and a 35% share of the profits generated thereafter

(“the BC Assets”). During the quarters ended March 31, 2024 and 2023, the Company reported revenues of $23,003 and $0, respectively,

from the CAMA. Inception to date, the Company has received $304,875 under the CAMA. Due to uncertainties of any future revenue, if any,

no value has been assigned to any potential future revenues.

As

partial consideration for the BC Assets being acquired by APH hereunder, APHP agreed to pay BC the first one hundred thirty thousand

dollars ($130,000.00 USD) that APHP collected from the BUFFALOED and to deliver one Preferred Share to BC for each ten thousand dollars

($10,000.00 USD), in value paid to the APHP from the BUFFALOED receivable above the one hundred thirty thousand dollars ($130,000.00

USD), not to exceed one hundred twenty-five (125) Preferred Shares. As of March 31, 2024, Bold Crayon was due to receive 17 Preferred

Shares of APHP.

Intangible

assets

The

Company’s intangible assets include in-service and under-development websites and licensed internal use software. During the year

ended December 31, 2023 the Company developed an external website that was placed in service during the third quarter of 2023. Additionally,

during the fourth quarter of 2023 the Company began developing additional aspects of its website that went live in April 2024. During

the fourth quarter of 2023, the Company licensed rights to new internal use software, but subsequently placed that project on hold and

has not established a timeline for placing the software in service.

The

capitalized costs of the Company’s websites placed into service were subject to straight-line amortization over a three-year period.

Amortization expense totaled $$750 and $0 for the quarters ended March 31, 2024 and 2023, respectively.

Deferred

Revenue

Deferred

revenue represents the amount billed to clients that has not yet been earned, pursuant to agreements entered into in current and prior

periods. As of March 31, 2024 and December 31, 2023, total net deferred revenue was $50,000 and $0, respectively. As previously noted,

the $50,000 in deferred revenue at March 31, 2024, relates to the grant of a producer credit to a proposed film.

Revenues

and Costs from Services and Products – Historically, Company’s revenue comes from contracts with customers for

consulting services and from the licensing and distribution of film and other entertainment rights. The consulting services typically

relate to development of business strategy and monetization of intellectual property rights. The Company accounts for a contract with

a customer when there is an enforceable contract between the Company and the customer, the rights of the party are identified, the contract

has economic substance, and collectability of the contract is considered probable. Historically, the term of these consulting agreements

has been approximately three to six months in duration. The Company’s revenue is measured based on considerations specified in

the contract with each customer. Accounting Standards Codification (“ASC”) 606 allows for adoption of an “as invoiced”

practical expedient that allows companies to recognize revenue in the amount to which the entity has a right to invoice when they have

a right to consideration from a customer in an amount that corresponds directly with the value to the customer of the entity’s

performance completed to date. The Company has elected to adopt this practical expedient with regards to its consulting services revenue.

Revenues for the three months ended March 31, 2023 totaled $165,000. As discussed in Note 10 – Related Party Transactions, $35,000

of the revenue was from Ribo Music and the remaining $135,000 was from a second client. The Company did not have any consulting revenues

in 2024.

Revenues

from Films and Licensed Rights, are calculated based on expected ultimate revenues estimated over a period not to exceed ten

years following the date of initial release of the motion picture. For an episodic television series, the period over which ultimate

revenues are estimated cannot exceed ten years following the date of delivery of the first episode, or, if still in production, five

years from the date of delivery of the most recent episode, if later. For titles included in acquired libraries, ultimate revenue includes

estimates over a period not to exceed twenty years following the date of acquisition.

Revenue

derived from the BUFFALOED CAMA totaled $23,003 and $0 for the quarters ended March 31, 2024 and 2023, respectively.

Fair

Value Measurements – The Company measures and discloses fair value in accordance with the ASC Topic 820, Fair Value

Measurements and Disclosures which defines fair value, establishes a framework and gives guidance regarding the methods used for measuring

fair value, and expands disclosures about fair value measurements. Fair value is an exit price, representing the amount that would be

received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in

pricing an asset or liability. As a basis for considering such assumptions there exists a three-tier fair-value hierarchy, which prioritizes

the inputs used in measuring fair value as follows:

Level

1 - unadjusted quoted prices are available in active markets for identical assets or liabilities that the Company has the ability to

access as of the measurement date.

Level

2 - pricing inputs are other than quoted prices in active markets that are directly observable for the asset or liability or indirectly

observable through corroboration with observable market data.

Level

3 - pricing inputs are unobservable for the non-financial asset or liability and only used when there is little, if any, market activity

for the non-financial asset or liability at the measurement date. The inputs into the determination of fair value require significant

management judgment or estimation. Level 3 inputs are considered as the lowest priority within the fair value hierarchy. The valuation

of the right to obtain control over affiliated company, right to acquire shares of other companies, contingent consideration to be paid

upon achieving of performance milestone, certain convertible bridge loans (following the maturity date and thereafter) and certain freestanding

stock warrants and bifurcated convertible feature of convertible bridge loans issued to the units’ owners, fall under this category.

This

hierarchy requires the Company to use observable market data, when available, and to minimize the use of unobservable inputs when determining

fair value.

The

fair value of cash and cash equivalents is based on its demand value, which is equal to its carrying value. Additionally, the carrying

value of all other short-term monetary assets and liabilities are estimated to be equal to their fair value due to the short-term nature

of these instruments.

Valuation

of Long-Lived Assets – The Company evaluates whether events or circumstances have occurred which indicate that the carrying

amounts of long-lived assets (principally produced and licensed content costs) may be impaired or not recoverable. The significant

factors that are considered that could trigger an impairment review include: changes in business strategy, market conditions, or the

manner of use of an asset; underperformance relative to historical or expected future operating results; and negative industry or economic

trends. In evaluating an asset for possible impairment, management estimates that asset’s future undiscounted cash flows and appraised

values to measure whether the asset is recoverable. The Company measures the impairment based on the projected discounted cash flows

of the asset over its remaining life.

Stock-Based

Compensation – The Company follows U.S. GAAP, which requires all stock-based compensation to employees, including the grant

of employee stock options, to be recognized in the statement of operations based on its fair value. Awards outstanding are accounted

for using the accounting principles originally applied to the award. The expense associated with share-based compensation is recognized

on a straight-line basis over the service period of each award. Refer to Note 8 for additional information related to this stock-based

compensation plan.

Income

taxes

The

Company accounts for income taxes under FASB ASC 740, “Accounting for Income Taxes”. Under FASB ASC 740, deferred

tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered

or settled. Under FASB ASC 740, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in

the period that includes the enactment date. FASB ASC 740-10-05, “Accounting for Uncertainty in Income Taxes” prescribes

a recognition threshold and a measurement attribute for the financial statement recognition and measurement of tax positions taken or

expected to be taken in a tax return. For those benefits to be recognized, a tax position must be more-likely-than-not to be sustained

upon examination by taxing authorities.

The

amount recognized is measured as the largest amount of benefit that is greater than 50 percent likely of being realized upon ultimate

settlement. The Company assesses the validity of its conclusions regarding uncertain tax positions quarterly to determine if facts or

circumstances have arisen that might cause it to change its judgment regarding the likelihood of a tax position’s sustainability

under audit.

Net

Loss per Share

Basic

(loss) income per share is computed by dividing net (loss) income available to Common Stockholders by the weighted average number of

common shares outstanding during the period. Diluted (loss) income per share reflects the potential dilution, using the treasury stock

method that could occur if securities or other contracts to issue Common Stock were exercised or converted into Common Stock or resulted

in the issuance of Common Stock that then shared in the (loss) income of the Company. In computing diluted (loss) income per share, the

treasury stock method assumes that outstanding instruments are exercised/converted, and the proceeds are used to purchase Common Stock

at the average market price during the period. Instruments may have a dilutive effect under the treasury stock method only when the average

market price of the Common Stock during the period exceeds the exercise price/conversion rate of the instruments.

The

following common share equivalents are excluded from the calculation of weighted average common shares outstanding because their inclusion

would have been anti-dilutive:

SCHEDULE OF ANTIDILUTIVE SECURITIES EXCLUDED FROM COMPUTATION OF WEIGHTED AVERAGE COMMON SHARES OUTSTANDING

| | |

March

31, 2024 | | |

December

31, 2023 | |

| Convertible

Preferred Stock | |

| 382,900,000 | | |

| 382,900,000 | |

| Options to Purchase Common Stock | |

| 5,083,471 | | |

| | |

| | |

| | | |

| | |

| | |

| 387,983,471 | | |

| 382,900,000 | |

Segment

Information

Operating

segments are defined as components of an enterprise about which separate discrete information is available for evaluation by the chief

operating decision maker (“CODM”), or decision-making group, in deciding how to allocate resources and in assessing performance.

For the period of these financial statements, the CEO of the Company was the CODM. The Company views its operations and manages its business

as one operating and reporting segment.

New

accounting standards

The

Company’s management has evaluated all the recently issued, but not yet effective, accounting standards and guidance that have

been issued or proposed by the FASB or other standards-setting bodies through the filing date of these financial statements and does

not believe the future adoption of any such pronouncements will have a material effect on the Company’s financial position and

results of operations.

Note

3 – Liquidity and Going Concern

The

Company’s financial statements are prepared using account principles generally accepted in the United States (“U.S. GAAP”)

applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business.

As of March 31, 2024, the Company had a working capital deficit of ($270,351) and an accumulated deficit of $6,517,683. These factors,

among others, raise doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do

not include adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and

classification of liabilities that may result from an inability of the Company to continue as a going concern.

The

Company has a limited operating history, which makes it difficult to evaluate current business and future prospects. During 2023, the

Company reported $169,111 of service revenues, down from $461,174 in 2023 and no revenues in 2021 and 2020. Management expects the Company

to incur further losses in the foreseeable future due to costs associated with content acquisition and production, the cost of on-going

litigation, and costs associated with being a public company. There can be no assurance that our operations will ever generate sufficient

revenues to fund continuing operations, or that we will ever generate positive cash flow from our operations, or that we will attain

or thereafter sustain profitability in any future period. To mitigate this situation, the Company has loan agreements with the Company’s

CEO and the Noah Morgan Private Family Trust, a trust controlled by the Company’s CEO, to fund its month-to-month cash flow needs.

During the first quarter of 2024, the Company borrowed $250,000 from the trust pursuant to a master loan agreement that is due and payable

in 2025. During 2023, the Company borrowed $178,500 from and repaid $178,500 to Mr. MacGregor pursuant to a master loan agreement. The

master note agreements accrue interest at a rate of 4.4% due and payable in a lump sum upon maturity of the obligation. These notes are

not convertible.

NOTE

4. Film Production Loans

Senior

Mezzanine Loan Agreement with Barron’s Cove Movie, LLC

In

February 2024, the Company loaned $200,000 to Barron’s Cove Movie, LLC pursuant to a Senior Mezzanine Loan Agreement. $20,000 of

the loan proceeds will be used to pay producer fees, including $10,000 to Mr. MacGregor. The $200,00 loan, plus a premium of twenty percent

(20%), is due and payable on that date which is the earlier of either (a) twelve (12) months from the date of the loan, or (b) from allocable

proceeds received by Barron’s Cove Movie, LLC related to the movie, whichever occurs first.

Senior

Loan Agreement with PNP Movie, LLC

In

February 2024, the Company agreed to loan PNP Movie, LLC $97,475 to be used solely in connection with a named feature length motion picture.

As of March 31, 2024, $20,000 had been advanced against this funding commitment. In April 2024, the loan agreement was amended whereby

the Company agreed to lend an additional $42,525 and to use best efforts to increase the aggregate financing to $597,475. As of the date

of this filing, a total of $195,000 had been advanced to PNP Movie, LLC. These loans, plus a premium of twenty percent (20%), is due

and payable on that date which is the earlier of either (a) twelve (12) months from the date of the loan, or (b) from allocable proceeds

received by PNP Movie, LLC related to the movie, whichever occurs first.

Additionally,

the agreement states that Mr. MacGregor shall be entitled to a producer fee based on work to be performed and that Mr. MacGregor will

receive a “Producer” credit and his son a “Co-Producer” credit on the film.

NOTE

5. Intangible Assets

The

identifiable intangible assets consist of the following assets:

SCHEDULE OF INTANGIBLE ASSETS

| | |

March

31, 2024 | | |

December

31, 2023 | |

| Website placed in service | |

$ | 9,000 | | |

$ | 9,000 | |

| Website - under development | |

| 42,000 | | |

| 42,000 | |

| Software – predeployment | |

| 24,864 | | |

| 21,684 | |

| Intangible

assets, gross | |

| 75,864 | | |

| 72,684 | |

| | |

| | | |

| | |

| Accumulated amortization | |

| (1,750 | ) | |

| (1,000 | ) |

| Intangible

assets, net | |

$ | 74,114 | | |

$ | 71,684 | |

There

were no impairment charges associated with the Company’s identifiable intangible assets during the quarters ended March 31, 2024

and 2023.

Amortization

expense recorded in the accompanying consolidated statements of operations was $750 for the quarter year ended March 31, 2024. The Company

did not own any intangible assets during the quarter-ended March 31, 2023.

Note

6 – Notes Payable

Note

Payable – Mr. MacGregor

During

the first quarter of 2023, the Company borrowed $125,500 from Mr. MacGregor pursuant to a master loan agreement dated March 1, 2023.

The master note agreement accrues interest at a rate of 4.4% due and payable in a lump sum upon maturity of the obligation. This note

is not convertible.

During

the first quarter of 2024, the Company borrowed $250,000 from a trust managed by Mr. MacGregor pursuant to a master loan agreement dated

February 6, 2024. The master note agreement accrues interest at a rate of 4.68% due and payable in a lump sum upon maturity of the obligation.

This note is not convertible.

Noah

Morgan Private Family Trust Loan Agreement (“NMPFT”)

On

February 6, 2024, the Company entered into a master loan agreement with the NMPFT. The master note agreement accrues interest at a rate

of 4.68%. Also during February 2024, the Company borrowed $250,000 pursuant to this loan agreement with this amount due and payable in

a lump sum on February 6, 2025. This note is not convertible. $200,000 of these loan proceeds were used to fund the senior mezzanine

loan to Barron’s Cove Movie, LLC as more fully described in Note 4 above.

Economic

Injury Disaster Loan

In

March 2021, the Company executed an Economic Injury Disaster Loan (“EIDL”) secured loan with the U.S. Small Business

Administration under the EIDL program in the amount of $149,900. The loan is secured by all tangible and intangible assets of the Company

and payable over 30 years at an interest rate of 3.75% per annum. Interest only installment payments commenced in September 2023.

Note

7 – Equity

Common

Stock

The

Company has 1,000,000,000 common shares authorized. As of May 2, 2024, the Company has 111,399,325 shares issued and outstanding. As

of May 2, 2024, the total number of shareholders of record was 331.

The

Common Stock has a one share one voting right with no other rights. There are no provisions in the Company’s Articles of Incorporation,

Articles of Amendment, or By-laws that would delay or prevent a change of control. The Board may from time to time declare, and the Company

may pay, dividends on its shares in cash, property, or its own shares, except when the Corporation is insolvent, when the payment thereof

would render the Company insolvent, subject to any preferential dividend rights of outstanding shares of preferred shares or when the

declaration or payment thereof would be contrary to any other state law restrictions.

Preferred

Stock

The

Preferred Stock consists of 1,000,000 preferred shares authorized, of which 100,000 preferred shares have been designated as Series A

Convertible Preferred Stock (“Series A preferred shares” herein). At present, 3,829 Series A preferred shares are issued

and outstanding. The Series A preferred shares have the following rights: (i.) a first position lien against all of the Company’s

assets including but not limited to the Company’s IP (“Intellectual Property”), (ii.) is convertible at a ratio of

1 to 100,000 so that each one share of Series A preferred stock may be exchanged for 100,000 Common Stock shares, (iii.) and that each

share of Series A preferred stock shall carry superior voting rights to the Company’s Common Stock and that each share of Series

A preferred stock shall be counted as 1,000,000 votes in any Company vote and (iv.) and any other benefits as deemed necessary and appropriate

at the time of such issuance. The Preferred shares do not have any specific redemption rights or sinking fund provisions.

The

“Liquidation Preference” with respect to a share of Series A preferred stock means an amount equal to the ratio of (i.) the

total amount of the Company’s assets and funds available for distribution to the Series A preferred shares to (ii.) the number

of shares of Series A preferred stock outstanding. The Series A preferred stock has a liquidation preference equal to $12.02 per preferred

share.

Dividend

Provisions

Subject

to preferential dividend rights, if any, of the holders of Preferred Stock, dividends on the Common Stock may be declared by the Board

of Directors and paid out of any funds legally available therefor at such times and in such amounts as the Board of Directors shall determine.

Note

8– Equity Based Compensation

The

American Picture House Corporation 2023 Directors, Employees and Advisors Stock Incentive and Compensation Plan (the “Plan”)

was established in January 2023 to create an additional incentive to promote the financial success and progress of the Company. The Plan

shall be administered by the Board of Directors and may grant options to purchase shares of the authorized but unissued Common Stock

of the Company. The options may be either incentive stock options or nonqualified stock options.

The

options granted under the Plan expire on the date determined by the Board of Directors and may not extend more than 10 years.

Under

the Plan, unless the board specifies otherwise, stock options must be granted at an exercise price not less than the fair value of the

Company’s Common Stock on the grant date. The aggregate fair value of incentive stock options held by any optionee shall not exceed

$100,000.

The

Board of Directors shall determine the terms and conditions of the options. The vesting requirements of all awards under the Plan may

be time or event based and vary by individual grant. The incentive stock options and nonqualified stock options generally become exercisable

over a two-year period. Vested and unexercised options may be available to be exercised no later than three months after termination

of employment (or such longer period as determined by the Board of Directors).

Stock

Option Grants

On

February 8, 2024, the Company’s Board of Directors authorized the issuance of 250,000 options to each of its nine board members,

1,673,250 options to advisors, 662,983 options to Mr. Macgregor, and 497,238 options to Mr. Blanchard for an aggregate of 5,083,471 options

with the rights to purchase common shares of the Company at an exercise price of $0.0125 per share. As all of the options vested 100%

upon grant, the Company recorded $1,258,160 of stock option compensation expense in the quarter ended March 31, 2024. Share-based compensation

expense is reported within General and Administrative expenses.

Note

9 – Contingencies and Uncertainties

Risks

and Uncertainties – The Company’s operations are subject to significant risks and uncertainties including financial,

operational, and regulatory risks, including the potential risk of business failure. The Company does not have employment contracts with

its key employees, including the controlling shareholders who are officers of the Company.

NOTE

10 – Related Party Transactions

The

Company has agreed to indemnify Mr. MacGregor for all legal and professional costs originating from the lawsuit Randall S. Sprung

v. Bannor Michael MacGregor, Jeffery Katz, and Life Design Station International, Inc. – Supreme Court of New York, County

of Kings, Index No.: 504677/2019.

During

the three months ended March 31, 2024 and 2023, the Company incurred approximately $45,000 and $30,000, respectively, of professional

fees to a legal firm affiliated with a member of the Board of Directors.

The

Company has consulting services relationships with members of the Board whereby they were compensated a total of $15,000 and $26,000

during the three months ended March 31, 2024 and 2023, respectively. As of March 31, 2024 and December 31, 2023, $0 and $20,000, respectively,

were accrued and unpaid. The consulting services are provided as requested by management and may be terminated at any time with no penalty.

On January 1, 2023, the $105,000 of the 2022 accrued consulting fees were exchanged for options to purchase 1,160,221 shares of Common

Stock at $0.125 per share.

During

2022, the Company entered into consulting agreements with Ribo Music LLC aka Ribo Media (“Ribo Media”) whereby the

Company assisted Ribo Media in developing an online media platform to deliver music and eventually movies directly to consumers via their

smart devices. Revenues from the Ribo Media consulting services totaled $0 and $35,000, for the three months ended March 31, 2024 and

2023, respectively. As of March 31, 2024 and December 31, 2023, accounts receivable from Ribo Media totaled $1,775 and $0, respectively.

Michael Blanchard, a director and shareholder of the Company and Timothy Battles, a director and shareholder of the Company, are both

Managing Members and controlling shareholders in Ribo Media.

In

August 2022, the Company funded Devil’s Half-Acre Productions, LLC owned by John Luessenhop to produce the feature film Devil’s

Half-Acre written and directed by Dashiell Luessenhop, a son of A. John Luessenhop, a former Board member. In July 2023 APH obtained

100% ownership of Devil’s Half-Acre Productions, LLC and executed a new option agreement with the writer. In September 2023, APH

paid a Five Thousand-Dollar (5,000) option fee to the writer. This option entitles APH to produce the film by July 2024, with the ability

to extend the option for an additional two (2) years. As of March 31, 2024, the Company has capitalized $148,824 of production costs

associated with this film.

During

2022, the Company entered into definitive agreements to secure Bold Crayon Corporation (“Bold Crayon” or “BC”)

as a development partner and purchased certain assets from Bold Crayon, including a portion of the rights to a feature film, and copyrights

on six film titles. The Parties agree that APHP will designate BC as a “Content Partner”, wherein BC will develop content

and present APHP with a first opportunity to co-finance and/or coproduce content developed by BC subject to a mutually agreed upon Content

Partner Agreement and BC will accept such designation. The Company anticipates any rights and obligations between APH and BC to be effective

upon the greenlighting of a specific film or show Mr. MacGregor, CEO and a director of the Company, Mr. MacGregor is also the CEO and

a director of Bold Crayon and effectively controls Bold Crayon as a managing manager of the trustee of the trust that owns the majority

ownership interest in Bold Crayon. Mr. Michael Blanchard was a past Director and Secretary/Treasurer of Bold Crayon and is a director

of APHP. The transaction between the parties has been consummated and all IP and copyrights have been transferred. During the quarters

ended March 31, 2024 and 2023, the Company reported revenues of $23,003 and $0, respectively, from the CAMA. Inception to date, the Company

has received $304,875 under the CAMA. As partial consideration for the BC Assets being acquired by APH hereunder, APHP agreed to pay

BC the first one hundred thirty thousand dollars ($130,000.00 USD) that APHP collected from the BUFFALOED and to deliver one Preferred

Share to BC for each ten thousand dollars ($10,000.00 USD), in value paid to the APHP from the BUFFALOED receivable above the

one hundred thirty thousand dollars ($130,000.00 USD), not to exceed one hundred twenty-five (125) Preferred Shares. As of March 31,

2024, Bold Crayon was due to receive 17 Preferred Shares of APHP.

On

November 10, 2022, the Company approved the optioning of MIDNIGHT’S DOOR written by Kirsten Elms from Mr. Luessenhop for

$12,700 (provided the Company produces MIDNIGHT’S DOOR as a feature film and further subject to producer agreements with Luessenhop

and MacGregor). Mr. Luessenhop was a director of the Company and owned 2.005% of the Company at the time of this transaction. The

Company elected to allow this option to expire during the first quarter of 2024 resulting in the expensing of $7,500 of previously capitalized

costs.

On

November 10, 2022 the Company entered into an additional agreement regarding THE DEVIL’S HALF-ACRE to extend additional

financing in an undetermined amount to the film in exchange among other things for increased equity in the film. At the time, DEVIL’S

HALF-ACRE was controlled by Mr. Luessenhop.

During

the first quarter of 2023, the Company borrowed $125,500 from Mr. MacGregor pursuant to a master loan agreement dated March 1, 2023.

The master note agreement accrues interest at a rate of 4.4% due and payable in a lump sum upon maturity of the obligation. This note

is not convertible.

During

the first quarter of 2024, the Company borrowed $250,000 from a trust managed by Mr. MacGregor pursuant to a master loan agreement dated

February 6, 2024. The master note agreement accrues interest at a rate of 4.68% due and payable in a lump sum upon maturity of the obligation.

This note is not convertible.

NOTE

11 – SUBSEQUENT EVENTS

In

accordance with FASB ASC 855-10, Subsequent Events, the Company has analyzed its operations subsequent to March 31, 2024, to the

date these consolidated financial statements were issued. Except as noted below, management has determined that it does not have any

material subsequent events to disclose in these consolidated financial statements.

Sales

of Common Stock

During

the period April 1, 2024 to present, the Company sold 616,000 shares of Common Stock at $0.25 per share to new investors resulting in

total proceeds of $154,000.

Borrowing

under Line of Credit

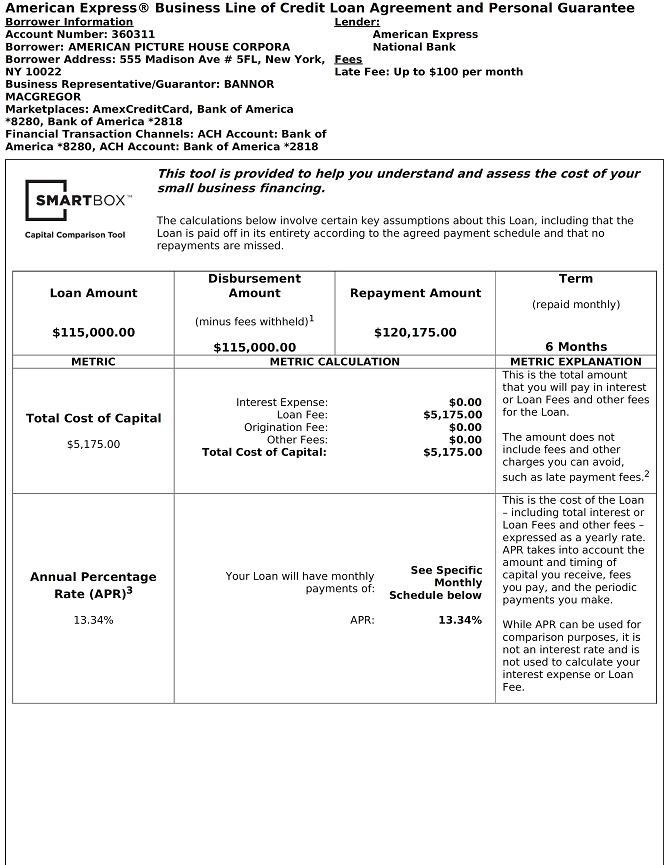

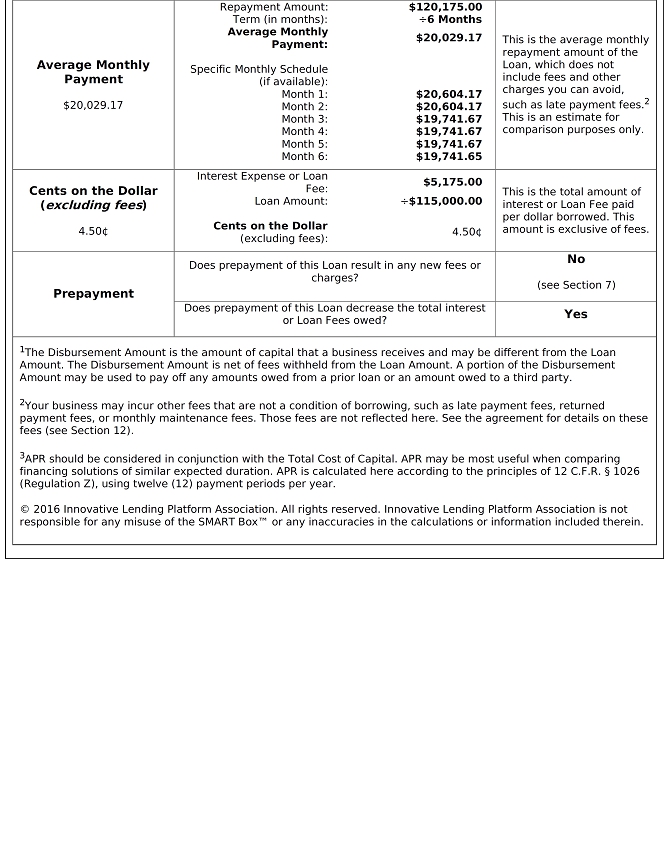

On

April 1 and April 10, the Company borrowed $70,000 and $44,300 under its American Express Business Line of Credit. The April 1st

advance had an annual percentage rate of 16.09% and is payable in twelve monthly installments. The April 10th advance

had an annual percentage rate of 32.67% and is payable in six monthly installments. Repayment of these borrowings commenced in May 2024.

Mr. MacGregor has personally guaranteed these loans.

On

April 1, 2024 Bannor Michael MacGregor loaned the Company $25,000. On April 15th, the Company paid back $12,500 to Mr. MacGregor.

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management’s

discussion and analysis of financial condition and results of operations

Organizational

History of the Company and Overview

American

Picture House Corporation aka American Picture House Pictures plans to be a premiere entertainment company with a focus on feature

films, limited series, and content-enhancing technologies. APHP is managed by astute financiers and supported by seasoned creatives.

To date, the Company has provided general consulting services to entertainment industry-based clients. These clients were interested

in our entertainment industry expertise and general business knowledge. The services provided included the strategy, development, and

procurement of materials including; business plans, financial projections, and corporate marketing materials for the entertainment industry.

The Company has refocused its efforts and will no longer be providing these services to independent clients. Going forward, APHP plans

to partner with filmmakers, showrunners, content developers and strategic technology partners to develop, package, finance, and produce

high-quality feature films and television shows with broad-market appeal. The Company’s management, Board of Directors and advisors

have had relationships with major studios due to many of them having worked within the entertainment industry on many films and shows

in a variety of specialties including: writing, producing, directing, casting, sales, and licensing. Although these relationships have

not yet yielded results to APHP to date, the Company anticipates it will be able to access these relationships to benefit the Company

in its future endeavors.

The

Company intends to specialize in mid-budgeted productions where more than 100% of the budget can be collateralized by a film’s

or show’s intellectual property (‘IP”), unsold licensing sales projections, pre-sold licensing contracts, incentive

agreements, tax rebates, and grants. The Company’s management and advisors will use these assets to limit risk and guarantee greater

profitability. The IP (e.g., the book rights, script, screenplay, etc.) of a particular film or show usually has a quantifiable value,

especially if such IP was written by a recognized author or by a WGA (“Writers Guild of America”) writer and further enhanced

by the addition of competent producers, proven directors and directors of photography, and talented actors. While the IP itself has value,

the previously mentioned elements plus the addition of factors like choosing favorable filming locales to film in (that provide monetary

and/or tax incentives) and formulating lean budgets, enable third party financiers to quantify a film’s or show’s value and

this quantifiable-value can be utilized to secure additional equity investors and or be utilized to secure loans. Through the development

of a strong package, APHP can limit its overall financial exposure, mitigate financial risk, and reduce the equity required from the

Company to produce a film or show Loans and additional equity, are usually only secured for films that have a package that has strong

elements and additional factors; therefore, a reduction in equity combined with third-party participation also is expected to increase

profitability to the Company.

The

Company will strive to become synonymous with creative ability, financial sophistication, and leading-edge technology. The Company has

optioned IP with the intent to co-finance and co-produce feature films and limited series shows.

Filmmaking

Stages and Our Strategy

To

understand our business strategy, it is useful to think of filmmaking in five stages - often with different teams involved at different

stages:

| |

● |

Development:

The first stage in which the ideas for the film are created, rights to books/plays are acquired and the screenplay is written. Financing

for the project has to be sought and obtained; |

| |

● |

Pre-Production:

Arrangements and preparations are made for the shoot, such as hiring cast and film crew, selecting locations and constructing sets; |

| |

● |

Production:

The raw footage and other elements for the film are recorded during the film shoot; |

| |

● |

Post-Production:

The images, sound, and visual effects of the recorded film are edited and combined into a finished product; and |

| |

● |

Distribution:

The completed film is distributed, marketed, and screened in cinemas and/or released to video or steaming services. |

Our

Strategy to Build Value

Our

business strategy is to purchase and/or option “entertainment properties” (e.g., book rights, screenplays, scripts,

etc.). that have had some level of financial investment in the development stage before we acquire the entertainment property

where the initial owner or development team decided to stop development for financial or other reasons after making a substantial investment

in development. For this investment, we may share with the original team rights to revenue from the acquired entertainment properties.

This strategy will allow the Company to reduce our initial cash outlay when acquiring intellectual properties, allows us to allocate

more funds in moving the entertainment property up the filmmaking chain, gives us assistance and goodwill from the original development

team, and reduces our financial risks.

Our

strategy requires us to make an informed assessment that our management team has the ability to move the script forward where the initial

team failed while allowing APHP to capitalize on the initial investment.

We

seek to build value in our entertainment properties by many means, including the following:

| |

● |

Hiring

other qualified Writers Guild of America (“WGA”) writers to further develop, polish, or re-write entertainment properties; |

| |

● |

Securing

or attaching quality talent (e.g., producers, director, actors, etc.); |

| |

● |

Determining

pre-sales values; |

| |

● |

Securing

some pre-sales (mostly in international markets); |

| |

● |

Securing

financial and banking relations; |

| |

● |

Hiring

a talent agency, retaining attorneys; |

| |

● |

Determining

shooting locations, including the best place to obtain financial incentives and/or grants; |

| |

● |

Developing

a comprehensive budget and devising financing strategy; |

| |

● |

Securing

a completion bond; and |

| |

● |

Developing

production and marketing materials (e.g., look-book, location scouting, poster-design, etc.). |

Critical

Accounting Policies and Estimates

Our

management’s discussion and analysis of our financial condition and results of operations are based on our financial statements,

which have been prepared in accordance with U.S. generally accepted accounting principles, or “GAAP.” The preparation of

these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities,

disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses

during the reported period. In accordance with GAAP, we base our estimates on historical experience and on various other assumptions

that we believe are reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or

conditions.

Our

significant accounting policies are fully described in Note 2 to our financial statements appearing elsewhere in this Quarterly

Report, and we believe those accounting policies are critical to the process of making significant judgments and estimates in the preparation

of our financial statements.

COVID-19

Update

To

date, the COVID-19 pandemic has not had a material impact on the Company, particularly due to our current lack of operations. The pandemic

may, however, have an impact on our ability to evaluate and acquire an operating entity through a reverse merger or otherwise.

Off-Balance

Sheet Arrangements

None.

Results

of Operations

Three

Months Ended March 31, 2024 Compared to Three Months Ended March 31, 2023

The

following table summarizes our results of operations for the three months ended March 31, 2024 and 2023:

| | |

Three

Months Ended March 31, | |

| | |

2024 | | |

2023 | | |

Change

$ | |

| | |

| | |