0000014272false00000142722023-10-262023-10-260000014272bmy:CommonStock0.10ParValueMember2023-10-262023-10-260000014272bmy:A1.000Notesdue2025Member2023-10-262023-10-260000014272bmy:A1.750Notesdue2035Member2023-10-262023-10-260000014272bmy:CelgeneContingentValueRightsMember2023-10-262023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 26, 2023

_____________________________

BRISTOL-MYERS SQUIBB COMPANY

(Exact name of registrant as specified in its charter)

_____________________________

| | | | | | | | |

| Delaware | 001-01136 | 22-0790350 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S Employer

Identification No.) |

Route 206 & Province Line Road, Princeton, New Jersey 08543

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code): (609) 252-4621

_____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.10 Par Value | BMY | New York Stock Exchange |

| 1.000% Notes due 2025 | BMY25 | New York Stock Exchange |

| 1.750% Notes due 2035 | BMY35 | New York Stock Exchange |

| Celgene Contingent Value Rights | CELG RT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | |

| Item 2.02 Results of Operations and Financial Condition. |

On October 26, 2023, Bristol-Myers Squibb Company (the “Company”) issued a press release (the “Earnings Press Release”) announcing its financial results for the third quarter of 2023. A copy of the Earnings Press Release is furnished pursuant to this Item 2.02 as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein in its entirety.

| | |

| Item 7.01 Regulation FD Disclosure. |

On October 26, 2023, the Company posted on its website at www.bms.com a presentation (the “Bristol Myers Presentation”) on certain financial and operating initiatives available for viewing during the Company’s conference call and webcast announcing its financial results for the third quarter of 2023 at 8:00 a.m. Eastern time on October 26, 2023. A copy of the Bristol Myers Presentation is furnished pursuant to this Item 7.01 as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference herein in its entirety. The Earnings Press Release and the Bristol Myers Presentation include references to non-GAAP financial information. Reconciliations between the non-GAAP financial measures and the comparable GAAP financial measures and the reasons for the presentation of such non-GAAP financial measures, are available in the Earnings Press Release which is included as Exhibit 99.1 hereto. The Bristol Myers Presentation should be read in conjunction with the Earnings Press Release. The Company reserves the right to discontinue availability of the Bristol Myers Presentation from its website at any time.

Pursuant to General Instruction B.2. to Form 8-K, the information set forth in this Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1, and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities thereof, nor shall it be incorporated by reference into future filings by the Company under the Exchange Act or under the Securities Act of 1933, as amended, except to the extent specifically provided in any such filing. Additionally, the submission of the information set forth in this Item 7.01 is not deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely by Regulation FD.

| | |

| Item 9.01 Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are furnished as part of this Current Report on Form 8-K:

| | | | | | | | |

| | |

Exhibit

No. | | Description |

| | |

| 99.1 | | Press release of Bristol-Myers Squibb Company dated October 26, 2023. |

| 99.2 | | Presentation Materials of Bristol-Myers Squibb Company dated October 26, 2023. |

| 104 | | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

EXHIBIT INDEX

| | | | | | | | |

| | |

Exhibit

No. | | Description |

| |

| 99.1 | | |

| 99.2 | | |

| 104 | | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | BRISTOL-MYERS SQUIBB COMPANY | |

| | | |

Dated: October 26, 2023 | | By: | | /s/ Kimberly M. Jablonski | |

| | Name: | | Kimberly M. Jablonski | |

| | Title: | | Corporate Secretary | |

| | | | | |

Bristol Myers Squibb Reports Third Quarter Financial Results for 2023

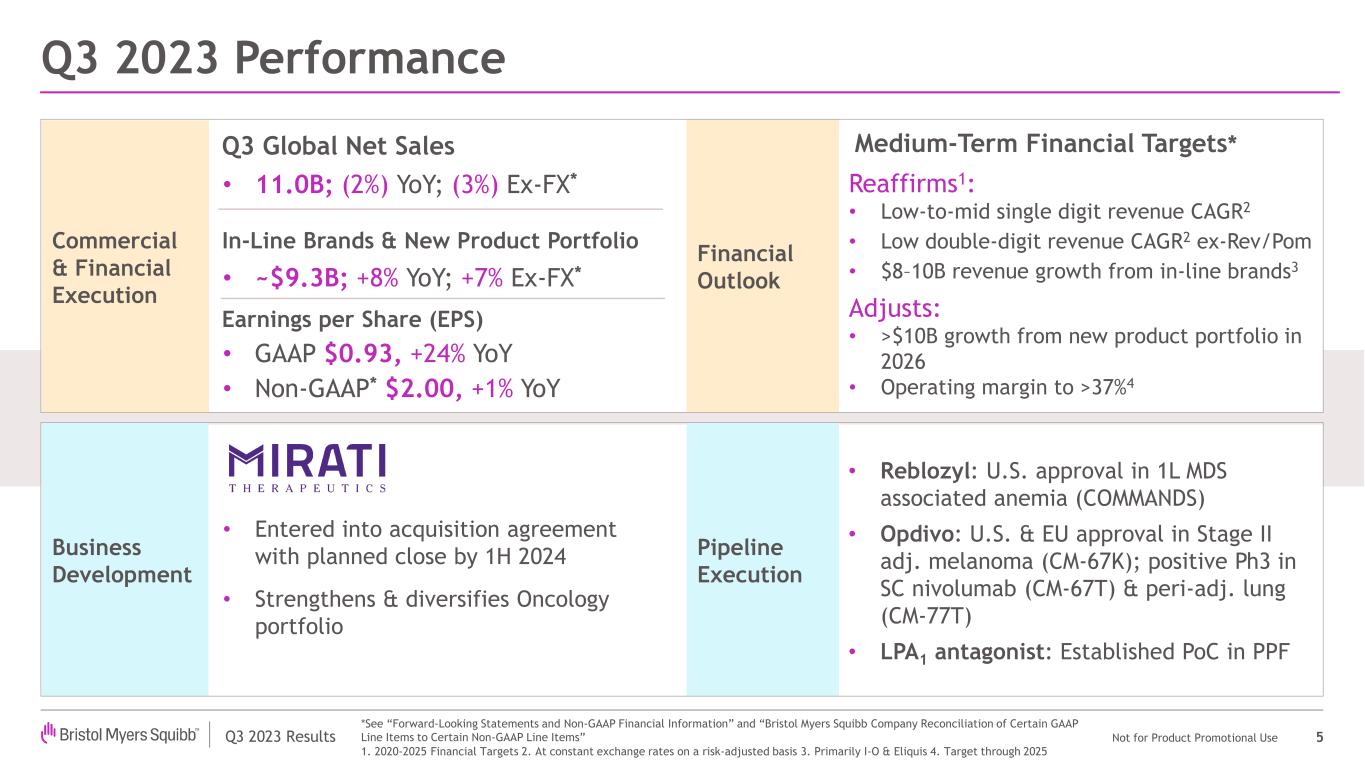

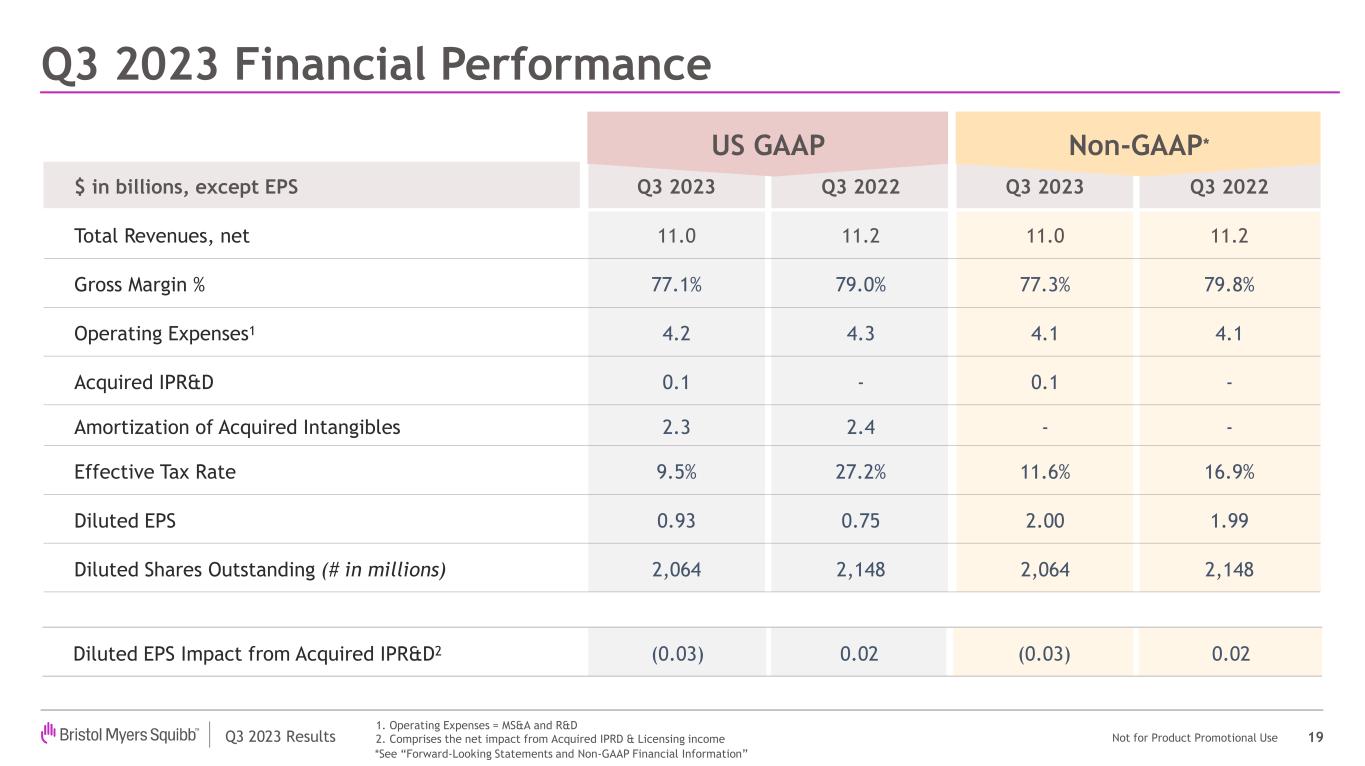

•Reports Third Quarter Revenues of $11.0 Billion

•Posts Third Quarter GAAP Earnings Per Share of $0.93 and Non-GAAP EPS of $2.00; Includes Net Impact of ($0.03) Per Share for GAAP and Non-GAAP EPS Due to Acquired IPRD Charges and Licensing Income

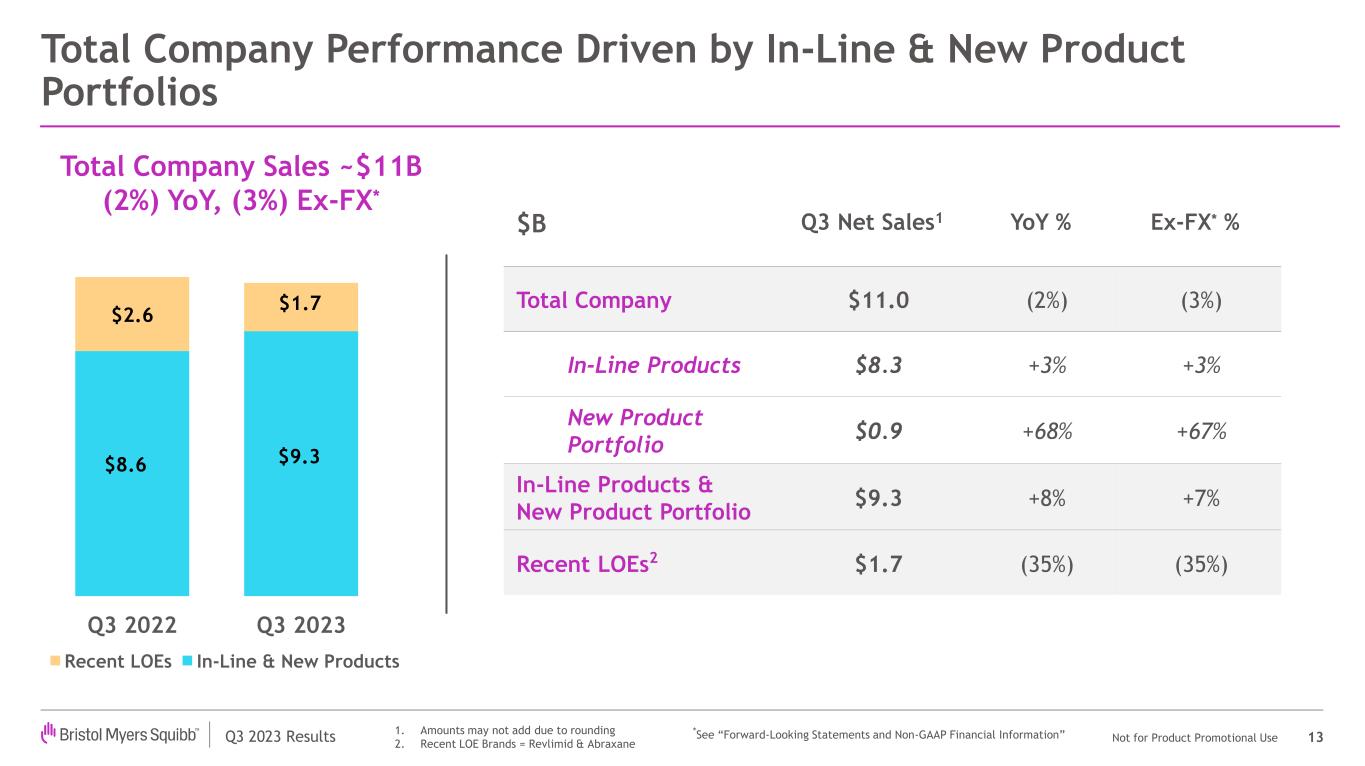

•Reports Third Quarter Revenue Growth for In-Line Products and New Product Portfolio of 8%, or 7% When Adjusted for Foreign Exchange

•Achieves Key Clinical and Regulatory Milestones Across Multiple Therapeutic Areas

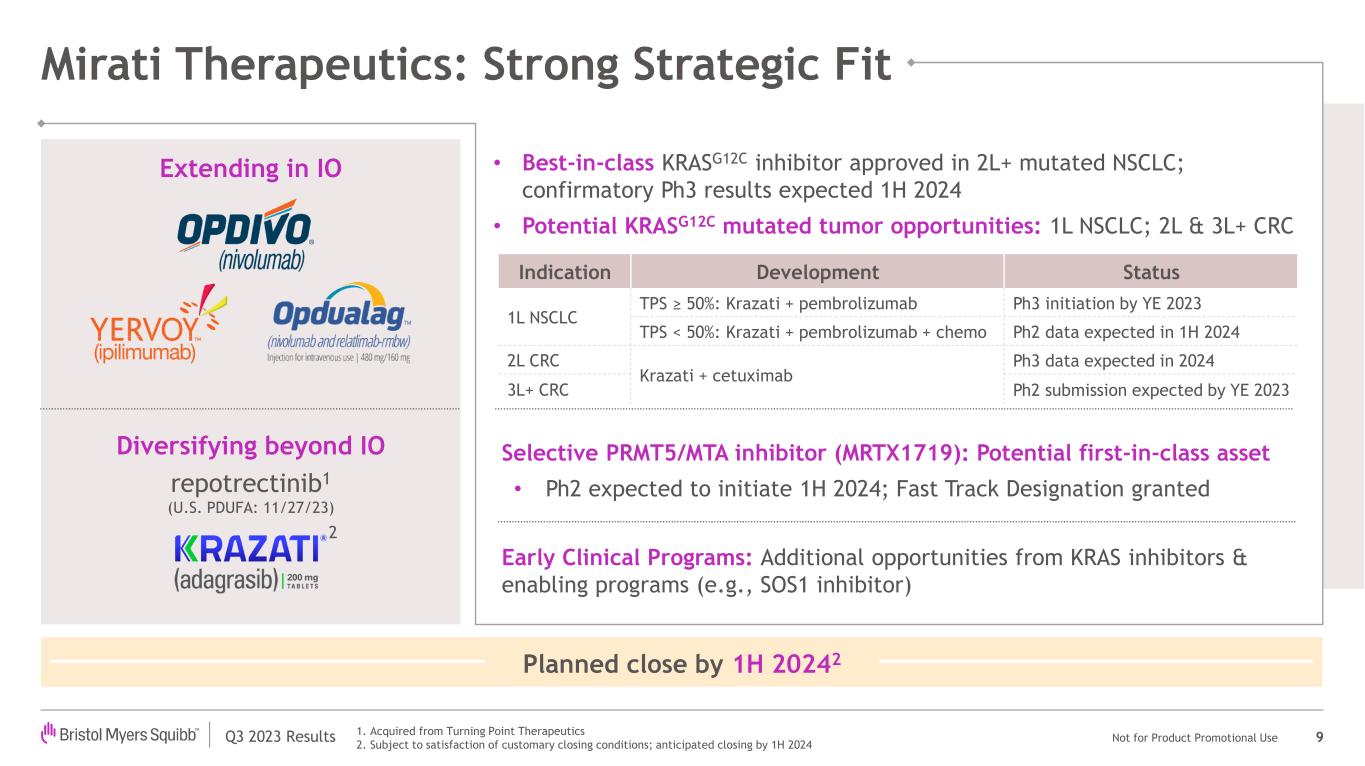

•Strengthens Oncology Portfolio with Planned Acquisition of Targeted Oncology Company Mirati Therapeutics

•Adjusts 2023 GAAP EPS Guidance; Raises Midpoint of Non-GAAP EPS Guidance Range

•Updates Medium-Term Financial Targets

(PRINCETON, N.J., October 26, 2023) – Bristol Myers Squibb (NYSE:BMY) today reports results for the third quarter of 2023, which reflect significant pipeline progress and advances in the company's portfolio renewal strategy.

“My excitement for the company's future is centered on the diversification of our business, the breadth of our new product portfolio and the strength of our pipeline,” said Giovanni Caforio, M.D., board chair and chief executive officer, Bristol Myers Squibb. “I am proud of what we have achieved together and look forward to what the dedicated people of our company will continue to accomplish for patients."

Christopher Boerner, Ph.D., executive vice president and chief operating officer and CEO-elect, Bristol Myers Squibb, added the following:

“I want to thank Giovanni for his tremendous leadership and commitment not only to patients, but also to strengthening our company. During the third quarter, we continued to grow our in-line and new product portfolio. We remain focused on accelerating commercial performance, advancing our pipeline and harnessing our financial flexibility to pursue business development opportunities that benefit patients."

| | | | | | | | | | | | | | | | | | | | | | | |

| Third Quarter |

| $ amounts in millions, except per share amounts | 2023 | | 2022 | | Change | | Change Excl. F/X** |

| Total Revenues | $10,966 | | | $11,218 | | | (2) | % | | (3) | % |

| Earnings per share - GAAP* | 0.93 | | | 0.75 | | | 24 | % | | N/A |

| Earnings per share - Non-GAAP* | 2.00 | | | 1.99 | | | 1 | % | | N/A |

| | | | | | | |

* GAAP and Non-GAAP earnings per share include the net impact of Acquired IPRD charges and licensing income, which decreased by $0.03 per share in the third quarter of 2023 compared to an increase of $0.02 per share in the third quarter of 2022.

** See "Use of Non-GAAP Financial Information".

THIRD QUARTER FINANCIAL RESULTS

All comparisons are made versus the same period in 2022 unless otherwise stated.

•Bristol Myers Squibb posted third quarter revenues of $11.0 billion, a decrease of 2%, or 3% when adjusted for foreign exchange, due to lower sales of Revlimid, partially offset by our new product portfolio and in-line products.

•U.S. revenues decreased 4% to $7.6 billion in the quarter primarily due to lower sales of Revlimid resulting from generic erosion and, as previously disclosed, an increase in the number of patients receiving free drug product for Revlimid, and to a lesser extent Pomalyst, from the Bristol Myers Squibb Patient Assistance Foundation, a separate and independent 501(c)(3) entity to which BMS donates products. This was partially offset by our new product portfolio and in-line products.

•International revenues increased 2% to $3.3 billion in the quarter. When adjusted for foreign exchange impacts, international revenues increased 1%, primarily due to Opdivo and our new product portfolio, partially offset by lower average net selling prices.

•On a GAAP basis, gross margin decreased from 79.0% to 77.1% and on a Non-GAAP basis, decreased from 79.8% to 77.3% primarily due to product mix and lower hedge settlement gains.

•On a GAAP basis, marketing, selling and administrative expenses increased 4% to $2.0 billion in the quarter primarily due to higher advertising and promotion costs to support new product launches, partially offset by the cash settlement of Turning Point Therapeutics, Inc. ("Turning Point") unvested stock awards in 2022. On a Non-GAAP basis, marketing, selling and administrative expenses increased 4% to $1.9 billion in the quarter, primarily due to higher advertising and promotion costs to support new product launches.

•On a GAAP basis, research and development expenses decreased 7% to $2.2 billion in the quarter due to lower clinical grants and supplies and cash settlement of Turning Point unvested stock awards in 2022. On a Non-GAAP basis, research and development expenses decreased 4% to $2.2 billion in the quarter primarily due to lower clinical grants and supplies.

•On a GAAP and Non-GAAP basis, Acquired IPRD increased to $80 million in the quarter from $30 million in the same period a year ago. On a GAAP and Non-GAAP basis, licensing income was $12 million in the quarter compared to $73 million in the same period a year ago.

•On a GAAP basis, amortization of acquired intangible assets decreased 7% to $2.3 billion in the quarter, primarily due to the Abraxane marketed product right being fully amortized in the fourth quarter of 2022.

•On a GAAP basis, effective tax rate changed from 27.2% to 9.5% in the quarter and on a Non-GAAP basis the effective tax rate changed from 16.9% to 11.6%, primarily due to changes in the IRS income tax guidance regarding deductibility of certain non-U.S. research and development expenses.

•The company reported on a GAAP basis net earnings attributable to Bristol Myers Squibb of $1.9 billion, or $0.93 per share, in the third quarter compared to $1.6 billion, or $0.75 per share, for the same period a year ago.

•The company reported on a Non-GAAP basis net earnings attributable to Bristol Myers Squibb of $4.1 billion, or $2.00 per share, in the third quarter compared to $4.3 billion, or $1.99 per share, for the same period a year ago.

•The EPS results in the third quarter of 2023 also include the impact of lower weighted-average common shares outstanding.

THIRD QUARTER PRODUCT REVENUE HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ amounts in millions) | | Quarter Ended September 30, 2023 | | % Change from Quarter Ended September 30, 2022 | | % Change from Quarter Ended September 30, 2022 Ex-F/X** |

| | | U.S.(c) | | Int'l | | WW(d) | | U.S.(c) | | Int'l | | WW(d) | | Int'l | | WW(d) |

| In-Line Products | | | | | | | | | | | | | | | | |

| Eliquis | | $ | 1,799 | | | $ | 906 | | | $ | 2,705 | | | 4 | % | | (2) | % | | 2 | % | | (6) | % | | — | % |

| Opdivo | | 1,352 | | | 923 | | | 2,275 | | | 9 | % | | 15 | % | | 11 | % | | 15 | % | | 11 | % |

| Pomalyst/Imnovid | | 610 | | | 262 | | | 872 | | | (5) | % | | 7 | % | | (2) | % | | 4 | % | | (2) | % |

| Orencia | | 719 | | | 206 | | | 925 | | | 5 | % | | 2 | % | | 5 | % | | 1 | % | | 5 | % |

| Sprycel | | 406 | | | 111 | | | 517 | | | 1 | % | | (30) | % | | (8) | % | | (29) | % | | (8) | % |

| Yervoy | | 362 | | | 217 | | | 579 | | | 12 | % | | 8 | % | | 11 | % | | 6 | % | | 10 | % |

Mature and other products (a) | | 191 | | | 285 | | | 476 | | | — | % | | (12) | % | | (7) | % | | (11) | % | | (7) | % |

| Total In-Line Products | | 5,439 | | | 2,910 | | | 8,349 | | | 4 | % | | 2 | % | | 3 | % | | — | % | | 3 | % |

| New Product Portfolio | | | | | | | | | | | | | | | | |

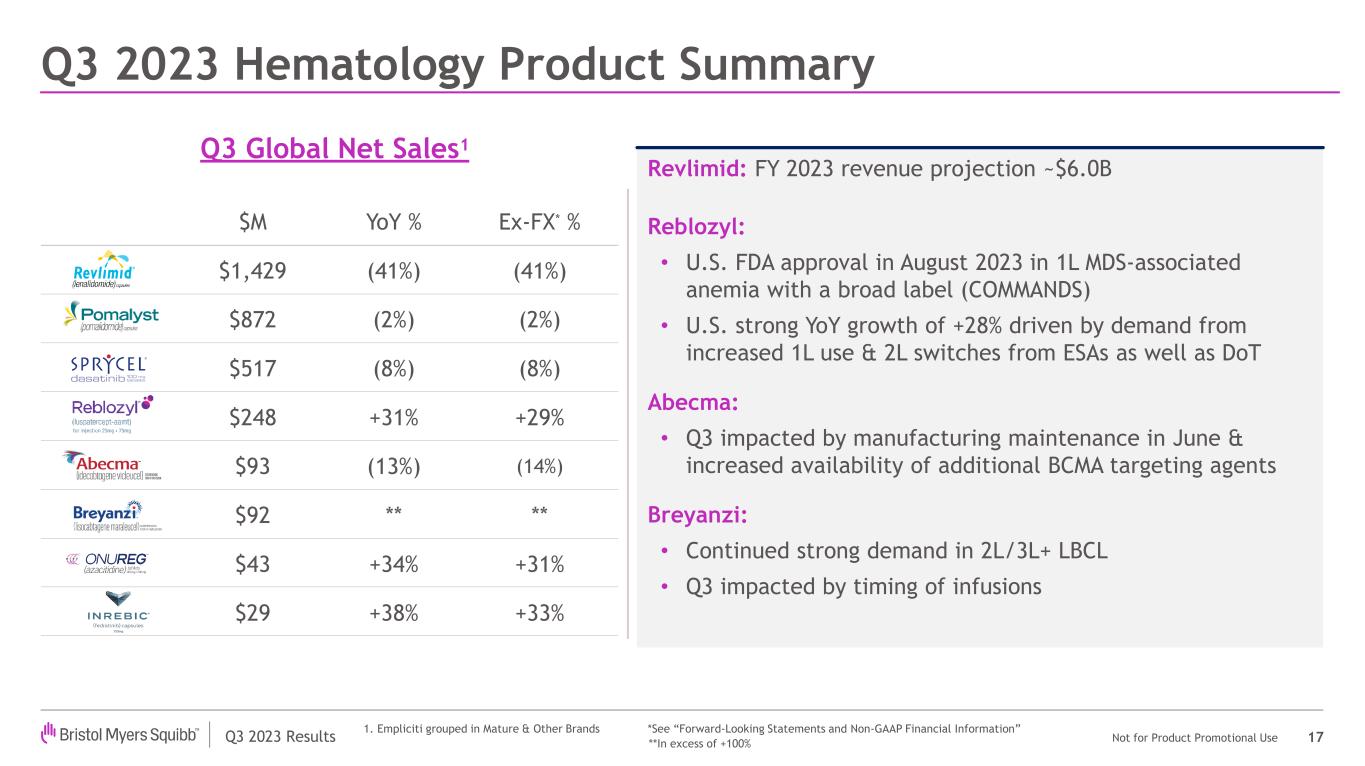

| Reblozyl | | 200 | | | 48 | | | 248 | | | 28 | % | | 41 | % | | 31 | % | | 35 | % | | 29 | % |

| Abecma | | 69 | | | 24 | | | 93 | | | (8) | % | | (25) | % | | (13) | % | | (28) | % | | (14) | % |

| Opdualag | | 162 | | | 4 | | | 166 | | | 93 | % | | N/A | | 98 | % | | N/A | | 98 | % |

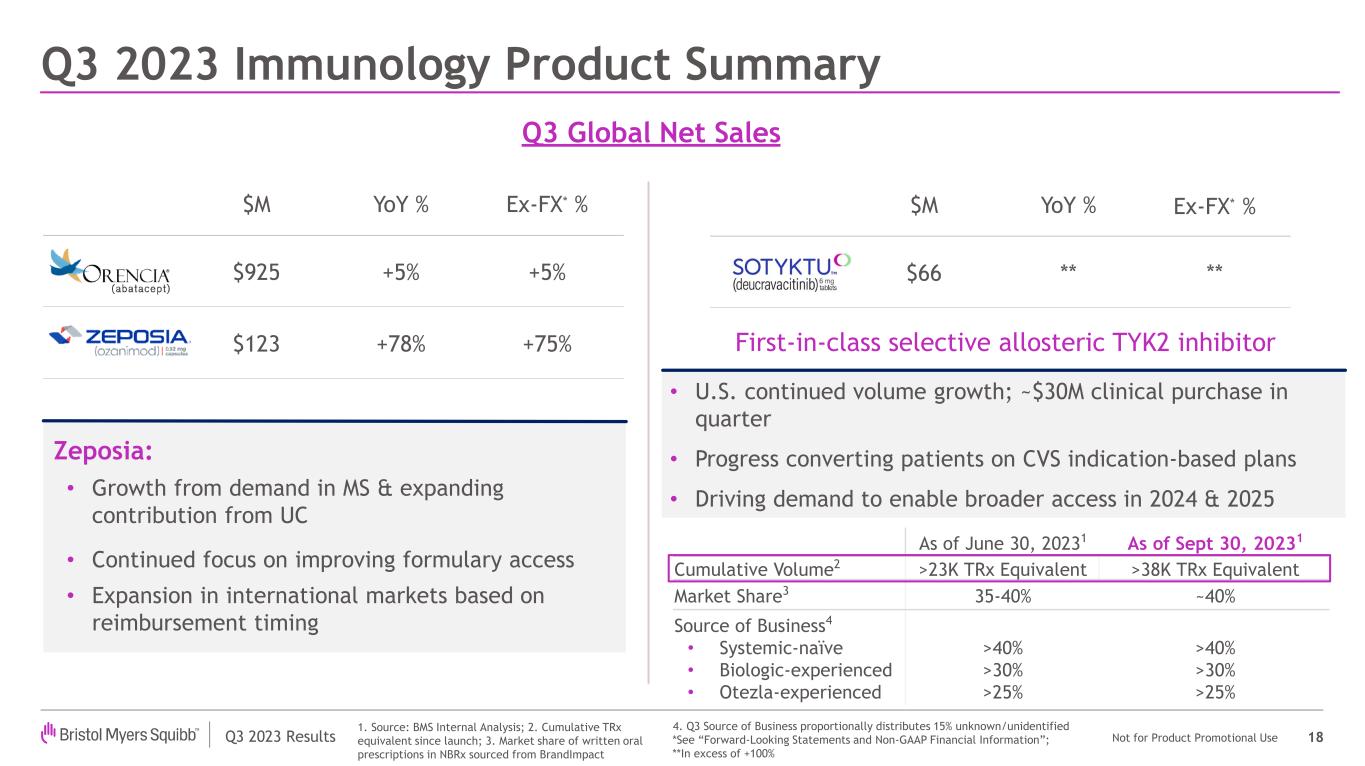

| Zeposia | | 96 | | | 27 | | | 123 | | | 92 | % | | 42 | % | | 78 | % | | 32 | % | | 75 | % |

| Breyanzi | | 77 | | | 15 | | | 92 | | | * | | 67 | % | | * | | 67 | % | | * |

| Onureg | | 30 | | | 13 | | | 43 | | | 25 | % | | 63 | % | | 34 | % | | 50 | % | | 31 | % |

| Inrebic | | 19 | | | 10 | | | 29 | | | 12 | % | | * | | 38 | % | | * | | 33 | % |

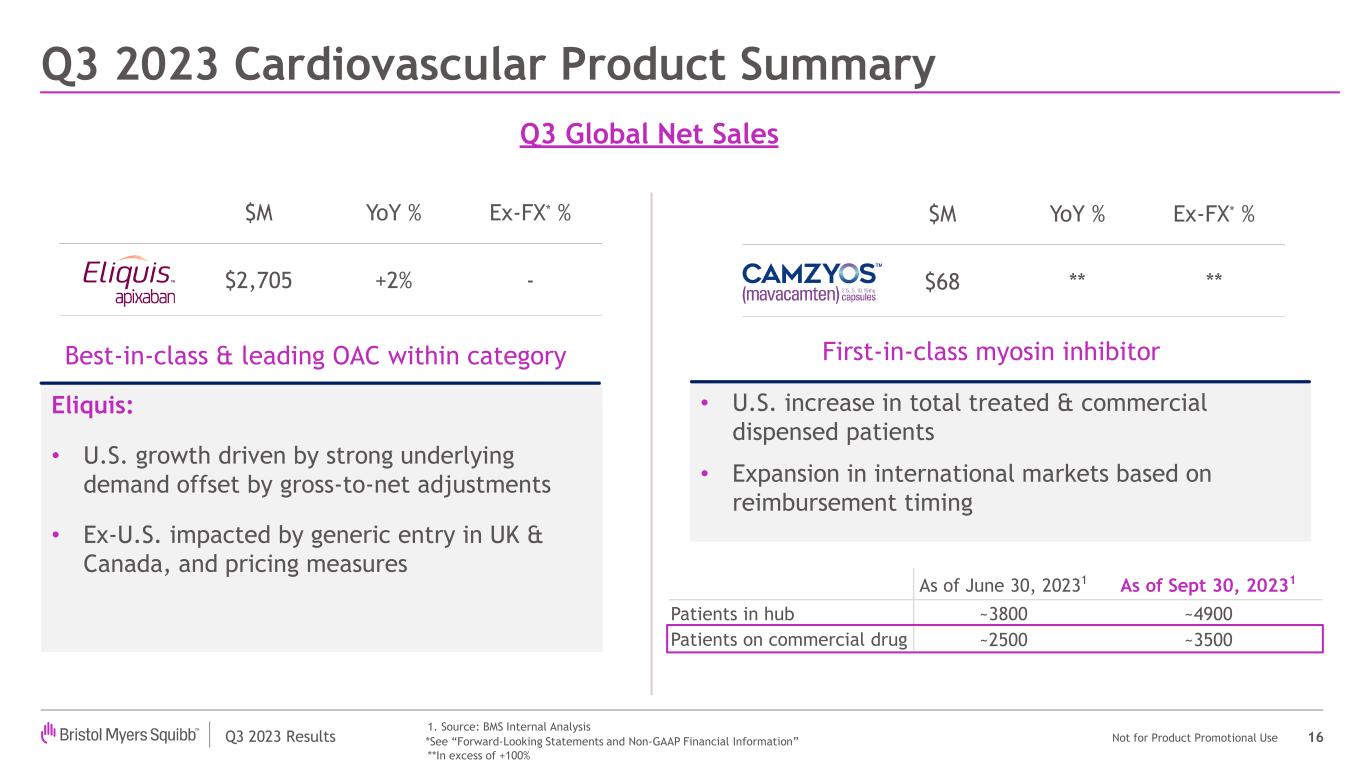

| Camzyos | | 67 | | | 1 | | | 68 | | | * | | N/A | | * | | N/A | | * |

| Sotyktu | | 62 | | | 4 | | | 66 | | | * | | N/A | | * | | N/A | | * |

| Total New Product Portfolio | | 782 | | | 146 | | | 928 | | | 75 | % | | 38 | % | | 68 | % | | 31 | % | | 67 | % |

| Total In-Line and New Product Portfolio | | 6,221 | | | 3,056 | | | 9,277 | | | 10 | % | | 3 | % | | 8 | % | | 1 | % | | 7 | % |

Recent LOE Products (b) | | | | | | | | | | | | | | | | |

| Revlimid | | 1,226 | | | 203 | | | 1,429 | | | (44) | % | | (19) | % | | (41) | % | | (18) | % | | (41) | % |

| Abraxane | | 181 | | | 79 | | | 260 | | | 57 | % | | 27 | % | | 47 | % | | 39 | % | | 51 | % |

| Total Recent LOE Products | | 1,407 | | | 282 | | | 1,689 | | | (38) | % | | (10) | % | | (35) | % | | (7) | % | | (35) | % |

| | | | | | | | | | | | | | | | |

| Total Revenues | | $ | 7,628 | | | $ | 3,338 | | | $ | 10,966 | | | (4) | % | | 2 | % | | (2) | % | | 1 | % | | (3) | % |

* In excess of +100%

** See "Use of Non-GAAP Financial Information".

(a) Includes over-the-counter (OTC) products, royalty revenue and mature products.

(b) Recent LOE Products includes products with significant expected decline in revenue from a prior reporting period as a result of a loss of exclusivity.

(c) Includes Puerto Rico.

(d) Worldwide (WW) includes International (Int'l) and U.S.

THIRD QUARTER PRODUCT REVENUE HIGHLIGHTS

In-Line Products

Revenues for in-line products in the third quarter were $8.3 billion compared to $8.1 billion in the prior year period. In-line products revenue was largely driven by:

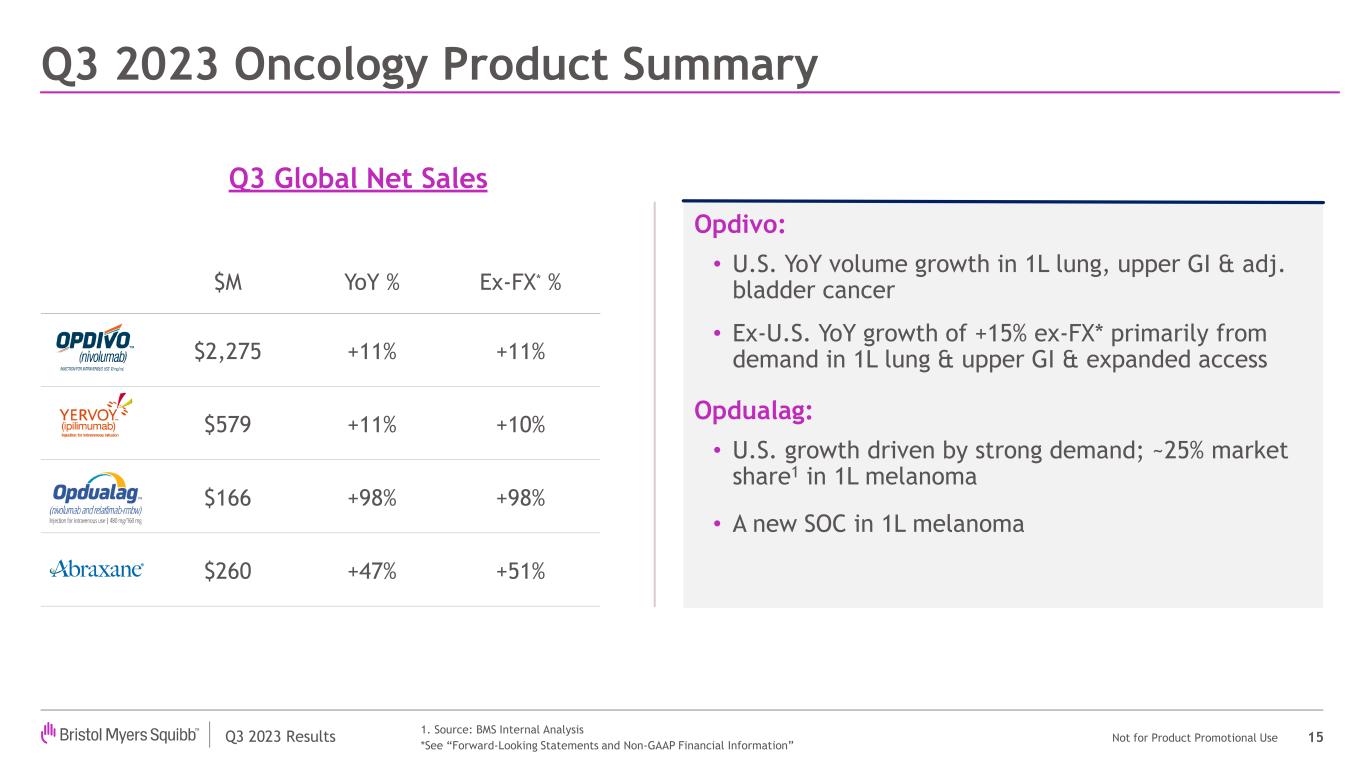

•Opdivo worldwide revenues increased 11% reported and when adjusted for foreign exchange. U.S. revenues increased 9% to $1.4 billion compared to the prior year period primarily due to higher demand. International revenues were $923 million compared to $804 million in the prior

year period, representing an increase of 15% reported and when adjusted for foreign exchange, primarily due to higher demand as a result of launches for additional indications and core indications.

•Eliquis worldwide revenues increased 2% compared to the prior year period. U.S. revenues were $1.8 billion compared to $1.7 billion in the prior year period, representing an increase of 4% primarily due to higher demand, partially offset by GTN adjustments in 2023. International revenues were $906 million compared to $926 million in the prior year period, representing a decrease of 2%, primarily driven by lower average net selling prices and generic erosion in Canada and the U.K.

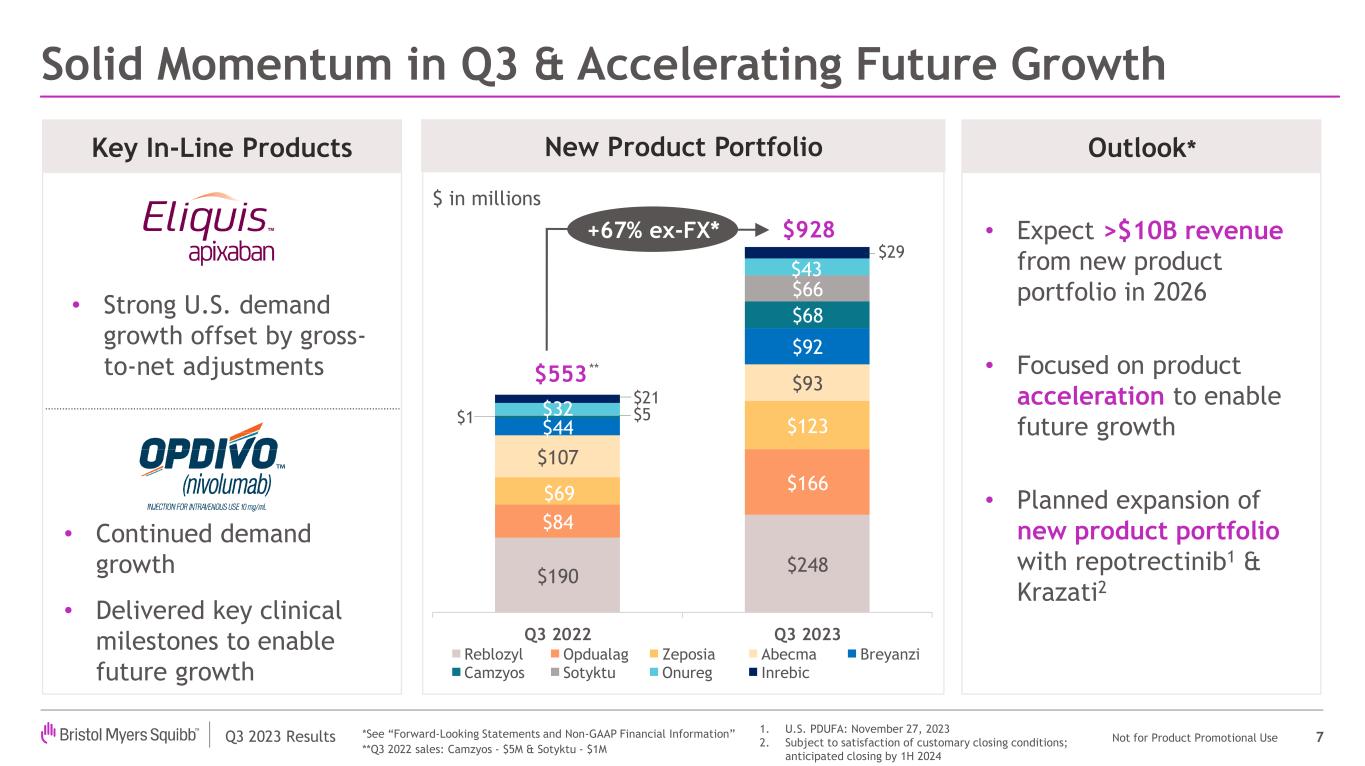

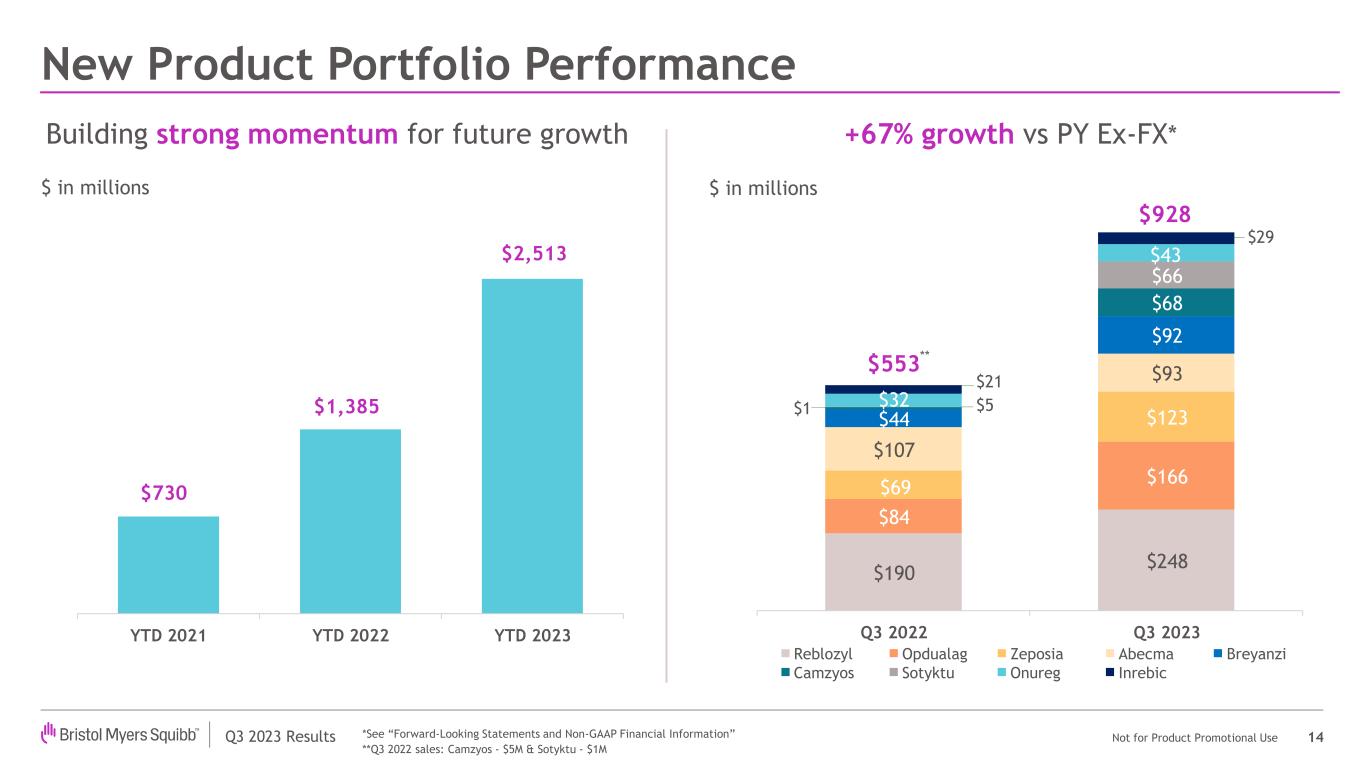

New Product Portfolio

•New product portfolio worldwide revenues increased to $928 million compared to $553 million in the prior year period, representing a growth of 68%, primarily driven by higher demand across the portfolio, including for Opdualag, Sotyktu, Camzyos, Reblozyl, Zeposia and Breyanzi.

Recent LOE Products

•Revlimid worldwide revenues declined by 41% compared to the prior year period, primarily due to generic erosion and, as previously disclosed, an increase in the number of patients receiving free drug product from the Bristol Myers Squibb Patient Assistance Foundation, a separate and independent 501(c)(3) entity to which the company donates products.

PRODUCT AND PIPELINE UPDATE

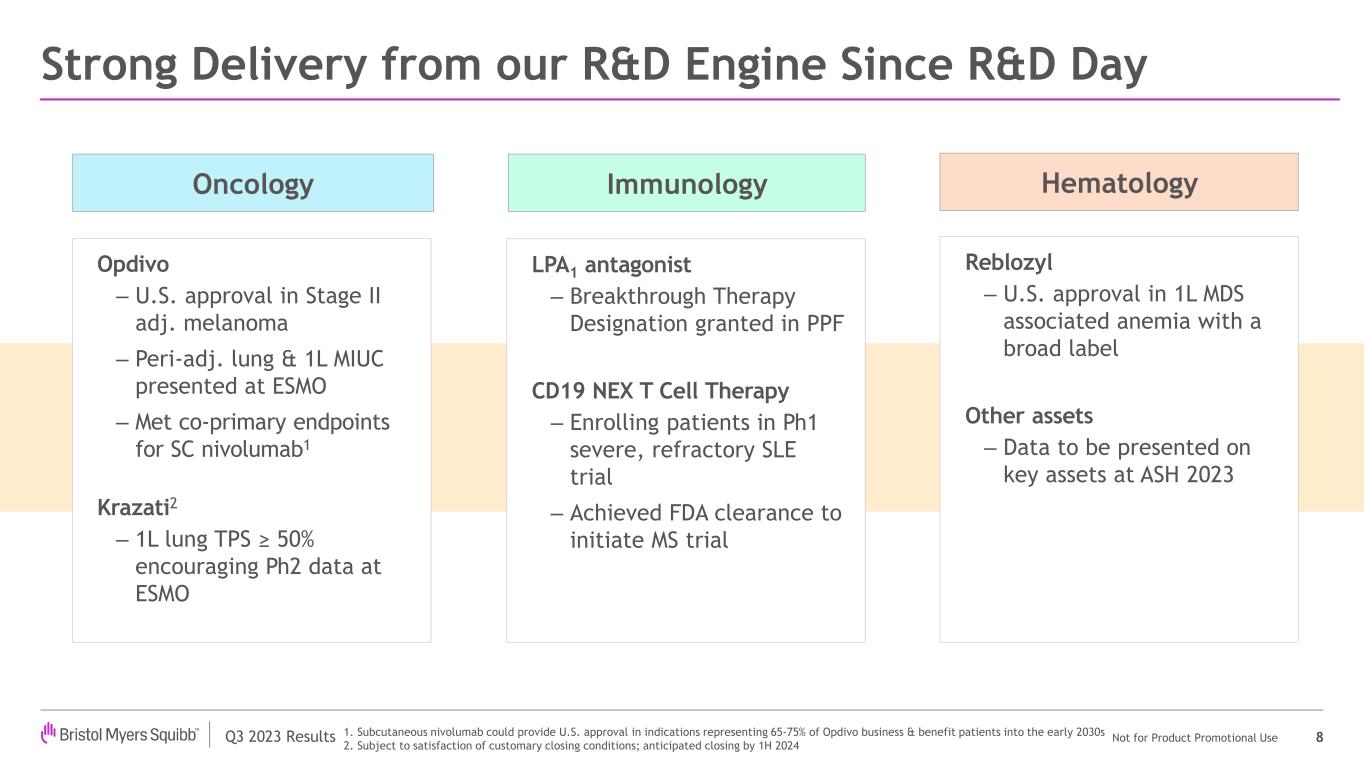

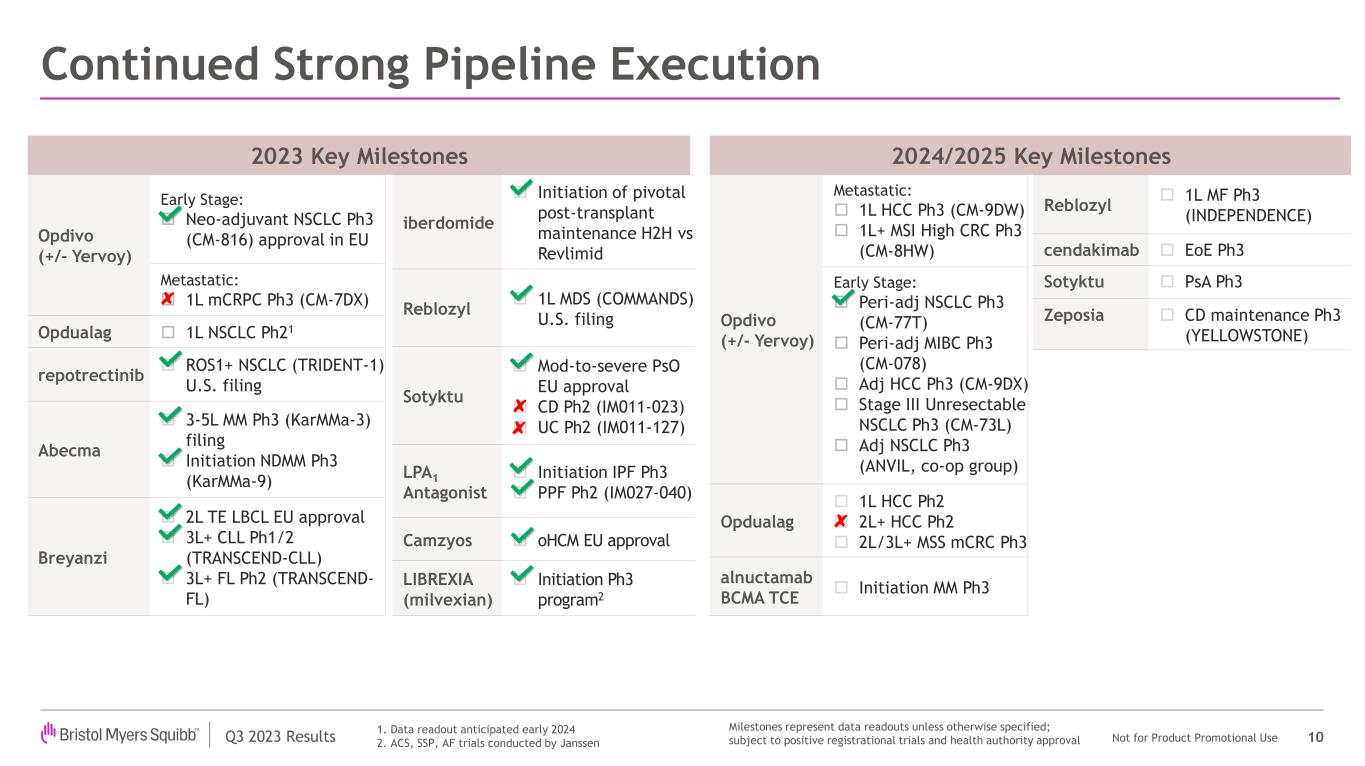

Bristol Myers Squibb recently achieved significant regulatory and clinical milestones, including an important U.S. regulatory approval for Reblozyl in first-line, MDS-associated anemia. In addition, the company achieved strong results from a Phase 3 study evaluating subcutaneous nivolumab and received two key approvals—from the U.S. Food and Drug Administration (FDA) and the European Commission for Opdivo in stage IIB or IIC melanoma. The company also announced initial data from a Phase 3 trial evaluating a perioperative regimen including Opdivo in non-small cell lung cancer, as well as positive Phase 2 results evaluating its potential first-in-class LPA1 antagonist in progressive pulmonary fibrosis.

Cardiovascular | | | | | | | | |

| Category | Asset | Milestone |

| Clinical & Research | Camzyos® (mavacamten) | Data from the EXPLORER-LTE cohort of the MAVA-LTE study showed sustained improvements in left ventricular outflow tract obstruction, symptoms and NT-proBNP levels in patients with symptomatic obstructive hypertrophic cardiomyopathy (HCM) based on a cumulative 120-week analysis. In addition, long-term follow-up results from the Phase 3 VALOR-HCM LTE trial demonstrated the consistent impact of oral treatment for severely symptomatic obstructive HCM patients by showing that nearly nine out of 10 patients treated with Camzyos have continued in the trial without septal reduction therapy at either 40 or 56 weeks of treatment.

|

| Eliquis® (apixaban) | Results presented by the Bristol-Myers Squibb-Pfizer Alliance from ATHENS, a retrospective real-world data study, demonstrated that switching from Eliquis to rivaroxaban in non-valvular atrial fibrillation patients was associated with a higher risk of stroke/systemic embolism and major bleeding than those who continued Eliquis. |

Oncology | | | | | | | | |

| Category | Asset | Milestone |

| Regulatory | Opdivo® (nivolumab) | The FDA approved the supplemental Biologics License Application for Opdivo as a monotherapy in the adjuvant setting for the treatment of eligible patients with completely resected stage IIB or IIC melanoma. The approval is based on results from the CheckMate -76K trial. |

|

| The European Commission approved Opdivo as a monotherapy for the adjuvant treatment of adults and adolescents 12 years of age and older with stage IIB or IIC melanoma who have undergone complete resection. The approval is based on results from the Phase 3 CheckMate -76K trial. |

| | | | | | | | |

| Clinical & Research | Opdivo | First results from the Phase 3 CheckMate -901 trial demonstrated that Opdivo in combination with cisplatin-based chemotherapy followed by Opdivo monotherapy demonstrated statistically significant and clinically meaningful improvements in the primary efficacy endpoints of overall survival and progression-free survival compared to standard-of-care cisplatin-based chemotherapy as a first-line treatment for patients with unresectable or metastatic urothelial carcinoma who are eligible for cisplatin-based chemotherapy. |

| | First data disclosure from the Phase 3 CheckMate -77T trial evaluating the perioperative regimen of neoadjuvant Opdivo with chemotherapy followed by surgery and adjuvant Opdivo in patients with resectable stage IIA to IIIB non-small cell lung cancer (NSCLC) demonstrated a statistically significant and clinically meaningful improvement in the primary efficacy endpoint of event-free survival compared to neoadjuvant chemotherapy and placebo followed by surgery and adjuvant placebo. |

| | Three-year follow-up results from exploratory analyses of the Phase 3 CheckMate -816 trial demonstrated sustained event-free survival (EFS) and promising overall survival trends with three cycles of Opdivo in combination with platinum-based chemotherapy for the neoadjuvant treatment of patients with resectable NSCLC, regardless of PD-L1 expression levels. Neoadjuvant Opdivo with chemotherapy also showed improvements in pathologic complete response (pCR) and major pathologic response (MPR) over chemotherapy alone in PD-L1 ≥1% and <1% patient populations. |

| | Part B of the Phase 3 CheckMate -914 trial, evaluating Opdivo as an adjuvant treatment for patients with localized renal cell carcinoma who have undergone full or partial removal of the kidney and who are at a moderate or high risk of relapse, did not meet the primary endpoint of disease-free survival as assessed by Blinded Independent Central Review. The safety profile was consistent with previously reported studies of other Opdivo and Opdivo-based combinations in solid tumors. |

| Subcutaneous nivolumab | Results from the Phase 3 CheckMate -67T trial evaluating subcutaneous nivolumab in advanced or metastatic clear cell renal cell carcinoma demonstrated noninferior pharmacokinetics and overall response rate (co-primary endpoints) and objective response rate (key secondary endpoint) when compared to intravenous Opdivo. The company looks forward to discussing next steps for subcutaneous nivolumab with health authorities across multiple indications. |

| Opdivo+Yervoy | Six-year follow-up results from Part 1 of the Phase 3 CheckMate -227 trial demonstrated long-term, durable survival benefits of Opdivo plus Yervoy compared to chemotherapy in the first-line treatment of patients with metastatic NSCLC, regardless of PD-L1 expression levels. |

| | | | | | | | |

| repotrectinib | Updated results from the registrational Phase 1/2 TRIDENT-1 study demonstrated that repotrectinib, a next-generation ROS1/TRK tyrosine kinase inhibitor, continued to show high response rates and durable responses in patients with ROS1-positive locally advanced or metastatic NSCLC. The FDA granted Priority Review of the New Drug Application for repotrectinib and assigned a Prescription Drug User Fee Act goal date of November 27, 2023. |

Hematology | | | | | | | | |

| Category | Asset | Milestone |

| Regulatory | Reblozyl® (luspatercept-aamt) | The FDA approved Reblozyl for the treatment of anemia without previous erythropoiesis stimulating agent use (ESA-naïve) in adult patients with very low- to intermediate-risk myelodysplastic syndromes who may require regular red blood cell transfusions. The approval is based on interim results from the pivotal Phase 3 COMMANDS trial, expanding Reblozyl indication to the first-line setting regardless of ring sideroblast status and enabling treatment across a broader array of patients. |

Immunology | | | | | | | | |

| Category | Asset | Milestone |

Regulatory | LPA1 antagonist BMS-986278 | The FDA granted BMS-986278, a potential first-in-class oral, lysophosphatidic acid receptor 1 (LPA1) antagonist, Breakthrough Therapy Designation for the treatment of progressive pulmonary fibrosis (PPF). |

Clinical & Research | LPA1 antagonist | Results from the Phase 2 study evaluating BMS-986278 in patients with PPF demonstrated that twice-daily administration of 60mg of BMS-986278 over 26 weeks reduced the rate of decline in percent predicted forced vital capacity by 69% compared to placebo. |

| Sotyktu™ (deucravacitinib) | Results from the POETYK-PSO long-term extension trial of Sotyktu treatment in adult patients with moderate-to-severe plaque psoriasis demonstrated that clinical response was maintained at 73.2% for Psoriasis Area and Severity Index 75 with 3 years of continuous Sotyktu treatment. Sotyktu demonstrated a consistent safety profile with no increases in adverse or serious adverse events and no new safety signals. |

| Zeposia® (ozanimod) | First interim readout from the Phase 3b ENLIGHTEN trial demonstrated that almost half of patients with early relapsing multiple sclerosis (RMS) have clinically meaningful improvement in cognitive functioning compared to baseline after one year of Zeposia treatment.

In addition, late-breaking data from the DAYBREAK and RADIANCE trials demonstrated that, after eight years of follow-up, 76% of patients treated with Zeposia for RMS were free of six-month confirmed disability progression. Findings also demonstrated treatment with Zeposia resulted in low rates of progression-independent relapse activity and relapse-associated worsening, key drivers of disease progression and permanent disability in multiple sclerosis.

|

Research and Development (R&D) Update

In September, Bristol Myers Squibb hosted an R&D Day highlighting its advancing pipeline and differentiated research platforms to support long-term sustainable growth. During the presentation, members of the company's leadership team discussed:

•The strengthening of Bristol Myers Squibb's scientific leadership and the advancement of a promising pipeline;

•An expectation of doubling registrational assets from six to 12 over the next 18 months;

•More than 25 indication expansion opportunities on the horizon and nine high-potential early assets that are expected to advance in the company’s pipeline;

•Differentiated research platforms that support long-term growth, including Cell Therapy and Targeted Protein Degradation;

•Increased depth across the company’s oncology, hematology, immunology and cardiovascular therapeutic areas and a growing presence in neuroscience; and

•Efforts to further increase and sustain the productivity of its R&D engine and bring treatments to patients faster.

Business Development

In October 2023, the company announced it had entered into a definitive merger agreement to acquire Mirati Therapeutics, Inc. ("Mirati"), a commercial-stage targeted oncology company. The pending acquisition, when complete, is expected to strengthen and diversify Bristol Myers Squibb's oncology franchise, add KRAZATI (adagrasib), a best-in-class KRASG12C inhibitor currently approved in lung cancer, to its commercial oncology portfolio, and add MRTX1719, a potential first-in-class MTA-cooperative PRMT5 inhibitor in Phase 1 development. Bristol Myers Squibb also gains access to several promising clinical and pre-clinical stage assets, including additional KRAS inhibitors and enabling programs.

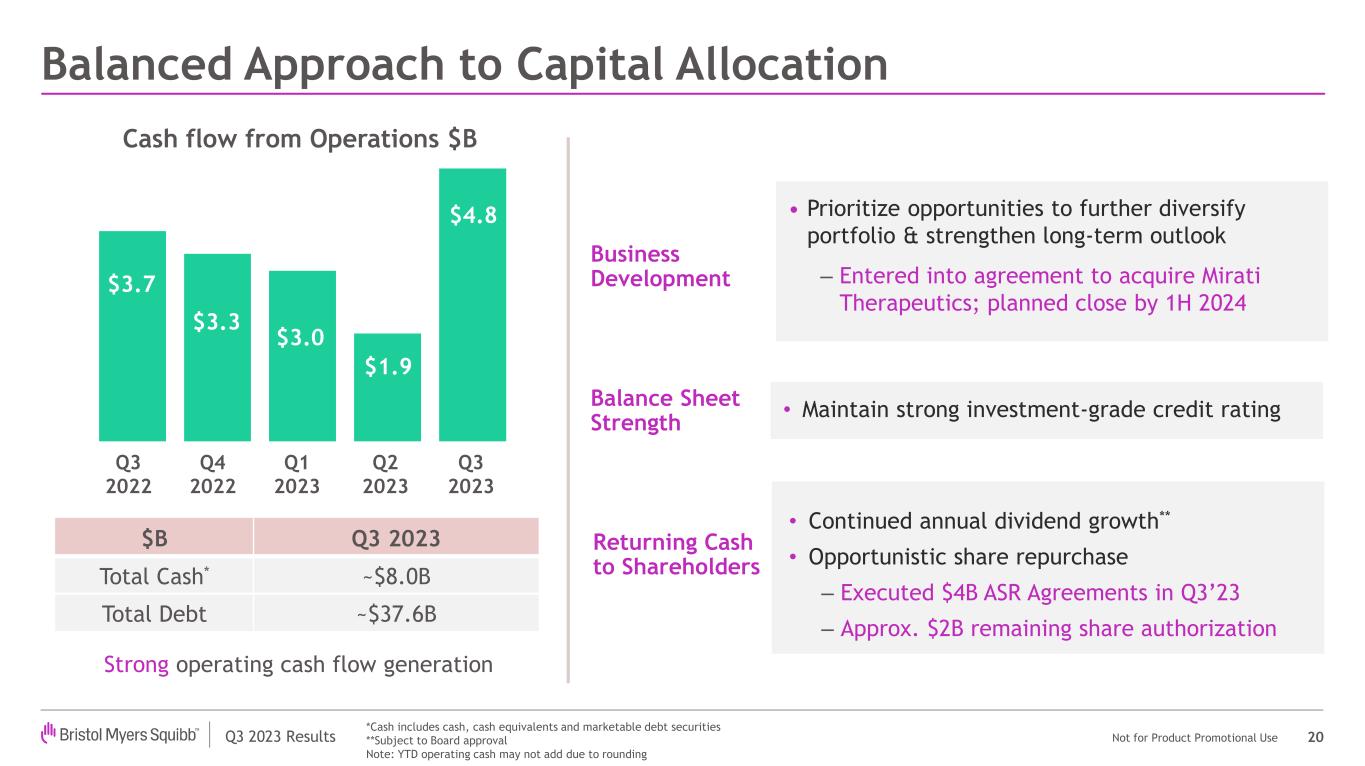

Capital Allocation

The company maintains a balanced approach to capital allocation focused on prioritizing investment for growth through business development, maintaining a strong balance sheet, growing the dividend and opportunistic share repurchases. Dividend decisions are subject to approval by the Board of Directors.

•In August, the company announced that it had entered into accelerated share repurchase (ASR) agreements to repurchase, in aggregate, $4 billion of Bristol Myers Squibb common stock. The company anticipates that final settlement of these transactions will occur during the fourth quarter of 2023.

Environmental, Social & Governance (ESG)

As a leading biopharmaceutical company, we understand our responsibility extends well beyond the discovery, development and delivery of innovative medicines. Our evolving ESG strategy builds on a

legacy of comprehensive and global sustainability efforts that seek to drive business value and positively impact patients, employees, communities and the planet.

•In August 2023, the company published its latest ESG report, which details the company's goals, strategies and performance across four ESG focus areas: ethics, integrity and quality; health equity and healthcare access; global inclusion and diversity; and environmental sustainability. Highlights include:

◦Increased access for underserved communities.

◦Progress toward global inclusion and diversity and health equity aspirational goals.

◦Expanded clinical trial diversity and advanced supplier diversity.

◦A reduced environmental footprint.

◦Strengthened ESG oversight and accountability.

•Bristol Myers Squibb was inducted into the Billion Dollar Roundtable, joining other Fortune 100 companies that have invested $1 billion with diverse-owned suppliers.

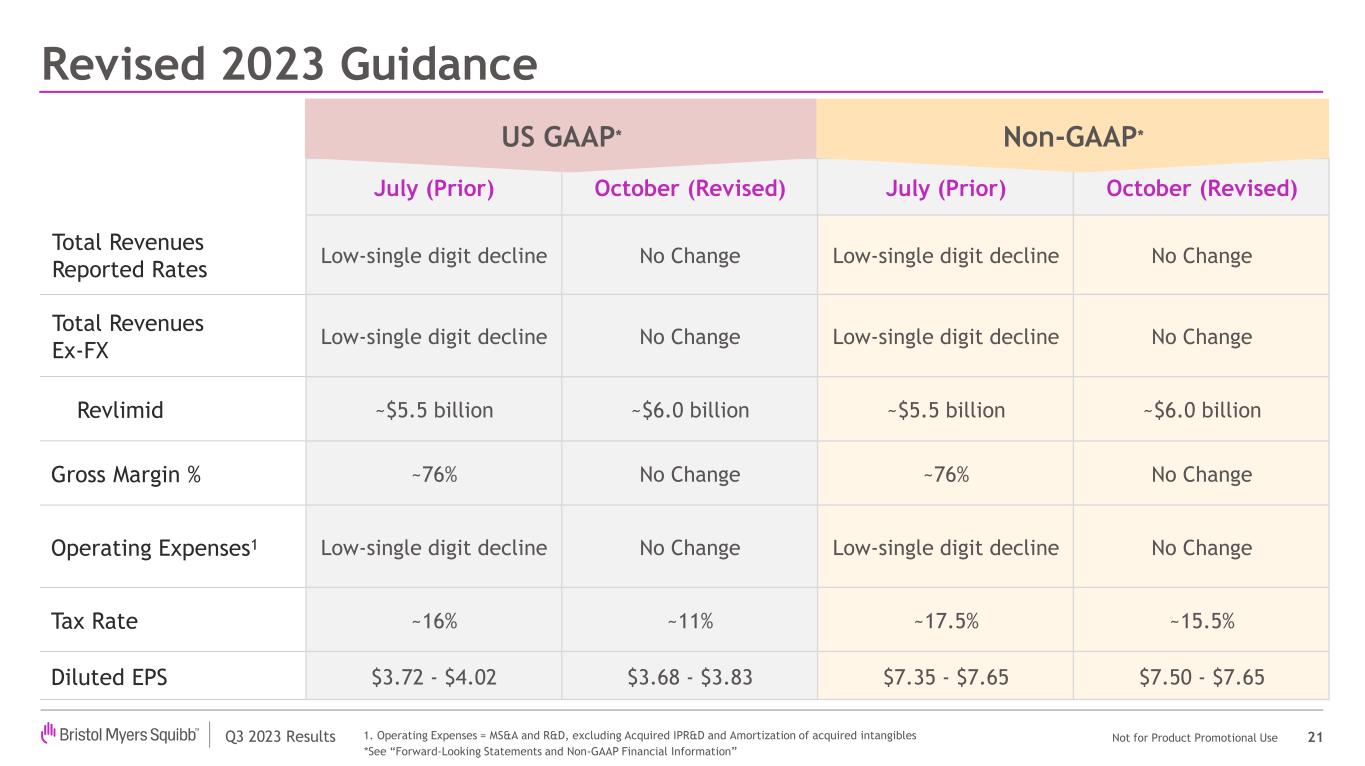

Financial Guidance

Bristol Myers Squibb is revising its 2023 GAAP and Non-GAAP line item guidance as follows:

•Adjusting total revenues for Revlimid to be approximately $6.0 billion.

•Adjusting GAAP diluted EPS range to $3.68-$3.83 and raising midpoint of Non-GAAP diluted EPS range, with the new range being $7.50-$7.65.

•Adjusting GAAP tax rate to approximately 11% and adjusting Non-GAAP tax rate to approximately 15.5%, primarily due to a reduction in previously estimated taxes resulting from changes in the income tax guidance regarding deductibility of certain non-U.S. research and development expenses.

Key 2023 GAAP and Non-GAAP line-item guidance assumptions are:

| | | | | | | | | | | | | | | | |

| | U.S. GAAP | Non-GAAP2 |

| | July (Prior) | October

(Revised) | July (Prior) | October

(Revised) |

Total Revenues (as reported) | | | Low single-digit decline |

No Change | Low single-digit decline | No Change |

Total Revenues (excl. F/X) | | | Low single-digit decline |

No Change | Low single-digit decline |

No Change |

| Revlimid | | | ~ $5.5 billion | ~$6.0 billion | ~ $5.5 billion | ~$6.0 billion |

| Gross Margin % | | | ~76% | No Change | ~76% | No Change |

Operating Expenses1 | | | Low single-digit decline |

No Change | Low single-digit decline | No Change |

| | | | | | | | | | | | | | | | |

| Tax Rate | | | ~ 16% | ~11% | ~ 17.5% | ~15.5% |

| Diluted EPS | | | $3.72-$4.02 | $3.68-$3.83 | $7.35-$7.65 | $7.50-$7.65

|

1 Operating Expenses — MS&A and R&D, excluding Acquired IPRD and Amortization of acquired intangible assets.

2 See "Use of Non-GAAP Financial Information."

The 2023 financial guidance excludes the impact of any potential future strategic acquisitions, including the planned acquisition of Mirati, and divestitures, and any specified items that have not yet been identified and quantified and the impact of future Acquired IPRD charges, including the charge associated with the re-acquisition of rights for mavacamten in China and certain other Asian territories. To the extent we have quantified the impact of significant R&D charges or other income resulting from upfront or contingent milestone payments in connection with asset acquisitions or licensing of third-party intellectual property rights, we may update this information from time to time on our website www.bms.com, in the "Investors" section. GAAP and Non-GAAP guidance assume current exchange rates. The 2023 Non-GAAP EPS guidance is further explained under “Use of Non-GAAP Financial Information.” The financial guidance is subject to risks and uncertainties applicable to all forward-looking statements as described elsewhere in this press release.

The company will no longer include GAAP financial guidance beginning with the presentation of the fourth quarter and year-end 2023 results.

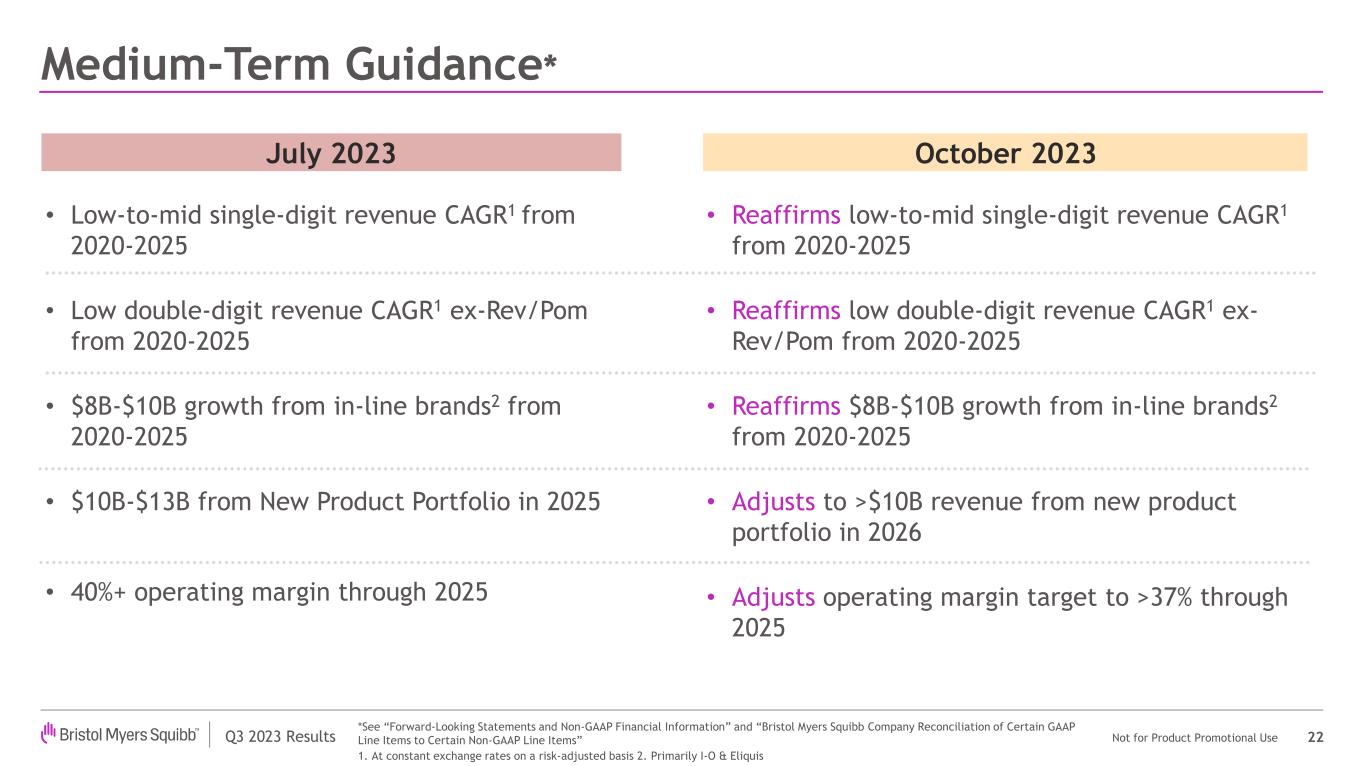

Medium-Term Financial Targets

The company is updating its previously communicated medium-term targets:

| | | | | | | |

| July (Prior) | October (Revised) |

| | Low-to-mid single digit revenue CAGR1 from 2020-2025 | Reaffirms low-to-mid single digit revenue CAGR1 from 2020-2025 |

| | Low double-digit revenue CAGR1 Ex-Revlimid/Pomalyst from 2020-2025 | Reaffirms low double-digit revenue CAGR1 Ex-Revlimid/Pomalyst from 2020-2025 |

| | $8-$10 billion growth from in-line brands2 from 2020-2025 | Reaffirms $8-$10 billion growth from in-line brands2 from 2020-2025 |

| | $10-$13 billion from new product portfolio in 2025 | Adjusts to >$10 billion revenue from new product portfolio in 2026 |

| | 40%+ Non-GAAP operating margin through 2025 | Adjusts Non-GAAP operating margin target to >37% through 2025 |

1 At constant exchange rates on a risk-adjusted basis.

2 Primarily I-O and Eliquis.

Conference Call Information

Bristol Myers Squibb will host a conference call today, Thursday, October 26, 2023, at 8:00 a.m. ET during which company executives will review the quarterly financial results and address inquiries from investors and analysts. Investors and the general public are invited to listen to a live webcast of the call at http://investor.bms.com.

Investors and the public can register for the live conference call here. Those unable to register can access the live conference call by dialing in the U.S. toll-free 1-833-816-1116 or international +1 412-317-0705. Materials related to the call will be available at http://investor.bms.com prior to the start of the conference call.

A replay of the webcast will be available at http://investor.bms.com approximately three hours after the conference call concludes. A replay of the conference call will be available beginning at 11:30 a.m. ET on October 26, 2023, through 11:30 a.m. ET on November 9, 2023, by dialing in the U.S. toll free 1-877-344-7529 or international +1 412-317-0088, confirmation code: 3515954.

About Bristol Myers Squibb

Bristol Myers Squibb is a global biopharmaceutical company whose mission is to discover, develop and deliver innovative medicines that help patients prevail over serious diseases. For more information about Bristol Myers Squibb, visit us at BMS.com or follow us on LinkedIn, Twitter, YouTube, Facebook, and Instagram.

###

corporatefinancial-news

For more information, contact:

Media: media@bms.com

Investor Relations: investor.relations@bms.com

Use of Non-GAAP Financial Information

In discussing financial results and guidance, the company refers to financial measures that are not in accordance with U.S. Generally Accepted Accounting Principles (GAAP). The Non-GAAP financial measures are provided as supplemental information to the financial measures presented in this press release that are calculated and presented in accordance with GAAP and are presented because management has evaluated the company’s financial results both including and excluding the adjusted items or the effects of foreign currency translation, as applicable, and believes that the Non-GAAP financial measures presented portray the results of the company's baseline performance, supplement or enhance management, analysts and investors overall understanding of the company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods. In addition, Non-GAAP gross margin, which is gross profit excluding certain specified items, as a percentage of revenues, Non-GAAP operating margin, which is gross profit less marketing, selling and administrative expenses and research and development expense excluding certain specified items as a percentage of revenues, Non-GAAP operating expenses, which is marketing, selling and administrative and research and development expenses excluding certain specified items, Non-GAAP marketing, selling and administrative expense, which is marketing, selling and administrative expense excluding certain specified items, and Non-GAAP research and development expenses, which is research and development expenses excluding

certain specified items, are relevant and useful for investors because they allow investors to view performance in a manner similar to the method used by our management and make it easier for investors, analysts and peers to compare our operating performance to other companies in our industry and to compare our year-over-year results.

This earnings release and the accompanying tables also provide certain revenues and expenses as well as Non-GAAP measures excluding the impact of foreign exchange ("Ex-Fx"). We calculate foreign exchange impacts by converting our current-period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current-period results. Ex-Fx financial measures are not accounted for according to GAAP because they remove the effects of currency movements from GAAP results.

Non-GAAP financial measures such as Non-GAAP earnings and related EPS information are adjusted to exclude certain costs, expenses, gains and losses and other specified items that are evaluated on an individual basis after considering their quantitative and qualitative aspects and typically have one or more of the following characteristics, such as being highly variable, difficult to project, unusual in nature, significant to the results of a particular period or not indicative of past or future operating results. These items are excluded from Non-GAAP earnings and related EPS information because the company believes they neither relate to the ordinary course of the company’s business nor reflect the company’s underlying business performance. Similar charges or gains were recognized in prior periods and will likely reoccur in future periods, including amortization of acquired intangible assets, including product rights that generate a significant portion of our ongoing revenue and will recur until the intangible assets are fully amortized, unwind of inventory purchase price adjustments, acquisition and integration expenses, restructuring costs, accelerated depreciation and impairment of property, plant and equipment and intangible assets, costs of acquiring a priority review voucher, divestiture gains or losses, stock compensation resulting from acquisition-related equity awards, pension, legal and other contractual settlement charges, equity investment and contingent value rights fair value adjustments (including fair value adjustments attributed to limited partnership equity method investments), income resulting from the change in control of the Nimbus Therapeutics TYK2 Program and amortization of fair value adjustments of debt acquired from Celgene in our 2019 exchange offer, among other items. Deferred and current income taxes attributed to these items are also adjusted for considering their individual impact to the overall tax expense, deductibility and jurisdictional tax rates. Certain other significant tax items are also excluded such as the impact resulting from a non-U.S. tax ruling regarding the deductibility of a statutory impairment of subsidiary investments.

Because the Non-GAAP financial measures are not calculated in accordance with GAAP, they should not be considered superior to and are not intended to be considered in isolation or as a substitute for the related financial measures presented in the press release that are prepared in accordance with GAAP and may not be the same as or comparable to similarly titled measures presented by other companies due to possible differences in method and in the items being adjusted. We encourage investors to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure.

Reconciliations of the Non-GAAP financial measures to the most comparable GAAP measures are provided in the accompanying financial tables and will also be available on the company’s website at www.bms.com. Within the accompanying financial tables presented, certain columns and rows may not add due to the use of rounded numbers. Percentages and earnings per share amounts presented are calculated from the underlying amounts.

Also note that a reconciliation of forward-looking Non-GAAP gross margin, Non-GAAP operating margin, Non-GAAP operating expenses and Non-GAAP effective tax rate is not provided because comparable GAAP measures for such measures are not reasonably accessible or reliable due to the

inherent difficulty in forecasting and quantifying measures that would be necessary for such reconciliation. Namely, we are not able to reliably predict the impact of the unwind of inventory purchase price adjustments, accelerated depreciation and impairment of property, plant and equipment and intangible assets and stock compensation resulting from acquisition-related equity awards, or currency exchange rates beyond the next twelve months. In addition, the company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. The variability of the specified items may have a significant and unpredictable impact on our future GAAP results.

Website Information

We routinely post important information for investors on our website, BMS.com, in the “Investors” section. We may use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. We may also use social media channels to communicate with our investors and the public about our company, our products and other matters, and those communications could be deemed to be material information. The information contained on, or that may be accessed through, our website or social media channels are not incorporated by reference into, and are not a part of, this document.

Cautionary Statement Regarding Forward-Looking Statements

This earnings release and the related attachments (as well as the oral statements made with respect to information contained in this release and the attachments) contain certain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, the Company’s 2023 financial guidance, plans and strategy, including its business development and capital allocation strategy, the acquisition of Mirati by the company, anticipated developments in the company’s pipeline and expectations with respect to the company’s future market position. These statements may be identified by the fact they use words such as “should,” “could,” “expect,” “anticipate,” “estimate,” “target,” “may,” “project,” “guidance,” “intend,” “plan,” “believe,” “will” and other words and terms of similar meaning and expression in connection with any discussion of future operating or financial performance, although not all forward-looking statements contain such terms. All statements that are not statements of historical facts are, or may be deemed to be, forward-looking statements. No forward-looking statement can be guaranteed and there is no assurance that the company will achieve its financial guidance and long-term targets, that the company’s future clinical studies will support the data described in this release, that the company’s product candidates will receive necessary clinical and manufacturing regulatory approvals, that the company’s pipeline products will prove to be commercially successful, that clinical and manufacturing regulatory approvals will be sought or obtained within currently expected timeframes, or that contractual milestones will be achieved or that the acquisition of Mirati will be completed on the current anticipated timeline or at all.

Forward-looking statements are based on current expectations and projections about the company’s future financial results, goals, plans and objectives and involve inherent risks, assumptions and uncertainties, including internal or external factors that could delay, divert or change any of them in the next several years, that are difficult to predict, may be beyond the company’s control and could cause the company’s future financial results, goals, plans and objectives to differ materially from those expressed in, or implied by, the statements. Such risks, uncertainties and other matters include, but are not limited to: increasing pricing pressures from market access, pharmaceutical pricing controls and discounting; market actions taken by private and government payers to manage drug utilization and contain costs; the company’s ability to retain patent exclusivity of certain products; regulatory changes that result in lower prices, lower

reimbursement rates and smaller populations for whom payers will reimburse; changes under the 340B Drug Pricing Program; the company’s ability to obtain and maintain regulatory approval for its product candidates; the company’s ability to obtain and protect market exclusivity rights and enforce patents and other intellectual property rights; the possibility of difficulties and delays in product introduction and commercialization; increasing industry competition; potential difficulties, delays and disruptions in manufacturing, distribution or sale of products; the company’s ability to identify potential strategic acquisitions, licensing opportunities or other beneficial transactions; failure to complete, or delays in completing, collaborations, acquisitions, divestitures, alliances and other portfolio actions and the failure to achieve anticipated benefits from such transactions and actions; the risk of an adverse patent litigation decision or settlement and exposure to other litigation and/or regulatory actions or investigations; the impact of any healthcare reform and legislation or regulatory action in the United States and international markets; increasing market penetration of lower-priced generic products; the failure of the company’s suppliers, vendors, outsourcing partners, alliance partners and other third parties to meet their contractual, regulatory and other obligations; the impact of counterfeit or unregistered versions of the company’s products and from stolen products; product label changes or other measures that could reduce the product's market acceptance for the company's products and result in declining sales; safety or efficacy concerns regarding the company’s products or any product in the same class as the company’s products; the risk of cyber-attacks on the company’s information systems or products and unauthorized disclosure of trade secrets or other confidential data; the company’s ability to execute its financial, strategic and operational plans; the company’s dependency on several key products; any decline in the company’s future royalty streams; the company’s ability to attract and retain key personnel; the impact of the company’s significant indebtedness; political and financial instability of international economies and sovereign risk including as a result of the Russian Federation-Ukraine conflict; interest rate and currency exchange rate fluctuations, credit and foreign exchange risk management; risks relating to the use of social media platforms; the impact of our exclusive forum provision in our by-laws for certain lawsuits on our stockholders’ ability to obtain a judicial forum that they find favorable for such lawsuits; issuance of new or revised accounting standards; and risks relating to public health outbreaks, epidemics and pandemics, including the impact of the COVID-19 pandemic on the company’s operations.

Forward-looking statements in this earnings release should be evaluated together with the many risks and uncertainties that affect the company’s business and market, particularly those identified in the cautionary statement and risk factors discussion in the company’s Annual Report on Form 10-K for the year ended December 31, 2022, as updated by the company’s subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the Securities and Exchange Commission. The forward-looking statements included in this document are made only as of the date of this document and except as otherwise required by applicable law, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise.

BRISTOL-MYERS SQUIBB COMPANY

CONSOLIDATED STATEMENTS OF EARNINGS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

(Unaudited, dollars and shares in millions except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net product sales | $ | 10,645 | | | $ | 10,813 | | | $ | 32,610 | | | $ | 33,606 | |

| Alliance and other revenues | 321 | | | 405 | | | 919 | | | 1,147 | |

| Total Revenues | 10,966 | | | 11,218 | | | 33,529 | | | 34,753 | |

| | | | | | | |

Cost of products sold(a) | 2,506 | | | 2,353 | | | 7,948 | | | 7,544 | |

| Marketing, selling and administrative | 2,003 | | | 1,930 | | | 5,699 | | | 5,548 | |

| Research and development | 2,242 | | | 2,418 | | | 6,821 | | | 6,999 | |

| Acquired IPRD | 80 | | | 30 | | | 313 | | | 763 | |

| Amortization of acquired intangible assets | 2,256 | | | 2,418 | | | 6,769 | | | 7,252 | |

| Other (income)/expense, net | (258) | | | (140) | | | (787) | | | 793 | |

| Total Expenses | 8,829 | | | 9,009 | | | 26,763 | | | 28,899 | |

| | | | | | | |

| Earnings Before Income Taxes | 2,137 | | | 2,209 | | | 6,766 | | | 5,854 | |

| Provision for Income Taxes | 203 | | | 601 | | | 488 | | | 1,534 | |

| Net Earnings | 1,934 | | | 1,608 | | | 6,278 | | | 4,320 | |

| Noncontrolling Interest | 6 | | | 2 | | | 15 | | | 15 | |

| Net Earnings Attributable to BMS | $ | 1,928 | | | $ | 1,606 | | | $ | 6,263 | | | $ | 4,305 | |

| | | | | | | |

| Weighted-Average Common Shares Outstanding: | | | | | | | |

| Basic | 2,057 | | | 2,133 | | | 2,083 | | | 2,137 | |

| Diluted | 2,064 | | | 2,148 | | | 2,093 | | | 2,154 | |

| | | | | | | |

| Earnings per Common Share: | | | | | | | |

| Basic | $ | 0.94 | | | $ | 0.75 | | | $ | 3.01 | | | $ | 2.01 | |

| Diluted | 0.93 | | | 0.75 | | | 2.99 | | | 2.00 | |

| | | | | | | |

| Other (income)/expense, net | | | | | | | |

Interest expense(b) | $ | 280 | | | $ | 299 | | | $ | 850 | | | $ | 938 | |

| Royalty and licensing income | (365) | | | (374) | | | (1,068) | | | (967) | |

| Royalty income - divestitures | (217) | | | (205) | | | (623) | | | (597) | |

| Equity investment losses | — | | | 14 | | | 213 | | | 966 | |

| Integration expenses | 54 | | | 114 | | | 180 | | | 343 | |

| Loss on debt redemption | — | | | — | | | — | | | 266 | |

| Divestiture gains | — | | | — | | | — | | | (211) | |

| Litigation and other settlements | (61) | | | 44 | | | (393) | | | 32 | |

| Investment income | (107) | | | (52) | | | (304) | | | (89) | |

| Provision for restructuring | 141 | | | 17 | | | 321 | | | 60 | |

| Other | 17 | | | 3 | | | 37 | | | 52 | |

| Other (income)/expense, net | $ | (258) | | | $ | (140) | | | $ | (787) | | | $ | 793 | |

(a) Excludes amortization of acquired intangible assets.

(b) Includes amortization of purchase price adjustments to Celgene debt.

BRISTOL-MYERS SQUIBB COMPANY

PRODUCT REVENUES

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

(Unaudited, dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Change vs. 2022 |

| | | 2023 | | 2022 | | GAAP | | Excl. F/X** |

| | U.S. (c) | | Int'l | | WW (d) | | U.S. (c) | | Int'l | | WW (d) | | U.S. (c) | | Int'l | | WW (d) | | U.S.(c) | | Int'l | | WW (d) |

| In-Line Products | | | | | | | | | | | | | | | | | | | | | | | | |

| Eliquis | | $ | 1,799 | | | $ | 906 | | | $ | 2,705 | | | $ | 1,729 | | | $ | 926 | | | $ | 2,655 | | | 4 | % | | (2) | % | | 2 | % | | 4 | % | | (6) | % | | — | % |

| Opdivo | | 1,352 | | | 923 | | | 2,275 | | | 1,243 | | | 804 | | | 2,047 | | | 9 | % | | 15 | % | | 11 | % | | 9 | % | | 15 | % | | 11 | % |

| Pomalyst/Imnovid | | 610 | | | 262 | | | 872 | | | 640 | | | 246 | | | 886 | | | (5) | % | | 7 | % | | (2) | % | | (5) | % | | 4 | % | | (2) | % |

| Orencia | | 719 | | | 206 | | | 925 | | | 682 | | | 201 | | | 883 | | | 5 | % | | 2 | % | | 5 | % | | 5 | % | | 1 | % | | 5 | % |

| Sprycel | | 406 | | | 111 | | | 517 | | | 402 | | | 158 | | | 560 | | | 1 | % | | (30) | % | | (8) | % | | 1 | % | | (29) | % | | (8) | % |

| Yervoy | | 362 | | | 217 | | | 579 | | | 322 | | | 201 | | | 523 | | | 12 | % | | 8 | % | | 11 | % | | 12 | % | | 6 | % | | 10 | % |

Mature and other brands(a) | | 191 | | | 285 | | | 476 | | | 191 | | | 323 | | | 514 | | | — | % | | (12) | % | | (7) | % | | — | % | | (11) | % | | (7) | % |

| Total In-Line Products | | 5,439 | | | 2,910 | | | 8,349 | | | 5,209 | | | 2,859 | | | 8,068 | | | 4 | % | | 2 | % | | 3 | % | | 4 | % | | — | % | | 3 | % |

| New Product Portfolio | | | | | | | | | | | | | | | | | | | | | | | | |

| Reblozyl | | 200 | | | 48 | | | 248 | | | 156 | | | 34 | | | 190 | | | 28 | % | | 41 | % | | 31 | % | | 28 | % | | 35 | % | | 29 | % |

| Abecma | | 69 | | | 24 | | | 93 | | | 75 | | | 32 | | | 107 | | | (8) | % | | (25) | % | | (13) | % | | (8) | % | | (28) | % | | (14) | % |

| Opdualag | | 162 | | | 4 | | | 166 | | | 84 | | | — | | | 84 | | | 93 | % | | N/A | | 98 | % | | 93 | % | | N/A | | 98 | % |

| Zeposia | | 96 | | | 27 | | | 123 | | | 50 | | | 19 | | | 69 | | | 92 | % | | 42 | % | | 78 | % | | 92 | % | | 32 | % | | 75 | % |

| Breyanzi | | 77 | | | 15 | | | 92 | | | 35 | | | 9 | | | 44 | | | * | | 67 | % | | * | | * | | 67 | % | | * |

| Onureg | | 30 | | | 13 | | | 43 | | | 24 | | | 8 | | | 32 | | | 25 | % | | 63 | % | | 34 | % | | 25 | % | | 50 | % | | 31 | % |

| Inrebic | | 19 | | | 10 | | | 29 | | | 17 | | | 4 | | | 21 | | | 12 | % | | * | | 38 | % | | 12 | % | | * | | 33 | % |

| Camzyos | | 67 | | | 1 | | | 68 | | | 5 | | | — | | | 5 | | | * | | N/A | | * | | * | | N/A | | * |

| Sotyktu | | 62 | | | 4 | | | 66 | | | 1 | | | — | | | 1 | | | * | | N/A | | * | | * | | N/A | | * |

| Total New Product Portfolio | | 782 | | | 146 | | | 928 | | | 447 | | | 106 | | | 553 | | | 75 | % | | 38 | % | | 68 | % | | 75 | % | | 31 | % | | 67 | % |

| Total In-Line and New Product Portfolio | | 6,221 | | | 3,056 | | | 9,277 | | | 5,656 | | | 2,965 | | | 8,621 | | | 10 | % | | 3 | % | | 8 | % | | 10 | % | | 1 | % | | 7 | % |

Recent LOE Products(b) | | | | | | | | | | | | | | | | | | | | | | | | |

| Revlimid | | 1,226 | | | 203 | | | 1,429 | | | 2,170 | | | 250 | | | 2,420 | | | (44) | % | | (19) | % | | (41) | % | | (44) | % | | (18) | % | | (41) | % |

| Abraxane | | 181 | | | 79 | | | 260 | | | 115 | | | 62 | | | 177 | | | 57 | % | | 27 | % | | 47 | % | | 57 | % | | 39 | % | | 51 | % |

| Total Recent LOE Products | | 1,407 | | | 282 | | | 1,689 | | | 2,285 | | | 312 | | | 2,597 | | | (38) | % | | (10) | % | | (35) | % | | (38) | % | | (7) | % | | (35) | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Revenues | | $ | 7,628 | | | $ | 3,338 | | | $ | 10,966 | | | $ | 7,941 | | | $ | 3,277 | | | $ | 11,218 | | | (4) | % | | 2 | % | | (2) | % | | (4) | % | | 1 | % | | (3) | % |

* In excess of +100%

** See "Use of Non-GAAP Financial Information".

(a) Includes over-the-counter (OTC) products, royalty revenue and mature products.

(b) Recent LOE Products includes products with significant expected decline in revenue from a prior reporting period as a result of a loss of exclusivity.

(c) Includes Puerto Rico.

(d) Worldwide (WW) includes International (Int'l) and U.S.

BRISTOL-MYERS SQUIBB COMPANY

PRODUCT REVENUES

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

(Unaudited, dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Change vs. 2022 |

| | | 2023 | | 2022 | | GAAP | | Excl. F/X** |

| | U.S. (c) | | Int'l | | WW (d) | | U.S. (c) | | Int'l | | WW (d) | | U.S. (c) | | Int'l | | WW (d) | | U.S.(c) | | Int'l | | WW (d) |

| In-Line Products | | | | | | | | | | | | | | | | | | | | | | | | |

| Eliquis | | $ | 6,693 | | | $ | 2,639 | | | $ | 9,332 | | | $ | 6,068 | | | $ | 3,033 | | | $ | 9,101 | | | 10 | % | | (13) | % | | 3 | % | | 10 | % | | (12) | % | | 3 | % |

| Opdivo | | 3,872 | | | 2,750 | | | 6,622 | | | 3,547 | | | 2,486 | | | 6,033 | | | 9 | % | | 11 | % | | 10 | % | | 9 | % | | 14 | % | | 11 | % |

| Pomalyst/Imnovid | | 1,725 | | | 826 | | | 2,551 | | | 1,813 | | | 807 | | | 2,620 | | | (5) | % | | 2 | % | | (3) | % | | (5) | % | | 4 | % | | (2) | % |

| Orencia | | 1,988 | | | 628 | | | 2,616 | | | 1,928 | | | 623 | | | 2,551 | | | 3 | % | | 1 | % | | 3 | % | | 3 | % | | 4 | % | | 3 | % |

| Sprycel | | 1,029 | | | 375 | | | 1,404 | | | 1,079 | | | 508 | | | 1,587 | | | (5) | % | | (26) | % | | (12) | % | | (5) | % | | (23) | % | | (11) | % |

| Yervoy | | 1,045 | | | 627 | | | 1,672 | | | 959 | | | 604 | | | 1,563 | | | 9 | % | | 4 | % | | 7 | % | | 9 | % | | 7 | % | | 8 | % |

Mature and other brands(a) | | 570 | | | 845 | | | 1,415 | | | 565 | | | 998 | | | 1,563 | | | 1 | % | | (15) | % | | (9) | % | | 1 | % | | (13) | % | | (8) | % |

| Total In-Line Products | | 16,922 | | | 8,690 | | | 25,612 | | | 15,959 | | | 9,059 | | | 25,018 | | | 6 | % | | (4) | % | | 2 | % | | 6 | % | | (2) | % | | 3 | % |

| New Product Portfolio | | | | | | | | | | | | | | | | | | | | | | | | |

| Reblozyl | | 537 | | | 151 | | | 688 | | | 434 | | | 84 | | | 518 | | | 24 | % | | 80 | % | | 33 | % | | 24 | % | | 79 | % | | 33 | % |

| Abecma | | 302 | | | 70 | | | 372 | | | 203 | | | 60 | | | 263 | | | 49 | % | | 17 | % | | 41 | % | | 49 | % | | 17 | % | | 41 | % |

| Opdualag | | 430 | | | 7 | | | 437 | | | 148 | | | — | | | 148 | | | * | | N/A | | * | | * | | N/A | | * |

| Zeposia | | 223 | | | 78 | | | 301 | | | 119 | | | 52 | | | 171 | | | 87 | % | | 50 | % | | 76 | % | | 87 | % | | 48 | % | | 75 | % |

| Breyanzi | | 218 | | | 45 | | | 263 | | | 109 | | | 18 | | | 127 | | | 100 | % | | * | | * | | 100 | % | | * | | * |

| Onureg | | 86 | | | 35 | | | 121 | | | 68 | | | 19 | | | 87 | | | 26 | % | | 84 | % | | 39 | % | | 26 | % | | 84 | % | | 39 | % |

| Inrebic | | 55 | | | 26 | | | 81 | | | 52 | | | 10 | | | 62 | | | 6 | % | | * | | 31 | % | | 6 | % | | * | | 31 | % |

| Camzyos | | 142 | | | 1 | | | 143 | | | 8 | | | — | | | 8 | | | * | | N/A | | * | | * | | N/A | | * |

| Sotyktu | | 101 | | | 6 | | | 107 | | | 1 | | | — | | | 1 | | | * | | N/A | | * | | * | | N/A | | * |

| Total New Product Portfolio | | 2,094 | | | 419 | | | 2,513 | | | 1,142 | | | 243 | | | 1,385 | | | 83 | % | | 72 | % | | 81 | % | | 83 | % | | 72 | % | | 81 | % |

| Total In-Line and New Product Portfolio | | 19,016 | | | 9,109 | | | 28,125 | | | 17,101 | | | 9,302 | | | 26,403 | | | 11 | % | | (2) | % | | 7 | % | | 11 | % | | — | % | | 7 | % |

Recent LOE Products(b) | | | | | | | | | | | | | | | | | | | | | | | | |

| Revlimid | | 4,004 | | | 643 | | | 4,647 | | | 6,338 | | | 1,380 | | | 7,718 | | | (37) | % | | (53) | % | | (40) | % | | (37) | % | | (52) | % | | (40) | % |

| Abraxane | | 532 | | | 225 | | | 757 | | | 464 | | | 168 | | | 632 | | | 15 | % | | 34 | % | | 20 | % | | 15 | % | | 46 | % | | 23 | % |

| Total Recent LOE Products | | 4,536 | | | 868 | | | 5,404 | | | 6,802 | | | 1,548 | | | 8,350 | | | (33) | % | | (44) | % | | (35) | % | | (33) | % | | (41) | % | | (35) | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total Revenues | | $ | 23,552 | | | $ | 9,977 | | | $ | 33,529 | | | $ | 23,903 | | | $ | 10,850 | | | $ | 34,753 | | | (1) | % | | (8) | % | | (4) | % | | (1) | % | | (6) | % | | (3) | % |

* In excess of +100%

** See "Use of Non-GAAP Financial Information".

(a) Includes over-the-counter (OTC) products, royalty revenue and mature products.

(b) Recent LOE Products includes products with significant expected decline in revenue from a prior reporting period as a result of a loss of exclusivity.

(c) Includes Puerto Rico.

(d) Worldwide (WW) includes International (Int'l) and U.S.

BRISTOL-MYERS SQUIBB COMPANY

INTERNATIONAL AND WORLDWIDE REVENUES

FOREIGN EXCHANGE IMPACT (%)

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2023

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| International | | WW (c) | | | | | | |

| Revenue Change % | | F/X % Favorable/ (Unfavorable) | | Revenue Change % Ex- F/X | | Revenue Change % | | F/X % Favorable/ (Unfavorable) | | Revenue Change % Ex- F/X | | | | | | |

| In-Line Products | | | | | | | | | | | | | | | | | |

| Eliquis | (2)% | | 4% | | (6)% | | 2% | | 2% | | —% | | | | | | |

| Opdivo | 15% | | —% | | 15% | | 11% | | —% | | 11% | | | | | | |

| Pomalyst/Imnovid | 7% | | 3% | | 4% | | (2)% | | —% | | (2)% | | | | | | |

| Orencia | 2% | | 1% | | 1% | | 5% | | —% | | 5% | | | | | | |

| Sprycel | (30)% | | (1)% | | (29)% | | (8)% | | —% | | (8)% | | | | | | |

| Yervoy | 8% | | 2% | | 6% | | 11% | | 1% | | 10% | | | | | | |

Mature and other products(a) | (12)% | | (1)% | | (11)% | | (7)% | | —% | | (7)% | | | | | | |

| Total In-Line Products | 2% | | 2% | | —% | | 3% | | —% | | 3% | | | | | | |

| New Product Portfolio | | | | | | | | | | | | | | | | | |

| Reblozyl | 41% | | 6% | | 35% | | 31% | | 2% | | 29% | | | | | | |

| Abecma | (25)% | | 3% | | (28)% | | (13)% | | 1% | | (14)% | | | | | | |

| Opdualag | N/A | | N/A | | N/A | | 98% | | —% | | 98% | | | | | | |

| Zeposia | 42% | | 10% | | 32% | | 78% | | 3% | | 75% | | | | | | |

| Breyanzi | 67% | | —% | | 67% | | * | | * | | * | | | | | | |

| Onureg | 63% | | 13% | | 50% | | 34% | | 3% | | 31% | | | | | | |

| Inrebic | * | | * | | * | | 38% | | 5% | | 33% | | | | | | |

| Camzyos | N/A | | N/A | | N/A | | * | | * | | * | | | | | | |

| Sotyktu | N/A | | N/A | | N/A | | * | | * | | * | | | | | | |

| Total New Product Portfolio | 38% | | 7% | | 31% | | 68% | | 1% | | 67% | | | | | | |

| Total In-Line Products and New Product Portfolio | 3% | | 2% | | 1% | | 8% | | 1% | | 7% | | | | | | |

Recent LOE Products(b) | | | | | | | | | | | | | | | | | |

| Revlimid | (19)% | | (1)% | | (18)% | | (41)% | | —% | | (41)% | | | | | | |

| Abraxane | 27% | | (12)% | | 39% | | 47% | | (4)% | | 51% | | | | | | |

| Total Recent LOE Products | (10)% | | (3)% | | (7)% | | (35)% | | —% | | (35)% | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total | 2% | | 1% | | 1% | | (2)% | | 1% | | (3)% | | | | | | |

* In excess of +/-100%.

** See "Use of Non—GAAP Financial Information".

(a) Includes over-the-counter (OTC) products, royalty revenue and other mature products.

(b) Recent LOE products include products with significant expected decline in revenue from a prior reporting period as a result of a loss of exclusivity.

(c) Worldwide (WW) includes International (Int'l) and U.S.

BRISTOL-MYERS SQUIBB COMPANY

INTERNATIONAL AND WORLDWIDE REVENUES

FOREIGN EXCHANGE IMPACT (%)

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2023

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| International | | WW (c) | | | | | | |

| Revenue Change % | | F/X % Favorable/ (Unfavorable) | | Revenue Change % Ex- F/X | | Revenue Change % | | F/X % Favorable/ (Unfavorable) | | Revenue Change % Ex- F/X | | | | | | |

| In-Line Products | | | | | | | | | | | | | | | | | |

| Eliquis | (13)% | | (1)% | | (12)% | | 3% | | —% | | 3% | | | | | | |

| Opdivo | 11% | | (3)% | | 14% | | 10% | | (1)% | | 11% | | | | | | |

| Pomalyst/Imnovid | 2% | | (2)% | | 4% | | (3)% | | (1)% | | (2)% | | | | | | |

| Orencia | 1% | | (3)% | | 4% | | 3% | | —% | | 3% | | | | | | |

| Sprycel | (26)% | | (3)% | | (23)% | | (12)% | | (1)% | | (11)% | | | | | | |

| Yervoy | 4% | | (3)% | | 7% | | 7% | | (1)% | | 8% | | | | | | |

Mature and other products(a) | (15)% | | (2)% | | (13)% | | (9)% | | (1)% | | (8)% | | | | | | |

| Total In-Line Products | (4)% | | (2)% | | (2)% | | 2% | | (1)% | | 3% | | | | | | |

| New Product Portfolio | | | | | | | | | | | | | | | | | |

| Reblozyl | 80% | | 1% | | 79% | | 33% | | —% | | 33% | | | | | | |

| Abecma | 17% | | —% | | 17% | | 41% | | —% | | 41% | | | | | | |

| Opdualag | N/A | | N/A | | N/A | | * | | * | | * | | | | | | |

| Zeposia | 50% | | 2% | | 48% | | 76% | | 1% | | 75% | | | | | | |

| Breyanzi | * | | * | | * | | * | | * | | * | | | | | | |

| Onureg | 84% | | —% | | 84% | | 39% | | —% | | 39% | | | | | | |

| Inrebic | * | | * | | * | | 31% | | —% | | 31% | | | | | | |

| Camzyos | N/A | | N/A | | N/A | | * | | * | | * | | | | | | |

| Sotyktu | N/A | | N/A | | N/A | | * | | * | | * | | | | | | |

| Total New Product Portfolio | 72% | | —% | | 72% | | 81% | | —% | | 81% | | | | | | |

| Total In-Line Products and New Product Portfolio | (2)% | | (2)% | | —% | | 7% | | —% | | 7% | | | | | | |

Recent LOE Products(b) | | | | | | | | | | | | | | | | | |

| Revlimid | (53)% | | (1)% | | (52)% | | (40)% | | —% | | (40)% | | | | | | |

| Abraxane | 34% | | (12)% | | 46% | | 20% | | (3)% | | 23% | | | | | | |

| Total Recent LOE Products | (44)% | | (3)% | | (41)% | | (35)% | | —% | | (35)% | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total | (8)% | | (2)% | | (6)% | | (4)% | | (1)% | | (3)% | | | | | | |

* In excess of +/-100%.

** See "Use of Non—GAAP Financial Information".

(a) Includes over-the-counter (OTC) products, royalty revenue and other mature products.

(b) Recent LOE products include products with significant expected decline in revenue from a prior reporting period as a result of a loss of exclusivity.

(c) Worldwide (WW) includes International (Int'l) and U.S.

BRISTOL-MYERS SQUIBB COMPANY

RECONCILIATION OF GAAP AND NON-GAAP GROWTH DOLLARS AND PERCENTAGES EXCLUDING FOREIGN EXCHANGE IMPACT

(Unaudited, dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THREE MONTHS ENDED | 2023 | | 2022 | | Change $ | | Change % | | Favorable / (Unfavorable) F/X $* | | 2023 Excl. F/X** | | Favorable / (Unfavorable) F/X %* | | % Change Excl. F/X** |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Revenues | $ | 10,966 | | | $ | 11,218 | | | $ | (252) | | | (2) | % | | $ | 43 | | | $ | 10,923 | | | 1 | % | | (3) | % |

| Gross profit | 8,460 | | | 8,865 | | | (405) | | | (5) | % | | N/A | | N/A | | N/A | | N/A |

Gross profit excluding specified items(a) | 8,476 | | | 8,951 | | | (475) | | | (5) | % | | N/A | | N/A | | N/A | | N/A |

| | | | | | | | | | | | | | | |

Gross margin(b) | 77.1 | % | | 79.0 | % | | | | | | | | | | | | |

| Gross margin excluding specified items | 77.3 | % | | 79.8 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Marketing, selling and administrative | 2,003 | | | 1,930 | | | 73 | | | 4 | % | | (2) | | | 2,001 | | | — | % | | 4 | % |

Marketing, selling and administrative excluding specified items(a) | 1,938 | | | 1,857 | | | 81 | | | 4 | % | | (2) | | | 1,936 | | | — | % | | 4 | % |

| | | | | | | | | | | | | | | |

| Marketing, selling and administrative excluding specified items as a % of revenues | 17.7 | % | | 16.6 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Research and development | 2,242 | | | 2,418 | | | (176) | | | (7) | % | | (3) | | | 2,239 | | | — | % | | (7) | % |

Research and development excluding specified items(a) | 2,178 | | | 2,258 | | | (80) | | | (4) | % | | (3) | | | 2,175 | | | — | % | | (4) | % |

| | | | | | | | | | | | | | | |

| Research and development excluding specified items as a % of revenues | 19.9 | % | | 20.1 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NINE MONTHS ENDED | 2023 | | 2022 | | Change $ | | Change % | | Favorable / (Unfavorable) F/X $* | | 2023 Excl. F/X** | | Favorable / (Unfavorable) F/X %* | | % Change Excl. F/X** |

| | | | | | | | | | | | | | | |

| Revenues | $ | 33,529 | | | $ | 34,753 | | | $ | (1,224) | | | (4) | % | | $ | (236) | | | $ | 33,765 | | | (1) | % | | (3) | % |

| Gross profit | 25,581 | | | 27,209 | | | (1,628) | | | (6) | % | | N/A | | N/A | | N/A | | N/A |

Gross profit excluding specified items(a) | 25,718 | | | 27,492 | | | (1,774) | | | (6) | % | | N/A | | N/A | | N/A | | N/A |

| | | | | | | | | | | | | | | |

Gross margin(b) | 76.3 | % | | 78.3 | % | | | | | | | | | | | | |

| Gross margin excluding specified items | 76.7 | % | | 79.1 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Marketing, selling and administrative | 5,699 | | | 5,548 | | | 151 | | | 3 | % | | 41 | | | 5,740 | | | — | % | | 3 | % |

Marketing, selling and administrative excluding specified items(a) | 5,614 | | | 5,469 | | | 145 | | | 3 | % | | 41 | | | 5,655 | | | — | % | | 3 | % |

| | | | | | | | | | | | | | | |

| Marketing, selling and administrative excluding specified items as a % of revenues | 16.7 | % | | 15.7 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Research and development | 6,821 | | | 6,999 | | | (178) | | | (3) | % | | 17 | | | 6,838 | | | 1 | % | | (2) | % |

Research and development excluding specified items(a) | 6,636 | | | 6,691 | | | (55) | | | (1) | % | | 17 | | | 6,653 | | | — | % | | (1) | % |

| | | | | | | | | | | | | | | |

| Research and development excluding specified items as a % of revenues | 19.8 | % | | 19.3 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

* Foreign exchange impacts were derived by converting our current-period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current-period results.

** See "Use of Non-GAAP Financial Information".

(a) Refer to the Specified Items schedule above for further details.

(b) Represents gross profit as a percentage of Revenues.

BRISTOL-MYERS SQUIBB COMPANY

SPECIFIED ITEMS

(Unaudited, dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Inventory purchase price accounting adjustments | $ | — | | | $ | 86 | | | $ | 84 | | | $ | 240 | |

| | | | | | | |

| | | | | | | |

| Site exit and other costs | 16 | | | — | | | 53 | | | 43 | |

| Cost of products sold | 16 | | | 86 | | | 137 | | | 283 | |

| | | | | | | |

| Employee compensation charges | — | | | 73 | | | — | | | 73 | |

| Site exit and other costs | 65 | | | — | | | 85 | | | 6 | |

| Marketing, selling and administrative | 65 | | | 73 | | | 85 | | | 79 | |

| | | | | | | |

| IPRD impairments | 60 | | | 58 | | | 80 | | | 98 | |

| Priority review voucher | — | | | — | | | 95 | | | — | |

| Inventory purchase price accounting adjustments | — | | | 22 | | | — | | | 130 | |

| Employee compensation charges | — | | | 80 | | | — | | | 80 | |

| Site exit and other costs | 4 | | | — | | | 10 | | | — | |

| Research and development | 64 | | | 160 | | | 185 | | | 308 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Amortization of acquired intangible assets | 2,256 | | | 2,418 | | | 6,769 | | | 7,252 | |

| | | | | | | |

Interest expense(a) | (12) | | | (18) | | | (39) | | | (66) | |

| Equity investment (income)/losses | (2) | | | 12 | | | 206 | | | 962 | |

| Integration expenses | 54 | | | 114 | | | 180 | | | 343 | |

| Loss on debt redemption | — | | | — | | | — | | | 266 | |

| Divestiture gains | — | | | — | | | — | | | (211) | |

| Litigation and other settlements | (62) | | | 36 | | | (397) | | | (4) | |

| | | | | | | |

| Provision for restructuring | 141 | | | 17 | | | 321 | | | 60 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other | 28 | | | 28 | | | 23 | | | 70 | |

| Other (income)/expense, net | 147 | | | 189 | | | 294 | | | 1,420 | |

| | | | | | | |

| Increase to pretax income | 2,548 | | | 2,926 | | | 7,470 | | | 9,342 | |

| | | | | | | |

| Income taxes on items above | (340) | | | (268) | | | (944) | | | (987) | |

| | | | | | | |

| | | | | | | |

| Income taxes attributed to a non-U.S. tax ruling | — | | | — | | | (656) | | | — | |

| Income taxes | (340) | | | (268) | | | (1,600) | | | (987) | |

| | | | | | | |

| Increase to net earnings | $ | 2,208 | | | $ | 2,658 | | | $ | 5,870 | | | $ | 8,355 | |

(a) Includes amortization of purchase price adjustments to Celgene debt.

BRISTOL-MYERS SQUIBB COMPANY

RECONCILIATION OF CERTAIN GAAP LINE ITEMS TO CERTAIN NON-GAAP LINE ITEMS

(Unaudited, dollars and shares in millions except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 | | Nine Months Ended September 30, 2023 |

| GAAP | | Specified Items(a) | | Non-GAAP | | GAAP | | Specified Items(a) | | Non-GAAP |

| Gross profit | $ | 8,460 | | | $ | 16 | | | $ | 8,476 | | | $ | 25,581 | | | $ | 137 | | | $ | 25,718 | |

| Marketing, selling and administrative | 2,003 | | | (65) | | | 1,938 | | | 5,699 | | | (85) | | | 5,614 | |

| Research and development | 2,242 | | | (64) | | | 2,178 | | | 6,821 | | | (185) | | | 6,636 | |

| Amortization of acquired intangible assets | 2,256 | | | (2,256) | | | — | | | 6,769 | | | (6,769) | | | — | |

| Other (income)/expense, net | (258) | | | (147) | | | (405) | | | (787) | | | (294) | | | (1,081) | |

| Earnings before income taxes | 2,137 | | | 2,548 | | | 4,685 | | | 6,766 | | | 7,470 | | | 14,236 | |

| Provision for income taxes | 203 | | | 340 | | | 543 | | | 488 | | | 1,600 | | | 2,088 | |

| Net earnings attributable to BMS used for diluted EPS calculation | $ | 1,928 | | | $ | 2,208 | | | $ | 4,136 | | | $ | 6,263 | | | $ | 5,870 | | | $ | 12,133 | |

| | | | | | | | | | | |

| Weighted-average common shares outstanding—diluted | 2,064 | | | 2,064 | | | 2,064 | | | 2,093 | | | 2,093 | | | 2,093 | |

| Diluted earnings per share | $ | 0.93 | | | $ | 1.07 | | | $ | 2.00 | | | $ | 2.99 | | | $ | 2.81 | | | $ | 5.80 | |

| | | | | | | | | | | |

| Effective tax rate | 9.5 | % | | 2.1 | % | | 11.6 | % | | 7.2 | % | | 7.5 | % | | 14.7 | % |

| | | | | | | | | | | |

| Three Months Ended September 30, 2022 | | Nine Months Ended September 30, 2022 |

| GAAP | | Specified Items(a) | | Non-GAAP | | GAAP | | Specified Items(a) | | Non-GAAP |

| Gross profit | $ | 8,865 | | | $ | 86 | | | $ | 8,951 | | | $ | 27,209 | | | $ | 283 | | | $ | 27,492 | |

| Marketing, selling and administrative | 1,930 | | | (73) | | | 1,857 | | | 5,548 | | | (79) | | | 5,469 | |

| Research and development | 2,418 | | | (160) | | | 2,258 | | | 6,999 | | | (308) | | | 6,691 | |

| Amortization of acquired intangible assets | 2,418 | | | (2,418) | | | — | | | 7,252 | | | (7,252) | | | — | |

| Other (income)/expense, net | (140) | | | (189) | | | (329) | | | 793 | | | (1,420) | | | (627) | |

| Earnings before income taxes | 2,209 | | | 2,926 | | | 5,135 | | | 5,854 | | | 9,342 | | | 15,196 | |