UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: June 30, 2023

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File Number: 000-55927

SecureTech Innovations, Inc.

(Exact name of registrant as specified in its charter)

Wyoming

(State or other jurisdiction of

incorporation or organization)

| 82-0972782

(I.R.S. Employer

Identification Number)

|

2355 Highway 36 West, Suite 400, Roseville, MN 55113

(Address of principal executive offices)

Tel: (651) 317-8990

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Title of each class

|

| Trading Symbol(s)

|

| Name of each exchange on which registered

|

N/A

|

| N/A

|

| N/A

|

Securities registered pursuant to Section 12(g) of the Act: None

Title of each class

|

| Trading Symbol(s)

|

| Name of each exchange on which registered

|

Common Stock, $0.001 par value

|

| SCTH

|

| OTC Pink Exchange

|

Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ¨

| Accelerated Filer ¨

|

Non-Accelerated Filer x

| Smaller Reporting Company x

|

| Emerging Growth Company x

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The number of shares outstanding of the Registrant’s common stock, $0.001 par value, as of August 14, 2023, was 79,850,513.

2

TABLE OF CONTENTS

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements5

CONSOLIDATED BALANCE SHEETS5

CONSOLIDATED STATEMENTS OF OPERATIONS6

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY7

CONSOLIDATED STATEMENTS OF CASH FLOWS8

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS9

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations15

Item 3. Quantitative and Qualitative Disclosures About Market Risk25

Item 4. Controls and Procedures25

PART II – OTHER INFORMATION

Item 1. Legal Proceedings27

Item 1A. Risk Factors27

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds27

Item 3. Default Upon Senior Securities27

Item 4. Mine Safety Disclosures27

Item 5. Other Information27

Item 6. Exhibits27

SIGNATURES29

3

Cautionary Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical fact contained in this Quarterly Report on Form 10-Q, including statements regarding our future results of operations or financial condition, business strategy, and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would,” and other similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements (collectively, “forward-looking statements”), but the absence of these words does not mean that a statement is not forward-looking. Our actual results or outcomes could differ materially from those indicated in these forward-looking statements for a variety of reasons, including, among others:

•

|

| Our ability to execute on our growth strategies

|

•

|

| Supply chain disruptions and general price inflation

|

•

|

| Our ability to maintain favorable relationships with suppliers and manufacturers

|

•

|

| Competition from more established and better financed competitors

|

•

|

| Our ability to attract and retain competent and qualified personnel

|

•

|

| Regulatory changes and developments affecting our business

|

•

|

| Our ability to obtain additional capital to finance operations

|

•

|

| Managing a “just right” product inventory size and mix

|

•

|

| Impacts on our business from epidemics, pandemics, or natural disasters

|

•

|

| Our ability to remediate the material weakness in our internal control over financial reporting or additional material weaknesses or other deficiencies in the future or to maintain effective disclosure controls and procedures and internal control over financial reporting

|

•

|

| Other risks and uncertainties, including those listed in the section titled “Risk Factors” in our contained in our filings with the United States Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

|

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10-Q primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 as filed with the SEC. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors described in our . Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report. The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results or outcomes could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Quarterly Report, and while we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to rely unduly on these statements.

The forward-looking statements made in this Quarterly Report are based on events or circumstances as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Quarterly Report to reflect events or circumstances after the date of this Quarterly Report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments.

As used in this Quarterly Report, the terms “we,” “us,” “our,” “SecureTech,” “Registrant,” “Company,” and “Issuer” mean SecureTech Innovations, Inc. unless the context clearly requires otherwise.

4

Table of Contents

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

SECURETECH INNOVATIONS, INC.

CONSOLIDATED BALANCE SHEETS

ASSETS

| | |

June 30, 2023 (unaudited) | |

December 31, 2022 |

| Current assets: | |

| | | |

| | |

| Cash and equivalents | |

$ | 10,516 | | |

$ | 138,318 | |

| Inventories | |

| 16,401 | | |

| 27,549 | |

| Deposits | |

| 1,174 | | |

| 30,674 | |

| Total current assets | |

| 28,091 | | |

| 196,541 | |

| | |

| | | |

| | |

| Property and equipment, net | |

$ | 3,978 | | |

$ | 4,470 | |

| | |

| | | |

| | |

| Total assets: | |

$ | 32,069 | | |

$ | 201,011 | |

LIABILITIES AND STOCKHOLDERS’ EQUITY

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 19,295 | | |

$ | 1,565 | |

| Accrued payroll | |

| 21,255 | | |

| 5,679 | |

| Credit cards payable | |

| 11,056 | | |

| 13,194 | |

| Taxes payable | |

| 4,088 | | |

| 5,153 | |

| Total current liabilities | |

$ | 55,694 | | |

$ | 25,591 | |

| | |

| | | |

| | |

| Total liabilities | |

$ | 55,694 | | |

$ | 25,591 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

Preferred stock, $0.001 par value, 50,000,000 shares authorized;

2,500 and -0- shares issued and outstanding, respectively | |

| 3 | | |

| — | |

Common stock, $0.001 par value, 500,000,000 shares authorized;

86,850,513 and 111,839,085 shares issued and outstanding,

respectively | |

| 86,850 | | |

| 111,839 | |

| Additional paid-in capital | |

| 1,045,225 | | |

| 1,000,239 | |

| Accumulated deficit | |

| (1,155,703 | ) | |

| (936,658 | ) |

| | |

| | | |

| | |

| Total stockholders’ equity (deficit) | |

$ | (23,625 | ) | |

$ | 175,420 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 32,069 | | |

$ | 201,011 | |

| | |

| | | |

| | |

The accompanying notes to the financial statements are an integral part of these statements.

5

Table of Contents

SECURETECH INNOVATIONS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | |

For the three months ended June 30, | |

For the six months ended June 30, | |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| | |

| |

| |

| |

|

| Revenues: | |

| |

| |

| |

|

| Sales | |

$ | 17,550 | | |

$ | 7,803 | | |

$ | 37,600 | | |

$ | 17,153 | |

| Cost of goods sold | |

| 4,732 | | |

| 2,068 | | |

| 10,017 | | |

| 4,690 | |

| Gross profit | |

| 12,818 | | |

| 5,735 | | |

| 27,583 | | |

| 12,463 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

$ | 112,556 | | |

$ | 103,647 | | |

$ | 241,277 | | |

$ | 166,238 | |

| Research and development | |

| 5,876 | | |

| 5,302 | | |

| 6,761 | | |

| 8,952 | |

| Total expenses | |

| 118,432 | | |

| 108,949 | | |

| 248,038 | | |

| 175,190 | |

| | |

| | | |

| | | |

| | | |

| | |

| (Loss) from operations | |

| (105,614 | ) | |

| (103,214 | ) | |

| (220,455 | ) | |

| (162,727 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

$ | 528 | | |

| 1,215 | | |

$ | 1,410 | | |

$ | 1,215 | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) | |

$ | (105,086 | ) | |

$ | (101,999 | ) | |

$ | (219,045 | ) | |

$ | (161,512 | ) |

| | |

| | | |

| | | |

| | | |

| | |

(Loss) per common share, basic and diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Weighted average number of

common shares outstanding, basic and diluted | |

| 107,608,755 | | |

| 111,657,284 | | |

| 107,703,268 | | |

| 112,076,577 | |

The accompanying notes to the financial statements are an integral part of these statements.

6

Table of Contents

SECURETECH INNOVATIONS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| |

|

|

|

|

|

|

|

|

| | |

For the six months ended June 30, |

| | |

2023 | |

2022 |

| Cash flows from operating activities: | |

| | | |

| | |

| Net (loss) | |

$ | (219,045 | ) | |

$ | (161,512 | ) |

| Adjustments to reconcile net (loss) to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 492 | | |

| 114 | |

| Stock option expense | |

| — | | |

| 18,488 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Decrease (increase) in inventories | |

| 11,148 | | |

| 4,892 | |

| Increase (decrease) in accounts payable | |

| 17,730 | | |

| 108 | |

| Decrease (increase) in deposits | |

| 29,500 | | |

| — | |

| Increase (decrease) in credit cards payable | |

| (2,138 | ) | |

| 10,765 | |

| Increase (decrease) in accrued payroll | |

| 15,576 | | |

| — | |

| Increase (decrease) in taxes payable | |

| (1,065 | ) | |

| 210 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (147,802 | ) | |

| (126,935 | ) |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisition of office equipment | |

$ | — | | |

$ | (3,423 | ) |

| Net cash used in investing activities | |

$ | — | | |

$ | (3,423 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Issuance of common stock for cash | |

$ | 20,000 | | |

$ | 113,501 | |

| Net cash provided by financing activities | |

$ | 20,000 | | |

$ | 113,501 | |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| (127,802 | ) | |

| (16,857 | ) |

| | |

| | | |

| | |

| Cash – beginning of period | |

| 138,318 | | |

| 214,026 | |

| | |

| | | |

| | |

| Cash – end of period | |

$ | 10,516 | | |

$ | 197,169 | |

| | |

| | | |

| | |

| Non-cash financing activities: | |

| | | |

| | |

| Exchange of common shares for preferred shares | |

$ | 25,000 | | |

$ | — | |

| Cancellation of common shares | |

$ | — | | |

$ | 1,700 | |

| | |

| | | |

| | |

The accompanying notes to the financial statements are an integral part of these statements.

8

Table of Contents

SECURETECH INNOVATIONS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2023

(unaudited)

NOTE 1 – Summary of Significant Accounting Policies

Organization

SecureTech Innovations, Inc. (“Company” or “SecureTech”) was incorporated under the laws of the State of Wyoming on March 2, 2017, under the name SecureTech, Inc. The Company amended its Articles of Incorporation on December 20, 2017, to change its name to SecureTech Innovations, Inc. On November 19, 2021 and November 25, 2021, SecureTech incorporated wholly-owned subsidiaries Piranha Blockchain, Inc. under the laws of the State of Wyoming and Piranha Blockchain, Ltd. under the International Business Company (IBC) laws of Anguilla, British West Indies, respectively (collectively, “Piranha”).

SecureTech is an emerging growth company focused on developing and marketing advanced security and safety technologies. SecureTech’s products preserve life, protect property, and prevent crime. Under the Top Kontrol brand, SecureTech currently sells the world’s only anti-theft and anti-carjacking automobile security and safety system. Under its wholly owned Piranha subsidiaries, SecureTech intends to develop and acquire secure green energy data centers, advanced cybersecurity technologies, blockchain and cryptocurrency systems, and platforms for mining, storage, and trading exchanges.

Unaudited Interim Financial Information

The unaudited condensed interim financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 8-03 of Regulation S-X. Accordingly, they do not include all the information and footnotes required by GAAP for complete financial statements. In the opinion of Management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included.

The balance sheet as of December 31, 2022, has been derived from audited financial statements.

Operating results for the six months ended June 30, 2023, are not necessarily indicative of results that may be expected for the year ending December 31, 2023. These condensed financial statements should be read in conjunction with the audited financial statements for the year ended December 31, 2022, filed with the Company’s Annual Report on Form 10-K with the Securities and Exchange Commission on April 13, 2023.

Impact of the COVID-19 (Coronavirus) Pandemic

The ongoing COVID-19 pandemic has significantly impacted economic activity and markets worldwide. In response, governmental authorities have periodically imposed, and others in the future may reimpose, stay-at-home orders, shelter-in-place orders, quarantines, executive orders, and similar government orders and restrictions to control the spread of COVID-19. Such orders or restrictions have resulted in temporary business closures, limitation of business hours, limitations on the number of people in business locations, enhanced requirements on sanitation, social distancing practices, and travel restrictions, among others. Historically, we were restricted in our ability to sell and distribute our products while these restrictive mandates were in place. Should similar future government orders and restrictions go into effect again, it will adversely impact our financial condition and operating results.

The long-term impact of the ongoing COVID-19 pandemic on our financial condition or results of operations remains uncertain, in particular, due to external factors related to the pandemic and as COVID-19 cases (including the spread of variants or mutant strains) continue to surge in certain parts of the world. In particular, COVID-19 could have a significant disruption to our supply chain for the products we sell, which could have a material impact on our sales and future earnings. Accordingly, COVID-19 may negatively impact our business in the future, and any future adverse impacts on our business may be worse than we anticipate. The ultimate impact will depend on the severity and duration of the current ongoing COVID-19 pandemic and future resurgences and actions taken by governmental authorities and other third parties in response, each of which is uncertain, rapidly changing, and difficult to predict. Our growth rates during the ongoing COVID-19 pandemic may not be sustainable and may not be indicative of future growth.

Basis of Presentation

The accompanying financial statements have been prepared in accordance with United States Generally Accepted Accounting Principles (“US GAAP”) for financial information and in accordance with the Securities and Exchange Commission’s (“SEC”) Regulation S-X. They reflect all adjustments which are, in the opinion of the Company’s Management, necessary for a fair presentation of the financial position and operating results as of and for the fiscal period ended June 30, 2023.

Use of Estimates

The accompanying financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates which have been made using careful judgment. Actual results may vary from these estimates.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers highly liquid financial instruments purchased with a maturity of three months or less to be cash equivalents. As of June 30, 2023, the Company had no cash equivalents.

Fair Value of Financial Instruments

ASC 820, “Fair Value Measurements” and ASC 825, Financial Instruments, requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. It establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. It prioritizes the inputs into three levels that may be used to measure fair value:

Level

|

| Description

|

|

|

|

Level 1

|

| Applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

|

Level 2

|

| Applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

|

Level 3

|

| Applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

|

Inventory and Cost of Sales

Inventories are stated at the lower of cost or realizable value, using the weighted average cost method. When an impairment indicator suggests that the carrying amounts of inventories might not be recoverable, the Company reviews such carrying amounts and estimates the net realizable value based on the most reliable evidence available at that time. An impairment loss is recorded if the net realizable value is less than the carrying value. Impairment indicators considered for these purposes are, among others, obsolescence, decrease in market prices, damage, and a firm commitment to sell.

Deposits

Refundable deposits are carried on the Company’s balance sheet at their fair market refundable value under current assets.

Net Loss per Share Calculation

Basic net loss per common share is computed by dividing the net loss attributable to common stockholders by the weighted average number of common shares outstanding for the period. Diluted earnings per share is calculated similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. SecureTech excludes all potentially dilutive securities from its diluted net loss per share computation since their effect would be anti-dilutive because SecureTech recorded a loss for the six months ended June 30, 2023.

Revenue Recognition

Effective January 1, 2018, the Company adopted ASC 606 — Revenue from Contracts with Customers.

The Company’s primary revenue source is from selling our Top Kontrol product. We began selling Top Kontrol in late April 2020.

Top Kontrol requires installation by a Certified Top Kontrol Technician. To become a Certified Top Kontrol Technician, an automotive technician must complete a one-day hands-on course hosted by the Company. Failure to have Top Kontrol installed by a Certified Top Kontrol Technician voids the product’s limited liability warranty.

Because of this professional installation requirement, the Company sells its products to and through Authorized Dealers and Certified Top Kontrol Technicians. In the instances where the Company sells directly to the end user, product installation must be performed by authorized Company personnel.

Revenue is recognized when performance obligations under the terms of a contract with our customers are satisfied. Revenue is recorded net of marketing allowances, volume discounts, and other forms of variable consideration. Generally, this occurs with the transfer of control of our product to the customer and payment has been received. The Company presently does not offer terms or credit to any of its customers.

Revenue Recognition; ASC 606 Five-Step Model

Under ASC 606, the Company recognizes revenue from the sale of service contracts by applying the following steps: (1) identify the contract with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to each performance obligation in the contract; and (5) recognize revenue when each performance obligation is satisfied.

Revenue Recognition; General Right of Return

Customers are allowed to return goods that are defective (warranty returns). In some instances, customers may be allowed to return a limited number of units for periodic stock adjustment returns. Such stock adjustment returns would be limited to no more than 5% of their total units sold.

As is standard in the industry, we only will accept returns from active customers. If a customer discontinues conducting business with us, we have no further obligation to accept additional product returns from that customer.

Income Taxes

The Company accounts for income taxes pursuant to FASB ASC 740, Income Taxes. Under FASB ASC 740-10-25, deferred tax assets and liabilities are determined based on temporary differences between the bases of certain assets and liabilities for income tax and financial reporting purposes. The deferred tax assets and liabilities are classified according to the financial statement classification of the assets and liabilities generating the differences.

The Company maintains a valuation allowance with respect to deferred tax assets. The Company establishes a valuation allowance based upon the potential likelihood of realizing the deferred tax asset and taking into consideration the Company’s financial position and results of operations for the current period. Future realization of the deferred tax benefit depends on the existence of sufficient taxable income within the carryforward period under the Federal tax laws.

Changes in circumstances, such as the Company generating taxable income, could cause a change in judgment about its ability to realize the related deferred tax asset. Any change in the valuation allowance will be included in income in the year of the change in estimate.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the following majority-owned subsidiaries as of June 30, 2023:

| Subsidiary | |

Percentage Owned |

| | |

|

| Piranha Blockchain, Inc. | |

| 100.0 | % |

| Piranha Blockchain, Ltd. | |

| 100.0 | % |

Fiscal Year

The Company elected December 31st for its fiscal year end.

Recent Accounting Pronouncements

There are various updates recently issued, most of which represent technical corrections to the accounting literature or application to specific industries and are not expected to have a material impact on the Company’s financial position, results of operations, or cash flows.

NOTE 2 – GOING CONCERN

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the ordinary course of business. As shown in the accompanying financial statements during the fiscal period ended June 30, 2023, the Company has not established a source of revenues sufficient to cover its operating costs. As such, it has incurred an operating loss since its inception. Further, as of June 30, 2023, the Company had an accumulated deficit of ($1,155,703). These and other factors raise substantial doubt about the Company’s ability to continue as a going concern.

The Company’s existence depends on Management’s ability to develop profitable operations and obtain additional financing sources. There can be no assurance that the Company’s financing efforts will result in profitable operations or resolve the Company’s liquidity problems. The accompanying statements do not include any adjustments that might result should the Company be unable to continue as a going concern.

NOTE 3 – INVENTORIES

Inventory is stated at the lower of cost or realizable value, using the weighted average cost method. When an impairment indicator suggests that the carrying amounts of inventories might not be recoverable, the Company reviews such carrying amounts and estimates the net realizable value based on the most reliable evidence available at that time. An impairment loss is recorded if the net realizable value is less than the carrying value. Impairment indicators considered for these purposes are, among others, obsolescence, decrease in market prices, damage, and a firm commitment to sell. The following table summarizes the Company’s inventories as of June 301, 2023 and December 31, 2022:

| | |

June 30, 2023 | |

December 31, 2022 |

| Inventories: | |

| | | |

| | |

| Raw materials and work-in-progress | |

$ | 2,113 | | |

$ | 2,185 | |

| Finished goods | |

| 14,288 | | |

| 25,364 | |

| Gross inventories | |

| 16,401 | | |

| 27,549 | |

| Inventory valuation reserves | |

| — | | |

| — | |

| Inventories, net | |

$ | 16,401 | | |

$ | 27,549 | |

12

Table of Contents

NOTE 4 – DEPOSITS

Refundable deposits are carried on the Company’s balance sheet at their fair market refundable value under current assets. The following table summarizes the Company’s refundable deposits as of June 30, 2023 and December 31, 2022:

| | |

June 30, 2023 | |

December 31, 2022 |

| Deposits: | |

| | | |

| | |

| Security deposit on leased office space | |

$ | 674 | | |

$ | 674 | |

| Refundable legal retainer | |

| 500 | | |

| — | |

| Discounted media purchase agreement deposit | |

| — | | |

| 30,000 | |

| Total deposits | |

$ | 1,174 | | |

$ | 30,674 | |

NOTE 5 – STOCKHOLDERS’ EQUITY

Preferred stock

The Company has authorized 50,000,000 shares of preferred stock, $0.001 par value. The Company’s Board of Directors is authorized, without further action by the shareholders, to issue shares of preferred stock and to fix the designations, number, rights, preferences, privileges, and restrictions thereof, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, and sinking fund terms.

On May 31, 2023, the Company’s Board of Directors created a new class of preferred stock designated as Series A Preferred Stock, $0.001 par value. The Company may issue up to 250,000 shares of Series A Preferred Stock with the following terms, rights, and privileges:

Designation and Amount

|

| This class of preferred stock shall be designated Series A Preferred Stock (“Preferred Stock”), $0.001 par value. The Corporation’s Board of Directors may issue up to two-hundred fifty thousand (250,000) shares of this Preferred Stock.

|

|

|

|

Rank

|

| The Preferred Stock shall rank superior to the Corporation’s common stock and all other classes, including currently outstanding or future preferred stock designations.

|

|

|

|

Dividends

|

| The Preferred Stock is eligible for all legal dividends as may be approved by the Corporation’s Board of Directors. If a dividend is declared across multiple classes of stock, the amount of any dividend to be received by holders of the Preferred Stock shall be calculated on a fully diluted, pro-rata basis with the other classes of stock participating in said dividend.

|

|

|

|

Voting Rights

|

| Holders of the Preferred Stock shall have the right to vote on all matters with holders of common stock (and other eligible classes of preferred stock, if any) by aggregating votes into one (1) voting class of stock. Each share of Preferred Stock shall have ten thousand (10,000) votes for any election or other voting matter placed before the shareholders of the Corporation, regardless if the vote is taken with or without a shareholders’ meeting. Holders of the Preferred Stock may not cumulate their votes in any voting matter.

|

On May 31, 2023, the Company issued 2,500 Series A Preferred Stock shares pursuant to a Share Exchange Agreement.

As of June 30, 2023, the Company had one class of preferred stock, Series A Preferred Stock, and 2,500 shares of it issued and outstanding.

Common stock

The Company has authorized 500,000,000 shares of common stock, with a par value of $0.001 per share.

Share Issuances

During the six months ended June 30, 2023, the Company sold an aggregate of 11,428 shares of its common stock, $0.001 par value, in exchange for $20,000 in cash, or about $1.75 a share.

Share Exchange and Cancellation

On May 31, 2023, the Company entered into a Share Exchange Agreement whereby it issued 2,500 shares of its Series A Preferred Stock in exchange for 25,000,000 shares of its common stock. The shares of common stock received were subsequently canceled. No consideration was paid or received in connection to the share exchange, which also is deemed a non-taxable event pursuant to Section 351 of the Internal Revenue Code.

As of June 30, 2023, the Company had 86,850,513 shares of common stock issued and outstanding.

NOTE 6 – RELATED PARTY FOUNDER’S SHARE ISSUANCES

On March 2, 2017, the Company issued an aggregate of shares of its common stock, $0.001 par value, as Founder’s Shares with $-- value.

Of these original Founder’s Shares were issued to the Company’s officers, to an entity controlled by one of the Company’s founding directors, and to outside consultants who assisted with the Company’s formation and early organization.

NOTE 7 – CONTINGENCY/LEGAL

As of June 30, 2023, and during the preceding ten years, no director, person nominated to become a director or executive officer, or promoter of the Company has been involved in any legal proceeding that would require disclosure hereunder.

From time to time, the Company may become subject to various legal proceedings and claims that arise in the ordinary course of our business activities. However, litigation is subject to inherent uncertainties for which the outcome cannot be predicted. Any adverse result in these or other legal matters could arise and cause harm to the Company’s business. The Company currently is not a party to any claim or litigation, the outcome of which, if determined adversely to the Company, would individually or in the aggregate be reasonably expected to have a material adverse effect on the Company’s business.

NOTE 8 – SUBSEQUENT EVENTS

Share Exchange and Cancellation

On June 10, 2023, the Company entered into a series of Share Exchange Agreements whereby it issued an aggregate of 700 shares of its Series A Preferred Stock in exchange for 7,000,000 shares of its common stock. The shares of common stock received were subsequently canceled.

As of August 14, 2023, the Company had 79,850,513 shares of common stock issued and outstanding.

No other material events or transactions have occurred during this subsequent event reporting period that required recognition or disclosure in the financial statements.

[This space intentionally left blank]

14

Table of Contents

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our independent registered public accounting firm has issued a going concern opinion in their audit report dated April 13, 2023, which can be found in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on April 13, 2023. This means that our auditors believe there is substantial doubt that we can continue as an ongoing business for the next 12 months.

The following discussion should be read in conjunction with our financial statements and the notes thereto and the other information included in this Quarterly Report as filed with the SEC on Form 10-Q.

Business Overview

SecureTech is an emerging growth company that develops and markets security and safety devices and technologies – our products preserve life, protect property, and prevent crime. SecureTech is the maker of Top Kontrol®, the only anti-theft and anti-carjacking system known that can safely stop a carjacking without any action by the driver. SecureTech is developing advanced cybersecurity technologies for blockchain and cryptocurrency systems and platforms involving cryptocurrency mining, digital asset storage and protection, and trading exchanges through its Piranha Blockchain subsidiary.

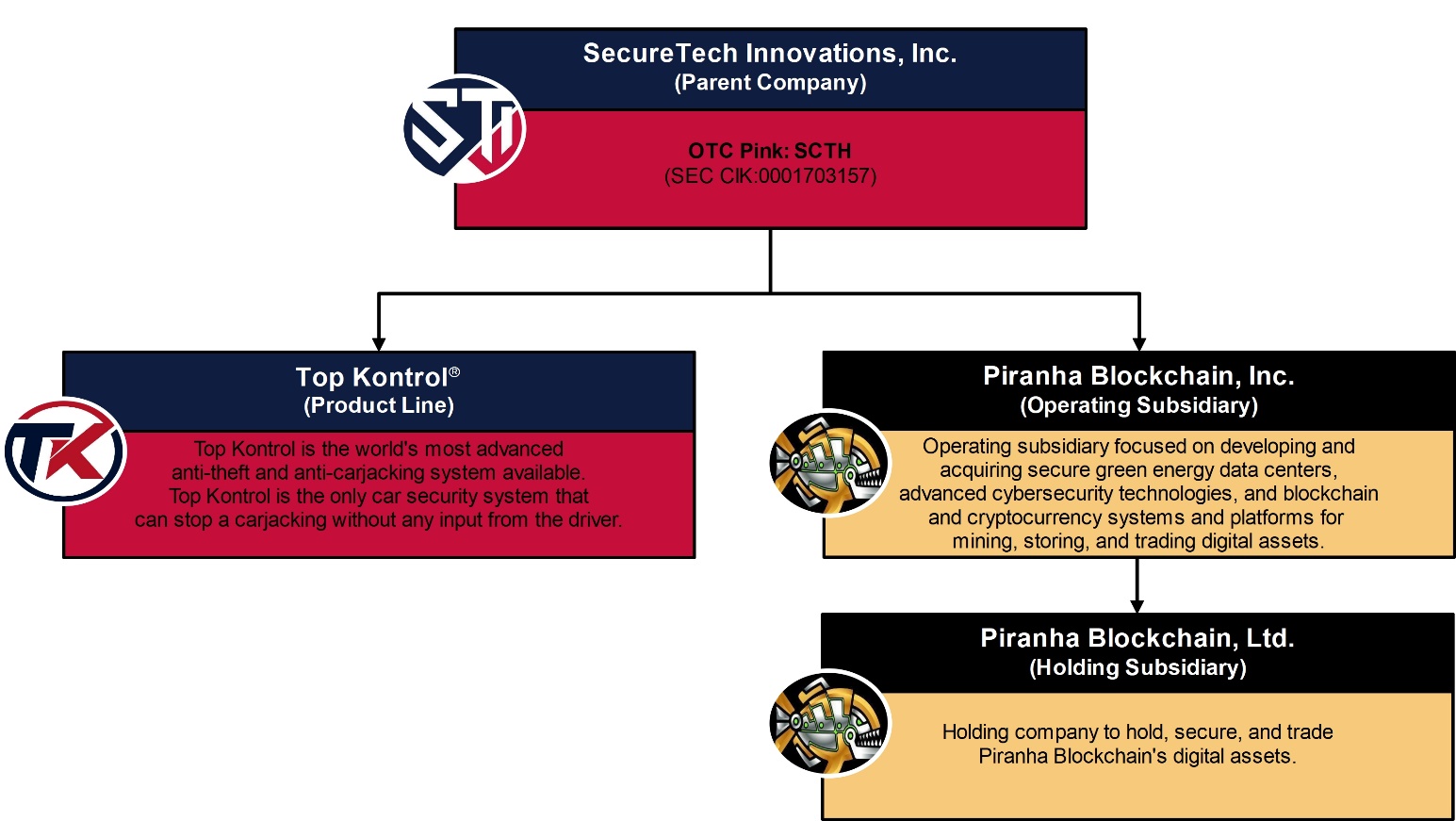

Corporate Structure

The following diagram illustrates our corporate structure as of June 30, 2023:

Corporate History

SecureTech was incorporated under the laws of the State of Wyoming on March 2, 2017, under the name SecureTech, Inc. SecureTech amended its Articles of Incorporation on December 20, 2017, to change its name to SecureTech Innovations, Inc. On November 19, 2021 and November 25, 2021, SecureTech incorporated wholly-owned subsidiaries Piranha Blockchain, Inc. under the laws of the State of Wyoming and Piranha Blockchain, Ltd. under the International Business Company (IBC) laws of Anguilla, British West Indies, respectively.

15

Table of Contents

Top Kontrol

Top Kontrol is the world’s most advanced anti-theft and anti-carjacking system. Unlike our competitors’ products that only protect a vehicle from unattended theft, Top Kontrol takes vehicle security and passenger safety to the next level – prioritizing the driver’s and passengers’ safety. Top Kontrol is presently the only automobile security and personal safety system able to thwart an active carjacking attempt without any action by the driver.

Key Advantages of Top Kontrol:

ü

|

| Anti-theft circuits actively prevent automobile theft and carjacking

|

ü

|

| Automatically prevents theft although keys are in ignition and engine is idling

|

ü

|

| Active and passive prevention of carjacking

|

ü

|

| Does not interfere with the vehicle’s other systems

|

ü

|

| Compatible with most makes and models of cars and trucks

|

ü

|

| Manual engine kill switch

|

ü

|

| Key-based system prevents thieves from hacking wirelessly transmitted security codes

|

ü

|

| Does not draw battery power – system works even with a disabled car battery

|

|

|

|

Retail Package Top

|

| Retail Package Bottom

|

For additional information on Top Kontrol or view product demonstration videos, please visit the Top Kontrol website at www.topkontrol.com or the Top Kontrol YouTube Channel, respectively.

16

Table of Contents

Industry: Automobile Theft in America

Automobile theft in America continues to soar on an annual basis. In 2022, America witnessed annual car thefts topping 1 million vehicles for the first time in history.

Top Kontrol keeps your car safe when you are not there. Top Kontrol prevents car thieves from stealing your car when parked and unattended. Below is recent data showcasing America’s auto theft crisis during 2022:

1,001,967

|

| Number of US cars stolen in 2022

|

$8.9 Billion

|

| Value of cars stolen in the US in 2022

|

$9,166

|

| Average dollar loss per theft

|

7%

|

| Increase in US car thefts over 2021

|

23 Seconds

|

| How often a car is stolen in the US

|

Industry: Carjackings Skyrocketing

Carjackings more than doubled during 2020, followed by an even sharper rise in carjackings to new record highs in 2021!

Top Kontrol is presently the only known automobile safety device that can thwart an active carjacking attempt without any action by the driver. Below are some highlighted major US cities that experienced record levels of carjackings in 2021:

Increase in Carjackings

2021

|

|

US City

|

|

|

|

343%

|

| Washington, DC

|

222%

|

| Minneapolis, MN

|

133%

|

| Chicago, IL

|

121%

|

| New Orleans, LA

|

115%

|

| Oakland, CA

|

Note: As of the date of this Quarterly Report, the FBI had yet to release updated 2022 carjacking statistics.

Competition

SecureTech faces formidable competition in every aspect of its business. Our company’s success or failure will depend largely upon management’s ability to develop competitive products and successfully market them to attract enough new customers, enabling us to generate sufficient revenues to become profitable.

SecureTech competes against better-established competitors with more significant financial resources and longer operating histories. Our competitors’ resources and market presence may give them considerable advantages in marketing, purchasing, and negotiating leverage. Some of our better-known competitors include Viper (www.viper.com), Clifford (www.clifford.com), and OnStar (www.onstar.com). In addition to these known competitors, we are competing with lesser-known competitors and competitors presently not known to us or possibly, not even formed yet.

Our targeted industry is sufficiently large enough that we should be able to compete successfully against our competitors with our existing and future products. However, it is essential to note that the underlying product technology is constantly evolving and expanding, with new competitors continuously innovating better products that could eventually outperform our then-offered products or, worse, possibly render them obsolete.

Manufacturing

SecureTech uses US-based contract manufacturers to manufacture its products, with final assembly performed at SecureTech’s Minnesota headquarters. SecureTech has no long-term or exclusivity agreements with any contract manufacturer and is free to change or negotiate with new contract manufacturers at its sole discretion.

SecureTech’s products proudly carry the “Made in the USA” designation.

17

Table of Contents

Piranha Blockchain

SecureTech is expanding into advanced cybersecurity and blockchain technologies through its newly formed Piranha Blockchain subsidiaries (collectively, “Piranha”). Through Piranha, SecureTech intends to:

•

|

| Build secure low-cost green energy data centers

|

•

|

| Offer advanced cybersecurity products to secure and protect client data, identity, and digital assets from theft and ransom

|

•

|

| Develop blockchain and cryptocurrency systems and platforms for mining, storage, and trading exchanges

|

Piranha intends to generate revenue through four potential sources:

•

|

| Individual one-time product sales of cybersecurity hardware and applications

|

•

|

| Recurring monthly revenue from cybersecurity subscriptions and hosting services

|

•

|

| Cryptocurrency mining

|

•

|

| Transaction fees from cryptocurrency exchange trades and conversions into and from fiat currencies

|

Piranha will pursue growth in this business expansion through a combination of internally developed products and technologies and strategic acquisitions.

Government Regulation

Our products are designed to meet all known existing or proposed governmental regulations. We currently meet all applicable standards for approvals by government regulatory agencies for our products and services.

Top Kontrol was issued a Federal Communications Commission (FCC) Declaration of Conformity certification in March 2020.

Compliance with Environmental Laws

We believe there are no material issues or costs associated with our compliance with current environmental laws. We did not incur environmental expenses in fiscal periods ended June 30, 2023 and December 31, 2022, nor do we anticipate environmental expenses in the foreseeable future.

Intellectual Property Rights and Proprietary Information

We operate in an industry where innovation, investment in new ideas, and protection of resulting intellectual property rights are essential drivers of success. We rely on various intellectual property protections for our products and technologies, including patent, trademark and trade secret laws, and contractual obligations. We pursue a policy of vigorously enforcing our intellectual property rights.

Patents that have been issued and/or licensed to SecureTech and their dates of issuance are:

·On May 7, 2013, Shongkawh, LLC, a related party controlled by our President and CEO, was issued US Patent No. 8,436,721 entitled “Automobile Theft Protection and Disablement System,” by the US Patent & Trademark Office (“USPTO”). This patent expires on March 19, 2030. SecureTech has the exclusive license for the use of this patent through its expiration date.

In addition to such factors as innovation, technological expertise, and experienced personnel, we believe robust product offerings that we continue to upgrade and enhance will keep us competitive. We will seek patent protection for significant technological improvements that we make. We have an ongoing policy of filing patent applications to seek legal protections

18

Table of Contents

for our products and technologies’ novel features. Before filing and granting patents, our policy is to disclose critical elements to patent counsel and maintain these features as trade secrets before product introduction. Patent applications may not result in issued patents covering all-important claims and could be denied in their entirety.

We also file for trade name and trademark protection when appropriate. We are the owner of federally registered trademarks, including SECURETECH INNOVATIONS® and TOP KONTROL®. Additionally, SecureTech has a pending trademark registration application with the USPTO for PIRANHA BLOCKCHAIN.

Our policy is to enter into nondisclosure agreements with each employee, consultant, or third party to whom any of our proprietary information may be disclosed. These agreements prohibit disclosing our confidential information to others during and after employment or working relationships.

Employees

As of June 30, 2023, we had five employees (two full-time employees and three part-time employees) and three independent commission-based sales representatives.

Results of Operations

Comparison of the Three Months Ended June 30, 2023 and 2022

The following table sets forth the results of our operations for the three months ended June 30, 2023 and 2022.

|

| Three months ended June 30,

|

|

|

2023

|

|

2022

|

Sales

| $

| 17,550

| $

| 7,803

|

Cost of goods sold

|

| (4,732)

|

| (2,068)

|

Gross profit

|

| 12,818

|

| 5,735

|

Operating expenses

|

| (118,432)

|

| (108,949)

|

Loss from operations

|

| (105,614)

|

| (103,214)

|

Other income

|

| 528

|

| 1,215

|

Net loss

| $

| (105,086)

| $

| (101,999)

|

Sales

Sales for the three months ended June 30, 2023, were $17,550, compared to $7,803 for the same period of 2022, representing an increase of $9,747, or a 124.9% increase compared to the previous fiscal period. All sales were attributable to Top Kontrol.

Cost of Goods Sold

Our cost of goods sold consists primarily of purchasing components and circuitry from various vendors and then utilizing third-party contract manufacturing facilities to produce our products, with final assembly conducted at our Minnesota headquarters. Cost of goods sold for the three months ended June 30, 2023, was $4,732, compared to $2,068 for the same period of 2022. As a percentage of overall sales, the cost of goods sold was 27.0% during the three months ended June 30, 2023, compared to 26.5% for the same fiscal period a year ago.

Gross Profit

Gross profit for the three months ended June 30, 2023, was $12,818, compared to $5,735 for the same period of 2022. Our gross profit margin was 73.0% during the three months ended June 30, 2023, compared to 73.5% for the same fiscal period a year ago.

19

Table of Contents

Operating Expenses

|

| Three Months Ended June 30,

|

|

|

2023

|

|

2022

|

Operating expenses:

|

|

|

|

|

| General and administrative

| $

| 112,556

| $

| 103,647

|

| Research and development

|

| 5,876

|

| 5,302

|

| Operating expenses

| $

| 118,432

| $

| 108,949

|

Our operating expenses for the fiscal period consisted of two components: general and administrative expenses and research and development expenses. Total operating expenses were $118,432 during the three months ended June 30, 2023, compared to $108,949 for the same period of 2022, representing an increase in operating expenses of $9,483, or 8.7%, from the three months ended June 30, 2022. The increase in operating expenses was primarily attributable to increases in legal, accounting, and regulatory compliance expenses. As SecureTech grows and expands, we anticipate these expenses will continue rising.

Loss From Operations

As a result of the foregoing, our loss from operations was ($105,614) during the three months ended June 30, 2023, compared with ($103,214) for the same period of 2022. This $2,400, or 2.3%, increase in our loss from operations was primarily attributable to increases in legal, accounting, and regulatory compliance expenses. As SecureTech grows and expands, we anticipate these expenses will continue rising.

Other Income

Our other income is comprised of bank interest received on cash deposits and cashback rewards generated from a bank credit card. During the three months that ended June 30, 2023, we received $528 in other income, compared to $1,215 for the same period of 2022.

Net Loss

The result was that our net loss was ($105,086) during the three months ended June 30, 2023, compared with ($101,999) for the same period of 2022. This $3,087, or 3.0%, increase in our net loss was primarily attributable to increases in legal, accounting, and regulatory compliance expenses. As SecureTech grows and expands, we anticipate these expenses will continue rising.

Comparison of the Six Months Ended June 30, 2023 and 2022

The following table sets forth the results of our operations for the six months ended June 30, 2023 and 2022.

|

| Six months ended June 30,

|

|

|

2023

|

|

2022

|

Sales

| $

| 37,600

| $

| 17,153

|

Cost of goods sold

|

| (10,017)

|

| (4,690)

|

Gross profit

|

| 27,583

|

| 12,463

|

Operating expenses

|

| (248,038)

|

| (175,190)

|

Loss from operations

|

| (220,455)

|

| (162,727)

|

Other income

|

| 1,410

|

| 1,215

|

Net loss

| $

| (219,045)

| $

| (161,512)

|

Sales

Sales for the six months ended June 30, 2023, were $37,600, compared to $17,153 for the same period of 2022, representing an increase of $20,447, or a 119.2% increase compared to the previous fiscal period. All sales were attributable to Top Kontrol.

20

Table of Contents

Cost of Goods Sold

Our cost of goods sold consists primarily of purchasing components and circuitry from various vendors and then utilizing third-party contract manufacturing facilities to produce our products, with final assembly conducted at our Minnesota headquarters. Cost of goods sold for the six months ended June 30, 2023, was $10,017, compared to $4,690 for the same period of 2022. As a percentage of overall sales, the cost of goods sold was 26.6% during the six months ended June 30, 2023, compared to 27.3% for the same fiscal period a year ago.

Gross Profit

Gross profit for the six months ended June 30, 2023, was $27,583, compared to $12,463 for the same period of 2022. Our gross profit margin was 73.4% during the six months ended June 30, 2023, compared to 72.7% for the same fiscal period a year ago.

Operating Expenses

|

| Six Months Ended June 30,

|

|

|

2023

|

|

2022

|

Operating expenses:

|

|

|

|

|

| General and administrative

| $

| 241,277

| $

| 166,238

|

| Research and development

|

| 6,761

|

| 8,952

|

| Operating expenses

| $

| 248,038

| $

| 175,190

|

Our operating expenses for the fiscal period consisted of two components: general and administrative expenses and research and development expenses. Total operating expenses were $248,038 during the six months ended June 30, 2023, compared to $175,190 for the same period of 2022, representing an increase in operating expenses of $72,848, or 41.6%, from the six months ended June 30, 2022. The increase in operating expenses was primarily attributable to increases in legal, accounting, and regulatory compliance expenses. As SecureTech grows and expands, we anticipate these expenses will continue rising.

Loss From Operations

As a result of the foregoing, our loss from operations was ($220,455) during the six months ended June 30, 2023, compared with ($162,727) for the same period of 2022. This $57,728, or 35.5%, increase in our loss from operations was primarily attributable to increases in legal, accounting, and regulatory compliance expenses. As SecureTech grows and expands, we anticipate these expenses will continue rising.

Other Income

Our other income is comprised of bank interest received on cash deposits and cashback rewards generated from a bank credit card. During the six months that ended June 30, 2023, we received $1,410 in other income, compared to $1,215 for the same period of 2022.

Net Loss

The result was that our net loss was ($219,045) during the six months ended June 30, 2023, compared with ($161,512) for the same period of 2022. This $57,533, or 35.6%, increase in our net loss was primarily attributable to increases in legal, accounting, and regulatory compliance expenses. As SecureTech grows and expands, we anticipate these expenses will continue rising.

Total Stockholders’ Deficit

Our stockholders’ deficit was ($23,625) as of June 30, 2023.

Liquidity and Capital Resources

Our principal demands for liquidity are related to our efforts to generate sales, manufacturing inventory, and expenditures related to sales, regulatory compliance, and general corporate purposes. We intend to meet our liquidity demands, including capital expenditures related to the manufacture of inventory and the expansion of our business, primarily through cash flow provided by operations and sales of our securities.

21

Table of Contents

As of June 30, 2023, we had a cashback revolving credit line of $15,000. As of June 30, 2023, we had an outstanding balance of $11,056 on this credit line. Under the terms of this line of credit, SecureTech is to receive 1.5% back on all purchases made through this credit line. Management strives to put as many ordinary operating expenses as possible through this credit line to reduce operating expenses passively.

We rely primarily on internally generated cash flow and available working capital to support operations and growth and are constantly exploring additional new capital sources. Without limiting our options, future financings will most likely be through the sale of additional shares of our common stock. We may also include warrants, options, and/or rights in conjunction with any future issuances of our common stock. However, we can give no assurance that future financing will be available to us and, if available to us, in amounts or on terms acceptable to us.

The following is a summary of cash provided by or used in each of the indicated types of activities during the six months ended June 30, 2023 and 2022:

| Six Months Ended March,

|

| 2023

|

| 2022

|

Cash provided by (used in):

|

|

|

|

| Operating activities

| ($147,802)

|

| ($126,935)

|

| Investing activities

| -

|

| (3,423)

|

| Financing activities

| $20,000

|

| $113,501

|

Net cash used in operating activities was ($147,82), an increase of $20,867, or 16.4%, from cash used in operating activities of ($126,935) during the same period of 2022. The increase in our cash used by operating activities was primarily attributable to increases in legal, accounting, and regulatory compliance expenses. As SecureTech grows and expands, we anticipate these expenses will continue rising.

Net cash used in investing activities was $-0- for the six months ended June 30, 2023 compared to ($3,423) for the same period a year ago.

Net cash provided by financing activities was $20,000, an increase of $20,000 from cash generated from financing activities of $113,501 during the same period of 2022. During the six months ended June 30, 2023, we issued an aggregate of 11,428 shares of our common stock in exchange for an aggregate of $20,000.

Ongoing and Future Capital Funding Efforts

As of August 14, 2023, SecureTech was preparing a Regulation A+ registered securities offering. Funds generated from this planned securities offering will be used for general working capital and to build Piranha Blockchain’s first hydroelectric-powered green data center.

Impact of the COVID-19 (Coronavirus) Pandemic

The ongoing COVID-19 pandemic has significantly impacted economic activity and markets worldwide. In response, governmental authorities have periodically imposed, and others in the future may reimpose, stay-at-home orders, shelter-in-place orders, quarantines, executive orders, and similar government orders and restrictions to control the spread of COVID-19. Such orders or restrictions have resulted in temporary business closures, limitation of business hours, limitations on the number of people in business locations, enhanced requirements on sanitation, social distancing practices, and travel restrictions, among others. Historically, we were restricted in selling and distributing our products while these restrictive mandates were in place. Should similar future government orders and restrictions go into effect again, it will adversely impact our financial condition and operating results.

The long-term impact of the ongoing COVID-19 pandemic on our financial condition or results of operations remains uncertain, in particular, due to external factors related to the pandemic and as COVID-19 cases (including the spread of variants or mutant strains) continue to surge in certain parts of the world. In particular, COVID-19 could have a significant disruption to our supply chain for the products we sell, which could have a material impact on our sales and future earnings. Accordingly, COVID-19 may negatively impact our business in the future, and any future adverse impacts on our business may be worse than we anticipate. The ultimate impact will depend on the severity and duration of the current ongoing COVID-19 pandemic and future resurgences and actions taken by governmental authorities and other third parties in response, each of which is

22

Table of Contents

uncertain, rapidly changing, and difficult to predict. Our growth rates during the ongoing COVID-19 pandemic may not be sustainable and may not be indicative of future growth.

Going Concern Consideration

Our independent registered public accounting firm has issued a going concern opinion in their audit report dated April 13, 2023, which can be found in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on April 13, 2023. This means that our auditors believe there is substantial doubt that we can continue as an ongoing business for the next 12 months.

Off-Balance Sheet Operations

As of June 30, 2023, we had no off-balance sheet activities or operations.

Contractual Obligations

As of June 30, 2023, we did not have any contractual obligations.

Critical Accounting Policies

Use of Estimates

The accompanying financial statements of SecureTech have been prepared in accordance with generally accepted accounting principles in the United States of America. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates which have been made using careful judgment. Actual results may vary from these estimates.

Cash and Cash Equivalents

For purposes of the statement of cash flows, SecureTech considers highly liquid financial instruments purchased with a maturity of three months or less to be cash equivalents. As of June 30, 2023 and December 31, 2022, SecureTech had no cash equivalents.

Fair Value of Financial Instruments

ASC 820, “Fair Value Measurements” and ASC 825, Financial Instruments, requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. It establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. It prioritizes the inputs into three levels that may be used to measure fair value:

Level

|

| Description

|

|

|

|

Level 1

|

| Applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

|

Level 2

|

| Applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

|

Level 3

|

| Applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

|

Inventory and Cost of Sales

Inventories are stated at the lower of cost or realizable value, using the weighted average cost method. When an impairment indicator suggests that the carrying amounts of inventories might not be recoverable, Management reviews such carrying amounts and estimates the net realizable value based on the most reliable evidence available at that time. An impairment loss is recorded if the net realizable value is less than the carrying value. Impairment indicators considered for these purposes are, among others, obsolescence, decrease in market prices, damage, and a firm commitment to sell.

23

Table of Contents

Net Loss per Share Calculation

Basic net loss per common share is computed by dividing the net loss attributable to common stockholders by the weighted average number of common shares outstanding for the period. Diluted earnings per share is calculated similarly to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. SecureTech excludes all potentially dilutive securities from its diluted net loss per share computation since their effect would be anti-dilutive because SecureTech recorded a loss for the six months ended June 30, 2023.

Revenue Recognition

Effective January 1, 2018, SecureTech adopted ASC 606 — Revenue from Contracts with Customers.

SecureTech’s primary revenue source is from selling our Top Kontrol product. We began selling Top Kontrol in late April 2020.

Top Kontrol requires installation by a Certified Top Kontrol Technician. To become a Certified Top Kontrol Technician, an automotive technician must complete a one-day hands-on course hosted by SecureTech. Failure to have Top Kontrol installed by a Certified Top Kontrol Technician voids the product’s limited liability warranty.

Because of this professional installation requirement, SecureTech generally sells its products to and through Certified Top Kontrol Technicians. When SecureTech sells directly to the end user, product installation is performed by authorized SecureTech personnel.

Revenue is recognized when performance obligations under the terms of a contract with our customers are satisfied. Revenue is recorded net of marketing allowances, volume discounts, and other forms of variable consideration. Generally, this occurs with the transfer of control of our product to the customer and payment has been received. SecureTech does not offer terms or credit to any of its customers.

Revenue Recognition; ASC 606 Five-Step Model

Under ASC 606, SecureTech recognizes revenue from the sale of service contracts by applying the following steps: (1) identify the contract with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to each performance obligation in the contract; and (5) recognize revenue when each performance obligation is satisfied.

Revenue Recognition; General Right of Return

Customers are allowed to return goods that are defective (warranty returns). In some instances, customers may be allowed to return a limited number of units for periodic stock adjustment returns. Such stock adjustment returns would be limited to no more than 5% of their total units sold.

As is standard in the industry, we only will accept returns from active customers. If a customer ceases doing business with us, we have no further obligation to accept additional product returns from that customer.

Income Taxes

SecureTech accounts for income taxes pursuant to FASB ASC 740, Income Taxes. Under FASB ASC 740-10-25, deferred tax assets and liabilities are determined based on temporary differences between the bases of certain assets and liabilities for income tax and financial reporting purposes. The deferred tax assets and liabilities are classified according to the financial statement classification of the assets and liabilities generating the differences.

SecureTech maintains a valuation allowance with respect to deferred tax assets. SecureTech establishes a valuation allowance based upon the potential likelihood of realizing the deferred tax asset and taking into consideration SecureTech’s financial position and results of operations for the current period. Future realization of the deferred tax benefit depends on the existence of sufficient taxable income within the carryforward period under the Federal tax laws.

24

Table of Contents

Changes in circumstances, such as SecureTech generating taxable income, could cause a change in judgment about its ability to realize the related deferred tax asset. Any change in the valuation allowance will be included in income in the year of the change in estimate.

Election to Use Extended Transitional Period Under Jumpstart Our Business Startups Act (“JOBS Act”)

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act, which allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Recent Accounting Pronouncements

There are various updates recently issued, most of which represent technical corrections to the accounting literature or application to specific industries and are not expected to have a material impact on SecureTech’s financial position, results of operations, or cash flows.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not applicable since we are a smaller reporting company.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We maintain a set of disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act) designed to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in rules and forms adopted by the SEC.

In accordance with Rule 13a-15(b) under the Exchange Act, as of the end of the period covered by this Quarterly Report on Form 10-Q, an evaluation was carried out under the supervision and with the participation of our Management, including our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), to assess the effectiveness of our disclosure controls and procedures as of June 30, 2023. Based upon that evaluation, our CEO and CFO concluded that our disclosure controls and procedures were not effective in providing reasonable assurance that information required to be disclosed by us in reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms and is accumulated and communicated to our Management, including the CEO and CFO, as appropriate to allow timely decisions regarding required disclosure due to a material weakness.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement in SecureTech’s annual or interim financial statements will not be prevented or detected on a timely basis.

Management’s Quarterly Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining effective internal control over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act). Management, under the supervision and with the participation of our principal executive officer and principal financial officer, evaluated the effectiveness of our internal control over financial reporting as of the end of the period covered by this report. Management’s evaluation of our internal control over financial reporting was based on the framework in Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. In designing and evaluating our internal control over financial reporting and related procedures, Management recognizes that because of inherent limitations, any controls and procedures, no matter how well designed and operated, may not prevent or detect misstatements and can provide only reasonable assurance of achieving the desired control objectives. In addition, the design of internal control over financial reporting procedures must reflect the fact that there are resource constraints and that management is required to apply its judgment in evaluating the benefits of possible controls and procedures relative to their costs.

Based on Management’s assessment, we have concluded that, as of June 30, 2023, our internal control over financial reporting was not effective in timely alerting Management to the material information relating to us required to be included in our annual and interim filings with the SEC.

25

Table of Contents

Management has concluded that our internal control over financial reporting had the following material weaknesses:

•

|

| We could not maintain any segregation of duties within our financial operations due to our reliance on limited personnel in the finance function. While this control deficiency has not resulted in any audit adjustments to our interim or annual financial statements, it could have resulted in a material misstatement that might have been prevented or detected by segregation of duties;

|

|

|

|

•

|

| SecureTech lacks sufficient resources to perform the internal audit function and does not have an Audit Committee;

|

|

|

|

•

|

| We do not have an independent Board of Directors, nor do we have a board member designated as an independent financial expert to SecureTech. The Board of Directors is comprised of two (2) members, both of whom also serve as executive officers. As a result, there is a lack of independent oversight of the management team, a lack of independent review of our operating and financial results, and a lack of independent review of disclosures made by SecureTech; and

|

|

|

|

•

|

| Documentation of all proper accounting procedures is not yet complete.

|

These weaknesses have existed since SecureTech’s inception on March 2, 2017, and have not been remedied as of June 30, 2023.

Management believes to cure the material weaknesses, SecureTech needs to take the following steps:

•

|

| Consider the engagement of outside consultants to assist in ensuring that accounting policies and procedures are consistent across the organization and that we have effective control over financial statement disclosures;

|

|

|

|

•

|

| Hire additional qualified financial personnel, including a Chief Financial Officer, on a full-time basis;

|

|

|

|

•

|

| Expand our current board of directors to include additional independent individuals willing to perform directorial functions; and

|

|

|

|

•

|

| Increase our workforce to accommodate growing sales and higher volumes.

|