false

0000932021

0000932021

2024-01-31

2024-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 31, 2024 (January 25, 2024)

GLOBAL

TECHNOLOGIES, LTD

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

000-25668 |

|

86-0970492 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

8

Campus Dr., Suite 105, Parsippany, NJ 07054

(Address

of Principal Executive Office) (Zip Code)

(973)

233-5151

(Registrant’s

Telephone Number, Including Area Code)

Not Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

Class

A Common Stock, $0.0001

par

value per share |

|

GTLL |

|

OTC Markets “PINK” |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On

January 25, 2024, the Company and its wholly owned subsidiary, 10 Fold Services, LLC (“10 Fold”), (collectively, the

“Buyers”) and Jetco Holdings, LLC (the “Seller”) (together, the “Parties”) entered into an

Asset Purchase Agreement (the “Agreement”) for the purchase of a Customer Relationship Management Sales Platform

(the “Purchased Asset”).

Under the terms of the Agreement, the Seller shall receive the following aggregate purchase

price for the Purchased Asset:

| |

(a) |

At Closing, the Company shall issue to Seller 25 shares

of Series L Preferred Stock (the “Preferred”); |

| |

|

|

| |

(b) |

Seller shall receive 50% of the net revenue from all sales

generated through 10 Fold utilizing the Purchased Asset, exclusive of any sales generated for GOe3, LLC; |

| |

|

|

| |

(c) |

Seller shall receive 10 shares of the Preferred when sales

through 10 Fold reach $500,000, net, utilizing the Purchased Asset, exclusive of any sales generated for GOe3, LLC; |

| |

|

|

| |

(d) |

Seller shall receive 10 shares of the Preferred when sales

through 10 Fold reach $1,000,000, net, utilizing the Purchased Asset, exclusive of any sales generated for GOe3, LLC; and |

| |

|

|

| |

(e) |

Seller shall receive 25 shares of the Preferred when sales through 10 Fold reach $2,000,000, net, utilizing the Purchased Asset, exclusive

of any sales generated for GOe3, LLC. |

The transaction closed on January

25, 2024.

The foregoing provides only a brief

description of the material terms of the Agreement and does not purport to be a complete description of the rights and obligations of

the parties thereunder, and such description is qualified in its entirety by reference to the full text of the document filed as an exhibit

to this Current Report on Form 8-K and is incorporated herein by reference.

ITEM

2.03. CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT.

The

information included in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

ITEM

3.02. UNREGISTERED SALE OF EQUITY SECURITIES.

The

information included in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 3.02.

The

issuance of the shares of Series L Preferred Stock and the issuance of the shares of Class A Common Stock issuable upon conversion of

the Series L Preferred Stock will be exempt from registration under Securities Act Section 4(a)(2) and Securities Act Rule 506(b). The

Investor is sophisticated and represented in writing that they were an accredited investor and acquired the securities for their own

account for investment purposes. A legend will be placed on the Series L Preferred Stock certificate and the stock certificates of Class

A Common Stock issued upon conversion of the Series L Preferred Stock, subject to the terms of the transaction documents, stating that

the securities have not been registered under the Securities Act and cannot be sold or otherwise transferred without registration or

an exemption therefrom.

Item

8.01. OTHER EVENTS.

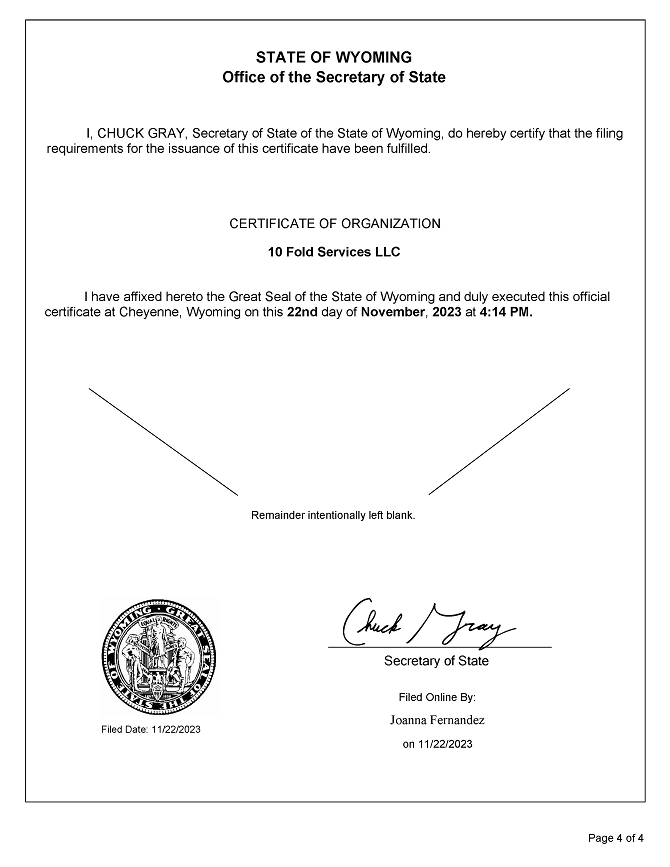

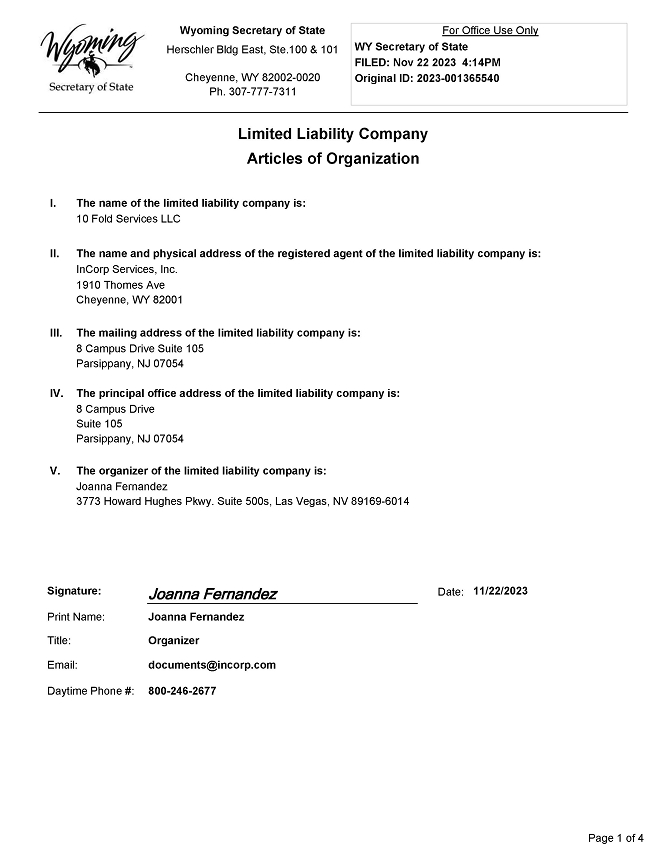

On

November 22, 2023, the Company filed a Certificate of Formation with the State of Wyoming for a new wholly owned subsidiary, 10 Fold

Services, LLC.

Item

9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

GLOBAL TECHNOLOGIES, LTD |

| |

|

|

| Date:

January 31, 2024 |

By: |

/s/ Fredrick

Cutcher |

| |

Name: |

Fredrick Cutcher |

| |

Title: |

Chief Executive Officer |

Exhibit

3.1

Exhibit

10.1

ASSET

PURCHASE AGREEMENT

This

Asset Purchase Agreement (this “Agreement”), dated as of January 23, 2024, is entered into by and among Jetco Holdings,

LLC, a Wyoming limited liability company (“Seller”), 10 Fold Services, LLC (“10 Fold”), a Wyoming

limited liability company and Global Technologies, Ltd, a Delaware limited corporation (“GTLL”)(GTLL and 10 Fold,

collectively, the “Buyers”).

RECITALS

A.

Seller is the owner of certain assets that equate to a “sales platform” (the “Asset”),

B.

Seller desires to sell, assign, transfer and deliver to Buyers, and Buyers desire to purchase from Seller, certain Assets upon the terms

and subject to the conditions set forth in this Agreement.

NOW,

THEREFORE, in consideration of the Explanatory Statement, which shall be deemed a substantive part of this Agreement, and the mutual

covenants, promises, agreements, representations and warranties contained in this Agreement, the parties hereto do hereby covenant, promise

and agree as follows:

Article

I

Purchase

and Sale

Section

1.01 Purchase and Sale of Asset. Subject to the terms and conditions set forth herein, Seller shall sell, assign, transfer, convey

and deliver to Buyers, and Buyers shall purchase from Seller, all of Seller’s right, title and interest in the asset set forth

on Schedule 1.01, hereto (the “Purchased Asset”), free and clear of any mortgage, pledge, lien, charge, security

interest, claim or other encumbrance (“Encumbrance”).

Section

1.02 Purchase Price. The aggregate purchase price for the Purchased Asset shall be as follows:

(a)

At Closing, Buyers shall issue to Seller 25 shares of Series L Preferred Stock (the “Preferred”);

(b)

Seller shall receive 50% of the net revenue from all sales generated through 10 Fold utilizing the Purchased Asset, exclusive of any

sales generated for GOe3, LLC;

(c)

Seller shall receive 10 shares of the Preferred when sales through 10 Fold reach $500,000, net, utilizing the Purchased Asset, exclusive

of any sales generated for GOe3, LLC;

(d)

Seller shall receive 10 shares of the Preferred when sales through 10 Fold reach $1,000,000, net, utilizing the Purchased Asset, exclusive

of any sales generated for GOe3, LLC;

(e)

Seller shall receive 25 shares of the Preferred when sales through 10 Fold reach $2,000,000, net, utilizing the Purchased Asset, exclusive

of any sales generated for GOe3, LLC.

Section

1.03 Assumption of Certain Liabilities:

Buyers

shall not assume any liabilities or obligations of Seller of any kind, whether known or unknown, contingent, matured or otherwise, whether

currently existing or hereinafter created.

Section

1.04 Review Period: Termination

(a)

Examination. After full execution of this Agreement, Buyers shall have up to three (3) business days (the “Review Period”)

to the relevant information of Seller, which Seller shall provide, certify and warrant as full, complete and accurate.

(b)

Termination. On or prior to the last day of the Review Period, Buyers shall have the right to terminate this Agreement for any

reason or no reason it its sole and complete discretion. (the “Termination “). In the event of a Termination, this

Agreement shall be deemed null and void. In the event that Buyers do not terminate this agreement during the Review Period, with such

changes as may have been previously agreed in writing by Buyers and Seller, this Agreement, shall be final and binding.

Article

II

Closing

Section

2.01 Closing. The closing of the transaction contemplated by this Agreement (the “Closing”) shall take place within

two (2) business days after the expiration of the Review Period in the event that this Agreement was not terminated by Buyers (the “Closing

Date”). The consummation of the transaction contemplated by this Agreement shall be deemed to occur at 12:01 a.m. on the Closing

Date.

Section

2.02 Closing Deliverables.

(a)

At the Closing, Seller shall deliver to Buyers the following:

(i)

a bill of sale in form and substance satisfactory to Buyers (the “Bill of Sale”) and duly executed by Seller, transferring

the Purchased Asset to Buyers;

(ii)

such other customary instruments of transfer, assumption, filings, documents or accounts, in form and substance reasonably satisfactory

to Buyers, as may be required to give effect to this Agreement.

(b)

At the Closing, Buyers shall deliver to Seller the following:

(i)

25 shares of Series L Preferred Stock in Sellers designated name.

Article

III

Representations

and warranties of seller

Seller

represents and warrant to Buyers that the statements contained in this Article III are true and correct and any similar phrases

shall mean the actual or constructive knowledge of any director or officer of Seller, after due inquiry.

Section

3.01 Organization and Authority of Seller; Enforceability. Seller is a corporation duly organized, validly existing and in good standing

under the laws of the state of Wyoming. Seller has full corporate power and authority to enter into this Agreement and the documents

to be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. The execution,

delivery and performance by Seller of this Agreement and the documents to be delivered hereunder and the consummation of the transactions

contemplated hereby have been duly authorized by all requisite corporate action on the part of Seller. This Agreement and the documents

to be delivered hereunder have been duly executed and delivered by Seller, and (assuming due authorization, execution and delivery by

Seller) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of Seller, enforceable

against Seller in accordance with their respective terms.

Section

3.02 No Conflicts; Consents. The execution, delivery and performance by Seller of this Agreement and the documents to be delivered

hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (a) violate or conflict with the certificate

of incorporation/formation, by-laws or other organizational documents of Seller; (b) violate or conflict with any judgment, order, decree,

statute, law, ordinance, rule or regulation applicable to Seller or the Purchased Asset; (c) conflict with, or result in (with or without

notice or lapse of time or both) any violation of, or default under, or give rise to a right of termination, acceleration or modification

of any obligation or loss of any benefit under any contract or other instrument to which Seller is a party or to which the Purchased

Asset is subject; or (d) result in the creation or imposition of any Encumbrance on the Purchased Asset. No consent, approval, waiver

or authorization is required to be obtained by Seller from any person or entity (including any governmental authority) in connection

with the execution, delivery and performance by Seller of this Agreement and the consummation of the transactions contemplated hereby.

Section

3.03 Title to Purchased Asset. Seller owns and has good title to the Purchased Asset, free and clear of Encumbrances.

Section

3.04 Non-foreign Status. Seller is not a “foreign person” as that term is used in Treasury Regulations Section 1.1445-2.

Section

3.05 Compliance With Laws Seller has complied, and is now complying, with all applicable federal, state and local laws and regulations

applicable to ownership and use of the Purchased Asset.

Section

3.06 Legal Proceedings. There is no claim, action, suit, proceeding or governmental investigation (“Action”) of

any nature pending or, to Seller’s knowledge, expected or threatened against or by Seller (a) relating to or affecting the Purchased

Asset or the Assumed Liabilities; or (b) that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated

by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

Section

3.07 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in

connection with the transaction contemplated by this Agreement based upon arrangements made by or on behalf of Seller.

Section

3.08 Undisclosed Liabilities. Seller has no Liabilities with respect to the Business, except those which have been incurred in the

ordinary course of business consistent with past practice and which are not, individually or in the aggregate, material in amount.

Section

3.09 Fair Market Value. To the best of Seller’s knowledge, the Purchase Price constitutes fair market value for the Purchased

Asset.

Section

3.10 Governmental Orders.

There

are no outstanding Governmental Orders (as the term is defined herein) and no unsatisfied judgments, penalties or awards against, relating

to or affecting the Business. Seller is in compliance with the terms of each Governmental Order set forth in the Disclosure Schedules.

No event has occurred or circumstances exist that may constitute or result in (with or without notice or lapse of time) a violation of

any such Governmental Order. “Governmental Order” means any order, writ, judgment, injunction, decree, stipulation,

determination or award entered by or with any federal, state, local or foreign government or political subdivision thereof, or any agency

or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory

authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authority have

the force of law), or any arbitrator, court or tribunal of competent jurisdiction.

Section

3.11 Insurance

Seller

has insurance policies in full force and effect (i) for such amounts as are sufficient for all requirements of Law and all agreements

to which it is a party or by which it is bound and (ii) that are in such amounts, with such deductibles and against such risks and losses,

as are reasonable for the Business and its assets and properties, subject to reasonable deductibles, and the risks insured against are

normal and customary for the industry.

Section

3.12 Full Disclosure. No representation or warranty by Seller in this Agreement and no statement contained in the Schedules, to this

Agreement or any certificate or other document furnished or to be furnished to Buyers pursuant to this Agreement contains any untrue

statement of a material fact, or omits to state a material fact necessary to make the statements contained therein, in light of the circumstances

in which they are made, not misleading.

Article

IV

Representations

and warranties of buyers

Buyer

represents and warrants to Seller that the statements contained in this Article IV are true and correct as of the date hereof.

For purposes of this Article IV, “Buyers’ knowledge,” “knowledge of Buyers” and any similar phrases

shall mean the actual or constructive knowledge of any director or officer of Buyers, after due inquiry.

Section

4.01 Organization and Authority of Buyer; Enforceability. Buyer is a corporation duly organized, validly existing and in good standing

under the laws of the state of Delaware. Buyer has full corporate power and authority to enter into this Agreement and the documents

to be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. The execution,

delivery and performance by Buyer of this Agreement and the documents to be delivered hereunder and the consummation of the transactions

contemplated hereby have been duly authorized by all requisite corporate action on the part of Buyer. This Agreement and the documents

to be delivered hereunder have been duly executed and delivered by Buyer, and (assuming due authorization, execution and delivery by

Seller) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of Buyer enforceable

against Buyer in accordance with their respective terms.

Section

4.02 No Conflicts; Consents. The execution, delivery and performance by Buyers of this Agreement and the documents to be delivered

hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (a) violate or conflict with the certificate

of incorporation, by-laws or other organizational documents of Buyer; or (b) violate or conflict with any judgment, order, decree, statute,

law, ordinance, rule or regulation applicable to Buyers. No consent, approval, waiver or authorization is required to be obtained by

Buyers from any person or entity (including any governmental authority) in connection with the execution, delivery and performance by

Buyers of this Agreement and the consummation of the transactions contemplated hereby.

Section

4.03 Legal Proceedings. There is no Action of any nature pending or, to Buyers’ knowledge, threatened against or by Buyers

that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. No event has occurred

or circumstances exist that may give rise to, or serve as a basis for, any such Action.

Section

4.04 Brokers. no broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in

connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Buyers.

Article

V

Covenants

Section

5.01 Public Announcements. Unless otherwise required by applicable law, neither party shall make any public announcements regarding

this Agreement or the transactions contemplated hereby without the prior written consent of the other party (which consent shall not

be unreasonably withheld or delayed).

Section

5.02 Further Assurances. Following the Closing, each of the parties hereto shall execute and deliver such additional documents, instruments,

conveyances and assurances and take such further actions as may be reasonably required to carry out the provisions hereof and give effect

to the transactions contemplated by this Agreement and the documents to be delivered hereunder.

Section

5.03 Conduct of Business Prior to the Closing. From the date hereof until the Closing, except as otherwise provided in this Agreement

or consented to in writing by Buyers (which consent shall not be unreasonably withheld or delayed), Seller shall (x) maintain the Asset

in the ordinary course of business consistent with past practice;

(a)

maintain the properties and assets included in the Purchased Asset in the same condition as they were on the date of this Agreement,

subject to reasonable wear and tear;

(b)

not take or permit any action that would cause material adverse changes, events or conditions in the Purchased Asset.

Section

5.04 Access to Information. From the date hereof until the Closing, Seller shall (a) afford Buyers and its Representatives full and

free access to and the right to inspect all of the Real Property, properties, assets, premises, books and records, Contracts and other

documents and data related to the Business; (b) furnish Buyers and its Representatives with such financial, operating and other data

and information related to the Business as Buyers or any of its Representatives may reasonably request; and (c) instruct the Representatives

of Seller to cooperate with Buyers in its investigation of the Business. Any investigation pursuant to this Section 5.04 shall

be conducted in such manner as not to interfere unreasonably with the conduct of the Business or any other businesses of Seller. No investigation

by Buyers or other information received by Buyers shall operate as a waiver or otherwise affect any representation, warranty or agreement

given or made by Seller in this Agreement.

Article

VI

Indemnification

Section

6.01 Survival. Unless otherwise provided in this Agreement, all representations, warranties, covenants and agreements contained herein

and all related rights to indemnification shall survive the Closing for a period of twenty-four (24) months following the Closing Date.

Section

6.02 Indemnification By Seller. Seller shall defend, indemnify and hold harmless Buyers, their affiliates and their respective stockholders,

directors, officers and employees (“Buyers Indemnitees”) from and against all claims, judgments, damages, liabilities, settlements,

losses, costs and expenses, including attorneys’ fees and disbursements, (“Losses”) arising from or relating to:

(a)

any inaccuracy in or breach of any of the representations or warranties of Seller contained in this Agreement or any document to be delivered

hereunder;

(b)

any breach or non-fulfillment of any covenant, agreement or obligation to be performed by Seller pursuant to this Agreement or any document

to be delivered hereunder; or

(c)

any Excluded Asset or Excluded Liability.

Section

6.03 Right to Set-Off. If, from time to time and at any time, Buyers in good faith, which is based on documents, evidence and facts,

which can be reasonably substantiated, believes it is entitled to indemnification by Seller or is entitled to be paid any amount under

the provisions of Section 6.02, Buyers shall be entitled, if it so elects in its sole discretion, at any time without requirement

of a judgment or adjudication of its right to indemnification, to set-off such amount against any obligation of Buyers pursuant to the

Assumed Liabilities. Neither the exercise of nor failure to exercise such right of set-off will constitute an election of remedies or

limit Buyers in any manner in the enforcement of any other remedies that may be available to it. Such right of set-off shall be in addition

to and not in substitution of any other rights to which Buyers may be entitled to under the provisions of Section 6.02 or otherwise.

If Buyers elect to exercise their right to set-off against an Assumed Liability(ies), then the Parties agree that it shall be

construed as if Seller had never assumed such Assumed Liability(ies) pursuant to this Agreement.

Section

6.04 Indemnification By Buyers. Buyers shall defend, indemnify and hold harmless Owner and Seller, its affiliates and their respective

stockholders, directors, officers and employees (“Seller Indemnitees”) from and against all Losses arising from or relating

to:

(a)

any inaccuracy in or breach of any of the representations or warranties of Buyers contained in this Agreement or any document to be delivered

hereunder;

(b)

any breach or non-fulfillment of any covenant, agreement or obligation to be performed by Buyers pursuant to this Agreement or any document

to be delivered hereunder; or

(c)

any Assumed Liability (Except as otherwise provided and subject to Section 6.03).

Section

6.05 Cumulative Remedies. The rights and remedies provided in this Article VI are cumulative and are in addition to and not

in substitution for any other rights and remedies available at law or in equity or otherwise.

Article

VII

Miscellaneous

Section

7.01 Expenses. All costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby shall be

paid by the party incurring such costs and expenses.

Section

7.02 Notices. All notices, requests, consents, claims, demands, waivers and other communications hereunder shall be in writing and

shall be deemed to have been given (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee

if sent by a nationally recognized overnight courier (receipt requested); (c) on the date sent by facsimile or e-mail of a PDF document

(with confirmation of transmission) if sent during normal business hours of the recipient, and on the next business day if sent after

normal business hours of the recipient; or (d) on the [third] day after the date mailed, by certified or registered mail, return receipt

requested, postage prepaid. Such communications must be sent to the respective parties at the following addresses (or at such other address

for a party as shall be specified in a notice given in accordance with this Section 7.02):

If

to Seller:

Jetco

Holdings, LLC

1910

Thomes Ave.

Cheyenne,

WY 82001

If

to Buyers:

Global

Technologies, Ltd.

8

Campus Dr., Suite 105

Parsippany,

NJ 07054

Section

7.03 Headings. The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section

7.04 Severability. If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity,

illegality or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such

term or provision in any other jurisdiction.

Section

7.05 Entire Agreement. This Agreement including all attachments and schedules and the documents to be delivered hereunder constitute

the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein, and supersede all

prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. In the event of

any inconsistency between the statements in the body of this Agreement and the documents to be delivered hereunder, the Exhibits and

Disclosure Schedules (other than an exception expressly set forth as such in the Disclosure Schedules), the statements in the body of

this Agreement will control.

Section

7.06 Successors and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their

respective successors and permitted assigns. Neither party may assign its rights or obligations hereunder without the prior written consent

of the other party, which consent shall not be unreasonably withheld or delayed. No assignment shall relieve the assigning party of any

of its obligations hereunder.

Section

7.07 No Third-party Beneficiaries. Except as provided in Article VI, this Agreement is for the sole benefit of the parties

hereto and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon

any other person or entity any legal or equitable right, benefit or remedy of any nature whatsoever under or by reason of this Agreement.

Section

7.08 Amendment and Modification. This Agreement may only be amended, modified or supplemented by an agreement in writing signed by

each party hereto.

Section

7.09 Waiver. No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and

signed by the party so waiving. No waiver by any party shall operate or be construed as a waiver in respect of any failure, breach or

default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or

after that waiver. No failure to exercise, or delay in exercising, any right, remedy, power or privilege arising from this Agreement

shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege

hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

Section

7.10 Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware

without giving effect to any choice or conflict of law provision or rule.

Section

7.11 Submission to Jurisdiction. Any legal suit, action or proceeding arising out of or based upon this Agreement or the transactions

contemplated hereby may be instituted in the federal courts of the United States of America or the courts of the State of Delaware, and

each party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action or proceeding.

Section

7.12 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together

shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic

transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

[SIGNATURE

PAGE FOLLOWS]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above by their respective

officers thereunto duly authorized.

| |

SELLER: |

| |

|

| |

JETCO

HOLDINGS, LLC |

| |

By |

|

| |

Name:

|

Timothy

Cabrera |

| |

Title:

|

Member

|

| |

|

|

| |

BUYERS: |

| |

By |

|

| |

Name: |

Fredrick

K. Cutcher Jr. |

| |

Title: |

President |

| |

10

FOLD SERVICES, LLC |

| |

|

|

| |

By |

|

| |

Name: |

Fredrick

K. Cutcher Jr. |

| |

Title: |

Managing

Member |

Schedule

1.01

PURCHASED

ASSET

The

following asset of Seller for use by Buyer with following features:

Key

Features:

Sales

Lead Management:

-

The CRM provides a centralized hub for tracking and managing sales leads from various sources.

-

Leads can be manually entered or automatically captured from sources like web forms, emails, and social media.

Email

and Social Media Integration:

-

Users can send emails, schedule follow-ups, and monitor social media interactions directly from the CRM interface.

Contact

Management:

-

The contact management module enables users to store detailed information about leads and customers, including contact details, communication

history, and preferences.

-

Users can segment contacts for targeted marketing and personalized communication.

Sales

Cycle Overviews:

-

Gain a comprehensive view of the entire sales cycle through intuitive dashboards and reports.

-

Track leads through various stages of the sales pipeline, monitor conversion rates, and identify bottlenecks for timely adjustments.

Sales

Channel Performance:

-

Evaluate the effectiveness of different sales channels, such as email campaigns, social media, or direct sales.

-

Analytics and reporting tools provide insights into which channels yield the best results, helping businesses allocate resources strategically.

Scalability:

-

The platform is designed to grow with your business. It can accommodate a growing customer base and an expanding sales team.

-

Customization options allow you to tailor the CRM to your unique business needs.

Third-Party

Platform Integration:

-

Built upon an industry-leading third-party platform, this CRM benefits from the latest technology and security updates.

-

Integration with other business tools and software is seamless, enhancing its functionality.

Website

Integration:

-

Web Form Capture: Capture leads directly from your website’s contact forms. Whenever a potential customer submits a form, their

information is automatically added to the CRM, reducing manual data entry.

Real-time

Chat Capabilities

-

Schedule

1.02

ISSUANCE

OF 25 SHARES OF SERIES L PREFERRED STOCK

v3.24.0.1

Cover

|

Jan. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 31, 2024

|

| Entity File Number |

000-25668

|

| Entity Registrant Name |

GLOBAL

TECHNOLOGIES, LTD

|

| Entity Central Index Key |

0000932021

|

| Entity Tax Identification Number |

86-0970492

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8

Campus Dr.

|

| Entity Address, Address Line Two |

Suite 105

|

| Entity Address, City or Town |

Parsippany

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07054

|

| City Area Code |

(973)

|

| Local Phone Number |

233-5151

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class

A Common Stock, $0.0001

|

| Trading Symbol |

GTLL

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Global Technologies (PK) (USOTC:GTLL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Global Technologies (PK) (USOTC:GTLL)

Historical Stock Chart

From Dec 2023 to Dec 2024